Research Article: 2021 Vol: 20 Issue: 6S

The e- banking financial services quality and its effect on the customers' Satisfaction analytical study in bank of al-rasheed- babil

Hayder Abd Noor Hadi, Al-Qasim Green University

AbdullahKhadem Hassan, University of Al-Qadisiyah

Abstract

Intromission Iraq within the World Trade Organization (WTO) creates and increases the competition among the banks which put forth in developing strategies facilitated in building the banking competitive capacities to have Iraq as a vivid member in the world. Furthermore the e- banking services quality has been regarded as a key to evaluate the banking service according to options and criteria that the customers concern in all the banks and administrative activities. According to what is mentioned above this study deals with the subject of e- banking services quality and its impact on the customers' satisfactions and aims to determine the relevance between the effect and correlation through concentration on the problem which bases on knowing what is the impact of e-banking financial services quality on the customers' satisfaction in bank of Al- Rasheed. The descriptive method with the correlated relevance is used to be an appropriate with solving- problem of study and fulfill its objectives, in addition data-collected is dependent through questionnaire. The adequate statistic methods have been used in data analyses through (SPSS.V.20). Number of conclusions are recommended by the researcher: one of the most important conclusions, there's significant correlated and effect relevance between the study variables.

Keywords

The Financial Services Quality, Electronic Bank Services, Usability, Secrecy, and Customers' Satisfactions

Introduction

This study focus on one of the most important subject in the domain of the banking work, which is the subject of electronic banking services quality effect measurement for the customers' satisfaction in province of babil. Measuring the e-banking services quality effect by the banks increases the competitive capacities to achieve the request aims. This study is limited to the e- banking financial services quality and its effect on the customers' satisfaction which includes a sample of customers who have been dealing with bank of Al-Rasheed. This study has been dependent on the available data through the first half of 2021, where the problem lies in the e-banking services type in the Iraqi banks and the challenges they face. And this comes back to some reasons: first, discontinuity with the outside world for a long time because of wars and the economic siege which was imposed against Iraq before 2003. So there's serious attempts to re-correct the banking sector and then guarantee supporting the other sectors which compose the national economy. So the problem focuses about (The impact of e- banking services quality for the customers' satisfaction). The problem can be summarized as following: Is there any relevance between the e- banking services quality and the customers' satisfaction in bank of Al- Rasheed? What is type of e- banking services presented by bank of Al- Rasheed? Does e- banking services quality contribute in increasing level of customers' satisfaction in bank of Al- Rasheed?

This study aims to measure the e- banking services quality presented by the Iraqi governmental banks according to the customers' view who have been dealing with these banks as following: Knowing the e- banking services nature presented by bank of Al-Rasheed, Knowing nature of relevance between the e- banking services quality and the customers' satisfaction, and Knowing effect of e- banking services quality for the customers' satisfaction. Furthermore, this study bases on the following hypothesis.

H: There's significant effect and correlation relevance between the e- banking services quality and the customers' satisfaction.

Literature Review

Several studies have been dealt with the subject of e- banking financial services quality such as:Shaheen's (2010) explained that to recognize nature and kinds of e- payment instruments applied of bank of Palestine and the controlling systems and the challenges related to, it was concluded that the new environment of the banking work, the intensive competition and the technician applications of the e-payment instruments have obliged the banks to find sophisticated methods in using and diversification of e-banking services, in addition the importance of finding controlling regulations and finding legislations and policies that can support them with regards to the continuity of researches and enhancing of e-banking performance and reduce the risks associate. This study recommends the necessity of supporting and development the researches of e-banking services and improving the career staff performance through the employments continued-training for better banking services, furthermore reversing of spare copies of e-systems, programs and files within an emergency plan outside the work centers.

Another study conducted by Al- Aaraj's (2013), he applied in his study on the effective factors in selecting the services type and windows that the e- banks offer in different areas of the capital the Doha, the results of study have revealed differences in the individuals opinions of study sample customers with the bank and this differences due to the personal merits, and there's agreements in the opinions of the customers with the bank. The agreement has been embodied through the modification to the e- banks which achieve the following merits: the most prominent permit is the customers' satisfaction with the banks, the speed in doing the banking service, reducing the banking service charge, achieving the confidence and peculiarity. Also the censorship and control all the activities.

