Research Article: 2022 Vol: 21 Issue: 2S

The Impact of Corporate Governance on Environmental Performance of Public Listed Companies in Malaysia: A Robust Standard Error Approach

Heshw Rebwar Ali, Erbil Polytechnic University

Aram Jawhar Mohammad, Erbil Polytechnic University

Farhad Rafaat Ali Al-Kake, Knowledge University

Muhammad Atif Nawaz, The Islamia University of Bahawalpur

Sajjad Hussain, Superior University

Keywords

Corporate Governance, Environmental Performance, Board Size, Institutional Ownership.

Citation Information

Ali, H.R., Mohammad, A.J., Al-Kake, F.R.A., Nawaz, M.A., & Hussain, S. (2022). The Impact of Corporate Governance on Environmental Performance of Public Listed Companies in Malaysia: A Robust Standard Error Approach. Academy of Strategic Management Journal, 21(S2), 1-14.

Abstract

Environmental degradation has become a worldwide issue due to the high carbon emission and wastage from the industry sector that needs to be examined frequently. Thus, the present research investigates the corporate governance (board size, inside directors, institutional ownership, and managerial ownership) role to improve the environmental performance in public listed companies in Malaysia. This study has selected the top twenty public listed companies and gathered the data from the financial statement and financial reports from 2008 to 2019. This research has executed the robust standard error to test the nexus among variables. The results revealed that inside directors, institutional ownership, and managerial ownership have negative while board size has a positive association with environmental performance. This study has guided the regulators while formulating regulations related to corporate governance and environmental performance. There should much need for effective policies that change the corporate governance intentions towards environmental performance.

Introduction

Over the past decade, the literature on corporate governance not only highlights its importance for the firm but also its relationship with environmental performance (Jacoby, Liu, Wang, Wu, & Zhang, 2019; Van Hoang, 2021a). Corporate governance is the combination of internal and external factors. Like the internal governance structure along with the external control system results in enhancing the firm environmental performance and transparency. Therefore the firm environmental performance and disclosure if based on the two elements like governing body of the firm and the executive team of the management. Particularly those firm which effectively combine these two elements results in better environmental disclosure and performance in comparison with the less efficient firms in this regards. Some other studies proposed that governance mechanism effectiveness has a significant and direct association with environmental information quality which is available to stakeholders (Przychodzen, 2018). The finance sector was regarded as one of the key players in the actor against global warming as per the Parties Conference in Paris in the year 2015. Tools such as green bond portfolios, socially conscious investments, the green environment fund, green innovation funding, the alliance decarburization portfolio, carbon price tags, etc. will play this key role towards the achievement of this task. In the investment strategies for investment funds and institutional investors, the finance sector should also engage by taking into account environmental, social, and governance (ESG) problems (García Martín & Herrero, 2020; Leyva-de la Hiz, Ferron-Vilchez, & Aragon-Correa, 2019). Literature proposed that the performance of environmental, social, and governance (ESG) is positively associated with the performance of the firm (Giannarakis, Andronikidis, & Sariannidis, 2020). A number of studies also proposed that environmental, social, and governance (ESG) increasing performance is an indicator for the financial industry therefore it is necessary for the firms to strongly consider the environmental, social, and governance (ESG) performance (Brogi & Lagasio, 2019). This is one of the reasons this study is conducted that how the environmental performance is influenced by corporate governance (Sroufe & Gopalakrishna-Remani, 2018).

After the implementation of the Malaysian Code of Corporate Governance (MCCG), in 2000, the governance landscape in the Malaysian business world has been undergoing a number of changes. Due to the economic downturn caused by the 1997/98 financial crisis, the MCCG was updated in 2007 and 2012 after discussions with different parties in reaction to the need to rebuild investor trust in Malaysia and clarify further the Board of Directors' functions and responsibilities. Improving organizational transparency and accountability is of central importance to the MCCG (Van Hoang, Przychodzen, Przychodzen, & Segbotangni, 2021b). MCCG was initially introduced in 2000 setup guidance and standards for helping businesses develop the corporate governance strategy. MCCG followed the Corporate Governance Code in order to set up the principles and guidelines for designing a corporate governance approach in Malaysia. The MCCG of 2000 recommended that positions should be clearly separated between the Chief Executive Officer (CEO) and independent directors, who include at least one-third of the board members. The amended MCCG (2007) sets the requirement of ongoing preparation and the requirement of eligibility for the recruitment of directors, audit committees, etc. (Jacoby et al., 2019; Van Hoang et al., 2021b).

