Research Article: 2022 Vol: 21 Issue: 2S

The Financial Incentive and its Effect in Improving the Employee's Capacities Analytic Study at Al- Qasim Green University

Hayder Abd Noor Hadi, Al-Qasim Green University

Abdullah Khadem Hassan, University of Al-Qadisiyah

Keywords

Financial Incentive, Employees' Capacities, Knowledge, Efficiency, Creativity

Citation Information

Noor Hadi, H.A., & Hassan, A.K. (2022). The financial incentive and its effect in improving the employee's capacities analytic study at Al- Qasim Green University. Academy of Strategic Management Journal, 21(S2), 1- 12.

Abstract

This study deals with the financial incentive and its effect in improving the employee's capacities. The enormous and speed growing the world testifies in domain of developing the institution leads to increase the concerning about improving the employees' capacities by supporting them with the financial incentive and rewards which in return reflect positively on all aspects of institution. This study aims to define the relevance of effect and correlation between the financial incentive and the employee's capacities by the focus on the represented issue with how to determine the adequate financial incentive which in return leads to promote the employee's capacities at Al-Qasim Green University. The researcher uses the descriptive method with a correlated relevance to be convenient with the research solving-problem and fulfill its aims. Also, he depends on the collecting data method by pre-prepared questionnaire for the same reason; the appropriate statistics are used in analyzing the data by the statistical package for the social science program (SPSS.V.20). The study reveals set of conclusions that there's significant correlation and effect relevance between the research bivariate. Furthermore the study indicates the following recommendations: the emphasis on yielding the convenient financial incentive to boost the employee's capacities.

Introduction

The different institutions has been taken in regard the crucial role the human resources play through investigation the effected factors in the employees' capacities, where the officials attempt to increase the productivity extremely. Being efficient employee’s staff can help fulfilling the requested aims further. Thus concerning the employees staff should be taken in consideration to improve the productivity level. Moreover the subject of the financial incentives has been regarded by the administrative behavior scientist who considers the financial incentives as one of the most important positive independent variables in employing motivation.

Thus the current study determines in analyzing the effect of the financial incentive in improving the employees' capacities and includes the employees in departments and administrative units at Al-Qasim Green University. This study depends on the employees' data through the first half of the year 2021, where the research Problem lies in the incentive system of some institution becomes below the required level which in return causes drawbacks in systems and styles of the yielded incentive and improving the employees' capacities and their performance are affected negatively, so the study problem embodies with (how to determine the adequate financial incentive which leads to promote the employees' capacities). The problem framework can be extracted as follow: is there any relevance between the financial incentive and the employees' capacities? can the financial incentive affect in improving the employees' capacities?, can the financial incentive contribute in boosting the employees' competence and improving their capacities? Also, this study aims to recognize: the extent of efficiency of the incentive system at Al- Qasim Green University, the relevance between the financial incentive and the employees' capacities, and the expected effects of the financial incentive in boosting the employees' competence and developing their capacities. So, the financial incentive plays pivotal role in the employees' capacities improving. And this is done through the concerning on the human resources which are the basic factors of the production process and this requires an adequate incentive system to be able to improve the employees' capacities and boosting their efficiencies. Furthermore, the present study bases on the following hypothesis (there's significant relevance of effect and correlation between the financial incentive and the employees' capacities).

Literature Review

Several studies have dealt with the subject of the financial incentive such as Silliman (2011), explained that there are two concepts of the stimulated policies and the organizational fidelity theoretically depending on the administrative literature and showing the relevance between the stimulated policies and the organizational fidelity. The study sample consists the employees from four public institutions. Their number are 324 includes females and males. The analytic descriptive method is applied. The results of the study indicate that there's no completely agreement in the employees' view about the concept of the stimulated policies and the organizational fidelity. And the employees' view contrast about the degree of being the organizational fidelity and then the functional performance. Also the study indicates that there's positive and strong relevance between the stimulated policies and the organizational fidelity, furthermore it indicates that there's no differences statistical significant between the functional title, the scientific qualification, age and the years of experience.

