Research Article: 2021 Vol: 20 Issue: 4S

The Impact of Economic Shocks on the Job or Labour Market in Iraq After 2003

Esraa said Saleh, Almustansiryah University

Nidal Shaker Jouda, Almustansiryah University

Afeifa Bachai Showket, Almustansiryah University

Key words:

Economic Shocks, Oil Prices, General Revenue, Unemployment

Abstract

External economic shocks directly affect the financial variables in countries exporting primary commodities, especially oil states, and this is due to a strong correlation between the general budget and foreign trade in these countries, so fiscal policy responds in a way that is in line or counter to the direction of the economic shock, and that response is reflected on relevant macroeconomic sectors.

The economic shocks resulting from fluctuations in oil prices on the international markets greatly affect the Iraqi economy, because of its dependence on oil revenues as a major financial resource, at a time when non-oil sectors suffer from low rates of contribution to GDP, which is reflected in the decline in their ability to absorb growth Growing in the workforce.

The main conclusion reached by the research is that the expansionary fiscal policy that was associated with the positive economic shocks, represented by the high oil prices was not employed in the development of the non-oil sector, which remained almost unable to absorb the labor force, and thus unemployment remains at relatively high levels, and that the main recommendation of the research was represented by following an integrated system of economic policies that work on diversifying the Iraqi economy, and reducing dependence on oil revenues, and developing the non-oil sector to address the problem of unemployment.

Introduction

The issue of economic shocks is one of the important topics that received attention in the seventies of the last century after the occurrence of unprecedented rises in oil prices, as developed and non-oil developing countries have suffered from the negative effects of these shocks.

Iraq is one of the countries that have been subjected to this type of shock, resulting from fluctuations in oil prices, as the price of oil is determined according to the conditions of the global economy, that is, external conditions, and this matter makes the Iraqi economy vulnerable to fluctuations in oil prices, because it is a rentier economy that depends on the sale of one commodity, which is oil, and this property made it vulnerable external shocks. Moreover, oil revenues have not been utilized to develop the rest of the economic sectors in order to increase their productivity, which led to a decline in their contribution to the gross domestic product, and thus their weak ability to absorb the growing labor force in the Iraqi labor market.

Research Problem

The Iraqi economy faces many economic shocks resulting from fluctuations in oil prices, whose effects are clearly reflected in the share of economic sectors in the gross domestic product, and on the labor market, which suffers from high unemployment rates, due to the intertwined nature of economic changes.

Research Hypothesis

The research is based on the hypothesis that "the economic shocks resulting from the constant fluctuations in international oil prices (it is the only channel for the transmission of the impact of economic shocks to the Iraqi economy) have a significant impact on the percentage of the economic sectors' contribution to the gross domestic product, and the labor market.

Research Objective

The research aims to study, analyze and measure the impact of some of the various macroeconomic shocks that occur in oil prices, GDPand employment levels in economic sectors, in Iraq for the period after 2003.

Research Methodology

The research methodology is based on the descriptive method in presenting concepts, and describing the relationship between research variables, as well as the use of a quantitative analysis method based on econometrics.

Macroeconomic Shocks and the Labor Market: A Theoretical Framework

The First Requirement: The Concept of Economic Shocks

Many countries face from time to time different economic imbalances, such as fluctuating rates of economic growth, fluctuations in demand and aggregate supply, high rates of inflation, unemployment, to form these imbalances (if they are large) economic shocks that affect negatively or positively in the macro economy, which led specialists to carry out many theoretical and applied studies to research the nature of these shocks, and find convincing explanations for them, and determine their sources whether they are internal or external, accidental or permanent, and reach to define the concept of economic shocks, and their types and the resulting economic effects.

Capitalists economists have demonstrated by explaining their concept of shock, as there are those who see economic shocks as "sudden external or internal events facing the state without having a direct and effective role in identifying these events or controlling their effects (Bhattachaya & Sabyasachikar, 2010)."

While others see that the concept of economic shocks indicates "unforeseen changes in aggregate demand and aggregate supply in the short run, and a new level of national balance is achieved, these shocks will generate fluctuation in the rate of economic growth, and may require the response of one of the macroeconomic policies in order to absorb and mitigate the impact of the shock and maintain macroeconomic equilibrium (Campbell, 2002) “.

