Research Article: 2021 Vol: 20 Issue: 1

The Effect of Authentic Corporate Social Responsibility (CSR) Intent and Substantiveness on Firm Performance

Sebastien Vendette, Central Michigan University

Abstract

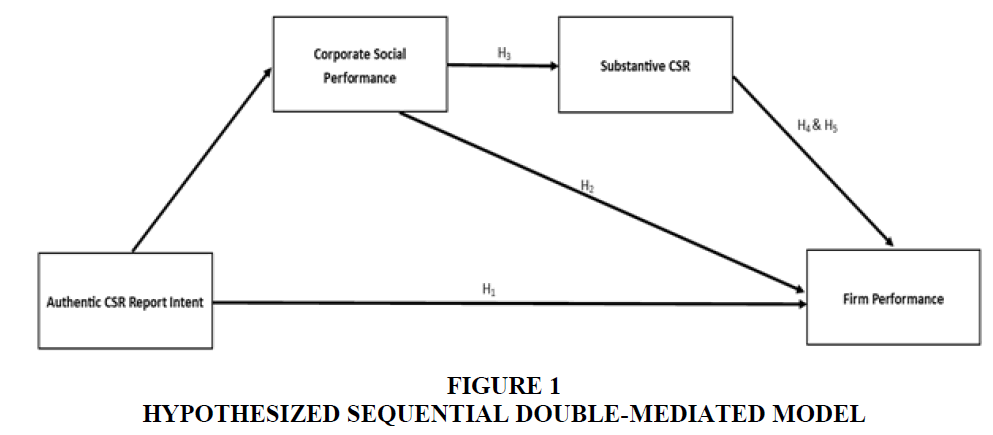

The direct relationship between corporate social performance (CSP) and firm performance has been examined by many scholars, but this direct test has resulted in ambiguous findings. Some argue that the inconsistencies are because of many untested factors that influence this relationship. We argue that CSP may, in fact, be a mediating variable itself, rather than a latent factor. Therefore, this study introduces a latent (authenticity of CSR report), and mediating factor (CSR substantiveness) that may help us understand the complex relationship between CSR and firm performance. The findings from 308 companies reveal a fully, double-mediated link between CSR report authenticity and firm performance. Taken together, our findings suggest the intent behind organizations’ CSR initiative impacts corporate social performance. Specifically, organizations will experience increased CSP when there is a perceived alignment signaling organizational stakeholders that the firm is engaging in substantive CSR activities.

Keywords

CSR Intent, CSR Authenticity, CSR-CSP Relationship.

Introduction

Over the past few decades, the strategic implications of corporate social responsibility (CSR) initiatives have gone from being hailed as a misuse of corporate funds and shareholder wealth to a strategic necessity as organizations take the lead in bringing business and society back together (Porter & Kramer, 2006). The attitudinal change is the result of environmentally sensitive customers who now demand organizations become sustainable and provide more ecologically friendly products and services (Carroll, 2015; Van Beurden & Gössling, 2008). Although CSR is now an essential part of business strategizing, the impact of CSR and corporate social performance (CSP) on an organization’s bottom line remains questionable as results support positive, negative, and even no relationship altogether (Salaiz et al., 2020). Given the inconclusive results of the direct relationship between CSR and CSP to firm performance, attention was redirected to mediating variables. Examining specific drivers of corporate social performance (CSP) rather than its simplistic relationship to performance highlights the complexity that rests within the CSR, CSP, and firm performance relationships (Angus-Leppan et al., 2010).

While there is still a lot we do not know regarding why organizations engage in CSR activities, one thing we do know is that organizations typically engage in CSR initiatives to receive some sort of benefit. The positive benefits associated with CSR activities are not straightforward as the novelty around CSR initiatives dwindles and becomes more prevalent. Prior studies suggest that the degree to which stakeholders associate an organization’s motives as either egoistic or altruistic can impact the effectiveness of its CSR activities through increased legitimacy (Salaiz et al., 2020; Kuo & Chen, 2013). Nowadays, organizations must signal to stakeholders that their CSR initiatives are genuine as stakeholders are wary of falling prey to organizations’ hypocrisy. Corporate hypocrisy stems from a lack of corporate integrity resulting from stakeholder’s perception of a misalignment between an organization's claimed values and actions (i.e., word–deed misalignment). For example, stakeholders may perceive organizations a s committing corporate hypocrisy when, at face value, they engage in CSR activities purely for social benefit but are later exposed as engaging in CSR for ulterior motives, such as financial motives (Fassin & Buelens, 2011). Organizations engaging in CSR initiatives for bogus reasons are faced with negative consumer beliefs (Arli et al., 2017), distrust and skepticism towards their environmental claims (Chen & Chang, 2013), negative word-of-mouth and lower purchase intentions as well as stock market sanctions (Bansal & Clelland, 2004) and constant bad publicity from the media and social activists. Therefore, not only is it important for organizations to engage in CSR activities but it is paramount for them to signal stakeholders the genuine nature of their intent behind their CSR initiatives (Garcia-Sanchez et al., 2014; Giannarakis et al., 2014).