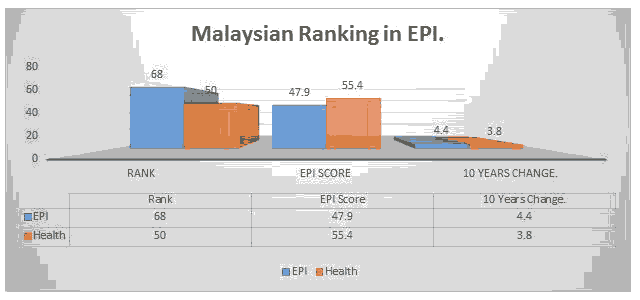

Environment Performance Index is a form which provides the facts and figure about the world environment performance like Environment Performance Index ranking, health ranking, ozone ranking, air quality, household solid fuels (Sun et al., 2020). It’s the joint project of Yale Center for environmental law and policy and the center of the international earth science information network (Colombia University Earth Institute). A data-driven overview of the state of sustainability worldwide is provided by the Environmental Performance Index (EPI 2020). The EPI ranks in 180 countries in environmental sustainability and ecosystem resilience, using 32 success metrics across 11 issue categories. These metrics offer a national measure of how close countries are to set environmental policy objectives. The EPI provides a scorecard that shows environmental success leaders and gaps and provides realistic advice for countries aspiring to a sustainable future. These metrics help to recognize challenges, identify objectives, monitor patterns, interpret results and define better policies. Great evidence and a factual assessment both contribute to refining the policy agenda of government agencies, facilitating contacts with core stakeholders, and maximizing environmental investment returns. The EPI provides a strong strategy instrument for actions in order to achieve the objectives and society's prosperous future under the UN Sustainable Development Goals (Jacoby et al., 2019). The EPI shows that out of 180 member’s Malaysian rank 68 in terms of EPI. The EPI score of Malaysia is 47.9 with a 4.4 change in 10 years. The air quality of Malaysia although is not very good but about to satisfactory. In the case of air quality, Malaysia ranks 55 with an EPI score of 50.3 along with 10 years change of 4.6. In the case of ozone Malaysia rank 100 with an EPI score of 40.1 along with 10 years change of -10.6. In the case of household solid fuels, sanitary and drinking water, sanitation, drinking water, solid waste, ecosystem vitality, and bio-diversity the ranking of Malaysia is 51, 59, 50, 74, 33, 108, and 110 respectively. The EPI score of household solid fuels, sanitary and drinking water, sanitation, drinking water, solid waste, ecosystem vitality, and bio-diversity 70.7, 57.6 71.8, 48.1 81.4, 42.9, and 55.1 respectively. The 10-year change of household solid fuels, sanitary and drinking water, sanitation, drinking water, solid waste, ecosystem vitality, and bio-diversity was recorded as 7.6, 3.1, 5.8, 1.3,0, 4.8, and -8.6 respectively. Malaysian ranking in environment performance index in 2020 is given in Figure 1:

This study will contribute in a number of ways to the existing literature like 1) it will try to define that how corporate governance influence environmental performance, 2) highlight the importance of corporate governance and environmental performance, 3) Abdlazez, Lasyoud and Boshanna (2019) investigate the relationship between the corporate governance and capital structure on the public listed firm of Malaysia by using governance factors like board size, CEO duality ownership structure and board meeting but this study will use the factors like inside directors, institutional ownership, managerial ownership, and firm size.

Literature Review

Environmental performance in many countries has been major limelight due to the negative and positive implications of corporate elements. These elements are importantly influential toward the ecosystem of many emerging countries like Malaysia. The size of the board and performance of the environment by involving assets as endogenous variables (Augusto, 2020). Specifically, the concerns of environmental performance among the companies are usually dependent on the board characteristics (Huyghebaert & Wang, 2019). These characteristics are awareness to the corporate world that help to measure the environmental disclosures in organizations. Board size is important to the board characteristics and contributes a prominent role to the environmental performance. Especially, the public listed companies of some emerging countries like Malaysia are more conscious about the board composition. For the efficient governance of nonprofits, the board's effectiveness, knowledge, and support with coaching are required (Mason & Kim, 2020). Although, some adverse roles have also been depicted in the environmental performance of such companies’ board size is a prominent one. This prominence is widely supported by the view of board composition and board size that discloses the importance of environmental performance (Mohsin, Kamran, Nawaz, Hussain, & Dahri, 2021). Significant associations depict the firm's corporate environmental performance and board size. While asserting the environmental performance, the involvement of board size and its characteristics are clear for the initiatives of firm performance (Vandenbroucke, Knockaert, & Ucbasaran, 2019). Even though, the existence of CSR committees and gender diversity are also associated with the environmental performance of public listed companies in emerging countries like Malaysia. The negative effects over the board size usually reflect the malfunctioning of board advisories (Falconieri, Filatotchev, & Tastan, 2019). With a view to sustainable environmental initiatives, the board size contributes a committing role with the relevancy of board characteristics (Mohammad & Ahmed, 2017).

The corporate inside directors are assessed on the basis of their qualifications that are highly influential toward the organizational performance. Although, many other factors related to corporate values are also important for organizations the independent directors are prominent ones (Kapoor & Goel, 2019). Many public listed companies of emerging countries like Malaysia are motivated for qualified inside directors. The types and nationalities of directors are also important that assert an important impact on corporate behavior and performance (Kang, 2019). These directors contribute a significant role in the enhancement of organizational environmental performance. Organizations have designed many seats for the inside and outside directors but the dual role of directors are also depicted in the organizations on single seats. This role pays much attention to the sustainability of environmental performance in organizations (Nawaz et al., 2021). Some of the public listed companies of emerging countries like Malaysia earn more considerable attention due to the fortunate roles of inside directors. The incorporation of directors' informative role is influential toward the voluntary disclosure of environmental performance (Ke, 2020). This role occupies appropriate functions of the inside directors that utilize staff to stable the environmental performance of organizations. External markets of the emerging countries especially Malaysia induced the evident role of inside directors. The role of inside and outside directors faces the effects of shareholders and opposing roles of organizations (Chen, Cussatt, & Gunny, 2017). This is due to the eminent holding performance in the corporate markets where the operating performance is analyzed as well as the ratios of book-to-market values. Mechanisms of governance are important in emerging countries with significant roles of firm performance and board of directors (Nitikasetsoontorn, 2019). Firms of public listed companies are better toward the acquisition of directors who are prominent due to their decision-making values. This decision-making uplift the overstate earnings as well as the cash holdings in running markets (Mohammad, 2015).

