Research Article: 2022 Vol: 21 Issue: 2S

The effect of social capital on organizational performance: The case of ecommerce firms

Patrick Balian, University Jean Moulin Lyon 3

Assaad Farah, American University in Dubai

Udo Braendle, American University in Dubai

Farah Arkadan, American University in Dubai

Keywords

Intellectual Capital, Social Capital, Socio-Economic, Ecommerce Performance

Citation Information

Balian, P., Farah, A., Braendle, U., & Arkadan, F. (2022). The effect of social capital on organizational performance: the case of ecommerce firms. Academy of Strategic Management Journal, 21(S2), 1-14.

Abstract

The competitive superiority & agility needed to grow often depends on the quality of a firm’s social capital. Using intervention research in the context of a US-based retail ecommerce business, this paper tests the hypothesis that enhancing social capital improves performance. This study uses socio-economic theory and socio-economic methodology to encourage the organizational reform from within the enterprise at all levels and with the participation of all the company's actors. The results of this intervention study supported the hypothesis at all stages. The study finds that enhancing social capital significantly contributes to the success of the retail ecommerce firm in terms unique qualitative and quantitative indicators, including enhanced stakeholder relationships, faster management decision making, enhanced internal and external stakeholder collaboration, enhanced cashflow and reduced product returns by customers, that extend existing research on the role of social capital in improving retail ecommerce firm performance.

Introduction

E-commerce companies face many challenges (Soni, 2020) the retail e-commerce sector and online shopping have grown very rapidly in the last decade. The sale growth of retail e-commerce is expected to almost double from 2019 to 2022 (Abid, 2019) the barrier to entry to the ecommerce business is very low. Hence, this market is becoming overly crowded and very competitive. Many new entrants are launching on a daily basis with the same product offering as the competition. This leads to a huge decrease in profit margins across the board, and companies’ revenues decrease, as the sales is being split among many local and international players. Today, business management focuses deeply on resources, reduces repetitive activities and intensifies the use of technology to meet organizational targets (Abid, 2019; Oppong, 2005). Customers expect their orders to be delivered on time, meaning that the company has to have adequate supplies in place to meet and satisfy the customers’ purchases. Retail ecommerce has a large inventory at hand that brings a lot of pressure on the company's cash flow. A timely inventory is thus very important and is continuously being used by e-commerce companies to align their customer loyalty needs with increasing demands (Abid, 2019). In fact, the cost of manufacturing, storage and distribution must be measured from an effectiveness point of view, which is known as "cost of order fulfillment" (Tian, 2008). The internet and technology revolution has transformed the way companies gather, secure and manage consumer data. In addition, quality targeting and advertising strategies have changed. These development programs have proven collecting important data from users. E-commerce companies that implement or improve these systems successfully deliver competitive advantages in terms of expense, focused, and procurement strategies.

As scholars have identified primary contributors to the success of ecommerce companies with a wide variety of electronic product offers (Park, 2012) intensely aggressive pricing (Bruce, 2010) and high-quality customer satisfaction capabilities and processes (Brugnoli, 2009) the use of the best technical logistics approaches (Ghezzi, 2012) as well as outstanding return and exchange criteria. The main factors of the company's performance are efficient coordination and monitoring between the procurement departments and vendors, production, storage and transportation firms, a corporate business strategy and rivalry and finally customer care and service (Oppong, 2005).

Retail e-commerce companies conduct borderless operations and face extreme competition from domestic and international e-commerce firms. Such corporations will also try to build their own competitive edge so that they can prosper and stay ahead of the game. In the dynamic corporate climate, market leaders are becoming increasingly familiar with intangible assets, especially intellectual capital, because of their important positive impact on organizational performance (Edvinsson, 1997) Scholars argue that intellectual capital would significantly accelerate creativity and output growth in this knowledge economy (Alrowwad, Edvinsson & Malone, 1997) describe intellectual capital as operational infrastructure, employee skills, expertise and knowledge, as well as customer relationships that create intellectual capital. Regarding the purposes of this intervention research, the researcher emphasized on only social capital out of three main types of intellectual capital: human, structural, and social capital (Youndt, 2005; Snell, 2004). The researcher argues that there are gaps in the literature providing opportunities for investigating the effect of social capital on the performance of retail ecommerce firms (Liu, 2018).

The context of this study is a US-based small family-owned enterprise which was founded in 2009 as an LLC entity. The entity has two brothers as owners and senior-level managers responsible for the company’s daily operations. The company has two more staff members and operates in the online retail ecommerce industry. The company's products are sold online worldwide. It has developed its own online retail portal and is using a third-party platform to sell its goods (Walmart, Amazon & eBay). This choice of organization as a field of intervention research has three folds: first, the business engages in the field of the researchers’ expertise & interest. The researchers have considerable expertise in valuing retail ecommerce businesses, in combining and incorporating the acquired organization with the current acquirer operation to synchronize all activities. Second, the study's results will be a great benefit to the organization, because it can strengthen its foundation and ensure long-term sustainability. Third, the researchers' motivation to undertake intervention research through the implementation of socio-economic (SEAM) methodology as a strategy. This method was developed by Henri Savall (1974) and refined by Jean Moulin University-Lyon III's ISEOR© Research Center as a methodology of institutional growth with quantifiable outcomes in the qualitative, quantitative and financial dimension.

