Research Article: 2022 Vol: 21 Issue: 2S

The Effect of Political Intervention and Family Ownership on Earnings Management: A Panel Study From Malaysia

Nurul Azlin Azmi, Universiti Teknologi MARA Cawangan Johor

Nor Balkish Zakaria, Universiti Teknologi MARA

Zuraidah Mohd Sanusi, Universiti Teknologi MARA

Rizqa Anita, Universitas Lancang Kuning

Abstract

Purpose: The presence of political intervention and family ownership domination in the capital market has created a unique business environment in Malaysia. The political intervention and family ownership control created Type I and Type II agency problems among controlling shareholders, minority shareholders, and stakeholders. This study aims to examine earnings management (EM) behaviour among politically connected firms and family firms in Malaysia. Methodology/Approach: This study adopts a quantitative approach by using 624 firms listed on main market Bursa Malaysia. The period of this study covers from 2013 to 2017 with final data set comprises 3,120 firm year observations. A fixed effect model of panel regression analysis is used to investigate the research questions. Findings: The finding reveals that politically connected firms have high prevalence involved in earnings management activities than non-politically connected firms. Meanwhile, family firms have prevalent to be involved in earnings management of performance-matched discretionary accrual. In addition, the presence of politicians in the family firms is able to moderate the effect of earnings management in the family firms. The findings have an important implication to regulators as it suggests that the presence of politician in the boardroom and high family ownership can influence earnings quality. This study also provides positive signals to the regulator’s governance initiatives to limit politician involvement in the business and thus alleviates agency problems. Significant Contribution: This study contributes to the body of literature by focusing on the political regime after the 13th general election and the effect of political intervention in the family business in Malaysia.

Keywords

Political Intervention, Family Firms, Earnings Management

Introduction

Financial statement users equate high earnings quality with the absence of earnings management and manipulation activities. Earnings management can distort the usefulness of earnings for its intended users with the potential risk of flawed decision-making process. Although these activities are legal practices, but it is considered as unethical activities because it may impair the credibility of the financial reporting. Lo (2008) claimed that earnings quality has a lot in common with earnings management because highly managed and manipulated earnings have an inferior quality of financial reporting. Prior studies have looked at the issue of earnings management from different angles; including corporate governance, nature of the county environment, and legal force (Azmi et al., 2021; Johl et al., 2013; Mohamad et al., 2012; Mohd Radzi et al., 2011). Earnings management activities still exist until now due to the flexibility in the accounting standard and discretionary management practices (Becker et al., 1998). These activities create an opportunity for the manager to window dress financial reporting. Moreover, firms tend to manage their reported earnings due to the pressure from the shareholders. Managers are motivated to manage the earnings to meet shareholders' expectations and secure their job. The issue of low financial reporting quality has been persistent due to earnings management activities, and there are no solutions to address this issue until today. Lo (2008) claimed that the absence of earnings management does not guarantee high-quality earnings because other factors (for instance, ownership structures, corporate governance, or political interventions) may distort the quality of earnings.

Unique characteristics of the Malaysian business environment with high politically connected firms and family firms are contributing factors that created agency problems and cost. Based on statistics across 41 countries, Faccio (2010) found Malaysia is the second largest politically connected firm after the United Kingdom. Systematic evidence has found that appointing politicians in the boardroom may bring government contracts (Chung et al., 2019), preferential access to credit, tax reduction, and market protection to the firms (Faccio, 2010). However, the political intervention has adverse effects on the firms, such as it can divert managers from their fundamental objective to the politician's personal interest (Hashmi, Brahmana & Lau, 2018). Moreover, Chaney, Faccio & Parsley (2011) found that financial reporting quality for politically connected firms is poorer than non-politically connected firms due to high leverage. These factors put high pressure to the manager to manage their reported earnings. Therefore, further research is warranted to examine the effect of political intervention and family ownership on earnings management among Malaysian firms. Another unique environment is high concentrated family firm in the Malaysian business environment. Malaysia is ranked as the third largest family ownership concentration after Indonesia and Thailand among East Asian countries (Claessens et al., 2000). Supported by Che-Ahmad & Mustafa (2017) that characterised Malaysian firms as highly concentrated ownership in which more than 70% of the listed firms are family businesses. Therefore, it is undeniable that family firms play an important role in Malaysia's economic growth because the large tycoon firms in Bursa Malaysia are among family firms. As such, the practice of earnings management in the family firm should be given more attention because the controlling shareholders may abuse their control and power to manage the firm’s reported earnings.

Political intervention and highly concentrated family ownership may cause a conflict of interest between two or more parties and agency costs. Political intervention may create Type I agency cost between shareholder and manager; while family ownership may generate Type II agency cost between majority and minority shareholders. Majority shareholders among family firms and the influence of the politician in the boardroom may create greater opportunity to manage firm’s earnings and lead to low financial reporting quality. Besides that, appointing politicians in the boardroom became common practice by some Malaysian firms and it is supported by resource dependency theory. Hence, we believed that political intervention could influence the association between family ownership and earnings management in Malaysia. Weak corporate governance and highly concentrated family ownership give an opportunity to manage their earnings. Supported by Teh, Ong & Ying (2017) found that family firms are more likely involved in earnings management activities in order to achieve their own objectives. Moreover, earnings management may further increase when family ownership holds majority ownership in the firms (Kim & An, 2019). Then, lack of directors diversification (i.e., the board size, board expertise, and board qualification) among family firms further lead to low earnings quality (Amran & Che Ahmad, 2011). Therefore, less monitoring mechanisms appear among the family firms to mitigate the exercise of earnings management.

