Research Article: 2021 Vol: 20 Issue: 3

The Effects of Company Characteristics on R&D Disclosure of Listed Companies in Stock Exchange of Thailand

Kulwadee Lim-U-Sanno, Prince of Songkhla University

Abstract

This article presents a study on effects of company characteristics on R&D disclosure of listed companies in Stock Exchange of Thailand in 173 sampled SET100 companies selected by purposive sampling that had been in the Stock Exchange of Thailand continuously between 2016 and 2018. Data collection is done from the balance sheet, annual report and the annual item list (56-1 form), thus 519 company years can be obtained. Content analysis uses text unit counting on sentences with data and meaning related with R&D from the annual report. The study reveals that (1) the R&D data has been increasingly disclosed since 2016, the year Thailand announced the use of Thailand 4.0 model, and (2) result of multiple regression analysis shows that company size and age of CEO have positive effect on R&D disclosure, while sector and leverage have negative effect on R&D disclosure. Ability to generate profit, auditor type and age of the business has inconclusive relationship. The result can be discussed that content analysis of the financial data in the annual report can be used for disclosure of R&D data, in the same direction with Thailand 4.0 promotion.

Keywords

Research and Development Disclosure, Company Characteristics, The Listed Companies in Stock Exchange of Thailand.

Introduction

The concept to develop the economy in three aspects: 1) Factor-driven Economies, 2) Efficiency-driven Economies, and 3) Innovation-driven Economies) (Kumpirarusk & Rohitratana, 2018) is considered for assessment of national competitiveness. According to The Global Competitiveness Report, presented in World Economic Forum (Rostami et al., 2019), it is accepted that economic growth of today is driven by investment in R&D which is the source of innovation, and developed countries are wealthy in innovation and driven by Innovation-driven Economies (Haseeb et al., 2019). The Bloomberg Global Innovation Index (GII) ranks innovativeness of a country with seven criteria: (1) Institutions (2) Human capital and research (3) Infrastructure (4) Market Sophistication (5) Business sophistication (6) Knowledge and Technology Outputs and (7) Creative Outputs, and publish the annual report along with suggestion to change ranking depending on national driven (Cornell University, INSEAD & WIPO, 2018). Because in 2016 Thailand was grouped as Efficiency-driven Economies, Thailand announced implementation of “Thailand 4.0 model” as a guideline to bring Thailand to innovation-based economy to increase international competitiveness along the guidelines of 1) biodiversity and 2) cultural diversity. The guideline is carried out along with economic structure adjustment from value-added to high value or high productivity with focus on five industries: 1) Food processing agriculture and biotechnology 2) Healthcare, health and medical technology, 3) industries with advanced technology and digital, 4) Creative industry, cultural capital and high-value service, 5) basic industry and support industry (Pensute, 2017). This leads to companies in industrial sectors adapting and placing more priority on R&D as a key to success especially listed companies that find R&D projects along with disclosure of their information such as new product, new projects, product, improvement and progress report are one factor that can build competitiveness and positive benefit for the company on the basis of resource and investment planning into information and technology that might affect performance, financial status and return the company gets from such investment and planning (Jermsittiparsert & Boonratanakittiphumi, 2019). Information disclosure will attract more investors to the company (Nekhili et al., 2016). Regarding financial standard guideline related with R&D (Thai Accounting Standards: TAS, No. 38, Intangible Assets), which requires the company to know and disclose R&D cost as installment expense, and allows the development investment as intangible asset (Federation of Accounting Professions under the Royal Patronage, 2018), make R&D Disclosure mandatory through accounting standard which supports the private sector to increase expense in R&D and get juristic person tax relief according to Governing Exemption of Taxes (No. 598) (2016) and by request from the National Science and Technology Development Agency (NSTDA) through the Securities and Exchange Commission, Thailand to have all listed companies disclose R&D cost (if any) in the annual 56-1 item form from 2017 onwards. The information can be disclosed in the Management Discussion and Analysis (MD&A) that reflects potential and value of the listed companies. From the overall national development in support and promotion of R&D development, an issue in follow-up and compliance with government direction that can be shown through a reputable process such as accounting information and disclosure by the listed company, along with influence from company characteristics that stimulate and disclose R&D activities to meet the expectation of the stakeholders and investors.

