Research Article: 2019 Vol: 18 Issue: 5

The Impact of Accounting Performance on Structure of Ownership and Accounting Conservatism, Case of Jordan

Omar Fareed Shaqqour, Zarqa University

Abstract

The goal of this paper is to study the moderating effect of the firm's performance on the relation between the ownership structure and the Accounting Conservatism Level (ACL) in Jordanian industrial firms listed in Amman Stock Exchange (ASE). The study population consisted of Jordanian industrial listed firms during the period 2013-2017. The sample of the study is 48 industrial firms, and the number of study data is 240. Many statistical methods were applied to analyze data, such as standard deviations, mean to descript the study variables, in addition to the simple regression to test the hypotheses. The study found that there is no relation between ownership determinants represented by institutional ownership, family ownership, foreign owners, and owners concentration, and ACL in Jordanian industrial listed firms, as well as, the study found that the firm's performance measured by Return on Assets (ROA) moderated the relation between the ownership determinants represented by institutional ownership, family ownership, and owners concentration, and ACL in Jordanian industrial listed firms, but does not moderated the relation between the foreign owners and ACL.

Keywords

Accounting Conservatism Level, Ownership Determinants and Firm's Performance.

Introduction

Accounting is intended to provide useful information to users, that help them in making appropriate decisions, however, the preparation of the financial statements and producing information by the accounting system from financial reports and statement, are governed by the accounting standards and principles, Which developed several policies and treatments for the same financial operation, but the firm's management selects accounting policies and practices based on its objectives, some management want to apply a conservative policies by recognizing the expenses when they expect it, while recognizing revenues only when it occurs. In other words, the firm's management recognizes the bad news in the financial statements, faster than good news Basu (1997), On the other hand, other firm's management is recognizing profits at a time they must recognize losses, Ball & Shivakumar (2005).

The agency theory is define as the separation between firm's ownership and firm's management, so firm's owners are separated and do not affect the management decisions. Several other studies have searched the impact of ownership determinants on the management choices of conservative or non-conservative policies and methods in accounting operations treatments; however the results of these studies were inconsistent (Chi et al., 2009; García Lara et al., 2007).

For owners concentration Yosef (2012) found that the increased in owners concentration leads to increase in ACL, whereas, Alkurdi et al. (2017) found that owners concentration does not affect on the ACL and Haw et al. (2012) found that the dispersion of cash flow rights among senior owners is positively correlated with the ACL, while Yunos et al. (2010) found a negative impact of owners concentration on financial reporting and financial performance, and Cullinan et al. (2012) identified that there is negative effect for the ACL with increasing the proportion of shares owned by biggest shareholder.

For the impact of family ownership on ACL, Yosef (2012), found that family ownership does not affect the ACL, whereas Haw et al. (2012) found that family ownership increased the use of an ACL. As well for foreign owners, Alkurdi et al. (2017) found a positive relation between it and ACL, As well for institutional ownership, Alkurdi et al. (2017); Abdul Majid & Hamidah (2013) and Obaid (2010), found a positive relation between them and the ACL, Li et al. (2015), also found that the ownership determinants does not affect on management in applying the ACL.

Note that there is not consistency between the results of studies on the effect of ownership determinants and ACL; this may be due to the diversity of firm’s performance. Therefore, this study attempts to investigate the moderating effect of the firm's performance on the relation between ownership determinants and ACL in Jordanian industrial listed firms.

Study Problem

Several studies have been conducted on ownership determinants and the ACL, but the results of these studies have been inconsistent. These studies were conducted in different countries and in different natures, Yosef (2012); Haw et al. (2012); Alkurdi et al. (2017) and Cullinan et al. (2012). Therefore, the difference in the external variables represented by the different in countries in which the study was conducted, as well as the difference in the internal variables represented by the performance of the firms, may be the reason for the inconsistencies in the results of the studies.

This study examines the moderating impact of the firm's performance on relation between the ownership determinants represented by institutional owners, family ownership, foreign owners, and the owner’s concentration, and ACL in Jordanian industrial listed firms. The problem of study is determined by answer the following questions:

1. What is the relation between ownership determinants and ACL in the Jordanian industrial listed firms?

2. What is the impact of firm's performance on the relation between ownership determinants and the ACL in the Jordanian industrial listed firms?

Objectives of Study

The study intends to achieve following objectives:

1. Knowing relation between ownership determinants and ACL.

2. Knowing the impact of the firm's performance on relation between the determinants of ownership and the ACL.

Importance of Study

The importance of the study is to know the impact of ownership determinants in ACL in Jordanian industrial listed firms, and to find the affect of the firm's performance on the relation between ownership determinants and ACL in Jordanian industrial listed firms.

