Research Article: 2020 Vol: 19 Issue: 1

The Extent of the Impact of Corporate Governance on the Effectiveness of Companies in the Jordanian Service Sector

Osama Mohammad Khaleel Ballout, Zarqa University

Abstract

This study aims to investigate the commitment of public shareholding companies in the service sector to apply Corporate Governance (CG) principles. It aims also to clarify the relationship between the practice of CG in the service sector and effectiveness, and the relationship between the practice of CG and the value of these companies. The study sample consists of all service companies listed on the Amman Stock Exchange (2016-2018) which were (54) service companies that meet conditions. Multiple regression analysis was used to test the effect of independent variables (ownership concentration, and the independence of the Board of Managers) on dependent variables (market value to book value, market value to net income, and turnover of assets), The researcher also used the test of the presence of the phenomenon of multiple linear correlation Collinearity by testing the significance of the correlation coefficient between variables, The researcher used Independent-Sample and One-Sample t-test to measure the differences between the means. In addition to the use of the variable control that can have an impact on effectiveness (size of the company). The study results show a positive and statistically significant correlation of ownership concentration on effectiveness measures. It also shows a statistically significant commitment to the implementation of CG principles in companies above average in terms of concentration of ownership and the independence of the board of directors. The means reached 0.633 and 0.530 respectively.

Keywords

Corporate Governance, Corporate Effectiveness, Service Sector.

Introduction

The definition of corporate governance differs according to its viewpoint. Johnson et al. (2008) defined it as the process by which power is distributed among different stakeholders, setting objectives and priorities of the company are defined and the best way to accomplish them.

As explained by Davies (2006), it is a system that aims to actively engage different stakeholders in achieving common goals, as they have a variety of possibilities that may contribute to the success or failure of the project. Alawneh (2008) also emphasized that corporate governance increases the company's growth rates and helps in raising its value and enhance its competitiveness. Ho (2005) indicated that effectiveness can be assessed by evaluating sales, calculating profits, knowing the return on investment, production level, quality, total costs, customer satisfaction and loyalty of employees.

According to the Duru et al. (2016) the relationship between duality and firm effectiveness are often mysterious as a result of Sustainability problems, which makes it hard to distinguish a causal relationship between the two. According to Van Tuan & Tuan (2016), countries where the external CG non- transparent and regulations are undeveloped, considered the role of independent directors' plays are very important like CG. This study attempts to identify the extent of the practice of CG and the impact of this practice on the effectiveness of service companies, which need a process through relations are regulated and roles are defined between the Board of directors, owners and the executive management of the company taking into account the benefits to stakeholders in an ambiance of transparency, disclosure and social responsibility, which leading to make the best use of the resources available to it, thus achieving its strategic objectives (Balachandran, 2006).

Importance of Study

This study is important both at the academic and practical levels. At the academic level it will contribute to enriching the Jordanian library with valuable information on the subject of CG and its impact on the effectiveness of companies and the standards used in evaluating the effectiveness of companies. On the practical level, it will contribute to assessing the impact of CG on the effectiveness of Jordanian service companies, thus positively reflected on economic and social development.

Study Objectives

The study aims to identify:

1. The extent of commitment of service companies to apply the principles of CG.

2. The relationship between the practice of CG in service companies and the effectiveness of these companies.

3. The relationship between the practice of CG in companies and the value of these companies.

Problem and Questions of the Study

Many international companies were subject to bankruptcy and sudden collapse, although they were considered as successful. The main reason for these sudden breakdowns was the weakness in the practice of CG as a system that helps to gather power, define roles and organize relationships within the organization to increase the efficiency of corporate performance and achieve their strategic objectives (Jackson & Nelson, 2004). Thus, the problem of the study is to try to answer the following questions?

• What is the extent of the practice of CG in Jordanian service companies?

• Is there a relationship between the practice of CG in Jordanian service companies and the effectiveness of these companies?

• Is there a relationship between the practice of CG in service companies and the value of these companies?

Study Hypotheses

Based on the previous studies, the following zero hypotheses were formulated:

The first main hypothesis is H01

“Jordanian service companies are not committed to apply the principles of CG”.

H01-1: Jordanian service companies are not committed to apply the principles of CG with respect to ownership concentration.

