Research Article: 2021 Vol: 20 Issue: 6S

The Effect of Green Loan and Ecological Sustainability on Pollution Depletion: Practical Evaluation in Developing and OECD Economies

Walaa Ismael Alnassar, University of Baghdad

Abstract

As the fossil energy consumption and the ever-worsening contamination of environment continue to expand, low-carbon improvement seems to be the only way to go. Green loan is an avenue for firms to reduce the finance pressure that comes from the reduction of carbon discharge. This loan has gained popularity worldwide in recent years due to the striking environmental issues from various economic activities. This research examines the role of green loan and CPIA policy (environmental sustainability index) in emission reduction with an application of a cross countries dataset of 82 countries in 2014. As revealed by the outcome, it is anticipated that the green loan and environmental sustainability policy give a positive impact on pollution reduction. This proposes that having the government endorse the green loan promote environmental sustainability can contribute to a much better and fresher ecosystem.

Keywords:

Green Loan, CPIA Policy and Institutions for Environmental Sustainability Rating, the Severity of Environmental Policy, Carbon Dioxide Emission, Regression Analysis

Introduction

Natural reserve waste and ecological pollution are indicators that humans cannot be easily avoided from development and subsistence. The international community is increasingly worried about the coordinated progress of economic growth and conservation environment. Declarations made in the “United Nations Framework Convention on Climate Change” in 1992, the “Kyoto Protocol” in 1997, the “Equator Principles” proposed by “financial institutions” around the world in 2002, the “Copenhagen Accord” in 2009 and the “Paris Agreement” in 2016, contain the global compromise in sustainable development and environmental protection. A lot of businesses are into transformation by promoting clean production and applying technique innovation so that the pressure of environment and resources can be lessened. To add, the governments support enterprises to proceed with environmental protection and energy conservation with the help of a series of efficient policies. Green loan is considered as a specific funding mode that advocates the “green production”. It could distribute “the economic resources” through those economic activities that can determine the environmental quality, address the climate change and save resources, where enterprises could expedite the processes of technique innovation that can yield clean production. “Additionally, it has been theorized that the environmental sustainability amendment have the potential to lower the rate of emission reduction (Li, Liao, Wang & Huang, 2018; Xu, Shangguan, Tan, Lu & Miao, 2018).

Green loan motivates an individual or firm to reduce carbon discharge. The loan permits borrower to spread the cost of borrowing over the time frame of 12-25 years. Green loan is applicable for various purposes as home purchase or installation of solar panel. There are Green savings accounts, Green credit cards, Online banking, Mobile Banking, also Remote deposit” (Maity, 2019).

The capability of banks to offer “long-term green loans” is restricted as their liabilities and of the insufficient number of instruments for hedging duration risks. For long-term green projects corporates that can only access short-term bank credit also face refinancing risks. If banks and corporates can produce medium- and long-term green bonds for green projects, the risks on the long-term green” financing can be assuaged (Boissinot, Huber & Lame, 2016).

There are dynamic activities when it comes to enabling environment for aggregation and” green securitization. The “European Central Bank” conducts a “loan data depository and the public 7 green investment banks” in the United States are warehousing green loans. The US Department of Energy and its “National Renewable Energy Laboratory” (NREL) had given support to a solar securitization initiative (Solar Access to Public Capital) that is now soaring to China (the Chinese PV Alliance) and Europe (RESFARM). In Mexico, a demonstration green securitization program for energy efficiency is underway, supported by the “Inter-American Development Bank” (Campiglio et al., 2018).

Evaluating the impact of green loan and environmental sustainability measures on CO2 emission reduction, and examining the relationship between Interest rate, GDP, FDI & CO2 emission in international view are the aims of this study. This is essential, as the latest empirical studies have laid an emphasis on homogenous country groups where most of the abovementioned variables were not analyzed together. They have the agreement that these variables can well affect pollution emission. However, the rest of the questions remain unanswered; for example, questions on the most influencing financial factors that affect CO2 emission. It can be seen at this point, that this study has given a significant contribution to the literature in the aspects of developed and developing scopes.

This research takes the following order. Section 2 concisely contains the literature on financial factors affecting CO2 emission and their impacts. The data collection and methodology are established in Section 3. Sections 4 points to some empirical outcomes which is then taken over by discussion and conclusions in Section 5.