Nevertheless, the overall problem was that public disclosure about performance caused confusion in the recipient and investor, generating necessity to study corporate R&D and size, sector, profit, leverage, auditor type, age of the business and CEO as factors in disclosure in reports that need more reliability and practicality than mere claims. Study to understand information available to stakeholders and investors, especially in companies listed in the Thai Stock Exchange that responded to Thailand 4.0 model between 2016 and 2018 that allows measurement of performance and responsiveness to government policy. And this study aim (1) Study degree of R&DDisclosure by companies listed in the Thai Stock Exchange that responded to Thailand 4.0 model, and (2) test effect of company characteristics on R&DDisclosure by companies listed in the Thai Stock Exchange that responded to Thailand 4.0 model under the concept of size, sector, profit, leverage, auditor type, age of the business and age of the CEO.

Concept of R&D Disclosure (R&DDisclosure)

Financial information disclosure is an independent mechanism for business administration that can affect performance of the company (Enache & Hussainey, 2020) R&D investment to find “innovation” is necessary for increasing value of the company in the age when everything constantly changes and competition is increasingly fierce. It is necessary to use diverse strategies and emphasize R&D that can make things change and is the key to future success (Hottenrott & Lopes-Bento, 2016). Nevertheless, good disclosure is a beneficial factor in operating a company with continuous operation, generating investor confidence in the company, but R&DDisclosure information has different intensity in corporate operation. When emphasis is placed on R&D, they have positive effect on disclosure. The company that has R&DDisclosure will see its true value (Merkley, 2014).

Concept of R&D Disclosure Standard

Financial information disclosure regulation is enacted by the Code of Commerce and General Accounting Plan, which are laws and accounting guidelines requiring the company to display performance and activities in the quarter and annual report. Nevertheless, the international standard and recommendation about R&D are on voluntary basis rather than compulsory (Nekhili et al., 2016). The Securities and Exchange Commission, Thailand defines a guideline for R&DDisclosure information pertaining to factors or incidents that might affect financial status or operation, requiring the company to explain internal and external factors under its administration. If the company has an R&D project that might affect performance, the company is required to explain such project (The Stock Exchange of Thailand, 2013). To reduce confusion, the Thai Accounting Standard no.38 and regulations not to acknowledge research expense as asset, while development cost can be acknowledged as asset according to accounting standard (Federation of Accounting Professions, 2018).

Company size and R&DDisclosure

Most studies found that company size has positive effect on innovative work (Xie et al., 2019). Larger companies are more likely to disclose information compared to smaller companies, as the former usually is mindful of regulations and disclosure to relieve pressure on the organization (Nigri & Baldo, 2018). Large companies also have better resources and operational capabilities. Thus, quality of disclosure depends directly on size and performance of the company (Nekhili et al., 2016). Lucia & Panggabean (2018) discovered positive relationship between size of the listed company and disclosure of financial information, thus a hypothesis can be formed as follows:

H1 Company size affects R&DDisclosure.

Company Sector and R&DDisclosure

Information disclosure by companies of similar size or sector usually are done at similar level (Burks et al., 2018) in accordance with company strategies to display performance, control uncertainties and future impact (Jaggi et al., 2018). Conversely, different industries have different degree of disclosure due to each type of information can affect the company differently (Enache & Hussainey, 2020). Highly efficient companies tend to disclose information despite such disclosure being varied in each industry type (Xie et al., 2019). Some industry groups are required to disclose information by law, especially groups that are sensitive to the disclosed information. Therefore, a hypothesis is formed as follows:

H2 Company sector affects R&DDisclosure.

Leverage and R&DDisclosure

Regarding Leverage, some studies used Debt Equity Ratio that explained the total debt and total equity, by restructuring the leverage in asset and growth opportunity and future of the company using R&D. R&D is found to be connected with probability that the company plans to increase return on equity (ROE). Thus, reporting of leverage structure has positive effect on R&D disclosure (Nekhili et al., 2016). It is found that companies with high leverage structure are more likely to disclose information compared to those with low leverage as the former want to disclose their operation to the stakeholders (Enache & Hussainey, 2020). In contrast, Lucia & Panggabean (2018) found that companies with high leverage had very trace to no relationship between leverage of listed companies and information disclosure, especially investment in environmental protection or sustainability development. Expenses related with interest that affect performance and financial risks are the reason not to disclose such information. Therefore, a hypothesis is formed:

H3 Leverage affects R&DDisclosure.

