Research Article: 2021 Vol: 20 Issue: 6S

The Impact of Corporate Innovation on Abnormal Stock Returns: The Moderating Role of Investor Sentiment

Safyan Majid, University of Lahore

Naheed Sultana, University of Lahore

Ghulam Abid, Kinnaird College for Women University

Ali Raza Elahi, Government College University

Abstract

The basic purpose of this research is to determine the influence of corporate innovation on abnormal stock returns; additionally, it examined the effect of noise trading & market sentiment on the stock returns of innovative firms. The study utilized the data of 06 years from 2013 to 2018 of S&P100 firms and employed the data of patents and citations to measure corporate innovation. The results confirmed the value relevance hypothesis that corporate innovation acts as a resource to enable a firm to get positive abnormal returns in the capital market. Our results also remained consistent when we introduced investors' sentiments to our analysis and found out that in the presence of noise trading and investors' biasedness, the abnormal stock returns of innovative firms remained positive. This study will shed light on the role of corporate innovation in finance and motivate stakeholders to encourage innovation in firms. Moreover, we also hope to provide an insight for investors to consider innovation while formulating their investment decisions.

Keywords:

Corporate Innovation, Stock Returns, Investor Sentiment

Introduction

Our study aims to investigate how corporate innovation impacts stock returns in the presence of market-wide investor sentiments. Corporate innovation has become a research focus and a point of debate for academics and practitioners alike (Boubakri, Chkir, Saadi & Zhu, 2021; Jia, 2018; Romer, 1986; Solow, 1956). Previous studies have highlighted the importance of corporate innovation for firms in enhancing competitive advantage (Chang, Fu, Low & Zhang, 2015; Hirshleifer, Low & Teoh, 2012; Kim & Choi, 2020). Moreover, previous studies are much more concerning with finding the firm-level drivers of innovation activities such as CEO compensation schemes, ownership structure, corporate governance, and financing choices (Cho, Halford, Hsu & Ng, 2016; Manso, 2011). In addition to firm-level characteristics, corporate innovation has also been examined with firm external characteristics that include the role of institutional investors, financial analysts, and hedge funds in the formulation of innovation strategy (Jia, 2018).

In contrast to the above studies, only a handful of studies have examined the role of corporate innovation in the capital market (Jia, 2018). Corporate innovation activities involve a high probability of failure, and the process is also associated with unpredictability and idiosyncrasy. Corporate innovation requires extraordinary tolerance for failure, and it is tough to motivate the managers to undertake innovation on a standard pay-for-performance incentive scheme (Holmstrom, 1989). In contrast to capital acquisition and expenditures, corporate innovation results in intangible assets from a risky process with a high likelihood of failure and minor prospects for positive abnormal returns. Hence, financing the innovation activity is a troublesome task for managers. As far as debtholders are concerned, they are more risk-averse and focus on short-term incentive whereas returns from corporate innovation are reaped in the long term (Hall & Lerner, 2010). Moreover, banks are also reluctant to finance the innovative project because they are less tolerant to risky experimentation (Atanassov, 2016). On the other hand, both efficient and inefficient financial market theories believe that equity values are positively related to business investments, which comprise both tangible and intangible assets (Dong, Hirshleifer & Teoh, 2017). According to Tobin's (1969) Q-theory of investment, higher equity values represent greater growth prospects, and whether these high valuations are directed toward corporate innovation, then the firm should achieve higher innovation output like patents, products, or techniques. Moreover, the failure of innovative projects may also cause a sharp decline in the stock prices and may trigger the margin call of a stock pledge (Pang & Wang, 2020).

In the contemporary world, corporate innovation has become the company's core competency (Jia, 2017). Firms especially that are knowledge-intensive emphasize significantly allocating resources and their capacity to foster innovation activities. Corporate innovation positively influences the firm's performance (He & Wong, 2004; Smith & Tushman, 2005). Corporate innovation is also considered a significant contributor to economic development (Kong, Wang & Zhang, 2020). Moreover, corporate innovation is also seen as making the firms more resilient to trade shocks (Hombert & Matray, 2018); they also found out that R&D-intensive firms in the USA downsize considerably less in the event of rising trade competitions from China.

Given the severity of the issue related to financing and implementation of corporate innovation, a financial manager must understand when to allocate resources & implement strategies to make an entity resilient to adverse external forces. The predominant characteristics of resilient organizations include assessing & adjusting strategy in response to a rapidly changing business & social environment proactively & continually. The financial crisis of 2008, trade liberalization & intensity of competition have broadened the role of managers where they are responsible for thwarting off business failures and endure financial distress caused by the security market turbulence. In this situation, innovation is often looked upon as a protective shield that guards against adverse market conditions such as competition, economic recession, & default vulnerability by letting the firm move forward in terms of quality, differentiation, & proactiveness. Firms that pursue innovation and product quality up-gradation can compete well in the market (Leamer, 2007). Hence, in this study, the authors aim to highlight the market-driven factor investors sentiment that can trigger the managers to implement the corporate innovation activity.

This research attempts to fill gaps in the previous literature by addressing several questions. Does a corporation that possesses intangible resources such as research and development, patents, and citations from innovation activities receive higher abnormal returns? What is the impact of market-wide investors' sentiment on the stock returns of innovative firms? Answering these questions shall contribute significantly to the existing literature on corporate innovation and its implications for capital market dynamics. Furthermore, it would be worthwhile to check how emotions, sentiments, and behaviors influence the stock returns of innovative firms.

Literature Review

Corporate Innovation

Generally, corporate innovation is defined as the planning and executing of new and unique ideas (Van de Ven, 2017). Although, despite the availability of various studies, there is still a lack of consensus on a single definition of innovation. The main reason lies in the segregation of innovation into different categories by the researchers. Innovation was first classified as technical and administrative innovation (Daft, 1978), in which the technical aspect includes products, services, and production processes up-gradation and improvements (Daft, 1978; Damanpour, 1991; Knight, 1967). Innovation related to management's structural changes and administrative procedures is considered administrative innovation (Kimberly & Evanisko, 1981). Utterback (1971) defined product innovation as producing new products and services aimed at creating new markets or satisfying existing markets/customers. Non-routine alterations that bring out drastic changes in carrying out core activities are known as radical changes. In contrast, incremental changes result from the continuous struggle for improvement embedded in the organization's routine activities (Dewar & Dutton, 1986). Jia (2018) has further identified types of corporate innovation strategy; an exploration that involves path-breaking, disruptive changes, and the pursuit of new opportunities and an exploitive that focuses on improving existing technology and processes.

In the literature of finance and economics, various indicators of corporate innovation have been discussed, along with their strengths and limitations. Jung & Kwak (2018) emphasized that technological advances are primarily dependent on the internal Research and Development (R&D) activities of the firm; however, some studies are critical of the use of R&D as the measure of corporate innovation, especially when innovation is the result of external sources rather than the product of internal R&D activity (Hall, Mairesse & Mohnen, 2010). Moreover, R&D refers to the expenditure incurred to produce output but does not qualify to express the outcome of the innovation process (Freeman, 2013). Hence, R&D is dedicated as the input measure of corporate innovation.

