Research Article: 2022 Vol: 25 Issue: 5

The Effect of Board Diversity on Firm Performance: Evidence from Non-Financial Firms Listed in Pakistan Stock Exchange

Nargus Batool, GIFT University

Qasim Saleem, GIFT University

Zaheer Abbas, GIFT University

Citation Information: Batool, N., Saleem, Q., & Abbas, Z. (2022). The effect of board diversity on firm performance: Evidence from non-financial firms listed in Pakistan stock exchange. Journal of Legal, Ethical and Regulatory Issues, 25(5), 1-14.

Abstract

Purpose-The-Study has aim to investigate how different board diversity attributes like age, gender, education and experience effect on firm-performance of non-financial-firms that is listed in Pakistan-stock exchange (PXS). Design/methodology/approach- A total of 100 non-financial firms listed in Pakistan stock exchange (PSX) were selected. The data were collected form the non-financial firms during the period of 2012-2020(n=540). The data were analyzed using GMM model to test the effect of board diversity on firm performance. Findings-Based on Resource Dependence theory and Behavioral Agency theory this study found that board gender and board education has significant relationship between firm performance and board age and board experience has insignificant relationship with firm performance. Therefore, this research suggests that policy makers should formulate regulations and support the Diversity of Directors. Research limitations-The present study include the demographic variables of board diversity like age, gender, education and experience; but excluded nationality and religion. The results recommend that board diversity in corporate boards is an attractive research topic in developed and under developed countries because diverse board of directors can carry the different knowledge, skills, abilities, expertise and experience in the firm that ultimately improving the firm performance. Corporate governance mechanisms are still needed in developing countries especially in Pakistan. This research paper provides insights to investors and shareholders on how to enhance their firm performance in term of financial growth. Originality/value-According to the author’s knowledge, this study delivers the empirical analysis of the relationship between board diversity and firm performance from the side of non-financial firms. The results will give both theoretically and empirically to the prevailing knowledge.

Keywords

Board Diversity, Firm Performance, Resource Dependence Theory, Behavioral Agency Theory.

Introduction

In the past, Organizations did not value board diversity factors and this concept has not been fully discussed or explored by academia. With the emergence of behavioral finance, the concept of board diversity between the directors has entered this field, and has received more and more attention from academics and even business Professionals. Now researchers define it competitively and explore each part of diversity without mutual agreement. Therefore, scholars have different definitions of board diversity in terms of meaning and background. For a long time, researchers have been disturbed about the relationship with the variety of dimensions of board diversity and diverse results at the company level. To increase the board diversity, mostly countries approve legislation to make sure the presence of female directors in corporate boards. A board gender diversity effect on firm performance is a growing debate and many countries focus on increase in women directors in board. Growing evidence shows that the involvement of women on the boards of directors is positively linked with the firm performance. Female directors are considered to be more energetic in attending board meetings and they improve performance. Mostly studies considered gender diversity is the only important attribute of board, but board diversity also have many other attributes like age, experience and education also effects the firm performance. Greater board diversity would bring large set of expertise, knowledge, skills and resource and also improve the overall operations of the firms. Board diversity is important for the firms because board diversity gives the firms strategies (Farag & Mallin, 2017).

In recent years, more and more concentration has been compensated to the gender diversity in board members. This concentration stems from the explosion of regulations in most developed countries, which recommend growing the number of female representation on board of directors to an equal level. In addition to ethical reasons, there are controversies in the economic world about the potential effect of gender equality on firm performance and other company uniqueness. The experiential evidence is very perplexing, and studies have established positive results, negative and mixed results or there is no relationship with gender and firm performance. In addition, establish that female directors significantly improved firm performance. Female directors are considered important because women and men have different characteristics, women are more efficient and active than men, Male and female representatives on the board are considered more efficient, active and social than men. Female come into view to be more risk averse and have opinions on other aspects of management (Al-Qahtani & Elgharbawy, 2020). This study investigates the relationship between board of directors and firm performance. The board of directors performs different consistent functions. Board of directors connects the company with external environment, enhancing the authority of the company. Also, a board director participates in the formulation of the tactical direction of the firm and reviews the advancement of its implementation (Bernile et al., 2018). There may be several reasons researchers didn’t study the functions of the board directors to facilitate strategic-change decisions. The management is believed to dominate the board of directors in making strategic decisions. Also, the exact strategic role of the board of directors still lacks clarity due to a lack of theoretical explanation. The board of directors generally has significant power on strategic changes, as well as the hiring and firing of shortfall managers, the reversal of deprived Strategic Decisions, and the evaluation of the strategic firm performance (Anifowose et al., 2017; Elmagrhi et al., 2018; Katmon et al., 2019; Ismail & Latiff, 2019).