Profitability and R&DDisclosure

R&DDisclosure affects performance of the company dealing with advanced innovation, which does not return profit early in the works (Enache & Hussainey, 2020). Ability to use asset for investment to generate income can be measured using EBIDIT return or return on equity, or return on asset (ROA) to measure overall performance of the company. Good performance and high profit will draw interest and capital from investors and stakeholders, resulting in information disclosure to draw more investors (Bischoff & Christiansen, 2017) Nicholas & John (2014) found that ability to generate profit has positive effect on information disclosure. On the other hand, some studies did not find relationship with R&DDisclosure, because R&D is investment for future profit, and R&DDisclosure is on voluntary basis and credibility creation. If expensive operation is carried out, the company might reduce degree of disclosure or replace the disclosure mechanism with something else (Enache & Hussainey, 2020). A hypothesis could be formed as follows:

H4 Profitability affects R&DDisclosure.

Auditor type and R&DDisclosure

The “Big 4” auditing companies in Thailand are PricewaterhouseCoopers (PwC), KPMG, Ernst & Young (EY), and Deloitte Touche Tohmatsu. Large auditing companies are expected to provide good service and drive the customer to disclose more information to maintain the auditors’ own reputation and reliability (Chanaklang & Chaengkling, 2018). Nekhili et al. (2016) found that information disclosure has positive effect on stock value in the market, and auditing has positive effect on disclosure. In contrast, Lucia & Panggabean (2018) found that auditing actually had negative effect on disclosure. Nevertheless, disclosure of financial budget requires data from the auditor and compliance with accounting standards. A hypothesis could be formed as follows:

H5 Auditor type affects R&DDisclosure

Business Age and R&DDisclosure

Age of the business affects innovation, and younger organizations have less innovation than the larger counterpart. It is found that performance of younger organizations has less profit than the older organizations (Enache & Hussainey, 2020). It can be seen that age of the organization represents experience, ability to generate profit, source of reputation, stability and resource readiness in making financial reports and disclosure, especially companies with experience in making financial reports and disclosure Xie et al. (2019). A hypothesis could be formed as follows:

H6 Age of the business affects R&DDisclosure.

CEO age and R&DDisclosure

Age is a demographic factor in attitude of the CEO towards creativity and innovation, along with strategies related with reforms. The CEO had effect on decision to disclose necessary information, and age of the CEO had positive relationship with R&DDisclosure, due to having wisdom, experience, managerial skills and ability to direct the company to achieve the goal (Glaeser et al., 2019), if that R&D operation affects long-term company sustainability (Koh et al., 2018). Studies that compared younger CEOs with limited experience showed that they were less likely to report R&D activities or avoided it altogether if the activities were not successful, due to the CEOs’ concerns about performance during their term and effect from investors (Glaeser et al., 2019). Some contradictions were found, as younger CEOs could build faster growth and had above-average resilience against fluctuation in making profit (Amran et al., 2014), or some studies that did not discover relationship between age of the CEO and disclosure. A hypothesis could be formed as follows:

H7 Age of the CEO affects R&DDisclosure.