The recent studies concerning corporate innovation, e.g. (Hasan, Hoi, Wu & Zhang, 2020; Jia, 2018; Li, Shan, Tian & Hao, 2020; Mazouz & Zhao, 2019), utilized the data on patents and citations to explore the implications and effect of corporate innovation on various aspects of finance, economics, and management. The seminal work of Kogan, Papanikolaou, Seru & Stoffman (2017) proposed a new measure of corporate innovation along with its economic importance. The predictions associated with their novel measure were also consistent with Schumpeterian growth models of growth, reallocation, and creative destruction; hence, they concluded that patents and citation measures are a reliable proxy to evaluate corporate innovation performance.

Investor Sentiment

Investor's sentiment is defined as the excess optimism or pessimism related to the stock's performance, and it also reflects the misperceptions of noise traders regarding future prices (Shefrin, 2008). The misperception of price has been attributed to various reasons, presence of investors under-reaction and overreaction (Bathia & Bredin, 2018), the fact that mispricing occurs when investors trading is based upon noise rather than fundamentals (De Long, Shleifer, Summers & Waldmann, 1990). It is also well known that global and local sentiments are contrarian predictors of market stock returns (Baker, Wurgler & Yuan, 2012). Stambaugh, Yu & Yuan (2012) investigated the role of investor sentiment in the prediction of cross-sectional stock returns; during periods of high investor sentiment, noise traders are also more bullish and aggressively trade high beta stocks. (Antoniou, Doukas & Subrahmanyam, 2016).

There are three categories of measuring investor sentiment: survey-based sentiment, market-based sentiment, and textual analysis-based sentiment. The survey-based measure is criticized for biasedness on the interviewee's part (Singer & Ye, 2013). Moreover, the quality of textual-based measure relies extensively on selecting the right words that comprehensively narrated good and bad news (Ding, 2018). The market-based measure also possesses some deficiencies since it is derived from an equilibrium of other economic forces than investor sentiment. Still, it has the advantage over others, mainly when the study is conducted to associate market anomalies. The market-based metric is modified on a regular basis. The market-based measure includes data on trading volume, the number of initial public offerings, first-day returns on IPOs, closed-end fund discount, dividend-paying stock premium, mutual fund flows, insider trading, and option implied volatility.

Corporate Innovation, Investor Sentiment & Abnormal Stock Returns

We base our hypothesis on a value relevance perspective, arguing that corporate innovation can allow firms to achieve higher stock returns, a proxy for long-term success (Chen, Leung & Evans, 2018). Another alternative point in the q-theory is how business creativity can result in higher stock returns (Cochrane, 1991; Zhang, Khan, Lee & Salik, 2019). It says that firms with creativity capability have a greater return on investment and, therefore, more profitability; thus, higher profitability expects higher return because it means that the company bought assets at a discount and bears a high-risk premium.

Several studies have found a connection between the R&D measure of corporate innovation & stock returns. Lev, Nissim & Thomas (2005) discovered a connection between changes in R&D and abnormal stock returns. Furthermore, Eberhart, Maxwell & Siddique (2008) discovered that increased R&D investment resulted in significant positive abnormal stock returns and operational outcomes. Furthermore, studies have been conducted to determine the predictability of organisational innovation returns using firm-level characteristics. Li (2011) shows that when a company's R&D strength is clarified, it can predict stock return with greater robustness. The emergence of risk is frequently cited as a factor in justifying the number of stock returns produced by R&D. According to Chambers, Jennings, and Thompson (2002), contend that the positive relationship between R&D investment and excessive returns derives from missing risk factors rather than mispricing.

The production measure of innovation, i.e., patent and citation counts, also include valuation information. Pandit, Wasley & Zach (2011) discovered a connection between patent citations and future operational results. Good stock returns and potential profits have been linked to an increase in patent and citation counts (Gu, 2005; Matolcsy & Wyatt, 2008). Hirshleifer, Hsu & Li (2013) created a new measure of corporate innovation known as innovation efficiency and discovered that it is a good predictor of potential returns after adjusting for firm characteristics and risk.

Hence it is established that corporate innovation influences the stock return through mispricing. We are of the view that market imperfections affect the association between corporate innovation & stock returns. We propose that changes in the investor sentiments influence the role of corporate innovation in determining stock returns. The significance of investor sentiment in affecting security prices has been well documented in various studies. Baker and Wurgler (2006) show that sentiments largely impact those subjective and difficult to arbitrage, and innovative firms completely fit this standard (Hirshleifer et al., 2013). Bathia & Bredin (2018) incorporated investor sentiment to capture the impact of size, value, and liquidity, and momentum effects on stock returns. They concluded that it empowers the performance of the asset pricing model. Therefore, we draw our hypothesis as follows:

Hypotheses 1: Ceteris paribus, firms with a high level of R&D are associated with positive abnormal stock returns.

Hypothesis 2: Ceteris paribus, firms with a higher number of Patents are associated with positive abnormal stock returns.

Hypothesis 3: Ceteris paribus, firms with a higher number of Citations are associated with positive abnormal stock returns.

Hypotheses 4: Following investor sentiments, firms with a high level of R&D are associated with positive abnormal stock returns.

Hypothesis 5: Following investor sentiments, firms with a higher number of Patents are associated with positive abnormal stock returns.

Hypothesis 6: Following investor sentiments, firms with a higher number of Citations are associated with positive abnormal stock returns.

Methodology

Sample Description

We used a sample of all companies included in the S&P 100 index for 2013-2018. We categorize these firms according to their industry. Additionally, we filtered by the data measurement requirements for each research variable and included those firms that consistently remained in the S&P 100 index for six years. Moreover, we excluded those firms that belong to the financial sector as the type of innovation and accounting data of those firms is different. It is worth analyzing S&P 100 because these firms have the highest capitalization in the USA, and any exogenous factors such as investors' sentiment directly influence these firms' returns and investment behaviour. Hence, the results of our study shall benefit a large audience. We obtained 75 firms as a result, for a total of 450 firm years observations. The distribution of the research sample by industry is shown in Table 1.

| Table1 Sample distribution by industry |

||

|---|---|---|

| Industry | Number of Firms | Observation |

| Communication Services | 9 | 54 |

| Consumer Discretionary | 7 | 42 |

| Consumer Staples | 10 | 60 |

| Energy | 3 | 18 |

| Health Care | 13 | 78 |

| Industrials | 12 | 72 |

| Information Technology | 13 | 78 |

| Materials | 2 | 12 |

| Real Estate | 2 | 12 |

| Utilities | 2 | 12 |

| Total | 75 | 450 |

The research sample is constituted of firms from every sector. The healthcare, IT and industrial sector comprise nearly 60% of our observations. The industries that have the least number of observations are utilities, real estate, and material.

