Research Article: 2021 Vol: 20 Issue: 6S

The Effect of Information and Communication Technology (ICT) on Bank Liquidity Risk

Sarmila Udin, Universiti Teknologi MARA

Imbarine Bujang, Universiti Teknologi MARA

Nancy Chiuh Noemi, Universiti Teknologi MARA

Jamaliah Said, Universiti Teknologi MARA

Keywords

Banking Environment, Finance Technology, Information Technology (ICT), Financial Innovations, Macro Economic

Abstract

Bank stability in a financial system is vital to hold adequate liquidity in preventing liquidity risk. Financial Institutions play an essential role as an intermediary to ensure efficient banking systems as the leverage force for development. They had undergone a significant transformation due to external factors such as the changes in the economic environment and the adoption of advanced technology. To enhance the level of the bank liquidity, participation from the public is needed through ICT. This paper aims to determine the effect of macroeconomic and ICT on bank liquidity risk in Asia and the Pacific region based on the level of income economies. The countries were selected based on data availability; therefore, the sample consisted of 24 countries in Asia and the Pacific region. The period of study was from 2011 to 2017. The static panel data was employed to test the hypothesis of the study and was run using Stata 15. The Hausman Specification test and Pooled OLS were used to test the result. This study found that ATM was a positive and significant transaction method. Mixed results were found in fixed broadband and mobile cellular. As for Internet security, it was found that it was an essential factor that will affect bank liquidity risk due to the lack of confidence in doing bank transaction.

Introduction

The current banking environment has become highly competitive today. In order to thrive and survive, banks can use the latest technology to help them improve their operations and make their services more flexible so that they can adapt rapidly to the complexities of a fast-changing business scenario. It occurs when technology has devastating effects and the banking sector is reshaped. Information technology in the industry is developing rapidly around the world. Under finance technology, the Basel Committee on Banking Supervision (BCBN) understands that financial innovations generated by technology can lead to more efficient financial services (Kolesova & Girzheva, 2018). Over the decades, the financial services industry has undergone significant transformations due to internal and external factors, including adopting advanced technologies, changing regulatory environments, etc. In the complex environment of the financial services industry, there is a need to broaden the range of risks to adapt to consumer behavior changes to continue to operate. In this era of Industrial Revolution 4.0 (IR 4.0), the use of technology and its inventions create opportunities for banks to improve banks' quality. With the abundance of technology, banks can improve their liquidity risk. It could help to improve the level of liquidity through deposits. Besides, technology can increase efficiency and customer loyalty and increase deposit volatility, thereby controlling the bank's liquidity risk (Alajlouni & Alhakim, 2019). Bank liquidity risk is also one of the critical elements for banks to continue their operations (Vodová, 2011). It refers to the capacity to fulfill short-term unexpected or planned commitments when they are due (Casu, Girardone & Molyneux, 2015). In order to fulfill their role in the maturing transformation of short-term liabilities into long-term assets, banks are thus exposed to liquidity risk (Luka, 2014).

Over the past decade, Asia and the Pacific region have been leading Information And Communication Technology (ICT). Some of the advanced ICT economies in the region are top performers in the essential ICT indicators (ITU, 2015). The World Economic Forum (WEF) study shows that in terms of overall ICT readiness in the Networked Readiness Index in 2016, seven Asia and the Pacific countries such as Australia, Hong Kong (China), Japan, the Republic of Korea, New Zealand, and Singapore are among the top 20 countries. This statistic indicates that the ICT revolution has fueled the Asia-Pacific region and brought people together to deploy technological change and infrastructure. As stated in the 2014 International Telecommunication Union (ITU) survey, the Organization for Economic Cooperation and Development (OECD) reports that ICT countries are the most advanced countries, followed by Asia and the Pacific region and the Arab States. The ITU report is illustrated in Figure 1.1. Countries with different income levels experience different growth rates in terms of their subscriptions. As the country is one of the fastest-growing communities of countries in the region, the upper-middle-income economies are powered by growth in China. In contrast, the lower-middle-income economies display accelerated growth.

