Research Article: 2021 Vol: 24 Issue: 1S

The Impact of Adopting Corporate Governance Strategic Performance in the Tourism Sector: A Case Study in the Kingdom of Bahrain

Nader Alaali, Boulevard Travels,

Amina Al Marzouqi, University of Sharjah

Ala Albaqaeen, Dubai Health Authority

Fares Dahabreh, Northumbria University

Muhammad Alshurideh, University of Jordan, University of Sharjah Elena Mouzaek, Rezotels Portal

Saddam Alrwasdh, Institute of Health Sciences, King Saudi Arabia

Saddam Alrwasdh, Institute of Health Sciences, King Saudi Arabia

Saddam Alrwasdh, Institute of Health Sciences, King Saudi Arabia

Ahmad Aburayya, Dubai Health Authority

Abstract

The aim of this study is to examine Corporate Governance (CG) practices in the Tourism Small And Medium-Sized Enterprises (TSMEs) in Bahrain. In addition, the research sought to clarify the challenges facing the implementation of CG in the tourism industry in Bahrain, as well as the appropriate mechanisms for ensuring the sustainability of CG. The theoretical framework is proposed based on CG agency theory and institutional theory, which helped in identifying the facts that related to the CG at multi-level working of the tourism sector in Bahrain. A qualitative research is adopted, whereas the primary data used in this research are collected through interviews with 10 managers and executives in the banking and finance sector and involved in CG. Thematic analysis is used to analyse the qualitative data. The results highlighted that the relevance and importance of CG for a range of tourism organisations in Bahrain. The results revealed that certain challenges have plagued the organisations seeking to implement CG in their business, including a lack of adequate system and business processes, higher costs, and lack of understanding and assistance from the government. In addition, the results offered several strategies for overcoming these challenges, including training on higher CG awareness, corporate governance mechanisms and audit report timelines, and the removal of unnecessary CG policies and procedures. The present study is an important contribution in the existing stock of CG literature as it helps in listing out the benefits of CG codes in the tourism industry. In addition, this study conveys the potential for driving suitable change in the organisational culture that will help in enhancing and positively shaping prevailing business behaviour.

Keywords

Corporate Governance, Service Sector, Tourism Sector, The Kingdom of Bahrain

Introduction

The issue of Corporate Governance (CG) is of great interest to businesses and international financial institutions today, due to a series of events that have occurred during the last two decades, such as the economic crises and financial meltdowns that hit many countries across the world. A lack of CG has enabled companies, represented by managers and board members, to commit serious abuses and violate the rights of shareholders, creditors, and other stakeholders (Musleh Al-Sartawi, 2018; Aburayya et al., 2020). Furthermore, CG has become increasingly important as a result of the tendency of many countries to shift to capitalist economic systems, in which they rely heavily on private companies to achieve high and sustained rates of economic growth (Al-Jarrah et al., 2012; Sari et al., 2018; Al-Gasaymeh et al., 2020). As a result, organisations have undergone rapid developments in a competitive environment, with business valuation no longer dependent on building a reputation on a financial position only to express the responsiveness of managers in these institutions to their social responsibility (Al-Hadi et al., 2018; Abu Zayyad et al., 2021). One of the most significant ongoing discussions over the last 10 years in many Gulf Cooperation Council (GCC) countries is the development of tourism and hospitality infrastructure for sport and leisure that could provide a variety of opportunities to diversify the economy. Countries such as Saudi Arabia, United Arab Emirates (UAE), Oman, and the Kingdom of Bahrain, hereinafter referred to as ‘Bahrain’, have attempted to substantially expand their economies by establishing national tourism development and marketing strategies for niche tourism initiatives (Mansfeld & Winckler, 2008; Al-Khayyal et al., 2020). In recent years, there has been an increasing interest in the global tourism industry, which has played a major role in diversifying international tourism opportunities, in particular for the economies of the GCC countries (Alhowaish, 2016). Notably, Dubai’s success in developing this sector has been reflected in its economy, leisure tourism, and foreign direct investment, becoming unique destination of international distinction (Bagaeen, 2007; Sharpley, 2008; Alshurideh et al., 2019; Taryam et al., 2020; Al Batayneh et al., 2021; Al Shebli et al., 2021). In the past decade, Bahrain has seen the robust development of its tourism infrastructure sector, due to its strategic location among the GCC countries, and it is today considered as the leading pillar of the expanding economy scale and providing of job opportunities (Alhowaish, 2016; Assad & Alshurideh, 2020).

Bahrain’s strategic location as an international financial hub of GCC countries is driving the growth of its tourism sector. The capital of Bahrain, Manama, was chosen by the GCC Ministers of Tourism as ‘the Gulf Capital of Tourism for the year 2016’ (Invest in Bahrain, 2020). Manama was named ‘Capital of Arab Tourism’ in 2020, during Bahrain’s participation in the 22nd Session of the Arab Ministerial Council for Tourism (Invest in Bahrain, 2020). The tourism sector in Bahrain has developed over the last 20 years, and it now plays a major role in the nation’s economic growth, levering Bahrain’s cultural, natural and retail sectors. Hence, it has become a competitive niche market for tourism and investment. The Kingdom of Bahrain is a small country belonging to the GCC region in the Arabian Gulf, where CG remains in a developmental phase (Maskati & Hamdan, 2017). However, the approximate Gross Domestic Product (GDP) of the county was ranked 13 per capita in the world as per the reports of United Nations 2017 (Maskati & Hamdan, 2017). Bahrain is considered to be the leader of the movement of Middle Eastern countries away from oil-based economies. Bahrain hosted the entrepreneurship and functionally re-emerged the economy through a process of reinvestment (Alrabeei & Kasi, 2014). As a result, these factors reveal the importance of understanding the growth aspects of the Bahraini firms with regards to CG.

CG became very important during the recession period, as shareholders sought to protect their assets and no agency costs were paid during the economic recovery. This created trust and confidence in shareholders, investors, and other stakeholders and relevant parties, thereby representing a means of increasing the companies’ value and sustaining their growth (Christiano et al., 2015; Raj et al., 2018; Al-Maroof et al., 2021). Bahrain is a small but economically important island nation in the GCC region of the Arabian Gulf. Here, CG remains in a developmental phase (Maskati & Hamdan, 2017). Bahrain is a dynamic, well-established global economy; so, to maintain the country’s financial level, a CG system is to be implemented to control the financial sector and develop regulation with which to meet future challenges (Shehata, 2016; Maskati & Hamdan, 2017). In addition, more improvement is needed, although GCC countries already have legal codes for implementing CG, unlike the regions of Middle East and North Africa (MENA) (Shehata, 2015). However, these codes may not always be enough; as, from 2007 to 2011, Bahrain’s firms fulfilled their CG requirements only 61.2% of the time (Ahmed & Hamdan, 2015). This underscores the need for future research regarding CG in Bahrain and its impact on firms’ success (Dalwai et al., 2015). In addition, the roles of several stakeholders in CG have not been determined (Cumming et al., 2015). It is necessary to understand the impact of firm size on CG and disclosure practices (Sanad et al., 2016). Therefore, the aim of this study is to examine CG practices among Tourism Small And Medium-Sized Enterprises (TSMEs) in Bahrain. In addition, it will clarify the challenges facing the implementation of CG in the TSME industry in Bahrain, as well as the appropriate mechanisms for ensuring the sustainability of CG.