Another study conducted by Bader (2011), he applied in his study on the employees work in the human resources management in the Prince Sultan Military Medical City, their number is (185) from the employees. The researcher applies the style of the comprehensive sample, the descriptive method and the questionnaire as an instrument to data collection. This study reveals the community sample members believe that the employees performance in the human resources management is high level performance in the mean (4.48-5), and the community sample members agree with high level about the applied financial and morale incentives which contribute in improving the employees' performance in the human resources management. The results reveal that there's positive relevance between the financial incentives and morale and the employees' performance level in the human resources management.

In addition, Rina (2018), in here study improved the personal performance of the employees. The sample of study includes (43) employees work in a company, the results reveal that the financial incentives program stimulate the modifications in motivations and then modifications the working patterns, and stimulating the employee to work. This study recommends the firms have to give much more concerning and intensive the studies about the incentives policy of the employees and their performance.

Chepkemol (2018) investigated the impact of the incentives on staffs' performance at kenya forest service Uasin Gishu County. The study depends on the domain- modification and evolutional theory of Chang. The descriptive survey is adopted in this design. All the staff at Kenya Forest Service in Uasin Gishu County is targeted which actually comprises of eight forest stations.. The Census method is applied for getting a sample size contains of 115 respondents. Collecting data is done depending on the questionnaires to test instruments validity, the supervisors and research experts are given the instrument. A pilot study is applied in Nandi County to test the reliability. Split half method is applied to test the reliability. A Cronbach alpha of 0.72 is obtained which emphasizes the reliability of the research instruments. Descriptive statistics (percentages, mean and standard deviation) are used to analyze data. Results of research indicate that the incentives are important in the organizational performance. It recommends that Kenya forest service and other government institutions should take in consideration the process of reengineering in the operational systems to promote the customers service, the modern values of teamwork and cooperation, reducing the employees' turnover which in return positively reflects in improving the organizational concept.

Definition of Basic Terms

First/The Financial Incentive

The financial or physical incentive can be considered as one of the most common and very old types used of the incentives, they contribute the employees' performance boosting, in addition to promote their capacities represented by the knowledge, competence, creativity. This type of incentive is distinguished by using the policy of the financial or cash belonging with increasing the percent of wages, or the worker's income, or through giving a sum of money not within the salary as a financial reward (Abo Hameed, 2020). According to the above, dealing with the concept of invective can be explained as follow:

The Concept of the Financial Incentive

Much of the concepts are defined by the researchers, some define it as a group of factors and external effects which reflect the desire and power the employees have to promote and improve their competence, capacities and the performance level (Noori et al., 2010). It also means the morale and financial substitution which serves for the individuals as a reward for their distinct performance (Maher, 2009). Other researchers define it as the opportunities and means prepared by the management of institution for the employees to stimulate their desire for getting these opportunities as a reward of their distinct performance (Shaweesh, 2011). The most important part of incentives is the financial incentives which represents the basic findings depended by the institutions to promote the employees' capacities and evolve their dexterities. The financial individual's needs are satisfied through activating the financial incentive or cash to stimulate them to produce and improve them dexterities and then increasing the efficiency and promoting the performance level. Furthermore, the incentive focuses on rewarding the employees for their distinct performance (Abo Al-Naser, 2012). Also, it can be defined as the stimulations which assist to satisfy the financial employees' needs in the institution which include: the wages, rewards, bonus and extra- working wages, etc. (Younis, 2010).