This study seeks to make three important contributions to the accumulated body of work on the relationship between CSR, CSP and firm performance. First, this study introduces a new latent variable to CSP, CSR report authenticity. While a lot of attention had focused on the direct relationship between CSP and firm performance, we have much to learn when it comes to identifying the latent factors that influence organizations’ CSP. This study contributes to an important call in the literature by assessing the intent behind the CSR initiatives. Additionally, we “flip the script” and attempt to look at CSP from another perspective – in a mediating perspective. Rather than assess the relationship between CSR and CSP as any other study has in the past, this study is the first to integrate a novel approach by breaking away from traditional modeling by proposing that CSP may, in fact, be a mediating variable which affects the relationship between CSR intent and firm performance. Finally, this study extends our current knowledge by introducing a new mediating variable inside the nomological network between CSP and firm performance. Specifically, this new mediating variable, grounded in signaling theory, aims to explain why traditional CSR research have failed to reach a consensus on the relationship between CSR and CSP. This new variable posits that organizations that signal their CSR initiatives to salient stakeholders through CSR reports for example will only reap the benefits from their CSP when they actually follow-through on their promise, or CSR signals.

Unlike prior research that examines these relationships using survey methodologies (e.g., Han et al., 2020; Kim, 2019), this study uses a novel approach by using a mixed-methods approach. This study not only relies on archival data to assess a firm’s CSR and CSP rankings but also combines qualitative analyses to extrapolate the intent behind a firm’s CSR initiative. To date, a firm’s intent has only been analyzed using survey methodologies asking employees of a specific firm whether or not they believe the intent behind their organization’s CSR initiatives were genuine. This study bypasses the limitations or survey methodologies by extrapolating the intent of a firm through the language it uses when using signals, such as CSR reports, to its stakeholders. Further, this study is, to the author’s knowledge, the first to leverage a double-mediated approach to examining the CSR-CSP-firm performance relationships. Using Preacher & Hayes’ (2008) methodology allows for each mediated variable (CSP and CSR intent) to be fully accounted for when looking at their individual impact on firm performance.

Literature Review

Intention behind CSR Initiatives

There are many social and political forces that drive organizations to engage in CSR initiatives (Heslin & Ochoa, 2008). However, organizations’ decision to engage in CSR activities is perceived by stakeholders as either authentic or inauthentic in their intent. Stakeholders perceive organizations’ CSR initiatives to possess an authentic intent when the initiative is one that is internal to the organization with no expectation of returns and is altruistic in nature whereas an inauthentic intent refers to CSR activities that are born out of opportunism (i.e., external) and have financial return expectations (Jeon & An, 2019). Organizational stakeholders’ evaluations of CSR activities come from their perception of an organization’s CSR initiatives as genuine and a true expression of the organization’s beliefs and behavior toward benefiting society extending beyond its legal requirements (Alhouti et al., 2016). A benefit to authentic CSR initiatives is its ability to draw an emotional response from stakeholders. How to best bring this affective and emotional response from stakeholders is a key component to creating a unified community between stakeholders and organizations. Conversely, inauthentic CSR decisions do not allow people to band together emotionally and any organizational efforts would appear as hypocritical, or opportunistic, limiting any positive impact on the firm, Inauthentic CSR decisions are viewed as manipulative efforts from organizations to fulfill some sort of agenda over benefiting some societal goal. In fact, research has shown that consumer perception of firms’ intentions positively affects firms’ reputation and consumer. We identify CSR intent, either authentic or inauthentic, to play a key strategic role in organizations’ decision to engage in CSR activities.

Assessing the intent of CSR, specifically the aspect of authenticity, would help us differentiate whether organizations engage in CSR activities for the purpose of social (i.e. authentic) or financial welfare (i.e. inauthentic). The operationalization of CSR intent has always been the greatest challenge researcher’s face in benchmarking CSR as authentic or simply a façade masking inauthentic intention. Existing studies looking into CSR intent as authentic or inauthentic are mostly theoretical or qualitative, largely exploring authenticity solely on the basis of employee perceptions. Rather than relying on employee perceptions, examining the sense-making dimension can provide a more reliable basis for determining the nature of CSR initiatives in place of evaluating an organization’s activities portfolio that may be prone to manipulation. Recent research suggests that CSR reports make an excellent sense-making tool that organizations leverage to signal the intent behind their CSR initiatives (Zerbini, 2017) in an effort to enhance their legitimacy amongst their salient stakeholders (e.g., Handelman & Arnold, 1999) and develop a positive social responsibility image (e.g,; Sen & Bhattacharya, 2001).

