Research Article: 2021 Vol: 20 Issue: 5

The Impact of Covid-19 Pandemic on the Effect of Earnings Per Share on Price to Book Value with Firm Size as Intervening Variable

Suyanto Suyanto, Sekolah Tinggi Ilmu Ekonomi IPWI Jakarta

Citation Information: Suyanto, S. (2021). The impact of covid-19 pandemic on the effect of earnings per share on price to book value with firm size as intervening variable. Academy of Strategic Management Journal, 20(5), 1-9.

Abstract

The objective of this research is to examine and analyze the effect of Earning Per Share on Price to Book Value with Firm Size as intervening variable. Population of research is 45 go-public firms in LQ45 Index that are listed at Indonesia Stock Exchange on period of 2017-2019. Sampling technique is purposive sampling that produces 36 samples but there are 9 firms that do not submit periodical financial statements to LQ45 Index on period of 2017—2019. Analysis technique is PLS-SEM supported by computer application of WarpPLS 7.0. Result of research shows that Earning Per Share has significant effect not only on Price to Book Value but also on Firm Size. The effect of Earning Per Share on Price to Book Value is significant. The result also indicates that Firm Size is the intervening variable in partial mediation. The increase of Earning Per Share is always followed by the increase of Price to Book Value. High level of Earning Per Share is delivering high level of profitability and conversely, small earnings is giving low profitability. The result proves that Firm Size is a factor needed for assessing profitability.

Keywords

Earning per Share, Price to Book Value, Firm Size.

JEL Classifications

G320, G390, G41.

Introduction

One reason behind the establishment of a firm (a company) is to maximize firm value (wealth) for shareholders. The maximization of firm value refers to the maximization of the current value of all profits currently received by shareholders in the future. Good firm value is reflected by its long term stability where high share price is associated with high firm value (Hanifah, 2019). Several factors determine firm value and one of them refers to price earnings ratio. This ratio represents how much investors would set price for share of the firm based on its earnings increment (Chhaya & Nigam, 2015). Earning per Share is the result of division between the level of profit received by the firms and the number of share in circulation (Almeida, 2019). The increase of Earnings Per Share (EPS) is always followed by the increase of Price to Book Value (PBV), which signifies that both are related linearly. High level of Earning Per Share is delivering high level of firm profitability whereas small earnings is giving low profitability.

This research focuses on an economic phenomenon, precisely the impact of Covid-19 pandemic on the value of the firms listed at Indonesia Stock Exchange. The firms are referring to those stated in LQ45 Index. The year of 2020 had begun its last quarter, precisely Quarter IV. The conditions of economic in general and of capital market in particular were not impressive during that quarter. Main sentiment that causes the dullness of capital market is the outbreak of Covid-19 pandemic that later becomes global catastrophy. Surely, real sector and financial sector in Indonesia were deeply affected by this pandemic. Capital market was also suffered. In Year-to-Date (YTD), Composite Stock Price Index (IHSG), which represents the general reference index for Indonesian capital market indices, was drastically corrected with a drop of 20.56% in the beginning of 2020. Meanwhile, LQ45 Index as one specific reference index for Indonesian capital market was also greatly affected. Although this index contains stocks with high liquidity and reliable business prospect, but this index was corrected worse than IHSG, which is shown by a drop of 24.67%. However, not all stocks were impacted badly by Covid-19 pandemic. Some stocks already recovered after the outbreak and even some sectors took benefits from the outbreak. Nevertheless, the number of badly corrected stocks due to Covid-19 pandemic is still far more than the number of recovered stocks. There were 9 constituent stocks of LQ45 Index that are seriously affected by Covid-19 pandemic and these stocks were corrected by over 40% in YTD. The worst correction level was booked by the share of PT Perusahaan Gas Negara Tbk (PGAS) that is corrected by 55.30% in YTD. Shockingly, the value of PGAS share had actually been seriously corrected since the beginning of 2020 and even before Covid-19 pandemic breaks up in Indonesia. Later, PGAS share was hit by double blows. One blow is that the share is a portfolio owned in majority by Reksadana, a management asset firm that its portfolio must be liquidated by Financial Service Authority (OJK) because the firm is proven to be offering fixed interest rate, which surely violates financial laws. The other blow is that Reksadana is known for its bold action in selling stocks in great numbers directly to regular market. If the price of the stock is under pressure, then the price is inclined to fall down. The pressure may be caused by direct impact of sale decline and long term psychological impact of continuous instability (cnbcindonesia.com).