Pakistan is still a developing country under the development stage of corporate governance (Makhlouf et al., 2018). There is a need to enhance corporate governance phenomenon and mechanism by studying and analyzing varies codes of governance like board diversity which severely lacks in under Pakistan’s corporate environment. It is significant to observe how several board diversity dimensions can enhance practices of corporate governance by decreasing corporate risk prevailing and enhance firm performance in Pakistani context. This study is important to be carried out because it sheds light on the importance of board diversity in Pakistan’s corporate sector as firm performance. The study is unique in Pakistani background as it takes into account education background, age diversity, gender diversity, experience in the investigation that is not commonly studied in literature specifically in Pakistan’s corporate environment. This investigation also uses control variables that are Firm size, total liability, total assets and liquidity that leads to firm financial performance in the corporate sector. This study have main objective to investigate the impacts of board diversity factors, as specified, on the financial performance of the company (Unite et al., 2019; Baker et al., 2020; Colakoglu et al., 2020; Al-Saidi, 2021). This study makes many contributions to the existing literature; there were a number of studies available on the measurement of financial performance. Whereas, there is no detailed study available on the connection between board diversity and firm financial performance in the non-financial firms listed in Pakistan stock exchange with the GMM model analysis. Most of the previous studies mainly focus on the Chinese or European context. Secondly, most of the existing researches like use only one attribute of diversity gender as the only significant factor of board diversity improve firm performance.

The reminder of the dissertation is as follows. Section 2 describes literature research and hypothesis development. Section 3 describes how to collect data from a sample, describe variables, and measure. Section 4 describes and interprets the results. And finally, complete the work in Section 5.

Literature Review and Hypothesis Development

The Effect of Board Diversity on Firm Performance

The relationship between board diversity and company and performance has been extensively studied in the literature and is considered a notorious topic in the context of progressive corporate governance. The literature presents two conflicting views on board diversity and corporate performance. On the one hand, behavioral agency theory explains the benefits of the diversity attribute of the board. First, behavior agency theory describes relationship with firm directors, CEOs and managers. Behavioral agency theory also identifies the assumptions and explains the board of director’s behaviors and describes the environmental condition. Behavioral agency theories explore the difficulties in board of director’s risk taking behavior. Many studies focus on how o improve the performance of firm through board of directors and how to reduce risk of the firm and understand the Rational Decision making, Boards, Internal controls, and Corporate Governance mechanism (Ooi et al., 2017). This theory assumes that the agents are rational in decision making and taking risk to improve firm performance and wealth. The skills, knowledge and experience of board of directors also influence the managerial decisions.

Moreover, this theory explain about how the firm performance through board of directors so, behavioral agency theory support our variables that is mentioned in framework and justify the relations between the board diversity vs. firm performance. On the other hand, an organization operates in a release structure and needs to exchange and obtain Resources to carry on, which makes the company dependent on the outside world. The four main benefits of external contacts as resources: (1) Information and professional knowledge; (2) Establishment of communication channels with important parts of the company; (3) Commitment to provide hold up from major organizations; (4) In the External environment Generate legality for the company. Resource dependence theory proposes that board directors join your firm with other external firms to solve the problem of environmental dependence. In this case, diversification board directors has expanded the communication channels, networks and contacts of the company, expanded the possibility of obtaining financing and improved relationships with competing companies and clients. For example, some entities appoint directors to their boards of directors to communicate with their clients. Therefore, the connections that directors provide with dependent external resources can increase key resources, thus improving the firm performance. Board of directors will provide resources. Mostly literature focuses on resource dependency theory revolves mainly around the functional experience of managers rather than gender. So, the different resources that the directors can contribute to the board directors have not been well explored.

Corporate Governance relies on the Board of Directors and focuses on the philosophy of transparency, responsibility, fairness, and corporate governance, which is considered the basis of the corporate governance framework. Of several factors that represent different aspects of a company's board, board diversity is becoming the most important issue in corporate governance. Board diversity is the heterogeneity among board members. It includes different categories such as age, gender, ethnicity, nationality, education, profession, skills, experience, preferences (political and sexual preferences), religion, and more. According to resource-based view theory, more diverse boards can attract more resources. Various institutions improve the quality of the company's strategic decision-making, identify and meet stakeholder requirements, and improve the company's reputation and performance. When classifying different types of diversity, a common technique is to distinguish between observable and non-observable attributes. Observable or easily identifiable attributes include demographics such as gender, race, ethnicity, and age. Unobservable or underlying attributes include cognitive characteristics such as education, seniority, professional background, and personal values. Observable attributes appear to be the focus of most diversity studies. Despite unobservable properties, unobservable attributes can make significant differences in consistency with organizational problems and styles of interaction. I am. In onboard diversity research, researchers may use one or more attributes as a proxy for diversity. The gender of board members seems to be the most commonly observed characteristic. Other observable features examined in the current literature include racial or ethnic background (Carter et al., 2003), age and nationality. Less often, researchers have been in office education level and professional background.