Literature Review

Corporate Governance (CG)

CG primarily concerns the control and oversight frameworks necessary to stop individuals or group actors within the organisation from exploiting the powers granted to them. CG helps to curb the employee’s potential misuse of power at the expense of the company or shareholders (Tricker & Tricker, 2019). From another point of view, CG should include appropriate enforcement and incentives to ensure that management and the board together assist them in seeking to achieve their goals and objectives in the interests of the company and its shareholders. CG should facilitate effective monitoring to encourage companies to use their resources efficiently (Aguilera et al., 2019). CG has traditionally been implemented to resolve the problems faced by organisations posed by the agency theory. Agency theory indicates that agents of a company or firm–such as managers–conduct activities that lead to their own personal maximisation, at the cost of negatively impacting the principal–that is, the owner of the company or firm. This theory assumes a relationship between two parties–namely, the agent and the principal–wherein the former acts and takes decisions on behalf of the latter. However, certain issues arise when agents conduct business activities that are not for the principal, but for their own personal gain and which are capable of impugning the reputation of the firm (Alabdullah, 2016; Mouzaek et al., 2021). Moreover, CG is related to the activities through which supervision and regulative control is exercised in the enterprise’s internal power framework (Tricker & Tricker, 2016; Taryam et al., 2021). It primarily involves the active participation of the board of directors, who are responsible for serving and effectively guiding and regulating the power of the CEO. Notably, shared dominance (CG) is an important element of an organisation, emphasising progress in the marketplace and building confidence among investors, while attracting more capital to the trading units (number of shares) (Ahmed & Hamdan, 2015).

The concept of CG has received acknowledgement from both the public and private sectors (Hopt, 2011; Mulyadi et al., 2012; Matei & Drumasu, 2015), and it has grown from its initially simplistic interpretations. The new perspective of CG involves the active participation of shareholders, who seek to create a balance between the interests of shareholders (Cumming et al., 2017). It can be further explained by the example of Malaysian small and medium-sized enterprises (SMEs), where organisational powers are mainly concentrated in the hands of the shareholders, which has resulted in the abuse of minor shareholders and become a major threat to effective CG practices (Umrani et al., 2015). Hence, several factors impact the practise of CG–at the country level (macro form), industry level (mono form), and the organisational level (micro form). However, the practices of CG also have certain benefits that help organisations to grow and prosper (Umrani et al., 2015). These advantages and influences are discussed in the following sub-sections.

Advantages of Effective Corporate Governance

The function and significance of good CG structures and mechanisms for organisational performance are well-established in the literature (Heracleous, 2008; Alkalha et al., 2021; Ahmed & Hamdan, 2015). In essence, good CG is linked to improved organisational performance in the modern business environment as well as enhancing shareholder protections (Heracleous, 2008). The main goal of implementing CG is to enhance firm performance through profit-earning abilities. It also prevents employees using the company resources for their own personal benefit. Given the significance of CG, the promoting of good CG standards has emerged as an important factor in attracting investment capital, enhancing organisational performance, and lessening risk (Ahmed & Hamdan, 2015). Good CG can be defined as codes of best practice that help to enhance organisational effectiveness with regards to its operations, ethical conduct, and financial profitability (Heracleous, 2008). Therefore, the rationale for increased adoption of good CG mechanisms is their contribution to higher returns for shareholders, and vice versa. In essence, the existing literature and evidence indicates a strong link between shared dominance, organisational achievement, and the protection of the interests of shareholders.

Another advantage of CG is that it encourages better tax-planning decisions and behaviours. For instance, Sá & Alves (2018) reviewed recent empirical studies on the topic and identified a positive correlation between shared dominance and tax planning, with smaller boards being more risk averse and less likely to use strategies for tax planning. More directly, good CG is associated with tax compliance (Suffian et al., 2017). The practice of CG has become more important in recent times. It is practised by high-profile corporations such as Enron and WorldCom, who would like reputations as good practitioners of CG. Hence, the CG activities introduced by these firms could enhance the workings of the enterprises, as well as protecting the rights of the shareholders in the organisation (Khan et al., 2014). CG helps to protect all organisational stakeholders especially corporate collapses and scandals have generated global concerns about the effectiveness of directors who are prominent members of the board. This has attracted more attention to the importance of good practice in CG activities for enhancing the effectiveness of organisational management and leadership.

Highlighting the advantages of CG, Dias, et al., (2017) found that good CG positively affects stakeholders by socially responsible disclosures–that is, the effective policies taken for the management of the firm or company. More specifically, the researchers found that larger companies with larger boards tend to have enhanced monitoring, better management of stakeholders, greater transparency, and higher standards for business communal accountability, due to the perception that they are subject to higher levels of public visibility and scrutiny. However, these factors are limited in nature and do not illuminate all effects of the practice of CG. In the following sub-sections, several of these factors are discussed. These factors include: (a) macro-level aspects, (b) mono-level aspects, and (c) micro-level aspects.

A study by Ahmed & Hamdan (2015) examined the impact of business supremacy on organisational presentation. The study was conducted on the premise that CG has been identified across the world as valuable for attracting positive investors, developing marketplace confidence, and improving economic performance and growth. They also conducted the research with the view that promoting good CG standards is vital for attracting investment capital, lessening risk, and improving organisational performance. The study found a positive relationship between good company supremacy and the presentation of large enterprises in Bahrain, especially those listed on the BSE. The outcomes revealed that performance measures such as ROA and ROE were used for the assessment of the organisations and also indicated the relation of the firm with CG practices in Bahrain.

Study Theoretical Framework

The researcher relied on CG agency theory and the institutional theory to build a theoretical framework of this research, which covers all aspects of the problem in Bahrain, as well as it is proportional to the tourism sector. Agency theory in economic thought was first proposed in the early 1970s, though the concepts on which this theory is based go back to the well-known economist Adam Smith, who discussed the problem of separating ownership and control (Panda & Leepsa, 2017). Agency theory arose as an attempt to resolve the problem of conflict of interest, presenting a view of the company as a series of optional contracts between various parties in the company to prevent management from prioritising its own personal interests over those of other parties. Agency theory in CG is a hypothesis that explains the relationships between managers and agents in the business environment (Shi et al., 2017). Institutional theory, which has been originally developed by Scott (2004), is the most frequently recommended theory for gaining the learning about CG. The theory is mainly known for commencing a set of regulations, prospects and features of shared identity. The institutional theory is based on the underlying assumption on the resilience and depth of social structures (Scott, 2004). As a result, the organisations act as the flexible communal structure that compromise of elements in the form of community regulations, prospects and regulatory element in the form of directives and legislation and cultural-cognitive element in the form of individuality and tradition (Alshurideh et al., 2019; Kabrilyants et al., 2021; Svoboda et al., 2021). The institutional theory also known as organisational concept is also broadly known to be based on theory aspects which emphasise rationality and legitimacy Scott (2004). Institutional theory emphasises the important process of imitation in developing and enhancing the resiliency of institutions as a structural entity, through the process of imitation, people within an organisation are able to find cues from other people within the same organisation for appropriate behaviours (Zhao et al., 2017).

