Research Article: 2019 Vol: 18 Issue: 6

The Effect of Corporate Governance and Investment Opportunity Set on Dividend Policy and Companys Performance in Indonesia Manufacturing Company

Muhammad Saifi, Brawijaya University

Abstract

The good corporate management is one way to overcome the problem of inconsistency of interests. Companies with corporate governance will have a more effective monitoring mechanism that makes more efficient company operations so that the company’s performance will be improved. The effectiveness of the implementation of corporate governance that is assumed to improve company’s performance cannot be separated from financial decision making by company management. The aim of this research is to test and analyze the effect of corporate governance, investment opportunity set on dividend policy and company’s performance of manufacturing companies listed in Indonesia Stock Exchange. The data analysis utilized is Generalized Structural Component Analysis (GSCA). The result of this research shows that the corporate governance does not have a significant effect on the dividend policy and company’s performance; the investment opportunity set reciprocally has a significant positive effect on the dividend policy; the investment opportunity set reciprocally has a significant positive effect on the company’s performance; and the dividend policy has significant effect on the company’s performance.

Keywords

Corporate Governance, Investment Opportunity Set, Dividend Policy, Company’s Performance.

Introduction

The principles of corporate governance and its form of expansion, both external and internal mechanism that was designed to protect the shareholders and stakeholders have given an institutional support and had the right market oriented. The main principles of corporate governance becoming indicators as offered by Organization for Economic Cooperation and Development (OECD, 2004) are Fairness, Transparency, Accountability, and Responsibility. The implementation of those principles for the shareholders can be realized concretely by giving the rights to the shareholders in Rapat Umum Pemegang Saham (RUPS) or the annual general meeting of shareholders including: the right to attend and to vote in RUPS, the right to get the material information of the company in time, the right to get interests in the form of dividend (Hindarmojo, 2002; Park & Song, 2019; Hasanah et al., 2019). Lundstrum (2009) discusses about the effect of modal structure on the company’s performance based on the optimum capital structure. He states that the optimum capital structure is one that can maximize the company’s performance. There is a certain novelty value in this research that is this research is based on rationality, concept, and theory. In addition, the testing was done in an integrated manner and it reciprocates to investment opportunity set variable and dividend policy.

Literature Review

Organization for Economic Cooperation and Development (OECD, 2004) defines corporate governance as a system by which a corporation is controlled and is directed. The corporate governance structure divides the rights and responsibilities of the member participated in the company such as leader, managers, shareholders, and stakeholders through some rules and procedures of a decision making related to the company activity. By conducting the procedures based on the structure, the goal of the company can be obtained, achieved, and the supervision of the performance can also be conducted. Effendi (2009), Organization for Economic Co-operation and Development (OECD) with the members of United States of America, European countries (Austria, Belgium, Denmark, Norway, Ireland, France, Germany, Greece, Italy, Luxenberg, Netherlands, Poland, Portugal, Sweden, Switzerland, Turkey, England), Asia Pacific countries (Australia, Japan, Korea, New Zealand), was developed The OECD Principal of Corporate Governance in April 1988. The good corporate governance encourages the more democratic management of organization that is determined by many participants, the more accountable, systems that supervises and ask responsibility for every action, the more transparent. The investment opportunity set according to Myers (1984) is considered as a signaling theory from the management to the parties outside company. The investment opportunity set, based on any theoretical and empirical article, can be defined as the future growth prospect of the company from the perspective of investors and other external companies. A company that has a high investment opportunity set gives the high performance achievement with a big bonus for executives who can complete the target.

According to Scott Besley & Brigham (2008), dividend is cash outflow conducted by shareholders for the company profits that is earned from the current period or from the previous period. Meanwhile, capital gain is the profit that results from a capital asset where the sale price exceeds the purchase price that gets by the investors. The rise of dividend is usually followed by the rise of the stock price while the decline of the dividend growth caused the stock price falls. This fact makes the investors prefer having certain dividend today to having uncertain capital gain in the future.

Two approaches to measure the company’s performance according to Holt et al., 2008 are financial performance and firm value. Financial performance is an accomplishment by a company in a certain period based on the standard. The financial performance measurement utilized in this research is the financial performance measured by return on investment performance profitability. Meanwhile, firm value is an economic measure reflecting the market value of a business. Brealey et al. (2006) states that firm value are equal to present value of a company. In other words it is equal to the total asset value.

Method

The aim of this research is explanatory or confirmatory which means to explain the influence between variables through hypothesis test. This research is an archival research; a research utilized historical data and other information (Bordens & Abbott, 2011). The inferential statistics analysis utilized is Generalized Structured Component Analysis (GSCA). Tenenhaus et al. (2005) states that GSCA is a new method of SEM based on components that can be applied in a very little sample. In addition, GSCA can also be utilized in a structural model that included variable with reflective or formative indicator. This research was conducted in the manufacturing companies listed in Bursa Efek Indonesia (BEI) or Indonesia stock exchange in 2009 until 2013 that is divided into 19 industrial subgroup. During the 2009 to 2013 of period there are differences in the number of industrial companies listed in BEI.