Research Methodology

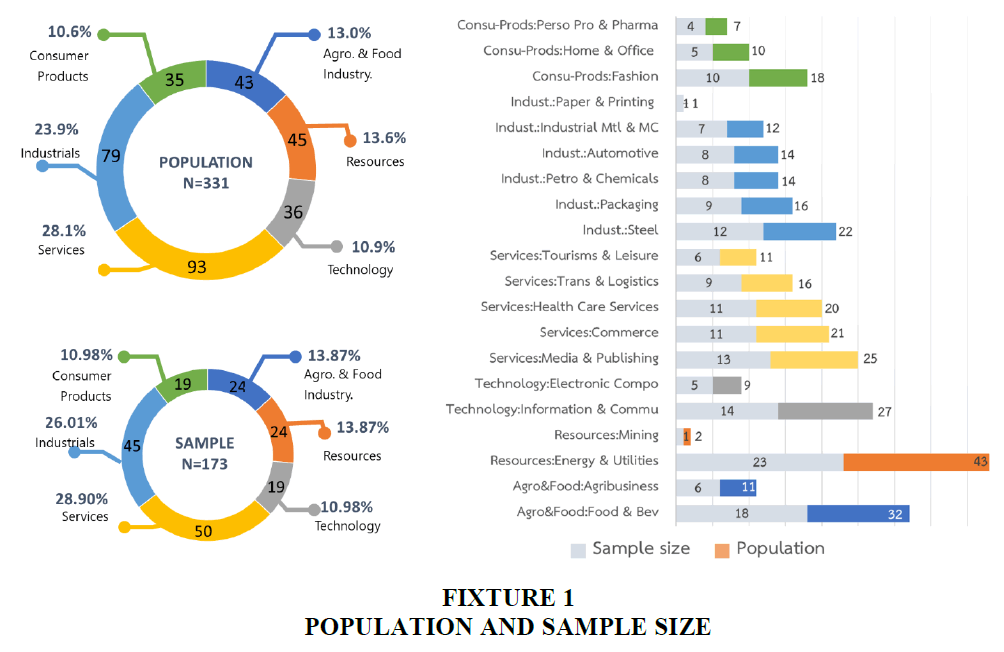

Data used in the research: This work collects data from and analyze financial budget from annual reports and annual item form (56-1 form) between 2016 and 2018 to collect R & DDisclosure data of companies listed in the Stock Exchange of Thailand, which has population of 331 companies. Sample group is selected by purposive sampling and elimination of companies with incomplete information, gaining 173 companies as sample. 519 reports of financial budgets with accounting period ending at 31 December 2016-2018 are acquired from businesses related with Thailand 4.0 model: 1) First S-Curve companies such as modern automotive, smart electronics, high-end tourism and health tourism, food processing, and agriculture and biotechnology, 2) New S-Curve companies such as industrial robotics, aviation and logistics, biofuel and biochemical, digital and comprehensive medical industries (Kumpirarusk & Rohitratana, 2018), and 3) companies not in the S-Curve. In total, 20 business types are included as shown in Figure 1.

Data analysis: This work uses text unit counting from sentences according to definition of sentence from the dictionary, as meaning of the sentence, or phrase that has meaning and completeness, that explains operation and result of R&D from the annual item list (56-1 form) according to the works by Masum et al. 2019; Moratanch & Chitrakala, 2016; and Bitvai & Cohn, 2015. Descriptive statistics is used to conclude the result, while multiple linear regression analysis models and multiple log linear regression analysis models (LN) are used to test the relationship with following model. And variables in the model and measurement can be summarized in Table 1.

| Table 1 Variable and Variable Measurement in the Relationship Model of Company Characteristics and R&DDisclosure | |

| Variable | Measurement |

| R&DDisclosure | Dependent variable: Level of R&D disclosure. Result of content analysis by counting frequency of text unit from the 56-1 form, such as (1) Input: R&D operation disclosure (2) Output: disclosure of successful (3) Future Expenditure revealing future R&D budget and content prediction (4) R&D financial information (5) disclosure of R&D Strategy |

| SIZE | Company size, measured from natural logarithm of total asset |

| SECTOR | There are six sectors and 20 business types, designated as a dummy variable, if in S-Curve=1 and Non-S-Curve=0 |

| LEV | Leverage, measured from D/E Ratio |

| PROFIT | Profitability, measured from Return on Equity (ROE) |

| AUDIT | Company auditor, a dummy variable. If Big4=1, Non Big4=0 |

| AGE | Age of the business, measured from company registration year to 2016-2018 |

| CEOAGE | Age of the CEO, measured from the oldest CEO in the year data is collected. |

R&DDisclosure = β0 + β1SIZE + β2SECTOR + β3LEV + β4PROFIT + β5AUDIT + β6AGE + β7CEOAGE + ?

Research Results

Data analysis with descriptive statistics: Result of data analysis with descriptive statistics using data between 2016-2018 is shown in the following table.

According to Table 2 result of multiple loglinear regression analysis models of R&DDisclosure (Mean=10.9, SD=9.86, Min=0 and Max=51); SIZE (LN) (Mean=9.05, SD=1.67, Min=5.36 and Max=14.67); PROFIT (ROE, Mean=14.52, SD=161.87, Min=-238.66, Max=3,655.30); LEV (D/E, Mean=0.99, SD=1.65, Min=-11.66 and Max=26.54); AGE (Mean=33.29, SD=16.90, Min=1 and Max=136); CEOAGE (Mean=59.12, SD=10.45, Min=33 and Max=86); and n=519 while Dummy Variable SECTOR (S-Curve) of 90 companies or 52.6%) and AUDIT Big-4 are 120 companies or 69.36%.