This report sheds light on the unevenness of subscriptions among other countries in the region. Moreover, UNCTAD reports found that despite the unprecedented growth of subscriptions among countries in the region, low internet penetration, weak postal reliability and a low number of secure servers are the key barriers in Asia and the Pacific, which are necessary for any online transaction, in particular for banking transactions. Therefore, this study was conducted to analyse the effect on macroeconomic and ICT towards bank liquidity risk based on income levels.

Literature Review

Liquidity refers to a bank's ability to fund the increase in assets and to meet obligations when overdue without incurring unacceptable losses (BIS, 2008 & Comptroller of the Currency, 2001). Furthermore, the SBP (2008) defined liquidity risk as the potential for loss to an institution, arising from the institution inability to meet its obligations or to fund increases in assets as they fall due without incurring unacceptable cost or losses. Therefore, the viability and efficiency of a bank are greatly influenced by the availability of liquidity in a sufficient amount. Banks must meet their obligations and execute the payments when they are due; otherwise, the banks stand the risk of being declared as illiquid (Crocket, 2008). Bank liquidity risk is divided into two categories funding risk and market risk. Funding or liability risk is defined as the possibility that banks cannot settle their positions with immediacy. In contrast to market liquidity, risk is the risk of a bank's loss due to the inability to liquidate an asset on short notice with no cost (IFSB, 2012). Managing liquidity risk is a prerequisite for sustaining financial stability and avoiding liquidity shortages in banks (ElMassah, 2015).

Some researchers used different liquidity ratios to calculate the banks' liquidity risk, such as the liquid assets to total assets ratio (Molyneux & Thornton, 1992). This ratio measures the bank's overall liquidity risk position. It measures the available liquidity to meet the expected cash demand, including cash on hand, institutional balance and cash on call, and short notice. Meanwhile, loans to deposit ratios (Demirgüç-Kunt & Huizinga, 1999 and Athanasoglou et al., 2005) are another liquidity ratio used to measure the liquidity risk available to the bank's total deposits showing how much the bank lends out of the deposits it has mobilized. It also shows how much bank core funds are being used for their prominent lending and borrowing facilities. This ratio used to determine the lending practices of financial institutions and credit institutions' ability to react to withdrawals from deposits. This is because loans considered the most illiquid assets, while deposits are considered the primary funding source (Trenca Petria & Corovei, 2015). The determinants of bank liquidity risk as specified by Vodová (2011) are bank-specific factors and macroeconomic factors. An external factor influencing the liquidity risk of the bank is the macroeconomic factors such as Gross Domestic Product (GDP), inflation rate, unemployment rate; monetary policy and crisis were used (Mehmed, 2014; Singh & Sharma, 2016; Trenca et al., 2015; El Chaarani, 2019; Vodova, 2011; Munteanu, 2011; Al-Harbi, 2017). The additional change in the external environment due to significant transformation in financial services had contributed towards the banking activities, specifically the bank liquidity risk. Furthermore, under finance technology, the Basel Committee on Banking Supervision (BCBN) understands 'financial innovations generated by technologies that can lead to more effective financial services' (Kolesova & Girzheva, 2018). Hence the elements of ICT have become essential towards the bank liquidity risk.

The use of ICT tools such as ICT, mobile phones and internet banking is beneficial for the bank to increase convenience, hence increasing the bank liquidity risk. (Ghodrati, 2014; Kajuju, 2016). Kajuju (2016) also added that embracing technology can reap the benefits of efficiency, accessibility and flexibility. The increase in the use of ATM may be associated with increasing liquidity and partly be due to reducing the bank's long queues. The use of ICT, specifically the ATM, allows the user from remote areas with no bank branches to do transactions. Furthermore, ICT can also help banks strengthen competitive position for lower-middle countries in facing the changes in the emerging economies, as stated by Luka & Frank (2012). Even though the internet and electronic banking have become an opportunity for banks to reach geographically distant, the lower-middle countries such as India were facing significant security issues (Raju, 2016; Singh & Tigga, 2012). The research found that security and privacy issues in the internet banking transaction become crucial; therefore, some customers are unwilling to provide their information details in doing the transaction.