Literature Review

The green loans market is still at its infancy and it is challenging to predict whether or not it can be successful or not at this point. The “green loan issuance requires very important phases like screening, labeling, disclosure and control-related activities, ultimately incurring some additional organizational and operational” costs. A large part of the above-mentioned charges is predictably independent from the amount of the loan. Thus, as Migliorelli & Dessertine (2019) stated, the economic viability of a wide implementation of “green loans” has been unclear at the moment, and the efficient usage of “green loans” may only be granted to large companies.

Although the literature on “green finance” has been quite extensive, most of them have laid an emphasis on the impacts and development by financial performance and banking progress. Few researches have stressed on the influences of “green loan” on the emission reduction management. In this section, some of the most contemporary studies particularly green loan under green finance will be scrutinized.

Kablana (2015) sees through the recent progresses made by Indian financial institutes and banks in terms of the ecological development and difficulties. Outcomes reveal that there is an urgency to raise awareness, apply and support green banking to provide the human friendly environment and augmented sustainability. Additionally, Kim & Park (2016) suggest that financial progress can contribute to the lessening of CO2 discharges by focusing on the role of commercial market in using renewable energy. To add, Liu & Liao (2017) demonstrated that green loan strategies curb investment efficiently in “energy intensive industry” and modify organizations with poor production.

Afterwards, Li et al., (2018) contemplate on the purpose of green loans for performance innovation amongst the banks, enterprises and government, and later find out that “green loan subsidies” offered by the government may alter the environmental quality by lowering the discharges when firms used the advanced procedures and technologies. Additionally, Xu, et al., (2018) run an examination on the “optimal solutions” in the “Stackelberg game” with “government and a monopolistic manufacturer having green production under the green loan policy. Having compared it with the optimal results under no green loan policy, the manufacturer’s profit, consumer surplus and environmental influence are all improved after the implementation of green loan policy, and there exists something called Pareto improvement. Moreover, Huang, Liao & Li (2019) improve a series of “game models” to establish openly the impacts of green loans and government subsidies on “green innovation activities of enterprises”. They have accepted the efficiency of “government subsidies as an intervention in supporting green innovation and environmental” protection. Lastly, Guo, et al., (2020) planned a “Three-Level Classification System of Green Technology” (CSGT) through a hybrid-method that marries the bottom-up and top-down approaches. The CSGT analyzed 2453 selected instances of green technologies. This CSGT concentrates on both immediate “green challenges and the ultimate goals of sustainable development by bringing together long-term visions and market practices, which can reflect on both the national green strategy and local demands.

Furthermore, highlighting environmental sustainability and quality, a lot of cross-country literature which links “environmental quality to governance or institutional quality has been established (for example, Panayotou, 1997; Lo?pez, 1997; Bhattarai & Hammig, 2001; Antweiler, Brian & Scott, 2001). With special regard to property rights and quality of” institutions, Panayotou (1997) proved that the faster the development of economic growth, the greater the populace density elevates the “environmental price of economic growth, but also the better policies” may compensate for these impacts and render economic growth more environmentally friendly and sustainable. Bhattarai & Hammig (2001) also emphasize the positive influences of the development in political “institutions and governance for forest preservation while using indices of political rights and civil” liberty in measuring institutional quality. In terms of the trade boundaries, Lopez (1997) discovered that “trade liberalization” lead to a much progressive deforestation in the Ghanaian economy. Antweiler, Copeland & Taylor (2001); Le, Chang & Park (2016) claimed that the impacts of “trade on the environment are manifold- technique, scale, growth and composition effects.

From this, during the last few decades, quite a large number of studies have looked into the determinants also the impacts of macroeconomics and financial elements and their impact on CO2 pollution. Since country-specific characteristics are not the same in each study, analysts are not expected to issue some conclusive sets of explanatory variables. Besides this, factors such as methodologies, sample-selections, analytical tools influence in giving justification to the diverse empirical evidence. Furthermore, the abovementioned literature shows that most of them did not see the green loan as a tool to help them promote emission reduction in their analyses. Also, within the author’s knowledge, this is the first study that adopts the cross-nationals analysis including more data in comparing with the previous study on the Green loan and CO2 emission. Thus, the outcome would be confirmed by using the alternative measurement of emission and other financial elements as well. Last but not least, the existing literature had not used the regression analysis to investigate the impact of green loan on pollution reduction. Hence, this study aims to bridge the gap and further address the existing debate in this field.