| Table 2 Descriptive Statistics of Factors Used in the Study | |||||||||

| Variable | Min | Max | Mean | Standard | Discrete Variable | N | Frequency | % | |

| Deviations (SD) | 1 | 0 | |||||||

| R&DDisclosure | 0 | 51 | 10.99 | 9.86 | SECTOR | 173 | 90 | 83 | 52.6 |

| SIZE (LN) | 5.36 | 14.67 | 9.05 | 1.67 | AUDIT | 173 | 120 | 53 | 69.36 |

| LEV | -11.66 | 26.54 | 0.99 | 1.65 | |||||

| PROFIT | -238.66 | 3,655.30 | 14.52 | 161.87 | |||||

| AGE | 1 | 136 | 33.29 | 16.9 | |||||

| CEOAGE | 33 | 86 | 59.12 | 10.45 | |||||

According to Table 3 (2016-2018), Average TEXUNIT (AT)/ R&DDisclosure (2016AT=9.29; 2017 AT=10.95; 2018 AT=12.75; and 2016-2017AT=10.99 sentences) R&DDisclosure explained through Average TEXUNIT has the same increasing trend for three years consecutively with Input 66.68%; Strategy 15.35%; Output 13.41% respectively. Future Expenditure 2.65% and Financial 1.91% are not as disclosed.

| Table 3 R&Ddisclosure Divided by Year and Disclosed Topic | ||||||

| R&DDisclosure | Year (Sentence) | Total TEXUNIT | Average | % | ||

| 2559 | 2560 | 2561 | TEXUNIT | |||

| Input | 1,037 | 1,297 | 1,471 | 3,805 | 7.33 | 66.68 |

| Output | 232 | 247 | 286 | 765 | 1.47 | 13.41 |

| Future Expenditure | 52 | 49 | 50 | 151 | 0.29 | 2.65 |

| Financial | 35 | 38 | 36 | 109 | 0.21 | 1.91 |

| Strategy | 251 | 263 | 362 | 876 | 1.69 | 15.35 |

| Total TEXUNIT | 1,607 | 1,894 | 2,205 | 5,706 | 10.99 | 100 |

| Average TEXUNIT | 9.29 | 10.95 | 12.75 | 10.99 | ||

Multiple Regression Analysis

Variable Correlation Analysis: Pearson Product Moment Correlation Coefficient used to test relationship is shown in Table 4. It is found that all independent variables have little relationship and Variance Inflation Factor (VIF=1.023-1.290, <10; Randall & Richard, 2016), signifying no Multicollinearity and thus making the data eligible for Multiple Regression Analysis with statistical significance.

| Table 4 Correlation Coefficient Analysis | |||||||||

| Variable | R&DDisclose | SIZE | SECT | LEV | PROFIT | AUDIT | AGE | CEOAGE | VIF |

| SIZE | 0.446** | 1 | 1.187 | ||||||

| SECTOR | 0.045 | 0.224** | 1 | 1.086 | |||||

| LEV | 0.022 | 0.206** | -0.01 | 1 | 1.29 | ||||

| PROFIT | 0.018 | 0.035 | 0.048 | -0.402* | 1 | 1.224 | |||

| AUDIT | 0.145** | 0.261** | 0.161** | 0.127** | 0.032 | 1 | 1.115 | ||

| AGE | 0.078 | 0.052 | -0.092* | -0.023 | -0.044 | -0.078 | 1 | 1.03 | |

| CEOAGE | 0.117** | 0.046 | 0.065 | -0.054 | 0.019 | -0.084 | 0.067 | 1 | 1.023 |

Table 5 shows the result of relationship between company characteristics and R&DDisclosure. Adjusted R Square = .212 that explains the fixed value of -19.401, Unstandardized Coefficients of SIZE = 2.699; CEOAGE = .093; SECTOR = -1.369; and LEV = -.527 that has statistical significance at 0.10. PROFIT, AUDIT and AGE do not have conclusive information to summarize statistical relationship. Multiple linear regression analysis models can be explained as

| Table 5 Multiple Regression Analysis Result | |||||

| Variable | Unstandardized Coefficients | Standardized Coefficients | t | Sig | |