Besides PGAS, there were other stocks in LQ45 Index that are also suffering. These stocks were held by several firms in several sectors, precisely, four stocks in construction & property sector and two stocks in banking sector. Stocks offered from construction & property sector are owned by PT Wijaya Karya Tbk (WIKA), PT Summarecon Agung Tbk (SMRA), PT PP Persero Tbk (PTPP), and PT Indocement Tunggal Prakarsa Tbk (INTP). All these firms are cement producers, which their products have been absorbed in majority by many firms in construction & property sector. Therefore, that is why it would not be so difficult to understand why the price of stocks held by the firms in construction & property sector was seriously corrected during the pandemic. This sector was known for many projects with capital value of billions or trillions rupiahs. Those projects were suddenly bogged down after the program of Limited Scale Social Distancing was launched, which gave great implication to corporate cash flow. Moody's Investor Service, one leading international rating organization, has degraded the rating of several construction & property firms that have been seriously suffered due to Covid-19 pandemic (cnbcindonesia.com).

Research gap is indicated by different findings regarding the effect of Earning per Share on Firm Value (in this research, it is represented by Price to Book Value). Some previous researches found that Earning Per Share has negative effect on Firm Value whereas others discovered that Earning Per Share has positive effect on Firm Value. According to Khan et al. (2014), Earning per Share (EPS) is the most important factor that determines stock price and firm value. Most individual investors make their investment decision based on EPS. This position confirms the positive effect of EPS on firm value and firm value is usually measured using Price to Book Value (PBV). Furthermore, Martina et al. (2019) asserted that Earning Per Share has positive effect on Firm Value. However, Hanifah (2019) found that based on the result of partial hypothesis test (t test), Earning Per Share (EPS) did not have significant effect on Price to Book Value. Moreover, Nassirzadeh et al. (2012) said that Earning per Share has negative effect on Firm Value.

In this research, firm value is proxied by Price to Book Value. The objective of this research is to examine and analyze the effect of Earning Per Share on Price to Book Value with Firm Size as intervening variable. The novelty of this research is the inclusion of Firm Size as intervening variable in the relationship between Earning Per Share and Price to Book Value.

Literature Review

Signalling theory was firstly introduced by Ross (1977). This theory says that two entities are involved in the signalling process. One entity is internal entity (management) that sends signal while other entity is external entity (investor) that receives signal. By giving sign or signal, the management attempts to provide relevant information that can be used by the investor. Later, the investor can adjust their investment decision to their understanding about the signal.

Price to Book Value (PBV) is a proxy used to measure firm value. This proxy indicates how far the firm can create value from the capital invested. If firm value is high, then firm owner receives high level of wealth (Sadeghi Lafmejani, 2017). One reason behind the establishment of a firm is to maximize firm value (wealth). Firm value refers to market value because firm value can give good wealth to shareholders if the price of the firm’s stock ascends. The management of the firm should always take effort to make policies to improve firm value. The management must also ensure that the stock price would improve the welfare of firm owner and shareholder (Brigham, Eugene F, 1999). Price to Book Value is a variable usually used by investor in determining which stock that should be bought.

Earnings refer to an indicator used to understand whether financial capacity of certain firm is increasing or decreasing after comparison with previous period. The increase or decrease of financial capacity may impact financial policies for the next activity. The policies can be either those regarding dividend determination, debt payment, amortization or reinvestment for the firm’s operational viability. Earning per Share (EPS) is the output after net profit received by the firm (Net Income) is divided by the number of share in circulation (Outstanding Share) (Don et al., 2012). High level of Earning Per Share is associated with high level of net income that will be received by the firm. In evaluating performance of the firm, investors should not only understand whether the income of the firm is increasing or decreasing, but investors must also know how income change may affect their investment decision. In general, more established firms have high level of Earning Per Share, whereas new firms tend to have low level of Earning Per Share.

Sale is the source of livelihood for a firm because the firm gets its income from sale. The growth of the sale is a manifestation of investment in the past and the income from that investment would be used as prediction for the future. Growth rate of a firm may affect the capability to maintain income in the future. High sale growth reflects high income, which in turn, dividend is expected to be also high. Dividend is one output expected by investors. High sale growth, in the other hand, is also associated with high asset size. The size of asset determines both the size of the firm and the trust of investors. When firm size is large, people are easier to seek information about the asset of the firm. Indeed, firm size describes the capability of the firm to increase its sale and earnings from total asset. Therefore, firm size is the measure of asset owned by the firm (Goodman & Peavy, 1986).

