Research Article: 2018 Vol: 17 Issue: 6

The Impact of Auditor Independence on Total Quality Management

Ali Naeem Jasim Al Ghani, Ministry of Higher Education and Scientific Research

Abstract

Total Quality Management (TQM) can increase the quality of processes in an organization and enhance customer satisfaction. Despite its value, only a few institutions that have tried with the approach have been successful. Improving auditor independence can help in the application of TQM principles. The study sought to establish the possible effects that the autonomy of the auditor can have on TQM. The objectives were: (i) to objectively assess the current state of auditor independence, and (ii) to analyze the relationship between total between auditor independence and TQM. Even though the relationship between the two elements has been suggested, the research toward this direction is limited. The study followed a comparative design in which the mean TQM indices were compared across two sets of firms. The first set comprised five companies from Forbes’ list of the most trustworthy firms. The second set included corporations that had reported financial scams in recent years. The TQM indices were computed based on employee reviews collected from Glassdoor and Indeed as well as information on the companies’ websites. In calculating the index, three aspects of quality, ethics, integrity, and trust were used. The stakeholder theory, which emphasizes the need for organizations to consider the interest of every stakeholder, was used as a guiding framework for the research. Regarding the first objective, despite the growing emphasis auditor independence, realizing its goals remain a challenge. The obstacles to achieving complete autonomy include the familiarity that may exist between auditors and their clients, the increase in the number of advisory services among accounting firms, management abdication, inconsistent report structures, and the self-inclination to soften disturbing reports. Concerning the second objective, the average TQM index for the first category of companies was 3.00 while the average for the second set was 3.004 indicating that companies that had better audit practices also had had higher TQM scores. The paired t-test showed that the difference in the means was significant (t=4.003; p=0.016). Based on the findings, the study recommends that: (i) organizations create a culture that encourages better disclosure to help identifying audit errors as well as questionable policies and practices and (ii) policymakers emphasize the need for all companies to practice auditor rotation to limit the compromises that result from the familiarity between auditors and their clients.

Keywords

Accounting and Governance Risk (AGR), Total Quality Management (TQM), Auditor Independence.

Highlights

1. Auditor independence requires practitioners to avoid any engagement that suggests they have shared interests in the activities of their clients.

2. TQM is an eight-element approach to quality improvement that attempts to integrate all elements of quality into a single framework.

3. Ethics, integrity, and honesty are the foundation blocks of TQM.

4. Auditor independence can help improve ethics, integrity, and honesty.

Introduction

The research background, problem, objectives, and hypothesis are presented in this section. The chapter also summarizes the significance of the study and its contribution to the literature. Although the relationship between auditing and quality management has been established, few studies, if any, have explored the possible association between auditor independence and total quality management.

Background

Customer satisfaction and loyalty are among the central factors in the success of an organization. Satisfied clients create platforms through which firms can enhance the image of their brands, increase their profitability, and remain competitively relevant (Allen et al., 2007). Today’s consumer has wide information base and a broad range of options. Therefore, many organizations struggle to keep their clients for extended periods. The situation has prompted companies to experiment with different strategies that can help them in tracking and monitor the changes in customers’ contentment and commitment to their products.

One framework that has proved successful in this regard is the Total Quality Management (TQM). TQM is an approach to process management that endeavors to put quality at the center of an organization’s leadership, planning, improvement initiatives, and other activities. The emphasis on “total” highlights the need for a complete collaboration of all the internal units of an organization, including production, human resource, accounting and finance, marketing, and other departments (Mohebbi et al., 2003). The use of TQM permits managers to create organizational environments in which each employee is sensitive to the need to make continuous improvements on their skills and abilities to ensure that a company’s goods and services meet the demands of its customers. In addition to enhancing consumer satisfaction, TQM also improves the production process of a business as well as the efficiency of the human resource force (Nasution et al., 2017).

As a philosophy, TQM bases its ideas on integrity, trust, as well as ethics and requires organizations to engage in practices that foster sincerity, fairness, and openness in the business environment (Mohebbi et al., 2003). A company’s auditing practices are central to the realization of these objectives. TQM auditors, especially external ones, play critical roles in ensuring that the firms that they represent are honest in their activities. As representatives of shareholders’ interests, auditors endeavor to promote honesty, openness, and accountability, which are essential elements of corporate governance. There are many debates surrounding the qualification for an entity to be considered a customer in the TQM model (Lemay et al., 2009). Despite such disagreements, the TQM framework continues to be popular among researchers.