The main challenge being addressed by this research intervention study is on the company social capital weakness, the organization faces problems that are hampering its growth performance. The researched firm is facing challenges on a micro level from a lack of strong social capital, which is hindering its overall growth performance. It had many microenvironment challenges that were hindering its growth. The weak firm’s interdepartmental communication and employees’ relation is affecting incoming and outgoing shipments, resolving out problems rapidly, affecting the enhancement of business and operational smooth workflow, and having sufficient cash on hand when required; this is decreasing potential sales and negatively affecting profit. The firm’s interchange with suppliers is shy which is resulting longer time to conclude a test deal, a prototype and enhancement; this resulting in a loss of potential sales and loss of potential profits. The firm’s interchange with customer is weak and lacking the ability to figure out metrics, such as product returns’ reasons and dissatisfaction reasons which is affecting potential sales growth. The firm’s market trend catchers are not allocated necessary time to draw new potential products launches. This is hindering potential growth of the company.

The objective of this intervention research is to promote change within the organization into competitive resilience in order to grow and to induce energetic innovative tactical strategic capacity by continuously developing firm resources. The socio-economic management paradigm that turns business challenges into opportunities, acknowledges critical creative thought, promotes changes within the enterprise, and all players of the firm’s become actively engaged who guarantee sound truthfulness and outcome trustworthiness. Thus, the research questions for this intervention research are as following: How can the enhancement of social capital help to improve the ecommerce firm’s performance and how can SEAM intervention contribute to the performance enhancement of ecommerce firms?

The core hypothesis for this study describes the complexities of intervention analysis and decodes the hypothesis proposed in the analytical study into the firm's institutional context as follow: “Enhancement of social capital improves retail ecommerce firm’s performance”.

Materials and Methods

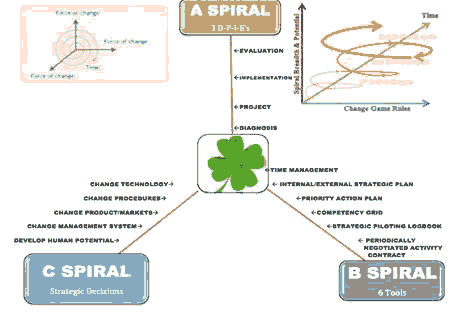

This study applies intervention research in the context of a US-based retail ecommerce business to test the hypothesis that enhancing social capital improves performance. The socio-economic approach Savall (1974-1975) applied in this research study focuses on behavioral transition and findings that are being analyzed as a result of the interplay within the enterprise between the intervener-researcher and the players of the firm, when they continue to arise concurrently and consecutively. That will lead to an integrated mix of qualitative, quantitative and financial data (Savall, 2012). This implemented socio-economic methodology is called the qualimetrics method, which is based on the tri-axial process: “the process of improvement, the innovative socio-economic management tools and the political and strategic decisions” (Cappelletti, 2009; Savall, 2012) You can see the details of the phases of the Thrihedron Axes in Figure 1, SEAM A, B&C Spiral Axes. This technique has been tested and implemented in many organizations through various industries and sectors in 34 countries all over the world since 1974 (Buono, 2007; Savall, 2003).

The negotiation process is a critical part of socio-economic intervention because the general manager of the company has to well grasp all the necessary appropriate steps of the intervention. This means he'd be actively supporting the initiative in all its phases up to the finalization of the intervention.

The socio-economic (SEAM) theory is a management theory that innovatively connects the social dimension of organizations and their economic output (Savall, 2004-2011). In addition, socio-economic theory has planned, built and evaluated a mixture of the qualitative, quantitative and financial aspects of a company (Savall, 2004-2011). The goal of the theory is to modify organizational behavior in order to reduce conflict and hidden costs. Theoretically, organizational systems are agent variables in the production of breakdowns in every process. There is an ongoing connection between the processes of the organization and the actions of the workers. This activity, which is essential to the production and manufacturing of products and services, is also a source of breakdowns. The theory focuses on hidden costs and human potential, in terms of resources, actions and competence. The theory is based on the socio-economic concept of optimizing the total operations and productivity of organizations, and a large organizational base performed over the years shows the immense importance of its utility and practice. Meta-analytical research reinforces the socio-economic approach, an approach proposed to bridge a significant divide between management theory and management practice (Buono, 2015).

Everything counts and everyone has the opportunity to move forward (Savall, 2012). When SEAM is correctly applied in an e-commerce business, it will give a durable strategic edge to the online territories of firms and will boost their accelerated adaptability on all fronts. According to Conbere & Heorhiadi (2011), traditional management focuses solely on financial data-based analysis without taking into consideration the employee viewpoints and role of the company. The SEAM theory is threefold: it includes an innovative framework for lasting corporate management, a mechanism for handling change in transformation within organizations, and a system of delivery across wider parts, composed of fundamentally different individuals and entities (Savall, 2003). There are two key concepts to be briefly defined in the SEAM theory: hidden costs and human potential. Human potential is the core concept of socio-economic theory, where it is established that each person has specific actions, skills and competencies, and the aim of SEAM is to enhance the human potential of the organization. Management has to work with the company's stakeholders to define and turn the latent potential into tangible potential.