Earning Per Share is an indicator mostly used by investors before they make investment decision. All outputs attained by the firm can directly affect income level based on number of share owned by the firm (Almeida, 2019). If Earning Per Share is increasing from one year to another, then the firm is said to be growing well or having a good income (compared to previous period) (Irfan, 2010). Regarding to those statements, first hypothesis is written as following:

H1 Earning Per Share has positive effect on Price to Book Value

Earning Per Share represents how much money the shareholders would receive for every share that they have after the profit of the stock in circulation is dispensed in the end of the year. Therefore, it can be said that Earning Per Share indicates the capability of the firm to produce profit. But, it must be noted that every firm has different level of profitability. Earning Per Share may differ between large firm and small firm. There is a possibility that Earning Per Share in small firm is higher than that in large firm (Taani et al., 2011). Number of stock in circulation can determine Earning Per Share because the income received by the firm will be alloted to all stocks issued by the firm. However, high level of Earning Per Share does not represent high performance. The point to be noted is that Earning Per Share is affected by number of stock in circulation. Principally, high level of Earning Per Share signifies that the firm is profitable for investment (Lau et al., 2002). In regard of the statements above, second hypothesis is proposed as following:

H2 Earning per Share has positive effect on Firm Size

Firm Size is a scale comprising of total asset and total sale. These two indicators help the researcher to understand the condition of the firm. Large firm has bigger fund source to finance its investment while small firm always has limited funding. Firm Size is one feature that characterizes financial condition of the firm. Large firm is always well established and therefore, it is easier for that firm than small firm in getting capital from capital market. Such easier access gives bigger flexibility to large firm. According to Brigham & Houston (2006), Firm Size is the average of total net sale from the current year to another years. If the sale is bigger than variable cost and fixed cost, then the firm will get good pre-tax income. Conversely, if the sale is smaller than those costs, then the firm will suffer (Babalola, 2013). Conforming to the statements above, third hypothesis is described as following:

H3 Firm Size has positive effect on Price to Book Value

Methodology

Population of research is 45 go-public firms in LQ45 Index that are listed at Indonesia Stock Exchange on period of 2017-2019. Sampling technique is purposive sampling in which representative sample will be obtained through criteria. Two criteria were used in this technique, respectively: (1) the firms are stated on LQ45 Index in period of 2017-2019; and (2) the firms have submitted regular reports to LQ45 Index in period of 2017-2019. After applying these criteria on research population, researcher got 36 samples but there were 9 firms that do not submit periodical financial statements to LQ45 Index on period of 2017—2019.

Ghaeli (2017) said that Price-Earnings Ratio indicates the schedule needed to return the fund at the level of stock price and firm income on certain period. Price-Earnings Ratio describes the capability of investors to pay certain amount of firm income. In this research, the formula of Earning Per Share is written as following:

Price to Book Value is the comparison between price per share and book value per share (Hanifah, 2019). The formula of PBV is counted as following:

Firm Size is a measure or scale for the size of the firm based on several indicators such as total asset, log size, market value, stock, total sale, total income, total capital and others. Based on operational scale, any firm is classified into three categories, namely large firm, medium firm and small firm (Embong et al., 2012). The formula for Firm Size is Firm Size = Ln Total Asset. In the current research, asset refers to wealth or resource owned by the firm. If the level of asset size is suffice, then the firm can make investment and also fulfill product demand. High asset level helps the firm to enhance its market scope and also to improve its profitability.

Analysis technique is Partial Least Squares (PLS) - Structural Equation Modeling (SEM). The implementation of this technique is facilitated by computer application of WarpPLS 7.0. The current research is predictive and explorative in nature. The use of PLS-SEM has two benefits. One of these two is that PLS-SEM can still work efficiently with small sample and complex model. Second benefit is that the assumption of data distribution at PLS-SEM is relatively slack than other method like CB (Covariance-based)-SEM.