This study makes three unique contributions to the extant body of knowledge. First, it extends the existing literature on political intervention, family ownership, and earnings management in the Malaysian business environment. Second, this study extends the definition of political intervention into president, prime minister, government minister, senior government employee, or a member of the parliament (Abdul Wahab et al., 2009; Faccio, 2006; Gul et al., 2016), or if a relative with the same last name as a head of state or minister is a top officer or a large shareholder (Faccio, 2006; Fung et al., 2015), or if firms indirectly connected when a top executive or a large shareholder has been connected with the royal family (Al Nasser, 2019; Habtoor & Ahmad, 2017). Third, this study specifically focuses on the 13th until 14th Malaysia election and current data on family ownership.

Literature Review and Hypotheses Development

The most common and reliable fraternal model to detect the quality of financial statements is by using discretionary accrual or accrual earning. In the 1970s and early 1980s, the common method among managers is a discretionary exercise through the choice of accounting method or policies (Sun & Rath, 2010). Accrual earnings involved General Accepted Accounting Principles (GAAP) choices that obscure or mask the actual performance (Dechow & Skinner, 2000). Accrual-based earnings, or sometimes known as discretionary accruals, involve operating accrual choices. Discretionary accruals are bad debt provisions, warranty provisions, inventory valuation, valuation of non-current assets, depreciation methods, deferred taxes, and others. The management's discretion towards discretionary accruals is often unlimited due to the varying accounting concepts and conventions. Accrual-based earnings were the preferred method to manage earnings before the Sarbanes Oxley Act (SOX) came into effect, as it does not have immediate cash flow consequences. Accruals-based earnings measures are widely accepted proxy for earning management (Dechow et al., 2010; Dechow et al., 1995; Healy & Wahlen, 1999).

The political involvement started after the government introduced New Economic Policy (NEP) in 1971. As part of the NEP program, selected firms were able to receive favourable investment resources from the government. The 1990s was when the United Malay National Organisation (UMNO) had direct and obscure interests in multiple firms. The NEP inadvertently opened the door for mass political intervention in Malaysian firms. As the government dispensed more favours to selected firms, business owners would intensify their connections with politicians to influence resource allocation (Gomez & Jomo, 1997). These opportunistic situations created a second wave of political favouritism that ran on informal ties between politicians and businessmen (Gul, 2006).

The political intervention and large control of family ownership in the firms may increase conflict of interest between two or more parties in the firms. Politician in the boardroom may divert manager intention from the firm’s objectives to politician’s objectives. The presence of politician puts pressure on the managers to mislead financial information to show better performance and indirectly generate Type I agency problem. On the other hand, large control of the family ownership in the firms generate Type II agency problem between majority and minority shareholders. Therefore, the involvement of the politician and family ownership in the business create greater opportunity for firms to mislead the financial statement due to pressure they faced, opportunity, a capability they possess, and rationalization they applied in managing the earnings (Fraud Triangle Theory).

Political Intervention and Earnings Management

Firms are inclined to have affiliations with politicians because of the immense benefits that come with political connections. This reality is aligned with the resources dependency theory, where directors are resources to firms (Chung et al., 2019). However, political intervention in firms may generate agency problems since politicians regularly interfere with the directors' decision making process and disclosure (Hasnan & Marzuki, 2017). There are many significant effects of the political intervention in the business sectors in which may impair firm’s earnings quality and performance (Al-dhamari & Ku Ismail, 2015; Chaney et al., 2011; Hashmi et al., 2018; Khlif & Amara, 2019). The existence of politicians in the boardroom can cause agency problems in the firms (Al-Dhamari & Ku Ismail, 2015; Chaney et al., 2011) because politician tend to divert shareholders from their main objective to the politician personal interest (Hashmi et al., 2018).

The presence of politicians may pressure the manager to window dress the financial statement, resulting in worst accounting information (Chaney et al., 2011). Chen, Ding & Kim (2010) found that the quality of financial reports of a firm is poor when the firm has political connections. Politically connected firms also have higher financial leverage and greater odds of managing their reported earnings to show a better financial position (Bliss & Gul, 2012). In a similar vein, Liedong & Rajwani (2018) have found that political interventions can cause a greater intensity of earnings management due to the contractual debt motive that is propelled by high leverage and interest rates. Furthermore, Amara & Khlif (2020) found that the management of politically connected firms exercised their discretion to reduce the quality of earnings through accrual or real earnings management in Asian countries. Prior studies have shown that political intervention leads to a high tendency to manage their reported earnings and leads to high earnings management. As such, we proposed the following hypothesis:

H1: Political interventions are associated with high earnings management.

Family Ownership and Earnings Management

Family ownership is related to a firm that is controlled and managed by family members. There are two perspectives of agency costs in family firms. In the first perspective, family ownership is the internal mechanism to minimise information asymmetry and align resources to improve firm performance. In this situation, the board of directors remains under family members' scrutiny, which minimises conflict of interest. However, in the second perspective, family firms have a high tendency to generate agency problem Type II. This situation materialises when the presence of controlling shareholders has its associated costs, as they may engage in insider dealings at the expense of minority shareholders (Ahmed et al., 2020). Firms with concentrated ownership are more likely to be tunnelled due to conflict of interest between controlling and minority shareholders (Che-Ahmad & Mustafa, 2017). In other words, the majority shareholders will undermine minority shareholders.