H01-2: Jordanian service companies are not committed to apply the principles of CG with regard to the independence of board of directors.

The second main hypothesis is H02

“There is no statistically significant effect of the practice of CG on the measures of effectiveness in Jordanian service companies”.

H02-1: There is no statistically significant effect of the practice of CG on the ratio of market value to book value in Jordanian service companies.

H02-2: There is no statistically significant effect of the practice of CG on the ratio of market value to net income in Jordanian service companies.

The third main hypothesis is H03

“There is no statistically significant effect of the practice of CG on the value of companies represented by assets turnover in Jordanian service companies”.

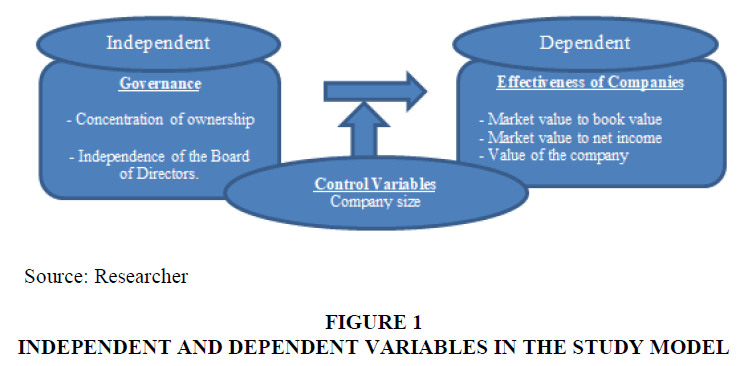

Study Variables

This study used six variables, two independent variables, three dependent variables, and one control variable. Concentration of ownership and independence of the board of directors are independent variables. Market value to book value (Market capitalization/Net book value), market value to net income (Market capitalization/Net income) and asset turnover (Total assets/(Beginning assets + Ending assets)/2)) are dependent variables. Company size is control variable.

Study Model

This study used the multiple regression models to determine the importance of each independent variable on the effectiveness of companies, which is represented by the following equation:

PER = Bi + B1(OW) + B2(N1) + B3Log(TA) + B4(SEC) + e

Where,

PER = Effectiveness of companies which includes three variables:

VBV = Market value to book value.

VNI = Market value to net income.

OMV = Value of the company represented by assets turnover (SETTURN).

Bi = Regression coefficient. (i = 0, 1, 2, 3, ……….5)

OW = Concentration of ownership, the percentage of ownership for major shareholders,

who own 5% or more of the company's shares.

NI = Independence of the Board of Directors.

Log (TA) = total assets

SEC = Represents the services sector where (0) will be used.

e = Random estimation error.

The following Figure 1 illustrates the study model

Literature Review

According to Brown & Caylor (2004) CG have shown that it helps to reduce risk in the institution, and helps to trade institutional stocks in the financial markets, and raise the value of these shares.

As Black et al. (2010) observed that CG has an important factor in explaining the market value for Korean joint stock companies, as he found a positive correlation between the overall corporate governance index and the value of the company. According to Drobetz et al. (2004) There is a strong positive relationship between the quality of the firm's corporate governance level and its evaluation (firm valuation), as the study results show that better corporate governance is largely related to higher operating performance of the company, higher stock returns and higher estimate in the stock exchange.

Methodology

Study Population and Sample

The study population consists of all the service companies listed on the ASE during (2016-2018), where the number of service companies as shown in the directory of companies was as follows: 55, 64, and 66 service companies respectively. The sample of the study was selected to be represented in the service companies that meet the following conditions:

• Its shares should be traded during the study period 2016- 2018.

• Its data related to the study variables should be available and fully disclosed.

• The above conditions were met by 54 public service companies and 12 public service companies were excluded.

Data Analysis

To answer the study questions and test hypotheses, the researcher used the appropriate statistical tools for the study after calculating the means, standard deviations and iterations of the study variables according to the study years. Statistical methods used in data analysis:

1. Test the presence of the multiple linear correlations (Collinearity) by testing the significance of the correlation coefficient between variables.