| B | Std. Error | Beta | |||

| (Constant) | -19.401 | 3.032 | -6.398 | 0 | |

| SIZE | 2.699 | 0.25 | 0.458 | 10.785 | 0.000*** |

| SECTOR | -1.369 | 0.802 | -0.069 | -1.707 | 0.088* |

| LEV | -0.527 | 0.265 | -0.088 | -1.984 | 0.048** |

| PROFIT | -0.002 | 0.003 | -0.033 | -0.753 | 0.452 |

| AUDIT | 1.282 | 0.878 | 0.06 | 1.46 | 0.145 |

| AGE | 0.025 | 0.023 | 0.043 | 1.084 | 0.279 |

| CEOAGE | 0.093 | 0.037 | 0.099 | 2.506 | 0.013** |

| R Square | 0.222 | ||||

| Adjusted R2 | 0.212 | ||||

| F-Value (Sig) | 20.889 (0.000) | ||||

R&DDisclosure = -19.401 + 2.699SIZE -1.369SECTOR + -.527LEV + .093CEOAGE

Hypothesis test can be summarized in Table 6. H1, H2, H3, and H7 are accepted.

| Table 6 Hypothesis Test Summary | |||

| Element | Coefficient of Correlation | Hypothesis Decision | Interpretations |

| H1: Company size affects R&DDisclosure. | 0.000*** | Accepted | Significant correlation between SIZE and R&DDisclosure |

| p <0.01 | |||

| H2: Company sector affects R&DDisclosure. | 0.088* | Accepted | Significant correlation between SECTOR and R&DDisclosure at pvalue <0.10 |

| p <0.10 | |||

| H3: Leverage affects R&DDisclosure. | 0.048** | Accepted | Significant correlation between LEV and R&DDisclosure |

| p <0.05 | |||

| H4: Profitability affects R&DDisclosure. | 0.452 | Rejected | Not Significant correlation between PROFIT and R&DDisclosure |

| H5: Auditor type affects R&DDisclosure. | 0.145 | Rejected | Not Significant correlation between AUDIT and R&DDisclosure |

| H6: Age of the business affects R&DDisclosure. | 0.279 | Rejected | Not Significant correlation between AGE and R&DDisclosure |

| H7: Age of the CEO affects R&DDisclosure. | 0.013** | Accepted | Significant correlation between CEOAGE and R&DDisclosure |

| p <0.05 | |||

Discussion and Conclusion

1) Level of R&DDisclosure between 2016-2018 of 517 accounting years’ reports of 173 companies listed in the Stock Exchange of Thailand that responded to Thailand 4.0 model is that service industry has 28.9%, Industrial product 26.01% agriculture and food industry and resource industry 13.87%, and technology industry and consumer product industry 10.98%. In addition, 1) disclosure of R&D information in increasing annually in accordance with Thailand 4.0 model in driving the national economy and transformation into innovation-driven economies. This results in industrial companies being stimulated to invest and disclose more R&D information, concurring with (Pensute, 2017; Kumpirarusk & Rohitratana, 2018).

2) Experiment shows 21.2% relationship between company characteristics and R&D (Adjusted R Square = 21.2%) that can explain independent factors SIZE, CEOAGE, SECTOR and LEV.

3) SIZE has positive effect on R&DDisclosure as larger companies have higher R&DDisclosure compared to smaller companies, concurring with Kumpirarusk & Rohitratana (2018) and Nigri & Baldo (2018) which found that larger companies have an advantage in economy of scale regarding making and disclosing the data. Glaeser, et al. (2019) found relationship with disclosure of intangible asset. Hottenrott & Lopes-Bento (2016) found that small companies had different accounting policy than larger companies with significance. Xie et al. (2019) found that large companies had higher R&D investment potential than smaller companies and thus able to draw more investors (Kumpirarusk & Rohitratana, 2018).

4) SECTOR has negative relationship with R&DDisclosure. Most studies found that companies in the same or similar sectors had similar level of disclosure. This result agreed with Burks et al, (2018) which found that difference in sector would lead to different accounting and disclosure policy. Jaggi, et al. (2018) found a possibility that industrial type had negative relationship with R&DDisclosure due to sensitivity to the environment. Sae-Lim & Jermsittiparsert (2019) found that industrial revolution based on innovation and advanced technology was not the answer for every sector.