Family firms are more likely to run into agency problem Type II between minority and majority shareholders. This is due to large shareholdings have more substantial incentives to influence the management decision making (Che-Ahmad & Mustafa, 2017). Teh, Ong & Ying (2017) found that family ownership is more likely involved in earnings management to achieve their own objectives. Hashmi, Brahmana & Lau (2018) found that family ownership in Malaysia positively influences earnings management. The same sentiment is presented by Razzaque, Ali & Mather (2020), who found that family firms are inclined to take part in accrual earnings management because of the active management role of family firm owners, especially in the less stringent corporate governance. Cherif, Ayadi & Hamad (2020) found that family firms do not have any significant effect on Accrual Earnings Management (AEM). These findings show that family firms have a penchant to manage their reported earnings, and as a result, they are more vulnerable to Type II agency problems.

Although some studies found a positive association between family ownership and earnings management, a prior study in family firms found that family firms are less likely to take part in earnings management. By focusing on Malaysian firms, Amran & Che Ahmad (2011) found that the quality of financial reporting and disclosure practices is greater for family firms because they are less likely to manage financial reports. This finding is consistent with Abdullah & Ismail (2016), who also found that family ownership does not influence earnings management's propensity. Al-Duais, Malek & Abdul Hami (2019) reveal that family firms tend to avoid earnings management because they have invested their personal assets in the business and are concerned on the firm’s survival and reputation. Align with Boonlert-U-Thai & Sen (2019) also found that family ownership produces a high quality of earnings, especially when the family firms are established by the founder family.

Political connection and family ownership have created agency cost to the firms and stakeholders because these parties tend to be involved in earnings management activities. However, the appointment of the politician in the family firm boardroom benefits the firms to enjoy government benefit (Chung et al., 2019), preferential access to credit, tax reduction, and market protection (Faccio, 2010). Prior literature found that political intervention (Al-Dhamari & Ku Ismail, 2015; Ben Rejeb Attia et al., 2016); and controlling shareholders among family members increased the earnings management practices (Boonlert-U-Thai & Sen, 2019; Teh et al., 2017). However, Hashmi, et al., (2018) found that family firms were able to moderate the negative effect between political intervention and earnings quality in Pakistan.

Mixed findings were found on the effect of family ownership, political intervention, and earnings management. This is due to different research setting such as law, regulations, and corporate governance. Therefore, we proposed the following hypotheses:

H2: Family ownership is associated with lower earnings management.

H3: Political intervention moderates the association between family ownership and earnings management.

Methodology

Data Collection Procedures

The study uses sample data from main market Bursa Malaysia from 2013 until 2017. The final sample of the study is 624 firms after excluding firms with insufficient data and banking and financial institution (BAFIA) due to high volatility and different regulations. A final total of 3,120 firm-year observations across industries. The data on political intervention and family firms are hand collected from the firm’s annual report, and all financial data are gathered from the Data stream. This study specifically departed based on the 13th general election period and post-implementation of the Malaysian Code on Corporate Governance 2012 (MCCG 2012).

Table 1 shows the data tabulation of this study. From the sample, 47.4% are considered politically connected firms. Then, 47.31% of the sample is under the category of family firms. From the sample, industry product (28.69%) shows the highest sample distribution and followed by trading/services (23.40%) and consumer product (16.51%).

| Table 1 Data Tabulation |

||

|---|---|---|

| No. of observations | Percentage | |

| Political connection | 1,479 | 47.4 |

| Non-political connection | 1,641 | 52.6 |

| Family firms | 1,644 | 47.31 |

| Non-Family firms | 1,476 | 52.69 |

| Industries | ||

| Construction | 195 | 6.25 |

| Consumer product | 515 | 16.51 |

| Hotel | 15 | 0.48 |

| Industrial product | 895 | 28.69 |

| Mining | 5 | 0.16 |

| Properties | 435 | 13.94 |

| Plantation | 185 | 5.93 |

| Technology | 130 | 4.17 |

| IPC | 15 | 0.48 |

| Trading/services | 730 | 23.40 |

Measurement of Earnings Management

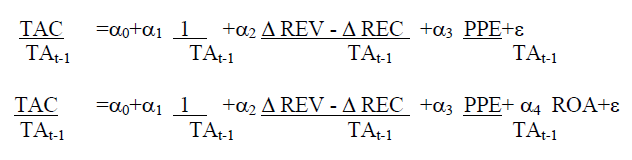

This study used two accrual models to measure earnings management:

1. Modified Jones discretionary accruals models

2. Performance-Matched discretionary accruals models

The above estimation models have been used as abnormal accrual values to measure the earnings management activities in the firms. The higher abnormal accrual values indicated that firms have a high tendency to manage their accrual items and have low earnings quality (Dechow, Ge & Schrand, 2010). These proxies have obsolete power to measure earnings management and it is widely used in earnings management studies (Ayedh et al., 2019; Islam et al., 2011; Iyengar et al., 2010; Kothari et al., 2005). The Modified Jones discretionary accruals model is an extension of the first model from Jones (1991) in which introduces changes of revenue and receivable in the model (Dechow, Sloan & Sweeney, 1995). The Modified Jones model assumes that all changes in revenue and receivables are a consequence of earnings management activities. Total accruals were calculated using the difference between net income available for common stock and net cash flows from the operations activities. Furthermore, we also used Performance-Matched discretionary accruals model to measure earnings management. The use of Return on Assets (ROA) as the firm performance was argued as it is correlated to accruals (Kothari et al., 2005). As such, ROA was included as an additional variable in the Modified Jones model proposed by Dechow, et al., (1995) in estimating discretionary accruals. The models for Modified Jones and Performance-Match discretionary accrual are as follows:

Where:

TAC = Total accruals

TAt-1 = Last year total assets

Δ REV = Change in revenue

Δ REC=Change in receivables

PPE = Property plant and equipment

ROA = Return on assets

Political Intervention

Political intervention in the business sectors significantly affects earnings quality and firm performance (Al-dhamari & Ku Ismail, 2015; Chaney et al., 2011; Hashmi et al., 2018; Khlif & Amara, 2019). Referring to the prior studies in political connection literature, we identify politically connected firms based on the following conditions:

1. If at least one of its senior management personnel (such as the chairman, chief executive officer, vice-president, executive director, or secretary of the board) or a major shareholder (with at least 10 per cent shareholding in the company) is the country’s current (or former) president, prime minister, government minister, senior government employee or a member of the parliament” (Abdul Wahab et al., 2009; Faccio, 2006; Gul et al., 2016).