2. Independent-Sample & One-Sample t-test to measure differences between means.

3. Multiple linear regression test and model construction.

Table 1 shows the description of variables using the descriptive statistics method represented by the mean and standard deviation.

| Table 1 Describe the Quantitative Variables of the Study | ||

| Variable | Mean | Standard Deviation |

| VBV | 2.049 | 4.288 |

| VNI | 29.971 | 55.708 |

| OW | 0.533 | 0.156 |

| SETTURN | 1.120 | 1.970 |

It can be noted from Table 1 that values of standard deviations for ratios within the sector are relatively high, indicating the dispersion of these ratios from their mean.

Binary Qualitative Variables

Independence of the board of directors (NI)

The above Table 2 indicates that the percentage of companies that showed the independence of the Board of Directors is 72.8%. This is an indication of the increasing commitment of companies to create independence for the members of the board of directors, so that their judgments on the decisions related to the company's operations, ways of financing these operations, the risks that may face judgments are true, fair and away from bias only in the interest of the company.

| Table 2 Description Independence of the Board of Directors Variable | |||

| Variable | Repetition | Percentage | |

| NI | Lack of independence of the Board of Directors | 12 | 27.2 |

| Independence of the Board of Directors | 42 | 72.8 | |

| Total | 54 | 100 | |

It can be noted from the values of the correlation coefficients between the independent variables in Table 3, there are no multiple linear correlations between the values of variables that may effect on results of study or affect the validity of the hypothesis test. As the majority of correlation coefficients were below 0.8. To confirm this observation, the variance coefficient of inflation (VIF) was found, which reveals the existence of linear correlation Collinearity to the integrity of the test results of hypotheses related to governance were the results as follows:

| Table 3 Multiple Linear Correlations Between Independent Study Variables | ||||

| VBV | VNI | OW | NI | |

| VBV | 1 | |||

| VNI | 0.212* | 1 | ||

| OW | 0.211* | 0.306* | 1 | |

| NI | 0.080 | 0.453* | 0.320* | 1 |

* Statistically significant at 5% level

The results of Table 4 indicate that the values of VIF are all below the number 5, according to this scale indicates that linear correlation between independent variables is not significantly to affect the results of the study.

| Table 4 The Test of Multiple Linear Correlation | |

| Independent variable | VIF |

| OW | 1.718 |

| NI | 1.747 |

Analyze Data and Test Study Hypotheses

The researcher used many statistical tests that will be mentioned in each hypothesis.

H1: The extent of commitment to apply the principles of corporate governance in Jordanian service companies.

The first main hypothesis is H01

The sub-hypotheses related to the first zero main hypotheses were subjected to a one-Sample-test at a significant level (α = 0.05), under the following decision rule:

We reject the null hypothesis (H0) and accept the alternative hypothesis (Ha) if the calculated T> T tabular or if the significance (Sig.) ≤ (0.05) and vice versa. The test results were as follows:

The first sub-zero hypothesis H01-1

Table 5 shows that the mean of concentration of ownership is 0.530 greater than the standard mean or reference adopted by the researcher (0.50). In addition, the significance value (Sig.) is 0.001 <0.05, which rejects the first null hypothesis (H0) and then accept the alternative hypothesis (Ha) that: “There is a statistically significant commitment to apply the principles of corporate governance in Jordanian service companies above the mean in terms concentration of ownership”.

| Table 5 T Test for Extent the Commitment: Jordanian Service Companies in Terms of Concentration of Ownership | ||||||

| Mean Value | Standard Deviation | Degrees of freedom DF | Calculated T value | T tabular value | Sig. | |

| There is a commitment to apply the principles of corporate governance in service companies in terms of concentration of ownership | 0.530 | 0.196 | 53 | 3.537 | 1.984 | 0.001 |

The second null hypothesis is H01-2

Table 6 shows that the mean of the Independence of the board of directors is 0.633 greater than the standard mean or reference adopted by the researcher is 0.05. In addition, the significance value (Sig.) Of 0.000 <0.05, which rejects the third null hypothesis (Ho) and then accept the alternative hypothesis (Ha) that: "There is a statistically significant commitment to apply the principles of corporate governance in Jordanian service companies above the mean in terms of the Independence of the board of directors.

| Table 6 T Test of the Commitment to Apply the Principles of Corporate Governance in Jordanian Service Companies in Terms Independence of the Board of Directors | ||||||

| Mean Value | Standard Deviation | Degrees of freedom DF | Calculated T value | T tabular value | Sig. | |

| There is a commitment to apply the principles of corporate governance in the Jordanian service companies in terms of the Independence of the board of directors | 0.633 | 0.487 | 113 | 13.659 | 1.984 | 0.000 |

H2: The effect of the practice of CG on the measures of effectiveness in Jordanian service companies.