The Effect of Board Gender Diversity and Firm Performance

Based on the behavioral agency theory the directors brought fresh opinions and different professional backgrounds Related to problem solving ability, the improvement of creativity and innovation and the improvement of access to information. Females are more risk-averse remains weak, with gender playing only a small role in accounting for the variance in risk attitudes and the variances changing depending on the methodologies adopted. The stereotypical view may not necessarily apply to specific groups, and more specifically, male and female managers are not only found to have similar risk preferences but they also make equal or similar quality decisions. Limited number of studies on the topic together with a lack of consensus by these researchers point to the need for further investigation and to provide a better and nuanced understanding of gender differences in financial decisions and thus risk taking in firms. In general terms, women will bring different knowledge, experiences, knowledge, as well as other ways to solve problems. On the basis of these intrinsic characteristics of women, Female directors can add value to meetings by offering different perspectives also discussing that women's guidelines contribute to meetings through the provision of legitimacy with consequent improvement of the image of a company and the provision of experience that Include the supply of internal company information through direct information and consultancy and consulting administration. The theory of resource addiction suggests that the provision of council resources is directly related to the firm performance. According to several researchers, there is a significant positive correlation with gender diversity of the executive board and the value of the firm (Karavitis et al., 2021). Found a positive correlation between gender diversity and firm performance of community development credit funds in the United States. According to the existing literature, this study hypothesizes that;

H1: Board gender diversity has positive and significant effect on Firm performance.

The Effect of Board Educational-Diversity and Firm Performance

In the management literature, education level is regarded to the measurement of person's knowledge, skill and cognitive ability. Knowledge, skills, and cognitive abilities are recorded in business strategies. The knowledge and skills of decision makers in the training help to participate in strategic decision-making because they can better suppose environmental opportunities and transform into important strategies. Research distinguishes between observable and unobservable (cognitive) characteristics. Observable characteristics usually include characteristics such as gender, age, and ethnicity. Based on the ambiguous results referred to in the level of education of administrators on company performance, If the board members have diverse educational background, the more likely they are differ in their views on the process and the way they respond to the problems faced by the board, and these differences may lead to higher levels of cognitive conflict. These conflicts arise, since you can expect that the highest educated females are eager to show their skills and impose their ideas that lead to a conflict of relationships and a bad dynamics of the board of directors. This conflict of reports in the council can lead to tensions, the discomfort and animosity between the directors and the performance of the company negative influence (Qureshi et al., 2020).

In contrast, the adverse effects of diversified board experience include hampering company performance. Some studies have found there is insignificant relationship with diversified board experience diversity and firm performance. According to the existing literature, this study hypothesizes that;

H2: A higher level education of board directors negatively and significant influences on Firm performance.

The Effect of Board Age-Diversity and Firm Performance

Age is considered a double-edged weapon and at the same time linked to more experience, while linking to higher risk aversion and loss of productivity (Bear et al., 2010). You are less likely to make changes. But young people are associated with strategic change. Older directors are less likely to go bankrupt (Ferreira, 2010). However, other studies have found that the relationship between age diversity and company performance is not important. According to the available literature, this study makes a hypothesis.

H3: Board age diversity boards and Firm Performance has non-significant relationship.

The Effect of Board Experience Diversity and Firm Performance

It is reported that the independence of board directors will weaken as director experience increases, and the extension of the board's experience will cause members to become more important in decision-making. they are usually related to providing valuable advice and improving board efficiency (Liu et al., 2020) directors keep their distance from new ideas. When making important decisions, long-term boards of directors are influenced by their own beliefs and plans. Several studies consistently report that the resistance of directors to change increases as the tenure of the board of directors increases. Short-term terms of office are intended to help progress the supervisory ability of board directors, as rotation encourages the arrival of newcomers and thus encourages different attitudes and perceptions of certain situations or decisions. Therefore, the board experience of previous researchers has a negative impact on company performance evidence of knowledge-intensive companies in India 2017. In contrast, the adverse effects of diversified board experience include hampering company performance. Some studies have found there is insignificant relationship with diversified board experience diversity and firm performance. According to the existing literature, this study hypothesizes that:

H4: Board experience diversity has non-significant influences on Firm performance.