For the purpose of testing Hypothesis 1, 2 and 3, two equations are made as following:

PBV α1+β1 EPSt+β2Size + ε1 (1)

SIZE α2+β4EPS+ ε2 (2)

Results and Discussion

In accordance with the result of the Table 1 above, it was shown that research model is fit. This position was proven by AVIF value of 1.055 and AFVIF value of 1.061. All these values are below 3.3, which signifies that there is no multicollinearity problem across indicators and across exogenous variables. Prediction power of the model is shown by GoF value of 0.232, which is higher than 0.36. Therefore, it can be said that prediction power of the model is strong.

| Table 1 Model of Fit | |

| Provisions | Conclusion |

| Average path coefficient (APC)=0.214, P=0.005 | FIT |

| Average R-squared (ARS)=0.054, P=0.143 | FIT |

| Average adjusted R-squared (AARS)=0.141, P=0.168 | FIT |

| Average block VIF (AVIF)=1.055, acceptable if <= 5, ideally <= 3.3 | FIT |

| Average full collinearity VIF (AFVIF)=1.061, acceptable if <= 5, ideally <= 3.3 | FIT |

| Tenenhaus GoF (GoF)=0.232, small >= 0.1, medium >= 0.25, large >= 0.36 | FIT |

By the virtue of the Table 2 above, all constructs in this research are in very good category. The constructs have fulfilled the rule of thumbs of <3.3, which implies that research model is free from problems of vertical collinearity, lateral collinearity and common method bias.

| Table 2 Results of Full Collinearity VIF, R Squared and Adjusted R Squared | |||

| PBV | EPS | SIZE | |

| Full Collinearity VIF | 1.091 | 1.045 | 1.045 |

| R-Squared | 0.063 | 0.045 | |

| Adj R Squared | 0.045 | 0.036 | |

Test over VIF value will help researcher to ensure whether there is vertical collinearity problem in research model. Based on the result in the table above, all variables of research have VIF value below 3.3, which clarifies that vertical collinearity does not pose as problem (Table 3).

| Table 3 Results of Effect Size and Variance Factor (VIF) | ||

| Path Description | Effect Size | VIF |

| EPS → PBV | 0.068 | 1.091 |

| EPS → SIZE | 0.008 | 1.045 |

| SIZE → PBV | 0.001 | 1.045 |

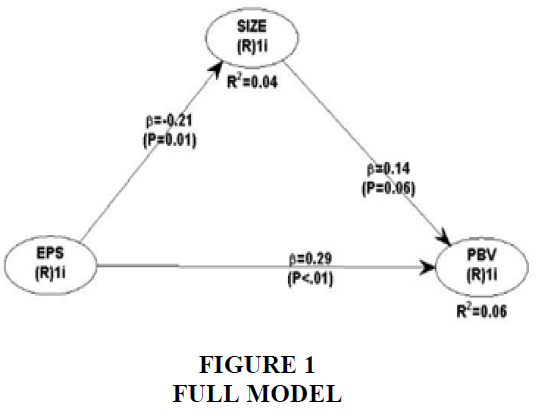

First hypothesis stating that Earning Per Share has positive effect on Price to Book Value was tested. Result of the test showed that coefficient value is 0.289 whereas p-value is <0.001. Based on this result, first hypothesis is accepted. Second hypothesis stating that Earning Per Share has positive effect on Firm Size was also tested. Result of the test revealed that coefficient value is 0.211 whereas p-value is 0.011. This result is consistent to the hypothesis and therefore, second hypothesis is accepted. Hypothesis test was done for third hypothesis, which states that Firm Size has positive effect on Price to Book Value. Result of the test showed that coefficient value is 0.142 whereas p-value is 0.064. Regarding to this result, third hypothesis is accepted (Table 4 & Figure 1).

| Table 4 Results of Path Coefficient and P-Value | ||

| Path Description | Path Coefficient | P-Value |

| EPS → PBV | 0.289 | <0.001 |

| EPS→ SIZE | 0.211 | 0.011 |

| SIZE → PBV | 0.142 | 0.064 |

According to Baron & Kenny (1986), mediation is differentiated into full mediation and partial mediation. Full mediation occurs when independent variable does not have significant effect on dependent variable unless there is mediator variable. Partial mediation occurs when independent variable still affects dependent variable without involvement of mediator variable. Besides this, mediation happens because independent variable can predict directly dependent variable but its prediction value is still less than prediction value of mediator variable. If coefficient value of prediction variable is higher than mediation variable, then there is no mediation at all. Besides testing the direct effect, it is also important to put the indirect effect and the total effect into the test in order to determine the coefficient value of indirect relationship. The current research uses formulation and procedure of mediation test that is proposed by Baron & Kenny (1986).