In addition, Shamim (2010), in her study to investigate the prevailing culture and the transformations into the e-banking and the obstacles of transformations into the e-banking in Pakistan. The quality and quantity method have been dependent to achieve the aims. The study has revealed that although the banks of Pakistan have applied the e-banking for their clients but there are some of obstacles that may prevent presenting the e-banking services, where some of clients are suffering from the sterile traditional procedures they deal with, and this is because some of reasons such as the discredit in the e-banking services, the lack of generalization and knowledge sufficiently to use the computers devices and the advanced information technology, in addition nescience about affairs of security and peculiarity when using the banking services through internet.

Gbadeyan (2012), measures the customers selecting effect extent of the bank through the presented e-banking services quality, where the stratified sample is used. This study concluded that the banking services through the internet been have presented extra- merits to the customers' satisfaction by improving the presented services quality. Also the banking services give the banks an extra competitive merit in the banking task performance. At the same time, some risks have been revealed through this type of services which prevent advance the banking services like increasing the anxiety about the peculiarity and the customers' information security, in addition the difficulty arriving the e- services because the need, not- spread the internet widely, weakness of education and learning, lack of experience in using computer, absence the legalizations about this type of the banking work.

Basic Definitions

First/The E-Banking Services Quality

The banking work has been largely developed in the advanced countries, where the transformation from the cash handling into the e- dealing, revealing the e- currency and the e- banking services, (Noori Zuhair, 2008). The banking management advance has been led to changes in strategies and the working policy in all the banking domains to enable the clients entering the network and knowing the activities belongs the banks and the presented financial services (Omer, 2008). Furthermore, the increasing concern in the e- banking services quality considers as the effective article to improve the presented and expected services level by the clients (Fdhila, 2010). So there's need to understand the concept of e-banking services quality.

Concept of E- Banking Services Quality

The banking services represent number of processes with an advantage content in which the non-tactile elements overcome on the tactile elements. The individuals and institutions can realize this through its significant and the advantage value to fulfill the financial and belonging customers' needs now and future, at the same time it will be profit for the bank through reciprocal relationship between the bank and the clients (association of banks-Jordan, 2012). Also, the concept means that these activities and the financial processes have been offering for the customers related with the value and the banking services providers (Kotler et al., 2011). While the e-banking services has been defined as a group of technicians and the technological method shave been brought by the technological revolution the banking system adopt to facilitate the banking processes generally which includes all the financial information among the individuals, organizations and companies (Al-Haj 2012). Chavan (2013) states it as the productions and the banking services available through the e- distribution channels for period of time in ATM and dealing by the phones, or through the internet as new connect channel to facilitate the banking services for both the banks and clients. Esmail (2010) indicates that the e- banking service quality is the coinciding the customers' expectations of the banking service presented for them with their actual realization of the advantage they have to get. Whereas (Awoke, 2015) illustrates that the service quality assists the firms to acquire competitive merit and considers as key for profitability. Another definition is given by (Srinivasan, 2004) reports that the comprehensive evaluation of the firm performance for a long time. Paschaloudis (2014) comments that the firm capacity to achieve high level of performance the competitors are hard to reach

Importance of E- Banking Services Quality

A. Provision the time and reducing the effort for the clients and possibilities connecting with the banks directly,

B. Accessibility with much of continued-clients,

C. Reducing the costs and the operational expenses the banks endure (Shandi, 2011),

D. Supporting the intellectual capital and improving the information technology,

E. Doing direct relationship with the clients and increasing their satisfaction level,

F. Increasing the market share and the capacity to compete through offering the e-banking services with lower price and high quality (Rushdi, 2008).

Dimensions of E- Banking Services

A. Usability: is the response degree in the e- website ability of the bank to be usability and simple (Hamadi, 2010). Also, it means accessibility and using the bank website on internet through searching, moving and dealing. Usability relates to the website use facility, organizing and structuring the content on the internet to make the website is easy to use with less effort, so the banks should take in consideration the e- banking services usability through the internet the clients use effectively (Dhurp et al., 2014). Thus this dimension must have the facility and simplicity in using the e-communication systems and accessibility to website of bank to facilitate the procedure sand knowing the instructions and particular data and available of the bank (Moghdam & Kaboly, 2015).