Importance of the Financial Incentive

The following points reveal the importance of the financial incentive:

A. Stimulating the employees' desire and improving the performance level.

B. Fulfilling the varied employees’ needs and evolve their capacities.

C. Notifying the proficient employees with the equivalent and justice within the institution.

D. A good impression should be given to a society about the institution.

E. Developing the cooperation among the employees and improving their dexterities. (Al- Ani, 2007)

Objectives of the Financial Incentive

A. Boosting the employees' competence and evolving their capacities.

B. Guarantee the employees' adequate living standard.

C. Providing the employees with the adequate purchasing capacities.

D. Giving the employees the feeling of respect for their done efforts. (Ashoor, 2017)

Dimensions of the Financial Incentive

A. Wages (Salaries): the wages can be considered as the most important financial or physical incentive the employees gain in the institution. And it can be considered the priority for their needs that should be obtained for their performance. It varies from institution to another and sometimes even within the institution itself depending on the employees' competence (Lotfi, 2007). It also it can be considered as a result of different factors depending on the nature of employment and the extent of its importance, in addition to the employees' priority and their performance level (Abed Al- Azize, 2008).

B. Financial Rewards: it is the reward the competent employees get for their distinct performances, the aim is to promote and improve their dexterities and capacities which in return develop the institution.

C. Bonus: it plays important role in stimulating the employees in the institution and increasing their competent and improving the performance level (Nasima, 2018).

Second/The Employees' Capacities

The literatures of contemporary administrative thought uses various terms as: capacity, dexterity, efficiency which is the synonym of competency to indicate that the employees have qualifications and experiences enable them to perform the tasks and duties precisely with high professional to contribute in improving the performance level for the individuals and the institutions equally. These dexterities, experiences, efficiencies name as the capacities that all the institutions attempt to reach in order to develop the human sources and fulfill its aims (Al-Selimi, 2004).

Concept of the Capacities

They are combinations of the knowledge, dexterities and behaviors which completely perform the required capacity to improve the performance level (Mary Pat Butler et al., 2011).

These capacities should be exploited by the institutions effectively to satisfy the markets needs and achieving the competitive peculiarity by having these capacities focus on aspects to distinguish them from the others (Almeida, Lisboa, Augusto & Batista, 2013). It also defines as the essential property the individual reflects through his/her high performance level. Or it may be as a trait which means the property or the characteristic the individual possesses in his/her performance (Torrington et al., 2008). Also, it means the features that the individual should possess to perform the required tasks and achieving high performance level. These peculiarities are represented by the knowledge, dexterity, traits or the expressed looks of the individual himself, the required behaviors of that performance (Dubois & Rothwell, 2004). Improving the employees' capacities considers the fundamental to the modern competitive institution capacities building and it is the reason behind the prevalence in the employment market. Hence finding out these capacities and exploiting and improving them is the veritable challenge of the management. Prevalence in domain of the employees' capacities is most important than the leadership in the domain of production of the commodity or service, since the prevalence in improving the capacities is the source of the prevalence in the production (Elselemi, 2004). The capacity is measured by the indicators of quantity through the behaviors embodied in the results or the expected outputs of the employment (Dubois & Rothwell, 2004).

Dimensions of the Capacities

Knowledge (Learning)

The concept of the knowledge is strongly related to the concept of the continued- improving by creating the continued- knowledge or exploiting the collective knowledge the employees possess. The institution determines this knowledge and implements it, and adding the institutional concept on it (King, 2009). This means that the institution concerns in thirsting the information and exploiting it to create new themes can contribute improving the institution and acquisition extra competitive peculiarity (Argote, 2011), furthermore it considers as a modification in the realization and behaviors the employees represented by the knowledge, facts, dexterities, practices and the efforts that increase their capacities and to behave efficiency and improving their performance level (Argote, 2012). Subsequently the institution should adopt the adequate financial incentives system depending on the concept of fees for knowledge, in addition relating the rewards yielded by the institution with improving the performance level which in return encourage employees to continue to give the best performance (Al-Shatat, 2003).

Competence

It is considered as one of the common terms used to clarify the individual's capacity, it is usually used to indicate the capacity of the well- task performance, and controlling in the knowledge, dexterities, required qualifications in a particular domain (Mansori, 2010), as well as it means the individual's capacity for recruitment by collecting the institutional resources and making harmony within specific process framework (Fatiha, 2014). Also it considers the available knowledge, capacities and dexterities in someone enable performing his tasks and employment them effectively. Subsequently being this type of competencies, the institution can be distinguished from the other competitors and gaining prestige in the markets (Bo Zaid, 2012).