This study’s approach benchmarks CSR intent based on the rhetoric used in the signaling of organizations’ CSR initiatives to their stakeholders (Kim, 2019). Similar approaches have been used in strategy (Short & Palmer, 2008), entrepreneurship (looking at the entrepreneurial orientation; Short et al., 2009 & 2010), leadership (Bligh et al., 2004a &b; Bligh & Robinson, 2010). Robinson, 2010), accounting (for the study of image management) and communicative action. By creating an authentic variable through computer-assisted text analysis software (CATA), we can determine the intent behind organizations’ CSR initiatives signaled to their stakeholders and remove any employee perception biases.

H1 The authenticity of organizations’ CSR report is positively associated to firms’ financial performance.

H2 The authenticity of organizations’ CSR report is positively associated to firms’ CSP.

CSP as a Mediating Variable

The direct relationship between CSP and firm performance has garnered much interest among scholars; the findings are rather inconclusive and somewhat misleading. Meaning, while a predominant number of researchers have found there to be a positive association between CSR and firm performance (e.g., Van Beurden & Gössling, 2008), others have suggested a negative and even no correlation to exist (e.g. Aupperle et al., 1985; Crisóstomo et al., 2011).

This lack of consensus has led some scholars to voice concerns regarding our current empirical approach to testing the direct effect of CSP and firm performance. They argue that a direct examination between CSP and firm performance cannot be reliable because the direct link may be influenced by other variables in its nomological network. Thus, the relationship between CSP and firm performance may be more complex than previously suggested and theorized. Taking an unconventional approach, we hypothesize that scholars can include CSP not as a direct factor to firm performance but rather as a mediator between CSR intent and firm performance.

H3 CSP will mediate the relationship between CSR intent and firm performance.

Substantive versus Symbolic CSR

The impact of CSR initiatives on CSP varies from one firm to the other. He explains that such disparity, which is reflected by the inconclusive results from CSP – CFP research, may be attributed to factors not yet specified. Meaning, there are undefined factors which have not been discovered that can affect the relationship between CSP and firm financial performance. Therefore, CSR may show a positive outcome on firm financial performance in certain situations, while showing a negative or no effect in other circumstances. One of the factors we believe determines whether CSR initiatives have a positive, negative or neutral effect on firm financial performance is CSR substantiveness.

CSR initiatives can be broadly understood as a signaling process in which firms’ send signals regarding their CSR intent to salient stakeholders (Weigelt & Camerer, 1988); stakeholders in turn use these signals to form impressions or relations of these organizations. CSR is increasingly relevant to strategic choices and strategic activities (Porter & Kramer, 2006) and is part of firms’ signaling strategies. There are two principle means by which CSR is expected to positively shape stakeholders’ assessment of firms’ initiatives: substantive CSR actions and symbolic CSR actions. Substantive CSR actions are actions that reflect an organization’s attempt at achieving its CSR goals. Therefore, substantive CSR means that organizations are walking-the-talk regarding their CSR initiatives. On the other hand, symbolic CSR refers to organizations that talk a big game, but does not follow-through on its CSR signals. Drawing on the theoretical foundation of symbolic management, symbolic actions occurs when organizations signal to salient stakeholder’s initiatives or positive organizational attributes without the intent of following-through. This is exemplified in CSR reporting in developing countries where CSR reporting is used as a symbolic tool to exploit the positive effects of engaging in CSR initiatives without any follow-through on said signaled initiatives (Hahn et al., 2016). Hence, we believe that the relationship between CSP and performance to be, in part, attributable to the substantiveness of organizations’ CSR initiatives.

H4 Substantive CSR will mediate the relationship between CSP and firm performance

H5 Substantive CSR will mediate the mediated relationship between CSR report authenticity, corporate social performance and firm performance

Study Design and Methodology

Sample Selection

The sample was selected from Corporate Responsibility (CR) Magazine’s list of the 100 Best Corporate Citizens for the years 2011-2015. This is the ranking featured in Fortune Magazine’s annual ranking of the world's most admired and respected companies. The organizations included in CR Magazine’s corporate citizenship lists are from the Russell 1000 database. The 100 Best Corporate Citizens database is built on publicly-available data sources (i.e., all data must be publicly available in order to be included in the data set). The selection of this sample is appropriate as it follows the logic behind Bhattacharya & Sen’s (2003) assertion that organizations must make the information available to stakeholders in order to reap the benefits from CSR initiatives. CR Magazine’s Corporate Citizenship database incorporates 298 data elements among seven data categories (environment, climate change, employee relations, human rights, governance, finance, and philanthropy). The methodology weights the seven data categories according to the relative importance of each category, which was determined by CR Magazine’s methodology committee. From the data gathering efforts, the final sample was comprised of a total of 314 firm-year observation across a five-year window (Figure 1).

Measurements

CSR intent

The report authenticity variable was collected through a qualitative analysis of organizations’ annual corporate citizenship reports. As previously mentioned, organizations utilize annual CSR report to signal their CSR strategies to salient stakeholders (Scalet & Kelly, 2010). This study utilized the Linguistic Inquiry and Word Count Engine (LICW) to content analyse the annual citizenship reports. Attention was focused on the authentic variable computed by LIWC. CSR reports with authentic intent were associated with a more honest, personal, and disclosing text whereas lower authentic intent scores suggest a more guarded, distanced form of discourse.