Realizing these goals is not always an easy task. Several situations in the business environment, most of which involve a conflict of interests, may prompt auditors to compromise their standards. Accordingly, accounting bodies have developed several measures that can help practitioners maintain their integrity. One such principle is auditor independence. The independence of auditors as a philosophy permits practitioners to uphold high levels of integrity, trust, and moral conducts. The present paper examines the role of auditor independence in promoting TQM concepts.

Statement of the Problem

For many years, the use of TQM was limited to the manufacturing sector. However, in recent decades, the scope of the application of these principles has extended beyond manufacturing. Many non-manufacturing firms are adopting TQM principles to enhance the quality of their processes. For this latter category, the emphasis has been on using TQM principles to promote not only processes, but also good governance (Kaynak & Roger, 2013). Despite this growing emphasis, few companies have been successful in their attempts to implement TQM strategies. Challenges that have been cited include low management and staff commitment, the absence of standard frameworks for defining quality, incompatibility with organizational culture, and problems with accuracy in planning (Kwama et al., 2014). There is a growing need for efficient approaches that can help companies to promote TQM practices. The current investigation assessed whether adhering to the requirements of auditor independence can be useful in this regard.

Significance and Scope

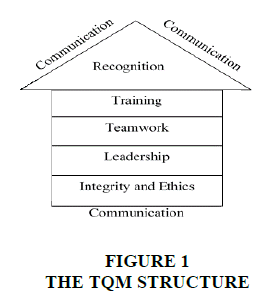

The relationship between auditing, both internal and external, and TQM has been established in the literature. Even though past studies on the subject have revealed mixed findings, many of them concur that the use of TQM enhances the quality of a firm’s auditing practices (Ahmad et al., 2012; Olcay & Sadikoglu, 2014). However, there has been little emphasis on the possible link between auditor independence and quality management practices of an organization. The present investigation attempts to address this gap, and its findings can be useful in establishing strategies for quality improvement through enhanced auditing practices. TQM is usually considered to comprise eight elements (Table 1 and Figure 1). The study focuses on three of these components, integrity, ethics, and trust. The choice of these factors is based on the assumption that the can be greatly affected by compromised auditor independence more than the other five factors.

Aim, Objectives, and Hypothesis

The present paper aims at assessing the possible impacts of auditor independence on TQM. The specific objectives are as follows:

1. To objectively assess the current state of auditor independence.

2. To analyze the relationship between total between auditor independence and TQM.

The independent auditor ensures quality by providing a third-party enforcement of integrity in a firm’s financial reporting practices (Ahmad et al., 2012). Adherence to established auditing standards can be helpful in improving the quality of processes in an organization. This observation formed the basis for the research hypothesis, which is state as follows:

H1: There is a positive relationship between the independence of the auditor independence and TQM.

Paper Structure

The paper has three sections. Following the introduction is literature review that presents the key concepts, supporting framework, and past studies on the relationship between auditor independence and TQM. The third section is the practical part, which includes the research methods used are summarized as well as description of the study sample. The main findings and their discussions, conclusions, implications, and recommendations for future practice are also included in the practical part.

Literature Review

The previous chapter has summarized the research problem, the relevant background, and the aim of the paper. The present section a brief overview of the key concepts used in the research, TQM and auditor independence. The relationship between the two variables as presented in previous studies is also highlighted. The section concludes with a discussion of the theoretical framework that has guided the investigation.

Total Quality Management

Organizations across the world and different economic sectors are implementing significant changes in their operations to improve the quality of their processes. Most approaches to quality enhancement emphasize particular dimensions of quality such as standards and measurements, efficient supervision and management, regular feedback, and staff training. TQM is an approach to process improvement that integrates several dimensions of quality. The method is viewed as a continual process that involves the constant evaluation of an organization’s practices to identify and eliminate errors while improving customer experience. The complete involvement of all the relevant stakeholders in an organization’s activities enhances their trust and commitment (Kaynak & Roger, 2013). Initially restricted to the manufacturing sector, the framework has gained popularity as an approach to improving organizational performance and profitability in all industries.