Creativity

It is the individual's capacity to produce with modern employment style, and contemporary theme, or for solving- problem, employment method or policy contributes in increasing the institution competence towards achieving its aims (Kadhm & Jaber, 2011). It also means creating new concepts and exploits it well with aim to be transformed to beneficial knowledge and dexterities for rivalry the development and applying the modern techniques for developing the institution (Kiziloglu, 2015). So the creativity represents the capacity to create and find modern techniques were not available. These techniques may be themes, solves, services, productions or methods and techniques the institution builds on (Khairallaha, 2009). Subsequently, the institution should apply an appropriate incentives system through proffering the financial rewards for those who have new brilliant ideas to stimulate and encourage the prominent ideas and suggestions for getting best results (Al-Otebi, 2007).

Methodology and the Procedures

First/Methodology

The descriptive method, which is quantity in nature, is used to recognize the effect of the financial incentives in developing the employees' capacities at Al-Qasim Green University. This method concerns collecting the data about phenomenon or specific problem and then classifying, analyzing and submitting it to precisely study for obtaining new results to explain the being studied phenomenon (Molhim, 2007).

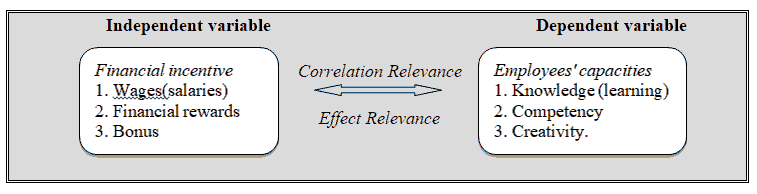

Hypothesized Diagram of the Study

The hypothesized diagram is designed depending on the problem and the study aims to reflect the nature of the effect and correlation relevance of the research variables, as shown in Figure 1 below.

Second/Field Procedures

Population and the Sample of the Study

Al-Qasim Green University out of the over (80) public and private universities in Iraq is used for this study. The population consists of (308) of staffs in the departments and the administrative units. (150) of (female/male) are chosen to be the study sample size with percent of (48.70) and distributed according to the sex variable (female- male). (75) Of them (female/ male) equally with percent of (24.35) are distributed to 6 groups with percent of (25%) per- group of the research sample. As provided in Table 1.

| Table 1 Reveals Distribution The Sample Size According To The Sex Variable |

|||

|---|---|---|---|

| Variable | Category | Percentage | Frequency |

| Sex | Male | 50% | 75 |

| Female | 50% | 75 | |

| Total | 100% | 150 | |

Methods of Collecting Data

A. The researcher depends in the theoretical aspect on several foreign and Arabic resources in addition to the theses, dissertations and internet information which contribute in covering the theoretical aspect of the study.

B. The researcher depends in the practical aspect on the questionnaire which is the essential resource for getting the data to explain the research variables which include the following three pivots:

The First Pivot: it comprises one item belongs the personal data concern with the personals of the selected sample (sex-age-years of service-academic achievement).

The Second Pivot: it encompasses (21) items belong the independent variable (the financial incentives) distributed according the it’s three dimensions (wages-financial rewards-bonuses).

Third Pivot: it includes (21) items belong the dependent variable (the employees' capacities) distributed according to its three dimensions (knowledge- competence-creativity).

All the items of the first and second pivots measure on 5-item Likert Scale which considers as one of the most common scales in the management province (Al-Najar, 2010), the value ranges between (5) agree completely to (1) doesn't agree completely, as shown in table 2.

| Table 2 One Of The Most Common Scales In The Management Province |

||||

|---|---|---|---|---|

| Agree completely | Agree | Neutral | Don't agree | Don't agree completely |

| 5 | 4 | 3 | 2 | 1 |

The validity and reliability test is designed to appropriate the questionnaire requirements as follow:

A. Face Validity: The questionnaire is submitted to jury members in the study domain, their notes have been taken in consideration by omitting some items and re-writing another substitutions to be appropriate with the nature of research.