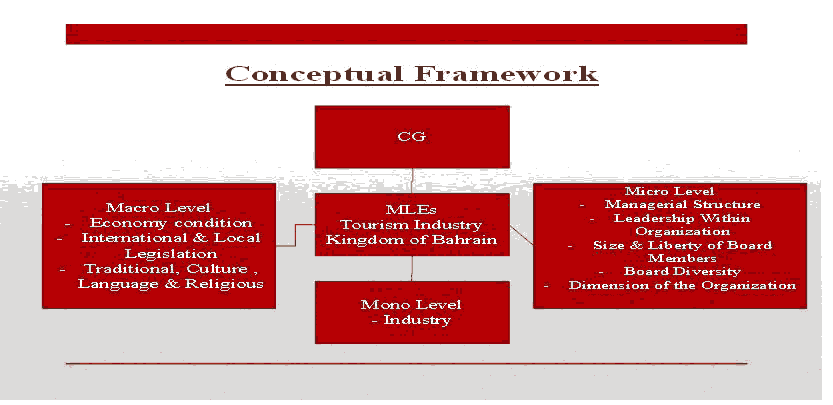

To get a better learning about the implementation of CG into the tourism sector in Bahrain, a deeper understanding is required to be developed which can be gained by adopting the conceptual model of contextual factors. The model highly relevant for the study because it helps in identifying the facts that related to the CG at multi-level working of the tourism sector in Bahrain., the first set of factors is related to the macro-level which provide the broad outlook of the whole economy and its financial conditions, laws and traditions. While, the second factor is related to the evaluation of companies at mono-level which is the segment of the financial sector in the single state. However, the frequency of factors is less in this segment but the existing ones are of great importance and necessary to be taken into consideration because they show significant differences. Finally, the third set of factors is related to the micro-level evaluation which takes the individual unit factors into consideration which are several in nature and can be categorized as size, structure or composition of the shareholders. The presentation of the examples of each level has been stated in the following research study which helps in providing a better learning about the nature of the practice of CG by the organisations in Bahrain. In respect to this, the Figure 1 effectively depicts the conceptual framework related to the proposed qualitative case study.

Research Methodology

This study adopted a qualitative method strategy using a descriptive research design integrated along with exploratory research design. In essence, the descriptive research design helps in investigating one or more variables that define a given population and incident. To continue with, a conceptual framework was also utilised along with the case studies that provided a rationale for the value of this research. The research study made use of an inductive reasoning approach since it proved conducive to define variables and conclusions based on the research. Furthermore, this study adopted interpretivism as its epistemological approach, as the study seeks to offer a meaningful explanation of some of the challenges and issues regarding CG and the performance of tourism firms to answer subjective questions by obtaining in-depth views of the participants from different banking and finance sector who has CG experiences through semi-structured interview method.

The present study makes use of both primary and secondary data collection techniques. The primary data is collected by using a qualitative method of data collection. The study used an interview technique to extract relevant data from the respondents. It comprised 24 questions that were developed on the basis of providing justification for the research objectives of the study. The interview consisted of semi-structured open-ended questions, wherein the respondents provided subjective answers pouring out their thoughts and ideas in a comprehensive manner. Further, these interviews were taken with the help of an interview guide.

The current study analysed the perspectives of the managers employed in banking and finance sector in Bahrain to provide their views about CG. For deriving answers for the above queries, interviews were conducted with 10 managers who were asked to answer open-ended semi-structured questions to ensure getting in-depth information from the respondents. All the respondents were postgraduates and were fully aware of the concept and guidelines pertaining to CG. They had above 5 years of relevant experience in CG. However, they had little or no awareness regarding corporate awareness until introduced as a part of their job role in their respective organisation. The study utilises ideas of the respondents about CG that have some relevant experience in dealing with CG. Further, these respondents were chosen with the purpose of extracting information regarding the implementation of CG with specific reference to Bahrain. Those respondents that have no experience of CG and have not more than five years of term been excluded from this study to make sure respondents have adequate knowledge. In addition, those respondents male and female that can communicate in good enough level of English were part of the study. It is due to the requirement of deep understanding of CG to investigate the implications of the adoption of CG in the range of tourism organisations of various sizes in Bahrain.

It was done to permit difference in opinions and requirement of representing suitable persons for the study (Mertens, 2015). The sampling technique used for the current study is a non-probability sampling technique. Under the non-probability sampling technique, the current study used a purposive sampling technique. To specifically select the respondents that were engaged in dealing with the norms pertaining to CG, purposive sampling was used. This was due to the fact that interviews could not be conducted with any person that was not fully aware of the concept and nuances of complying with CG code.

There are several ethical issues or considerations for this study as follows, the researcher prepared an informed consent form, which participants were asked to sign prior to any engagement in the research to allow participants voluntary involvement. The form will not only acknowledge the participants’ rights but will also protect them during the data collection process. Some of the information that will be contained in this form include researcher details, assurance of participants’ withdrawal at any time, research purpose, benefits of engaging in the research, guarantee of privacy and confidentiality, participants’ selection process, and the level of involvement of participants (Dempsey, 2018). In addition, the research respondents were notified regarding the study principle and its aims along with permission forms attained from respondents for the research ethical concerns, comprising confidentiality, using small sample, and in reality, various respondents engaged were well-known to the researcher. Therefore, clarity was provided to the respondents that their input to the research is essential, and assurance was given that participation in the research will not produce physical, psychological, legal and financial threats.

This study used thematic analysis as data analysis tools. Since the study adopts an inductive reasoning approach, analysing the data using the thematic analysis approach complements the study. While using the thematic analysis for the study, the researcher adopted a two-stage procedure that identified relevant themes and patterns from the data collected. The first stage involved preparing data for analysis through transcribing. The second stage will entail themes or develop patterns involved in interpreting participants' responses. This was carried out after each interview for accurate transcribing and translating. The main step of the thematic analysis of the interview transcriptions was discovering initial codes. Based on that, 55 initial codes were generated through extensively and rigorously exploring the transcripts by the researcher. Based on the main codes captured in the interviews, seventeen themes emerged, which are (1) benefits of CG in the tourism sector, (2) implementation of effective CG, (3) scenario of CG in the tourism sector, (4) challenges encountered by tourism sector during adoption of CG, (5) strategies to overcome challenges encountered by tourism sector, (6) knowledge about CG, (7) exposure to CG, (8) experience with CG implementation, (9) complexity of CG, (10) perception towards CG, (11) importance of CG in the tourism sector, (12) benefits of adopting CG for tourism sector, (13) needs of specific legislation for tourism sector, (14) separation of management from ownership, (15) compliance of tourism sector companies with CG, (16) tourism sector resistance during implementation of CG, and (17) solutions to resistance from tourism sector.