Institutions that apply TQM assume a building-based framework that has eight elements that can be grouped in four categories, foundation, bricks, mortar, and roof (Leon, 2008). Table 1 and Figure 1 provide a summary of the eight components.

Measuring quality is a complex process due to the numerous domains involved. One approach to quantifying TQM has been proposed by Mohebbi et al. (2003), and has been adopted by the present study. The model computes a TQM index based on the weighted sums of the various elements of TQM. The weights are assigned according to their relevance and level of importance. After assigning the weights, the index, TQI can be calculated as follows:

(1)

(1)

Where,

Wi=the weight assigned to a TQM factor.

wi=the weight assigned to an item associated with a TQM factor.

r=the rating assigned to the item.

n and k=the number of items in each case.

This model has been used in the computation of TQM indices used in the present analysis. For the purpose of the study, only the first three components of TQM (integrity, ethics, and trust) are included in the model.

Auditor Independence

Independence is a primary requirement for auditing. According to Bakar et al. (2008) the trust that the public and other stakeholders develop toward a company’s financial report can be a reflection of the perception of autonomy in the firm. The concept of auditor independence implies that practitioners execute their functions objectively without the fear of compromise or intimidation. At the basic level, independence requires auditors to avoid any action that may suggest that they have shared interests with the management of the firms that they serve. For instance, they should not invest or borrow money from their client company. They should also not participate, either directly or indirectly, in the management of the company that they represent (Adelopo, 2016; Law, 2011).

Maintaining independence remains a challenge for many practitioners. Despite the many controls that have been developed to ensure autonomy, regulatory agencies have expressed their concern on the risks of the auditor being compromised (Church et al., 2015; Fitzgerald et al., 2017). One problem that has been highlighted involves the familiarity that may exist between auditors and their clients. Some firms have kept the same auditor for long periods. The closeness that may develop between the auditor and the company presents a significant threat to autonomy (Lennox et al., 2014; Jenkins & Vermeer, 2013). Another issue is the increase in the number of advisory services among accounting firms (Hay et al., 2016). In the recent decades, the Big Four firms have made several acquisitions that have enabled them to expand the range of services that they offer. Some of these services including advertising, asset management, banking, or personal recruitment generate huge amounts of revenues even though they are not necessarily related to accounting. The trend implies that auditing is no longer the focus of accounting companies, a situation that has resulting in increasing cases of conflicts of interests. Other challenges that have been noted include management abdication, inconsistent report structures, and the selfinclination to soften harsh reports (Law, 2011; Roy & Saha, 2015).

Compromised auditor independence can have adverse impacts on various aspects of quality such as the absence of accountability and openness. Roy & Saha (2015) observe that many of the major accounting scandals in the modern history are due to the conflict of interests of different stakeholders. Still, as Gupta & Kukreja (2016) conclude, due to the evolving strategies of such scams, no amount of control can eliminate them completely, but their occurrence and impacts can be minimized. Strong frameworks that protect auditors from the various threats to their independence can be helpful in this regard.

Relationship between TQM and Auditor Independence

The relationship between auditor independence and process quality has been established in the literature. Chang & Chen (2015) argue that the central concepts that govern TQM such as employee and customer empowerment are hardly compatible with the conventional approaches to internal controls. Conversely, the fundamental principles of the traditional internal auditing functions do not support the TQM environment. Modern auditing approaches, which try to adapt to the emerging issues in the profession, have made significant contributions to TQM by ensuring that all internal stakeholders have full participation in quality management programs in their organizations. The building blocks of TQM are summarized in Table 1 and Figure 1 (Leon, 2008). Due to its scope, the present paper focuses on the foundation, which compromises integrity, trust, and ethics since they are the elements emphasized in auditing.