Modelling Abnormal Stock Returns

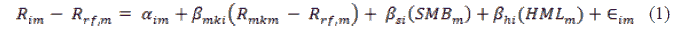

The stock returns indicate a firm's financial performance (Fama & French, 1992, 1993). We employ a three-factor Fama-French model to estimate stock returns and obtain risk-adjusted stock returns. The central idea behind this selection is that the FF model derives performance measure from financial theory more concretely (Srinivasan & Hanssens, 2018) than from the Capital Asset Pricing Model (Lintner, 1965; Sharpe, 1964). Additionally, the three-factor FF model has gained considerable attention in the finance literature (Angulo-Ruiz, Donthu, Prior & Rialp, 2018). The three-factor FF model is specified as follows:

where Rim denotes the monthly return on stock i in month m, R rf,mdenotes the monthly risk-free return in month m, R mkm denotes the monthly market return in month m, and, Rmkm denotes the monthly return on a value in month m. weighted portfolio of small companies minus the return on a value investment weighted portfolio of large companies for the month m,, and HMLm = = monthly return on a value. -weighted portfolio of stocks with a high book-to-market ratio minus the return on a value investment -weighted portfolio of stocks with a low book-to-market ratio for the month m.

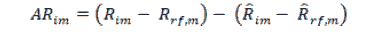

For each firm i and period m, the abnormal returns ( AR im) are obtained as the residual of Eq. (1), as follows:

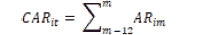

Since the current study annually examines the relationship between corporate innovation and stock returns, cumulative stock returns are calculated as follows:

where: CARit= Annual cumulative abnormal stock returns of stock i in year t.

When modelling annual abnormal stock returns as a dependent variable, finance and accounting literature employs measures taken one quarter prior to fiscal year end. This quarter-ahead indicator verifies that capital market participants have updated their expectations in light of new information. Therefore, CAR it is defined as a one-quarter ahead of fiscal year end measure. Thus, if firm i's fiscal year ends in December of year t, CAR is calculated from the end of March of year t to the end of March of year t + 1 for firm i.

Measuring Corporate Innovation

We employ data from (Kogan et al., 2017) to measure the corporate innovation of a firm. It reports all the patents issued by the US Patent and Trademark Office (USPTO). In this database, the firm's identification is given by CRSP permanent number identifier and the number of patents filed by the firms, and the citations received against that patent. We proxy the firm's innovation activity by using three metrics. A simple count of the number of patents the firm applied for each year is the first measure; secondly, we measure the number of citations received by the patents that the firm applied for each year. The third measure is the ratio of firm R&D expenditure scaled to total assets.

Measuring Investor Sentiment

Following Baker & Wurgler (2006), a composite index of investor sentiment is constructed using the common variations in six underlying sentiment indicators: the closed-end fund discount, NYSE share turnover, the number and average first-day returns on initial public offerings, the equity share in a new issue, and the dividend premium. Annually, sentiment proxies are calculated. Each sentiment proxy is likely to contain both sentiment and non-sentiment-related components. Finally, principal component analysis is used to identify the shared component.

Modelling Stock Returns

We employ data from (Kogan et al., 2017) to measure the corporate innovation of a firm. It reports all the patents issued by the US Patent & Trademark Office (USPTO). In this database, the firm's identification is given by CRSP permanent number identifier and the number of patents filed by the firms, and the citations received against that patent. We proxy the firm's innovation activity by using three metrics. A simple count of the number of patents the firm applied for each year is the first measure; secondly, we measure the number of citations received by the patents that the firm applied for each year. The third measure is the ratio of firm R&D expenditure scaled to total assets.

Measuring Control Variable

Following the corporate innovation literature, this study includes free cash flow to operating cash flow, advertisement to sales, market to book value, debt ratio, return on assets and return on equity.

The variables in Table 2 are listed along with their operationalization and data sources. Secondary data were analysed in this study. COMPUSTAT and the CRSP provided financial and control data. Corporate innovation data were gathered from a variety of sources, as detailed below, while investor sentiment data came from the National Bureau of Economic Research (NBER).

| Table 2 Variable & Sources Of Data |

|||

|---|---|---|---|

| Variable | Operationalization | Symbol | Data Source |

| Monthly Stock | ??? = [(??? + ??,?) - ??(?-1)]/??(?-1) The price of stock i at the last trading day of the month is denoted by ???, whereas ??,?is dividend and ??(?-1)is the stock price of stock i at the last trading day of previous month. | - | CRSP |

| Returns | |||

| Risk-free return, | As obtained from Kenneth French | - | - |

| market return, | |||

| website | |||

| SMB and HML | |||

| CAR | Log of CAR estimated through | CAR | Self-estimated |

| equation (3). | |||

| Research and | Research and development | XRD | Compustat |

| Development | expenditure scaled by total assets. | ||

| Number of Patents | Number of Patents filed by firm i in | NPAT | ( Kogan et al., |

| year t scaled by total assets. | 2017) | ||

| Number of | Number of Citations on patents of | NCITE | (Kogan et al., |

| Citations | firm i in year t scaled by total assets. | 2017) | |

| The composite index of investor | Sent | NBER | |

| sentiment is constructed using the | |||

| common variations in six underlying | |||

| Investors | sentiment indicators: the closed-end | ||

| Sentiments | fund discount, NYSE share turnover, | ||

| the number and average first-day | |||

| returns on initial public offerings, the | |||

| equity share in the new issue, and the | |||

| dividend premium. | |||

| Return on Assets | Earning after interest and tax scaled | ROA | Compustat |

| by total assets. | |||

| Return on Equity | Earning after interest and tax scaled | ROE | Compustat |

| by total equity. | |||

| Free Cash Flow | Free cash flow to operating cash | FCF | Compustat |

| flow. | |||

| Market to book | The market value of equity divided | MBV | Compustat |

| ratio | by the book value of equity in year t. | ||

| Leverage | Book value of debt divided by book | LEV | Compustat |

| value of total assets. | |||

| Asset Turnover | Total sales divided by total assets. | ATO | Compustat |

| Advertisement | Total advertisement expenses scaled | ADV | Compustat |

| by total assets. | |||

Results

Firstly, we emphasize descriptive statistical findings regarding dependent, independent, and moderating variables. It contains the mean, minimum and maximum values, as well as the standard deviation. This analysis will complete our preliminary test by determining the extent to which these variables deviate from their mean, maximum, and minimum values. The following tables summarise the descriptive and correlational statistics performed on the variables.

Based on the information provided in Table 2, CAR has a mean value of 0.134, with a maximum value of 3.441 and a minimum value of -0.527, while the standard deviation is 0.219.