While asserting the role of organizational characteristics and structural importance, the role of ownership could not be omitted. Ownership pays a prominent impact on the performance of many public listed companies while the influence of policies acts differently. Institutional ownership significantly influences governance, social and environmental performance (Oikonomou, Yin, & Zhao, 2020). This influence is significantly defined by the dependence of institutional investors and fluctuating ecosystems in emerging countries like Malaysia. Various shipping companies of developed countries have asserted the impact of institutional ownership on firm performance (Tsouknidis, 2019). The influence of institutional ownership is attenuated upon the reach at a prominent percentage in environmental conditions of markets. Various perspectives have been viewed with the importance of organizational performance and strategy. This importance also states clearly the prominence of institutional ownership as well as the forums of ownership that impacts the performance and strategy of many public listed companies. These public listed companies are having the profound impacts of institutional ownership over the environmental performance in emerging countries like Malaysia. While asserting the corporate social performance and investment horizon, the virtuous circle of firm conduct and institutional ownership is imminent (Oikonomou et al., 2020). Outside the global markets, the role of institutional ownership is significant but the elements of shareholding effects disrupt the environment from different aspects (Nawaz et al., 2020). Firm performance and capital structure are interrelated with each other and have unusual impacts on institutional ownership (MIR et al., 2020). These unusual impacts are certain with the extending roles of corporate executives, insider institutions, and family owners (Hooy, 2020). These factors are eminently illustrating the various corresponding factors that influence the environment of organizations. The independence of the board and institutional independence is necessary to assert the disclosures over environmental performance (Cui, Peng, Jia, & Wu, 2020). Mostly, the public listed companies of Malaysia have asserted the impact of institutional ownership. The role of institutional ownership is clear but the global markets are bifurcated due to the ownership and impact the environments of countries due to living classes.

This confronting situation in a competitive environment is explained through strategic tactics and suggestive measures by managerial ownership to address environmental performance (Chien et al., 2021). It is upon the gaps of the market which are tackled by leading-edge and company success from the past records meeting consumer demands. The connection among firm performance, board independence, and managerial ownership is analyzed with incremental insights (Shan, 2019). The elements of adaptability and flexibility in organizational environmental performance are an important aspect of strategic directions adopted by managerial ownership. Managerial competency eliminates the elements of rigidity that lead the public listed companies of emerging countries toward progression, obstruct advancements (Hamlin & Patel, 2020). Public listed companies of Malaysia are well-acquainted with the organizational hierarchy to attain a considerable increase in environmental performance. Organized and effective coordination among departments of an organization through managerial ownership asserts considerable growth in performance. Firms are better performers having the elements of liquid equity and managerial ownership (Fabisik, 2021). In this context, managerial competence interprets significant coordination between different departments of public listed companies of emerging countries. Therefore, managerial encouragement helps the employees to retain scope and attention toward the task of environmental performance. Decision-making in organizations must be centralized as supported by managerial ownership though. For the purpose of environmental performance and ecological sustainability, the role of managerial ownership could not be eluded in Malaysia. Therefore, managerial ownership plays a significant role in the attainment of environmental performance sustainability in public listed companies of emerging countries. Managerial ownership is concerned with proper controls of engagement among the performance and antecedents (Skiba, 2019). In the above mechanism, the environmental performance is a significant assertion of implicated internal environmental in the organizations managed by managers. The existence of internal environmental management through managerial ownership is an important measure of environmental performance (Min & Oh, 2020).

Firm hierarchy is an important term for organizations that is dependent on many factors like the environment and size of the organization (Chien et al., 2021). There is a leverage of size factors in the organizations that differentiate the external and internal environmental performance (Zhang, 2021). In the public listed companies of emerging countries, the optimal size of a firm matters a lot and contributes a significant role in performance. The actions and innovation of the firm’s environment contribute a significant portion toward the firm performance (Andries & Stephan, 2019). Malaysia is the emerging countries that induce a contingent role of firm size influencing the environmental performance of organizations. Firm size is an important element for large as well as small firms that could enable the significant performance of the environment. Companies could enhance their business activities by the larger size of their organizations and it could be prevalent in strategic decision making. While implementing the practices of the green supply chain, the corporate performance and firm age with size possess control over environmental performance (Younis & Sundarakani, 2020). The patterns of firm size extend the activities of information gathering, attitudes, and plans for exports and internal purchases. Even though, selling off most of the public listed companies are prevalent on the firm side due to converting the attention of purchasers. Firm size is mostly dependent on the firm dynamics which are mostly designed according to the existing markets. There are a probability small and larger firms that induce their firm size to gain the market share. For tackling the obstacles, firm size really matters and formulates perception of poor financial and infrastructure (Ede, 2021). Although, the impact of firm size is clear on the environmental performance of an organization the impacts of advanced technology, market share, and capital intensity, on the other hand, is certain. In Malaysia the firm size is primarily important for structuring the environmental performance.

Methodology

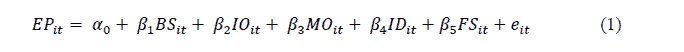

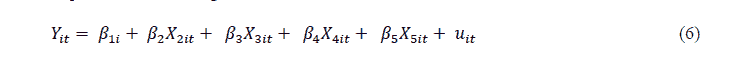

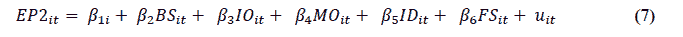

This article investigates the role of corporate governance (board size, inside directors, institutional ownership, and managerial ownership) to improve the environmental performance in public listed companies in Malaysia. This study has taken the firm size as the control variable. This study has selected the top twenty public listed companies and gathered the data from the financial statement and financial reports from 2008 to 2019. This research has executed the robust standard error to test the nexus among variables. The estimation equation for the study has been given as under:

