Research Article: 2021 Vol: 20 Issue: 2S

The Effect of Top Management Support and Non-Accounting Ownership on (Abc) Adoption Among Jordanian Manufacturing Companies

Mohammad Jebreel, Applied Science Private University

Mohammad ALDweiri, AL-Zaytoonah University of Jordan

Monir AL-Hakim, Zarqa University

Abd AL-Salam AL-Hamad, Applied Science Private University

Abstract

This paper seeks to investigate the effect of top management support and none accounting ownership on organisational performance, based on a literature review showed shortage in effect adoption of ABC for many of manufacturing companies are weak. The scope of the study encompasses the manufacturing companies in Jordan, and the financial managers were identified as the respondents for the questionnaire survey. Therefore, the managers and decision-makers should take these factors into consideration when making their decisions. Equally, the findings could facilitate policies formulation among the relevant bodies in developing countries, particularly those policies concerning manufacturing. In addition enriching the knowledge of organizational performance for manufacturing organizations’, this study can become a starting point for further investigation and analysis of organisational performance among Jordanian manufacturing companies

Keywords

Top Management Support, None Accounting Ownership, Abc Adoption. Manufacturing Companies.

Introduction

At present days and according to competitive and incessantly changing business atmosphere, businesses need to be deal with of the forces of alter in the business environment. (Johnson & Kaplan, 1987; Malmi, 1990). The managers need to reassessment their managerial practices due to their depend on the traditional cost systems, and at also, they need to formulate their existing accounting systems, particularly their managerial accounting systems. Therefore the importance of Activity-Based Costing (ABC) adoption is considered an attractive chance to reassessment the methods used in cost system.

The ABC studies shows that gaining an understanding of the elements that support to the success and adoption of ABC has been high interest in the field of Management Accounting Practices (MAPs) for more than two decades. Moreover, these studies explain that organizational antecedents can influence ABC adoption and implementation like top management support and none accounting ownership (Al-Omiri & Drury, 2007; Maelah & Ibrahim, 2007). Furthermore, they showed that the impact of ABC adoption on organizational performance for manufacturing companies due to the ABC can play an important role in providing relevant information for managerial operating decisions, which, in turn, should have a positive impact on profitability and shareholders’ equity.

Previous studies on the ABC adoptions focused in developed countries, (e.g. Fawzi, 2008; JawaharLal, 2009; Askarany & Yazdifar, 2009; Pavlatos & Paggios, 2009; Rahmouni & Charaf, 2010; Rajasekaran, et al., 2011; Saxena et al., 2011; Arora, 2013; Horngren et al., 2013; Shaban, 2014). Few studies was focusing in developing countries such as Jordan (Moalla, 2007; Sartorius et al., 2007; Majid & Sulaiman, 2008; Maelah, 2010; Fei & Isa, 2010; Rbaba'h, 2012; & Mansour, 2015). As will existing studies also, give more attention for manufacturing organization, (e.g. Baird et al., 2007; Al-Omiri & Drury, 2007; Yazdifar & Tsameny, 2012) and few studies investigated the relationships in the services organizations (Rbaba'h, 2012; Hutibat, 2012; Nassar et al., 2013; Mansour, 2015).

Some researchers (Nassar et al., 2009; Al-Refa’ee, 2012; Rbaba'h, 2012; Nassar, 2013) state that the most cited factors that facilitate the decision to adopt ABC are adequate support from top management and the role of none accounting ownership (Al-Refa’ee, 2012; Rbaba'h, 2012; Nassar, 2013). The level of awareness about the ABC system among financial managers in high positions is an important factor in its successful adoption in Jordanian companies it can be enhance their performance because the competition levels in Jordan will be influenced greatly by the adoption of the ABC system; this type of system greatly increases profitability, which therefore allows companies to control costs and compete more effectively (Al-kahdash & Nassar, 2010; Al-Refa’ee, 2012; Rbaba'h, 2012). Within the Jordanian case, Jordan is a developing country. It is very attractive for foreign investments, due too many reasons such as safety, political stability and its central location in the Middle East. In same time the industry sector in Jordan is separated into two parts the manufacturing and mining sector that contains of the Chemical, Electrical, Engineering and Construction (Jaradat et al., 2018). The manufacturing sector significantly support to promoting the Jordanian dinar exchange rate in light of their stability by supporting the Jordanian foreign currency reserves (Jaradat et al., 2018). As mentioned in Jaradat, et al., (2018), the sector of manufacturing greatly affects the achievement of financial stability through support the treasury every year from the direct and indirect taxes.