In addition to this, the results in Table 3 show that the minimum value of corporate innovation variables XRD, NPAT, NCITE is 0, which means we also have firm years in our sample which did not engage in innovation activity. The maximum value of XRD, NPAT, NCITE are 0.320, 0.076, and 0.090, and the standard deviation is 0.081, 0.010, and 0.008, respectively. We also obtain information on the mean investors' sentiment measured using SENT of 0.056 and having standard deviation, minimum value, and maximum value of 0.086, 0.174, and 0.066, respectively. Moreover, information of control variables ROA, ROE, FCF, MBV, LEV, ATI, and ADV is also provided in which ATO has the variations, and ROE has the maximum value.

| Table 3 Descriptive Statistics |

|||||

|---|---|---|---|---|---|

| Variable | Observation | Mean | Std. Dev. | Min | Max |

| CAR | 450 | 0.134 | 0.219 | -0.527 | 3.441 |

| XRD | 450 | 0.064 | 0.081 | 0.000 | 0.320 |

| NPAT | 450 | 0.005 | 0.010 | 0.000 | 0.076 |

| NCITE | 450 | 0.002 | 0.008 | 0.000 | 0.090 |

| SENT | 450 | 0.056 | 0.086 | 0.174 | 0.066 |

| ROA | 450 | 0.165 | 0.086 | 0.046 | 0.626 |

| ROE | 450 | 0.285 | 0.508 | 0.791 | 5.040 |

| FCF | 450 | 0.583 | 0.449 | 3.348 | 1.000 |

| MBV | 450 | 0.332 | 0.264 | 0.007 | 1.437 |

| LEV | 450 | 0.633 | 0.199 | 0.096 | 1.356 |

| ATO | 450 | 0.807 | 0.592 | 0.100 | 3.710 |

| ADV | 450 | 0.022 | 0.034 | 0.000 | 0.357 |

In the Table 4 of the correlation matrix, the correlation of CAR is positive with variables XRD, NPAT, NCITE, and SENT, but the degree of association with these variables is not substantial. Especially in ATO and ADV, the association level is limited up to 0.0269 and 0.031, respectively. At the same time, all the other variables have a negative association with CAR. Moreover, the degree of relationship is very weak in negative cases. The negative association with the other variables is of the significant amount above 0.20, and in the case of LEV, the association is -0.3458. It means that leverage is negatively related to abnormal stock returns.

| Table 4 Correlation Matrix |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CAR | XRD | NPAT | NCITE | SENT | ROA | ROE | FCF | MBV | LEV | ATO | ADV | |

| CAR | 1.000 | |||||||||||

| XRD | 0.152 | 1.000 | ||||||||||

| NPAT | 0.176 | 0.294 | 1.000 | |||||||||

| NCITE | 0.198 | 0.162 | 0.527 | 1.000 | ||||||||

| SENT | 0.122 | -0.015 | 0.140 | 0.283 | 1.000 | |||||||

| ROA | -0.068 | 0.066 | 0.082 | 0.026 | 0.011 | 1.000 | ||||||

| ROE | -0.084 | -0.124 | 0.031 | -0.008 | -0.039 | 0.343 | 1.000 | |||||

| FCF | -0.044 | 0.207 | 0.113 | 0.017 | 0.002 | 0.373 | 0.176 | 1.000 | ||||

| MBV | -0.121 | -0.285 | -0156 | -0.069 | 0.062 | -0.438 | -0.339 | -0.368 | 1.000 | |||

| LEV | -0.068 | -0.346 | -0.175 | -0.113 | -0.097 | -0.084 | 0.335 | -0.140 | -0.103 | 1.000 | ||

| ATO | 0.027 | -0.294 | -0.028 | 0.032 | 0.039 | 0.229 | 0.220 | 0.035 | -0.320 | 0.130 | 1.000 | |

| ADV | 0.031 | 0.009 | -0.037 | 0.019 | 0.010 | 0.067 | -0.018 | 0.020 | -0.160 | 0.046 | -0.062 | 1.000 |

As the unequal variation among variables. We have applied the most widely used Breusch-Pagan test for the calculation of the heteroskedasticity problem. As shown in table 5 all our models have the presence of heteroscedasticity. Therefore, the authors have applied the relevant statistically estimating technique for each model keeping because of the above-stated facts.

| Table 5 Heteroskedasticity Test |

||||

|---|---|---|---|---|

| Null Hypothesis (Ho): Constant variance | ||||

| Statistics | Notation | p-value | ||

| Model 1 | 37.89 | χ2 | 0.0000 | |

| Model 2 | 42.64 | χ2 | 0.0000 | |

| Model 3 | 44.99 | χ2 | 0.0000 | |

| Model 4 | 53.62 | χ2 | 0.0000 | |

| Model 5 | 43.04 | χ2 | 0.0000 | |

| Model 6 | 46.77 | χ2 | 0.0000 | |

Table 6 shows the multicollinearity among variables. The mean VIF is less than 5, hence it can be concluded that there is no multicollinearity in our variables.

| Table 6 Test for Multi-Collinearity |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |||||||

| Variable | VIF | 1/VIF | VIF | 1/VIF | VIF | 1/VIF | VIF | 1/VIF | VIF | 1/VIF | VIF | 1/VIF |

| XRD | 1.62 | 0.617710 | 2.05 | 0.488744 | ||||||||

| NPAT | 1.10 | 0.905822 | 1.16 | 0.861914 | ||||||||

| NCITE | 1.11 | 0.901464 | 2.91 | 0.343156 | ||||||||

| SENT | 1.02 | 0.981772 | 1.11 | 0.904365 | 1.04 | 0.960933 | 1.65 | 0.605369 | 1.12 | 0.893280 | 1.27 | 0.785761 |

| ROA | 1.47 | 0.678189 | 1.47 | 0.681249 | 1.47 | 0.681407 | 1.48 | 0.677573 | 1.47 | 0.681241 | 1.47 | 0.680071 |

| ROE | 1.41 | 0.709982 | 1.40 | 0.715854 | 1.40 | 0.714351 | 1.41 | 0.709399 | 1.40 | 0.715771 | 1.40 | 0.714215 |

| FCF | 1.30 | 0.769925 | 1.30 | 0.770108 | 1.30 | 0.770768 | 1.30 | 0.769907 | 1.30 | 0.769921 | 1.30 | 0.770517 |

| MBV | 1.97 | 0.507728 | 1.57 | 0.637716 | 1.60 | 0.623285 | 1.97 | 0.507694 | 1.58 | 0.634658 | 1.61 | 0.623009 |

| LEV | 1.42 | 0.704867 | 1.26 | 0.793152 | 1.29 | 0.775855 | 1.42 | 0.704523 | 1.27 | 0.788170 | 1.29 | 0.775855 |

| ATO | 1.43 | 0.700499 | 1.19 | 0.843641 | 1.19 | 0.837418 | 1.43 | 0.700473 | 1.19 | 0.842422 | 1.19 | 0.836885 |

| ADV | 1.07 | 0.933501 | 1.05 | 0.950406 | 1.06 | 0.943250 | 1.07 | 0.933188 | 1.05 | 0.950367 | 1.06 | 0.943244 |

| SENT*XRD | 2.09 | 0.479235 | ||||||||||

| SENT*NCITE | 2.88 | 0.346809 | ||||||||||

| SENT*NPAT | 1.27 | 0.788377 | ||||||||||

| Mean VIF | 1.41 | 1.27 | 1.27 | 1.59 | 1.62 | 1.30 | ||||||

Corporate Innovation & Abnormal Stock Returns

We conduct tests to determine the validity of our hypothesis. This test is used to determine the extent to which corporate innovation affects the abnormal stock returns of firms. To begin, we used the Breusch Pagan LM Test to select the appropriate model. Second, we analyzed the test results to determine the proper model. The Breusch Pagan LM Test had a significance level of 0.000. In light of the results, we chose the Generalized Least Square technique to test our hypotheses.