2. If a relative with the same last name as a head of state or minister is a top officer or a large shareholder” (Faccio, 2006; Fung et al., 2015).

3. If a firm is indirectly connected when a top executive or a large shareholder has been connected with the royal family (Al Nasser, 2019; Habtoor & Ahmad, 2017).

Model Estimation

This study also controls the firm’s size, leverage, performance, and liquidity to examine the effect of political intervention and family ownership on earnings management. The control variable of the firm’s Size (FSIZE) is calculated as the natural logarithm of the firm’s total assets. Firm’s leverage (FLEV) is the ratio of total liabilities to total assets. Firm’s Profitability (FP) is measured by the ratio of net income available to common stock to total assets. Firm’s Liquidity (FL) is calculated by the ratio of current assets minus cash and cash equivalent to current liability.

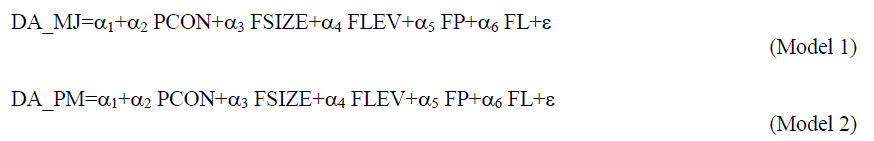

To examine the first hypothesis on the effect of political intervention on earnings management, we robustly tests accrual earnings management using Modified Jones and Performance-Match Model. The econometric model equations are as follows:

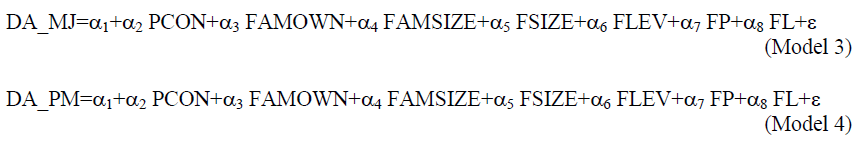

To address second research hypothesis on the effect of family firms and earnings management, the econometric model equations are as follows:

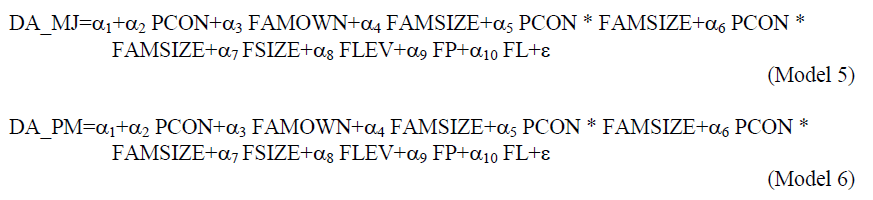

To address the third research hypothesis on the interaction effect of the political intervention between family firms and earnings management, the following econometric model equations are as follows:

The variables are as follows:

DA_MJ=Discretionary accrual of Modified Jones discretionary accrual

DA_PM=Discretionary accrual of Performance-Match discretionary accrual

PCON=Dummy variable of 1 if politically connected firm and 0 otherwise

FAMWON=Total percentage of family share ownership

FAMSIZE=Total number of family members divided by total board size

FSIZE=Total assets of the firms

FLEV=Total liabilities divided by total assets

FP=Net income divided by total shareholder equity

FL=Current assets minus cash and cash equivalent divided by current liabilities

Findings and Discussions

Descriptive Analysis

Table 2 presents descriptive results of continuous and dichotomous variables. The average discretionary accrual for Modified Jones and Performance-Matched are slightly the same with the mean value 0.0135 and 0.0132, respectively. The independent variables of the study show that the politically connected firms (PCON) are 47.4%, which indicates almost half of the sample is politically connected. FAMOWN shows the maximum value of family share ownership is 100% which belongs to Cheetah Holdings Bhd for the year 2013 and 2014. This is aligned with prior studies that found Malaysia in the rank third-highest concentration of control after Thailand and Indonesia (Claessens et al., 2000). Moreover, FAMSIZE shows that 87.5% of the board members are seating by family members in the boardroom. The average control variable of firm characteristics such as FSIZE, FLEV, FP, and FL is 13.1976, -1.1740, 0.0547, and 0.3507 respectively.