Where,

FP = Environmental Performance

i = Company

t = Time Period

BS = Board Size

IO = Institutional Ownership

MO = Managerial Ownership

ID = Insider Directors

FS = Firm Size

This research has adopted the environmental performance and measures as the environmental protection expenses / total expenses. In addition, this article has taken four variables four corporate governance such as board size that measured as the logarithm of the number of board members (Butt & Hasan, 2009), institutional ownership that is measured as the logarithm of shares owned by institutions, managerial ownership and measured as the logarithm of shares owned by managers and insider ownership and measured as the logarithm of the number of insider directors. This study has also taken firm size as the control variable and measured as the logarithm of total assets. These constructs and measurements are mentioned in Table 1.

| Table 1 Measurements Of Variables |

||

|---|---|---|

| S# | Variables | Measurements |

| 01 | Environmental Performance | Environmental protection expenses / Total expenses |

| 02 | Board Size | The logarithm of the number of board members |

| 03 | Institutional Ownership | The logarithm of shares owned by institutions |

| 04 | Managerial Ownership | The logarithm of shares owned by managers |

| 05 | Insider Directors | The logarithm of the number of insider directors |

| 06 | Firm Size | The logarithm of total assets |

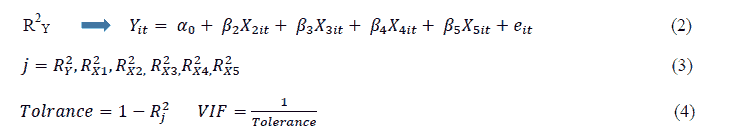

This study executed the descriptive statistics that describe the characteristics of the constructs, such as mean and mediation, along with minimum and maximum values. In addition, this study executed the correlation matrix that exposed the direction of relations among the constructs. Moreover, this article also executed the variance inflation factor (VIF) that shows the multicollinearity issue among the constructs. This study has also executed the robust standard error to examine the nexus among the variables. Firstly, this article executed the VIF that show the multicollinearity issue among the constructs, and if the VIF values are lower than five, that means no issue with multicollinearity, and the equation for VIF are given as under:

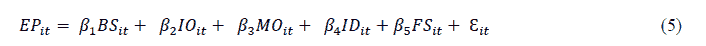

Secondly, the current article has also executed the robust standard error to examine the nexus among the variables because it adjusts the model's heterogeneity issues that generally exist (Falk, 2018). The data is correctional-dependent because the number of cross-sections (companies) is more than the time series (years), which is another reason to adopt the robust standard error. This article has formulated the robust standard error equation as under:

This article executed the Hausman test to find out the appropriate model. If the probability values of the Hausman test are less than 0.05, then the random model is appropriate, and vice versa. The present executed has executed fixed effect model (FEM), and the equation for FEM is given as under:

The subscript (i) represented the individual company and made the different companies according to their characteristics. A FEM is a statistical model in which parameters are non-random quantities or fixed quantities (Jarboui, 2021). A FEM also means a regression model in which a fixed group means from a population (Jochmans & Weidner, 2019). In a FEM, each group means a group-specific fixed quantity. This study has developed the FEM equation as under:

Results

This study executed the descriptive statistics that describe the characteristics of the constructs, such as mean and mediation, along with minimum and maximum values. The mean value of EP is 0.56 while BS is 1.188 and the average value of IO of 8.601 while MO is 0.246. Finally, the average value of ID is 0.138, and CS is 5.028. These values are mentioned in Table 2.

| Table 2 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| EP | 240 | 0.356 | 0.226 | 0.001 | 0.967 |

| BS | 240 | 1.188 | 0.206 | 0.021 | 1.771 |

| IO | 240 | 8.601 | 0.616 | 5.699 | 9.986 |

| MO | 240 | 0.246 | 0.262 | 0.000 | 0.846 |

| ID | 240 | 0.138 | 0.199 | 0.000 | 0.983 |

| CS | 240 | 5.028 | 0.824 | 2.862 | 6.399 |

This study executed the correlation matrix that exposed the direction of relations among the constructs. The results have been indicated that BS, IO, ID, and CS have a negative association with EP while MO has a negative association with EP. These links are mentioned in Table 3.

| Table 3 Matrix Of Correlations |

||||||

|---|---|---|---|---|---|---|

| Variables | EP | BS | IO | MO | ID | CS |

| EP | 1 | |||||

| BS | 0.013 | 1 | ||||

| IO | 0.072 | -0.264 | 1 | |||

| MO | -0.101 | 0.021 | -0.49 | 1 | ||

| ID | 0.003 | 0.168 | -0.48 | -0.162 | 1 | |

| CS | 0.123 | -0.309 | 0.537 | -0.379 | 0.033 | 1 |

This article also executed the VIF that shows the multicollinearity issue among the constructs. The results revealed that VIF values are less than five that show no problem of multicollinearity. These values are highlighted in Table 4.

| Table 4 Variance Inflation Factor |

||

|---|---|---|

| VIF | 1/VIF | |

| IO | 3.267 | 0.306 |

| ID | 2.068 | 0.483 |

| MO | 1.829 | 0.547 |

| CS | 1.768 | 0.565 |

| BS | 1.16 | 0.862 |

| Mean VIF | 2.019 | 0.000 |

The current article has also executed the robust standard error to examine the nexus among the variables. The results revealed that inside directors, institutional ownership, and managerial ownership have negative while board size has a positive association with environmental performance. This study has guided the regulators while formulating regulations related to corporate governance and environmental performance. These results are shown in Table 5.

