Review Article: 2021 Vol: 20 Issue: 2S

The Cost of Investing in Information Systems and their Reality in Iraqi Banks

Zainab Sabah Faraj, Ministry of Higher Education and Scientific Research

Keywords

Information Systems, Global Developments, E-Commerce, Financial Market

Abstract

This research is about the information system and its effectiveness of the Iraqi banks, as some investments in the bank are relying on the information system as The existence of accounting information systems in the Iraqi organizations is accompanied by capital and operational spending related to this investment, and therefore it is necessary to harmonize these investments with the expected returns, so that there is a feasibility of these investments, so the problem of the study revolves around the connection between the cost of investing in information systems and their demands and activity of the organization. Also, the cost of the information system in the Iraqi bank is one of the most important aspects to consider in mind as some banks get effected by the many investments, and some banks benefit from it in addition, This research deals with an important and vital issue that has caused widespread and profound change And a radical change in the structures of organizations, business practice, trade and management of contemporary organizations, It is that issue of information systems and technology. A few years ago of the century The past and we are living in the information revolution, which is considered the most important human achievement, which provided Much effort and time required to develop science and economies of nations, and they have become systems The information and technology used with it is one of the main determinants of achieving efficiency and effectiveness It is sought by organizations and has also become the rationale and effective basis for achieving advantage Competitiveness in the market and access to leadership for business organizations.

Introduction

Because of innovative, monetary and worldwide turns of events, data frameworks have become a critical spot in all zones, where data frameworks have created at a quick speed and their applications have duplicated at all authoritative levels, these frameworks have been utilized at operational, specialized and key levels, bookkeeping data frameworks accomplish numerous preferences through the significant data gave to all gatherings of clients of bookkeeping data. The data delivered by the frameworks is a fundamental asset of associations in different structures; it is the foundation of monetary choices, (Abdulameer, 2010). Regardless of whether they are choices involved or contributed or financed, as these choices add to raising the presentation of the association and accomplish an upper hand that considers emphatically the market estimation of the association and in this manner augment the abundance of investors, and its continuation in the area wherein it works. Among the venture areas in Iraq in which the utilization of data frameworks has extended altogether the financial area, where it added to the fruition of banking tasks and diminished the expense and time and improved the nature of administrations gave to clients. That depends on sufficient knowledge of how systems can be used better to support the needs of decision makers and strategists in organizations that information systems contribute to many benefits and these benefits require costs, so this research highlights the extent to which there is a relationship between the cost of investing in those systems and the performance which can be given back in the rate of get back on ownership and investment rate (Conde, 2000).

The aim of present study is to identify the influence of information system on the Iraqi banks as it will show the meaning of the information system and how it is beneficial to the bank. Also, it shows how the banks in Iraq work with the information system and how does it affect the bank.

Literature Review

The task of data framework in the establishment is that numerous Iraqi associations depend on data frameworks to settle on their choices, where the chance to improve client assistance and create arranging cycles and control measures, notwithstanding the advancement of new administrations, for example, web based business, can show the job of data frameworks in taking an interest in the execution of the arrangement, where data frameworks can partake by accomplishing the work done by representatives physically or put the fundamental advances and strategies for usage and connecting arranging, execution and follow-up frameworks, during the subsequent interaction the data framework follows the essential data For follow-up, where the subsequent framework takes care of the usage framework with its outcomes to address the course, just as feeds the arranging framework with similar data so likely arrangements are unbiased and coordination between crafted by various subsystems, data frameworks assume a critical part in the coordination of the subsystems of the association where it gathers information, cycles and delivers data when required Between system (Hassan, 2014).