Data and Methodology

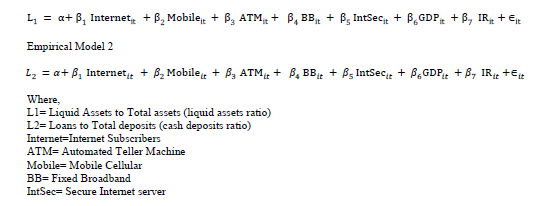

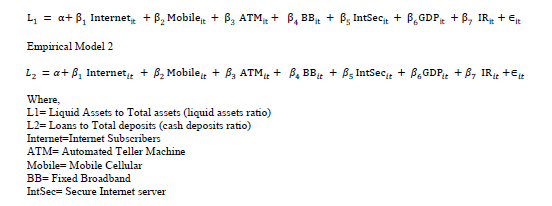

The unit of analysis used to assess the data's aggregation level was the high, upper-middle, and lower-middle income economies of the countries located in the Asia and Pacific region, based on their income levels. The reason for the segregation was due to the unevenness of subscriptions among the countries in the region. Also, UNCTAD reports have found that there is also unparalleled development of subscriptions between countries in the region. The information was obtained from 2011 until 2017. For this paper, only those countries that can reach data availability have been selected after the filtration process. The figures represent 24 countries throughout the Asia and Pacific region. The data was gathered at the Knowledge Management Centre (KMC) in INCEIF from World Development Indicators (WDI) and Fitch Connect. In this paper, the dependent variable used is liquidity ratios. It contains two ratios: the liquidity ratio (L1) and the cash deposit ratio (L2). Liquidity ratio determined by the liquid assets to total assets or L1 (model 1 in %) and the cash deposit ratio measured by loans over deposits or L2 (model 2 in %). The set of proxies is being used to determine the relationship between the macroeconomic and ICT tools as independent variables. An average ratio was used to reflect the data from the region. Using the average is due to the alignment of the calculation of the independent variable using the data of the region. Therefore, this paper's analytical model is described below, and the list of variables and predicted results is shown in Table 1.

Empirical Model 1

| Table 1 List of Variables and Expected Signs |

|||

|---|---|---|---|

| Variables | Model 1 | Model 2 | Sources |

| Internet | Positive (+) | Positive (+) | Ghodrati (2014); Kajuju (2016); Luka & Frank (2012); Singh & Tigga (2012); Raju (2016). |

| Automated Teller Machine | Positive (+) | Positive (+) | |

| Mobile Cellular | Positive (+) | Positive (+) | |

| Fixed Broadband | Positive (+) | Positive (+) | |

| Secure Internet Server | Positive (+) | Positive (+) | |

| GDP | Negative (-) | Positive (+) | Singh & Sharma (2016); Vodova (2013); Tran & Nguyen (2017); Mahmood et al., (2019); Peyavali & Sheefeni (2016) |

| Interest Rate Margin | Negative (+) | Positive (+) | Vodova (2012); Vodova (2013) |

The null hypothesis suggests that bank liquidity risk has a negative relationship between ICT and macroeconomics. The alternate hypothesis, meanwhile, offers a positive relationship between ICT and macroeconomic liquidity for banks. To evaluate the empirical model, static panel data had been used. After performing the descriptive statistics, the data transformation was performed when the data was not normal. The natural logarithm used to transform data was (Ln). After that, the unit root test was tested whether the model is stationary and prevents estimates from producing a spurious regression to the model's basic assumption. The Poolability test was tested either using the Pooled OLS or Hausman Specification to get the p-value on the data's significance and relationship. The diagnostic test was often used to test the data, and it normally subjected to problems such as non-stationarity, multicollinearity, heteroskedasticity, and autocorrelation. This is to make sure that the whole model is accurate, consistent, and bias-free. STATA 12.0 software was used for the entire test.

Findings and Discussion

Finding

The finding as shown in Table 2 indicates the descriptive statistics for high, upper-middle and lower-middle-income countries. The overall ICT for high-income economies shows high number of users and subscribers as compared to the two-levels of income: upper-middle and lower-middle-income. However, the bank liquidity shows different direction whereby the lower-middle-income possesses a high bank liquidity risk of L1 and lower level of liquidity of L2. The rule of thumb for skewness and kurtosis stated that skewness cannot be less than 2; meanwhile kurtosis must be greater than 2. Hence, based on the result, the selected variables will be treated into natural logarithm (Ln).