B. Reliability: Reliability of the questionnaire items Cronbach’s alpha coefficient is used to measure the reliability items statistically. Table 3 shows Cronbach’s alpha coefficient for all the research variables.

| Table 3 Shows Cronbach’s Alpha Coefficient For All The Research Variables |

|||

|---|---|---|---|

| N | Items | Cronbach’s alpha coefficient | Validity Coefficient |

| 1 | Financial Incentives | 0.793 | 0.89 |

| 2 | Employee's capacities | 0.844 | 0.918 |

| 3 | Total of the sample items | 0.905 | 0.951 |

The above table reveals that all the questionnaire items have high degree accepted reliability average after the value of Cronbach’s alpha coefficient all the items mounts to (0.905), and this indicates the precision possibility the reliability. Also, it appears that reliability coefficient for all the questionnaire items amounts to (0.951) with high level of reliability.

Located Application

The questionnaires are distributed to the sample individuals by the researcher himself at Al- Qasim Green University. Also meetings are held with the staff in the administrative departments for explaining the questionnaire items answer.

Statistical Methods

The important statistical methods are depended for getting the results and test the hypothesis by use the statistical packages (SPSS), the percentages, Cronbach’s alpha coefficient, the mean average, standard deviation, value of (T-test), value of (F), correlation coefficient and simple regression coefficient.

Results and Discussion

The research variables are arranged according to particular questions per-variable, by using the statistical indicators (means, standard deviations, correlation and regression coefficient, value of (T test) and value of (F) according to the research sample respondents, as shown in table 4.

| Table 4 Shows The Relevance Of Effect And Correlation Between The Independent Variable (The Financial Incentive) And The Dependent Variable (The Employees' Capacities) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Variable | The mean Average | Standard Deviation | R** | R2 | F | Sig | T-test | Sig |

| 1 | Financial Incentive | 3.91 | 0.35 | 0.88 | 0.78 | 552.31 | 0.00a | 23.5 | 0 |

| 2 | Employee's Capacities | 4.04 | 0.38 | ||||||

The above table 4 reveals that the calculated means, deviation standards of the research sample respondents at Al-Qasim Green University belong the independent variable (the financial incentive) in its three dimensions (wages-financial rewards-bonuses) where the mean is (3.91) and the deviation standard is (0.35), whereas the mean for the dependent variable (the employee's capacities) is (4.04) with standard deviation is (0.38). The correlation coefficient (R) is (0.88), this indicates that there's strong and accepted correlation relevance with high level between the bivariate of research, the determination coefficient value (R2) is (0.78). And this indicates that (78%) of the occurred variables in the employees' capacities is because the financial incentive, whereas the other effects may be because the other incentive represented by the morale incentive. The calculated and extracted value (F) from (ANOVA) table is (552.31) with significant level is (0.00) which is lower of (0.01), the value of (T-test) is (23.50) with significant level is (0.00) which is lower of (0.01) too. And this indicates that there's statistically significant relationship between the bivariate, independent variable (the financial incentives) and the dependent variable represents in the employees' capacities. as shows in Table 5.