Corporate social performance

The scores obtained for CSP were gathered from CRwire’s world’s best corporate citizen report (Also known as Fortune magazine’s Most Responsible Companies). The report computes the score by calculating the seven components of CSR (environment, climate change, employee relations, human rights, governance, finance, and philanthropy), which are then added to compose the weighted average score. Using the scores form the Most Admired Companies as a proxy for CSP is consistent with prior work in strategy research of CSR (e.g., Anderson & Smith, 2006).

Substantive CSR

Since substantive CSR is the ratio of walking-the-talk, we calculate the variable using a three-step approach. First, to measure the “talk” component of CSR initiatives, we content analyzed the corporate citizenship reports using DICTION software. DICTION is CATA software that allows researchers to build (customize) dictionaries in order to quantify texts. To create our “talk” measure, we created seven custom dictionaries that reflect each component of CSR. Second, we follow previous CSR work and measured the “walk” component (i.e., CSR actions) through the Kinder, Lyndenberg and Domini (KLD) ratings. Finally, substantive CSR was calculated by dividing the DICTION score by the KLD ratings.

Firm performance

Firm performance was used as the sole dependent variable in this study and was measured by calculating firms’ Return on Investment (ROI). Data were gathered from WRDS’ COMPUSTAT database.

Control variable

In terms of measurement of control variables, this study utilized firm size where firm size is measured by natural logarithm of net sales. Following prior work, it was decided to base the measure of financial slack on leverage, and measured slack using the equity-to-debt ratio.

Hypotheses testing

We used a two-step approach to assess this study’s hypotheses. First, to test the direct relationship hypothesized in H1 and H2, we used linear regression. Following, in order to test the moderating hypotheses, Baron & Kenny's (1986) procedure is employed which discusses the four steps in establishing mediation. First, a significant relation of the independent variable to the dependent variable is required. Second, a significant relation of the independent variable to the hypothesized mediating variable is required. Third, the mediating variable must be significantly related to the dependent variable. Fourth, to establish that the mediating variable completely mediates the relationship, the effect of independent on dependent variable should be no longer significant.

The second step entails assessing the specific mediating effects associated with CSP and CSR substantiveness in a sequential double-mediation model. To investigate these relationships, we rely on Preacher & Hayes’s (2008) PROCESS macro which allows for the modeling of a sequential, double-mediation approach. This method allows for the evaluation of specific mediated effect of an independent variable on a dependent variable when the model includes more than one mediator. Therefore, the conditions for mediation were analyzed (for each mediator) according to the causal steps approach outlined by Baron & Kenny (1986). When multiple mediators are present, it is critical to assess each specific mediated effect because summing the total mediated effects does not reveal the accurate mediated effect as said effect may be due to other mediating effects (Bollen, 1990; Cheung & Lau, 2007; Preacher & Hayes, 2008). To avoid this pitfall, Preacher & Hayes’ (2008) PROCESSS macro was leveraged which allows for the investigation of specific mediated effect of each mediating variable in a sequential-mediation model.

Results

Tables 1 present the descriptive statistics and correlation matrix for the model variables in this study. To explore in more detail the relationship among in the first two hypotheses, an OLS regression analyses for the ROI and CSP was performed. The OLS results in Table 2 show that the authentic CSR intent is positive and significant (0.004, p <0.05) for its direct on firm performance. Therefore, hypothesis 1 is supported. Additionally, Table 2 also demonstrates that authentic CSR intent is positive and significant (0.002, p<0.05) in its direct relationship to CSP. Therefore, the results also prove support for hypothesis 2.

| Table 1 Descriptive Statistics and Correlation for Continuous Variables | ||||||||||

| Variable | Mean | SD | Min | Max | 1 | 2 | 3 | 4 | 5 | 6 |

| 1. Slack | 0.65 | 0.49 | -0.17 | 2.55 | 1.00 | |||||

| 2. Size | 98.68 | 157.01 | 2.77 | 2200.00 | -0.15** | 1.00 | ||||

| 3. CSR Intent | 13.37 | 3.82 | 1.00 | 23.20 | -0.06 | 0.30** | 1.00 | |||

| 4. CSP | 13.95 | 8.97 | 0.00 | 44.00 | 0.10 | 0.21** | 0.17** | 1.00 | ||

| 5. Substantive CSR | 3.94 | 5.06 | 0.00 | 43.32 | -0.04 | -0.08 | -0.11 | -0.52** | 1.00 | |

| 6. ROI | 0.13 | 0.11 | -0.41 | 0.60 | 0.05 | 0.17** | 0.19** | 0.16** | -0.18** | 1.00 |

| Table 2 OLS Regression Results | ||||||

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| s | B | Std. Error | Beta | |||