Theoretical Review

Top Management Support

Top management support is required to manifest a policy into objectives, goals and strategies. Top managers are responsible for achieving targets and meeting for project’s needs. They should share the firm’s vision of the future, and they are held responsible for a company’s success (Amran, 2011; Mustapa, 2013). Furthermore, the top management support is defined as the role that top management plays in ABC adoption through making decisions that could affect everybody involved, holding them responsible for rendering them to adopt ABC and utilising funds to adopt the system (Jibril, 2018).

None Accounting Ownership

Generally, an ABC system is solely owned by accountants, while other users tend to be excluded to satisfy accountants’ needs. A crucial factor in companies’ failure to share ownership with non-accountants is adoption experience. Thus, non-accounting ownership and support of top managers, greatly influences ABC adoption (Brick & Chidambaran, 2007; Maelah et al., 2010; Amran, 2011; Jebril, 2018) mentioned that the non-accounting ownership have basic role in ABC adoption in Jordanian manufacturing companies.

ABC Adoption

Adoption is a term defined by Saya, Pee & Kankanhalli, (2010) as the acceptance and the use of something new. In light of technology adoption, adoption refers to a decision to make complete use of an innovation as the available top course of action (Rogers, 2003). In the context of the organization, Deering, Tatnall & Burgess, (2012) linked adoption to the admission of a novel innovation for the purpose of adoption. In relation to the research topic, adoption refers to the acceptance of the ABC as an innovation in the organizations. Notably, the upsurge in researchers’ and practitioners’ interest in the implementation of ABC in organizations has occurred as a result of ABC’s superiority over traditional costing methods and its significance in enhancing organizational performance (Fei & Isa, 2010; Fatma & Habib, 2014; Jibril, 2018).

Hypothesis Development

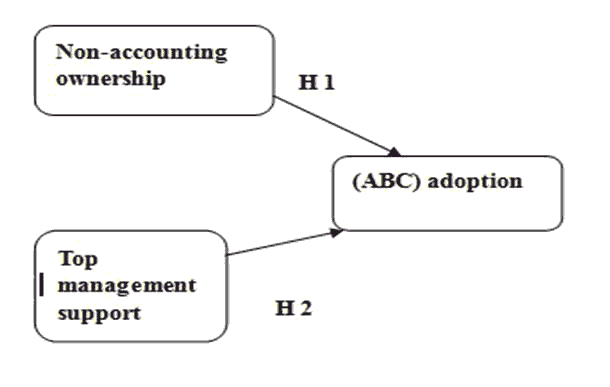

The concept of activity based costing system adoption are merged in one conceptual framework. Figure (1) explains the framework of study. In this conceptual framework, the main element ABC adoption by (top management support, non-accounting ownership) and ABC adoption independent and dependent variables respectively. This study seeks to bridge the gap by providing a basis for discerning the impact the ABC factor successes.

Top Management Support and ABC adoption

The main factors for the success of an innovation depend on the maximum ranking managements such as chairman, president, executive directors, executive vice presidents that is responsible for the entire organizations (Walton, 1987; Hoffman, 1999; Scott, 1994; Cobb, 1992; Johnson, 1987; Lana, 2007; Sheild, 1996; Taba, 2005; Sheild, 1995 ). Also, they mentioned that the top management support the main factor can give the high degree in ABC adoption and implementation system. Furthermore, Ruhanita (2006) explained that the top management support link ABC to performance measure and affected on the ABC success adoption significantly.

Top management contribute to achieve the policy into aims, goals, and plans, thus its makes decisions that have an effect on everyone in the company and is detained completely accountable for the achievement or failure of the business. Gosselin (1997) explained that the role impact of top management support for each stage of ABC adoption process in manufacturing firms. Based above discussion, this study proposes the following hypotheses for testing:

H1: The top management support is positively related to ABC adoption.

Non Accounting Ownership and ABC adoption

The previous studies mentioned the role of accounting ownership have possessed threats of ABC adoption due to have good execution knowledge in cost system (Sheild, 1985; Johnson, 1987; Shield, 1996; Norries, 1995; Mohammed, 2007; Jibril, 2018). Therefore, Krumwidev reported that the non- accounting ownership has significant role in affect each stage of ABC adoption process in manufacturing and service companies. Due to when the companies need to accomplish adopt or implement new system the accountants not succeed in distribution possession with non-accountants.

Ruhanita (2006); Jibril (2018) explained that the top management support, Non-accounting ownership has significant role ABC to performance measure and influenced the ABC success adoption significantly. Additionally, Cooper (1992) found that the existence of accounting staff can be give effective role on ABC adoption and implementation. From the aforementioned discussion, therefore, the following hypothesis is proposed by this study:

H2: The Non-accounting ownership is positively related to ABC adoption.