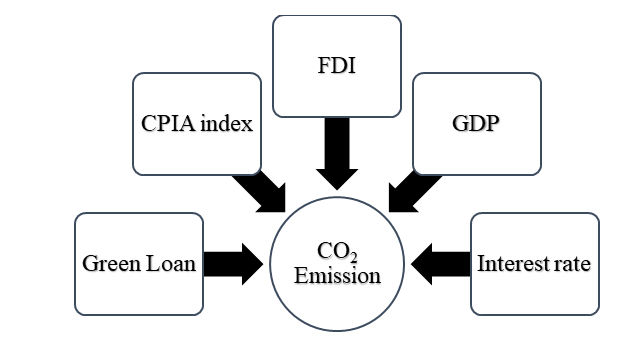

Therefore, the use of the “Ordinary least square method” to analyze the impact of Green loan, environmental sustainability measures (including Environmental Policy Stringency/CPIA index), real interest rate, GDP, and FDI on CO2 emission in international scope considering developed and developing economies, has been determined. Based on the abovementioned gap, the following five hypotheses have been posited:

Hypothesis

H1: There is a significant relation between green loan and CO2 pollution emission in the international scope.

H2: There is a significant relation between Environmental Policy Stringency/CPIA index and CO2 pollution emission in the international scope.

H3: There is a significant relation between Real Interest rate and CO2 pollution emission in the international scope.

H4: There is a significant relation between GDP and CO2 pollution emission in the international scope.

H5: There is a significant relation between FDI and CO2 pollution emission in the international scope.

According to what has been mentioned so far, the proposed framework is presented in Figure 1 as follows:

Data and Methodology

The objective of this research is to assess the equilibrium relationships between CO2 Pollution and abovementioned independent variables including Green loan, Environmental Policy Stringency/CPIA INDEX, Real Interest Rate (RIR), Gross DOMESTIC PRODUCT (GDP), FOREIGN DIRECT INVESTMENT (FDI) in the international scope and this includes both the developed and developing economies.

In general, all the variables are collected from the World Bank database, International Energy Agency (IEA), Thomson Reuters Bloomberg, and OECD database of 82 countries (including 26 developed and 56 developing countries) for the year 2014 (latest year for available green loan data). For the environmental sustainability, this study adopted “Index of the severity of environmental policy” for developed economies ranging from “0” (low degree) to “6” (high degree of environmental policy stringency) and considering a set of 14 measures and instruments that focus on the quality of the environment and pollution from the OECD source. Also, it employed “CPIA policy and institutions for environmental sustainability rating” for developing economies from world bank database which varies between “0” (low) and “6” (high). This rating studies the extent to which a country’s environmental regulations and policies (and implementation thereof) can provide the much-needed protection and sustainable use of natural resources and the pollution management. The CPIA rating also represents the investment climate of the host countries (Aniscenko, Robalino-López, Rodríguez & Pérez, 2017; Rahman, Dinar & Larson, 2016).

| Table 1 Variables Details |

|||

|---|---|---|---|

| Variables | Proxy | Units | Sources |

| CO2 emission | LnCO2 | million tons | World Bank’s Indicator database |

| GHG emission (robust equation) | LnGHG (CO2 eq) | million tons of CO2 eq | World Bank’s Indicator database and International energy agency (IEA) |

| Green Loans | Gloans | Current US$ billion | Thomson Reuters, Bloomberg |

| Environmental Policy Stringency/CPIA INDEX | EPS_CPIA | Index of the severity of environmental policy. “0” (low degree) to “6” (high degree) for developed economies | OECD database |

| CPIA policy and institutions for environmental sustainability rating”. 0 (low) to 6 (high) for developing countries. | World Bank’s Indicator database | ||

| Real interest rate | RIR | Percent % | World Bank’s Indicator database |

| Interest rate spread (robust equation) | IRlndp | Percent % (lending rate minus deposit rate, %) | World Bank’s Indicator database |

| Market GDP | LnGDP | Current US$ billion | World Bank’s Indicator database |

| GDP PPP (robust equation) | LnGDPppp | Current US$ billion | World Bank’s Indicator database |

| FDI net inflows | FDInetinflow | Current US$ billion | World Bank’s Indicator database |

| FDI net (robust equation) | FDInet | Current US$ billion | World Bank’s Indicator database |

To assess the equilibrium relationship between CO2 inflows and its independent variables of the equation, Ordinary Least Square Method (OLS) is adopted:

LnCO2i=β0+β1Gloansi+β2EPS_CPIAi+β3RIRi+β4LnGDPi+β5FDInetinflowi+εi

Where, β0 denote intercepts; from β1 to β5 are the coefficients of independent variables; and ε1 is representative of the error terms.