| 1 | (Constant) | 0.085 | 0.013 | 6.595 | 0.000 | |

| Slack | 0.011 | 0.012 | 0.049 | 0.895 | 0.372 | |

| Size | 0.000 | 0.000 | 0.151 | 2.716 | 0.007* | |

| CSR intent | 0.002 | 0.001 | 0.129 | 2.333 | 0.020* | |

| 2 | (Constant) | 0.046 | 0.024 | 1.947 | 0.052 | |

| Slack | 0.018 | 0.013 | 0.078 | 1.401 | 0.162 | |

| Size | 9.69E-5 | 0.000 | 0.139 | 2.393 | 0.017* | |

| CSR intent | 0.004 | 0.002 | 0.151 | 2.621 | 0.009* | |

To test the mediated hypotheses (H3 and H4) we follow Baron and Kenny’s (1986) four step approach. First, a test of the direct relationship between CSP and firm performance and CSR substantiveness and firm performance was performed. The results gained from the first step model (CSR-FP and CSRSub-FP) show that there is a positive and significant relationship between CSP and firm performance and CSR substantiveness and firm performance.

To test hypothesis 3, CSP was entered as the mediating variable between CSR intent and firm performance. It was revealed that there is a significant relationship between CSR intent and CSP (0.26, p<0.05), and CSP to performance (0.001, p<0.05). It is worth noting that there is still a significant relationship between authentic CSR intent and firm performance (0.004, p< 0.05) which means that the relationship is only partially mediated by CSP. Therefore, hypothesis 3 is partially supported.

The process was repeated to test outlined above to test the mediating effect of CDR substantiveness on the direct relationship between CSP and firm performance. It was revealed that there is a significant relationship between CSP and CSR substantiveness (0.29, p<0.001), and CSR substantiveness to performance (.003, p <.05). It is worth noting that in this case, that there is no longer a significant relationship between CSP and firm performance (0.000, p=0.35). This shows that the CSP and firm performance relationship is a fully mediated relationship through CSR substantiveness Therefore, hypothesis 4 was supported.

To test the final model, the sequential double-mediation model, the Preacher & Hayes’ (2008) approach was leveraged to investigate the multiple mediators. Preacher & Hayes (2008) propose assessing multiple mediators through a bootstrapping procedure of the observed variables. While an SEM approach accounts for measurement error, Preacher & Hayes’ (2008) method can quantify specific indirect effect associated with each unique mediator (a feature not currently possible using AMOS). Therefore, the regression-based estimates of IO, MO, organization commitment to CSR, and CEO charisma were used. Much like the SEM approach, a bootstrapping approach with 2000 samples to provide us with the effects, 95% bias-corrected confidence intervals, and p-values for the indirect effects was used. Table 3 details the results of our analysis. It is important to note that the mediated path from CSP to firm performance is no longer significant (0.001, p=0.53) when CSR substantiveness is included as a sequential mediator. Therefore, the results of the analysis show that CSR substantiveness fully mediates (0.003, p <0.05; LLCI .000 ULCI 0.006) the mediated relationship between authentic CSR intent, CSP, and firm performance. Therefore, the results offer support for hypothesis 5.

| Table 3 Result of the Sequential Double-Mediated Analysis | |||||||

| OUTCOME VARIABLE:ROI | |||||||

| Model Summary | |||||||

| R | R-sq | MSE | F | Df1 | Df2 | p | |

| 0.279 | 0.078 | 0.011 | 5.223 | 5.000 | 308.000 | <0 .001 | |

| Model | coeff | se | t | p | LLCI | ULCI | |

| constant | 0.060 | 0.027 | 2.235 | 0.026* | 0.007 | 0.1129 | |

| CSR intent | 0.003 | 0.002 | 2.290 | 0.023* | 0.001 | 0.007 | |

| CSP | 0.001 | 0.001 | 0.627 | 0.530 | -0.001 | 0.002 | |

| CSR sub | 0.003 | 0.001 | 1.980 | 0.048* | 0.000 | 0.006 | |

| Slack | 0.015 | 0.013 | 1.157 | 0.248 | -0.010 | 0.039 | |

| Size | 0.000 | 0.000 | 2.081 | 0.038* | 0.000 | 0.002 | |

| DIRECT AND INDIRECT EFFECTS OF X ON Y | |||||||

| Direct effect of X on Y | |||||||

| Effect | se | t | p | LLCI | ULCI | ||

| 0.004 | 0.002 | 2.291 | 0.023 | 0.000 | 0.001 | ||

| Indirect effect(s) of X on Y: | |||||||

| Effect | BootSE | BootLLCI | BootULCI | ||||

| TOTAL | 0.0005 | 0.0003 | -0.0001 | 0.0011 | |||

| Ind1 | 0.0001 | 0.0002 | -0.0002 | 0.0006 | |||

| Ind2 | 0.0001 | 0.0002 | -0.0002 | 0.0005 | |||

| Ind3 | 0.0002 | 0.0002 | 0.0000 | 0.0006 | |||

| Indirect effect key: Ind1 Authenti -> CSR_Perf -> ROI Ind2 Authenti -> CSR_Walk -> ROI Ind3 Authenti -> CSR_Perf -> CSR_Walk -> ROI |