B. Provision Time: it considers as one of the essential factors which has directly influenced in the e- banking services domain, since it regards as an extra merit of the service quality the clients have to get, also this dimension is considered as an important factor for the clients' preference by using the e- banking services. So the banking management should have the data and information about the services available on the e- website to facilitate the required procedures.

C. Secrecy And Privacy: (Al-Radaida, 2011) states that the clients' privacy information should be kept and not used by others, in addition the banking procedures between the clients and the banks should be protected extremely. Parasuraman, et al., (2005) show the degree in which the clients realize that their information and data are protected. So there is need to use particular software for the e- trade procedures concealment, since the secrecy and privacy regard as an obstacle that affect negatively for the clients to accept an idea dealing through the internet, especially the e- reciprocal process requires getting some information from the clients like name, identity card, method of payment, etc…(Al-Ashhib, 2015)

Second/Customers' Satisfaction

The crucial element for the institution continuing/ discontinuing is the customer, so the institutions attempt extremely increasing level of the customers' satisfaction. Furthermore the client is considered as an important aim of the quality objectives and improving the quality level to fulfill the clients' satisfaction. Mizyan (2012) views that the successful institution is the one that has been contributing the clients' opinions through the services presented to them, listening to their suggestions and complaints, how to deal with them and doing much more efforts for giving distinguished services and assurance their satisfaction.

Concept of Customers' Satisfaction

The e-banking service quality has been aiming to fulfill the customers' satisfaction, the satisfaction relates with the clients' realization of the banking performance which exceeds their expectations (Al-Saren & Raad, 2008). Wahbah (2002) defines as the state through which the clients' need and expectations are done by offering services with high quality to satisfy the clients. Lovelock & Jochen (2007) define it as a good feeling the clients realize when their satisfaction of profits have been done, so it is the comparison between what the clients' expectations and what is done. Janet (2010) compares the concept between the clients' emotional response of experiments relate with productions or services they purchase, and that response represents the clients' reaction resulted from the evaluation process and the knowledge realization with what they expect to obtain.

Importance of Customers' Satisfaction

A. Set programs and plans of the institution

B. Developing the production quality and fulfill the market competitive merit of the institution.

C. Satisfying the clients' needs and rising their satisfaction level is done through success the organization in fulfilling the profits and increasing the market share (Al-Taay 2009),

D. Creating loyalty by the clients for the institution

E. Encourage the customers to deal continually with an institution (Samiha, 2012)

Satisfaction Features

A. Complacency is personal (self-satisfaction): clients' satisfaction has been reflected through two aspects: the clients' personal expectations level, and the clients' complacency of the presented actual service. The clients' views should be taken in consideration, and the presented services by the institution should be in correspondence according to the clients' expectation and needs, so the institution have to adopt clear policies and procedures depend on the clients' satisfaction and the quality specifications (Nooradeen, 2010).

B. Complacency is proportional: it represents the clients' satisfy proportionally, where the clients make comparison through their views of the market criteria, in this case the clients' satisfaction may change according to the expectations level which vary from one client to another, thus the important role of the market partition can be understood, and determine the clients' homogenous expectations for presenting services are more correspondence with these expectations (Al-Niamat, 2014).

C. Complacency is developmentally: the clients' satisfaction, in this case, modify through development the expectation level from one aspect and the realized performance level from another aspect, so the customers' expectations have been developing due to the special criteria of the presented services and appearing new services in addition to the competitive increasing. So the clients' satisfaction should follow system in correspondence with these developments and the modifications are done (Qarawi & Ghazi, 2015).

Methodology & The Procedures

First/Methodology

The descriptive method, which is quantity in nature, is used to recognize the effect of the e- banking financial services quality for the clients' satisfaction in the bank of Al-Rasheed. This method concerns collecting the data about phenomenon or specific problem and then classifying, analyzing and submitting it to precisely study for obtaining new results to explain the studied phenomenon (Molhim,2007).

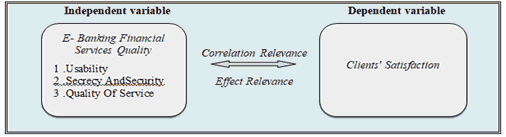

Hypothesized Diagram of the Study

The hypothesized diagram is designed depending on the problem and the study aims to reflect the nature of the effect and correlation relevance of the research variables, as shown below Figure 1.