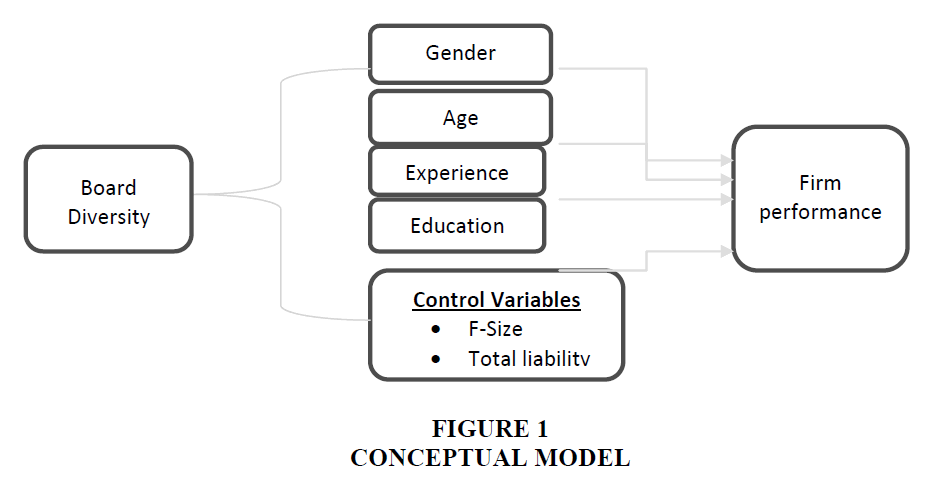

Conceptual Framework

The Conceptual Framework has been developed with the theoretical background and empirical evidence of the relationship between board diversity and corporate performance in the board. Based on behavioral agency theory and resource dependence theory, we will explain the relationship between the diversity of the board of directors of non-financial companies listed on the Pakistan Stock Exchange and corporate performance. In this study, we added diversity attributes that were not considered in previous literature, such as age, education, experience, and corporate performance, and added an important role in corporate social responsibility. By doing so, I expanded my research. The proposed conceptual model is shown below (Figure 1).

Data Source and Sample Size

Data is collected from 100 non-financial listed firms on the PSX during the time period 2012-2020. The primary reason for selecting non-financial firms, because Pakistan is a developing country with a huge number of non-financial firms listed in Pakistan Stock Exchange, almost 36 industries are working in the country, but less focused has been made on the non-financial sector in terms of firm performance as impacts of board diversity. It is believed that effect of board diversity on firm performance is significant and apparent in non-financial firms. Quantitative studies used for testing of theories and hypothesis. The assumptions in the quantitative approach are more likely to be consistent with positivism research paradigm. Positivism paradigm generally focuses on the objective approach. It is the objective reality of research questions irrespective of beliefs of researchers. This study would be deduction which means this research paper used narrow to broader concept that means in this study used other board diversity variables like age, experience, and education. Moreover, Pakistani firms have been considered as it is still a developing market hence, there is necessity to enhance corporate governance procedures by recommending Governance codes. The data has been collected for variables such as gender, experience, age and education diversity and ROA as a variable to measure firm performance. Therefore, the financial and non-financial sector cannot be analyzed simultaneously. Moreover, the financial sector is bound to maintain the minimum capital reserve requirements and hence it is obligatory for them to follow the central bank rules and regulations (Manita et al., 2020). The panel regression model is used to examine the impact of board diversity on corporate performance. This study focused on developing a model for empirically estimating the impact of board diversity on corporate performance. Company performance is an important factor in increasing the wealth of shareholders. Board diversity, on the other hand, is an independent or explanatory variable that has a significant impact on a company's performance. When members of the board work efficiently, the company increases the profitability of the company. Company performance is a dependent variable, and board diversity is an independent variable along with control variables (company size, liquidity, total assets and total liabilities) as shown in Table 1.

| Table 1 Variables Explanation and Measurement | ||

| Variables Name | Abbreviation | Measurements |

| Dependent variables Firm performance |

FP | It is calculated by the total number of assets and net income of the firm. e.g.; ROA. |

| Independent variables Board gender diversity |

GEN | It is computed taking percentage or number of male and female executives working on the company’s board. |

| Board age diversity | AGE | It is estimated on the base of total numbers of years of birth. |

| Board education diversity | EDU | It is computed by the utilization of five categories of education level such as Associate degree, Bachelor, Masters, Ph.D., and professional certifications (CA, ACCA, CMA, etc.) (Beath et al., 2021). |

| Board experience diversity | EXP | It is calculated on base of total numbers of worked on the workplace. |

| Control variables Firm size |

F-Size | Log of total assets (Carter et al., 2003) |

| Total assets | TA | Total assets held by the company |

| Liquidity | Liquidity | Current ratio=current Assets/Current liability |

| Total liability | T.L | Total liabilities held by the company (Miller & Del-Carmen, 2009) |

Methodology

The study is designed to test the power of corporate board diversity on firm performance in Pakistani firms, the dependent variable is firm performance and age, gender, experience, and education are independent variables. The following statistical methods are used to test the hypothesis.

1. Descriptive statistics.

2. Correlation matrix.

3. Pooled OLS model/Fixed effect model/Random effect model/GMM model.

Descriptive statistics is the technique which is used describes the basic aspects of collected data for the study. This technique is helpful for the researcher in providing simple summarizes regarding the measures and samples. They are simply used to analyze the normality and reliability of data and to examine frequency of the data. The matrix of correlation is utilized to summarize data as and input into additionally advanced analysis as test of diagnostics for advanced analysis that is regression analysis.