| Table 2 Descriptive Statistics |

||||||||

|---|---|---|---|---|---|---|---|---|

| Continuous Variables | Min | Max | Mean | SD | ||||

| DA_MJ | -0.2002 | 0.0646 | 0.0135 | 0.0297 | ||||

| DA_PM | -0.2917 | 0.2259 | 0.0132 | 0.0458 | ||||

| Independent Variables | ||||||||

| FAMOWN | 0 | 100 | 6.6257 | 13.1529 | ||||

| FAMSIZE | 0 | 0.8750 | 0.21760 | 0.2243 | ||||

| Control Variables | ||||||||

| FSIZE | 9.0159 | 18.7868 | 13.1976 | 1.5119 | ||||

| FLEV | -6.8733 | 1.5175 | -1.1740 | 0.7782 | ||||

| FP | -1.1927 | 1.1318 | 0.0547 | 0.2001 | ||||

| FL | -5.2579 | 4.6776 | 0.3507 | 0.9786 | ||||

| Dichotomous Variable | Politically Connected Firms | Non-Politically Connected Firms | ||||||

| PCON | Observation | Percentage | Observation | Percentage | ||||

| 1,479 | 47.4 | 1,641 | 52.6 | |||||

| Notes: DA_MJ is discretionary accrual of Modified Jones discretionary accrual; DA_PM is discretionary accrual of Performance-Match discretionary accrual; PCON is dummy variable of 1 if politically connected firm and 0 otherwise; FAMWON is total percentage of family share ownership; FAMSIZE is total family member divided by board size; FSIZE is natural logarithm of total assets; FLEV is total liabilities divided by total assets; FP is net income divided by total shareholder equity; FL is current assets minus cash and cash equivalent divided by current liabilities. | ||||||||

Univariate Analysis

Table 3 and Table 4 show the means difference between political group and family group on earnings management. Table 3 presents different means test for political connection and non-politically connected firms. The results indicate that political connection firms involved in the Modified Jones discretionary accrual than non-political connected firms. However, there is no statistical difference in Performance-Match discretionary accrual between these two groups. The results show politically connected firms are interested in managing their earnings using accrual-based method. This finding aligns with prior studies that also found politically connected firms have a positive influence on accrual earnings management (Al-dhamari & Ku Ismail, 2015; Ben Rejeb Attia, Lassoued & Attia, 2016; Chaney et al., 2011; Hashmi et al., 2018).

| Table 3 Difference of Means Test of Political and Non-Political Connected Firms |

|||

|---|---|---|---|

| Politicalconnected firms | Non- politicalconnected firms | T-Statistic | |

| DA_MJ | 0.0156 | 0.0117 | 0.0135*** |

| DA_PM | 0.0143 | 0.0122 | -0.0021 |

Table 4 presents different means test of family firms and non-family firms. The results indicate that there is no statistically mean difference between family and non-family firms on Modified Jones discretionary accrual. However, the findings show family firms involved in Performance-Matched discretionary accrual by managing their Return on Assets (ROA). This finding aligns with prior studies that found family firms are more likely to be involved in Performance-Matched discretionary accrual (Bertin & Iturriaga, 2014; Paiva et al., 2016).

| Table 4 Difference of Means Test of Family and Non-Family Firms |

|||

|---|---|---|---|

| Family firms | Non-family firms | T-Statistic | |

| DA_MJ | 0.0137 | 0.0134 | -0.0003 |

| DA_PM | 0.0157 | 0.0105 | 0.0132*** |

Correlation Analysis

Table 5 presents correlation result of the study and shows a significant and positive association between PCON and DA_MJ. This findings provide earlier signal that the presence of politician in the firms further increases earnings management activities. Meanwhile, FAMOWN and FAMSIZE show a significant and negative association on both accrual earnings management. The findings provide earlier signal that family firms are less likely to be involved in earnings management since the firms are belong to their family. In addition, firm size (FSIZE) shows a significant and negative association with both earning management because large firms are less likely involved in earnings management. This is due to greater firms size are stable enough in the market and they have to maintain their reputation.

Meanwhile, Performance-Match discretionary accrual shows FAMSIZE is a significant and positive association with earnings management, which indicates FAMSIZE is not involved in accrual, but they are involved in the Performance-Match accrual. FLEV shows a significant and negative association with Performance-Match discretionary accrual; while FP and Fl show significant and positive to Performance-Match discretionary accrual. The overall result shows that the correlations between all independent variables are less than 0.80, and no multicollinearity issues were suspected (Hair et al., 2010).

| Table 5 Correlation Result |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| DA_MJ | DA_PM | PCON | FAMOWN | FAMSIZE | FSIZE | FLEV | FP | FL | |

| DA_MJ | 1.0000 | ||||||||

| DA_PM | 0.4725*** | 1.0000 | |||||||

| PCON | 0.0644*** | 0.0228 | 1.0000 | ||||||

| FAMOWN | -0.1067*** | 0.0185 | -0.0747*** | 1.0000 | |||||

| FAMSIZE | -0.0302* | 0.0462*** | -0.1042*** | 0.4032*** | 1.0000 | ||||

| FSIZE | 0.1600*** | 0.0605*** | 0.1780*** | -0.1375*** | -0.0015 | 1.0000 | |||

| FLEV | -0.0174 | -0.1410*** | 0.0708*** | -0.0131 | -0.0384** | 0.1977*** | 1.0000 | ||

| FP | 0.0277 | 0.6980*** | -0.0023 | 0.0296* | 0.0374** | 0.1286*** | -0.0144 | 1.0000 | |

| FL | 0.0768*** | 0.0713*** | -0.0940*** | -0.0291 | -0.0108 | -0.0878*** | -0.5612*** | -0.0014 | 1.0000 |

| Notes: ***, **, and * represent statistical significance at 1, 5, and 10 percent levels respectively.DA_MJ is absolute value of Modified jones discretionary accrual; DA_PM is absolute value of Performance match discretionary accrual; PCON is dummy variable of 1 if politically connected firm and 0 otherwise; FAMWON is total percentage of family share ownership; FAMSIZE is total family member divided by board size; FSIZE is natural logarithm of total assets; FLEV is total liabilities divided by total assets; FP is net income divided by total shareholder equity; FL is current assets minus cash and cash equivalent divided by current liabilities. | |||||||||