Cost of Investment on Information Systems

The size of the costs of accounting information systems and their accompanying as well as the benefits resulting from the use of these systems, therefore, the alignment between them is of great importance worth researching and studying, and on the other hand the banking sector in Iraq is one of the most active and used sectors of accounting information systems and thus attention to analysis of performance and linking it to the costs and requirements of the systems is essential in order to identify the factors that contribute to the success of this sector, as this success will positively affect the achievement of the Iraqi banks ‘objectives, in addition The importance of the study in the contributions that are expected to be added at the scientific and practical level. Investments in information technology depend on several key factors that the management of the organization must take into account when deciding on the transition to more advanced information systems, or it seeks to develop its own information systems, the most important of these factors is to estimate the suitable discount rate, several firms use high deduct/ discount rates extending from 15% to 20% depended on the balanced cost rate of the notion of capital. A usage of low rates improves the acceptance of new investments. The shift to more advanced systems is not only measured by the tangible returns that the organization will have, but there are other intangible benefits that need to be taken into account, such as saving time and effort. The information system requires a cost and this cost can be divided into measurable costs and others that are difficult to measure materially, the costs measured such as hardware costs tools, equipment and programs, cost of labor, operation and training, and costs that are difficult to measure or not measurable such as disloyalty, dissatisfaction and operational inefficiency. The expense of the data framework that can be estimated can be isolated into capital expenses, in particular the expense of buying new hardware and programming (UNICEF, 2017). The expense of preparing clients, the expense of handling the site, and the expense of changing to the new framework. We likewise have working expenses coming about because of the proceeded with advancement and utilization of the framework (Abed & Hanandeh, 2013), for example, the expense of upkeep of programming and gear, information stockpiling costs, radio expense, cost of leased hardware, cost of extra hardware and different costs, for example, paper.