| Table 1 The Building Components Of TQM |

||

| Building Unit | Elements | Description |

| Foundation | Integrity, ethics, and trust | Integrity defines the characteristics that customers expect to observe in an organization’s practices and include honesty, truthfulness, fairness, and moral values. Trust emerges from integrity and the two are outlined in a company’s code of ethics, which stipulates the expended conduct of employees. |

| Bricks | Teamwork, training, and leadership | Teamwork is an essential aspect of TQM and ensures that all the stakeholders embrace the values of the organization. Regular training ensures that employees remain productive. The various aspects of the training include team dynamics, interpersonal skills, decision making, problem solving, and technical skills. Effective leadership provides direction and guidance for employees to ensure the values are maintained. |

| Mortar | Communication | Communication is the element that binds all the other components to each other. |

| Roof | Recognition | Recognition provides a framework for appreciating employees, both individually and in teams. |

The traditional approach to auditing perceives auditors as policing agents whose only focus are documentation and compliance. From this perspective, auditing does little to improve processes in an organization. However, this view is changing gradually due to the everincreasing complexity of the business environment. Accordingly, there have been a growing number of studies that attempt to make auditing to be relevant to today’s business practices. Their outcomes indicate that auditing can add value to a firm’s practices beyond compliance and verification (Gremyr & Lenning, 2017). In recent years, the rise in the number and magnitude of accounting scandals across the globe have prompted policymakers to modify the regulations governing the accounting practice to ensure that auditors have sufficient powers and resources to execute their functions as integrity agents.

Consequently, the role and scope of the auditing practice have expanded significantly. Johnson & Parker (2017) who traced the development of America’s accounting practice in the 20th century noted a changing scope and perception of the duties of the auditor. Even though there are ongoing debates on the level control and scope and power of auditors, they are viewed as fundamental to good governance. Auditor supremacy has been used effectively to help in tracking and exposing fraudulent activities.

In specific, external auditors along with other watchdog agencies have been considered essential in promoting a culture of integrity and accountability (Chang & Chen, 2015; Head, 2012). Still, as Head (2012) argues, it is unrealistic to expect practitioners to execute their functions effectively in non-supportive political and business environments. The efficiency of external auditors is enhanced in the presence of strong institutional frameworks that enforce their independence from the interests of their client organizations (Head, 2012). As the scope and power of auditors grow, they become highly vulnerable to the lack of independence. Johnson & Parker (2017) do not note that despite the struggle to achieve autonomy in the profession, neither the internal nor the external auditor has attained complete autonomy. Such observations should be of critical concern since any compromise in the independence of auditors affects the quality of their services

Theoretical Model

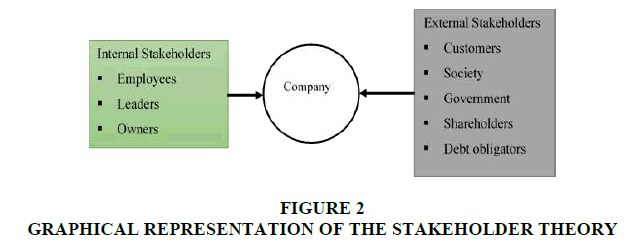

The theoretical framework that forms the basis for this research is the stakeholder model. The theory has been used extensively in analyzing organizational behavior, corporate governance, and ethics. At the center of the model is the stakeholder, both internal and external parties that have interests in the organization (Stieb, 2009). Internal stakeholders are the employees, managers, and owners, while external agents include customers, the society, suppliers, the government, debtors, and others (Figure 1). The central idea of the theory is that organizations need to act in ways that maximize the value of the stakeholder and not the shareholder or owner. The argument is that every agent whose survival is influenced by a corporation, directly or indirectly, has the right to take part in its regulation. From this perspective, an organization’s policies or activities are evaluated based on the legitimate claims of the stakeholders, their rights, and the justifiable responsibilities, as well as the obligations that they can impose on it (Stieb, 2009). Therefore, firms should view them as the end and not the means to achieving profitability.

In the practical business environment, each of the stakeholders has unique expectations. Hence, companies find it difficult to maximize all their values simultaneously (Macey et al., 2017). Even though TQM focuses on the customer, it emphasizes the need to embrace a total approach that integrates all the relevant stakeholders. Accordingly, the stakeholder model provides a basis for quality improvement (Hickman & Akdere, 2017). The model has also been used extensively in corporate governance and ethics and stakeholder democracy (Gangone & G?nescu, 2014; Moriarty, 2012). The argument in this paper is that auditor independence ensures that organizations achieve their goals without jeopardizing the interest of any of its stakeholder. Such an approach is essential in meeting the objectives of TQM.