The grouped OLS method is known as a model type that has stable and fixed coefficients, referring to both pendants and interceptions. For this model, researchers can group all information and data and perform the "model of Ordinary Square" of the OLS. It can be used to obtain coherent and impartial estimates of the parameters even in the presence of attributes relating to constant time. The safety model is used to measure the difference between the transverse units. Therefore, these units are captured in the differences between the interception and the constant term of the regression model varies between the transversal units. On the other hand, in the random effect model, the individual impacts are verified and distributed randomly between the transversal units to capture the individual impacts. The regression model is specified by the interception of the term that highlights the general term. Therefore, in this research, the discovered methods are applied to study the impacts and influences of the diversity of the board of directors at a business risk. The GMM model is used to study the relationship between board diversity and company performance. The different characteristics of the board of directors affect the decision-making process and thus the business process. The characteristics of the board of directors do not take into account some factors that cause endogenous problems.

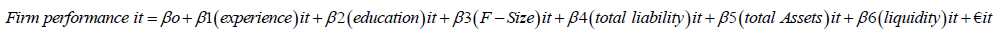

In the GMM model, the size, total assets, liquidity, and total liabilities of a company are determined endogenously, and the company strives for optimal levels and weighs emergency costs against tax benefits. In addition, since all variables are based on accounting value, they are determined endogenously and exacerbate the problem of endogeniety. Dynamic panel data was used in the study to avoid endogenous problems. The calculated selected variables are presented in the form of multiple regression equations to achieve the research goals. In the GMM model above, this study used the lag value of the dependent variable as the independent variable in the dynamic panel model. This dynamic panel model was developed to determine the mean reversion behavior of enterprise performance. This shows that the performance of the previous year affected the performance of the current year, indicating the speed of adjustment. In light of the above discussion, our regression equations and models are:

Relation Oriented Equation

Task Oriented Equation

Results

Univariate Analysis

Table 2 shows the statistical outputs, mean, standard deviation. The total number of observations are (n=540). Standard deviation and mean are high values its means data has normal distribution and sample size are greater.

| Table 2 Descriptive Statistics | |||||

| Variables | Obs | Mean | SD | MAX | MIN |

| ROA | 540 | 0.17 | 9.28 | 22.16 | -78.09 |

| Gen F | 540 | 0.575 | 0.76 | 3.0000 | 0.00000 |

| Gen M | 540 | 5.86 | 1.49 | 10.000 | 3.0000 |

| Edu-M | 540 | 15.90 | 3.175 | 42.0000 | 14.0000 |

| Edu-F | 540 | 15.18 | 1.442 | 38.0000 | 14.0000 |

| Age-M | 540 | 4.2876 | 5.6000 | 58.0000 | 19.0000 |

| Age-F | 540 | 1.3326 | 8.2259 | 65.0000 | 24.0000 |

| Exp-M | 540 | 23.76 | 12.860 | 56.0000 | 6.0000 |

| Exp-F | 540 | 39.07 | 14.193 | 68.000 | 4.0000 |

| F-size | 540 | 5.28 | 0.906 | 7.318 | 2.651 |

| TA | 540 | 1039115.0 | 2949724.3 | 20803776 | 325.0000 |

| Liquidity | 540 | 2.94 | 3.096 | 18.29 | 0.000186 |

| TL | 540 | 509813.0 | 137986.9 | 13325973 | 1459.000 |

Task oriented variables have greater mean and less standard deviation as compared to relation oriented variables Table 3.

| Table 3 Correlation Matrix | |||||||||||||

| Variables | ROA | Gen F | Gen M | Edu-F | Edu M | Exp-F | Exp-M | Age-F | Age-M | TA | TL | Liquidity | F-size |

| ROA | 1 | ||||||||||||

| Gen F | -0.07 | 1 | |||||||||||

| Gen M | 0.04 | -0.335 | 1 | ||||||||||

| Edu F | -0.19 | 0.002 | 0.054 | 1 | |||||||||

| Edu M | -0.02 | -0.064 | 0.07 | 0.35 | 1 | ||||||||

| Exp F | -0.04 | -0.005 | 0.277 | 0.113 | -0.048 | 1 | |||||||

| Exp-M | -0.04 | -0.08 | 0.07 | 0.081 | 0.137 | 0.174 | 1 | ||||||

| Age-F | 0.16 | -0.14 | -0.42 | -0.14 | 0.188 | -0.248 | -0.241 | 1 | |||||

| Age-M | -0.16 | 0.099 | -0.07 | 0.105 | -0.18 | -0.02 | -0.209 | -0.09 | 1 | ||||

| TA | 0.07 | 0.105 | 0.007 | 0 | -0.011 | 0.009 | -0.169 | 0.05 | 0.023 | 1 | |||

| TL | 0.153 | 0.076 | -0.04 | -0.05 | 0.0067 | -0.011 | -0.1377 | 0.072 | -0.014 | 0.479 | 1 | ||

| Liquidity | 0.056 | -0.015 | 0.07 | -0.05 | -0.076 | -0.028 | -0.098 | 0.065 | 0.0297 | 0.313 | -0.11 | 1 | |

| F-size | 0.152 | -0.011 | 0.018 | -0.01 | 0.032 | -0.007 | -0.0155 | 0.074 | 0.051 | 0.501 | 0.334 | 0.346 | 1 |