The Effect of the Information System on the Iraqi Banks

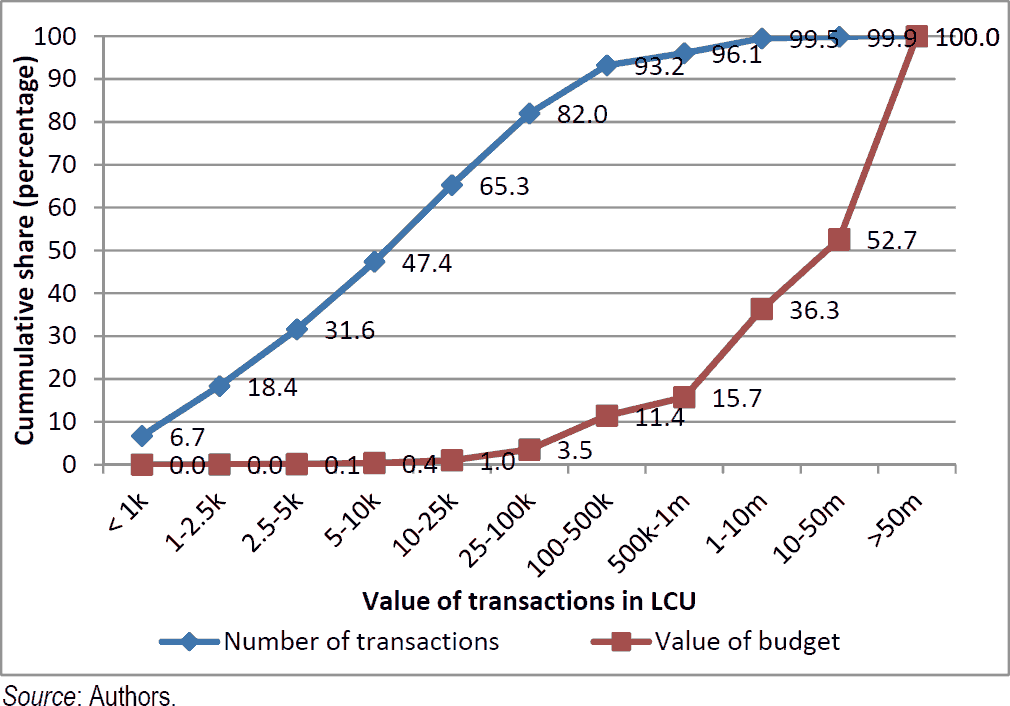

Banks only grow up via compiling new clients and clients, which requires the bank to extend and this normally happens development exclusively by causing extra expenses. Innovation has not changed the conventional elements of Iraqi banks, for example, stores, advances, moves and credits; however what has changed is the manner in which these capacities are drilled and how to convey administration to clients in a highly competitive and risky atmosphere (Khaleel, 2012). Technology has given banks additional capacity to expand and diversify services, to develop the efficiency of operations, to speed up the adoption of the current and to control, to open new branches to the traditional context as before, as the use of technological uses has made up for the need to banking in a region is solved by electronic systems and hardware charged with the performance of functions that use multiple technical tools that allow connection and immediate connectivity to branches and banks in Other regions within and outside the country (Yunus, 2009 ; Davoudizadeh, 2020). The effect of interest in data innovation on the monetary execution of the organizations in Iraq understanding with the guidelines of bookkeeping execution of customary bookkeeping Return on Resources (ROA) (Fünfkirchen & Hashim, 2018), Return on Value (ROE), Return on Deals (ROS), deals develop- ment and market estimation of the organization determined, the examination incorporated an example of 22 public business entities recorded on the Iraq Financial Market, Regression models were utilized to investigations the information. The investigation found that there was an effect on bookkeeping execution estimates like Profit for Resources (ROA), Return on Value (ROE), Return on Deals (ROS), deals development rate and that effect was apparent inside at any rate two years of the going through year (Hassan, 2014). There is an effect available estimation of the organization's reasonable worth. Which expected to consider the effect of the possession structure fair and square of interest in innovation (Nawal, 2011). Data in improving the exhibition of Iraqi banks in the Iraqi monetary market. The investigation found that there is an effect of the possession structure in putting resources into programming, equipment and trade machines and the positive effect of the degree of interest in data innovation in added market esteem, return on value and profit for resources (Hammoudi & Others, 2008; kalari, 2020). (Figure 1)

Methodology

A questionnaire is written and emailed to 100 participants either by their emails or personal delivery. This section focuses on bank highlights, as to capital and the quantity of years it had been working. One inquiry concerning bank type was incorporated for near examination goals. Another inquiry area incorporates inquiries regarding business execution utilizing the data framework and is it viable? Respondents being given as follows. (Table 1)

| Table 1 Respodents |

||

|---|---|---|

| Question | Yes | No |

| Is the bank features beneficial to the clients | 87 clients | 13 clients |

| Is the information system bank features beneficial | 60 clients | 40 clients |

| Is the business performance using the information system effective? | 70 clients | 30 clients |

| Can the bank continue without the information system? | 78 clients | 22 clients |

Information System Effectiveness Statistics

Banking information systems are a fundamental necessity imposed by the economic, social and technical technological developments in the global banking market, where these systems have been able to have a clear impact on banks because of their reliance on digital technology in the delivery of banking services to their applicants, which has increased the quality and effectiveness of the performance of services, processes and marketing mix banking and made it more efficient and effective in increasing and improving customer satisfaction with the banking services provided. Information systems can play a major role in Iraqi private banks through their ability to improve the bank's marketing performance and provide high-quality, low- cost services and products by redesigning banking operations, quickly communicating with customers, and providing extensive data and information on customer consumption patterns, quickly, efficiently and efficiently, enabling bank managers to use this information to develop plans and programs that improve the quality of The performance of the Iraqi banking services provided, and increase the degree of satisfaction and loyalty of customers by focusing on the efficiency and skill of the performance of employees of banking services and thus facilitating the delivery of service to customers in the best way. As information has become a major resource alongside other resources for any organization, Iraqi banks need information to increase productivity, reduce costs and increase profitability, which is the ultimate goal of Iraqi Banks, especially Private Iraqi banks, as the backbone of the national economy, especially since Iraq is a developing country. The researcher tried to review the development of some banks in the field of diversification and the provision of banking services and compare that with some Arab banks, some of which reached the global level and drew attention to the fact that Iraqi banks are still far away, especially as they face several challenges, including globalization and the subsequent agreements in the field of global trade and services and the merger of banks to strengthen financial centers and competition that increased the entry of banks and branches of foreign banks to Iraq.