Table 7 shows the results of the first three models. It shows that the primary variable corporate innovation that we measure using XRD reflects the significance of 0.045, significant at the level of 5% with a positive direction. The result shows that control variables MBV is significant at 1% level of significance while FCF and ROA are significant at 5% significance level. However, all other control variables showed no significance.

| Table 7 Regression Model Estimation |

||||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | ||||

| Dependent Variable is CAR | ||||||

| Regressors | (General Least Square Regression, FGLS) | |||||

| Coefficient | P-value | Coefficient | P-value | Coefficient | P-value | |

| XRD | 0.314 | 0.045 | - | - | - | - |

| NPAT | - | - | 3.015 | 0.003 | - | - |

| NCITE | - | - | - | - | 4.301 | 0.001 |

| SENT | 0.327 | 0.005 | 0.275 | 0.019 | 0.216 | 0.075 |

| ROA | -0.301 | 0.035 | -0.312 | 0.027 | -0.309 | 0.029 |

| ROE | -0.315 | 0.188 | -0.039 | 0.098 | -0.0372 | 0.117 |

| FCF | -0.044 | 0.081 | -0.043 | 0.086 | -0.039 | 0.112 |

| MBV | -0.160 | 0.003 | -0.184 | 0.000 | -0.194 | 0.000 |

| LEV | -0.044 | 0.470 | -0.055 | 0.336 | -0.066 | 0.240 |

| ATO | 0.167 | 0.404 | 0.005 | 0.792 | 0.000 | 0.998 |

| ADV | 0.045 | 0.884 | 0.042 | 0.893 | -0.033 | 0.913 |

| constant | 0.283 | 0.000 | 0.313 | 0.000 | 0.328 | 0.000 |

The results of model 1 are consistent with our predictions, that corporate innovation measure by research & development has a significant impact on the firm's abnormal stock returns. The R&D intensity provides a competitive edge to the firm that translates into new products and innovativeness and as a result, the shareholders benefit from this investment decision and earn a higher-than-normal rate of return. Our results also confirm the first hypotheses that corporate innovation is positively associated with abnormal stock returns. The coefficients on the control variables are generally consistent with prior studies. Firms that are a higher market to book ratio, higher free cash flow and higher ROA are associated with negative abnormal returns. The main reason behind this phenomenon is that these variables are already responsible for the excess return from the risk model and hence the information contained in these variables is already embedded in the market in line with the efficient market hypothesis.

The result of models 2 and 3 are also consistent with our prediction and support our hypotheses. The results show that variable NPAT and NCITE have a significant positive effect on abnormal stock returns at 1% level of significance. The number of patents and citations positively affect abnormal stock returns. This means that the presence of intangible assets in the form of patents is resourceful for the firms to generate abnormal stock returns for the investors. Our results are in line with the resource-based view and other value relevance propositions. The results also support our hypothesis 2 and 3.

The results show that the investor sentiments influence the abnormal stock returns independently. This finding is in line with the previous literature that studied the role of investor sentiments (Baker & Wurgler, 2006). It means that noise trading, behaviours, and market-wide investors sentiments play a vital role in security mispricing. Moreover, our results also state the notion that firms earn positive abnormal returns following optimistic investors sentiments.

Corporate Innovation, Investor Sentiment and Abnormal Stock Returns

We conducted further tests to answer our fourth, fifth and third hypotheses to examine the moderating role of investor sentiments in the relation between corporate innovation and abnormal stock returns. To test the moderating role of investors sentiments, we conducted three separate tests using the Generalized Least Square technique after thoroughly checking for any multicollinearity & heteroskedasticity. Hence the appropriate model for this relationship is also examined in detail.

Based on table &, we obtain concrete evidence that the role of investors sentiment is amplified for firms that undertake innovation activity. The significance level of the moderating effect of investors' sentiment with corporate innovation variables measured as SENT*XRD,

| Table 8 Regression Model Estimations |

||||||

|---|---|---|---|---|---|---|

| Model 4 | Model 5 | Model 6 | ||||

| Dependent Variable is CAR | ||||||

| Regressors | (General Least Square Regression, FGLS) | |||||

| Coefficient | P-value | Coefficient | P-value | Coefficient | P-value | |

| SENT*XRD | 3.021 | 0.036 | ||||

| SENT*NPAT | - | - | 20.189 | 0.065 | ||

| SENT*NCITE | - | - | 94.461 | 0.005 | ||

| SENT | 0.135 | 0.364 | 0.173 | 0.181 | 0.178 | 0.140 |

| ROA | -0.292 | 0.040 | -0.301 | 0.033 | -0.308 | 0.028 |

| ROE | -0.033 | 0.167 | -0.039 | 0.091 | -0.036 | 0.121 |

| FCF | -.0438403 | 0.081 | -0.042 | 0.091 | -0.0387 | 0.119 |

| MBV | -.1611468 | 0.002 | -0.186 | 0.000 | -0.203 | 0.000 |

| LEV | -.0408296 | 0.497 | -0.055 | 0.335 | -0.079 | 0.160 |

| ATO | .0165157 | 0.409 | 0.003 | 0.827 | -0.002 | 0.917 |

| ADV | .0573303 | 0.853 | 0.040 | 0.896 | -0.039 | 0.898 |

| constant | .2694361 | 0.000 | 0.307 | 0.000 | 0.342 | 0.000 |

SENT*NPAT and SENT*CITE all significant at 5%, 5%, and 10%, respectively. In this test, we also obtain information on the direction of the coefficient. Investors' sentiment has a positive and significant impact on firms' abnormal stock returns with higher research and development expenditure, number of patents, and citations. This finding is novel evidence for the academicians and practitioners of finance because the moderating impact of investors' sentiment on the relationship between corporate innovation and abnormal stock return is still a new concept.

Our results also confirm our fourth, fifth, and sixth hypotheses. We proposed that, following investor sentiment, innovative firms enjoy higher abnormal stock returns than those who do not pursue corporate innovation. Our results also prove that corporate innovation provides a competitive advantage for firms and stakeholders who can differentiate their returns based on corporate innovation even among the highly capitalized firms such as S&P 100.

Conclusions

Our study examined the association between corporate innovation and abnormal stock returns in the presence of investor sentiment. We used data from all non-financial firms included in the S&P 100 for this analysis. The test results concluded that corporate innovation causes positive abnormal stock returns, and the magnitude of this relationship is increased in the presence of optimistic market-wide investors sentiments. We found significant results for both of our independence as well as moderating variables. The results are also consistent with the studies conducted to check the effect of corporate innovation on firm performance. At the same time, we also contributed to the literature that examined the role of investor sentiments in the security market (Fisher et al., 2000).

This research work will contribute to the world of corporate finance literature in many fold aspects. Firstly, in the development of the MM theory, which denotes that the market value of the corporate firms is dependent on the earning power rather than the modes of financing (Debt or equity) (Modigliani & Miller, 1958). However, later many scholars have added various constructs to this theory, like the pay-out behavior of the firm. Keeping in view the scenario mentioned above, it is noted that the theory revolves around the internal decision-making of the company's capital structure but completely ignores the external environment like positive investment behaviors of individuals or companies towards the sustainable competitive advantage through innovative activities. Secondly, under the purview of the resource-based view, this sustainable competitive advantage can be achieved by accumulating the resources. These resources can be attained through corporate innovation, which creates a conducive environment for investments and pools the company's resources to maximize shareholder wealth.