<

| Table 2 Descriptive Statistics |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Int | Mobile | Bband | ATM | Intsec | GDP | Interest | L1 | L2 | |

| High-Income | |||||||||

| Mean | 83.5346 | 176.7441 | 31.2713 | 155.5477 | 7858.371 | 2.4952 | 3.5048 | 17.6566 | 81.3242 |

| Standard Deviation | 7.5216 | 78.3526 | 4.585 | 16256.15 | 90.8588 | 4.4822 | 1.7913 | 15.7961 | 7.0233 |

| Skewness | -0.92 | 0.8772 | 0.8037 | 0.3673 | 3.439 | -3.4711 | -0.4084 | 0.8341 | 0.9402 |

| Kurtosis | 3.8459 | 2.222 | 2.6122 | 1.7857 | 15.056 | 21.5456 | 1.5124 | 2.1306 | 2.741 |

| Upper-Middle-Income | |||||||||

| Mean | 51.5418 | 137.9309 | 10.2401 | 57.4447 | 479.5487 | 5.0195 | 3.4373 | 20.0394 | 81.4322 |

| Standard Deviation | 18.698 | 28.413 | 5.9976 | 32.6863 | 1147.247 | 1.9663 | 1.8457 | 6.8501 | 20.4846 |

| Skewness | -0.3144 | -0.3468 | 1.3143 | 0.3285 | 3.7597 | -0.1666 | 0.9134 | 0.234 | 0.0151 |

| Kurtosis | 2.2572 | 2.2001 | 5.0497 | 1.8964 | 16.4443 | 2.3959 | 2.9402 | 1.8502 | 2.1672 |

| Lower-Middle-Income | |||||||||

| Mean | 33.8416 | 86.2773 | 4.2971 | 25.5088 | 162.3223 | 5.8018 | 6.503 | 21.1864 | 78.2144 |

| Standard Deviation | 34.6439 | 37.6233 | 6.3308 | 20.6043 | 380.8321 | 2.4227 | 4.9043 | 8.7583 | 17.7455 |

| Skewness | 2.2419 | -0.3658 | 2.3064 | 1.6666 | 3.2001 | 0.1107 | 1.429 | 0.8602 | 0.9619 |

| Kurtosis | 7.3105 | 2.5018 | 7.3138 | 6.1563 | 12.0226 | 4.6961 | 4.7646 | 3.447 | |

Table 3 explores the effects of macroeconomic and ICT on the ratio of liquid assets (L1). The statistical panel data results show that high-income economies' outcome proves that the total ICT variables with the L1 are insignificant. Variables such as mobile cellular, fixed broadband, and ATM, on the other hand, correlate positively with the banks' liquid assets, hence, reject the null hypothesis. There is also a significant and positive effect of GDP on L1. The Internet and fixed broadband have a significant relationship with L1 for upper-middle-income economies. Therefore, it indicates the 1% increase in internet subscription in upper-middle-income; the liquidity ratio will increase to 0.47. The overall macroeconomic variables have a positive effect on L1. Therefore, the overall result on macroeconomic for upper-middle-income was rejecting the null hypothesis. For the lower-middle-income countries, there is a significant relationship between ATM and internet security towards L1. Furthermore, the mobile cellular, fixed broadband and ATM have a positive effect on L1, consequently rejecting the null hypothesis. Similarly, GDP has a positive and significant effect on L1.