Findings and Discussion

In this section, we roughly guess the impact of Green loan, environmental sustainability, interest rate, GDP and FDI on Carbon dioxide (pollution emission) in the abovementioned sample. Also, a robust equation will be assessed to confirm the main equation’s outcome of this study.

The analysis section begins with the correlation analysis. This study applies the pairwise method to reach the correlation matrix. Table 2 establishes the correlation coefficient among the variables. This table helps reveal the existence of relationship and collinearity between variables, particularly among the independent variables. The correlation of Carbon Dioxide Emission (LnCO2) and most of independent and control variables excluding Real Interest Rate (RIR) has been revealed to be moderate. The remaining correlation coefficient is lower than the above-mentioned and, it suggests that there would be no collinearity issue according to the correlation coefficient method.

| Table 2 Correlation Coefficients Between all Included Variables |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LnCO2 | FDInetinflow | Gloans | EPS_CPIA | RIR | LnGDP | |||||||

| LnCO2 | 1 | |||||||||||

| ----- | ||||||||||||

| FDInetinflow | 0.473 | *** | 1 | |||||||||

| 0.000 | ----- | |||||||||||

| Gloans | -0.380 | *** | -0.178 | 1 | ||||||||

| 0.001 | 0.110 | ----- | ||||||||||

| EPS_CPIA | -0.367 | ** | -0.190 | 0.104 | 1 | |||||||

| 0.010 | 0.196 | 0.481 | ----- | |||||||||

| RIR | -0.217 | -0.059 | 0.084 | -0.177 | 1 | |||||||

| 0.118 | 0.676 | 0.548 | 0.368 | ----- | ||||||||

| LnGDP | 0.928 | *** | 0.500 | *** | -0.294 | *** | -0.237 | -0.248 | * | 1 | ||

| 0.000 | 0.000 | 0.007 | 0.105 | 0.073 | ----- | |||||||

Source: Output of STATA software

However, pairwise correlation analysis is not the most perfect tools that can be used to detect the issue of multicollinearity. Therefore, this research uses the Variance Inflation Factors (VIF) to confirm the outcome of pairwise correlation analysis. VIF has shown how much the estimated coefficient variance fluctuates when there is no correlation among all explanatory variables (Damodar & Porter, 2009). Based on the outcome of VIF in table 3, all computed VIF values are not more than 10, so the multicollinearity is not an issue here (Damodar & Porter, 2009).

| Table 3 Result of Multicollinearity Test VIF |

||||||

|---|---|---|---|---|---|---|

| Variable | LnGDP | FDInetinflow | RIR | EPS_CPIA | Gloans | Mean VIF |

| Centered VIF | 2.51 | 1.77 | 1.35 | 1.25 | 1.23 | 1.62 |

Source: Output of STATA software

Referring to the above section, this research also tests the main model for autocorrelation, heteroscedasticity and normality of residual with their outcomes provided in table 4. Regarding autocorrelation detecting, the study adopted the Breusch-Godfrey LM method with the null hypothesis of no autocorrelation and the alternative of existing autocorrelation. The result of LM test in table 4 reveals that the probability value is insignificant indicating that the null hypothesis of no autocorrelation cannot be rejected. Thus, autocorrelation is not the case to be concerned about in the model.

Following that, table 2 sheds light on the result Breusch-Pagan test for detecting heteroscedasticity issue of the main equation. In the result, the probability of Chi-square is insignificant, so the null hypothesis of homoscedasticity (not heteroscedasticity) effect is far from being rejected. Hence, this model does not have the problem of heteroscedasticity. Finally, the main model is diagnosed to check on the normality of residuals. This research leaned on the Doornik-Hansen test to assess the normal distribution of residuals. If the P-value of Doornik-Hansen test is significant, the residual distribution is not normal and otherwise it is normally distributed (Damodar, 2003). According to the outcome of normality testing in table 2, the insignificant P-value leads to the acceptance of the null hypothesis of the normal distribution of residuals. Therefore, there is no issue of the non-normality of residual.