Results and Discussion

The system is a unit consisting of overlapping subsystems that all objective to fulfillment a group of aims, and the accounting information system in Iraq being one of the elements of those systems and being specialized in collecting, tabulating, processing, analyzing and communicating appropriate financial information to the beneficiary parties to make appropriate decisions and at the appropriate times. The function of information systems, preparation and use is an important function in any organization as information systems management is responsible for the search, absorption and understanding of information systems, and the benefit of information systems includes by their capacity to fulfillment several interests for organizations, for example, flexibility, speed of delivery, cost reduction, the ability of supplying necessary and timely information, in addition to using them at the level of various processes and activities of the organization.

The Components of the information system is that Information systems relies on a bunch of covering components and parts that interface with one another to accomplish a shared objective or targets, to be specific people who are the clients of the framework, bookkeepers, specialists, clients and chiefs, just as people working and numbers, for example, experts and framework originators. The product that the framework utilizes is the drivers to control PCs and application programming that are utilized to address the issues of the board. Also, organizations, which is the foundation of correspondence among PCs and projects liable for overseeing correspondence among gadgets and the information base, being the vessel that contains the basic data stored on the various storage methods that must be available in order to be operational and operating manuals are usually printed in the form of manuals containing instructions for preparing the data and how to enter it as well as instructions for the workers who run the system.

Conclusion

As for the role of information technology in improving banks' operational performance measured by return on Assets, it has been found that information technology has an important role in the bank’s operational performance and its ability to exploit Its assets are optimized for generating profits; Due to the time savings of IT, Effort, costs and the positive impact on financial performance. Based on these results, the study recommends that the Iraqi financial market work to encourage investment Foreigner; Because of its task in magnetizing recent information technology, and encouraging investment Institutions; Because of its task for raising supervision over banks' work, and developing their investment in technology Information, it also recommends that supervisors of the work of Jordanian banks promote investment in technology Information, and recruiting what is said from it; Because of its essential task for developing the activity of banks, through Supporting the information technology departments in these banks, providing them with budgets, and qualified human cadres, And the trainer, including the presence of these banks, and their role in the development of investments.

References

- Abdulameer, H.H. (2010). An empirical study for a sample of banks which are listed in Iraqi market for financial securities.

- Conde, C. (2000). The OECD Iraq Project.

- Khaleel, A.A. (2012). Measuring the cost of the financing structure for the banking sector. UNICEF. (2017). E trade readiness assessment.

- Yunus, N. (2009). Iraq Economic Monitor.

- Mustafa, H. (2014). Evaluating the financial performance of banks using financial ratios-A case study of erbil bank for investment and finance. Komar University of Science & Technology.

- Moritz, P.F., & Ali, H. (2018). Reforming financial management information systems: Insights from World Bank Project Evaluations, world bank.

- Adam, N. (2011). Computer Based Information Systems (CBIS) usage by banks managers in Sudan : An empirical investigation, Sudan academy of banking and financial sciences. Center for Research, Publishing and Consulting.

- Abed, A.S., & Hanandeh, R. (2013). The impact of implementing information security management systems on e- business firms. Case Study in Jordanian banking sector, Middle East University.

- Hammoudi, D. (2008). Evaluation of performance of the financial and accounting computerized information systems in the Jordanian banking sector. An Empirical Study, Yarmouk University.

- Kalari, D.K.B. (2020). Selecting the appropriate model to study the relationship between timeliness and reliability scores of financial reporting quality. Sjamao, 2(2), 10-19.

- Davoudizadeh, R., & Hosseini, S.S.A. (2020). Analyzing advantages and benefits of information technologies in organizations. Sjis, 2 (1), 7-19.