Summary

Evidence from past studies suggests an association between the autonomy of the auditor and TQM. Compromised auditor independence can affect the implementation of TQM practices in a firm. In specific, auditor independence ensures that organizations engage in appropriate corporate governance practices and, therefore, can influence the ethics, integrity, and trust. The review has also identified a gap in quantifying the relationship between the two variables. Even though past studies have suggested a link between auditor independence and TQM, the research in this area is limited. As per the knowledge of this study, the present study is the first to attempt to quantify the relationship based on the three foundation blocks of TQM, integrity, ethics, and trust using a computed TQM index. The next section presents the research methods employed in the study and the findings.

Practical Aspects

This section presents the research methods including the sample and the model applied. The main findings, implications, and recommendations are also presented in this part.

Research Design

The study assumed a comparative approach, which involves comparing similar attributes of different subjects to establish a relationship between them (Esser & Vliegenthart, 2017). During the comparison, the TQI indices for companies with good accounting practices were compared against those that had reported instances of financial frauds. The sample for the study comprised ten companies that were grouped into two categories. For ethical reasons, the names of the firms are not disclosed. Instead, they are designated A to J. The first group consisted of five companies (A to E) that were randomly selected from Forbes’s 100 American and 10 UK most trustworthy firms in 2017 and 2016 respectively (Forbes, 2017; Strauss, 2017). A general web search was conducted to ensure that none of the selected corporations had engaged in a major accounting scandal. Forbes’ criteria for ranking include aspects related to auditor independence such as ethical governance, adherence to accounting standards, and regulatory actions (Strauss, 2017). Therefore, the study assumed that those firms had high levels of auditor independence.

The second group comprised companies that had ongoing cases of accounting frauds as at 2016. For the selected firms in this category, auditor independence was cited as a leading factor to the fraud. Therefore, the study regarded adequate independence was not being practiced in these firms, at least, by the time the scam was reported. The websites of these firms were searched to verify their corporate governance affairs and any reported issues that may affect the extent of auditor independence. Additionally, a web search was done for any case reports on either quality management or accounting practices in the companies.

Data Collection

The data for the study was obtained from two employee review websites, Glassdoor and Indeed. These websites provide employee assessments of their firms. Since the reviewers remain anonymous, these websites provide employees with excellent opportunities to make honest evaluations of their organizations without fear of victimization or intimidation. The reviews used in the computation of the indices were those that mentioned any of the three elements of TQM assessed, that is, ethics, trust, and integrity. Since the perception on these factors are different from each based on the definition they assign to it, the study focused, not on the factors only, but also on the various aspects that defines each factor. The reviews were used in computing TQM indices.

Computing the TQM Index

The TQM index for each of the firms was calculated based on the model proposed by Mohebbi et al. (2003). According to this model, the index, TQI, is calculated as:

(2) (See the literature review)

(2) (See the literature review)

The weights Wi and wi were assigned based on the researcher’s discretion such that

For Wi, ethics and integrity were each assigned 0.35. Trust has been considered a product of integrity and ethics and, therefore, it was assigned a slightly less weight, 0.3. The element of ethics had one factor, ethical governance. This factor was assessed based on the companies’ code of conduct as reported on their websites as well as employee comments on the state of governance in the company. The element integrity had three components, morals, ethical values, fairness, and honesty (Olcay & Sadikoglu, 2014). The weighted value was calculated by multiplying the assigned with the average of each of the four components. Each the factors were assigned a weight of 0.25. For trust, Wi was computed as a the product of the ethics and integrity.

The r values were computed based on the assessment that the employees provided on each factor analyzed. For this rating, the researcher looked for modifying words such as poor, fair, good, or excellent. A rating “poor” was assigned 1 while “excellent” was assigned 4. Based on this criterion, a high value signified better TQM while a low score implied the opposite.