The second main hypothesis is H02

Sub-zero hypotheses emanating from the second main hypothesis were subjected to multiple linear regression analysis, as follows:

Impact of Governance Practice on Market Value to Book Value

First sub-zero hypothesis H02-1

The following tables show the results of subjecting this hypothesis to the multiple regression analysis tests where the dependent variable is the market value to book value, and the independent variables are OW, NI, as follows:

The results of Table 7 indicate that there is a statistically significant effect of the independent variables representing the practice of CG on the dependent variable represented by market value to book value. Where the calculated value of F is equal to (3.146), and a significant level (Sig = 0.015) which is less than the significance level 0.05, This is an indication of the ability of independent variables combined to explain the change in the ratio of market value to book value. The coefficient of determination was (0.103), which indicates that the independent variables combined can explain (10.3%) of the changes in the market value to book value ratio.

| Table 7 Results of the Test of the Impact of the Practice of Corporate Governance on the Ratio of Market Value to Book Value in Jordanian Service Companies | |||||

| The dependent variable | R Correlation coefficient |

R2 The coefficient of determination |

F Calculated |

Significance level Sig |

DF Degrees of freedom |

| VBV | 0.320 | 0.103 | 3.146 | 0.015 | 2 |

| 51 | |||||

| 53 | |||||

Table 8 shows that the effect of OW is statistically significant on the market value to book value ratio (VBV). Where the value of β for the concentration of ownership was 5.214 and statistically SIG = 0.015. This indicates the ability of this variable to explain the change in the ratio of market value to book value. We therefore reject the null hypothesis and accept the hypothesis which states: “There is a statistically significant effect of the practice of CG on the ratio of market value to book value in Jordanian service companies”.

| Table 8 Regression Coefficients and Statistical Significance for Each of the Independent Variables | ||||

| Regression coefficients | ||||

| Statement | β | Standard error | T Calculated | Sig ** level Significance |

| OW | 5.214 | 2.113 | 2.468 | 0.015 |

| NI | -0.864 | 0.861 | -1.004 | 0.318 |

Impact of Governance Practice on Market Value to Net Income

Second null hypothesis H02-2

The following tables show the results of subjecting this hypothesis to the multiple regression analysis tests where the dependent variable is the market value to net income, and the independent variables are OW, NI, as follows:

The results of Table 9 indicate that there is a statistically significant effect of the independent variables represented by the practice of corporate governance on the dependent variable represented by market value to net income. Where the calculated value of F is equal to (10.630), and a significant level (Sig = 0.000) which is less than the significance level 0.05, This is an indication of the ability of independent variables combined to explain the change in the ratio of market value to net income. The coefficient of determination was (0.264), which indicates that the independent variables combined can explain (26.4%) of the changes in the ratio of market value to net income.

| Table 9 Results the Test of the Practice Corporate Governance on the Ratio of Market Value to Net Income in Jordanian Service Companies | |||||

| The dependent variable | R Correlation coefficient |

R2 The coefficient of determination |

F Calculated |

Significance level Sig | DF Degrees of freedom |

| VNI | 0.514 | 0.264 | 10.630 | 0.000 | 2 |

| 51 | |||||

| 53 | |||||

Table 10 shows that the impact of the independence of the board of directors NI is statistically significant on the ratio of market value to net income VNI, Where the value of β for the independence of the board of directors variable was 27.217 and statistically significant SIG = 0.003. This indicates the ability of this variable to explain the change in the ratio of market value to net income. The above table also shows that there is no significant effect of OW on the ratio of market value to net income where the value of SIG was greater than 0.05 as shown in the table. For all the above we reject the null hypothesis and accept the hypothesis which states: “There is a statistically significant effect of the practice of corporate governance on the ratio of market value to net income in the Jordanian service companies”.

| Table 10 Regression Coefficients and Statistical Significance for Each of the Independent Variables | ||||

| Regression coefficients | ||||

| Statement | β | Standard error | T Calculated | Sig ** level Significance |

| OW | 34.568 | 21.670 | 1.595 | 0.114 |

| NI | 27.217 | 8.827 | 3.083 | 0.003 |

H3: The impact of corporate governance factors combined on the value of the company represented by the assets turnover.