| Table 5 Robust Standard Error |

||||||

|---|---|---|---|---|---|---|

| EP | Beta | S.D. | t | P>t | L.L. | U.L. |

| BS | 0.213 | 0.120 | 1.770 | 0.092 | -0.038 | 0.464 |

| IO | -0.143 | 0.052 | -2.770 | 0.012 | -0.251 | -0.035 |

| MO | -0.399 | 0.070 | -5.710 | 0.000 | -0.546 | -0.253 |

| ID | -0.269 | 0.078 | -3.460 | 0.003 | -0.432 | -0.106 |

| CS | 0.117 | 0.051 | 2.300 | 0.033 | 0.011 | 0.224 |

| _cons | 0.880 | 0.337 | 2.610 | 0.017 | 0.175 | 1.585 |

This article executed the Hausman test to find out the appropriate model and random and fixed, and the probability values are not larger than 0.05, which shows FEM is appropriate. These figures have been shown in Table 6.

| Table 6 Hausman Specification Test |

|

|---|---|

| Coef. | |

| Chi-square test value | 8.513 |

| P-value | .013 |

The FEM also shows the nexus among the constructs, and the results revealed that inside directors, institutional ownership, and managerial ownership have negative. In contrast, board size has a positive association with environmental performance. These relations are mentioned in Table 7.

| Table 7 Fixed Effect Model |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| EP | Beta | S.D. | t-value | p-value | L.L. | U.L. | Sig | |||

| BS | 0.213 | 0.099 | 2.14 | 0.033 | 0.017 | 0.409 | ** | |||

| IO | -0.143 | 0.073 | -1.95 | 0.052 | -0.288 | 0.001 | * | |||

| MO | -0.399 | 0.192 | -2.08 | 0.039 | -0.778 | -0.021 | ** | |||

| ID | -0.269 | 0.187 | -1.44 | 0.150 | -0.637 | 0.099 | ||||

| CS | 0.117 | 0.076 | 1.55 | 0.123 | -0.032 | 0.267 | ||||

| Constant | 0.880 | 0.487 | 1.81 | 0.072 | -0.079 | 1.839 | * | |||

| R-squared | 0.590 | Number of obs | 238.000 | |||||||

| F-test | 2.658 | Prob > F | 0.000 | |||||||

Discussions and Implications

The study results have indicated that the board size has a positive association with environmental performance. The study demonstrates that the public listed companies which have more number boards of directors are more likely to overcome carbon emission during business operations and thus, can improve environmental performance, as the board of directors can better perform in decision making concerning the responsibility of the organization. These results are in line with the past study of Endo (2020). This study analyzes the environmental performance of business organizations on the part of corporate governance. This study posits that the board size matters a lot in making environmentally friendly decisions. The more number of board of directors can have a better contribution to the decisions made for reduction of carbon emission as these outside directors have broad knowledge and broad scope of thinking. These results are also in line with the past study of Lu and Wang (2021), which states that the outside directors have unbiased behavior and do not have any personal benefit in the business operations. Thus, these directors take honest participation in the decision-making of the organization. These directors are helpful in regulating the ecological friendly programs which can overcome carbon emission.

These study results have also indicated that the existence and performance of inside directors have a negative association with environmental performance. These results are supported by the past study of Masud, Nurunnabi, and Bae (2018), which implies that the inside board of directors, who may be employees, any officers, or direct stakeholders, can make ineffective decisions or not take initiatives regarding several outside or inside issues about different departments of organizations so as to reduce the emission of carbon. Thus, the inside board of directors is not helpful in enhancing the environmental performance of the firm. These results are also in line with the previous study of Elmagrhi, Ntim, Elamer, and Zhang (2019), which elaborates that as the inside directors have better knowledge about the organizational system, its resources, processes, risks, threats, and opportunities, but they cannot adopt better ways to reduce the carbon emission. In this way, they cannot successfully improve environmental performance accordingly to the requirements of government regulators and general public.

The study results have also revealed that institutional ownership is linked with the environmental performance in a negative manner. These results are approved by the previous study of Lagasio & Cucari (2019), which demonstrates that if the institutions like the insurance companies, investment firms, private foundations or other large institutions having strong financial position, have ownership in the particular company, it is not more likely for the company to reduce the amount of carbon emission into the atmosphere and thus, they cannot enhance the environmental performance. These results are also approved by the past study of Haque & Ntim (2018), which shows that when more amount of company stock is held by the successful institutions, it has a high financial position and also has support from these institutions. Thus, it cannot carry ecological friendly programs which help reduce amount of carbon emission and improve environmental performance due to their entire focus towards their financial position. The study results have also indicated that managerial ownership is linked with the environmental performance. The study implies that when the company’s stocks are held by the persons involved in the management of the organization, it cannot make better decisions and not initiates different ecological friendly programs to fulfill the environmentally friendly requirements of ecologists, customers, and general people. These results are supported by the past study of Raimo (2020). This study analyzes the ecological friendly performance of the leading business organizations. It concludes that as the managers are responsible for the administration of all the areas of the company and its overall performance and know-how to do so, but their share in the ownership does not contribute to the company’s capacity to reduce the emission of pollutants like carbon emission and thus, the company cannot improve the environmental performance of the firm.