Correlation coefficient shows the strong relationship of firm performance with control variables and shows the weak relationship with independent variables. The characteristics of the board of directors do not take into account some factors that cause endogenous problems. In the regression model, when there is a correlation between the error terms, the variables solve the problem of endogeneity. In addition, these problems may be caused by auto regression with missing variables, measurement errors, and autocorrelation errors. Therefore, it is imperative to control the endogenous nature of the diversity problem of the analysis committee. Therefore, in order to solve this endogenous problem, many economic methods are used to solve endogenous problems, but GMM model is very suitable to solve endogenity. GMM is the greatest model in dealing with endogeneity. Table 4 shows the results GMM model results.

| Table 4 Relation Oriented | ||||

| ROA | Coefficient | Standard Err. | t-value | p-value |

| L.ROA | 0.061*** | 0.013 | 4.677 | 0.000 |

| Gen F | 31.83*** | 5.356 | 5.945 | 0.000 |

| Gen M | 29.68*** | 4.46 | 6.632 | 0.000 |

| Age M | 0.261 | 0.791 | 0.329 | 0.7 |

| Age F | 0.233 | 0.589 | 0.395 | 0.6 |

| F-Size | 0.828 | 0.786 | 1.054 | 0.3 |

| TA | 0.000*** | 0.000 | 3.133 | 0.00 |

| TL | -0.000 | -0.000 | -0.907 | 0.3 |

| Liquidity | -0.927*** | 0.213 | -4.38 | 0.000 |

| *** p<.01, ** p<.05, * p<.1 | ||||

Table 4 results shows that firm performance has positive and significant relationship with board gender diversity and board age has positive insignificant relationship with firm performance. So, firm performance has no link with board director’s ages. However, age diversity does not have the same impact on growth opportunities or market outlook. Perhaps older board members hate risk. Gender diversity has a positive and significant impact on the implementation of activities. Women tend to bring the following leadership and special skills into the meeting room, high ethical standards, risk aversion, cooperation, and less radical decisions can all contribute to improving a company's performance. Empirical evidence provided significant support for women in company meetings, but suggested that women's instructions were better prepared for the meeting, including meeting sessions, discussion processes, and as a result. The quality of the company's performance is greatly improved. Therefore, the aforementioned studies supported the H1 and H3 hypothesis (Colakoglu et al., 2020).

Table 5 results shows that firm performance has negative and significant relationship with board education diversity because due to high level of education many conflicts arises. So, many researchers reported negative and significant relationship with firm performance. Above mentioned Studies support hypothesis H2 (Feng et al., 2020). Another difference between the two types of directors is the changing diversity of education. This shows that in a segmented work environment where social barriers exist between groups with different backgrounds, the company's performance is negatively impacted and significantly impacted.

| Table 5 Task Oriented | ||||

| ROA | Coefficient | Standard Err. | t-value | p-value |

| L.ROA | -0.204*** | 0.029 | -6.87 | 0.000 |

| Edu F | -21.42*** | 1.038 | -20.64 | 0.000 |

| Edu M | 27.16*** | 2.137 | 12.71 | 0.000 |

| Exp F | -0.16 | 0.323 | -0.49 | 0.6 |

| Exp M | 0.571 | 0.42 | 1.36 | 0.2 |

| F-Size | 0.200 | 0.69 | 0.289 | 0.2 |

| TA | 0.000*** | 0.000 | 5.328 | 0.000 |

| TL | -0.000 | -0.000 | -1.66 | 0.2 |

| Liquidity | -0.326* | 0.229 | -1.42 | 0.1 |

| *** p<.01, ** p<.05, * p<.1 | ||||

Board experience has insignificant relationship with firm performance. So, firm performance has no link with board director’s experience. Several studies agree in reporting that directors’ conflict to change increases with years of experience. Short experience should help to increase the ability for monitoring of board of directors. So, according to the pervious researcher and above Table shows that board experience diversity has insignificant influence on the firm performance (ROE). Above mentioned Studies support hypothesis H4. (Martinez-Jimenez et al., 2020; Beji et al., 2021; Reguera-Alvarado & Bravo-Urquiza, 2020; Rehman et al., 2020).

Therefore, in relation to our general hypothesis, we find some evidence that board gender diversity and board training are more important to the company's performance than board age and experience increase.