| Table 3 Result Of Static Panel Data For L1 |

||||||

|---|---|---|---|---|---|---|

| Variables | High-Income | Upper-Middle-Income | Lower-Middle-Income | |||

| Coefficient | Sign | Coefficient | Sign | Coefficient | Sign | |

| lnInt | -0.8765343 | -0.472 | 0.4715374 | (0.0001)*** | -0.0516066 | -0.752 |

| lnmobile | 1.921028 | -0.522 | -0.4133047 | -0.102 | 0.0615265 | -0.7 |

| lnbband | 1.599509 | -0.595 | -1.287599 | (0.002)** | 0.0543178 | -0.543 |

| lnatm | 0.7974512 | -0.398 | 0.1766671 | -0.822 | 0.3559817 | (0.094)* |

| lnintsec | -0.146808 | -0.488 | -0.0865519 | -0.38 | -0.0474854 | (0.076)* |

| lngdp | 0.2297379 | ( 0.043)** | 0.0427772 | -0.7 | 0.1034335 | (0.096)* |

| lninterest | -0.8165252 | -0.453 | 0.023808 | -0.566 | -0.0384937 | -0.585 |

| R-Squared | 0.0717 | 0.1766 | 0.0859 | |||

| BP LM | 0 | 0 | 30.32 | |||

| -1 | -1 | (0.0001)*** | ||||

| Hausman | N/A | N/A | 4.53 | |||

| -0.7166 | ||||||

| Heteroscedasticity | N/A | N/A | 917.23 | |||

| (0.0001)*** | ||||||

| Serial Correlation | N/A | N/A | 166.438 | |||

| (0.0001)*** | ||||||

| Observation | 30 | 30 | 72 | |||

Table 4 explained the result of model 2 (L2); the higher ratio indicates the high loan provided, resulting in a decrease in liquidity risk. The Internet and bband are positive, and ATM has a significant relationship with L2 for high-income economies. The macroeconomics shows that both variables had a positive relationship. The result indicates that the mobile cellular has a significant and positive effect on the cash deposit ratio. Thus, it explains that with the changes of 1% in the number of mobile subscriptions, the loan activity can increase by 85% and reduce the bank deposit. Also, the Internet is found to have a significant link with L2. Fixed broadband and internet security positively affect the loan to deposit the bank's bank activity. The macroeconomic exhibits the interest rate has a positive relationship with L2. For lower-middle-income, mobile cellular, fixed broadband and ATM have a positive relationship with L2. The variable is only significant to ATM. The macroeconomic shows that the increase in 1% of interest rate margin will increase the loan activity by 79%.

| Table 4 Result Of Static Panel Data For L2 |

||||||

|---|---|---|---|---|---|---|

| Variables | High-Income | Upper-Middle-Income | Lower-Middle-Income | |||

| Coefficient | Sign | Coefficient | Sign | Coefficient | Sign | |

| lnInt | 0.546082 | -0.337 | -0.2080746 | (0.005)** | -0.018963 | -0.771 |

| lnmobile | -1.563045 | -0.283 | 0.8506101 | (0.0001)*** | 0.0649741 | -0.469 |

| lnbband | 1.138839 | -0.56 | 0.4551121 | -0.117 | 0.0634017 | -0.369 |

| lnatm | -1.721598 | (0.012)** | -0.0383527 | -0.942 | -0.1477969 | (0.047)** |

| lnintsec | -0.0171642 | -0.874 | 0.0288282 | -0.614 | -0.0184909 | -0.378 |

| lngdp | 0.0393656 | -0.544 | -0.0862867 | -0.109 | -0.0619982 | -0.229 |

| lninterest | 1.308437 | -0.148 | -0.2054974 | (0.007)** | 0.0794623 | (0.019)** |

| R-squared | 2.19 | 0.1383 | 0.1839 | |||

| BP LM | 0 | 0 | 15.4 | |||

| -1 | -1 | (0.0001)*** | ||||

| Hausman | N/A | N/A | 78.6 | |||

| (0.0001)*** | ||||||

| Heteroscedasticity | N/A | N/A | 4056.52 | |||

| (0.0001)*** | ||||||

| Serial Correlation | N/A | N/A | 26.281 | |||

| (0.0003)*** | ||||||

| Observation | 30 | 30 | 72 | |||

For both result models, the high-income and upper-middle were tested using the pooled OLS, and the lower-middle used the Hausman specification test.

Discussion

High-income economies have a high coefficient of fixed broadband subscribers and mobile subscribers relative to middle-income and low-income economies (Moradi & Kebryaee, 2010). Information technology has become more available with the widespread growth of the fixed network in a high-income economy. The result shows, even though highincome economies have a high ICT readiness index, the number is lower when it comes to transaction activity with a commercial bank. The mean for L1 and L2 are 17.66 percent and 22.59 percent, respectively, by comparison to the descriptive statistics, they are lower than the percentage of liquidity compared to the upper-middle and lower-middle-income economies. This indicates that the use of ICT has remained limited. Most mobile devices are primarily used for communication and entertainment, as stated in the Groupe Spécial Mobile Association (GSMA) survey. Despite the increase in the number of upper-middle-income internet users, internet protection remains a significant tool that can affect bank liquidity risk. Udin, Bujang & Beli’s (2019) study highlighted the importance of safe internet servers in transactions, as it is very important to evaluate the perception of security when depositors lack confidence and require support in dealing with privacy risks.