These results are also supported by the past of Long, Chen, Du, Oh, & Han (2017), which indicates that the organizations where the more number managers have ownership of the company does not show better environmental performance. Thus, higher managerial ownership does not enhance environmental performance. Moreover, the study results have also indicated that firm size has a positive association with environmental performance. These results are supported by the past study of Arocena, Orcos, and Zouaghi (2021), which states that the high firm size means the company has more number of resources (financial, physical, and human resources), high management, and high profitability. A large size company has more capacity to make changes in the business process, technology, and techniques to reduce the emission of harmful gases like carbon dioxide in order to meet the ecological friendly programs. The current study makes both theoretical and empirical implications. The study has great theoretical importance because of its remarkable contribution to the literature on environmental protection. The study checks the influences of corporate governance on environmental performance. It throws light on the influences of board size, inside board of directors, institutional ownership, managerial ownership, and firm size on the carbon emission and, thus, on the environmental performance. In the existing literature, many studies have been conducted to explore the influences of corporate governance as a collective term on carbon and the environmental performance of a business organization. But all these studies have addressed the influences of board size, inside board of directors, institutional ownership, managerial ownership, and firm size on the carbon emission and on the environmental performance of business organization separately, not at the same time. But, this study addresses the influences of board size, inside board of directors, institutional ownership, managerial ownership, and firm size on the carbon emission and, thus, on the environmental performance at the same time. This study has great importance in practical life. It has great importance to the public listed companies of Emerging Countries like Malaysia, Turkey, UAE, Kuwait and Singapore, and other similar economies as it provides a guideline on how to improve environmental performance. This study suggests that the environmental performance can be improved with the increased size of the board, efficient inside directors, effective institutional ownership, managerial ownership, and high firm size.

Conclusion and Limitations

This study analyzes the environmental performance of public listed companies of Malaysia. In this regard, it examines the influences of board size, inside board of directors, institutional ownership, managerial ownership, and firm size on the carbon emission and, thus, on the environmental performance. The study states that the increase in the board size is helpful in bringing improvement in the environmental performance. As the inside directors have broad information and do not have interest in the environmental protection, and thus, they does not prove to be helpful in reducing carbon emission and raising environmental performance. The study elaborates that when there are high profit seeker inside directors in the company, they cannot regulate the business operations in such a manner as to reduce the amount of carbon emission and thus, does not improve the environmental performance. The nature of the institution has a great influence on carbon emission and environmental performance. If there are more owners and heavy investors, it is in a better financial position but not willing to handle the environmental issues. If the managers of the company have ownership in the company, they actively manage all organizational areas as if the company shows bad performance, but less concern on the environmental issues. Moreover, high firm size improves the financial resources, which can be used to reduce pollutants and increase performance. The current study has several limitations that must be covered by the scholars in the future while replicating or extending the conceptions of the study. This analyzes the role of just corporate governance elements such as board size, inside board of directors, institutional ownership, managerial ownership, and firm size on the carbon emission and, thus, on the environmental performance. Several economic, organizational, and energy factors can influence the amount of carbon emission into the air. But this study pays no heed to these factors while analyzing the carbon emission and the environmental performance, and thus, the scope of the study is limited. Future authors are recommended to analyze more factors along with corporate governance while analyzing environmental performance. Moreover, this study is supported by the analysis of environmental performance as a result of the capacity of corporate governance in public listed companies of Malaysia. Malaysia has particular atmospheres and particular economic conditions. So, the study conducted in this country may not have equal value in other countries. The scholars in the future must raise the number of countries under discussion.

References

Abdlazez, F., Lasyoud, A., & Boshanna, A. (2019). The relationship between Malaysian public-listed firms’ corporate governance and their capital structure. Corporate Ownership and Control, 16, 98-112.

Crossref, GoogleScholar, Indexed At

Andries, P., & Stephan, U. (2019). Environmental innovation and firm performance: How firm size and motives matter. Sustainability, 11(13), 1-17.

Crossref, GoogleScholar, Indexed At

Arocena, P., Orcos, R., & Zouaghi, F. (2021). The impact of ISO 14001 on firm environmental and economic performance: The moderating role of size and environmental awareness. Business Strategy and the Environment, 30(2), 955-967.

Crossref, GoogleScholar, Indexed At

Augusto, M., Pascoal, R., & Reis, P. (2020). Firms’ performance and board size: A simultaneous approach in the European and American contexts. Applied Economics Letters, 27(13), 1039-1043.

Crossref, GoogleScholar, Indexed At

Brogi, M., & Lagasio, V. (2019). Environmental, social, and governance and company profitability: Are financial intermediaries different?Corporate social responsibility and environmental management, 26(3), 576-587.

Crossref, GoogleScholar, Indexed At

Butt, S.A., & Hasan, A. (2009). Impact of ownership structure and corporate governance on capital structure of Pakistani listed companies. International Journal of Business & Management, 4(2), 50-57.

Chen, J.Z., Cussatt, M., & Gunny, K.A. (2017). When are outside directors more effective monitors? Evidence from real activities manipulation. Journal of Accounting, Auditing & Finance, 35(1), 26-52.

Crossref, GoogleScholar, Indexed At

Chien, F., Pantamee, A.A., Hussain, M.S., Chupradit, S., Nawaz, M.A., & Mohsin, M. (2021). Nexus between financial innovation and bankruptcy: Evidence from information, communication and technology (ICT) sector. The Singapore Economic Review, 1-22.

Crossref, GoogleScholar, Indexed At

Chien, F., Sadiq, M., Kamran, H.W., Nawaz, M.A., Hussain, M.S., & Raza, M. (2021). Co-movement of energy prices and stock market return: environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environmental Science and Pollution Research, 1-15.

Crossref, GoogleScholar, Indexed At

Cui, X., Peng, X., Jia, J., & Wu, D. (2020). Does board independence affect environmental disclosures by multinational corporations?Moderating effects of national culture. Applied Economics, 52(52), 5687-5705.

Crossref, GoogleScholar, Indexed At

Ede, O.C. (2021). Obstacles to firm performance in Nigeria: does size matter?Journal of Small Business & Entrepreneurship, 33(1), 49-70.