| Table 5 Explains The Relevance Of Effect And The Correlation Between The Bivariate Independent Variable (The Financial Incentives) And The Dependent Variable (Knowledge) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Variable | The mean Average | Standard Deviation | R** | R2 | F | Sig | T-test | Sig |

| 1 | Financial Incentive | 3.91 | 0.35 | 0.77 | 0.59 | 216.74 | 0.00a | 14.72 | 0 |

| 2 | Knowledge | 4.04 | 0.38 | ||||||

Table 5 shows that means, standard deviations of the research sample respondents at Al-Qasim Green University for the independent variable (the financial incentive) in its three dimensions (wages-financial incentive-bonuses) where the mean is (3.91) with standard deviation is (0.35), whereas the mean for the dependent variable (knowledge) is (4.03) with standard deviation is (0.38). The correlation coefficient (R) is (0.77). And this indicates that there's accepted correlation relevance between the bivariate of research, while the determination coefficient value (R2) is (0.59). And this indicates that (59%) of the occurred variables in the knowledge level (learning) of the employees is because the financial incentive, whereas the other effects may be because the other incentive includes the morale incentive or other factors the study does not deal. The calculated and extracted value (F) from (ANOVA) table is (216.74) with significant level is (0.00) which is lower of (0.01), the value of (T-test) is (14.72), with significant level is (0.00), which is lower of (0.01) too. And this indicates that there's statistically significant relationship between the bivariate, independent variable (the financial incentive), the dependent variable represents in the (knowledge). as shows in Table 6.

| Table 6 Explains The Relevance Of Effect And The Correlation Between The Bivariate Independent Variable (The Financial Incentive) And The Dependent Variable (Competence) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Variable | The mean Average | Standard Deviation | R** | R2 | F | Sig | T-test | Sig |

| 1 | Financial Incentive | 3.91 | 0.35 | 0.91 | 0.83 | 758.21 | 0.00a | 27.53 | 0 |

| 2 | Competence | 4.01 | 0.35 | ||||||

Table 6 shows that means, standard deviations of the research sample respondents at Al-Qasim Green University for the independent variable (the financial incentive) in its three dimensions (wages-financial rewards-bonuses) where the mean is (3.91) with standard deviation is (0.35), whereas the mean for the dependent variable (competence) is (4.01) with standard deviation is (0.35). The correlation coefficient (R) is (0.91). And this indicates that there's high degree and accepted correlation relevance between the bivariate of research, while the determination coefficient value (R2) is (0.83). And this indicates that (83%) of the occurred variables of the employees' competency is because the financial incentives, whereas the other effects may be because the other incentive includes the morale incentive. The calculated and extracted value (F) from (ANOVA) table is (758.21) with significant level is (0.00) which is lower of (0.01), the value of (T-test) is (27.53), with significant level is (0.00), which is lower of (0.01) too. And this indicates that there's statistically significant relationship between the bivariate, the independent variable (the financial incentive), the dependent variable represents in the (the employees' competence). as shows in Table 7.

| Table 7 Explains The Relevance Of Effect And The Correlation Between The Bivariate Independent Variable (The Financial Incentive) And The Dependent Variable ( Creativity) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| N | Variable | The mean Average | Standard Deviation | R** | R2 | F | Sig | T-test | Sig |

| 1 | Financial Incentives | 3.91 | 0.35 | 0.88 | 0.78 | 535.57 | 0.00a | 23.14 | 0 |

| 2 | Creativity | 4.09 | 0.44 | ||||||

Table 7 shows that the means, deviation standards of the research sample respondents at the Green University of Al-Qsim for the independent variable (the financial incentive) in its three dimensions (wages-financial competence-bonuses) where the mean is (3.91) with deviation standard is (0.35), whereas the mean for the dependent variable (employees' creativity ) is (4.09) with standard deviation is (0.44). The correlation coefficient (R) is (0.88). And this indicates that there's high degree, accepted correlation relevance between the bivariate of research, while the determination coefficient value (R2) is (0.78) and this means that (78%) of the occurred modifications in the creativity level because the financial incentive, while the other effect may be because the incentives represented by the morale incentive. The calculated and extracted (F) value from (ANOVA) table is (535.57) with significant (0.00) which is lower of (0.01). The value of (T-test) is (23.14) with significant is (0.00) which is lower of (0.01) too. And this indicates that there's statistical significant relevance between the bivariate, the independent variable (the financial incentive) and the dependent variable (creativity).