Regression Analysis

Several test procedures were carried out before testing the hypotheses. Two econometric tests were performed to select the estimation model among Pool OLS, random effect, and fixed-effect models. First, Breusch & Pagan Lagrangian multiplier test was performed to choose the most suitable estimation model between Pool OLS and random effect. All the equation estimation models in this study were rejected Pool OLS. Second, Hausman test was conducted to choose between random effect and fixed-effect models. Again, all equation estimation models were significant and accept the fixed-effect model estimation. Then, the fixed effect cluster firms robust is used to fit panel data and overcome heteroscedasticity, serial correlation, and firms effect problem. The final estimation equation model shows F-statistics is significant at 1% level and indicates the validity of the models. The adjusted R2 of the Modified Jones model is slightly lower than Hashmi, et al., (2018), but slightly higher than Al-Thuneibat, Al-Angari & Al-Saad, (2016); Ibrahim, Xu & Rogers (2011); Nuanpradit (2019). The adjusted R2 of Performance-Matched discretionary accrual is similar with the prior study by Hashmi et al. (2018). PCON shows significant and positive association for all models. This finding is in line with prior research that also found political intervention has a positive influence on earnings management (Ben Rejeb Attia et al., 2016; Chaney et al., 2011).

The result in Table 6 shows that FAMOWN is positively and significant on Modified Jones and Performance-Matched discretionary accrual. This indicates that large family ownership has a high tendency involved in earnings management activities. This finding is consistent with (Teh et al., 2017) that found controlling families have a positive association with earnings management in Malaysian. Meanwhile, the existence of politicians in the family firms (FOSIZE) could mitigate the tendency of earnings management. The interaction effect of political connection is strengthen the negative relationship between family size (FAMSIZE) and discretionary accrual. This provides evidence that political intervention in the family firms are able to reduce the exercise of earnings management. The existence of politicians in the family firm’s boardroom is able to limit family members to further manage their earnings. This findings provide different view on the effect of politician in the firms and posit the earlier findings that found negative effect between political connection and earnings quality (Al-Dhamari & Ku Ismail, 2015; Amara & Khlif, 2020; Hashmi et al., 2018).

Firm’s Profitability (FP) is negatively significant on Modified Jones, but positively significant on Performance-Match discretionary accrual. Firm’s Leverage (FL) shows a significant and positive association with all models for Modified Jones and Performance-Matched discretionary accrual. This implies that firms with higher liquidity have more tendency to be involved in earnings management. This direction may be due to the contracting motives of management compensation.

| Table 6 Regression Result |

||||||

|---|---|---|---|---|---|---|

| Model 1DA_MJ | Model 2DA_PM | Model 3DA_MJ | Model 4DA_PM | Model 5DA_MJ | Model 6DA_PM | |

| Constant | 0.06321.52 | 0.03900.69 | 0.06181.50 | 0.03660.64 | 0.05831.43 | 0.03390.56 |

| PCON | 0.0052**2.30 | 0.0059**2.21 | 0.0051**2.26 | 0.0059**2.25 | 0.0074***2.97 | 0.0085***2.74 |

| FAMOWN | - | - | 0.0002*1.71 | 0.0002**2.23 | 0.00021.62 | 0.000171.64 |

| FAMSIZE | - | - | -0.0041-0.59 | -0.0022-0.25 | -0.0001-0.00 | 0.00410.47 |

| PCON*FAMOWN | -0.0001-0.35 | 0.00021.29 | ||||

| PCON*FAMSIZE | - | - | - | - | -0.0019**-2.08 | -0.0034**-2.50 |

| FSIZE | -0.0041-1.30 | -0.0035-0.85 | -0.0040-1.28 | -0.0034-0.82 | -0.0038-1.22 | -0.0032-0.77 |

| FLEV | -0.0002-0.14 | -0.0060*-1.72 | -0.0002-0.10 | -0.0060*-1.70 | -0.0001-0.07 | -0.0059*-1.67 |

| FP | -0.0115***-3.27 | 0.1219***7.34 | -0.0117***-3.31 | 0.1217***7.32 | -0.0116***-3.29 | 0.1217***7.35 |

| FL | 0.0069***4.69 | -0.0118***3.40 | 0.0069***4.67 | 00.0118***3.39 | 0.0070***4.71 | 0.0119***3.41 |

| Firm effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Year effect | No | No | No | No | No | No |

| Observation | 3120 | 3120 | 3120 | 3120 | 3120 | 3120 |

| Adj. R squared (%) | 5.80 | 44.91 | 6.01 | 45.01 | 6.21 | 45.13 |

| Notes: ***, **, and * represent statistical significance at 1, 5, and 10 percent levels respectively.DA_MJ is absolute value of Modified jones discretionary accrual; DA_PM is absolute value of Performance match discretionary accrual; PCON is dummy variable of 1 if politically connected firm and 0 otherwise; FAMWON is total percentage of family share ownership; FAMSIZE is total family member divided by board size; FSIZE is natural logarithm of total assets; FLEV is total liabilities divided by total assets; FP is net income divided by total shareholder equity; FL is current assets minus cash and cash equivalent divided by current liabilities. | ||||||

Conclusion

This study intended to examine the influence of political intervention, family ownership, and earnings management in the Malaysian market. The unique Malaysian environment with high politically connected firms and controlling family ownership has a significant effect on the firm’s earnings quality and performance. This study found that 47% of public listed firms are in the category of political connection and 47% is family firms. Based on the findings, we found that politically connected firms involved in earnings management activities. This is consistent with a prior study that also found a negative effect of the political intervention on the firm’s earnings quality and performance (Al-dhamari & Ku Ismail, 2015; Chaney et al., 2011; Hashmi et al., 2018; Khlif & Amara, 2019).