The study will provide beneficiaries and interested parties with information and results about the role of ownership determinants in ACL in Jordanian industrial listed firms, and to find the affect of the firm's performance on the relation between ownership determinants and ACL in Jordanian industrial listed firms.

Study Methodology

Study Hypotheses

Ho1 There is no significant impact of institutional ownership in increasing the ACL in Jordanian industrial listed firms.

Ho2 There is no moderating impact of the firm’s performance in the relation between institutional ownership and ACL in Jordanian industrial listed firms.

Ho3 There is no significant impact of family ownership in increasing ACL in Jordanian industrial listed firms.

Ho4 There is no moderating impact of the firm’s performance in the relation between family ownership and ACL in Jordanian industrial listed firms.

Ho5 There is no significant impact on foreign owners in increasing ACL in Jordanian industrial listed firms.

Ho6 There is no moderating impact of the firm’s performance in the relation between foreign owners and ACL in Jordanian industrial listed firms.

Ho7 There is no significant impact of owner’s concentration in increasing ACL in Jordanian industrial listed firms.

Ho8 There is no moderating impact of the firm’s performance in the relation between owner’s concentration and ACL in Jordanian industrial listed firms.

Method of Study

The study used descriptive analytical method, because it fits the nature of the study and its objectives.

Study Population and Sample

Study population is Jordanian industrial listed firms during the period 2013-2017, but the study sample is Jordanian industrial listed firms, which have required data during the period 2013-2017. The sample of the study is 48 industrial firms.

Measuring Study Variables

Study variables are one dependent variable which is the ACL, and four independent variables, which are institutional ownership, family ownership, foreign owners, and owner’s concentration, and one moderating variable which is firm’s performance.

(1) Dependent variable: ACL: ACL was measured by the form of Beaver & Ryan (2005); ACL was calculated by the book value of the firm to the market value of the firm.

(2) Independent variables:

- Institutional ownership: shares owned by firms to firm's shares number.

- Family ownership: shares owned by persons from the same family to firm's shares number.

- Foreign owners: shares owned by non-Jordanians to firm's shares number.

- Owners concentration: A share owned by people owns 5% or more of the firm's shares to firm's shares number.

(3) Moderating variable: Firm’s performance:

The firm's performance was measured by ROA (net income to total assets)

Research Model

Regression analysis applied to test the hypotheses (Ho1, Ho3, Ho5, and Ho7) using the following model

Where:

CL = Conservatism level

IO = institutional ownership

FaO = family ownership

FoO = foreign owners

OC = owners concentration

ε = error

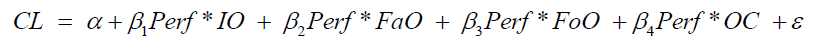

Regression analysis applied to test the hypotheses (Ho2, Ho4, Ho6, and Ho8) using the following model

Where:

CL = Conservatism level

Perf*IO = Interaction between performance and institutiomal ownership

Perf*FaO = Interaction between performance and family ownership

Perf*FoO = Interaction between performannce and foreign ownership

Perf*OC = Interaction between performannce and ownership concentration

ε = error

Study Results

The study data was analyzed by EXCEL and SPSS. Table 1 illustrates descriptive statistics for study variables, whereas Table 2 illustrates the hypothesis test results.

| Table 1: Descriptive Statistics | |||||

| N | Min | Max | Mean | Std. Deviation | |

|---|---|---|---|---|---|

| ROA | 240 | -195.3 | 38.4 | -0.5276 | 16.08566 |

| Conservatism Level | 240 | 0.13 | 80.79 | 1.5488 | 5.28237 |

| Institutional Ownership | 240 | 0.01 | 1 | 0.5008 | 0.32747 |

| Family Ownership | 240 | 0 | 0.82 | 0.1408 | 0.19606 |

| Foreign Owners | 240 | 0 | 0.99 | 0.1952 | 0.27706 |

| Owners Concentration | 240 | 0.07 | 1 | 0.6365 | 0.25463 |

Descriptive Statistics for Study Variables

Table 1 shows the mean of ACL which is 1.55, the minimum value 0.13, the maximum value 80.79, the mean of ROA is 0.52, the minimum value -195.30, and the maximum value 38.40. As well as, the mean of institutional ownership is 50.08%, the minimum value 0.01, the maximum value 100%, thus, the Table 1 illustrates the mean of family ownership is 14.08%, the minimum value 0%, and the maximum value 82%, the mean of foreign owners is 19.52%, the minimum value 0%, and the maximum value 99%. Finally, the Table 1 illustrates that the mean of owner’s concentration is 63.65%, the minimum value 7% and the maximum value 100%.