Diagnostic Process

The researcher must take multiple steps in this intervention diagnostic process which is comprised of qualitative and quantitative phases. The method is applied to everyone in the organization, from the management to front line staff in the company. This stage starts with the collection of company reports, relevant field observations and semi-structured interviews with all involved parties in the company. Calculation of hidden costs, mirror effect and basket production follows.

Qualitative Semi Structured Interviews

The qualitative semi-structured interviews are conducted in the diagnostic first stage, with the entire firm’s participants separately, for approximately 1 hour each. The second phase of the interviews is to collect details by interviewing the two senior-level managers responsible for the company’s daily operations and the finance manager for an hour and a half each in order to fully comprehend the viewpoints of the organization’s actors, the obstacles and breakdowns they face in their day-to-day operations and their implications.

The analysis of these interviews produced expert guidance focused on quoted recorded breakdowns core ideas, aggregated ideas and the conversation about the mirror effect that highlighted the most cited breakdowns that seemed to be the most distressing and detrimental to the organization's service and summarized in a very plain language. It is an additional degree of appraisal, beyond the already collected information. The expert opinion grants company’s actors a technique for validation and contradictory arguments on the quoted breakdowns; thus, it is unique to the firm (Savall, 1992). The key themes and overall aim that came out of the interview analysis are to reorganize the aggregated ideas to form the resulting initiatives that will be built into the socio-economic projects. The remaining two stages are then the execution of the improvement socio-economic projects followed by an appraisal phase.

Quantitative Analysis

The second stage is a quantitative process. This is to collect estimated quantitative data, from the related managers, based on all the company’s actors cited breakdowns. In this step, hidden costs are estimated. Costs associated with the acknowledged breakdowns are measured so that the management of the organization can see and truly evaluate the financial extent of the costs associated with the identified breakdowns (Savall, 2003). SEAM diagnosis has a very uncomplicated method to follow, and the outcomes are usually irrefutable, as evidenced by a combination of qualitative and quantitative data (Buono, 2007). The hidden costs appraisal seeks to explain and shed light on the known economic impact of breakdowns of the company; Moreover, it is to entice staff of the company to embrace transition evolution.

Hidden Costs Calculation

The hidden costs analysis is carried out with appropriate managers in each department to assess the effect of the pinpointed breakdowns in six elements and five economic impact indicators. The hidden costs method is a powerful instrument to analyze and make visible the financial cost of the breakdowns so that managers can grasp the extent of the disorder better. Managers who have a clear knowledge of the operations of their respective departments analyze and measure the estimated hidden costs.

Mirror Effect

The mirror effect is a qualitative analysis based on the quotations of the firm’s players, which makes them perceive their quotes in a manner that validates, undermines, reinforces or complicates them. The mirror effect is the review of the semi-structured interview content with quotations from actors that is delivered aggregately and anonymously to all the actors in the whole company. It results in much dialogue and clarification of breakdowns, opening the way for a more positive understanding to fix them.

31 Management Tools

The socio-economic management tools include improve primacy management tasks, better use of existing skills resources, enhanced exposure via piloting tasks and breakdown pointer steps and hidden cost avoidance and improved apprehension of a medium-and long-term market environment transformation (Edvinsson, 1997).

Internal & External Strategic Action Plan

An organization's short and long-term master plan is an internal and external strategic action plan. This method reflects the goal of the organization for the next 3-5 years and details the steps for the corporate strategy, so that the company's players can formulate plans for the attainability of the organization's strategic goals (Savall, 2008).

Priority Action Plan

Priority task plan is a six-month initiative, and it is focused on organizational internal and external strategic action plan. The method provides an array of measures to identify, step by step, the added-value projects and strategies required to achieve the organization's target objectives.

Time Management

The self-assessment process for time management is a very useful tool for clarifying and evaluating how managers allocate and spend their time on tasks and assignment. The executive committee should be focused to determine how the manager’s time has been used and if it was invested on value-added tasks. Managers should fill it up to five consecutive days to reflect their typical true time distribution during the working day.

Competency Grid

The competency grid illuminates and illustrates the existing expertise skills in the company. Each manager uses this to determine the required skills in his team and what additional skills are required to achieve the corporate strategy. It involves day-to-day operations, tasks of growth, required skill attributes and even new operations to be developed (Savall, Zardet & Bonnet, 2008).

Strategic Piloting Logbook

The piloting logbook evaluates the impacts of the implementation of change management (Savall, 2008).

Periodically Negotiable Activity Contracts

A company employee and his direct manager use this tool, which mutually decide and set specific objectives & plans that represent the priorities of the organization, departmental and internal objectives.