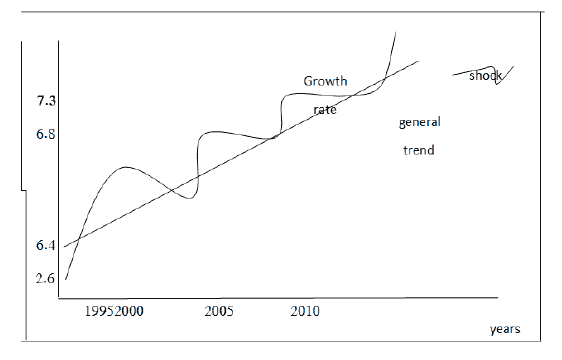

Some economists also believe that the shock is only a deviation of the chain of the economic variable from the general trend, and to achieve this, an attempt is made to separate the general trend from the economic shock by estimating a linear regression, as follows:

Y (t)=a+b (t)+e (t)

Where: Y (t): logarithm of GDP over a period of time.

a: value of the constant term representing the initial value of the variable Y (t), before the shock occurred.

B (t): variable rate of growth, over time.

e (t): residues, which express the magnitude of the shock.

Therefore, the variable chain Y (t) is divided into two parts, the first is a+b, and represents part of the direction and the second e (t) as shock. This can be illustrated by the following diagram: as shows in Figure 1.

Economic Shocks are Divided into Two Types:

First - Shocks of demand, which means a sudden shift in the function of aggregate demand, whose movement depends on the outcome of the forces acting on it, which may be in one direction or in different directions.

A set of factors behind the demand shock are: (Agnello, 2011)

1. Change in the money supply: The increase in the money supply by the central bank will lead to a decrease in the interest rate and a decrease in interest rates that will lead to an increase in investment (investment is one of the components of aggregate demand).

2. Change in taxes: The impact of taxes on aggregate demand is indirect, through consumption, and through disposable income.

3. Change in government spending: Increase or decrease in government spending will lead to changes in aggregate demand, such as increased spending on infrastructure, health, and education, or a decrease in government spending on investment projects.

4. The expectations of consumers and investors. The optimistic or pessimistic expectations of consumers and investors about the future of the economic situation push them to increase or decrease their spending, and then this will affect the aggregate demand.

Second - Total supply shocks: are the occurrence of a change in one of the components of the total supply function, which leads to a change in the total supply. For example, high oil prices lead to higher costs, so the output decreases and the total supply decreases. Supply shocks occur due to several factors, the most important of which is the change in production costs, technological progress, change in the size of the workforce, and capital formation.

The Labor Market: Concept and Mechanisms

First - The Concept of the Labor Market

The labor market is defined as "the market responsible for distributing the workforce to jobs and professions, and coordinating between available employment decisions", and through it the predicted size of the expected demand for manpower by business owners and establishments in addition to estimating the supply available from the workforce, according to different professions and specialties (Taqa & Ajlan, 2008).

The job market has two important aspects (Al-Ani & Al-Naseh, 2010)

A. The Market Aspect of the Labor Market

It is the supply and demand governed by the price, which is determined by a number of factors, such as the volume of demand, the size of the supply and the efficiency component available to job seekers and the resulting intense competition, especially in a situation characterized by scarcity of work and the high ceiling of conditions required for employment by institutions and the high volume of job seekers due to unemployment, and this is called the employment market governed by economic dimensions and market mechanisms.

B. The Non-Market Aspect of the Labor Market

The side that is not subject to market mechanisms represents, and this is represented in labor legislation and social dialogue between production partners and collective bargaining ....etc., and this is the role played by public authorities in coordination with the social parties.

Second - How the Labor Market Aspects Work

The labor market has two aspects that determine wages (the price of a good or service), namely supply and demand for labor. Through the concepts explained to the labor market, the market consists of two aspects:

A. Labour Supply

The job or labour offer means "the number of manpower represented by the effort actually displayed or ready to work during a period of time", and it represents that part of the total population of people between the ages of (15-65 years), and is called effective population or manpower after excluding those unable to work, due to impairments or injuries that hinder it, as well as persons under the age of 15 years, or 65 years and over, who do not perform any ineffective economic activity ”(Taqa & Ajlan, 2008).

B. Demand for Work

The demand for work is defined as "the amount of human efforts required by employers against a certain fee", and it is expressed by the demand for workers who have the capacity to provide the required effort by the productive units, whose component is determined according to the type of activity, in which it operates and the technical and technical method used, and which in turn is affected by the organizational procedures and productive levels prevailing in the country. Indeed, the demand side of the labor market occupies more importance than the supply side, as the level of employment in any economy is determined mainly by the level of actual needs from the workforce in the present and the future, and in light of the current economic conditions, and expected developments, in addition to that the demand for work is called in the economic theory (derivative demand). The intention is that the demand for this good or service does not mean the good or service itself, but is required due to the demand for the goods it produces or the services provided by the said commodity (work) (Borjas, 1996).