Results of Analysis and Testing the Study Hypotheses

The first hypothesis

Ho1 There is no significant impact of institutional ownership in increasing the ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig.=0.794, which is greater than the level α = 0.05, therefore, the null hypothesis is accepted, that is, the percentage of institutional ownership does not impact on increasing ACL in Jordanian industrial listed firms.

The second hypothesis

Ho2 There is no moderating impact of the firm’s performance in the relation between institutional ownership and ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig.=0.001, which is less than the level α=0.05, and therefore, the alternative hypothesis is accepted, that is, the firm’s performance affects on the relation between the institutional ownership and ACL in Jordanian industrial listed firms, while the value of T=-3.228 is negative value, In other words, the low performance of the firm leads to an increase in the relation between the institutional ownership and ACL in Jordanian industrial listed firms. This means that the increase in institutional ownership makes the management of the firm use the ACL, even if the performance of the firm is low.

| Table 2: Test Study Hypotheses | |||||

| Hypotheses | N | T value | DF | Asymp. sig. | P-value sig. |

|---|---|---|---|---|---|

| HO1 | 240 | -0.262 | 239 | 0.794 | 0.05 |

| HO2 | 240 | -3.228 | 239 | 0.001 | 0.05 |

| HO3 | 240 | 0.576 | 239 | 0.565 | 0.05 |

| HO4 | 240 | 6.051 | 239 | 0 | 0.05 |

| HO5 | 240 | 0.552 | 239 | 0.581 | 0.05 |

| HO6 | 240 | 0.696 | 239 | 0.487 | 0.05 |

| HO7 | 240 | 0.773 | 239 | 0.44 | 0.05 |

| HO8 | 240 | 5.396 | 239 | 0 | 0.05 |

The third hypothesis

Ho3 There is no significant impact of family ownership in increasing ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. = 0.565, which is greater than the level α = 0.05, therefore, the null hypothesis is accepted, that is, the family ownership does not impact in increasing ACL in Jordanian industrial listed firms.

The fourth hypothesis

Ho4 There is no moderating impact of the firm’s performance in the relation between family ownership and ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. =0.00, which is less than the level α=0.05, and therefore, the alternative hypothesis is accepted, that is, the firm's performance affects the relation between family ownership and ACL in Jordanian industrial listed firms, that mean, the increasing in the firm’s performance leads to increase the relation between family ownership and ACL in Jordanian industrial listed firms.

The fifth hypothesis

Ho5 There is no significant impact of foreign owners in increasing ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. =0.581, which is greater than the level of significance α=0.05, therefore, the null hypothesis is accepted, that is, the foreign owners does not impact in increasing ACL in Jordanian industrial listed firms.

The sixth hypothesis

Ho6 There is no moderating impact of the firm’s performance in the relation between foreign owners and ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. =0.487, which is greater than the value of α=0.05. Therefore, the null hypothesis is accepted, that is, the performance of the firm does not affect in the relation between foreign owners and ACL in Jordanian industrial listed firms.

The seventh hypothesis

Ho7 There is no significant impact of owner’s concentration in increasing ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. = 0.440, which is a value greater than the level of morale α = 0.05, therefore, the null hypothesis is accepted, that is, the owners concentration does not impact in increasing ACL in Jordanian industrial listed firms.

The eighth hypothesis

Ho8 There is no moderating impact of the firm’s performance in the relation between owner’s concentration and ACL in Jordanian industrial listed firms.

The hypothesis was tested by the test of simple regression. Table 2 illustrates the results of test the hypothesis, which illustrates the value of P-value sig. =0.00, which is less than the level α = 0.05, the alternative hypothesis is accepted, that is, the performance of the firm affects in the relation between the owners concentration and ACL in Jordanian industrial listed firms, that mean, the increasing in the performance of the firm leads to increase the relation between owners concentration and ACL in Jordanian industrial listed firms.

Discussion and Conclusions

Through the above, a set of conclusions can be found:

1. The study found that institutional ownership does not impact in increasing the ACL in Jordanian industrial listed firms. This result is not consistent with Alkurdi et al. (2017), which was found there is a positive relation between institutional ownership and the ACL. The reason for the difference results may be due to the different in firm’s nature or performance, on the other hand the study identified that the firm’s performance affects in the relation between institutional ownership and ACL in Jordanian industrial listed firms.