Mediation test was conducted on mediation hypothesis of EPS → SIZE → PBV. Result of mediation test showed that coefficient value of indirect effect is 0.064 with p-value of 0.002 (p<10%). This result explained that SIZE has mediated significantly the effect of EPS on PBV. In the other hand, direct path of EPS → PBV was found to be significant with significance value <0.001. Total effect of EPS → SIZE → PBV is producing coefficient value of 0.259 and p-value of 0.011. In regard of these results, it can be said that there is partial mediation in the relationship between Earning Per Share (EPS) and Price to Book Value (PBV) with Firm Size (SIZE) as mediation variable (Table 5).

| Table 5 Indirect Effect and Total Effect | ||

| Indirect effect | Path coefficient | P-value |

| EPS → SIZE →PBV | 0.064 | 0.002 |

| Total effect | Path coefficient | P-value |

| EPS → SIZE →PBV | 0.259 | 0.011 |

All results of this research are explained by hypothesis. First hypothesis stating that Earning Per Share has positive effect on Price to Book Value is proven with coefficient value of 0.289 and p-value <0.001. Earning Per Share (EPS) is one of market ratios that determine the income received by shareholders for each share they have in the firm. High level of Earning Per Share indicates high level of firm income. When investors evaluate performance of the firm, therefore, they need not only to ensure whether firm income goes up or down but they also need to know what is the consequence of income change to their investment. This position is in line with the findings of previous researches done by Markus & Sormunen (2018) and Patricia & Trevor (1993).

Second hypothesis stating that Earning Per Share has positive effect on Firm Size is also confirmed with coefficient value of 0.211 and p-value of 0.11. This position is in conformity with the finding given by Abutaber (2018), which said that Earning Per Share is the strongest variable that can help the firm to predict the market value of the stock. Besides this, Abutaber also found that Firm Size has significant effect on firm income if it is measured from total asset of the firm. Other support was given by Pouraghajan et al. (2013) that discovered that there is positive and significant effect from both Earning per Share and Firm Size on firm income.

Third hypothesis stating that Firm Size has positive effect on Price to Book Value is verified with coefficient value of 0.142 and p-value of 0.064. According to Fama & French (1995), Firm Size strongly affects firm value. Next, Chandrapala (2013) and Charitou et al. (2001) explained that Firm Size is the determinant of how the management takes care of the firm, which therefore, it can be said that managerial style has impact on firm value. Firm Size plays role as mediator in the effect of Earning Per Share on Price to Book Value. After conducting data processing and mediation test, it was found that Firm Size is indeed successfully mediating the effect of Earning Per Share on Price to Book Value and the mediation is partial. Result of the test gave a proof that Firm Size is one of the most important factors that the firm must take into consideration. In addition, it can also be said that firm value depends on Firm Size. As said by Abutaber (2018), Firm Size determines the final value of the firm. Firm Size can also be used as guidance in assessing performance of the firm (Jasman & Kasran, 2017).

Conclusions

The objective of this research is to examine and analyze the effect of Earning Per Share on Price to Book Value with Firm Size as intervening variable. Research took place at 45 go-public firms in LQ45 Index that are listed at Indonesia Stock Exchange on period of 2017-2019. Result of research gave several findings. First hypothesis stating that Earning Per Share has positive effect on Price to Book Value was successfully proven, which therefore first hypothesis is accepted. Second hypothesis stating that Earning Per Share has positive effect on Firm Size was also verified, which therefore second hypothesis is accepted. Third hypothesis stating that Firm Size has positive effect on Price to Book Value was successfully confirmed, which therefore third hypothesis is accepted. Firm Size was also proven as mediator in the relationship across variables and the nature of mediation is partial. These findings are consistent to signalling theory, which says that that management gives sign or signal to investors as its attempt to provide relevant information that can be used by investors whom then adjust their investment decision to their understanding about the signal. Firm Size is one of signals that may affect the assessment of investors regarding the firm.

References

- Abutaber, T. (2018). The effect of dividends and earning per share on the stock market value by moderating bank size. Journal of Modern Accounting and Auditing, 14(8), 408-415.