Policy & Strategic Decision Axis

The third axis is the policy and strategic decision which is focused on the measures the executive team will take to promote the adoption and implementation of changes based on the organization's strategic plan. The impact of the procedures conducted to mitigate or remove breakdowns, help to create momentum for the proposed improvement process framework applied by the axis of the management tool. “The socio-economic intervention helps the actors of the company speed up the policy and strategic decision-making process. It also challenges these same actors to be consistent in their choice (Savall, 2003).

Assessment of Intervention & Hypothesis Validation

Twelve months after the completion of the intervention and implementation of the approved priority action plans, interviews are conducted with each shareholder for one hour to discuss the outcomes of the intervention undertaken and the socio-economic projects implemented. These are analyzed and outcomes of the intervention are assessed.

Results

Following the diagnostic first stage whereby one-hour qualitative semi-structured interviews were conducted with all the firm’s participants separately, the two senior-level managers responsible for the company’s daily operations and the finance manager were interviewed in the second phase of the interviews to assess the obstacles and breakdowns they face in their day-to-day operations and their implications. Table 1 shows the distribution of the breakdowns mentioned by staff and the number of main ideas created by themes. Table 1 shows the distribution of the staff-mentioned breakdowns and the number of key ideas generated classified by SEAM themes.

| Table 1 Distribution Of Breakdowns Cited By Personnel |

||

|---|---|---|

| Total number of dysfunction quotes distribution by them | 66 Nb | % |

| work conditions | 15 | 23% |

| work organization | 17 | 26% |

| communication coordination coperation |

10 | 15% |

| Time Management | 8 | 12% |

| Integrated Training | 12 | 18% |

| Strategic Implementation | 4 | 6% |

Resulting Initiatives

Several resulting initiatives, or improvement socio-economic projects, were created from the analyzed interviews which addresses most of the identified breakdowns during the diagnostic process. These included: redefining the process for new product development & acquisitions, re-aligning the budget with the objectives of the business development team, ensuring both the company’s annual budget and cash flow position is in line with the company’s growth strategy, enhancing the effectivements of inventory & financial software infrastructures, reevaluating the effectiveness of existing job descriptions and employee roles & responsibilities per department, redesigning training programs to be competency-based, enhancing cross-functional communication, and finally, enhancing both internal and external relationships with stakeholders.

In order to decide which to tackle first, the steering committee took a few days to evaluate it and review it internally, the resulting initiatives were presented and discussed at length and approved by the steering committee composed by both senior-level managers Table 2 displays the eleven resulting initiatives which have been produced. Afterwards, the project group stage took place, followed by the execution and review processes.

| Table 2 Calculating The Hourly Contribution To The Value-Added On Variable Cost |

||

|---|---|---|

| Annual sales-variable cost=margin on Variable cost | ||

| HCVAVC=Margin on Variable cost/ Total Work Hours | ||

| Calculation on HCVAVC Hourly Contribution to value-Added on Variable Cost 2017 | ||

| Revenues | $ | 16,44,160.32 |

| variable Cost | $ | 10,97,835.27 |

| Margin on Variable cost VAVC | $ | 5,46,325.05 |

| Annual work hours for all factors | 6,664.00 | |

| Total Work Hours | 6,664.00 | |

| HCVAVC | $ | 81.98 |

Hidden Costs Calculation

The hidden costs analysis was carried out with appropriate managers in each department to assess the effect of the pinpointed breakdowns in terms of hidden costs which, on average, amounted to $35,000 per employee per annum.

Post-Intervention Assessment

A post-intervention appraisal was undertaken one year later by conducting hour-long interviews with company shareholders. By this time, the prioritized initiatives resulting from the intervention were implemented. Below is a description of the outcome of this assessment.

Qualitative Outcomes

Qualitative outcomes include faster management decisions and internal social capital enhanced & external social capital is enhancing.

Faster Management Decision

When the shareholders plunged in the intervention research and when they have started developing the IESAP and the PAP they have decided to put on hold a part of their expansion strategy, which entails to acquire small businesses. This decision was made in order to solidify their business bedrock and enhance their business operation and financials through the priority action plans before continuing the acquisitions. This is a remedy for the breakdown field quotes “The mission and/or objective of each department is not coherent with other departments”; “It is very important, for other departments, to have a minimum monthly meeting with the financial department”.

Internal Social Capital Enhanced & External Social Capital is Enhancing

The shareholders have decided and shared the following information to all players in the company: the communication channel should always be open between all actors of the company regardless of their departments and the company encourages all actors to strengthen their coworkers’ bonds and share work experiences and share suggestion at all levels of the company. Moreover, they have organized a monthly get together with all company’s actors to go for a social drink after work. Furthermore, the company shareholders decided on enhancing the manufacturing and suppliers’ relationship by meeting manufacturers face-to-face in China and increasing their communication with them, in order to get more market, competition, product and trend information that is of very important material for the company decisions. Additionally, all client servicing and relationship process is being redesigned in order to enhance them. This is a remedy remedial action for the breakdown field quotes “The communication between department heads is not always smooth “, “Meetings are not scheduled regularly”. “There is no regular face-to-face meetings between departments because of some remotely working members”.

Quantitative Outcomes

Quantitative outcomes include external and internal stakeholder relationship enhancement.