Data Analysis

Participants Information

Interviews were conducted with 10 senior managers and executives in banking & finance sector who are involved in CG, where semi-structured questions were asked. The motive of interview was to understand research about the effects by imposing CG strategic performance in tourism sectors in the Kingdom of Bahrain. The respondents had good experience in CG, where all of them where post graduates (Table 1). Four of the respondents were over the age of 50 years, and two others were aged 41-50 years. The remaining two were female and in the 31-40 age group. One respondent was working as a compliance officer, three were CEOs, one respondent had employment experience at the central bank of a Bahrain licensed company, and the rest were in managerial positions. Most of the respondents had between 5 and 10 years of experience pertaining to CG. Regarding how they were introduced to CG, one respondent was appointed as the board secretary of a company and became aware of the CG responsibilities attached to that role. The respondent was responsible for ensuring that the company complied with the regulatory requirements in an effective manner. Another respondent was exposed to CG when he became a CEO of a company, and was required to adopt and implement CG. The respondent was responsible not only for the board but also to the central bank for any non-compliance in CG, as it was essential to follow the defined CG procedures. The other two respondents engaged in CG when working at their respective organisations. One of the respondents revealed that, ‘CG is always being there in any company that operating in a sensible manner’. It is therefore understood that all the respondents were highly experienced and had fair idea on the subject, thus providing reliable and valuable information to address the present research objectives.

| Table 1 Participants Information |

||||

|---|---|---|---|---|

| Participant | Gender | Level of Education | Years of CG Experience | Position |

| Interviewee A | Male | Post-graduate | More than 5 years | Chief Executive Officer (CEO) |

| Interviewee B | Male | Post-graduate | More than 5 years | Chief Executive Officer (CEO) |

| Interviewee C | Male | Post-graduate | More than 5 years | Acting Chief Executive Officer (CEO) |

| Interviewee D | Female | Post-graduate | More than 5 years | Board secretary |

| Interviewee E | Male | Post-graduate | More than 5 years | Chief Executive Officer (CEO) |

| Interviewee F | Male | Post-graduate | More than 5 years | Chief Financial Officer (CFO) |

| Interviewee G | Female | Post-graduate | More than 5 years | Compliance officer |

| Interviewee H | Female | Post-graduate | More than 5 years | Compliance officer |

| Interviewee I | Male | Post-graduate | More than 5 years | Finance and accounts manager |

| Interviewee J | Male | Post-graduate | More than 5 years | Board secretary |

Thematic Map

In this study, all the codes were segregated into 17 preliminary themes. Now, it is essential to review, modify and confirm whether all the developed themes are relevant or not. Any repetition, either in the themes or codes must be identified here to ensure the most efficient analysis and interpretation of the responses. Further, it is ensured here if all the themes are aligned with the present research context. So, all 17 themes have been reviewed and modified to final five themes and the researcher ensures here that all the themes are distinct from each other, none of them overlap, and if the themes have any relevant sub-themes or not. It is essential to note that while some of the codes that were repetitive are removed, not all the repetition can be avoided as the study only interviewed 10 respondents, and so the data is limited.

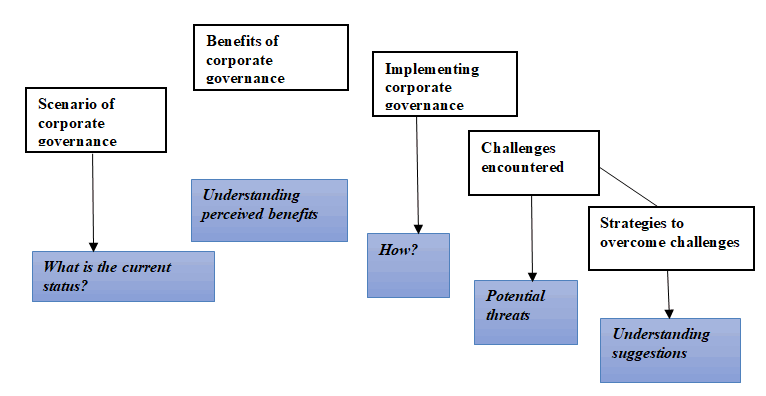

The final refinement of the themes is done by developing a thematic map that describes the relation among five themes. The perspective here is to relate the themes and ensure that the analysis is done adequately by giving it a final check. This step helps in understanding the themes’ perspectives; and their interaction as shown in the figure 2 below. As the role of each theme and its assistance in fulfilling research objectives is represented. The relation among themes are also evident from this figure. Here, the theme, scenario of CG, provides relevant information regarding current status of CG implementation in Bahrain, and therefore is regarding the theme, implementing of CG, which provides knowledge on how it is implemented. This theme elaborates on what processes the organisations follow to implement CG in their businesses. Benefits of CG is related to the study objectives which aims to understand the perceived benefits by the managers in the banking & finance sector in the Kingdom of Bahrain. The other themes are challenges encountered which elaborates on the potential threats and relates with the theme, strategies to overcome the challenges. The last theme provides an understanding on the perceptions of the respondents towards how the potential threats and challenges can be surpassed in an orderly manner.

Figure 2: Thematic Map

Theme 1: Benefits of Corporate Governance in Tourism Sector

The respondents have elaborated on several benefits of CG where they have pointed out that it signifies the corporate behaviour of a company, balances the interests of the stakeholders, ensures compliance of a company with the defined regulations, enables the adoption of best practices, provides high business efficiency and profitability, offers transparency, and attracts more investors. It is understood from the analysis that implementing CG sheds valuable light on how an organisation functions, what procedures it follows and how seriously does it consider the laws. This affects the perception of the investors towards the organisations as well and thus, facilitates high investments. CG is a good guide for companies, especially in the balance of conflict of interest situations between investors, company management and other stakeholders, and it works to increase investor confidence, increase the market value of companies ’shares, and helps them obtain international and local financing, especially after the financial turmoil that afflicted global markets. Therefore, there is no doubt that the implementation of CG in Bahrain is of great importance, as it helps clarify the roles and responsibilities of all actors, and thus avoiding conflicts of interest.

Theme 2: Implementation of Effective Corporate Governance

It is understood from the analysis that the ways with which organisations can successfully implement CG is through report development, conducting regular audits, self-training, and taking assistance from consultants. Small-scale or medium-scale organisations often find implementation of CG difficult as it includes a lot of processes which the people are not well aware of. In such scenarios it is essential to acquire assistance of professionals and consultants who can guide the organisations on how to effectively ensure a proper system and procedure of CG. Implementing CG is also made easier if a company willing to implement it develops reports of compliance so to better engage with all the procedures. Report development further assists the employees in the company clearly understand the expectations of CG.

Theme 3: Scenario of Corporate Governance in Tourism Sector

The analysis revealed that the central bank of Bahrain has placed mandatory and strict CG guidelines, and yet the private organisations and family businesses do not comply with them as it is not mandatory for them. While the public organisations install CG, the family businesses are not well versed with this and therefore, do not implement CG in their organisations. When asking the respondents whether will be more effective if CG is imposed by the government or organisations themselves volunteer, all the respondents agreed that it is better if it is enforced and imposed by the government.

Theme 4: Challenges Encountered by Tourism Sector during Adoption of Corporate Governance

The analysis revealed three most common challenges encountered by the organisations, which were higher cost of human resources and personnel to monitor all the processes ensuring CG is in required place, lack of adequate system, and ignorance by companies to implement CG. Among the most prominent problems facing the small and medium-sized companies sector is their ability to withstand the conditions imposed by the external environment and the internal difficulties that may precipitate the failure of the company. In addition to poor management and leadership skills of the executive management. The principles of CG today are an essential tool for improving corporate performance and advancing development. The respondents further specified that an organisation with adequate size, i.e., medium size must implement CG. It was inferred from the responses that organisations found increase in their finances to manage the implemented system of CG as it requires regular monitoring and auditing for ensuring optimal implementation. While it definitely offers several practices, which are best for the system, organisations avoid implementing CG as it is found to be costly.