|||||||

Discussion and Implication

Oblivious that no concrete direct relationship between CSR and firm performance exist, many studies have attempted to examine this relationship directly. Some found positive relationships, while others were found to be negative or neutral (e.g., Aupperle et al., 1985). These studies did not clarify, or add much value as to how CSR can be associated with firm performance positively, negatively, or neutrally. In an attempt move beyond the insanity of assessing the direct relationship solely authors contend that examining specific drivers of social performance rather than its indicators would be more beneficial. Therefore, we followed this advice by introducing a new latent variable which aims at addressing how organizations gain value from their CSR initiatives. In addition, by examining a firm’s authentic intent, we fill a gap in the literature by looking at the reason behind which organization leverage CSR initiatives. Our result suggests that organization that signal and engagement in CSR initiatives that are more authentic experience greater levels of CSP, which in turn, leads to greater firm performance. This can help strategic leaders understand that the signals sent to stakeholders have an effect on how their behavior is assessed.

In addition to introducing a new latent variable, we attempted a new approach to the conceptualization of CSP. Although corporate social responsibility and performance attract considerable attention there appears to be a lack of understanding of mediating effects affecting CSP relationships (Aguinis & Glavas, 2012). Only a few studies mentioned and/or attempted to apply a contingency approach in examining this relationship. For analyzing the real effects of CSR on financial benefits, omitted mediators and moderators should be applied. To address this void, this study introduces two mediating variables. First, we flip the script by proposing that CSP be viewed as a mediating variable between CSR intent and firm performance. Second, we contribute to the CSR literature by identifying the underlying mechanism through which CSR activities influence firm performance. Specifically, we extend CSR literature by theoretically proposing and empirically showing that the effects of CSR on firm performance are mediated by a firm’s substantive action to CSR initiatives. Our result should be of particular interest to practitioners in that it suggests that signaling to stakeholders that you are engaging in CSR activities is not enough anymore. In fact, because of increase engagement from corporations, stakeholders are now expecting firms to engage in CSR activities (Van Beurden & Gössling, 2008). However, our study suggests that a firm’s ability to follow-through on its promise delivered through corporate citizenship reports may provide firms with the differentiating factor in the battle for competitive advantage. That is, leaders should pay close attention to make sure that their organization’s CSR initiatives reflect the strategic direction of the firm. By creating this alignment between strategy and action firms may be able to show substantive CSR action and garner greater bottom-line performance.

Additionally, this study holds value for scholars and practioners in the green and sustainable supply chain management fields. Studies on green supply chain management (GSCM) and sustainable supply chain management (SSCM) have long looked at the role inside and outside stakeholders play in a firms’ decision to engage in these initiatives (Ahi & Searcy, 2013; Uygun & Dede, 2016). This study contends that understanding a firm’s intent is not only paramount to helping form and foster customers’ positive interpretation of an organization but also plays a key role in what firm initiatives a firm can engage in to foster this genuine interpretation from customers. Gong et al. (2019) note that research should seek to understand the reasons behind firm’s decision to engage in SSCM initiatives. While prior researchers have identified key drivers behind SSCM initiatives (Zimon et al., 2019 & 2020), this study posits that firms should not only look at the key drivers behind the implementation of SSCM but should also consider how these initiatives are perceived by stakeholders in order to maximize their sustainability efforts. While prior studies on SSCM have stressed the importance for firms to engage in sustainable innovation (Kusi-Sarpong et al., 2019), little work has been done to understand how firms can increase their bottom line by engaging in sustainability innovation initiatives that resonate with the organization’s stakeholders. Future scholars should identify and investigate what criteria of interest matters for stakeholder when they consider whether or not a firm’s sustainable supply chain management innovation advancement appears to be genuine or not.

Conclusions and Limitations

Several limitations exist in this study. First, rather than using traditional regression type analyses, scholars have voiced preference for CSR researchers to use structural equation modeling (SEM). Some authors have also claimed that SEM is superior on both theoretical and empirical statistical grounds. This is because SEM is a second-generation statistical technique, which concurrently tests the causal relationship between multiple dependent variables and independent variables contrary to first generation techniques like factor analysis, discriminate analysis and multiple regressions, which cannot. They also claim that the SEM is considered better than the traditional regression because it can reduce bias by taking measurement errors into account. Additionally, SEM approaches were consistently more powerful in detecting a mediation result than regression approach. While we concede that SEM may have added a bit more strength to our results, the PROCESS macro utilized for our third hypothesis testing still provides us superior benefits than that of SEM.