- Almeida, H. (2019). Is it time to get rid of earnings-per-share (EPS)? Review of Corporate Finance Studies, 8(1), 174-206.

- Babalola, Y.A. (2013). The effect of firm size on firms profitability in Nigeria. Journal of Economics and Sustainable Development, 4(5), 90-94.

- Baron, R.M., & Kenny, D.A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173.

- Chandrapala, P. (2013). The value relevance of earnings and book value: The importance of ownership concentration and firm size. Journal of Competitiveness, 5(2), 98-107.

- Charitou, A., Clubb, C., & Andreou, A. (2001). The effect of earnings permanence, growth and firm size on the usefulness of cash flows and earnings in explaining security returns: Empirical evidence for the UK. Journal of Business Finance & Accounting, 28.

- Chhaya, G., & Nigam, P. (2015). Value investing with price-earnings ratio in India. IUP Journal of Applied Finance, 21(2), 34.

- Don, S., Author, C., Reviewed, J.M.S., & Journal, F.A. (2012). PerShr earnings don’t count. Financial Analysts Journal, 30(4), 39-40.

- Embong, Z., Mohd-Saleh, N., & Hassan, M. S. (2012). Firm size, disclosure and cost of equity capital. Asian Review of Accounting, 20(2), 119-139.

- Fama, E.F., & French, K.R. (1995). Size and book-to-market factors in earnings and Returns. The Journal of Finance, L(1).

- Ghaeli, M.R. (2017). Price-to-earnings ratio: A state-of-art review. Accounting, 3(2), 131-136.

- Goodman, D.A., & Peavy, J.W. (1986). The interaction of firm size and price-earnings ratio on portfolio performance. Financial Analysts Journal, 42(1), 9-12.

- Hanifah, A. (2019). The Effect of Earning Per Share (EPS), Price Earning Ratio (PER) and Price Book Value (PBV) against the stock price of telecommunications sector company included in the Indonesian Islamic Stock Index (ISSI). KnE Social Sciences, 2019, 711-726.

- Irfan, M. (2010). Munich personal repec archive price earning ratio and market to book ratio price earning ratio and market to book ratio: A case study of pakistani textile sector. Munich Personal RePEc Archive Price, 23969.

- Jasman, J., & Kasran, M. (2017). Profitability, earnings per share on stock return with size as moderation. Trikonomika, 16(2), 88-94.

- Khan, T.R., Islam, M., Choudhury, T.T., & Adnan, A.M. (2014). How earning per share (EPS) affects on share price and firm value.

- Lau, S.T., Lee, C.T., & McInish, T.H. (2002). Stock returns and beta, firms size, E/P, CF/P, book-to-market, and sales growth: Evidence from Singapore and Malaysia. Journal of Multinational Financial Management, 12(3), 207–222.

- Markus, D., & Sormunen, J. (2018). A study of value investment strategies based on dividend yield, price-to-earnings and price-to-book ratios in Swedish stock market.

- Martina, S., Sadalia, I., & Bukit, R. (2019). The effect of quick ratio, debt to equity ratio, earning per share, price to book value and return on equity on stock return with money supply as moderated variables (Study of Banking Companies Listed on Indonesia Stock Exchange Period 2008-2017). International Journal of Public Budgeting, Accounting and Finance, 2(3), 1-10.

- Nassirzadeh, F., Salehi, M., & Alaei, S.M. (2012). a study of the factors affecting earnings management: Iranian overview. Science Series Data Report, 4(2), 22-27.

- Patricia, M., & Trevor, S. (1993). Price-earnings and price-to-book anomalies: Tests of an intrinsic value expla ... Contemporary Accounting Research.

- Pouraghajan, A., Mansourinia, E., Maryam, S., & Bagheri, B. (2013). investigation the effect of financial ratios , operating cash flows and firm size on earnings per share: Evidence from the tehran stock exchange. International Research Journal of Applied and Basic Sciences, 4(5), 1026-1033.

- Sadeghi Lafmejani, M.A. (2017). The relationship between size, book-to-market equity ratio, earnings–price ratio, and return for the Tehran stock Exchange. Accounting, 3, 11-18.

- Taani, K. (2011). The effect of financial ratios, firm size and cash flows from operating activities on earnings per share:(an applied study: on Jordanian industrial sector). International Journal of Social Sciences and Humanity Studies, 3(1), 197-205.