Theme 5: Strategies to Overcome Challenges Encountered by Tourism Sector

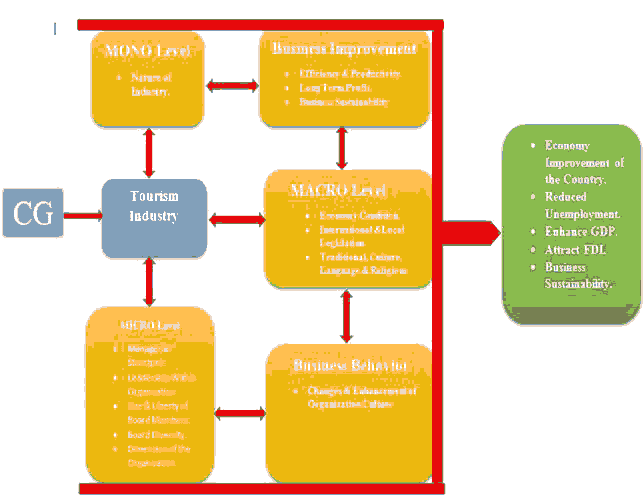

The analysis revealed that the strategies to overcome the challenges were to initiate training, conducting regular auditing and board meetings, ensuring proper management and regulation by the government, adequate implementation of CG at the organisations’ end, and removal of unnecessary policies. The organisations or government institutes must also offer training so as to help out companies. Apart from this, it is essential for the government to regulate the procedures for ensuring proper management. There is a need to remove unnecessary policies which are implemented by the companies and are found to crease unrequired complexities that affect the overall business processes and efficiency. It is therefore concluded that the government must intervene to assist the organisation in not only implementing CG effectively but also helping them reduce their costs. This will attract the organisations in promoting CG. With this analysis, it is essential to note that the study provides key inputs into the overall scenario and structure of CG in the tourism, food and beverage sector of Bahrain. The promotion of CG in all the organisations of every sector in Bahrain is recommended, especially the tourism sector as it will grow further with the adoption of best practices, and therefore, facilitate the economy of the country. Model developed to show the CG necessity for the business sustainability as well as whole economy of the country (Figure 3).

Discussion and Conclusion

This study has shown the key findings obtained by analysing the qualitative data collected from the interviews. Thematic analysis has been performed to interpret the data efficiently by following six relevant steps. This study has significantly highlighted the relevant and utmost importance of implementing CG on a range of tourism organisation in Bahrain. It has been pointed out from the analysis that the organisations benefit from CG as it provides insight into the best practices that can be followed to increase the profitability. CG ensures that a company abides by various laws, regulations and systems applicable in a particular sector. Such adoption also reveals how a specific company builds its business processes in the market for better competitiveness and corporate image. As understood from the analysis, CG relates to the corporate behaviour of an organisation, which can be either positive or negative. This in turn may or may not attract domestic or foreign investors. As the investors rely more on an organisation following all the compliances and regulations, it is beneficial for an organisation to follow and implement CG successfully. However, certain challenges have plagued the organisations to implement CG in their business, which are lack of adequate system and businesses processes, higher costs, lack of understanding and assistance by the government. The respondents have offered several strategies to overcome these challenges, which are organizing training for higher awareness, conducting timely audits, and removing policies that are not really required.

In the case of tourism sector, there are no guidelines pertaining to CG. However, the companies must implement these for better strategic decision-making at the board level and for showcasing a level of accountability. According to Ahmed & Hamdan (2015), companies that embrace CG perform 33% better than those who don’t. The higher cost is incurred as they have to hire additional personnel who can monitor all activities and comply that all rules are properly followed. There is a need for proper training among employees to follow CG in a regular and efficient fashion. Discussing in regards to the awareness of CG, the respondents were either dealing with CG or had to refer to its guidelines as a part of their job responsibilities for the company. Awareness of CG highlighted main characteristics that were perceived by the respondents. One of these characteristics perceived by the respondents was that CG was regulations that altered the corporate behaviour of a company, since these guidelines are mandatory and strict and they are monitored by the Central Bank of Bahrain, which is the regulator responsible for issuing CG guidelines. There are constantly upgrading the guidelines pertaining to CG with a view to enhance its implementation. The companies had to submit regular financial audit reports for compliance. Along with submitting these reports to the Bahraini central bank, it was also to be submitted to the board of the company, which helped in ensuring transparency and accountability. According to Tricker & Tricker (2015), CG helped in balancing the interests of the stakeholders, as it gives a broad framework for companies to attain good profit and control the behaviour of stakeholders of attaining self-interest. There are many instances that showcase that stakeholders in attaining their self-interest indulge in illegitimate practices. Involving in such practices not only results in financial losses to the companies but also results in loss of trust and reputation. These acts of financial fraud result in degrading the value and trust of investors in a given organisation, hence, CG is instrumental in avoiding conflict of interest issues among stakeholders. Due to the systematic changes in the CG rules issued by the Central Bank, it was necessary to update the information from time to time in the circulars. It was also found that help from outsourcing consultants was considered as an option by the companies. However, companies with limited asset capacity and small in size would have difficulty in adapting to time-to-time changes, as regular changes in rules, especially pertaining to financial matters is seen as a drawback by FDI. This adheres to the fact that investors find it annoying when they have to retrieve their profits from a country that changes financial rules every now and then. Thus, it does not give them clarity about the amount of profit that they will actually remunerate in their host countries. Thus, in such countries, availing international capital for investment becomes difficult as local capital is expensive.

Most respondents view CG as a need of hour that must be fully filled by all firms operating in various sectors. CG is more transparent and its compliance is strong. On the other hand, CG guidelines are more self-enforcing than adapting them. The most important problem with organisations operating in a long family line is conflict of stakeholder interests, which play a role in compliance with CG rules. According to Al-Najjar (2014), there are many benefits of implementing CG in the tourism industry, one of them is it helps in the distribution of rights and responsibilities, assuring that each individual employed in an organisation has appropriate and transparent access to involve in a decision-making process. This bolsters in enhancing the value of shareholders. Thus, instrumental in improving the quality and effectiveness of the administration. In addition, CG is influential in getting rid of the corruption present in organisations that consider that they are not under the purview of surveillance of the government, thereby, assist in promoting the tourism sector and its popularity. In this regard, when major institutions and firms that are engaged in the tourism sector comply with CG, it will help in promoting competitiveness among the firms. Since the economy of Bahrain significantly benefits from the tourism industry, regularizing this sector will help it grow strategically. All the respondents were of the view that the implementation of CG in the tourism industry would be beneficial. It will help in providing better clarity of the way in which the tourism industry operates. Further, it will be instrumental in gaining attention from investors for generating foreign exchange revenue, creating employment and maintaining stability. Moreover, the adaptation of CG in the tourism sector would be successful when the specific and varied requirements of the stakeholders are fulfilled.