According to the above, and after discussion and analyzing results the correlation and effect relevance for the independent variable (the financial incentive) with its three dimensions (wages-the financial rewards-bounces) in the dependent variable (the employee's capacities) with its three dimensions (knowledge-competence-creativity) the hypothesis is accepted that (there's significant effect and correlation relevance between the financial incentive and the employees' capacities).

Conclusion

This research deals with very important factor it was the financial incentive and its impact in order to improve the employee's capacities, for that there are set of conclusions were summarized:

1. Human resources are the basic source for all the processes and activities the institution plays to achieve its aims. And Human resources are fundamental variable and dynamic for the elements of production. Subsequently, they determine the succeeding or failing of the institution activity.

2. Financial incentive considers the fundamental motivation which stimulates the employees' desire to improve their competences and boost the capacities and dexterities.

3. Financial incentive can be considered as the rewards for the employees distinguished performance which motivate them to work hard, subsequently the improving and increasing the production of the institution.

4. Financial incentives regards as the important element of the institution for increasing the employees' competence, improving their creativity capacities and then the competitive peculiarity is achieved, subsequently it reflects positively for the institution.

5. Financial incentives are yielded by Al- Qasim Green University account the most important findings to develop the employees' capacities and promote their dexterities and then stimulate them to improve their performance level.

6. Practical aspect of the study reveals that there's statistical significant strong correlation relevance between the bivariate: the independent variable (the financial incentive) and the dependent variable (the employees' capacities),

7. Also the practical aspect of the study shows that there’s statistical significant strong correlation relevance between the bivariate, the independent variable (the financial incentive) and the dependent variable represent by the employees' capacities with its three dimensions: (knowledge- competence- creativity).

Recommendations

1. The institutions have to focus on the importance of the sufficient financial incentive presented for the employees since it effects in increasing and developing their competencies and capacities,

2. The importance of yielding the qualified employees the appropriate financial incentive, and award them through assign them in the adequate position to exploit their capacities, dexterities to achieve the required performances and fulfill the institution aims,

3. Stimulating and encouraging the employees and reward them through set policies and procedures to guarantee their sustenance and developing their cognitive and creativity capacities

4. The employees should have a role in the process of evaluation the financial incentive to stimulate and evolve their capacities for improving the performance level.

5. Necessity of evaluating the financial incentive policy done in the institution and developing it to guarantee the equivalent distribution among the employees and promoting their dexterities and fulfill their needs.

References

Abidalaziz, S. (2008). The organizational incentives and activity of the harbored institute for Skikda as sample. Thesis, faculty of economic sand commercial sciences. University of Skikda, 15.

Abraheem, L. (2007). Sociology of organization. Dar Ghareeb for distribution, Cairo, 89.

Ahmed, M., (2009). Wages and compensations systems. Al-Dar Al- Jamyaia, Alexandria, 248.

Ali, S., (2004). The organizational behavior management. Dar Ghareeb for printing, distribution and publication, Cairo, 108.

Argote, L. (2012). Organizational learning: Crating, retaining and transferring knowledge. Springer Science & Business Media, 43.

Crossref, GoogleScholar, Indexed at

Argote, L. (2011). Organizational learning research: Past, present and future. Management learning, 439.

Crossref, GoogleScholar, Indexed at

Bader, E. (2011). The financial and morale incentives and its relevance in improving the employee's performance of management of the wild materials in Prince Sultan Military Medical City, Riyadh. Thesis, Naif Arab University for security sciences. Riyadh, Saudi Arabia, 1-25.

Butler, M.P. (2011). Competency assessment methods tool and processes: A survey of nurse 5- preceptors in Ireland. Nurse Education in Practice, 11, 299.

Crossref, GoogleScholar, Indexed at

Chepkemoi, J. (2018). Effect of incentives on employee performance at kenya forest service Usain Gishu county. IOSR Journal of Business and Management (IOSR_JBM), 1-34.

David, D., & Dubois, W.J.R. (2004). Competency-based human resources management, (1st edition). USA, 16.