| Table 4 Diagnostics Tests |

|||

|---|---|---|---|

| Breusch-Godfrey LM test for Autocorrelation: | |||

| Chi-Square | 0.268 | Prob | 0.6046 |

| Heteroskedasticity Test: Breusch-Pagan test | |||

| Chi-Square | 0.15 | Prob | 0.6963 |

| Normality of Residuals | |||

| Doornik-Hansen chi2 | 0.186 | Prob | 0.9112 |

Source: Output of STATA software

Ultimately, Table 5 highlights the results of the regression analysis of the main equation. It is shown here that the green loan (Gloans), Environmental sustainability index (EPS_CPIA) and Real Interest Rate (RIR) have a significant and negative impact on Carbon dioxide emission (CO2) with 5%, 1% and 10% level of significance. On the other hand, market GDP (lnGDP) shows a meaningful positive impact on Carbon Dioxide emission (CO2). Therefore, conclusively, the greater the green loan, Environmental sustainability index and Real interest rate will contribute to lower CO2 emission while higher GDP value will definitely lead to higher CO2 emission.

| Table 5 Regression Outcomes of Main Equation. (DV: CO2 Emission) |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| G-loans | -0.017 | 0.008 | -2.09 | 0.049 |

| EPS_CPIA | -0.463 | 0.136 | -3.41 | 0.003 |

| RIR | -0.050 | 0.025 | -1.99 | 0.059 |

| LnGDP | 0.790 | 0.087 | 9.09 | 0.000 |

| FDInetinflow | 0.002 | 0.002 | 1.03 | 0.313 |

| Constant | 1.871 | 0.822 | 2.28 | 0.033 |

Source: Output of STATA software

To verify the outcome of this study, the robust model has been examined. In the robust equation, CO2 emission has been taken over by the GHG emission (CO2 equivalent) as dependent variable, also real interest rate, Market GDP and FDI net inflow are substituted by IR Spread (IRlndp: lending rate minus deposit rate), GDP Power purchase parity (lnGDPppp) and FDI net. According to table 6, like the main outcome of main equation, the result of the robust model has given the green light to the significant negative impact of green loans on the dependent variable, although the Environmental sustainability index with negative signs does not show any significant impact in the robust model.

Robust equation:

LnCO2eqi=β0+β1Gloansi+β2EPS_CPIAi+β3IRlndpi+β4LnGDPpppi+β5FDIneti+εi

| Table 6 Regression Outcomes for Robust Model (Dv: GHG Emission Co2eq) |

||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| Gloans | -0.058 | 0.023 | -2.48 | 0.018 |

| EPS_CPIA | -0.177 | 0.333 | -0.53 | 0.598 |

| IRlndp | -0.002 | 0.017 | -0.11 | 0.913 |

| LnGDPppp | 0.234 | 0.108 | 2.17 | 0.036 |

| FDInet | 0.005 | 0.002 | 2.89 | 0.007 |

| Constant | 5.421 | 0.830 | 6.53 | 0.000 |

Source: Output of STATA software

Conclusions

June in 2019 marked the “17th consecutive month of record high heat” for both land and oceans. As there was an increasing heat, 2019 was the warmest year ever. As the effect, it is becoming progressively important to further investigate “low-carbon development”. Not being able to capitalize in low “carbon infrastructure” will lock in high discharges and susceptibility to the compound effects of “climate change, causing energy generation, road, building and others to be very expensive (Yang, Chen & Ji, 2018).

This study looks into the impact of Green loan and environmental sustainability and principal financial variables on CO2 emission in the scale and scope of the international economy. The findings of this study give the empirical evidence on how Green loan and environmental sustainability affect CO2 pollution in developed and developing countries. Since these two variables coefficient have negative sign, they are the cause for lower emission. Moreover, the outcomes of this research give further understanding over the relationship between financial and economic variables and CO2 emission. These outcomes manage to highlight the impact of each element including Real Interest rate, GDP, FDI in separation. These findings verify the positive impact of GDP and FDI on CO2 emission and also confirm the negative effect of Real interest rate on the economic pollution.