The second limitation of this study relates to the organizations chosen in the analyses. The organizations were all chosen from the list of Fortune magazine’s most admired companies which contains a relatively large percentage U.S. companies (87%), and as such, the relations found cannot be generalized to other cultural contexts. Recent research on CSR suggests there are cultural differences in the way organizations decide to engage in and react to CSR initiatives (Jamali & Mirshak, 2007). The use of additional organizations from more diverse regions of the world would have provided more generalizability to our results.

Finally, the firm performance variable utilized in this study was only measured through one item, ROI. Firm performance could have been measured through seven items which are related to the financial performance in Balanced Scorecard (BSC) methodology. Developed by Robert Kaplan and David Norton in 1992 the Balanced Scorecard methodology is a comprehensive approach that analyzes an organization's overall performance in four ways and has been suggested to be one of the best instruments to measure performance. Measuring financial perspective in firm performance is one of the dimensions in this methodology. Therefore, we could have included Return on Equity (ROE), Return on Sales (ROS) Return on Assets (ROA), and net profit margin of the firm as monetary accounting performance construct.

In conclusion, the findings from this study make several contributions to the CSP nomological domain. We contributed to the understanding by introducing authentic CSR intent. CSR intent contributed to overcome some of the ambiguity surrounding why some organizations engaging in CSR initiatives achieved higher levels of CSP over others. Additionally, we attempted to overcome some of the ambiguity surrounding the relationship between CSP and firm performance by proposing that CSP act as a mediating variable between CSR initiatives and firm performance. Finally, we extended the CSR literature by introducing that CSR substantiveness, as a sequential mediator to CSP, which could help explain the inconclusive results from previous research examining the direct CSP -firm performance results.

References

- Aguinis, H., & Glavas, A. (2012). What we know and don’t know about corporate social responsibility a review and research agenda. Journal of Management, 38(4), 932-968.

- Ahi, P., & Searcy, C. (2013). A comparative literature analysis of definitions for green and sustainable supply chain management. Journal of Cleaner Production, 52, 329-341.

- Alhouti, S., Johnson, C.M., & Holloway, B.B. (2016). Corporate social responsibility authenticity: Investigating its antecedents and outcomes, Journal of Business Research, 69(3), 1242-1249.

- Anderson, J., & Smith, G.N. (2006). A great company can be a great investment. Financial Analysts Journal, 62(4), 86-93.

- Angus-Leppan, T., Metcalf, L., & Benn, S. (2010). Leadership styles and CSR practice: An examination of sensemaking, institutional drivers and CSR leadership. Journal of Business Ethics, 93(2), 189-213.

- Arendt, S. & Brettel, M. (2010). Understanding the influence of corporate social responsibility on corporate identity, image, and firm performance. Management Decision, 48(10), 1469-1492.

- Aupperle, K.E., Carroll, A.B., & Hatfield, J.D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446-463.

- Bansal, P. & Clelland, I. (2004). Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Academy of Management Journal, 47(1), 93-103.

- Baron, R.M., & Kenny, D.A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173-1182.

- Bhattacharya, C.B., & Sen, S. (2003). Consumer-company identification: A framework for understanding consumers’ relationships with companies. Journal of Marketing, 67(2), 76-88.

- Bianchi, E., Bruno, J.M., & Sarabia-Sanchez, F.J. (2019). The impact of perceived CSR on corporate reputation and purchase intention. European Journal of Management and Business Economics, 28(3), 206-221.

- Bligh, M.C., & Robinson, J.L. (2010). Was Gandhi ‘charismatic’? Exploring the rhetorical leadership of Mahatma Gandhi. The Leadership Quarterly, 21(5), 844-855.

- Bligh, M.C., Kohles, J.C., & Meindl, J.R. (2004a). Charisma under crisis: Presidential leadership, rhetoric, and media responses before and after the September 11th terrorist attacks. The Leadership Quarterly, 15(2), 211-239.

- Bligh, M.C., Kohles, J.C., & Meindl, J.R. (2004b). Charting the language of leadership: a methodological investigation of President Bush and the crisis of 9/11. Journal of Applied Psychology, 89(3), 562.

- Bollen, K.A. (1990). A comment on model evaluation and modification. Multivariate Behavioral Research, 25(2), 181-185.

- Carroll, A.B. (2015). Corporate social responsibility: The centerpiece of competing and complementary frameworks. Organizational Dynamics, 44(2), 87-96.

- Cheung, G.W., & Lau, R.S. (2007). Testing mediation and suppression effects of latent variables: Bootstrapping with structural equation models. Organizational Research Methods, 11(2), 296-325.

- Crisóstomo, V.L., de Souza Freire, F., & De Vasconcellos, F. C. (2011). Corporate social responsibility, firm value and financial performance in Brazil. Social Responsibility Journal, 7, 295-309.

- Fassin, Y., & Buelens, M. (2011). The hypocrisy?sincerity continuum in corporate communication and decision making. Management Decision, 49(4), 586-600.