Results

Company Profile

Table 2 shows the profile of the countries assessed (names are withheld for ethical considerations). The last five companies were not rated by Forbes’ and therefore, their AGR (Accounting and Governance Risk) indices. Five of the firms were based in the U.S. while the other five were in the U.K. Three of them were from the financial, two from manufacturing, and two from retail sectors. The remaining three were from insurance, real estate, and energy/ transport industries.

| Table 2 Company Profile And TQI Indices |

|||

| Company | Country | Industry | Forbes’ AGR Index |

| A | U.S. | Energy and Transport | 84 |

| B | U.S | Real Estate | 97 |

| C | U.K. | Food and Retail | 95 |

| D | U.K | Manufacturing | 94 |

| E | U.S. | Finance | 96 |

| F | U.K. | Retail | - |

| G | UK | Finance | - |

| H | U.K. | Insurance | - |

| I | U.S. | Manufacturing | - |

| J | U.S. | Finance | - |

Review Distribution and TQI indices

Since the reviews in Glassdoor and Indeed are not directed to a specific research question, the study aimed as collecting as many reviews as possible to ensure a sufficient sample for the final computation. The final sample had 96 reviews distributed across the companies as shown in Table 3.

| Table 3 Company Profile And TQI Indices |

||

| Company | Number Of Reviews | QTM Index |

| A | 9 | 3.004 |

| B | 11 | 3.06 |

| C | 8 | 2.858 |

| D | 10 | 3.045 |

| E | 9 | 3.049 |

| F | 12 | 2.590 |

| G | 7 | 2.534 |

| H | 10 | 2.567 |

| I | 13 | 3.001 |

| J | 7 | 2.528 |

| Total | 96 | |

All the companies analyzed had engaged in some aspects of quality improvement such as the recruitment of highly skilled workforce as well as product and service quality. Based on the computation methodology, the maximum possible index was 3.388 while the least possible value was 0.737. The highest computed index was 3.049 (Company E) while the lowest was The mean TQM index for the first set of companies A-E was 3.00 while that for the second set was 2.528 (Company J). The best performance for the first set was in corporate governance (3.68) while the aspect with the best score among the second set were fairness and corporate values (the score for each was 3.584)

A paired sample t-test was run to compare the mean indices of the two sets at 95 percent confidence level. The difference in the means was 0. 359 (std. dev.=0.200). The result of the comparison is in Table 4. The t-statistic was significant (t=4.003; p=0.016) indicating that the difference was significant.

| Table 4 Comparing The Means Of Set 1 And Set 2 Firms |

|||||||

| Mean | Std. Dev | Std. Error | 95% Confidence Interval Of The Difference | t-value | Df | Sig | |

| Lower | Upper | ||||||

| .35920 | .20063 | .08972 | .11009 | .60831 | 4.003 | 4 | .016 |

Discussion

The intention of the study was to assess the impact of auditor independence on TQM. The above findings suggest that companies that have good audit practices are likely to have better TQM performances. The low scores across the second set of firms were possibly due to the decline in reputation that usually accompanies financial scandals. One factor that has been cited as an obstacle to complete autonomy is the familiarity between the auditing firm and the client (Lennox et al., 2014; Jenkins & Vermeer, 2013). At least two of the firms in the second had maintained the same external auditor for more than 20 years. Such a state made it easy for autonomy to be compromised.

Another aspect of independence that emerged in the analysis involves the management. As noted in the findings, the first five firms scored better in corporate governance than they did in other aspects of quality. In the wake of many accounting scams, the subject of corporate governance has become central to many debates and policies on accounting standards. One problem that has been cited is the tendency for auditors, the board of directors and other regulatory agencies pay little attention to the principles of governance, a situation that has been responsible for the many frauds reported today (Roy & Saha, 2015).

The issue of governance was likely a distinguishing feature regarding TQM. Two companies in the first set indicated on the websites that the majority of their board of director members was autonomous. In contrast, a CEO of one firm that had reported a scandal admitted that managers in the previous regime had been pressurized into engaging in unethical practices. They also acknowledged the absence of transparency, openness, honesty, and fairness. Even though it may not be possible to ascertain the difference created by having independent management, it appears such a strategy is a useful approach for improving integrity and honesty within an organization.