5) PROFIT is not found to have significant relationship with R&DDisclosure, concurring with Sae-Lim & Jermsittiparsert (2019) which found that disclosure still needed consideration about risk management, and was in conflict with Bischoff & Christiansen (2017) and Nicholas & John (2014) which found that profitability had positive relationship with disclosure, but still concur with Enache & Hussainey (2020) that also did not find any relationship with R&DDisclosure because it was possible that in case of failed expensive R&D investment would result in low profitability and return, thus the management would be less likely to disclose the information. Glaeser, et al. (2019) also showed similar findings.

6) LEV had negative relationship with R&DDisclosure. Companies with high leverage are less likely to disclose information compared to those with lower leverage, in agreement with Lucia & Panggabean (2018) which also found that companies with high leverage are less likely to disclose information compared to those with lower leverage because capital from the debtor must be repaid which affected performance. Overdependence on this source of capital had high financial risk thus less incentive to reveal information. This finding conflicts with Nekhili et al. (2016) which found that companies with higher LEV would be more likely to disclose information as they wanted to revealed performance to stakeholders.

7) AUDIT is not found to have significant relationship with R&DDisclosure, in conflict with Chanaklang & Chaengkling (2018) which found that auditing had positive effect on disclosure due to credibility of the auditor, but AUDIT did not have effect on R&DDisclosure regarding data protection due to increasing competitive intensity. Lucia & Panggabean (2018) found that auditing had negative effect on disclosure if the auditing did not conform to accounting standards.

8) Company AGE is not found to have significant relationship with R&DDisclosure, in conflict with Enache & Hussainey, (2020) which found positive relationship between age of the company and R&DDisclosure because company age was like experience in profitability, reputation, stability and resource readiness. Xie et al. (2019) also stated that younger organizations were less likely to disclose information than larger organizations. Because of tax relief for R&D expense available from Thailand 4.0 model and accounting standard, young and old organizations alike saw benefits in this aspect.

9) CEOAGE has positive effect on R&DDisclosure as the older the CEO the more disclosure of R&D information, because the CEO manages and controls the operation in accordance with the policy and strategy of the organization, for optimal benefit for the company and stakeholders. Older CEOs have higher wisdom, experience, skills and ability to fully meet the needs of the stakeholders. This finding is in agreement with Glaeser et al. (2019) and Koh et al. (2018), and in conflict with works that did not discover relationship between CEOAGE and R&DDisclosure and works that could not draw a consistency with Amran et al. (2014) regarding ability to generate more growth and resistance against profit fluctuation of younger CEOs.

10) Examination of disclosed accounting information along with Text unit research as shown in the annual item report (56-1 form) and regression (Bitvai & Cohn, 2015) to examine R&DDisclosure of companies listed in the stock exchange (1) the government or market controller can track R&D of the listed companies, (2) characteristics of the companies listed in the stock exchange concluded by this study may be used as information and guideline for government policymaking and support of investment and disclosure of company R&D, especially compliance with Thailand 4.0 model that will get support from other sectors for success in R&D, (3) other issues that were not included in this study such as using the disclosed annual report or accounting report, and consistency with other R&D activities such as investment data, intangible asset, or R&D expense, could be further researched in depth or in breadth.

References

- Amran, N.A., Yusof, M.A.M., Ishak, R., & Aripin, N. (2014). Do characteristics of CEO and chairman influence government-linked companies performance?. Procedia-Social and Behavioral Sciences, 109, 799-803.

- Bischoff, C.S., & Christiansen, F.J. (2017). Political parties and innovation. Public Management Review, 19(1), 74-89.

- Bitvai, Z., & Cohn, T. (2015). Non-linear text regression with a deep convolutional neural network. The 7th International Joint Conference on Natural Language Processing, Beijing, China, July 26-31, (2015), 180-185.

- Burks, J.J., Cuny, C., & Gerakos, J. (2018). Competition and voluntary disclosure: evidence from deregulation in the banking industry. Rev Account Stud, 23(2018), 1471-1511.

- Chanaklang, A., & Chaengkling, U. (2018). Market concentration of audit and assurance services in Thailand. KKBS Journal of Business Administration and Accountancy, 2(3), 12-27.

- Cornell University, INSEAD., & WIPO. (2018). The global innovation index 2018: Energizing the world with innovation. Ithaca; Fontainebleau and Geneva.

- Enache, L., & Hussainey, K. (2020). The substitutive relation between voluntary disclosure and corporate governance in their effects on firm performance. Review of Quantitative Finance and Accounting, 54(2), 413-445.