- Garcia-Sanchez, I.M., Cuadrado-Ballesteros, B., & Sepulveda, C. (2014). Does media pressure moderate CSR disclosures by external directors?. Management Decision, 52(6), 1014-1045.

- Giannarakis, G., Konteos, G., & Sariannidis, N. (2014). Financial, governance and environmental determinants of corporate social responsible disclosure. Management Decision, 52(10), 1928-1951.

- Gong, R., Xue, J., Zhao, L., Zolotova, O., Ji, X., & Xu, Y. (2019). A bibliometric analysis of green supply chain management based on the Web of Science (WOS) platform. Sustainability, 11(12), 3459.

- Han, H., Chi, X., Kim, C.S., & Ryu, H.B. (2020). Activators of airline customers’ sense of moral obligation to engage in pro-social behaviors: Impact of CSR in the Korean marketplace. Sustainability, 12(10), 4334.

- Handelman, J.M., & Arnold, S.J. (1999). The role of marketing actions with a social dimension: Appeals to the institutional environment. The Journal of Marketing, 63 (3), 33-48.

- Heslin, P.A., & Ochoa, J.D. (2008). Understanding and developing strategic corporate social responsibility. Organizational Dynamics, 37(2), 125-144.

- Jamali, D., & Mirshak, R. (2007). Corporate social responsibility (CSR): Theory and practice in a developing country context. Journal of Business Ethics, 72(3), 243-262.

- Jeon, M.A., & An, D. (2019). A study on the relationship between perceived CSR motives, authenticity and company attitudes: a comparative analysis of cause promotion and cause-related marketing. Asian Journal of Sustainability and Social Responsibility, 4(7), 1-14.

- Kim, S. (2019). The process model of corporate social responsibility (CSR) communication: CSR communication and its relationship with consumers’ CSR knowledge, trust, and corporate reputation perception. Journal of Business Ethics, 154(4), 1143-1159.

- Kuo, L., & Chen, V.Y.J. (2013). Is environmental disclosure an effective strategy on establishment of environmental legitimacy for organization?. Management Decision, 51(7), 1462-1487.

- Kusi-Sarpong, S., Gupta, H., & Sarkis, J. (2019). A supply chain sustainability innovation framework and evaluation methodology. International Journal of Production Research, 57(7), 1990-2008.

- Porter, M.E., & Kramer, M.R. (2006). The link between competitive advantage and corporate social responsibility. Harvard Business Review, 84(12), 78-92.

- Preacher, K.J., & Hayes, A.F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879-891.

- Salaiz, A., Evans, K., Pathak, S., & Vera, D. (2020). The impact of corporate social responsibility and irresponsibility on firm performance: New insights to an old question. Organizational Dynamics, 49(2), 100698.

- Scalet, S., & Kelly, T.F. (2010). CSR rating agencies: What is their global impact?. Journal of Business Ethics, 94(1), 69-88.

- Sen, S., & Bhattacharya, C.B. (2001). Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. Journal of Marketing Research, 38(2), 225-243.

- Short J.C., & Palmer T.B. (2008). The application of DICTION to content analysis research in strategic management. Organizational Research Methods, 11, 727-752.

- Short, J.C., Broberg, J.C., Cogliser, C.C., & Brigham, K.C. (2009). Construct validation using computer-aided text analysis (CATA): An illustration using entrepreneurial orientation. Organizational Research Methods, 13(2), 320-347.

- Short, J.C., Payne, G.T., Brigham, K.H., Lumpkin, G.T., & Broberg, J.C. (2010). Family firms and entrepreneurial orientation in publicly traded firms: a comparative analysis of the S &P 500. Family Business Review, 22(1), 9-24.

- Tian, X., & Slocum, J.W. (2016). Managing corporate social responsibility in China. Organizational Dynamics, 45(1), 39-46.

- Uygun, Ö., & Dede, A. (2016). Performance evaluation of green supply chain management using integrated fuzzy multi-criteria decision making techniques. Computers & Industrial Engineering, 102, 502-511.

- Van Beurden, P. & Gössling, T. (2008). The worth of values–a literature review on the relation between corporate social and financial performance. Journal of Business Ethics, 82(2), 407-424.

- Weigelt, K., & Camerer, C. (1988). Reputation and corporate strategy: A review of recent theory and applications. Strategic Management Journal, 9(5), 443-454.

- Zerbini, F. (2017). CSR initiatives as market signals: A review and research agenda. Journal of Business Ethics, 146(1), 1-23.

- Zimon, D., Tyan, J., & Sroufe, R. (2019). Implementing sustainable supply chain management: reactive, cooperative, and dynamic models. Sustainability, 11(24), 7227-7249.

- Zimon, D., Tyan, J., & Sroufe, R. (2020). Drivers of sustainable supply chain management: Practices to alignment with un sustainable development goals. International Journal for Quality Research, 14(1), 219-236.