Crossref, GoogleScholar, Indexed At

Elmagrhi, M.H., Ntim, C.G., Elamer, A.A., & Zhang, Q. (2019). A study of environmental policies and regulations, governance structures, and environmental performance: The role of female directors. Business strategy and the Environment, 28(1), 206-220.

Crossref, GoogleScholar, Indexed At,

Endo, K. (2020). Corporate governance beyond the shareholder–stakeholder dichotomy: Lessons from Japanese corporations' environmental performance. Business Strategy and the Environment, 29(4), 1625-1633.

Crossref, GoogleScholar, Indexed At,

Fabisik, K., Fahlenbrach, R., Stulz, R.M., & Taillard, J.P. (2021). Why are firms with more managerial ownership worth less?Journal of Financial Economics, 140(3), 699-725.

Crossref, GoogleScholar, Indexed At

Falconieri, S., Filatotchev, I., & Tastan, M. (2019). Size and diversity in VC syndicates and their impact on IPO performance. The European Journal of Finance, 25(11), 1032-1053.

Crossref, GoogleScholar, Indexed At

Falk, C.F. (2018). Are robust standard errors the best approach for interval estimation with nonnormal data in structural equation modeling?Structural Equation Modeling: A Multidisciplinary Journal, 25(2), 244-266.

Crossref, GoogleScholar, Indexed At

García Martín, C.J., & Herrero, B. (2020). Do board characteristics affect environmental performance? A study of EU firms. Corporate social responsibility and environmental management, 27(1), 74-94.

Crossref, GoogleScholar, Indexed At

Giannarakis, G., Andronikidis, A., & Sariannidis, N. (2020). Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Annals of Operations Research, 294(1), 87-105.

Crossref, GoogleScholar, Indexed At

Hamlin, R.G., & Patel, T. (2020). Toward an emergent Asian behavioural model of perceived managerial and leadership effectiveness: A cross-nation comparative analysis of effective and ineffective managerial behaviour of private sector managers in India and South Korea. Human Resource Development International, 23(3), 259-282.

Crossref, GoogleScholar, Indexed At

Haque, F., & Ntim, C.G. (2018). Environmental policy, sustainable development, governance mechanisms and environmental performance. Business Strategy and the Environment, 27(3), 415-435.

Crossref, GoogleScholar, Indexed At

Hooy, G.K., Hooy, C.W., & Chee, H.K. (2020). Ultimate ownership, control mechanism, and firm performance: Evidence from Malaysian firms. Emerging Markets Finance and Trade, 56(15), 3805-3828.

Crossref, GoogleScholar, Indexed At

Huyghebaert, N., & Wang, L. (2019). Value creation and value distribution in Chinese listed firms: The role of ownership structure, board characteristics, and control. The European Journal of Finance, 25(6), 465-488.

Crossref, GoogleScholar, Indexed At

Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2019). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions and Money, 58, 269-283.

Crossref, GoogleScholar, Indexed At

Jarboui, S. (2021). Renewable energies and operational and environmental efficiencies of the US oil and gas companies: A true fixed effect model. Energy Reports, 15(2), 1-11.

Crossref, GoogleScholar, Indexed At

Jochmans, K., & Weidner, M. (2019). Fixed effect regressions on network data. Econometrica, 87(5), 1543-1560.

Crossref, GoogleScholar, Indexed At

Kang, Y.S., Huh, E., & Lim, M.H. (2019). Effects of foreign directors’ nationalities and director types on corporate philanthropic behavior: Evidence from Korean firms. Sustainability, 11(11), 1-18.

Crossref, GoogleScholar, Indexed At

Kapoor, N., & Goel, S. (2019). Do diligent independent directors restrain earnings management practices? Indian lessons for the global world. Asian Journal of Accounting Research, 4(1), 52-69.

Crossref, GoogleScholar, Indexed At

Ke, R., Li, M., & Zhang, Y. (2020). Directors' informational role in corporate voluntary disclosure: An analysis of directors from related industries. Contemporary Accounting Research, 37(1), 392-418.

Crossref, GoogleScholar, Indexed At

Lagasio, V., & Cucari, N. (2019). Corporate governance and environmental social governance disclosure: A meta analytical review. Corporate Social Responsibility and Environmental Management, 26(4), 701-711.

Crossref, GoogleScholar, Indexed At

Leyva-de la Hiz, D.I., Ferron-Vilchez, V., & Aragon-Correa, J.A. (2019). Do firms’ slack resources influence the relationship between focused environmental innovations and financial performance? More is not always better. Journal of Business Ethics, 159(4), 1215-1227.

Crossref, GoogleScholar, Indexed At

Long, X., Chen, Y., Du, J., Oh, K., & Han, I. (2017). Environmental innovation and its impact on economic and environmental performance: Evidence from Korean-owned firms in China. Energy Policy, 107, 131-137.

Crossref, GoogleScholar, Indexed At

Lu, J., & Wang, J. (2021). Corporate governance, law, culture, environmental performance and CSR disclosure: A global perspective. Journal of International Financial Markets, Institutions and Money, 70, 101-110.

Crossref, GoogleScholar, Indexed At

Mason, D.P., & Kim, M. (2020). A board coaching framework for effective non-profit governance: Staff support, board knowledge, and board effectiveness. Human Service Organizations: Management, Leadership & Governance, 44(5), 452-468.

Crossref, GoogleScholar, Indexed At

Masud, M.A.K., Nurunnabi, M., & Bae, S.M. (2018). The effects of corporate governance on environmental sustainability reporting: Empirical evidence from South Asian countries. Asian Journal of Sustainability and Social Responsibility, 3(1), 1-26.