Second/Scope of Study

Population & Sample of Study

Number of clients who deal with bank of Al-Rasheed represent the society of study, (160) of them have been distributed according to the sex variable, (75%) males and (25%) females. They are distributed into eight branches with proportion of (20%) per- branch of the sample, as shown in table (1).

| Table 1 Reveals Distribution of the Sample Size According to the Sex Variable |

|||

|---|---|---|---|

| Percentage | Frequency | Category | Variable |

| 75% | 120 | Male | Sex |

| 25% | 40 | Female | |

| 100% | 160 | Total | |

Collecting Data

A. Several foreign and Arabic resources have been dependent in addition to theses, dissertations and internet information in covering the theoretical aspect of the study.

B. Questionnaire has been dependent in the practical aspect which is the essential resource for getting data to explain the variables which include the following pivots:

First pivot: includes of one item belongs the personal data concerns with the individuals of the selected sample (sex- age- years of service- academic achievement),

Second pivot: encompasses of (24 items) belong the independent variable (the e-banking services quality) is distributed according into three dimensions (usability- provision time- the secrecy and privacy).

Third pivot: consists of (11) items belong the dependent variable (the customers' satisfaction).

All the items of the second and third pivots have been measured according to 5-item Likert Scale which considers as one of the most common scales in the management domain (Al-Najar, 2010), the value ranges between (5) agree completely to (1) doesn't agree completely, as shown in table (2).

| Table 2 Likert Scale |

||||

|---|---|---|---|---|

| Don't agree completely | Don't agree | Neutral | Agree | Agree completely |

| 1 | 2 | 3 | 4 | 5 |

The validity and reliability test is designed to appropriate the questionnaire requirements as follow:

A. Face validity: the questionnaire is submitted to jury members in the study domain, their notes have been taken in consideration by omitting some items and re-writing another substitutions to be appropriate with the nature of research.

B. Reliability: Cronbach’s alpha coefficient is used to measure the questionnaire reliability items statistically. Table (3) shows Cronbach’s alpha coefficient for all the research variables.

| Table 3 Shows Cronbach’s Alpha Coefficient for all The Research Variables |

|||

|---|---|---|---|

| Validity coefficient | Cronbach’s alpha coefficient | Items | No |

| 0.930 | 0.930 | The E-Banking Services Quality | 1 |

| 0.918 | 0.844 | Customers' Satisfaction | 2 |

| 0.983 | 0.968 | Total of the sample Items | 3 |

The above table reveals that all the questionnaire items have high accepted reliability average, where Cronbach’s alpha coefficient value has reached all the items (0.968). And this indicates to the precisely and the reliability. Also it appears that the validity of all questionnaire items of reached (0.983) and this indicates that the measurement may be determined with high level of reliability.

The Located Application

Questionnaires have been distributed to the sample individuals by the researcher himself at bank of Al-Rasheed. Also meetings have been held with the bank customers to explain method of answering of the questionnaire items.

Statistical Methods

The important statistical methods are dependent for getting the results and test the hypotheses by using the statistical packages (SPSS), the percentages, Cronbach’s alpha coefficient, mean average, standard deviation, value of (Test t), value of (F), correlation coefficient and simple regression coefficient.

Results & Discuss

The research variables are arranged according to a particular question per variable, by using the statistical indicators (the statistical means, standard deviations, correlation coefficient, regression coefficient, the value of (T-test) and value of (F), according to the research sample respondents), as shown in table (4).

| Table 4 Shows the Relevance of Effect and Correlation Between the Independent Variable (the E- Banking Services Quality) and the Dependent Variable (the Customers' Satisfaction) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Sig | T-test | Sig | F | R2 | R** | Standard Deviation | The mean average | variable | No |

| 0.00 | 35.85 | 0.00a | 1285.85 | 0.89 | 0.94 | 0.49 | 3.82 | The E- Banking Services Quality | 1 |

| 0.55 | 3.75 | Customers' Satisfaction | 2 | ||||||

The above table (4) shows that the statistical means, standards deviation of the research sample respondents at bank of Al-Rasheed for the independent variable (the e- banking services quality) in its three dimensions (usability- provision time- secrecy &privacy) where the mean is (3.82) and the deviation standard is (0.49). The mean for the dependent variable (the customers' satisfaction) is (3.75) with standard deviation is (0.55). The correlation coefficient (R) is (0.94), this indicates that there's strong and accepted correlation relevance with high level between the bivariate of research, the determination coefficient value (R2) is (0.89).