External Stakeholder Relationship Enhancement

This improvement socio-economic project that was implemented has three folds. First, it tackled the relationship enhancement of the suppliers and second it tackled the enhancement of the relationships with banks. The result of the first pillar is that the company was able to secure favorable terms of payment of two major lines of products that they have been promoting and selling for more than 4 years without getting any terms of payments from suppliers. The company secured a 100% term of payment for a 100 days against the bill of lading. In addition, the company acquired many important market and product trend information that was used to enhance a line of product and to launch an additional product. This has resulted in an enhancement in the company cash flow needs and less use of line of credits. The second pillar result is that two different banks have extended two long-term lines of credit of $250,000 each at 4% and 6%, in addition to two short-term lines of credit of $50,000 each at 3.99% and 6%. This has resulted in an enhancement in the company cash flow needs and better rates of financing which reflects positively on the bottom line of the company figures. The third pillar is based on the enhancement of the relationship with customers. This has led to an increase in the number of positive feedback, which is very important in the retail ecommerce realm, in addition, to enhancing the products features to answer the most important features required by customers. Moreover, the company has noticed a reduction in customer product returns. This has led to have more sustainable products and increase sales of the company. The overall calculated value of post-intervention initiatives executed is approximately $53,000 per year. As such, the hypothesis that an improvement of the social capital in the context of an ecommerce firm will lead to improved performance is validated.

Discussion

While a variety of influential scholars have made important contributions to the broader intellectual capital literature [e.g. 5, 10, 19, 38 43, 44 45], this study focuses on a specific facet of intellectual capital, social capital, and its role in enhancing firm performance. Additionally, while scarce (Youndt, 2004) extant research examines the link between intellectual capital and firm performance in general (Subramaniam, 2005) or within the public sector [e.g. 9]. The positive effect of intellectual capital on organizational performance, however, varies in terms of organizational outcomes, from market share, operational productivity, shareholder interest, financial performance and a firm’s valuation. As such, this study uniquely focuses on a specific context, that of retail e-commerce firms, a sector which has grown rapidly in the last decade [1] and faces many challenges (Soni, 2020).

In line with the above-mentioned scope of this intervention study, the guiding research questions are the following: How can the ecommerce firm’s performance be improved by enhacing social capital & how can SEAM intervention enhance the performance of ecommerce firms? As such, the following hypothesis was developed: Enhanced social capital can improve the performance of an ecommerce firm. The results of this study, thus, extend existing research on the specific role of social capital in improving retail ecommerce firm performance.

Various general definitions for intellectual capital have been developed. One definition is says that it can be identified as all intangible assets and resources, such as knowledge, technical skills and experience, supplier and customer relationships, internal and external exchange of information, regulations, records, patents, organizational systems, manuals, operating processes that are used effectively to build economic value for the company (Sullivan, 1996; Steward, 1997) described intellectual capital as data, intellectual property and content, expertise, core strategies, relationships with customers and experience that can be used to make the business wealthy (Stewart, 1997) Furthermore, an alternative definition is that intellectual capital encompasses the amount of all knowledge intelligence firms use for strategic advantage (Subramaniam, 2005). Other extant research suggests that intellectual capital is the main engine of the firm (Bontis, 1996; Wang, 2005) We believe that such definitions are very similar, emphasizing more or less the same points but with different terminology. In this study, we have opted to use the same interpretation of intellectual capital as defined by Sullivan & Edvinsson in 1996, as it encompasses all the important aspects of our research area.

Extant research delineates three main types of intellectual capital: human, structural, and social capital (Subramaniam, 2005; Sullivan, 1996). In terms of social capital, which is the focus of this study, businesses can manufacture or deliver a profitable and creative product or service, but the likelihood of success is scattered if it does not create the necessary solid partnerships and does not create sufficient relationships with its consumers, suppliers and all external stakeholders, in addition to a solid relationship internally among all employees, internal stakeholders (Liu, 2016; Soni, 2020). This demonstrates the important role of social capital in a firm.

Various definitions of social capital have been established. First definition is that refers only to the external relationship with the company such as: The value and knowledge embedded in external relations of the firm, including the relationships with its customers, suppliers, distributors, partners, the local community, and all related external parties, comprises a relationship-centered capital (Edvinsson, 1997; Bontis, 1998) define relational capital as the association between an organization and its external stakeholders. Along the same lines, other scholars defined social capital as the external relationship that the company has with vendors, customers, agents, shareholders, authorities, and the community (Cabrita, 2006). On the other hand, Youndt & Snell (2004) added to the previous mentioned definition, the internal relationship that employees have or create between themselves that is considered essential to integrate and synthesize employee knowledge (Subramaniam & Youndt, 2004).

For the purpose of this research, we have chosen to define social capital as Subramaniam & Youndt (2005); Youndt, et al., (2004) did, linking between associations and other persons or associations. These persons & organizations links include customers, managers, staff, suppliers, administrative professionals, creditors, financial specialists, suppliers, service providers and any other internal & external stakeholder.