2. The study found that family ownership does not impact in increasing ACL in Jordanian industrial listed firms. This result is in line with Yosef (2012), which was found that family ownership does not affect in the ACL. The reason for the difference results may be due to the different in firm’s nature or performance, and the study identified that the firm’s performance affects in relation between family ownership and ACL in Jordanian industrial listed firms.

3. The study found that foreign owners do not impact in increasing ACL in Jordanian industrial listed firms. This result is not consistent with Alkurdi et al. (2017), which was found there is a positive relation between foreign owners and the ACL. The reason for the difference results may be due to the different in firm’s nature or performance, but the study identified that the firm’s performance does not affect in the relation between foreign owners and ACL in Jordanian industrial listed firms.

4. The study found that owner’s concentration does not impact in increasing ACL in Jordanian industrial listed firms. This is result is consistent with Alkurdi et al. (2017), where it was found that the dispersion of ownership does not affect in the ACL, but this result is not consistent with Yosef (2012), Where it was found that the increased in dispersion of ownership leads to increase in the ACL, as well as Yunos et al. (2010), which was found there was a negative impact of the owners concentration on the financial reports and financial performance, thus the study identified that the firm’s performance affects in the relation between the owners concentration and ACL in Jordanian industrial listed firms.

Recommendations

The study suggests some recommendations, which are:

1. Increasing the interest of institutional ownership and encourage the firms to increase percentage of institutional ownership.

2. Increasing interest of the minority’s rights by restricting the role of the majority in the selection of accounting policies to achieve their interests.

3. The management of firms should apply conservative accounting policies without the application of this policy.

4. Identifying and disclosing ownership percentages in different forms in firms in order to protect the various stakeholders associated with the firm.

Future Directions

The study suggests some of future direction which related with variables of the study:

1. Conducting the same study variables on other firms, such as service firms and financial firms.

2. The impact of the firm's performance on relation between the procedures of the external audit and ACL in the financial reports.

3. Future studies may focus on impact of firms governance tools on the ACL.

Acknowledgement

This research is funded by the Deanship of Research in Zarqa University, Jordan.

References

- Abdul Majid & Hamidah M., (2013). Measuring the accounting conservatism level and the factors affecting it in the financial reports of the Saudi insurance companies. Journal of Accounting and Auditing 1 (2), 139-174.

- Alkurdi, A., Al-Nimer, M., & Dabaghia, M. (2017). Accounting conservatism and ownership determinants effect: evidence from industrial and financial Jordanian listed companies.International Journal of Economics and Financial Issues,7(2), 608-619.?

- Ball, R., & Shivakumar, L. (2005). Earnings quality in UK private firms: comparative loss recognition timeliness.Journal of Accounting and Economics,39(1), 83-128.?

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings.Journal of Accounting and Economics,24(1), 3-37.?

- Beaver, W.H., & Ryan, S.G. (2005). Conditional and unconditional conservatism: Concepts and modeling.Review of Accounting Studies,10(2-3), 269-309

- Chi, W., Liu, C., & Wang, T. (2009). What affects accounting conservatism: A corporate governance perspective.Journal of Contemporary Accounting & Economics,5(1), 47-59.?

- Cullinan, C.P., Wang, F., Wang, P., & Zhang, J. (2012). Ownership determinants and accounting conservatism in China.Journal of International Accounting, Auditing and Taxation,21(1), 1-16.?

- García Lara, J.M., Osma, B.G., & Penalva, F. (2007). Board of directors' characteristics and conditional accounting conservatism: Spanish evidence.European Accounting Review,16(4), 727-755.?

- Haw, I.M., Ho, S.S., Tong, J.Y., & Zhang, F. (2012). Complex ownership determinants and accounting conservatism. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1478641

- Li, W.X., He, T.T., Tang, G.Y., & Marshall, A. (2015), Accounting conservatism-Does ownership structure matter? Retrieved from https://pdfs.semanticscholar.org/bebf/be6a30e10a383420870651d399562cb51e2f.pdf

- Obaid, I. (2010). The role of institutional investment in increasing the degree of accounting reservatism.Journal of King Saud University Administrative Sciences,20, 1-38.

- Yosef, A., (2012), Impact of determinants of firm?s ownership determinants in the conservatism of financial reports. Damascus University Journal of Economic and Legal Sciences, 38(1).

- Yunos, R.M., Smith, M., & Ismail, Z. (2010). Accounting conservatism and ownership concentration: Evidence from Malaysia.Journal of Business and Policy Research,5(2), 1-15.