Moreover, controlling Family Ownership (FAMOWN) has a positive association with the Performance-Match discretionary accrual. This indicates that controlling family ownership tends to manage their earnings to achieve their performance. Align with prior studies that also found family ownership are more likely involved in earnings management and this activities further increase when family firms hold majority ownership in the firms (Teh, Ong & Ying, 2017). This study reveals that the presence of politicians are able to moderate the negative effect of family firms size (FAMSIZE) and discretionary accrual. The presence of politicians in family firm’s boardroom is able to limit family members to manage their reported earnings.

This is due to the fact that politicians and family members may act as the check and balance mechanism in the firms. Politicians cannot influence family firms to meet their personal interests whenever the family firms are strongly established by the founder family (Boonlert-U-Thai & Sen, 2019). While maintaining their business reputation, family members are also unable to manage their reported earnings since the existence of the politician that can act as a watchdog in the firms.

This study has implications to the policy maker in Malaysia by limiting the involvement of the politician in the boardroom since many prior studies found a negative effect of the political connection to the earnings quality. Besides that, this study also contributes to the academic front by offering the current list of political connected firms and family firms prior to the new Malaysian government. While conducting this study, several limitations should be addressed which is this study does not consider corporate governance as a monitoring mechanism in reducing earnings management activities. In addition, this study was conducted during the 13th general election before the political parties' regime was changed. Future studies can examine the influence of political intervention and family ownership on earnings management before and after the 14th general election.

Acknowledgement

The authors acknowledge this research was supported by Bestari Research Grants Phase 1/2021 UiTM Cawangan Johor, Malaysia (600-UiTMJ PJIA. 5/2).

References

Abdul Wahab, E.A., Mat Zain, M., James, K., & Haron, H. (2009). Institutional investors, political connection and audit quality in Malaysia. Accounting Research Journal, 22(2), 167–195.

Abdullah, S.N., & Ku Ismail, K.N.I. (2016). Women directors, family ownership and earnings management in Malaysia. Asian Review of Accounting, 24(4), 525–550.

Ahmed, S., Ali Shah, S.S., & Ali Bhatti, A. (2020). Corporate governance, ownership structure and dividend smoothing: The mediating role of family ownership and board diversity in emerging markets. European Research Studies Journal, 23(3), 199–216.

Al-Dhamari, R., & Ku Ismail, K.N. (2015). Cash holdings, political connections, and earnings quality: Some evidence from Malaysia. International Journal of Managerial Finance, 11(2), 215–231.

Al-Duais, S., Malek, M., & Abdul Hamid, M.A. (2019). Family ownership and earnings management in Malaysia. Journal of Advanced Research in Business and Management Studies, 15(1), 53–60.

Al-Thuneibat, A.A., Al-Angari, H.A., & Al-Saad, S.A. (2016). The effect of corporate governance mechanisms on earnings management: Evidence from Saudi Arabia. Review of International Business and Strategy, 26(1), 2–32.

Al Nasser, Z. (2019). The effect of royal family members on the board on firm performance in Saudi Arabia. Journal of Accounting in Emerging Economies, 10(3), 487–518.

Amara, I., & Khlif, H. (2020). A review of the influence of political connections on management’s decision in non-US settings. Journal of Financial Reporting and Accounting, 18(4), 687–705.

Amran, N.A., & Che Ahmad, A. (2011). Board mechanisms and Malaysian family companies’ performance. Asian Journal of Accounting and Governance, 2, 15–26.

Ayedh, A., Fatima, A.H., & Mohammad, M. (2019). Earnings management in Malaysian companies during the global financial crisis and the coincidental effect of IFRS adoption. Australasian Accounting, Business and Finance Journal, 13(1), 4–26.

Azmi, N.A., Zakaria, N.B., Mohd Sanusi, Z., & Abdul Wahab, E.A. (2021). The effect of board monitoring on operating cash flows manipulation among Malaysian firms. Journal of Legal, Ethical and Regulatory Issues, 24 (Special Issue 1), 1–13.

Becker, C.L., Defond, M.L., Jiambalvo, J., & Subramanyam, K.R. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15(1), 1–24.

Ben, R.A.M., Lassoued, N., & Attia, A. (2016). Political costs and earnings management: Evidence from Tunisia. Journal of Accounting in Emerging Economies, 6(4), 388–407.

Bertin, M.J., & Iturriaga, F.J.L. (2014). Earnings management and the contest to the control: An international analysis of family-owned firms. Spanish Journal of Finance and Accounting, 43(4), 355–379.

Bliss, M.A., & Gul, F.A. (2012). Political connection and cost of debt: Some Malaysian evidence. Journal of Banking and Finance, 36(5), 1520–1527.

Boonlert-U-Thai, K., & Sen, P.K. (2019). Family ownership and earnings quality of Thai firms. Asian Review of Accounting, 27(1), 112–136.

Chaney, P., Faccio, M., & Parsley, D. (2011). The quality of accounting information in politically connected firms. Journal of Accounting and Economics, 51(1–2), 58–76.

Che-Ahmad, A., & Mustafa, A. S. (2017). Ownership patterns and control of top 100 Malaysian listed companies. SHS Web of Conferences, 34, 1–8.