Conclusion

TQM provides organizations with a platform for enhancing the satisfaction of their customers and improving their profitability. Organizations are currently experimenting with different approaches to help them implement TQM principles. As a framework for quality improvement, TQM identifies eight elements that are essential for process and product quality. Three of them are ethics, integrity, and trust. One policy that can help in the realization of TQM goals is auditor independence. The presented study has established a possible relationship between auditor independence and TQM. The findings suggest that the autonomy of the auditor can help improve an organization’s ethics, trust, and integrity, which are the foundation of TQM. Suggestions to improve independence include auditor rotation and the creation of a culture that encourages members to be alert to situations that may compromise autonomy.

Limitations

Some flaws in the design limit the findings of the present study. First, the sample size of ten firms and 96 reviews is small and may not provide an adequate representation of the relationship between TQM and auditor independence. Second, there were no standard mechanisms for quantifying the level of auditor autonomy in the firms. The assumption was that organizations that had experienced scandals in the recent years had their independence of their auditors compromised. Even though the assumption may have been true at the time the scandal was revealed, there is a possibility that the companies have endeavored to align their practices with the required standards.

Similarly, for the first set of firms, the study relied on Forbes’ AGR index. There was no basis for validating the extent to which the index reflected auditor autonomy. Additionally, the computation of the TQM indices used in the study was based on weights that were assigned according to the researcher’s discretion, which may have been flawed.

Implications

Auditor independence is a requirement by many accounting standards and companies that do not abide it risk attracting huge penalties. In addition to legitimation, the present findings hint to the possibility that auditor autonomy has a significant impact on the quality management practices in an organization. In specific, the level of independence influences the three foundation elements of TQM, ethics, integrity, and trust. The complex nature of today’s business environments makes it hard for auditors to maintain full autonomy from their clients. There exists a need for strategies that can help firms and their auditors meet the objectives of independence.

Recommendations

The evidence from this and other previous studies indicate a significant relationship between auditor independence and the quality of processes in an organization. However, many obstacles make it difficult for auditors to maintain autonomy. The study makes the following recommendations:

1. Organizations should create a culture that encourages better disclosure to help identifying audit errors as well as questionable policies and practices.

2. Policymakers and implementers should emphasize the need for all companies to practice auditor rotation to limit the compromises that result from the familiarity between auditors and their clients.

Based on the scope and findings of the study, the study suggests the following for further research:

1. As outlined in the literature review, the TQM framework has three elements each of which is critical for improved processed. The present investigation has focused only on the first three of these factors, ethics, integrity, and trust. Future studies should attempt to develop a model that integrates all the eight elements.

2. The study relied mainly on customer data and personal judgments based on the information presented in the company’s websites. TQM is a collaborative approach that should include all the stakeholders, particularly customers, a criterion that was not satisfied by the research design. Future researchers can attempt to address this gap.

3. Previous studies have suggested a relationship between auditor independence and QTM. The current research is the first to attempt to quantify the relationship between the two. Nevertheless, it was based on comparative design and did not establish any correlational association between the two factors. A correlational approach to the association between the two factors is a potential area for future investigations.

References

- Adelopo, I. (2016). Auditor independence: Auditing, corporate governance, and market confidence. Routledge.

- Ahmad, S.H., Haron, M.S., & Idiab, A. (2012). Total quality management and its relationship with the internal audit. Australian Journal of Basic and Applied Sciences, 6(9), 660-668.

- Allen, R., Hill, N., & Roche, G. (2007). Customer satisfaction: The customer experience through the customer's eyes. London, UK: Cogent.

- Bakar, N.B., Rahman, A.A., & Rashid, H.M. (2008). Factors influencing auditor independence: Malaysian loan officers' perceptions. Managerial Auditing Journal, 20(8), 804-822.

- Chang, W.C., & Chen, Y.S. (2015). The role of external auditors in business group governance: Evidence from the number of audit firms selected in Taiwanese Groups. The International Journal of Accounting, 50(2), 170-194.

- Church, B.K., Jenkins, J.G., McCracken, S.A., Roush, P.B., & Stanley, J.D. (2015). Auditor independence in fact: Research, regulatory, and practice implications drawn from experimental and archival research. Accounting Horizons, 29(1), 217-238.

- Esser, F., & Vliegenthart, R. (2017). Comparative research methods. The International Encyclopedia of Communication Research Methods.