Examples within the retail ecommerce context include good customer service & satisfaction, suppliers’ relationships, strong relationships with investors & a strong bond between employees at all levels of the business. Good customer service & satisfaction are every important in the ecommerce industry as the client communicates with the company mostly via email or telephone; in addition, the client never sees or touches the product before buying it. Suppliers’ relationship is a major pillar as well, because as mentioned earlier the retail ecommerce business is very inventory intensive; therefore, having good relationship with the suppliers from quality & constructive communication in terms of trend, quality & new product development & occasional visit to their premises will create a more solid bond. Furthermore, a strong relation with investors in terms, open channel, transparency and readily available information is a major pillar for sustainable funding. Moreover, a strong bond between employees at all level creates synergy, sharing environment and creative problem-solving capabilities for the firm.

The retail ecommerce industry is a very fast pace industry and business, operation and sales relations are built and maintained mostly from behind the computer screen. Accordingly, social capital plays an important role in firm success in this particular context. Various facets of social capital influence retail ecommerce firm operations including relationships amongst employees and relationships with suppliers and clients. When breakdowns in such relationships are mitigated, enhancing the firm’s social capital, this enhances firm performance, as this study hypothesized. We discuss findings of our study in the following.

The first key relationship is between employees themselves. Retail ecommerce company staff should have strong relations among themselves and specifically between employees of different departments. All actors within a firm should have strong understanding of all departments’ objectives within an organization in order to avoid deadlock. Moreover, sharing experiences (tacit knowledge) with other staff members in order to spread knowledge and know how throughout the firm (Singh, 2021). This is supported by scholars when they confirmed the development of social capital requires close attention to promoting standards and values in the company that enable interchange, facilitate relationship development and encourage employee cooperation (Subramaniam, 2005). Moreover, transferring know-how and information through social capital will encourage imagination, invention and problem-solving (Youndt, 2004) For example, the logistic department has to know that the sale and marketing departments functions objectives are tight to the logistic department in order for a smooth operational flow and to avoid having an out of stock event where the company potential sales and velocity are jeopardized. Studies have indicated that the effects of social capital accruing from the exchange of indirect and explicit information within a nexus of individuals across organizations are significant advantages and competitive company advantages. Hence, productivity, creativity and performance would be enhanced (Soni, 2020).

The second key relationship is with the local and international suppliers. Some suppliers might have difficulties in the English language or different business culture. Therefore, a strong relationship with them, will provide a source of trend and market data information; hence, the company could better source or manufacture creative products that meets the market trend, and to get insight information from the manufacturer on this industry. In addition, a strong relation with suppliers gives the firm some additional value added in terms of payment terms and product prototype capabilities. This is supported by scholars when they confirmed that social capital cannot be easily imitated by competition and creates value for the company through the communication and assimilation of individual know-how that enables companies to achieve and preserve competitive benefits (Barney, 2001). Therefore, this would give a competitive edge and increase the likelihood of sourcing & launching winning products. Hence, this would generate a positive impact on company performance.

Third key relationships is with customers as the client never meet employees or see or touch the product before he buys it. The ability to maintain a constructive dialogue, relationship building with customers and create a loyalty for the brand is a major pillar in order to generate new customer referrals and increase brand mouth to mouth awareness; this would result in more sales or sale velocity and sustainability of the company. This is confirmed by scholars when they mentioned social capital as knowledge control, linked engagement, authoritative creativity, customer relations and professional skills that offer the company an active business advantage (Agostini, 2017). Moreover, social capital positively related to the company lastingness (Bontis, 2000).

The basis of the hypothesis that enhanced social capital can improve the performance of a retail ecommerce firm stems from the notion that there is a misalignment of objectives between business development and operation departments. As such, this intervention research focused on improving the efficiency of the distribution of tasks between actors and department is not efficient. Extant literature states the following: “Social capital development requires close attention to the fostering of norms and values within the firm that enable interaction facilitate the development of relationships, and spur collaboration among employees” (Subramaniam, 2005) which validates our sub-hypothesis. Moreover, social capital cannot be easily imitated by competition and creates value for the company through the communication and assimilation of individual know-how that enables companies to achieve and sustain competitive benefits (Barney, 2001). Along the same lines, confirmed that social capital positively related to the company longevity (Bontis, 2000) and positively influence firm’s performance (Gogan, 2016).

A second key notion underlying our hypothesis is that communication, coordination and cooperation is weak at all company level. Extant research validates this second sub-hypothesis. The communication and information sharing that occurs via a nexus of individuals, both internally and externally, are often considered critical for integrating and synthesizing the knowledge generated by employees (Subramaniam, 2005) which is seen as an essential determinant of SME performance (McDowell, 2018) moreover, other scholar acknowledges that social capital cannot be easily imitated by competition and creates value for the company through the communication and assimilation of individual know-how that enables companies to achieve and sustain competitive benefits (Barney, 2001).

The first research problem of this study, “enhanced social capital can improve the performance of an ecommerce firm”, has been validated and confirmed from the literature standpoint and from the intervention research field outcome and assessment provided. Prioritized initiatives that were rolled out, focusing on enhancing the various facets of social capital described above, had overall benefits for the company of $78,000 per year.