As a policy recommendation, there is a suggestion that governments should come up with a series of carbon finance policies, to help firms reduce their emissions. This is better explained when the better green investment situation and advanced technology lead to the mitigation of the pollution of production and consumption, and this will lead to much improved environment and then preserving the future population. Also, improving environmental sustainability like the CPIA index could back up the emission reduction in economies. Also, the outcome reveals that there is a significant relationship between CO2 emission and GDP indicating that more production increases the CO2 pollution, upsurges resource consumption and gradually, consequently leads to more emission. In addition, the result highlights that there is a negative relationship between Real inflation rate and pollution emission internationally. Thus, the Policy makers have to concentrate more on the current interest rate and the proper management by the central banks.

This research has been able to meet its objectives. That said, like most studies, this research is not without its limitations. The most important limitations dismiss the financial and macroeconomic variables following the data availability (such as accessing to external funds and etc.). Also, the database can be updated so that the most recent data can be pooled. Finally, it is thought that there might be a need to take more than one year to run the Panel data model of this analysis.

References

- Aniscenko, Z., Robalino-López, A., Rodríguez, T.E., & Pérez, B.E. (2017). Regional cooperation in dealing with environmental protection. E-government and sustainable development in Andean countries. Paper presented at the Proceedings of the 11th International Scientific and Practical Conference, 1.

- Antweiler, W., Copeland, B.R., & Taylor, M.S. (2001). Is free trade good for the environment? American Economic Review, 91(4), 877-908.

- Bhattarai, M., & Hammig, M. (2001). Institutions and the environmental Kuznets curve for deforestation: A cross country analysis for Latin America, Africa and Asia. World Development, 29(6), 995-1010.

- Boissinot, J., Huber, D., & Lame, G. (2016). Finance and climate. OECD Journal: Financial Market Trends, 2015(1), 7-23.

- Campiglio, E., Dafermos, Y., Monnin, P., Ryan-Collins, J., Schotten, G., & Tanaka, M. (2018). Climate change challenges for central banks and financial regulators. Nature Climate Change, 8(6), 462-468.

- Gujarati, D.N. (2003). Basic Econometrics (4th edition). New York: McGraw-Hill.

- Gujarati, D.N., & Porter, D. (2009). Basic econometrics Mc Graw-Hill International Edition.

- Guo, R., Lv, S., Liao, T., Xi, F., Zhang, J., Zuo, X., … & Zhang, Y. (2020). Classifying green technologies for sustainable innovation and investment. Resources, Conservation and Recycling, 153, 104580.

- Huang, Z., Liao, G., & Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technological forecasting and social change, 144, 148-156.

- Kablana, J. (2015). Green banking in India: A study of various strategies adopt by banks for sustainable development.

- Kim, J., & Park, K. (2016). Financial development and deployment of renewable energy technologies. Energy Economics, 59, 238-250.

- Le, H.T., Chang, Y., & Park, D. (2016). Governance, vulnerability to climate change, and green growth: International evidence. Asian Development Bank Economics Working Paper Series (500).

- Li, Z., Liao, G., Wang, Z., & Huang, Z. (2018). Green loan and subsidy for promoting clean production innovation. Journal of Cleaner Production, 187, 421-431.

- Liu, Y., & Liao, G. (2017). The measurement and asymmetry tests of business cycle: Evidence from China. Quantitative Finance and Economics, 1(2), 205-218.

- Lopez, R. (1997). Environmental externalities in traditional agriculture and the impact of trade liberalization: The case of Ghana. Journal of Development Economics, 53(1), 17-39.

- Maity, S. (2019). Green banking: A new strategic initiative for growth and sustainable development. IJSDR.

- Migliorelli, M., & Dessertine, P. (2019). The rise of green finance in Europe (3030225100).

- Panayotou, T. (1997). Demystifying the environmental Kuznets curve: Turning a black box into a policy tool. Environment and Development Economics, 2(4), 465-484.

- Rahman, S.M., Dinar, A., & Larson, D.F. (2016). The incidence and extent of the CDM across developing countries. Environment and Development Economics, 21(4), 415-438.

- Xu, S., Shangguan, L., Tan, Z., Lu, J., & Miao, Z. (2018). Decision analysis of government and manufacturer under green loan policy. Paper presented at the 2018 15th International Conference on Service Systems and Service Management (ICSSSM).

- Yang, L., Chen, Y., & Ji, J. (2018). Cooperation modes of operations and financing in a low-carbon supply chain. Sustainability, 10(3), 821.