Crossref, GoogleScholar, Indexed At

Min, B. H., & Oh, Y. (2020). How do performance gaps affect improvement in organizational performance? Exploring the mediating roles of proactive activities. Public Performance & Management Review, 43(4), 766-789.

Crossref, GoogleScholar, Indexed At

MIR, N., Abubakr, Z.A., Jawhar, A.M., Omar, R., & Onn, U.H. (2020). The effect of exchange rate and inflation on the economic performance of selected industries stock-iran on the economic performance of selected. Solid State Technology, 63(6), 12584-12602.

Mohammad, A.J. (2015). Human capital disclosures: Evidence from Kurdistan. European Journal of Accounting Auditing and Finance Research, 3(3), 21-31.

Mohammad, A.J., & Ahmed, D.M. (2017). The impact of audit committee and external auditor characteristics on financial reporting quality among Malaysian firms. Research Journal of Finance and Accounting, 8(13), 9-16.

Mohsin, M., Kamran, H.W., Nawaz, M.A., Hussain, M.S., & Dahri, A. S. (2021). Assessing the impact of transition from non-renewable to renewable energy consumption on economic growth-environmental nexus from developing Asian Countries. Journal of Environmental Management, 284, 1-8.

Crossref, GoogleScholar, Indexed At

Nawaz, M.A., Hussain, M.S., Kamran, H.W., Ehsanullah, S., Maheen, R., & Shair, F. (2020). Trilemma association of energy consumption, carbon emission, and economic growth of BRICS and OECD regions: Quantile regression estimation. Environmental Science and Pollution Research, 1-15.

Crossref, GoogleScholar, Indexed At

Nawaz, M.A., Seshadri, U., Kumar, P., Aqdas, R., Patwary, A.K., & Riaz, M. (2021). Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Environmental Science and Pollution Research, 28(6), 6504-6519.

Crossref, GoogleScholar, Indexed At

Nitikasetsoontorn, S. (2019). Governance mechanism of state enterprises in Thailand: the roles of the board of directors and the firm’s performance. Journal of Asian Public Policy, 12(2), 186-205.

Crossref, GoogleScholar, Indexed At

Oikonomou, I., Yin, C., & Zhao, L. (2020). Investment horizon and corporate social performance: the virtuous circle of long-term institutional ownership and responsible firm conduct. The European Journal of Finance, 26(1), 14-40.

Crossref, GoogleScholar, Indexed At

Przychodzen, W., Gómez-Bezares, F., & Przychodzen, J. (2018). Green information technologies practices and financial performance – The empirical evidence from German publicly traded companies. Journal of Cleaner Production, 201, 570-579.

Crossref, GoogleScholar, Indexed At

Raimo, N., Vitolla, F., Marrone, A., & Rubino, M. (2020). The role of ownership structure in integrated reporting policies. Business Strategy and the Environment, 29(6), 2238-2250.

Crossref, GoogleScholar, Indexed At

Shan, Y.G. (2019). Managerial ownership, board independence and firm performance. Accounting Research Journal, 32(2), 203-220.

Crossref, GoogleScholar, Indexed At

Skiba, J., Saini, A., & Friend, S.B. (2019). Sales manager cost control engagement: antecedents and performance implications.Journal of Personal Selling & Sales Management, 39(2), 123-137.

Crossref, GoogleScholar, Indexed At

Sroufe, R., & Gopalakrishna-Remani, V. (2018). Management, social sustainability, reputation, and financial performance relationships: An empirical examination of U.S. Firms. Organization & Environment, 32(3), 331-362.

Crossref, GoogleScholar, Indexed At

Sun, H., Awan, R.U., Nawaz, M.A., Mohsin, M., Rasheed, A.K., & Iqbal, N. (2020). Assessing the socio-economic viability of solar commercialization and electrification in south Asian countries. Environment, Development and Sustainability, 1-23.

Crossref, GoogleScholar, Indexed At

Tsouknidis, D.A. (2019). The effect of institutional ownership on firm performance: the case of U.S.-listed shipping companies. Maritime Policy & Management, 46(5), 509-528.

Crossref, GoogleScholar, Indexed At

Van Hoang, T.H., Przychodzen, W., Przychodzen, J., & Segbotangni, E.A. (2021a). Environmental transparency and performance: Does the corporate governance matter?Environmental and Sustainability Indicators, 10, 100-123.

Crossref, GoogleScholar, Indexed At

Vandenbroucke, E., Knockaert, M., & Ucbasaran, D. (2019). The relationship between top management team–outside board conflict and outside board service involvement in high-tech start-ups. Journal of Small Business Management, 57(3), 891-908.

Crossref, GoogleScholar, Indexed At

Younis, H., & Sundarakani, B. (2020). The impact of firm size, firm age and environmental management certification on the relationship between green supply chain practices and corporate performance. Benchmarking: An International Journal, 27(1), 319-346.

Crossref, GoogleScholar, Indexed At

Zhang, C., Yu, N., Yin, X., & Randhir, T.O. (2021). Environmental performance evaluation of enterprises using internal resource loss and external environmental damage costs. Journal of Environmental Planning and Management, 64(6), 1089-1110.

Crossref, GoogleScholar, Indexed At

Received: 25-Nov-2021, Manuscript No. asmj-21-9290; Editor assigned: 28- Nov -2021, PreQC No. asmj-21-9290 (PQ); Reviewed: 05- Dec -2021, QC No. asmj-21-9290; Revised: 15-Dec-2021, Manuscript No. asmj-21-9290 (R); Published: 04-Jan-2022