This intervention research induced the firm’s transition into competitive agility within the organization allowing it to grow. It introduced an energetic, creative intellectual into the continuous growth of the company's resources. The SEAM paradigm, which transforms the organization's shortcomings into opportunities, emphasizes pragmatic strategic analysis, embrace of transformation within the organization, and true engagement from all stakeholders that merit strong truthfulness and accountability for performance. Moreover, the study revealed the hidden costs in ecommerce companies and promoted strategies for minimizing those costs and transforming low-value added functions into added value by increasing the organizations' sustainable efficiency.

The study’s results also confirmed the second research question of “how can SEAM intervention contribute to enhanced performance of ecommerce firms". In the business and by the players themselves, the socio-economic intervention has stimulated reforms. The project group process that the staff went through was reinforced in the way they conduct projects in the organization, and the level of coordination, cooperation and collaboration among employees at all corporate levels was dramatically improved. Hence, it increases the efficiency of interdepartmental projects and significantly decreases operational slipups. The mirror effect has initiated a lot of fruitful dialog between actors to explore the breakdowns with the end goal of discovering solutions. This creates a lot of cooperation between employees with common interests to increase the company's productivity and performance.

The importance of this work is that the enhancement of social capital makes a significant contribution to the success of a retail ecommerce firm that affects specific qualitative and quantitative metrics produced for this study that previous scholars have not looked into. This thesis provides opportunities for future research which focuses on the role of social capital in enhancing ecommerce firm performance outside of North America. Additionally, there are future research opportunities to examine the effect of other intellectual capital variables on the success of ecommerce firms, as well as to explore the specific role of social capital in firm success within other contexts outside of retail ecommerce.

References

Abid, S. (2019). Future of e-commerce: An analysis of ecommerce in retail business. International Research Journal of Engineering and Technology 5(4), 10-14.

Alrowwad, A., Habis, S., & Masa'deh, A.R. (2020). Innovation and intellectual capital as intermediary variables among transformational leadership, transactional leadership, and organizational performance. Journal of Management Development, 39(2), 196-222.

Crossref, GoogleScholar, Indexed at

Agostini, L., Nosella, A., & Filippini, R. (2017). Does intellectual capital allow improving innovation performance? A quantitative analysis in the SME context. Journal of Intellectual Capital, 18(2), 400-418.

Crossref, GoogleScholar, Indexed at

Barney, J. (2001). Is the resource-based “view” a useful perspective for strategic management research? Yes. Academy of Management Review, 26(1), 41-56.

Crossref, GoogleScholar, Indexed at

Bontis, N. (1996). Intellectual capital: An exploratory study that develops measures and models. paper presented at the 17th McMaster Business Conference,Richard Ivey School of Business, 13-26.

Crossref, GoogleScholar, Indexed at

Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63-76.

Crossref, GoogleScholar, Indexed at

Bontis, N. (2001). Assessing knowledge assets: A review of the models used to measure intellectual capital. International Journal of Management Reviews, 3, 41–60.

Bontis, N., Chua, W., & Richardson, S. (2000). Intellectual capital and the nature of business in Malaysia. Journal of Intellectual Capital, 1.

Crossref, GoogleScholar, Indexed at

Braendle, U., Farah, A., & Balian, P. (2017). Corporate governance, intellectual capital and performance: Evidence from the public sector in the GCC. Risk Governance & Control: Financial Markets & Institutions, 7(4-2), 23-29.

Crossref, GoogleScholar, Indexed at

Brooking, A. (1996). Intellectual capital. International Thomson Business Press, London.

Bruce, G.M., & Daly, L. (2010). Innovative process in e-commerce fashion supply chains. Heidelberg, 227-241.

Crossref, GoogleScholar, Indexed at

Brugnoli, G., Mangiaracina, R., & Perego, A. (2009). The ecommerce customer journey: A model to assess and compare the user experience of the ecommerce websites. Journal of Internet Banking and Commerce, 14, 31-11.

Buono, A., & Savall, H. (2015). The socio-economic approach to management revisited. Information Age Publishing Inc., Charlotte.

Buono, A., & Savall, H. (2007). Socio-Economic interventions in organizations. Charlotte, NC: Information Age Publishing, 428.

Cabrita, M.D.R., & Bontis, N. (2008). Intellectual capital and business performance in the Portuguese banking industry. International Journal of Technology Management, 43(1), 212–237.

Cappelletti, L., & Baker, C. (2009). Developing human capital through a pragmatic oriented action research project: A French case study. Sage Publications.

Crossref, GoogleScholar, Indexed at

Conbere, J., & Heorhiadi, A. (2011). Socio-economic approach to management. OD PRACTITIO-NER, 43(1).

Conbere, J., Savall, H., & Heorhiadi, A. (2015). Decoding the socio-economic approach to management; Charlotte. Information Age Publishing.

Edvinsson, L., & Malone, M. (1997). Intellectual capital: Realising your company’s true value by finding its hidden brainpower. Harper Collins, New York, NY.

Ghezzi, A., Mangiaracina, R., & Perego, A. (2012). Shaping the e-commerce logistics strategy: A decision framework. International Journal of Engineering Business Management, 4(13), 1-13.