Research Model

In general, the contingency theory is an organizational theory that based that the best way to lead the company, or to make decisions, the optimal action is contingent upon the internal and external situation of the company (Fiedler, 1964). The contingency perspective has been employed in management accounting studies to indicate a range of contingent variables including organization structure (Chia, 1995; Gosselin et al., 2005), training (Chenhall & Langfield-Smith, 1998b), and accounting information system design (Otley, 1980).

Contingency theory explains the factors that impact on the ABC adoption (Anderson et al., 2002; Kallunki & Silvola, 2008; Liu & Skillet, 2007; Cadez & Guilding, 2008; Jibril, 2018). In the late 1980s, ABC was as a new costing technique procedure that offered cost data that is more as accurate compared with to the traditional costing system. Then, in 1990, the contingency theory has been employed in examining the factors that impact the adoption of the systems. Based on this theory, there has been change on the present management accounting practices in order to responding the conditions faced by firms; thus, these the change to practice were influenced by the contextual and organizational factors and these are turned as contingency factors (Jebril, 2018).

According to the contingency theory perspective, this research will explain the role of top management support, and non-accounting ownership from the internal organizational such as contextual and organizational factors and external environmental variables. These factors will directly impact the ABC adoption. The significant determinant of ABC adoption is the contingent fit between the organizational internal and the contingencies. Meanwhile, the framework of contingency theory reported the factors influencing its adoption. Hence, these factors have influence on the choice of accounting and information systems. This enables the managers and companies to adapt quickly to changing markets and technologies for the adopting accounting and organizational changes, thus is very important to understand what is driving these changes on strategies and organizational performance in organizations.

Research Methodology

Zikmund et al., (2013) explained that objectives, availability of information, and cost for conducting research, are factors influencing the choice of research design. Hence, this study adopts a survey method since the data obtained from a survey is used to examine the relationships between the dependent and independent variables (Bryman & Bell, 2015). In addition, as the respondent is financial managers, has expected to be highly educated, making a survey approach the most suitable technique for this context (Cooper et al., 2006). Another advantage of the survey strategy is that a large amount of data can be gathered from respondents, and the results can be generalized to the population at large (Jarrdat, 2018).

The instruments used in this research based on Oppenheim's (2000) guidelines. In particular, Oppenheim (2000) mentioned that an instrument should fulfil two requirements: relevancy and accuracy. In terms of fulfilling the relevancy requirement, this study employed questionnaires to gather information on the research objectives. Concerning the fulfilment of the accuracy requirement, (Zikmund et al., 2013).

The impact of top management support and none accounting ownership on the ABC adoption was examined in this study via the application of questionnaires distributed to financial managers of 291 randomly selected Jordanian manufacturing companies. The questionnaire consists of three main sections: Part A to Part C Part A gathers demographic data of the respondent and his/ her companies. Part B focused on the factors (Top management support, none accounting ownership) influencing the ABC adoption; Part C gathers data related information about ABC adoption in companies.

Five items representing the construct of top management support and ABC adoption were supplemented with a 5-point Likert scale S1-S5 range as well where S1 “strongly disagree” while S5 signifies “strongly agree.” Three items representing the construct of none accounting ownership were supplemented with a 5-point Likert scale with S1-S5 range as well where S1 “strongly disagree” while S5 signifies “strongly agree.” Meanwhile, a total of six items were representing the construct of ABC adoption.

Results and Discussion

Data Analysis

Factor analysis was in this research, and evaluation was made to the measures of the construct to determine both its reliability and validity. Further, the model proposed in this study demonstrates the used variables’ unidimensionality, in the explaining of factor analysis. With the use of AMOS-SEM, the (measurement model) and the (structural model) were evaluated after the data have been checked and screened. In particular, AMOS-SEM analysed this study’s direct results.