And this indicates that (89%) of the occurred changes in the customers' satisfaction is because the e-banking services quality, whereas the other effects may be because other factors. The calculated and extracted value (F) from (ANOVA) table is (1285.85) with significant level is (0.00) which is lower of (0.01), the value of (T. test) is (35.85) with significant level is (0.00) which is lower of (0.01) too. And this indicates that there's statistically significant relevance between the bivariate, independent variable (the e- banking services quality) in the dependent variable represented in the customers' satisfaction.

| Table 5 Explains the Relevance of Effect and The Correlation Between the Bivariate, Independent Variable (Usability) and The Dependent Variable(The Customers' Satisfaction) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Sig | T-test | Sig | F | R2 | R** | Standard Deviation | The mean average | variable | N |

| 0.00 | 15.12 | 0.00a | 228.60 | 0.59 | 0.76 | 0.53 | 3.68 | Usability | 1 |

| 0.55 | 3.75 | Customers' Satisfaction | 2 | ||||||

Table (5) shows that the statistical means, deviation standards of the research sample respondents at bank of Al-Rasheed for the independent variable (usability), where the mean is (3.68) with standard deviation is (0.53), whereas the mean for the dependent variable (customers' satisfaction) is (3.75) with standard deviation is (0.55). The correlation coefficient (R) is (0.76). And this indicates that there's accepted correlation relevance between the research bivariate, while the determination coefficient value (R2) is (0.59). And this indicates that (59%) of the occurred changes in the customers' satisfaction is because the e- banking services usability, whereas the others effects may be because other factors the study does not deal. The calculated and extracted value (F) from (ANOVA) table is (228.60) with significant level is (0.00) which is lower of (0.01), whereas the value of (T. test) is (15.12), with significant level is (0.00). Which is lower of (0.01) too. And this indicates that there's statistically significant relevance between the bivariate, independent variable (the e- banking services usability) in the dependent variable represented in the customers' satisfaction.

| Table 6 Explains the Relevance of Effect and the Correlation Between the Bivariate in Dependent Variable (Provision Time) and the Dependent Variable ( the Customers' Satisfaction) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Sig | T-test | Sig | F | R2 | R** | Standard Deviation | The mean average | variable | No |

| 0.00 | 65.86 | 0.00a | 4338.10 | 0.96 | 0.98 | 0.57 | 3.77 | Provision Time | 1 |

| 0.55 | 3.75 | Customers' Satisfaction | 2 | ||||||

Table (6) shows that the statistical means, standards deviation of research sample respondents at bank of Al-Rasheed for the independent variable (provision time), where the mean is (3.77) with standard deviation is (0.57), whereas the mean for the dependent variable (customers' satisfaction) is (3.75) with standard deviation is (0.55). The correlation coefficient (R) is (0.98). And this indicates that there's strong and accepted correlation relevance between the research bivariate, while the determination coefficient value (R2) is (0.96). And this indicates that (%96) of the occurred changes in the customers' satisfaction is because the provision time resulted of using the e- banking services, while the value (F)calculated and extracted from (ANOVA) table is (4338.10) with significant level is (0.00) which is lower of (0.01), the value of (T. test) is (65.86) with significant level is ( 0.00) which is lower of (0.01) too. And this indicates that there's statistically significant relevance between the bivariate, independent variable (the provision time) in the dependent variable represented in the customers' satisfaction.