Crossref, GoogleScholar, Indexed at

Gogan, L., Artene, A., Sarca, I., & Draghici, A. (2016). The impact of intellectual capital on organizational performance. Procedia-Social and Behavioral Sciences, 221,194-202.

Crossref, GoogleScholar, Indexed at

Liu, H., Ke, W., Wei, K.K., & Lu, Y. (2016). The effects of social capital on firm substantive and symbolic performance: In the context of e-business. Journal of Global Information Management (JGIM), 1, 61-85.

Crossref, GoogleScholar, Indexed at

McDowell, W., Peake, W., Coder, L., & Harris, M. (2018). Building small firm performance through intellectual capital development: Exploring innovation as the “black box”. Journal of Business Research, 88, 321-327.

Crossref, GoogleScholar, Indexed at

Oliveira, M., Curado, C., Balle, R.A., & Kianto, A. (2020). Knowledge sharing, intellectual capital and organizational results in SMES: Are they related?Journal of Intellectual Capital, 21(6), 893-911.

Crossref, GoogleScholar, Indexed at

Oppong, S., Yen, D., & Merhout, J. (2005). A new strategy for harnessing knowledge management in e-commerce. Technology in Society, 27(3), 413-435.

Crossref, GoogleScholar, Indexed at

Park, E.J., Kim, E.Y., Funches, V.M., & Foxx, W. (2012). Apparel product attributes, web browsing, and e-impulse buying on shopping websites. Journal of Business Research, 65(11), 1583-1589.

Crossref, GoogleScholar, Indexed at

Savall, H. (1974-1975). Work &people: An economic evaluation of job enrichment. Paris: Dunod.

Savall, H. (2003). An updated presentation of the socio-economic management model. Journal of Organizational Change Management, 16(1), 33-48.

Crossref, GoogleScholar, Indexed at

Savall, H., & Zardet, V. (1992). New management control: The hidden cost-performance method. Paris: Eyrolles-Éditions Comptables Malesherbes.

Savall, H., & Zardet, V. (2004-2011). The qualimetrics approach: Observing the complex object. Charlotte, NC: Information Age Publishing.

Savall, H., & Zardet, V. (2012). Family businesses creation, succession, governance at management Paris. Economica.

Savall, H., Zardet, V., & Bonnet, M. (2008). Releasing the untapped potential of enterprises through socio-economic management, (2nd Edition). Geneva: International Labor Office and Lyon: ISEOR-Université Lyon III.

Savall H., Zardet V., Péron M., & Bonnet, M. (2012). Possible contributions of qualimetrics intervention-research methodology to action research. International Journal of Action Research, 8(1), 102-130.

Singh, S.K., Mazzucchelli, A., Vessal, S.R., & Solidoro, A. (2021). Knowledge-based HRM practices and innovation performance: Role of social capital and knowledge sharing. Journal of International Management, 27(1).

Crossref, GoogleScholar, Indexed at

Smith, P., & Coakes, E. (2012). Exploiting KM in support of innovation and change. Hershey, PA: IGI Global.

Crossref, GoogleScholar, Indexed at

Soni, V.D. (2020). Emerging roles of artificial intelligence in ecommerce. International Journal of Trend in Scientific Research and Development, 4(5), 223-225.

Stewart, T. (1997). Intellectual capital: The new wealth of organizations. Double day, New York, NY.

Subramaniam, M., & Youndt, M.A. (2005). The influence of intellectual capital on the types of innovative capabilities.

Crossref, GoogleScholar, Indexed at

Sullivan, P., & Edvinsson, L. (1996). Developing a model for managing intellectual capital. John Wiley & Sons, New York, NY, 249-260.

Tian, L., Vakharia, A., Tan, Y., & Xu, Y. (2018). Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Production & Operations Management, 27(8), 1595-1610.

Crossref, GoogleScholar, Indexed at

Wang, W.Y., & Chang, C. (2005). Intellectual capital and performance in causal models: Evidence from the information technology industry in Taiwan. Journal of Intellectual Capital, 6(2), 222–236.

Crossref, GoogleScholar, Indexed at

Youndt, T. (2004). Intellectual capital profiles: An examination of investments and returns. Journal of Management Studies, 333-361.

Crossref, GoogleScholar, Indexed at

Youndt, M.A., & Snell, S.A. (2004). Human resource configurations, intellectual capital, and organizational performance. Journal of Managerial Issues, 16(3), 337-360.

Crossref, GoogleScholar, Indexed at

Youndt, M.A., Subramaniam, M., & Snell, S.A. (2004). Intellectual capital profiles: An examination of investments and returns. Journal of Management Studies, 41(2), 335-362.

Crossref, GoogleScholar, Indexed at

Received: 06-Nov-2021, Manuscript No. asmj-21- 7485; Editor assigned: 11- Nov -2021, PreQC No. asmj-21-8742 (PQ); Reviewed: 20- Nov -2021, QC No. asmj-21-8742; Revised: 04-Dec-2021, Manuscript No. asmj-21-8742 (R); Published: 03-Jan-2022