Measurement Model

Based on the Amos-SEM, the component measurement was included in the model and this model provides the determination the indicators (items) hypothetically and link to the resultant constructs. In this study, the model analysis results affirm that the items of the survey measure the constructs as they should, affirming both their validity and reliability.

| Table 1 Convergent Validity Analysis |

||||||

|---|---|---|---|---|---|---|

| Construct | Items | Loadings | Cronbach's Alpha | CR | AVE | |

| TMS | 0.95 | 0.948 | 0.786 | |||

| TMS1 | 0.74 | |||||

| TMS2 | 0.84 | |||||

| TMS3 | 0.87 | |||||

| TMS4 | 0.81 | |||||

| TMS5 | 0.83 | |||||

| NAO | 0.853 | 0.854 | 0.662 | |||

| NAO1 | 0.83 | |||||

| NAO2 | 0.8 | |||||

| NAO3 | 0.81 | |||||

| ABCA | 0.931 | 0.933 | 0.697 | |||

| ABCA1 | 0.86 | |||||

| ABCA2 | 0.83 | |||||

| ABCA3 | 0.83 | |||||

| ABCA4 | 0.84 | |||||

| ABCA5 | 0.81 | |||||

| ABCA6 | 0.84 | |||||

For each construct used in this study, its values of CR and Cronbach’s alpha were determined (see Table 1). The constructs used in this study all achieved the values of CR and Cronbach’s alpha that are greater than the suggested threshold value of 0.70 (see Hair et al., 2013; Henseler et al., 2009; Wong, 2013). Furthermore, Henseler, et al., (2009) elaborated that convergent validity relates to the degree to which measures of constructs with theoretical association are linked. As mentioned in Hair, et al., (2013), the achieved value shows the level of linkage among the measures of similar construct.

Hypotheses Testing

In this study, the test was executed on the hypothesised model with the first stage in application of Amos-SEM algorithm. Accordingly, as explained in Table 2:

| Table 2 Results of Hypothesized Direct Effects of The Variables |

||||

|---|---|---|---|---|

| Hypotheses | Path coefficient | T. Statistics | P-Values | Decision |

| TMSàABCA | 0.2 | 3.275 | 0.075 | H1 Supported |

| NAOàABCA | 0.268 | 4.036 | 0 | H2 Supported |

Concerning with the path between TMS, NAO constructs and ABCA construct (Hypotheses (H1 and H2), the beta coefficient is positive and statistically significant at p-value<0.001 (β=0.200; t=3.275 and β=0.268; t=4,036, respectively).

Discussion of Results

This study found that the relationship between TMS and NAO with ABC adoption is positive; this result supported by hypothesis H1 and H2. Based on that, it seems that TMS and NAO make effective of and improve ABC adoption. This result in line with studies that support a positive relationship between TMS and ABC adoption (Nassar et al., 2011; Al-Refa’ee, 2012; Fadzi & Rababah, 2012; Rababah, 2014). Also, this result in line with studies that support a positive relationship between NAO and ABC adoption (Nassar et al., 2011; Al-Refaee, 2012; Rababah, 2012).

Based above discussion in the previous sections, the following framework is proposed, explained by Figure 1, for this study. This paper aim to investigate the roles of the ABC factors on ABC adoption among Jordanian manufacturing companies. The study seek to as a wake-up call for reforming the management practices in Jordan. To achieve this proposed, namely, Non-accounting ownership, top management support on the other hand the two hypotheses are developed to validate the hypothesis survey research will be undertaken.

Conclusion and Recommendations

The calls for additional research using a contingency perspective to improve the understanding of ABC adoption in manufacturing companies and the increasing importance of manufacturing companies globally, especially in developing countries has motivated this study. Therefore, among manufacturing companies, this study explores top management support and none accounting ownership in terms of the factors impacting on ABC adoption.

Considering the positive impact top management support and none accounting ownership on ABC adoption, the managers and decision-makers should increase the knowledge of ABC adoption. Likewise, professional bodies should enrich the knowledge of ABC adoption particularly concerning in manufacturing companies through the use of workshops and conferences. As the impact top management support and none accounting ownership on improve the level of ABC adoption, policymakers should encourage these role on ABC adoption in manufacturing companies. Therefore, considering the positive impact of these factors on ABC adoption, managers and decision-makers in manufacturing companies should take these factors into consideration when making their decisions.

This study provides knowledge on ABC adoption in manufacturing companies in developing countries. According to study results, the concerned bodies could be assisted in reformulating the policies associated with manufacturing companies. Also, the awareness of factors affecting ABC adoption assists the professional bodies in the enrichment of manufacturing companies understanding particularly concerning the ABC adoption affecting factors. In the context of manufacturing companies, this study can stimulate more scrutiny and analysis concerning manufacturing companies.

However, there are several limitations related to this study which are worth considering. Firstly, the variables employed in this study were limited and this may cause the neglect of certain vital variables. Hence, there is merit in having the understanding of other factors related to ABC adoption on manufacturing companies. Accordingly, among these factors are: training, information technology, and organisational culture as well. Another notable limitation is the use of limited sample in this study, whereby it consisted the manufacturing companies. The use of limited sample reduces the generalizability of the outcomes of this study to other types of organisations in other industries. Hence, it might be of value to consider other sectors, for instance, the service sector, as this would allow comparison of outcomes, increasing the generalisation.