Einas Abid, A.R.A.S. (2003). Role of the human resources administration in achieving the institutional creativity. Thesis, department of business administration. University of Al-Yarmook, Jordan, 145.

Haithem, A.A. (2007). The administration by the incentives, (1st Volume). Darkonoz Almarefa for distribution, 15.

Howria, A., (2017). The incentives policy and improving the human resources performance, studying the state of the commercial directorate in the state of M'sila. Thesis, faculty of legal and political sciences. University of Mohammed Boudiaf, 34.

Jamal, K. (2009). The administrative creativity. Dar Asama for publication, Oman.

Kamal, M. (2010). Managing the efficiencies: The conceptual framework and the major dominations, magazine of economic and administrative research. University of Mohamed Khidr de Biskra, 7, 17.

King, W.R. (2009). Knowledge management and organizational learning. Springer USA, 8.

Kiziloglu, M. (2015). The effect of organizational learning on firm innovation capability: An investigation in the banking sector.Global Business and Management Research, 17.

Muhammed Bin, S.A.H. (2020). The effect of the financial incentives on the employee's performance, Saudi Arab. Arab journal of scientific publishing, 21, 637.

Muhhmed, Z.A.O. (2007). The way to creativity and distinction. Dar Al- Fajer for publication, Cairo, 33.

Muhmmed Madhat, A.N. (2012). An administration by the incentives-the functional incentives styles, (1st edition). The Arabic group for training and distribution. Egypt, p107.

Muneer, N., & Fareed, K. (2010). Human resources management. Oman, Arab Community Library for distribution, 136.

Mustafa, N.S. (2011). Human resources administrations-individuals administrations. Dar Al-shariq, Oman, Jordan.

Nabeel, N. (2010). Statistic of education and human sciences with programmed applications. Dar Al- Hamed for publication and distribution. Oman, Jordan, 64.

Nama'a, K., & Rafea, J. (2011). The creativity features of the directors and the core ability: The effect and the relevance (empirical study). Journal of management and economic, 135.

Natheera, B.Z. (2012). The role of managing in management the human efficiencies in the small and middle institutes. Thesis, faculty of economic and commercial and management sciences. University of Kasidi Merbah Ouargla, 48.

Novianty, R., & Siti Noni, E. (2018). Financial incentives: The impact on employee motivation. Academy of Strategic Management Journal, 122.

Qalal, N. (2018). The impact of stimulation in improving the employee's performance within the institution, study the status of Algeria telecommunications. Thesis, faculty of economic sand commercial and management sciences. University of Abdelhamid Ibn Badis, 24.

Salami, F. (2014). The role of efficiencies management in achieving the competitive peculiarity. Thesis, faculty of economic and management sciences. University of Akli Muhind Olhadj- Bouria, Algeria, 4.

Sami Muhmmed, M. (2007). The research methodologies of education and psychology. Oman, Jordan, Dar Al- Masyearah for printing, publication and distribution.

Siliman, A.F. (2011). The effect of the stimulation policies of the organizational fidelity in the public institution. Journal of Damascus University for the economic and legal sciences, 27(1), 2-16.

Sousa Batista, P.C. (2013). Organization capacities, strategic orientation, strategy formulation quality implementation and organization performance in Brazilian Textile Industries, 63.

Torrington, D., Hall L., & Talyor S. (2008). Human resources management, (7th edition). Prentice Hall, London.

Younis, A.R. (2010). Analyzing the incentives systems and its relevance on the employee's performance in Libyan's industrial organizations in Benghazi city. Thesis, business administration department. University of Garyounis, 37.

Received: 22-Nov-2021, Manuscript No. asmj-21- 8129; Editor assigned: 24- Nov -2021, PreQC No. asmj-21-8129 (PQ); Reviewed: 29- Nov -2021, QC No. asmj-21-8129; Revised: 10-Dec-2021, Manuscript No. asmj-21-8129 (R); Published: 05-Jan-2022