As demonstrated by Ahmed & Hamdan (2015), there are many implied benefits of submitting to CG. Apart from promoting accountability and transparency, it also helps in attaining high efficiency in the businesses. Besides high profits, investors are attracted when they find clarity in the way a company’s financial assets are allocated, as investors that watch out for investing in foreign markets, look out for the transparency in a company. Therefore, companies that follow the rules related to CG require that they submit their audit reports to the Central Bank of Bahrain and their Board of Directors, and some also add to the publication of annual reports. The debate continues concerning whether CG should be imposed as an obligation by the government or should be voluntarily implemented. Most respondents are of the view that it should be imposed as compulsion by the government. Apart from the problems associated with it, the firms are assumed to be lethargic. Therefore, a compulsion by the government will help in implementing it. It is a common perception among respondents that companies that have not been subject to CG guidelines are less successful in the market. As well as, there is a common concept that exists among people regarding the perspective of separating the management of the tourism sector in Bahrain from corporate ownership, since it was found that splitting the above two entities from each other will have its effects in delivering long-term corporate success and further boost economic growth.

Compliance of the tourism sector to CG will ensure that information is timely provided to all the stakeholder/shareholders, regulators, suppliers, and related third parties, hence; it has an effective role in attracting businesses to Bahrain. Adherence to CG standards will increase the power of management bodies and shareholders, ensuring that priority is given to companies that operate in the interest of shareholders. This means that there will be increasing pressure on the organisation's board of directors to continuously formulate strategy, including controls and focus more on identifying and mitigating risks. Implementing CG as a strategic decision process will be conducive in defining the roles and responsibilities of each area, so that the sector can prosper in the long run. Imposing CG helps in maintaining the confidence and trust of the investors in the organisation. Further, it proves useful for companies in raising capital efficiently and effectively. As a result, there is a positive impact on the price of shares as it improves trust in the market. Apart from these perspectives which implied that it should be imposed by the government, there were few views that highlighted the importance of voluntarily adopting CG. They were of the opinion that adhering to norms of CG voluntarily will play a vital role in promoting the accountability of the stakeholder. While some were also of the view that voluntarily organisations would have long back adopted it. There are many sectors such as banking & finance sector that have benefitted from submitting to CG. Since tourism is an unstructured sector, corruption can accelerate, thereby, applying CG norms can help in curbing corruption practices, which will boost transparency and attract investors. When regarded as norms and rules, people don’t tend to follow them voluntarily irrespective of the benefits that are associated with it. Regulations and obligations tend to be assumed as burdens until their merits are experienced. If the government does not make it compulsory, it will remain unregulated and corrupt. For the overall economic development of any country, it is crucial that there are rules and regulations followed by all sectors.

There was a lack of awareness about the concept of CG within tourism sector. Hence, it can adhere as a possible reason for low compliance and adaptation to rules and regulations of CG in different industries. For the implementation of CG in the tourism industry, it is necessary to outline the delegation of responsibilities associated with it. Further, it would be more effective if the role of each employee in an organisation is clearly defined and segregated according to its importance. Apart from this, the segregation of responsibilities will ensure that business ethics and standards are maintained. The reason for most organisations not voluntarily adopting CG is that it is seen as complex and difficult to comply with. Most respondents in the study clarified their opinions on whether CG was a complex system. The study highlighted responses in different themes. The first theme highlighted is that the implementation of CG depends on the Board in a company. Further, it is attributed that guidelines pertaining to CG should be tailor-made. Perhaps, each organisation within an industry is of different size. The same rules and regulations cannot be followed by each company subject to varied financial positions of companies in a given market. The sudden implementation of a new concept does result in noise in an organisation. The process will help in identifying and rectifying any inaccuracies at an earlier stage of implementation. Furthermore, the approach of CG is regarded as not a complex but rigid process. This is due to the fact that the code set by the government pertaining to CG has stringent requirements. CG operates on a predefined process that acts as a medium in conducting and controlling the interests of the stakeholders, board of directors and management. The norms help in protecting the interest of the stakeholders, thus, it helps in achieving the ultimate aim of transparency and accountability which further prove instrumental in maintaining the ethical standards of the company. Referring to the tourism industry, in particular, not only the demand from the market but also the stakeholders have changed significantly. This change in demand can be attributed both to the form and content. To meet these demands, the tourism industry should submit to the guidelines outlined by CG, which will help in developing and professionalizing companies and firms engaged in tourism. Thus, CG will ensure the sustainability of the organisations engaged in the tourism industry. Furthermore, implementation of CG will help in improving the cultural, political and economic aspects in the tourism industry and ensuring the interests of the stakeholders, especially in the tourism industry, where the hotels are privately owned that helps in building a positive reputation at the international level.

With regard to the challenges faced that restrict the adoption of CG, several issues were found. Some of them were issues of conflict, oversight issues, accountability, transparency, and violations of ethics. Since CG is a new approach, it is difficult to adapt it by the industry in the near future. Moreover, companies are restricted from adopting new models that they have little or no awareness of. Apart from these issues, it was found that education does not provide the moral justification that they are aware of all the facts regarding CG or any other new concepts. Another major challenge in implementing CG in the tourism industry was found that there would be too many regulations to comply with. Besides this, it would require more employees that are technically and financially sound to help in the process of adopting CG code sets. According to Alrabeei & Kasi (2014), SMEs in Bahrain facing a scarcity of human resources and on the other hand, hiring more employees to monitor CG would lead to an increase in cost incurred by firms. Another major obstacle to adhering to CG laws is the lack of an adequate system, as most companies do not have a properly designed system to follow and comply with CG standards. The regular changes in the rules and regulations, make it difficult for the companies to adopt it. When referring to the tourism sector of Bahrain, there is very little or no transparency regarding the matters of financial discipline. Therefore, it is attributed that compliance with CG in that sector will lead to new financial obligations. The terms compliance, rules, regulations, norms and so on seem like a threat to a company. Unless the companies figure out its benefits, voluntarily adhering to them is quite difficult.

As discussed above, there are many challenges and obstacles in implementing CG in the companies. In the same way, there are many solutions that can be applied to resolve these issues. The employees should be educated in all aspects of the concept of CG as well as they should be trained and educated in regard to their roles and responsibilities concerning CG. Moreover, external guidance must be taken in case there is inappropriate or insufficient information about any guidelines or norms concerning any approaches. Taking help from professional advisors and compliance officers will also help in better understanding what mistakes have been continued. In addition, it is necessary to identify the risks associated with the breach of procedures that are not followed. For mitigating the risk identified, it is indispensable to conduct regular meetings and audits that will help in recognizing the faults and shortcomings in the implementation of CG. Further, the awareness must be spread from the top-level management to the bottom level regarding why CG is followed. It is fundamental for organisations to instil confidence in all their employees for whatever approach they follow, which will help not only in bringing transparency from top to bottom level, but also help in complying with the norms. Besides, it is necessary that the regulatory body acts rational and removes unnecessary policy guidelines, where policies that will not benefit any to the company must be removed.