The third main hypothesis is H03

The sub-zero hypotheses emanating from this hypothesis have been subjected to multiple linear regression analysis, as follows:

The results of Table 11 above indicate that multiple regression model of dependent variable assets turnover on independent variables. Governance practices Significant effect in statistical significance 0.05, Where the calculated value of F is equal to (5.836), and the level of significance (Sig. =0.000) is less than the significance level 0.05. The coefficient of determination is 0.176, which means that the independent variables combined can account for 17.6% of the changes in obtaining the assets turnover.

| Table 11 Results of Testing the Impact of the Practice of Cg on the Assets Turnover | |||||

| The dependent variable | R Correlation coefficient |

R2 The coefficient of determination |

F Calculated |

Significance level Sig | DF Degrees of freedom |

| Assets turnover SETTURN | 0.420 | 0.176 | 5.836 | 0.000 | 2 |

| 51 | |||||

| 53 | |||||

Table 12 shows the value of the regression coefficients, where the concentration of the property appeared to be characterized by the highest moral significance at the level of statistical significance 0.05. Where the total effect of this variable was (-3.397) and the significance level (Sig. =0.000). This indicates the role of this variable in explaining the change in the assets turnover.

| Table 12 The Value of Regression Coefficients for the Effect of Corporate Governance Practice on The Assets Turnover | ||||

| Regression coefficients | ||||

| Statement | β | Standard error | T Calculated | Sig ** level Significance |

| OW | -3.397 | 0.792 | -4.289 | 0.000 |

| NI | -0.136 | 0.323 | -0.423 | 0.673 |

Conclusion

One of main results of the study it's a positive impact of corporate governance on the effectiveness of companies. The percentage of companies that showed the independence of the board of directors is 72.8%. This demonstrates the interest of companies in the service sector to separate the functions and responsibilities of the chief executive officer (CEO) that would lead to better company efficiencies.

There is an indication of the quality of the model and the ability of the independent variables combined to explain the change in assets turnover.

Recommendations

Based on the results of the study, the researcher recommends the following:

1. Jordanian service companies seek to increase the concentration of ownership and maintain the independence of the board of directors, because the positive impact of corporate governance on the effectiveness of companies.

2. Emphasize the importance of expanding the application of the concept of corporate governance in the Jordanian market and benefiting from it to enhancing control mechanisms and achieving the quality and transparency of accounting information that will be reflected positively on the market.

3. The need to monitor the compliance of Jordanian service companies for principles of corporate governance, and the imposition of sanctions on companies which is not committed to those principles, in order to preserve the economic resources in Jordan.

References

- Alawneh, A. (2008). Corporate governance in Palestine: Challenges and future prospects.

- Balachandran, B. (2006). Best practice in corporate governance: Building reputation and sustainable success.

- Black, B.S., Kim, W., Jang, H., & Park, K.S. (2010). How corporate governance affects firm value: Evidence on channels from Korea.

- Brown, L.D., & Caylor, M.L. (2004). Corporate governance and firm performance. Available at SSRN 586423.

- Drobetz, W., Schillhofer, A., & Zimmermann, H. (2004). Corporate governance and expected stock returns: Evidence from Germany. European Financial Management, 10(2), 267-293.

- Duru, A., Iyengar, R.J., & Zampelli, E.M. (2016). The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. Journal of Business Research, 69(10), 4269-4277.

- Ho, C.K. (2005). Corporate governance and corporate competitiveness: an international analysis. Corporate Governance: An International Review, 13(2), 211-253.

- Jackson, I.A., & Nelson, J. (2004). Profits with principles: Seven strategies for delivering value with values. Broadway Business.

- Johnson, G., Scholes, K., & Whittington, R. (2008). Exploring corporate strategy: Text & cases. Pearson education.

- Van Tuan, N., & Tuan, N.A. (2016). Corporate governance structures and performance of firms in Asian markets: A comparative analysis between Singapore and Vietnam. Organizations and Markets in Emerging Economies, 7(2).