- Fitzgerald, B.C., Newton, N.J., & Wolfe, C.J. (2017). The effect of partition dependence on assessing accounting estimates. Auditing: A Journal of Practice & Theory, 36(3), 185-197.

- Forbes. (2017). The U.K.'s 10 most trustworthy companies 2016. Retrieved from https://www.forbes.com/pictures/5718fea9a7ea43722d7819bc/the-uks-10-most-trustwort/#11e9ca6845d9

- Gangone, A.D., & G?nescu, M.C. (2014). Corporate social responsibility in emerging and developing economies in Central and Eastern Europe-a measurement model from the stakeholder theory perspective. Economic Research, 27(1), 539-558.

- Gremyr, I., & Lenning, J. (2017). Making internal audits business-relevant. Total Quality Management & Business Excellence, 28(9-10), 1106-1121.

- Gupta, S., & Kukreja, G. (2016). Tesco accounting misstatements: Myopic ideologies overshadowing larger organizational interests. SDMIMD Journal of Management, 7(1), 9-18.

- Hay, D., Holm, C., & Zhang, Y. (2016). Non-audit services and auditor independence: Norwegian evidence. Cogent Business & Management, 3(1), 33-56.

- Head, B.W. (2012). The contribution of integrity agencies to good governance. Policy Studies, 33(1), 7-20.

- Hickman, L., & Akdere, M. (2017). Stakeholder theory: Implications for total quality management in higher education. 4th International Conference on Lean Six Sigma for Higher Education.

- Jenkins, D.S., & Vermeer, T.E. (2013). Audit firm rotation and audit quality: Evidence from academic research. Accounting Research Journal, 26(1), 75-84.

- Johnson, L.A., & Parker, S. (2017). The development of internal auditing as a profession in the U.S. during the twentieth century. Accounting Historians Journal, 44(2), 47-67.

- Kaynak, E., & Roger, R.E. (2013). Implementation of total quality management: A comprehensive training program. Routledge.

- Kwama, L.O., Ojera, P., & Okungu, N.A. (2014). Obstacles to the implementation of total quality management and organizational performance in private higher learning institutions. Journal of Business and Management, 16(5), 8-17.

- Law, P. (2011). Audit regulatory reform with a refined stakeholder model to enhance corporate governance: Hong Kong evidence. The International Journal of Business in Society, 11(2), 123-135.

- Lemay, G., Larson, P., Johnson, D.M., & Quinn, A. (2009). Service quality in higher education. Total Quality Management & Business Excellence, 20(2), 139-152.

- Lennox, C.S., Wu, X., & Zhang, T. (2014). Does mandatory rotation of audit partners improve audit quality? The Accounting Review, 89(5), 1775-1803.

- Leon, A. (2008). ERP demystified. New Delhi, India: Tata McGraw-Hill.

- Macey, S., Sigouin, A., & Vogler, D. (2017). Stakeholder analysis in environmental and conservation planning. Lessons in Conservation, 7, 5-16.

- Mohebbi, B., Kennedy, D.T., & Tavana, M. (2003). Total quality index: A benchmarking tool for total quality management. An International Journal, 10(6), 507-527.

- Moriarty, J. (2012). The connection between stakeholder theory and stakeholder democracy: An excavation and defense. Business & Society, 53(6), 820-852.

- Nasution, A.A., Sari, R.M., & Siregar, I. (2017). Effect of total quality management on the quality and productivity of human resources. Materials Science and Engineering, 180(1).

- Olcay, H., & Sadikoglu, E. (2014). The effects of total quality management practices on performance and the Reasons of and the barriers to TQM practices in Turkey. Advances in Decision Sciences, 1-17.

- Roy, M.N., & Saha, S.S. (2015). Statutory auditors' independence in the backdrop of corporate corruption: Select case studies. Indian Journal of Corporate Governance, 8(1).

- Stieb, J.A. (2009). Assessing Freeman’s stakeholder theory. Journal of Business Ethics, 87(3), 401-414.

- Strauss, K. (2017). The 100 most trustworthy companies in America, 2017. Retrieved from https://www.forbes.com/sites/karstenstrauss/2017/04/07/the-100-most-trustworthy-companies-in-america-2017/#2a4df56c4b17