| Table 7 Shows Relevance of Effect and Correlation Between the Bivariate: Independent Variable (Secrecy and Privacy) and the Dependent Variable (the Customers' Satisfaction) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Sig | T-test | Sig | F | R2 | R** | Standard Deviation | The mean average | Variable | No |

| 0.00 | 14.08 | 0.00a | 198.25 | 0.55 | 0.74 | 0.56 | 4.03 | Secrecy&Privacy | 1 |

| 0.55 | 3.75 | Customers' Satisfaction | 2 | ||||||

Table (7) shows that the statistical means, standards deviation of research sample respondents at bank of Al-Rasheed for the independent variable (secrecy & privacy), where the mean is (4.03) with standard deviation is (0.56), whereas the mean for the dependent variable (customers' satisfaction) is (3.75) with standard deviation is (0.55). The correlation coefficient (R) is (0.74). And this indicates that there's high, accepted correlation relevance with high level between the research bivariate, while the determination coefficient value (R2) is (0.55). And this indicates that (%55) of the occurred changes in the customers' satisfaction level is because of the secrecy & the privacy in the e- banking services using. The calculated and extracted (F) value from (ANOVA) table is (198.25) with significant (0.00) which is lower of (0.01). The value of (T. test) is (14.08) with significant is (0.00) which is lower of (0.01) too. And this indicates that there's statistical significant between the bivariate: the independent variable (secrecy & privacy) in the dependent variable (customers' satisfaction).

According to the above, and after discussing & analyzing results the relevance of correlation and effect for the independent variable (the e- banking services quality) with its three dimensions ( usability- provision time- secrecy & privacy) in the dependent variable (customers' satisfaction) we accept the current hypothesis has reported that (there's significant effect & correlation relevance between the e- banking services quality and the customers' satisfaction).

Conclusions

Set of conclusions have been summarized below:

1. Client's satisfaction is one of the important criteria that assists to evaluate the e-banking services quality presented by the banks,

2. The e- banking services quality has been considered as one of the important factors the clients attract since they can get the presented services easily in short time and effort in addition to the merit of secrecy and privacy,

3. Offering the e- banking services at bank of Al-Rasheed have been regarded as one of the essential features to improve the banking industrial in Iraq and gaining the customers' satisfaction too,

4. In the practical aspect, the study has revealed that there's statistical significant correlation relevance between the independent variable, the e- banking services quality and the dependent variable the customers' satisfaction, and

5. Also, in the practical aspect, the study has revealed that there's statistical significant effect relevance between the independent variable, the e- banking services quality and the dependent variable the customers' satisfaction.

Recommendations:

1. Importance of developing the technology presented by the banks to the customers and developing the e- websites and updating continually,

2. Distributing much of ATM (automatic teller machine) and providing the currency and maintaining continually,

3. Maintaining the governmental banks infrastructures because its effects on the customers' view during evaluating the services quality,

4. Set an adequate strategies to improve the e- banking services in the governmental banks, and they should be capable to compete the international banks in the industrial banks especially after Iraq has associated with the world trade organization,

5. Importance of supposing much control on the e- banking processes and the immediately- updating of data at every process or activity, accuracy, time saving and supporting the confidence and peculiarity of the customers.

References

- Abdullateef, R. (2008). Importance and merits of the e-banks in Gaza- Palestine, the obstacles of its spread, journal of the Islamic University– series of the human studies Palestine, 16, 861.

- Abdulqader, M. (2012). Influence of services quality determinations for the customers' satisfaction, thesis, University of Tlemcen.

- Adeeb, K.S. (2011). The e- banking its patterns, the options of accepting and rejecting. Journal of Kuwait for the administrative and economic sciences. University of Waist, 1, p26.

- Ali, A.S. (2010), the e- payment systems, its risks, & methods of controlling- applied study of bank of Palestine, 1-8.

- Aslam, Q., Muhmed, G., (2015). Effect of the services quality for the outside customers' satisfaction, Algeria, thesis, University of Akli Mohand Oulhadj, 37.

- Association of banks-Jordan, (2012). Guide of banking services, productions & solutions presented by banks in Jordan, first part, Oman- Jordan.

- Awoke, H.M. (2015). Service quality customer satisfaction: Empirical evidence from saving account customers of banking industry. European Journal of Business and Management, 7(1), 144-164.

- Chavan, J. (2013). Internet banking- benefits and challenges in an emerging economy. International Journal Business Management (IJRBM), 1 (1), 19-26.

- Fadihla, C.H. (2010). Impact of the e- market on the banking services quality, case study of some Algerian banks, thesis, Universite Mentouri Constantine, Algeria, 81.

- Gbadeyan, O.O., & Akinyosoye, (2012). Customer preference for e-banking services: A case study of selected banks in sierra Leone, Kuwait Chapter of Arabian Journal of Business and Management Review 1, 6 2-4.