Discussion

This research covers the vacant literature on board diversity by investigative the relationship with firm performance. Board of directors is one of the main governance mechanisms that help to support the interests of managers and shareholders (Ullah et al., 2020). Composition of board of directors can affect the decision-making process, which, one by one, influences on firm performance. The percentage of females in the workforce has increased every day. The main reason for testing the relationship with the board of directors and firm performance is to (1) provide further evidence of the relationship between board diversity (Age, Experience, and Education) and firm performance in the PSX environment. We found the following results. Table 3 & 4 shows that Board gender and education diversity have significant correlated with ROA. Board experience and board age have non-significant relationship with firm performance. This finding is consistent with the view of resource dependence theory and behavioral agency theory, which shows that directors are in a good position to provide the company with key resources so that they can do better (Zhang, 2020; Harjoto et al., 2015; Kuebbing et al., 2021). In our study, board diversity is a phenomenon that is too complex to be fully understood from a single point of view, and as a complement to traditionally used theories, cognitive and behavioral factors. Shows a deeper study, including consideration and board analysis-dynamics is board performance and efficiency.

Conclusion

For practical implications, the diversity of textile industry and sugar industry is currently an important issue; the results of the survey will serve corporate shareholders as a practical guideline in the selection of board members. This means that if a textile company wants to appoint a new candidate for the board, it will need to make more detailed decisions, taking into account the impact of board diversity on the company's performance. With a particular emphasis on gender diversity, corporate shareholders can benefit from the diverse and accumulated human capital (knowledge, perspectives, ideas & know-how) of both male and female boards of directors. There is increasing research on board diversity, which can be an important area of board diversity research. Like any other study, this study has its limits. First, we considered only the effects of the following four variables on board gender, age, educational background, and experience. However, Pakistan's diversity provides its own research background, with great diversity in many other features such as language diversity, religious diversity, caste diversity, and regional diversity. Pakistan's population is made up of people who share the world's major religions. However, because the data is not available, other related demographic aspects cannot be taken into account. Second, we use only second-hand data to investigate the impact of diversity on the board. For future studies, preliminary research can be conducted to supplement the findings. Finally, because the survey focuses on non-financial companies in Pakistan, the survey may not apply to other industries or countries. Future studies may weigh the impact of board diversity across multiple countries.

References

Al-Saidi, M. (2021). Boards of directors and firm performance: A study of non-financial listed firms on the Kuwait Stock Exchange. Corporate Ownership & Control, 18(2), 40-47.

Indexed at, Google Scholar, Cross Ref

Al-Qahtani, M., & Elgharbawy, A. (2020). The effect of board diversity on disclosure and management of greenhouse gas information: Evidence from the United Kingdom. Journal of Enterprise Information Management, 33(6), 1-9.

Indexed at, Google Scholar, Cross Ref

Anifowose, M., Rashid, H.M.A., & Annuar, H.A. (2017). Intellectual capital disclosure and corporate market value: does board diversity matter? Journal of Accounting in Emerging Economies, 7(3), 1-9.

Indexed at, Google Scholar, Cross Ref

Baker, H.K., Pandey, N., Kumar, S., & Haldar, A. (2020). A bibliometric analysis of board diversity: Current status, development, and future research directions. Journal of Business Research, 108, 232-246.

Indexed at, Google Scholar, Cross Ref

Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207-221.

Indexed at, Google Scholar, Cross Ref

Beath, C., Chan, Y., Davison, R.M., Dennis, A.R., & Recker, J.C. (2021). Editorial board diversity at the basket of eight journals: A report to the college of senior scholars.Communications of the Association for Information Systems: CAIS.

Indexed at, Google Scholar, Cross Ref

Beji, R., Yousfi, O., Loukil, N., & Omri, A. (2021). Board diversity and corporate social responsibility: Empirical evidence from France. Journal of Business Ethics, 173(1), 133-155.

Indexed at, Google Scholar, Cross Ref

Bernile, G., Bhagwat, V., & Yonker, S. (2018). Board diversity, firm risk, and corporate policies. Journal of Financial Economics, 127(3), 588-612.

Indexed at, Google Scholar, Cross Ref

Carter, D.A., Simkins, B.J., & Simpson, W.G. (2003). Corporate governance, board diversity, and firm value. Financial Review, 38(1), 33-53.

Indexed at, Google Scholar, Cross Ref

Colakoglu, N., Eryilmaz, M., & Martínez-Ferrero, J. (2020). Is board diversity an antecedent of corporate social responsibility performance in firms? A research on the 500 biggest Turkish companies. Social Responsibility Journal, 17(2), 1-9.

Indexed at, Google Scholar, Cross Ref

Elmagrhi, M.H., Ntim, C.G., Malagila, J., Fosu, S., & Tunyi, A.A. (2018). Trustee board diversity, governance mechanisms, capital structure and performance in UK charities. Corporate Governance, 18(3), 1-9.

Indexed at, Google Scholar, Cross Ref

Farag, H., & Mallin, C. (2017). Board diversity and financial fragility: Evidence from European banks. International Review of Financial Analysis, 49, 98-112.