References

- Al-Khadash, H., & Feridun, M. (2006). Impact of strategic initiatives in management accounting on corporate financial performance: Evidence from Amman Stock Exchange. Managing Global Transitions, 4(4), 299–313.

- Abu-Tapanjeh, A.M. (2008). Activity-based costing approach to handle the uncertainty costing of higher educational institutions: Perspective from an academic college. JKAU: Econ. & Adm, 22, 29-57.

- Anderson, S.W. (1995b). A framework for assessing cost management system changes: The case of activity based costing implementation at general motors, 1986-1993. Journal of Management Accounting Research, 7, 1-51.

- Anderson, S., & YOUNG, S. (2001). The impact of contextual and process factors on the evaluation of activity-based costing systems. Accounting, Organizations and Society, 24, 525-559.

- Anthony, R.N. (1989). Reminiscences about management accounting. Journal of Management Accounting Research, 1, 1-20.

- Armitage, H.M., & Nicholson, R. (1993). Activity-Based costing: A survey of Canadian practice. Society of Management Accountants of Canada, 3.

- Babad, Y.M., & Balachandran, B.V. (1993). “Cost driver optimization in activity-based costing”. The Accounting Review, 68(3), 563-575.

- Chongruksut, W. (2002). The adoption of activity-based costing in Thailand. Unpublished PhD, Victoria University.

- Cooper, R.B., & Zmud, R.W. (1990). Information technology implementation research: A technological diffusion approach. Management Science, 36(2), 123–139.

- Cooper, R., & Kaplan, R.S. (1991). Profit priorities from activity-based costing. Harvard Business Review, 130-137.

- Cooper, R., & Kaplan, R.S. (1992). Activity-Based systems: Measuring the costs of resource usage. Accounting Horizons, 6(3), 1.

- Green, F.B., & Amenkhienan, F.E. (1992). Accounting innovations: A cross-sectional survey of manufacturing firms. Journal of Cost Management for the Manufacturing Industry, 58-64.

- Gosselin, M. (1997). The effect of strategy and organizational structure on the adoption and implementation of Activity-Based Costing. Accounting, Organizations and Society, 22(2), 105-122.

- Hoffman, R.C. (1999). Organizational innovation: Management influence across cultures. Multinational. Bus, 7(1), 37.

- Innes, J., & Mitchell, F. (1991). ABC: A survey of CIMA Members. Management accounting (UK), 28-30.

- Fie, Z., & Isa, C. (2010). Factors influencing activity-based costing success: A research framework. International Journal of Trade, Economics and Finance, 1(2).

- Johnson, H.T., & Kaplan, R.S. (1987). Relevance lost. The rise and fall of management accounting. Boston, MA. Harvard Business School Press.

- Lana, Y.J.L., & Fei, P. (2007). The implementation of activity-based costing in China. An innovation action research approach. 39(3), 249-264.

- McGowan, A.S., & Klammer, T.P. (1997). Satisfaction with activity-based cost management implementation. J. Manage, 9, 217-237.

- Ministry of Planning Report, the Economic indicators 2007, Amman, Jordan, 2007

- MacArthur, J.B. (1996). From activity-based costing to throughput accounting. Management accounting, 30(34), 36-38.

- Mohammed, A.O., & Colin, D. (2007). Organizational and behavioral factors influencing the adoption and success of ABC in the UK. Cost, Manage, 21(6), 38-48.

- Norris, G. (1997). The formation of managers' views of ABC and their impact on the outcome of its use. A grounded theory case study' Acc. Res. J., 10(2), 180-200.

- Ruhanita, M., & Daing, N.I. (2006). Activity Based Costing (ABC) adoption among manufacturing organizations - The Case of Malaysia. Inter. J. Bus. Soc., 7(1), 70-101.

- Shields, M., & Young, S. (1989). A behavioral model for implementing cost management systems. Journal of Cost Management, winter, 17-27.

- Shield, (1995). An empirical analysis of firms' implementation experiences with Activity-Based Costing Management Accounting Research, 7, 148-166.

- Taba, L.M. (2005). Measuring the successful implementation of Activity Based Costing (ABC) in the South African post office unpublished master thesis. University of South Africa.

- Valanciene, L., & Gimzauskiene, E. (2007). Changing role of management accounting: Lithuanian experience case studies. Inzinerine Economical Engineering Economics (5), 16-23.