- Hamdi, C. (2010). The impact of online banking on customer commitment, IBIMA Publishing. Communications Of IBIMA, 34.

- Jenet, M.A. (2010). The Relationship Between Customer Satisfaction And Service Quality: A Study Of Three Service Sectors Umea School Of Business Spring Semester Master Thesis,368.

- Kotler, P., Armstrong, G., Tolba, A., & Habib, A. (2011). Principle of Marketing- Arab World Edition. Person Education Limited, 102.

- Laith M.A-H. (2012). The e- banking services system in supporting the relevance between the banks by (SMS) and its role in fulfill the customers' loyalty in the Jordanian trade banks, thesis, University of middle-east- Jordan, 92.

- Lovelock Christopher and Wirtz Jochen, (2007). Service Marketing, People Technology, Strategy. Pearson Prentice Hall, 41, 422.

- Manillall, D., Jhalukpre, S., Ehpraim, R. (2014). Customer perceptions of online banking service quality. Mediterranean Journal of Social Science, MCSCER Publishing, Rome- Italy, 5(2), 587- 594.

- Moghdam, S.R., & Kaboly, M.R. (2015). Analyzing electronic service quality customer point of view n telecommunication of Esfahan. International Journal of Life Science and Engineering, 1(2) 39-44.

- Elisha, M.A. (2010). E- Banking in developing economy: Empirical evidence from Nigeria. Journal of Applied Quantitative Methods, 2(5), 212-222.

- Muhmed, N., Abdalfatah Z., (2008). The e-banking, Dar Wael for publication, Jordan,33.

- Nabeel, N. (2010). Statistics in education and human sciences with programs applications, Dar Alhamed for publication & distribution. Oman, Jordan, 64.

- Nawal, A.A-A. (2015). The e-trade, (1st edition). Oman, Dar Amjed for publication and distribution, 28.

- Nooradeen, B.A. (2010). The services quality and its effect for the customers' satisfaction- located study at the institutions of Sakikda harbor. thesis, UniversitéMohamed Boudiaf- M'Sila, Algeria, p61.

- Omer, A. (2008). The e- services, according to the international transformations. Journal of administrative and economic researches, University de Blida, Algeria (4), p67.

- Parasuraman, A., Zeithaml, V.A., & Malhorta, A. (2005). E-S-QUAL: A multi item scale for assessing electronic service quality. Journal of Service Research, 7(3), 1-21.

- Paschaloudis, D. (2014). Using E-S-QUAL to measure internet service quality of e- banking websites in Greece. Journal of Internet Banking and Commerce, 19(1), 1-17.

- Raad, H.A-S. (2008). e-service quality globalization, (1st edition). Damascus, Dar Al- Tawasel Al-Arabi for print, publication and distribution, 51.

- Ramzi, A-R. (2011). The effect of the e- banking service quality in supporting the relevance between the bank and the customers, comparative study on sample of the Jordanian banks and the foreign banks in Oman city, thesis, University of middle- east, Oman, Jordan,117.

- Salman, S., & Kashif, S. (2010). Electronic banking & e- readiness adoption by commercial banks in Pakistan. Information System: Master Course Code: 1V9014, 1-6.

- Sami, M.M. (2007). Research methods in education and psychology. Oman, Dar Almasira for publication and distribution, 33.

- Samiha B. (2012). Effect of the services quality for fulfilling the customers' satisfaction, Algeria, thesis, University Kasdi Merbah, 24.

- Srinivasan, R. (2004). Service marketing, the Indian context, prentice- hall of Indian private limited. New Delhi, 72.

- Suliman Z.A-N. (2014). effect the banking services quality dimensions on the performance- located study on the Jordanian banks, dissertation, The World Islamic Science & Education University, Jordan, 82.

- Tariq, A-A. (2013). the effected factors in selecting type of services and windows the e- banks have been offering, analytic study to sample of dealers with bank of Qatar, dissertation, administration of banks, the open Arabic academy – Denmark, collage of economic, 2-15.

- Wahbah, Z. (2002). Contemporary banking transaction. Damascus: Dar Alfikr For Publication, 37.

- Yousif, H.S.A-T. (2009). Administration the relationships with the customers, Dar Al-Waraq for publication & distribution, Jordan, 233.