Many studies have addressed the issues relating to the investor sentiments towards the innovation in a scattered way. However, no study found that investigated the relationship between corporate innovation, investor sentiments, and stock returns in a systematic way. Further, this study provides the solution to the company's top management to enhances their resources and attain a sustainable competitive advantage over others and maximizes the shareholder wealth at the same time.

Our study has some limitations. First, we only used the observations from the S&P100. Future studies can broaden their scope and make comparisons by incorporating additional indexes or cross-country data. Second, in terms of time, we collected data only from 2013 to 2018. We recommend collecting data with a longer time dimension for future studies to expand and deepen the study.

Author Contributions

Conceptualization, SM, and NS.; Data curation, ARE, and GA; Formal analysis, SM, and NS; Funding acquisition, SM; Investigation, GA; Methodology, SM, and NS; Project administration, NS; Resources, GA; Software, ARE; Supervision, NS; Validation, SM; Writing—original draft, SM; Writing—review and editing, ARE, and SA. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aggarwal, V., Hsu, D., & Wu, A. (2015). R&D Production Team Organization & Firm-Level Innovation. Angulo-Ruiz, F., Donthu, N., Prior, D., & Rialp, J. (2018). How does marketing capability impact abnormal stock returns? The mediating role of growth. Journal of Business Research, 82, 19-30.

- Antoniou, C., Doukas, J.A., & Subrahmanyam, A. (2016). Investor sentiment, beta, and the cost of equity capital. Management Science, 62(2), 347-367.

- Arrow, K.J. (1972). Economic welfare & the allocation of resources for invention. In Readings in industrial economics (pp. 219-236): Springer.

- Aryal, G., Mann, J., Loveridge, S., & Joshi, S. (2018). Exploring innovation creation across rural and urban firms. Journal of Entrepreneurship & Public Policy.

- Atanassov, J. (2016). Arm’s length financing & innovation: Evidence from publicly traded firms. Management Science, 62(1), 128-155.

- Atanassov, J., Julio, B., & Leng, T. (2015). The bright side of political uncertainty: The case of R&D. Available at SSRN 2693605.

- Baker, M. (2009). Capital market-driven corporate finance. Annu. Rev. Financ. Econ., 1(1), 181-205.

- Baker, M., Stein, J.C., & Wurgler, J. (2003). When does the market matter? Stock prices & the investment of equity-dependent firms. The quarterly journal of economics, 118(3), 969-1005.

- Baker, M., & Wurgler, J. (2002). Market timing & capital structure. The journal of finance, 57(1), 1-32.

- Baker, M., & Wurgler, J. (2006). Investor sentiment & the cross?section of stock returns. The journal of finance, 61(4), 1645-1680.

- Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. Journal of economic perspectives, 21(2), 129-152.

- Baker, M., Wurgler, J., & Yuan, Y. (2012). Global, local, & contagious investor sentiment. Journal of financial economics, 104(2), 272-287.

- Barber, B.M., & Lyon, J.D. (1997). Detecting long-run abnormal stock returns: The empirical power & specification of test statistics. Journal of financial economics, 43(3), 341-372.

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of management, 17(1), 99-120.

- Bathia, D., & Bredin, D. (2013). An examination of investor sentiment effect on G7 stock market returns. The European Journal of Finance, 19(9), 909-937.

- Bathia, D., & Bredin, D. (2018). Investor sentiment: Does it augment the performance of asset pricing models? International Review of Financial Analysis, 59, 290-303.

- Benveniste, L.M., & Spindt, P.A. (1989). How investment bankers determine the offer price and allocation of new issues. Journal of financial economics, 24(2), 343-361.

- Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of political economy, 81(3), 637-654.

- Boubakri, N., Chkir, I., Saadi, S., & Zhu, H. (2021). Does national culture affect corporate innovation? International evidence. Journal of Corporate Finance, 66, 101847.

- Burrel, G., & Morgan, G. (1979). Part 1: In search of a framework-1. Assumptions about the nature of social science; 2. Assumptions about the nature of society. BURREL, G; MORGAN, G. Sociological paradigms and organizational analysis. London.

- Burrell, G., & Morgan, G. (2006). Sociological paradigms & organizational analysis. Aldershot, Gower.

- Chambers, D., Jennings, R., & Thompson, R.B. (2002). Excess returns to R&D-intensive firms. Review of Accounting Studies, 7(2), 133-158.

- Chambers, D., Jennings, R., & Thompson, R.B. (2003). Managerial discretion and accounting for research and development costs. Journal of Accounting, Auditing & Finance, 18(1), 79-114.

- Chan, L. K., Lakonishok, J., & Sougiannis, T. (2001). The stock market valuation of research and development expenditures. The journal of finance, 56(6), 2431-2456.

- Chang, L.L., Hsiao, F.D., & Tsai, Y.C. (2013). Earnings, institutional investors, tax avoidance, & firm value: Evidence from Taiwan. Journal of International Accounting, Auditing and Taxation, 22(2), 98-108.

- Chang, X., Fu, K., Low, A., & Zhang, W. (2015). Non-executive employee stock options and corporate innovation. Journal of financial economics, 115(1), 168-188.

- Chen, J., Leung, W.S., & Evans, K.P. (2018). Female board representation, corporate innovation & firm performance. Journal of Empirical Finance, 48, 236-254.

- Chen, J., Leung, W.S., & Evans, K.P. (2018). Female board representation, corporate innovation and firm performance. Journal of Empirical Finance, 48, 236-254.

- Cho, C., Halford, J.T., Hsu, S., & Ng, L. (2016). Do managers matter for corporate innovation? Journal of Corporate Finance, 36, 206-229.

- Chung, S.L., Hung, C.H., & Yeh, C.Y. (2012). When does investor sentiment predict stock returns? Journal of Empirical Finance, 19(2), 217-240.

- Cochrane, J.H. (1991). Production?based asset pricing & the link between stock returns & economic fluctuations. The journal of finance, 46(1), 209-237.

- Crotty, M. (1998). The foundations of social research: Meaning & perspective in the research process. Sage.

- Cui, J., Jo, H., & Na, H. (2018). Does corporate social responsibility affect information asymmetry? Journal of Business Ethics, 148(3), 549-572.

- Czarnitzki, D., & Kraft, K. (2004). Firm leadership and innovative performance: Evidence from seven EU countries. Small Business Economics, 22(5), 325-332.

- Daft, R.L. (1978). A dual-core model of organizational innovation. Academy of management journal, 21(2), 193-210.

- Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of management journal, 34(3), 555-590.

- De Long, J.B., Shleifer, A., Summers, L.H., & Waldmann, R.J. (1990). Noise trader risk in financial markets. Journal of political economy, 98(4), 703-738.

- Dergiades, T. (2012). Do investors sentiment dynamics affect stock returns? Evidence from the US economy. Economics Letters, 116(3), 404-407.