For the present study, the novel and significant contribution of the study are conducive to determining its originality and its importance in regard to the findings of the study (Al Kurdi et al., 2021; Capuyan et al., 2021; Salloum et al., 2021). From the theoretical perspective, the present study is exclusively oriented in understanding the implications of CG in the specific field of tourism industry. Further, this will not only help in promoting and achieving the goals of CG, but also in spreading awareness regarding the same. In addition, by reviewing various pieces of existing literature during the course of the study, it was found that there was a dearth of theoretical frameworks that dealt with CG, especially pertaining to the tourism industry. As this study has outlined its importance and effectiveness in the field of tourism, which has not been focused by prior research. Moreover, a model called CG and business sustainability has been developed to show the relationship between CG and business growth and sustainability. From the practical perspective, the results of this study will contribute to enhancing adherence to CG standards in the tourism sector that will help create a positive image for the Bahraini economy, which in turn will attract foreign direct investment. Since complying by the laws of CG will help in bringing a change in the organisational culture, it boosts the profitability of the business entity. The study has some limitations, including that the sample size for this study was only 10 different interviews to generate data for the research. However, the researcher seeks to utilize a small sample size because of its numerous advantages including time- and cost-effectiveness. The second limitation for this study is the lack of extensive data on the incorporation of business supremacy for planned presentation of tourism industry in Bahrain. The relatively limited data or literature is a major hindrance to this study given the significance of such data in conducting the research. The third limitation involves the use of self-reported data. The researcher will rely on self-reported data through semi-structured interviews, which can rarely be independently verified. Finally, because this is a phenomenological study, it limited the ability of the researcher to ensure the dependability of the study as there were no previous studies conducted in the same context.

References

- Aburayya, A., Alshurideh, M., Alawadhi, D., Alfarsi, A., Taryam, M., & Mubarak, S. (2020). An investigation of the effect of lean six sigma practices on healthcare service quality and patient satisfaction: Testing the mediating role of service quality in Dubai primary healthcare sector. Journal of Advanced Research in Dynamical and Control Systems, 12(8), 56-72.

- Abu Zayyad, H.M., Obeidat, Z.M., Alshurideh, M.T., Abuhashesh, M., Maqableh, M., & Masa’deh, R.E. (2021). Corporate social responsibility and patronage intentions: The mediating effect of brand credibility. Journal of Marketing Communications, 1-2 .

- Aguilera, R.V., Marano, V., & Haxhi, I. (2019). International corporate governance: A review and opportunities for future research. Journal of International Business Studies, 50, 457–498.

- Ahmed, E., & Hamdan, A. (2015). The impact of corporate governance on firm performance: Evidence from Bahrain Bourse. International Management Review, 11(2), 21-37.

- Al Batayneh, R.M., Taleb, N., Said, R.A., Alshurideh, M.T., Ghazal, T.M., & Alzoubi, H.M. (2021). IT governance framework and smart services integration for future development of Dubai infrastructure utilizing AI and big data, its reflection on the citizens standard of living. In The International Conference on Artificial Intelligence and Computer Vision, 235-2 7. Springer, Cham.

- Al Kurdi, B., Alsurideh, M., Nuseir, M., Aburayya, A., & Salloum, S.A. (2021). The effects of subjective norm on the intention to use social media networks: An exploratory study using PLS-SME and machine learning approach. In A. Hassanien & K. Chang. Advanced Machine Learning Technologies and Applications, 324-334. Springer..

- Alabdullah, T.T.Y. (2016). Corporate governance from the perspective of the past and the present and the need to fill an international gap: Risk governance and control. Financial Markets and Institutions, 6, 6-101.

- Al-Gasaymeh, A., Almahadin, A., Alshurideh, M., Al-Zoubid, N., & Alzoubi, H. (2020). The role of economic freedom in economic growth: evidence from the MENA region. Int. J. Innov. Creat. Chang, 13(10), 75 -77 .

- Al-Hadi, A., Al-Yahyaee, K.H., Hussain, S.M., & Taylor, G. (2018). Market risk disclosures, corporate governance structure and political connections: Evidence from GCC firms. Applied Economics Letters, 25(1 ), 13 6-1350.

- Al-Jarrah, I., Al-Zu’bi, M.F., Jaara, O., & Alshurideh, M. (2012). Evaluating the impact of financial development on economic growth in Jordan. International Research Journal of Finance and Economics, 94, 123-13 .

- Alhowaish, A.K. (2016). Is tourism development a sustainable economic growth strategy in the long run? Evidence from GCC Countries. Sustainability, 8(7), 605.

- Alkalha, Z., Al-Zu’bi, Z., Al-Dmour, H., Alshurideh, M., & Masa’deh, R. (2012). Investigating the effects of human resource policies on organizational performance: An empirical study on commercial banks operating in Jordan. European Journal of Economics, Finance and Administrative Sciences, 51(1), -6 .

- Al-Khayyal, A., Alshurideh, M., Al Kurdi, B., & Aburayya, A. (2020). The impact of electronic service quality dimensions on customers’ e-shopping and e-loyalty via the impact of e-satisfaction and e-trust: A qualitative approach. International Journal of Innovation, Creativity and Change, 14(9), 257-281.

- Al-Maroof, R., Alhumaid, K., Alhamad, A.Q., Aburayya, A., & Salloum, S.A. (2021). User acceptance of smart watch for medical purposes: An empirical study. Future Internet, 13(5), 127.

- Al-Najjar, B. (2014). Corporate governance, tourism growth and firm performance: Evidence from publicly listed tourism firms in five Middle Eastern countries. Tourism Management, 42, 3 2-351.

- Alrabeei, H., & Kasi, B.R. (2014). Barriers to growth: Key challenges facing Bahraini small and medium enterprises. Arabian Journal of Business and Management Review, 4(3), 45-62.

- Al Shebli, K., Said, R.A., Taleb, N., Ghazal, T.M., Alshurideh, M.T., & Alzoubi, H.M. (2021). RTA’s employees’ perceptions toward the efficiency of artificial intelligence and big data utilization in providing smart services to the residents of Dubai. In The International Conference on Artificial Intelligence and Computer Vision, 573-5 5. Springer, Cham.

- Alshurideh, M., Alsharari, N.M., & Al Kurdi, B. (2019). Supply chain integration and customer relationship management in the airline logistics. Theoretical Economics Letters, 9(02), 392-414.

- Alshurideh, M., Kurdi, B.A., Shaltoni, A.M., & Ghuff, S.S. (2019). Determinants of pro-environmental behaviour in the context of emerging economies. International Journal of Sustainable Society, 11( ), 257-277.

- Assad, N.F., & Alshurideh, M.T. (2020). Financial reporting quality, audit quality, and investment efficiency: Evidence from GCC economies. WAFFEN-UND Kostumkd. J, 11(3), 1 -20 .

- Bagaeen, S. (2007). Brand Dubai: The instant city; or the instantly recognizable city. International Planning Studies, 12 (2), 173–197.

- Capuyan, D.L., Capuno, R.G., Suson, R., Malabago, N.K., Ermac, E.A., …& Lumantas, B.C. (2021). Adaptation of innovative edge banding trimmer for technology instruction: A university case. World Journal on Educational Technology, 13(1), 31-41.

- Christiano, L.J., Eichenbaum, M.S., & Trabandt, M. (2015). Understanding the great recession. American Economic Journal: Macroeconomics, 7(1), 110-67.