Other than that, the finding indicates that it is convenient for customers to use technology such as ATM in the bank in making their transactions (Ghodrati, 2014). The positive result of ATM shows that the more the banks embrace ATM banking, the higher the banks' liquidity risk, partly due to more efficient automated cash deposits than the long queues in the banking halls. The effect of the rising number of internet users may sum up that the deposit ratio of the bank liquid assets will decrease, thereby affecting the deposits (Kajuju, 2016). The result of the ESCAP reveals that the upper middle is many emerging and developed economies. China, Malaysia, Mongolia, Sri Lanka and Thailand remain among the top five in Asia and the Pacific region regarding overall ICT preparation. The Asian populations in the area with the minimum individual usage of the Internet were, unlike previously, the lowest globally, but they have risen enormously. The ITU report supports the value, noting that China's growth is driving the upper-middle-income economies as the country is one of the fastest-growing nations in the region. More than half of Asia and the Pacific's broadband subscriptions were registered in China in 2015. The growth of broadband subscriptions has gradually increased in China over the past decade. At the same time, China is one of the region's top 20 countries with a high index of technology readiness, especially for Internet and fixed broadband.

Moreover, it does not affect bank liquidity risk during the economic boom, as opposed to a lower level of liquidity during economic expansion. In the expansionary economy, higher-income companies and higher-income households rely more on internal sources to fund their needs instead of taking out a loan. Therefore, the liquidity of banks is less affected in Asia and the Pacific as a whole.

Conclusion

The emergence of technology is currently quickly entering economics with the era of IR4.0. This involves the emergence of new risks affecting external economies, especially financial institutions. Following the latest liquidity crisis, the empirical results on macroeconomics have been overcome. In this recent period, increasing the level of public liquidity participation in banking will, by ICT, increase the level of bank liquidity risk. High-income economies in the region have shown steady growth in the ICT adoption rate and, similarly, in upper-middle-income economies. The disparity between other income classes, such as lower-middle-income and low-income economies, however, persists. The highlighted finding in this paper suggested that, there is a massive gap between economies with high and lower incomes. High-income, stable internet servers were registered at 7858.371 million servers, while only 162.3223 million servers were recorded in lower-middle-income economies. The lack of confidence among customers when doing online transactions results from the low number of secure servers. Therefore, it demonstrates that there is critical security of internet protocol. Policymakers should stress the importance of hardware and software related to computer security, such as firewalls, encryption systems, and software for virus detection. Besides, a pool of software application developers and database managers needs to be created to manage e-business applications appropriately. The growth in e-commerce and internet banking has supported better security options for banking transactions with confidentiality in the transaction, contributing to the importance of internet banking today.

References

- Al-Harbi, A. (2017). Determinants of banks liquidity: Evidence from OIC countries. Journal of Economic and Administrative Sciences, 33(2), 164-177.

- Athanasoglou, P., Brissimis, S., & Delis, M. (2005). Bank specific, industry specific and macroeconomic determinants of bank liquidity. Journal of International Financial Markets, 18(2), 121-136.

- Bank for International Settlements (2008). Guidelines to the international consolidated banking statistics (Basle).

- Casu, B., Girardone, C., & Molyneux, P. (2015). Introduction to banking. Harlow, England: Pearson.

- Comptroller of the Currency (2001). Liquidity: Comptroller’s Handbook, Comptroller of the Currency: Administrator of the National Banks. Washington, DC.

- Crockett, A. (2008). Market liquidity and financial stability. Financial Stability Review, 1, 13-17.

- Demirgüç-Kunt, A., & Levine, R. (1999). Bank-based and market-based financial systems: Cross-country comparisons. The World Bank.

- El-Chaarani, H. (2019). Determinants of bank liquidity in the Middle East region. International Review of Management and Marketing, 9(2), 64.

- ElMassah, S. (2015). Banking sector performance: Islamic and conventional banks in the UAE. International Journal of Information Technology and Business Management, 36(1).