- Derrien, F. (2005). IPO pricing in hot market conditions: Who leaves money on the table? The journal of finance, 60(1), 487-521. Dewar, R.D., & Dutton, J.E. (1986). The adoption of radical and incremental innovations: An empirical analysis.

- Management Science, 32(11), 1422-1433.

- Dicks, D.L., & Fulghieri, P. (2020). Uncertainty & contracting in organizations. Kenan Institute of Private Enterprise Research Paper (19-1).

- Ding, W. (2018). Investor sentiment & cross-sectional stock returns. Cardiff University,

- Dong, M., Hirshleifer, D., & Teoh, S.H. (2017). Stock market overvaluation, moon shots, & corporate innovation: National Bureau of Economic Research.

- Easton, P.D. (2004). PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. The Accounting Review, 79(1), 73-95.

- Eberhart, A., Maxwell, W., & Siddique, A. (2008). A reexamination of the tradeoff between the future benefit & riskiness of R&D increases. Journal of Accounting Research, 46(1), 27-52.

- Eberhart, A.C., Maxwell, W.F., & Siddique, A.R. (2004). An examination of long?term abnormal stock returns and operating performance following R&D increases. The journal of finance, 59(2), 623-650.

- Edmans, A., Goldstein, I., & Jiang, W. (2012). The real effects of financial markets: The impact of prices on takeovers. The journal of finance, 67(3), 933-971.

- Eisenhardt, K.M., & Martin, J. A. (2000). Dynamic capabilities: what are they? Strategic management journal, 21(10?11), 1105-1121.

- Fama, E.F., & French, K.R. (1992). The cross-section of expected stock returns. The journal of finance, 47(2), 427-465.

- Fama, E.F., & French, K.R. (1993). Common risk factors in the returns on stocks and bonds. Journal of financial economics, 33(1), 3-56.

- Fazzari, S., Hubbard, R.G., & Petersen, B. (1988). Investment, financing decisions, and tax policy. The American economic review, 78(2), 200-205.

- Fazzari, S.M. Hubbard, R.G., & Petersen, B.C. (2000). Investment-cash flow sensitivities are useful: A comment on Kaplan & Zingales. The quarterly journal of economics, 115(2), 695-705.

- Fisher, K.L., & Statman, M. (2000). Investor sentiment and stock returns. Financial Analysts Journal, 56(2), 16-23.

- Freeman, M. Goodwin, F., & Johnson, S. (2013). Achievement, innovation, & leadership in the affective spectrum. Paper presented at the 166 Annual Meeting of the American Psychiatric Association. San Francisco.

- Giniuniene, J., & Jurksiene, L. (2015). Dynamic capabilities, innovation and organizational learning: Interrelations and impact on firm performance. Procedia-Social and Behavioral Sciences, 213, 985-991.

- Griffith, R., Huergo, E., Mairesse, J., & Peters, B. (2006). Innovation and productivity across four European countries. Oxford review of economic policy, 22(4), 483-498.

- Groves, R.M., Singer, E., & Corning, A. (2000). Leverage-saliency theory of survey participation: Description and an illustration. The Public Opinion Quarterly, 64(3), 299-308.

- Gu, F. (2005). Innovation, future earnings, & market efficiency. Journal of Accounting, Auditing & Finance, 20(4), 385-418.

- Habermas, J. (1973). What does a crisis mean today? Legitimation problems in late capitalism. Social research, 643-667.

- Hall, B.H., & Lerner, J. (2010). The financing of R&D and innovation. In Handbook of the Economics of Innovation 1 Elsevier.

- Hall, B.H., Mairesse, J., & Mohnen, P. (2010). Measuring the returns to R&D. In Handbook of the Economics of Innovation 2, Elsevier.

- Han, X., & Li, Y. (2017). Can investor sentiment be a momentum time-series predictor? Evidence from China. Journal of Empirical Finance, 42, 212-239.

- Hasan, I., Hoi, C.K.S., Wu, Q., & Zhang, H. (2020). Is social capital associated with corporate innovation? Evidence from publicly listed firms in the US. Journal of Corporate Finance, 62, 101623.

- He, Z.L., & Wong, P.K. (2004). Exploration vs. exploitation: An empirical test of the impact of innovation strategy on firm performance.

- Hirshleifer, D., Hsu, P.H., & Li, D. (2013). Innovative efficiency & stock returns. Journal of financial economics, 107(3), 632-654.

- Hirshleifer, D., Low, A., & Teoh, S.H. (2012). Are overconfident CEOs better innovators? The journal of finance, 67(4), 1457-1498.

- Holmstrom, B. (1989). Agency costs & innovation. Journal of Economic Behavior & Organization, 12(3), 305-327.

- Hombert, J., & Matray, A. (2018). Can innovation help US manufacturing firms escape import competition from China? The journal of finance, 73(5), 2003-2039.

- Jia, N. (2017). Corporate innovation strategy, analyst forecasting activities and the economic consequences. Journal of Business Finance & Accounting, 44(5-6), 812-853.

- Jia, N. (2018). Corporate innovation strategy and stock price crash risk. Journal of Corporate Finance, 53, 155-173.

- Jung, S., & Kwak, G. (2018). Firm characteristics, uncertainty and Research and Development (R&D) investment: The role of size and innovation capacity. Sustainability, 10(5), 1668.

- Kahn, K.B. (2018). Understanding innovation. Business Horizons, 61(3), 453-460.

- Kim, H.D., Park, K., & Roy Song, K. (2019). Do long?term institutional investors foster corporate innovation? Accounting & Finance, 59(2), 1163-1195.

- Kim, J., & Choi, S.O. (2020). A comparative analysis of corporate R&D capability and innovation: Focused on the Korean manufacturing industry. Journal of Open Innovation: Technology, Market, & Complexity, 6(4), 100.

- Kim, J.S., & Chung, G.H. (2017). Implementing innovations within organizations: A systematic review and research agenda. Innovation, 19(3), 372-399.

- Kim, S.H., & Kim, D. (2014). Investor sentiment from internet message postings and the predictability of stock returns. Journal of Economic Behavior & Organization, 107, 708-729.

- Kimberly, J.R., & Evanisko, M.J. (1981). Organizational innovation: The influence of individual, organizational, & contextual factors on hospital adoption of technological & administrative innovations. Academy of Management Journal, 24(4), 689-713.

- Knight, K.E. (1967). A descriptive model of the intra-firm innovation process. The journal of business, 40(4), 478-496.

- Kogan, L., Papanikolaou, D., Seru, A., & Stoffman, N. (2017). Technological innovation, resource allocation, and growth. The quarterly journal of economics, 132(2), 665-712.

- Kong, D., Wang, Y., & Zhang, J. (2020). Efficiency wages as gift exchange: Evidence from corporate innovation in China. Journal of Corporate Finance, 65, 101725.

- Kumpamool, C. (2018). Equity & debt market timing, cost of capital and value & performance: Evidence from listed firms in Thailand. University of Hull,

- Lam, H.K., Yeung, A.C., & Cheng, T.E. (2016). The impact of firms’ social media initiatives on operational efficiency and innovativeness. Journal of Operations Management, 47, 28-43.