Chen, C.J., Ding, Y., & Kim, C. (2010). High-level politically connected firms, corruption, and analyst forecast accuracy around the world. Journal of International Business Studies, 41(9), 1505–1524.

Cherif, Z.F., Ayadi, S.D., & Ben, H.S.B. (2020). The effect of family ownership on accrual based and real activities based earnings management: Evidence from the French context. Accounting and Management Information Systems, 19(2), 283–310.

Chung, C.Y., Byun, J.H., & Young, J. (2019). Corporate political ties and firm value: Comparative analysis in the Korean market. Sustainability, 11(2), 327–332.

Claessens, S., Djankov, S., & Lang, L.H. (2000). The separation of ownership and control in East Asian corporations. In Journal of Financial Economics, 58.

Dechow, P., Ge, W., & Schrand, C. (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics, 50(2–3), 344–401.

Dechow, P.M., & Skinner, D.J. (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons, 14(2), 235–250.

Dechow, P.M., Sloan, R.G., & Sweeney, A.P. (1995). Detecting earnings management. Accounting Review, 70(2), 193–225.

Faccio, M. (2006). Politically connected firms. The American Economic Review, 96(1), 369–386.

Faccio, M. (2010). Differences between politically connected and non-connected firms: A cross country analysis. Financial Management, 39(3), 905–927.

Fung, S.Y.K., Gul, F.A., & Radhakrishnan, S. (2015). Corporate political connections and the 2008 Malaysian election. Accounting, Organizations and Society, 43, 67–86.

Gomez, E.T., & Jomo, K.S. (1997). Malaysia’s political economy: Politics, patronage and profits. Cambridge University Press

Gul, F.A. (2006). Auditors’ response to political connections and cronyism in Malaysia. Journal of Accounting Research, 44(5), 931–963.

Gul, F.A., Munir, S., & Zhang, L. (2016). Ethnicity, politics and firm performance: Evidence from Malaysia. Pacific-Basin Finance Journal, 40, 115–129.

Habtoor, O.S., & Ahmad, N. (2017). The influence of royal board of directors and other board characteristics on corporate risk disclosure practices. Corporate Ownership and Control, 14(2), 326–336.

Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2010). Multivariate Data Analysis (7th edition). Pearson/Prentice Hall.

Hashmi, M.A., Brahmana, R.K., & Lau, E. (2018). Political connections, family firms and earnings quality. Management Research Review, 41(4), 414–432.

Hasnan, S., & Marzuki, H. (2017). Board of directors’ characteristics and financial restatement. The Journal of Muamalat and Islamic Finance Research, 14(1), 1–22.

Healy, P.M., & Wahlen, J.M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13, 365–383.

Ibrahim, S., Xu, L., & Rogers, G. (2011). Real and accrual-based earnings management and its legal consequences: Evidence from seasoned equity offerings. Accounting Research Journal, 24(1), 50–78.

Islam, M.A., Ali, R., & Ahmad, Z. (2011). Is modified jones model effective in detecting earnings management? Evidence from a developing economy. International Journal of Economics and Finance, 3(2), 116–125.

Iyengar, R.J., Land, J., & Zampelli, E.M. (2010). Does board governance improve the quality of accounting earnings? Accounting Research Journal, 23(1), 49–68.

Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228.

Johl, S., Kaur Johl, S., Subramaniam, N., & Cooper, B. (2013). Internal audit function, board quality and financial reporting quality: Evidence from Malaysia. Managerial Auditing Journal, 28(9), 780–814.

Khlif, H., & Amara, I. (2019). Political connections, corruption and tax evasion: A cross-country investigation. Journal of Financial Crime, 21(4), 545–554.

Kim, S.-H., & An, Y. (2019). Influence of family ownership on earnings quality. Asian Journal of Business and Accounting, 12(2), 61–92.

Kothari, S.P., Leone, A.J., & Wasley, C.E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197.

Liedong, T.A., & Rajwani, T. (2018). The impact of managerial political ties on corporate governance and debt financing: Evidence from Ghana. Long Range Planning, 51(5), 666–679.

Lo, K. (2008). Earnings management and earnings quality. Journal of Accounting and Economics, 45, 350–357.

Mohamad, M.H.S., Abdul Rashid, H.M., & Mohammed Shawtari, F.A. (2012). Corporate governance and earnings management in Malaysian government linked companies: The impact of GLCs’ transformation policy. Asian Review of Accounting, 20(3), 241–258.

Mohd Radzi, S.N.J., Islam, M.A., & Ibrahim, S. (2011). Earning quality in public listed companies: A study on Malaysia exchange for securities dealing and automated quotation. International Journal of Economics and Finance, 3(2), 233–244.

Nuanpradit, S. (2019). Real earnings management in Thailand: CEO duality and serviced early years. Asia-Pacific Journal of Business Administration, 11(1), 88–108.

Paiva, I.S., Lourenço, I.C., & Branco, M.C. (2016). Earnings management in family firms: Current state of knowledge and opportunities for future research. Review of Accounting and Finance, 15(1), 85–100.

Razzaque, R.M.R., Ali, M.J., & Mather, P. (2020). Corporate governance reform and family firms: Evidence from an emerging economy. Pacific Basin Finance Journal, 59, 1–21.

Sun, L., & Rath, S. (2010). Earnings management research: A review of contemporary research methods. Global Review of Accounting and Finance, 1(1), 121–135.

Teh, B.H., Ong, T.S., & Ying, L.Y. (2017). Earnings management in Malaysian public listed family firms. Journal Pengurusan, 51, 183–193.