Indexed at, Google Scholar, Cross Ref

Feng, X., Groh, A., & Wang, Y. (2020). Withdrawn: Board diversity and CSR.

Indexed at, Google Scholar, Cross Ref

Ferreira, D. (2010). Board diversity. Corporate governance: A synthesis of theory, research, and practice.

Harjoto, M., Laksmana, I., & Lee, R. (2015). Board diversity and corporate social responsibility. Journal of Business Ethics, 132(4), 641-660.

Indexed at, Google Scholar, Cross Ref

Ismail, A.M., & Latiff, I.H.M. (2019). Board diversity and corporate sustainability practices: Evidence on environmental, social and governance (ESG) reporting. International Journal of Financial Research, 10(3), 31-50.

Indexed at, Google Scholar, Cross Ref

Karavitis, P., Kokas, S., & Tsoukas, S. (2021). Gender board diversity and the cost of bank loans. Journal of Corporate Finance, 71.

Indexed at, Google Scholar, Cross Ref

Katmon, N., Mohamad, Z.Z., Norwani, N.M., & Al-Farooque, O. (2019). Comprehensive board diversity and quality of corporate social responsibility disclosure: evidence from an emerging market. Journal of Business Ethics, 157(2), 447-481.

Indexed at, Google Scholar, Cross Ref

Kuebbing, S.E., McCary, M.A., Lieurance, D., Nuñez, M.A., Chiuffo, M.C., Zhang, B., & Meyerson, L.A. (2021). A self-study of editorial board diversity at Biological Invasions. Biological Invasions.

Indexed at, Google Scholar, Cross Ref

Liu, Y., Lei, L., & Buttner, E.H. (2020). Establishing the boundary conditions for female board directors’ influence on firm performance through CSR. Journal of Business Research, 121, 112-120.

Indexed at, Google Scholar, Cross Ref

Makhlouf, M.H., Al-Sufy, F.J., & Almubaideen, H. (2018). Board diversity and accounting conservatism: Evidence from Jordan. International Business Research, 11(7), 130-141.

Indexed at, Google Scholar, Cross Ref

Manita, R., Elommal, N., Dang, R., Saintives, C., & Houanti, L.H. (2020). Does board gender diversity affect firm performance? The mediating role of innovation on the French stock market. International Journal of Entrepreneurship and Small Business, 39(1-2), 263-278.

Indexed at, Google Scholar, Cross Ref

Martinez-Jimenez, R., Hernández-Ortiz, M.J., &Fernández, A.I.C. (2020). Gender diversity influence on board effectiveness and business performance. Corporate Governance, 20(2), 307-323.

Indexed at, Google Scholar, Cross Ref

Miller, T., & Del-Carmen, T.M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management Studies, 46(5), 755-786.

Indexed at, Google Scholar, Cross Ref

Ooi, C.A., Hooy, C.W., & Som, A.P.M. (2017). The influence of board diversity in human capital and social capital in crisis.Managerial Finance.

Indexed at, Google Scholar, Cross Ref

Qureshi, M.A., Kirkerud, S., Theresa, K., & Ahsan, T. (2020). The impact of sustainability (environmental, social, and governance) disclosure and board diversity on firm value: The moderating role of industry sensitivity. Business Strategy and the Environment, 29(3), 1199-1214.

Indexed at, Google Scholar, Cross Ref

Reguera-Alvarado, N., & Bravo-Urquiza, F. (2020). The impact of board diversity and voluntary risk disclosure on financial outcomes. A case for the manufacturing industry. Gender in Management, 35(5), 1-9.

Indexed at, Google Scholar, Cross Ref

Rehman, S., Orij, R., & Khan, H. (2020). The search for alignment of board gender diversity, the adoption of environmental management systems, and the association with firm performance in Asian firms. Corporate Social Responsibility and Environmental Management, 27(5), 2161-2175.

Indexed at, Google Scholar, Cross Ref

Ullah, I., Zeb, A., Khan, M.A., & Xiao, W. (2020). Board diversity and investment efficiency: evidence from China. Corporate Governance: The International Journal of Business in Society, 21(4), 1-9.

Indexed at, Google Scholar, Cross Ref

Unite, A.A., Sullivan, M.J., & Shi, A.A. (2019). Board diversity and performance of Philippine firms: Do women matter? International Advances in Economic Research, 25(1), 65-78.

Indexed at, Google Scholar, Cross Ref

Zhang, L. (2020). An institutional approach to gender diversity and firm performance. Organization Science, 31(2), 439-457.

Indexed at, Google Scholar, Cross Ref

Received: 09-Dec-2021, Manuscript No. JLERI-21-10346; Editor assigned: 10-Dec-2021, PreQC No. JLERI-21-10346(PQ); Reviewed: 25- Dec-2021, QC No. JLERI-21-10346; Revised: 27-Jul-2022, Manuscript No. JLERI-21-10346(R); Published: 03-Aug-2022