- Federation of Accounting Professions under the Royal Patronage. (2018). Accounting Standards TAS 38: Intangible assets.

- Glaeser, S., Michels, J., & Verrecchia, R. E. (2020). Discretionary disclosure and manager horizon: Evidence from patenting. Review of Accounting Studies, 25(2), 597-635.

- Haseeb, M., Kot, S., Hussain, H.I., & Jermsittiparsert, K. (2019). Impact of economic growth, environmental pollution, and energy consumption on health expenditure and R&D expenditure of ASEAN countries. Energies, 12(19), 3598.

- Hottenrott, H., & Lopes-Bento, C. (2016). R&D partnerships and innovation performance: Can there be too much of a good thing?. Journal of Product Innovation Management, 33(6), 773-794.

- Jaggi, B., Allini, A., Macchioni, R., & Zagaria, C. (2018). The factors motivating voluntary disclosure of carbon information: evidence based on italian listed companies. Organization & Environment, 31(2), 178-202.

- Jermsittiparsert, K., & Boonratanakittiphumi, C. (2019). The supply chain management, enterprise resource planning systems and the organisational performance of Thai manufacturing firms: Does the application of industry 4.0 matter? International Journal of Innovation, Creativity and Change 8(8), 82-102.

- Koh, P.S., Reeb, D.M, & Zhao, W. (2018). CEO Confidence and Unreported R&D. Management Science, 64(12), 5725-5747.

- Kumpirarusk, P., & Rohitratana, K. (2018). Industry 4.0: Future industries of Thailand. WMS Journal of Management, Walailak University, 7(3), 52-64.

- Li, D., Lin, A., & Zhang, L. (2019). Relationship between Chief Executive Officer characteristics and corporate environmental information disclosure in Thailand. Frontiers of Engineering Management, 6(4), 564-574.

- Lucia, L., & Panggabean, R.R. (2018). The effect of firm’s characteristic and Corporate Governance to Sustainability report disclosure. SEEIJ 2 (1), 18-28.

- Masum, A.K.M., Abujar, S., Talukder, M.A.I., Rabby, A.S.A., & Hossain, S.A. (2019). Abstractive method of text summarization with sequence to sequence RNNs. In 2019 10th International Conference on Computing, Communication and Networking Technologies (ICCCNT) (pp. 1-5). IEEE.

- Merkley, K. (2014). Narrative disclosure and earnings performance: Evidence from R&D disclosures. The Accounting Review, 89(2), 725-757.

- Moratanch, N., & Chitrakala, S. (2016). A survey on abstractive text summarization. 2016 International Conference on Circuit, Power and Computing Technologies [ICCPCT], 1-7.

- Nekhili, M., Hussainey, H., Cheffi, W., Chtioui, T., & Tchuigoua, H. (2016). R&D narrative disclosure, corporate governance and market value: Evidence from France. The Journal of Applied Business Research 32 (1), 111-128.

- Nicholas, A., & John, S. (2014). The role of R&D expenses for profitability: Evidence from U.S. fossil and renewable energy firms. International Journal of Economics and Finance, 6(3), 8-15.

- Nigri, G., & Baldo, M.D. (2018). Sustainability reporting and performance measurement systems: How do small- and medium sized benefit corporations manage integration? Sustainability, 10(4499), 1-17.

- Pensute, C. (2017). Thailand 4.0 economics and political contexts. Political Science and Public Administration Journal, 8(1), 67-99.

- Randall, E.S., & Richard, G.L. (2016). A beginner's guide to structural equation modeling, (4th ed.), Routledge; New York.

- Rostami, N., Khyareh, M.M., & Mazhari, R. (2019). Competitiveness, entrepreneurship, and economic performance: evidence from factor, efficiency-, and innovation- driven countries. Economic Annals, LXIV (221), 33-64.

- Sae-Lim, P., & Jermsittiparsert, K. (2019). Is the Fourth Industrial Revolution a Panacea? Risks toward the Fourth Industrial Revolution: Evidence in the Thai Economy. International Journal of Innovation, Creativity and Change, 5(2), 732-752.

- The Stock Exchange of Thailand. (2013). Guidelines on disclosure of information of listed companies, Circular letter no. 23-00, Announced on 30 April 2013.

- Xie, J., Nozawa, W., Yagi, M., Fujii, H., & Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance?. Business Strategy and the Environment, 28(2), 286-300.