Results

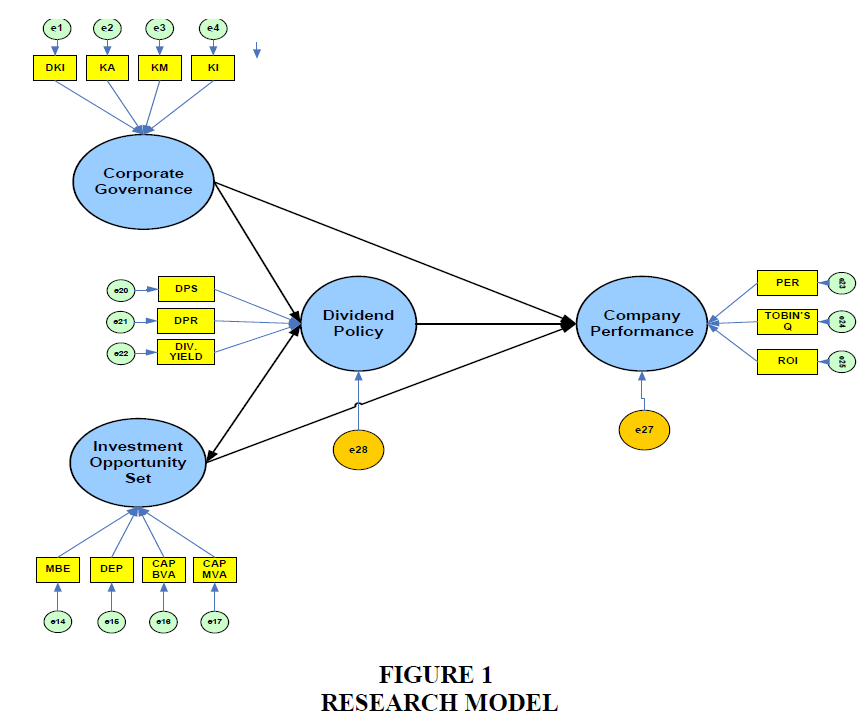

Research model is depicted in Figure 1. The result explains that the significant effect of the corporate governance is rejected. The direction of effect is positive which means that every change in the variable of corporate governance does not give a significant effect on the variable of the dividend policy. The result of this study less supports the signaling hypothesis theory which states that investors assume that the change in dividend is a signal for the good future prospect of the company. Other than that, the significant effect of the corporate governance on the company’s performance is rejected. The direction of effect is positive which means that every change in variable of corporate governance does not give a significant effect on the variable of the company’s performance.

In the effect of investment opportunity set on the dividend policy shows a significant positive which means that the raise of the investment opportunity set can raise the dividend policy. Reciprocally, the dividend policy has a significant effect on the investment opportunity set with a positive direction. It indicates that the raise of dividend policy can increase the investment opportunity set.

In the next result, the significant effect of the investment opportunity set is achieved. The direction effect is positive which means the increase of investment opportunity set can increase company’s performance. The significant effect of dividend policy on the company’s performance is accepted. The direction is positive which means the increase of dividend policy can increase company’s performance. The result of this research indicates that Indonesian investors prefer definite dividend to uncertain capital gain in the future.

Discussion

The result of this research explains that the corporate governance does not have a significant effect on the dividend policy and the company’s performance. The non-significant effect is caused by the concentration of ownership of the manufacturing company so that there is an affiliation connection between the owner, the supervisor, and the director of the company. Furthermore, the supervision by the independent commissioners in the non-fully independent company in Indonesia is caused by there are some companies that have independent commissioners with tenure of more than one period. The further reason is that many independent audit committees have more than one period of tenure that cause the independency of audit committee is doubtful. Based on the result of this research, the companies should make corporate governance become the corporate culture so that the implementation of corporate governance principles are not only for following the rule but it can also increase the company’s performance as a whole.

Conclusion

In conclusion, the corporate governance does not have a significant effect on dividend policy because of the concentration of ownership that can create affiliation relation between the owner, the supervisors, and the directors of a company. One of the reasons for the insignificance of corporate governance is that the independence of the audit committee becomes doubtful. The high investment opportunity set becomes the positive signal for the market which can ultimately improve the company’s performance. The dividend policy has a positive significant effect on the company’s performance so that most of the investors prefer having the certain dividend today to having the uncertain capital gain in the future.

References

- Besley, S., & Brigham, E.F. (2000). Essentials of managerial finance. South-Western Pub.

- Bordens, K.S., & Abbott, B.B. (2011). Research design and methods: A process account 8th ed.

- Brealey, R.A., Myers, S. C., & Allen, F. (2006). Corporate finance. Auflage, New York.

- Effendi, M.A. (2009). The power of good corporate governance: theory and implementation. Jakarta: Salemba Empat

- Hasanah, N., Anggraini, R., & Purwohedi, U. (2019). Single entry method as the way to improve small and medium enterprise governance. International Journal of Entrepreneurship, 23(1), 1-11.

- Hindarmojo, H. (2002). The Essence of Good Corporate Governance “Concepts and Implementation of Indonesian Public and Corporate Companies”. Jakarta: Indonesian Capital Market Education Foundation & Sinergy Communication.

- Lundstrum, L.L. (2009). Entrenched management, capital structure changes and firm value. Journal of Economics and Finance, 33(2), 161-175.

- Myers, S.C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 574-592.

- OECD, O. (2004). The OECD principles of corporate governance. Accounting and Administration.

- Park, S.Y., & Song, Y. (2019). The effect of managerial ability on a firm's dividend policy: Evidence from Korea. International Journal of Entrepreneurship, 23(1), 1-15.

- Tenenhaus, M., Vinzi, V.E., Chatelin, Y.M., & Lauro, C. (2005). PLS path modeling. Computational Statistics & Data Analysis, 48(1), 159-205.