- Lamont, O.A., & Stein, J.C. (2006). Investor sentiment and corporate finance: Micro and macro. American Economic Review, 96(2), 147-151.

- Lartey, T., Danso, A., & Owusu-Agyei, S. (2020). CEOs' market sentiment and corporate innovation: The role of financial uncertainty, competition and capital intensity. International Review of Financial Analysis, 72, 101581.

- Leamer, E.E. (2007). A flat world, a level playing field, a small world after all, or none of the above? A review of Thomas L Friedman's The World is Flat. Journal of Economic Literature, 45(1), 83-126.

- Lee, H.H., & Oh, F.D. (2020). Corporate innovation and credit default swap spreads. Finance Research Letters, 32, 101082.

- Lev, B., Nissim, D., & Thomas, J. (2005). On the informational usefulness of R&D capitalization and amortization. Visualizing Intangibles, 97-128

- Lev, B., Radhakrishnan, S., & Ciftci, M. (2006). The stock market valuation of R&D leaders.

- Li, D. (2011). Financial constraints, R&D investment, and stock returns. The Review of Financial Studies, 24(9), 2974-3007.

- Li, J., Shan, Y., Tian, G., & Hao, X. (2020). Labor cost, government intervention, and corporate innovation: Evidence from China. Journal of Corporate Finance, 64, 101668.

- Li, K., & Zhao, X. (2008). Asymmetric information and dividend policy. Financial management, 37(4), 673-694.

- Lintner, J. (1965). Security prices, risk, and maximal gains from diversification. The journal of finance, 20(4), 587 - 615.

- Manso, G. (2011). Motivating innovation. The journal of finance, 66(5), 1823-1860.

- Matolcsy, Z.P., & Wyatt, A. (2008). The association between technological conditions and the market value of equity. The Accounting Review, 83(2), 479-518.

- Mazouz, K., & Zhao, Y. (2019). CEO incentives, takeover protection and corporate innovation. British Journal of Management, 30(2), 494-515.

- McLean, R.D., & Zhao, M. (2014). The business cycle, investor sentiment, and costly external finance. The journal of finance, 69(3), 1377-1409.

- Modigliani, F., & Miller, M.H. (1958). The cost of capital, corporation finance and the theory of investment. The American economic review, 48(3), 261-297.

- Naranjo-Valencia, J.C., Naranjo-Herrera, C.G., Serna-Gómez, H.M., & Calderón-Hernández, G. (2018). The relationship between training and innovation in companies. International Journal of Innovation Management, 22(02), 1850012.

- Nason, R.S., & Wiklund, J. (2018). An assessment of resource-based theorizing on firm growth and suggestions for the future. Journal of management, 44(1), 32-60.

- Nelson, R.R. (1959). The simple economics of basic scientific research. Journal of political economy, 67(3), 297-306.

- O’Neill, P., Sohal, A., & Teng, C.W. (2016). Quality management approaches and their impact on firms? financial performance–An Australian study. International Journal of Production Economics, 171, 381-393.

- Orlikowski, W.J., & Baroudi, J.J. (1991). Studying information technology in organizations: Research approaches and assumptions. Information systems research, 2(1), 1-28.

- Palomino, F., Renneboog, L., & Zhang, C. (2009). Information salience, investor sentiment, & stock returns: The case of British soccer betting. Journal of Corporate Finance, 15(3), 368-387.

- Pandit, S., Wasley, C.E., & Zach, T. (2011). The effect of research and development (R&D) inputs & outputs on the relation between the uncertainty of future operating performance and R&D expenditures. Journal of Accounting, Auditing & Finance, 26(1), 121-144.

- Pang, C., & Wang, Y. (2020). Stock pledge, risk of losing control and corporate innovation. Journal of Corporate Finance, 60, 101534.

- Piao, Z., & Wu, J. (2011). The enterprise innovation performance, R&D investment & default risk-based on the listed company in yangtze river delta region. Paper presented at the 2011 International Conference on Management and Service Science.

- Polk, C., & Sapienza, P. (2008). The stock market and corporate investment: A test of catering theory. The Review of Financial Studies, 22(1), 187-217.

- Romer, P.M. (1986). Increasing returns and long-run growth. Journal of political economy, 94(5), 1002-1037.

- Ryu, D., Ryu, D., & Yang, H. (2020). Investor sentiment, market competition, and financial crisis: Evidence from the Korean Stock Market. Emerging Markets Finance & Trade, 56(8), 1804-1816.

- Schmeling, M. (2009). Investor sentiment & stock returns: Some international evidence. Journal of Empirical Finance, 16(3), 394-408.

- Sharpe, W.F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The journal of finance, 19(3), 425-442. Shefrin, H. (2008). A behavioral approach to asset pricing: Elsevier.

- Shi, C. (2003). On the trade-off between the future benefits and riskiness of R&D: A bondholders’ perspective. Journal of Accounting and Economics, 35(2), 227-254.

- Singer, E., & Ye, C. (2013). The use and effects of incentives in surveys. The ANNALS of the American Academy of Political and Social Science, 645(1), 112-141.

- Smith, W.K., & Tushman, M.L. (2005). Managing strategic contradictions: A top management model for managing innovation streams. Organization science, 16(5), 522-536.

- Solow, R.M. (1956). A contribution to the theory of economic growth. The quarterly journal of economics, 70(1), 65-94.

- Srinivasan, S., & Hanssens, D.M. (2018). Marketing and firm value: Metrics, methods, findings, and future directions. LONG-TERM IMPACT OF MARKETING: A Compendium, 461-519.

- Stambaugh, R. F., Yu, J., & Yuan, Y. (2012). The short of it: Investor sentiment and anomalies. Journal of financial economics, 104(2), 288-302.

- Sunder, J., Sunder, S.V., & Zhang, J. (2017). Pilot CEOs and corporate innovation. Journal of financial economics, 123(1), 209-224.

- Swaminathan, B., & Purnanandam, A.K. (2004). Are IPOs really underpriced? Review of Financial Studies, 17, 811-848.

- Teece, D.J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic management journal, 28(13), 1319-1350.

- Teece, D.J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic management journal, 18(7), 509-533.

- Tetlock, P.C. (2007). Giving content to investor sentiment: The role of media in the stock market. The journal of finance, 62(3), 1139-1168

- Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of money, credit and banking, 1(1), 15-29.

- Utterback, J.M. (1971). The process of technological innovation within the firm. Academy of management journal, 14(1), 75-88.

- Van de Ven, A.H. (2017). The innovation journey: You can't control it, but you can learn to maneuver it. Innovation, 19(1), 39-42.

- Walker, R.M., Chen, J., & Aravind, D. (2015). Management innovation and firm performance: An integration of research findings. European Management Journal, 33(5), 407-422.

- Xu, Z., & Dang, T.V. (2018). Market sentiment & innovation activities. Journal of Financial & Quantitative Analysis

- Zhang, Y., Khan, U., Lee, S., & Salik, M. (2019). The influence of management innovation and technological innovation on organization performance. A mediating role of sustainability. Sustainability, 11(2), 495.