- ESCAP (2016). State of ICT in Asia and the Pacific 2016. Working Paper by the Information and Technology and Disaster Risk Reduction Division.

- Ghodrati, H., & Khah, M.S. (2014). A study on relationship between electronic banking and liquidity management on Iranian banks. Management Science Letters, 4(6), 1259-1270.

- GSMA, Mobile Infrastructure Sharing (2012). Retrieved from http://www.gsma.com/publicpolicy/wpcontent/uploads/2012/09/Mobile-Infrastructure-sharing.pdf.

- Islamic Financial Services Board (IFSB) (2012). Guiding principles on liquidity risk management for institutions offering Islamic financial services. Retrieved from https://www.ifsb.org/.

- International Telecommunication Union (2017). ICT Development Index 2015: IDI 2015 Rank. Retrieved from https://www.itu.int/net4/ITU-D/idi/2017/index.html.

- Kajuju, N.K. (2016). The effect of electronic banking on liquidity of commercial banks in Kenya (Dissertation, UoN).

- Kolesova, I.V, & Girzheva, Y.S. (2018). Impact of financial technologies on the banking sector. KnE Social Sciences, 3(2), 215–220.

- Luka, M.K. (2014). The impacts of ICTS on banks a case study of the Nigerian banking industry.

- Luka, M.K., & Frank, I.A. (2012). The impacts of ICTs on Banks. Editorial Preface, 3(9), 145-149.

- Mahmood, H., Khalid, S., Waheed, A., & Arif, M. (2019). Impact of macro specific factor and bank specific factor on bank liquidity using FMOLS approach. Emerging Science Journal, 3(3), 168-178.

- Mehmed, G. (2014). An empirical study on liquidity risk and its determinants in Bosnia and Herzegovina. The Romanian Economic Journal, 17(52), 157-184.

- Molyneux, P., & Thornton, J. (1992). Determinants of European bank profitability: A note. Journal of banking & Finance, 16(6), 1173-1178.

- Moradi, M.A., & Kebryaee, M. (2010). Impact of information and communication technology on economic growth in selected Islamic countries. Quarterly Journal of New Economy and Commerce.

- Munteanu, I. (2012). Bank liquidity and its determinants in Romania. Procedia Economics and Finance, 3, 993-998.

- Peyavali, J., & Sheefeni, S. (2016). Macroeconomic determinants of commercial banks’ liquidity in Namibia. European Journal of Business, Economics and Accountancy, 4(5), 19.

- Raju, N.T. (2016). Need of Information Technology (IT) in indian banking sector scenario. International Journal of Marketing and Technology, 6(12), 1-11.

- SBP. (2008). Pakistan’s banking sector remarkably resilient despite challenging economic environment: SBP’s Financial Stability Review. State Bank of Pakistan, Islamabad.

- Singh, A., & Sharma, A.K. (2016). An empirical analysis of macroeconomic and bank-specific factors affecting liquidity of Indian banks. Future Business Journal, 2(1), 40-53.

- Singh, H.K., & Tigga, A.E. (2012). Impact of information technology on Indian banking services. In 2012 1st International Conference on Recent Advances in Information Technology (RAIT).

- Tran, T.T., Nguyen, Y. (2019). The determinants of liquidity risk of commercial banks in Vietnam. Banks and Bank Systems, 14(1), 94-110.

- Trenca, I., Petria, N., & Corovei, E.A. (2015). Impact of macroeconomic variables upon the banking system liquidity. Procedia Economics and Finance, 32, 1170-1177.

- Udin, S., Bujang, I., & Beli, S.R. (2019). Technology effects towards banks’ liquidity risk on Southeast Asian commercial bank. The Business & Management Review, 10(3), 329-335.

- Vodová, P. (2011). Liquidity of Czech commercial banks and its determinants. International Journal of Mathematical Models and Methods in Applied Sciences, 5(6), 1060-1067.

- World Bank (2018). World development indicators. Washington, D.C: World Bank.

- World Economic Forum (2014). The Global Information Technology Report 2014. Retrieved fromhttp://www3.weforum.org/docs/WEF_GlobalInformationTechnology_Report_2014.pdf.

- World Economic Forum (2016). Global Information Technology Report 2016 (Geneva, 2016).