- Cumming, D., Filatotchev, I., Knill, A., Reeb, D.M., & Senbet, L. (2017). Law, finance, and the international mobility of corporate governance. Journal of International Business Studies, 38(2), 123-147.

- Dalwai, T.A.R., Basiruddin, R., & Abdul Rasid, S.Z. (2015). A critical review of relationship between corporate governance and firm performance: GCC banking sector perspective. Corporate Governance, 15(1), 18-30.

- Dempsey, K.E. (2018). Negotiated positionalities and ethical considerations of fieldwork on migration: Interviewing the interviewer. ACME. An International Journal for Critical Geographies, 17(1), -10 .

- Dias, A., Rodrigues, L.L., & Craig, R. (2017). Corporate governance effects on social responsibility disclosures. Australasian Accounting Business and Finance Journal, 11(2), 3-22.

- Heracleous, L. (2008). What is the impact of corporate governance on organisational performance? Corporate governance: an international review, 3, 165-173.

- Hopt, K.J. (2011). Comparative corporate governance: The state of the art and international regulation. The American Journal of Comparative Law, 59(1), 1-73.

- Invest in Bahrain. (2020). Manama named ‘Capital of Arab Tourism’ for 2020–Invest In Bahrain.

- Kabrilyants, R., Obeidat, B., Alshurideh, M., & Masadeh, R. (2021). The role of organizational capabilities on e-business successful implementation. International Journal of Data and Network Science, 5(3), 17- 32.

- Khan, A., Bibi, M., & Tanveer, S. (2016). The impact of corporate governance on cash holdings: A comparative study on the manufacturing and service industry. Financial Studies, 20(3), 40-79.

- Mansfeld, Y., & Winckler, O. (2008). The role of the tourism industry in transforming a rentier to a long-term viable economy: The case of Bahrain. Current Issues in Tourism, 11(3), 237-267.

- Maskati, M.M.A., & Hamdan, A.M.M. (2017). Corporate governance and voluntary disclosure: Evidence from Bahrain. International Journal of Economics and Accounting, 8(1), 1-28.

- Matei, A., & Drumasu, C. (2015). Corporate governance and public sector entities. Procedia Economics and Finance, 26, 5-50 .

- Mertens, D.M. (2015). Mixed methods and wicked problems. Journal of Mixed Methods Research, 9, 3-6.

- Mouzaek, E., Al Marzouqi, A., Alaali, N., Salloum, S.A., Aburayya, A., & Suson, R. (2021). An empirical investigation of the impact of service quality dimensions on guests satisfaction: A case study of Dubai hotels. Journal of Contemporary Issues in Business and Government, 27(3), 1187-1199.

- Mulyadi, M.S., Anwar, Y., & Ikbal, M. (2012). The importance of corporate governance in public sector. Global Business and Economics, 1(1), 25-31.

- Musleh Al-Sartawi, A. (2018). Corporate governance and intellectual capital: Evidence from gulf cooperation council countries. Academy of Accounting and Financial Studies, 22(1), 1528-35.

- Panda, B., & Leepsa, N.M. (2017). Agency theory: Review of theory and evidence on problems and perspectives. Indian Journal of Corporate Governance, 10(1), 7 - 5.

- Raj, M., Kumar, R., & Sukumaran, S. (2018). Agency costs in US banks–have the factors changed post crisis? International Journal of Corporate Governance, 9(2), 175-200.

- Rodriguez-Fernandez, M. (2016). Social responsibility and financial performance: The role of good corporate governance. BRQ Business Research Quarterly, 19(2), 137-151.

- Sá, C., & Alves, H. (2018). How corporate governance' structures influence tax planning strategies? European Journal of Applied Business and Management, 4(3), 77-93.

- Salloum, S.A., Al Ahbabi, N., Habes, M., Aburayya, A., & Akour, I. (2021). Predicting the intention to use social media sites: A hybrid SME- machine learning approach. In A. Hassanien & K. Chang (Eds.), Advanced Machine Learning Technologies and Applications, 324-334.

- Sanad, Z.R., Al-Sartawi, A., & Musleh, M.A. (2016). Investigating the relationship between corporate governance and Internet Financial Reporting (IFR): Evidence from Bahrain Bourse. Jordan Journal of Business Administration, 12(1), 239-269.

- Sari, M., Lubis, A.F., Maksum, A., Lumbanraja, P., & Muda, I. (2018). The influence of organization's culture and internal control to corporate governance and its impact on state-owned enterprises corporate. Journal of Applied Economic Sciences, 13(3), 673-684.

- Scott, W.R. (2004). Institutional theory. Encyclopedia of social theory, 11, 408-414.

- Sharpley, R. (2008). Planning for tourism: The case of Dubai. Tourism and Hospitality Planning and Development, 5(1), 13–30.

- Shehata, N. (2016). Assessment of corporate governance disclosure in the GCC countries using the UNCTAD ISAR benchmark. The Journal of Developing Areas, 50(2), 453–460.

- Shehata, N.F. (2015). Development of corporate governance codes in the GCC: An overview. Corporate Governance, 15 (3), 315-338.

- Shi, W., Connelly, B.L., & Hoskisson, R.E. (2017). External corporate governance and financial fraud: Cognitive evaluation theory insights on agency theory prescriptions. Strategic Management Journal, 38(6), 126 -12 6.

- Suffian, M.T.M., Shamsudin, S.M., Sanusi, Z.M., & Hermawan, A.A. (2017). Malaysian code of corporate governance and tax compliance: Evidence from Malaysia. Management & Accounting Review, 16(2), 157-217.

- Svoboda, P., Ghazal, T.M., Afifi, M.A., Kalra, D., Alshurideh, M.T., & Alzoubi, H.M. (2021). Information systems integration to enhance operational customer relationship management in the pharmaceutical industry. In The International Conference on Artificial Intelligence and Computer Vision, 553-572.

- Taryam, M., Alawadhi, D., Aburayya, A., Albaqa'een, A., Alfarsi, A., Makki, I., … & Salloum, S.A. (2020). Effectiveness of not quarantining passengers after having a negative covid-19 PCR test at arrival to dubai airports. Sys Rev Pharm, 11(11), 1384-1395.

- Taryam, M., Alawadhi, D., Al Marzouqi, A., Aburayya, A., Albaqa'een, A., Alfarsi, A., … & Alaali, N. (2021). The impact of the covid-19 pandemic on the mental health status of healthcare providers in the primary health care sector in Dubai. Linguistica Antverpiensia, 21(2), 2995-3015.

- Tricker, B., & Tricker, G. (2014). Business Ethics: A stakeholder, governance and risk approach. Routledge.

- Tricker, R.B., & Tricker, R.I. (2015). Corporate governance: Principles, policies, and practices. Oxford University Press, USA.

- Umrani, A I., Johl, S.K., & Ibrahim, M.Y. (2015). Corporate governance practices and problems faced by SMEs in Malaysia. Global Business & Management Research, 7(2), 71-77.

- Zhao, E.Y., Fisher, G., Lounsbury, M., & Miller, D. (2017). Optimal distinctiveness: Broadening the interface between institutional theory and strategic management. Strategic Management Journal, 38(1), 3-113.