Third: The Concept of Unemployment and its Types

The problem of unemployment and employment of the workforce is one of the most complex issues with economic, social and political repercussions in society, and its seriousness is not limited to the increasing number of the unemployed and wasting the energies of the human element, but also lies in the social and political results that accompany it, which pave the environment for poverty, destitution, deprivation, hunger, begging, ignorance and crime. As unemployment is defined as "the difference between the amount of work offered at the prevailing wage levels and the amount of work and demand for it in the labor market (unemployment gap)".

A. Types of Unemployment

There are many criteria that are relied upon to determine the types of unemployment, and by creating these criteria in terms of time and place, there are many types. Some of them become a distinct characteristic of some societies and systems clearly due to the stage of their economic growth, the nature of the structure of their economy and the prevailing production relationships in them as well as some social features that prevail, so one can refer to the types of unemployment (Al-Ani & Al-Nasih, 2010).

1. Cyclical Unemployment.

2. Structural unemployment.

3. Frictional Unemployment.

4. Disguised Unemployment.

5. Seasonal Unemployment.

Fourth: The Impact of Economic Shocks on the Labor Market

If the national economy is exposed to an economic shock, it must create a set of effects that will be reflected on various aspects of economic activity, varying according to the source of the shock if it is an internal or external shock, and according to the nature of the shock, whether it is a demand shock or a supply shock, and those effects vary according to the degree of progress of the economy and its openness to the outside world, and thus how the effects of these shocks can be concentrated in economic variables such as local output, consumption and investment, and as a result of Okun law these shocks also affect unemployment (Eichhorst, 2010).

With regard to the channel for the transmission of economic shocks and their future effects to the economies of developing countries, in general, and rentier, in particular, they are through the prices of raw materials, especially oil, that countries that rely heavily on exports of raw materials as an important source of revenue, any fluctuation in prices in the international markets for those materials, it leads to fluctuating government spending that increases in periods of positive shocks, while in periods of negative shocks the government is forced to make difficult choices to meet the decline in revenues, either by deducting a large part of government spending or looking for an alternative source of revenue, and this confirms the fragility of those economies.

It can be said that there is an inverse relationship between economic shocks and unemployment rates, this relationship is indirect as positive shocks translate into an increase in investments that contribute to the high volume of demand for the labor market and thus absorption of part of unemployment, and in the case of negative shocks, returns decline and projects freeze, and this is reflected in the high unemployment rates

Economic Shocks and Labor Market Performance in the Iraqi Economy

The gross domestic product is one of the main factors in estimating the demand for the workforce. The increase in the gross domestic product will contribute to an increase in economic activity, and consequently the expansion of development projects in the country, and then an increase in the demand for new numbers of the workforce at its various levels of professional, professional and educational, and vice versa. When the output decreases, this leads to a contraction of economic activity, a reduction in projects, and the suspension of many industries and projects, which leads to dispensing with large numbers of the workforce.

The First Requirement: An Analysis of Economic Shocks After 2003

After the events of 2003, Iraq witnessed a major change on all levels, especially political and economic ones. As these events have had great damages to all important economic, social and cultural institutions and major infrastructure in the Iraqi economy, as well as disrupting the total production of the commodity sectors, social, health and educational services ... etc., In addition to the failure of industrial establishments to stop work and their low contribution to the gross domestic product, thus weakening the ability to create job opportunities and absorb new entrants into the labor market, this reflects the use of the GDP growth rate as an indicator that reflects the full performance of the economy, according to the World Bank data. We note that the rate of growth of output in many periods decreases gradually, and sometimes suddenly at other times, which reflects the economy’s exposure to a number of shocks during this period, for various domestic or external reasons (Table 1).

| Table 1 The Gross Domestic Product in Iraq for the Period 2004-2017, (Million Dinars) |

|||||

|---|---|---|---|---|---|

| Years | GDP | Annual growth rate of output% | Oil prices | Ratio of the Contribution of the oil sector to GDP | Ratio of the contribution of the non-oil sectors to GDP |

| $ | |||||

| 2004 | 53235358.7 | ---- | 31.4 | 58 | 45.4 |

| 2005 | 73533598.6 | 38.12 | 45.6 | 58 | 49.3 |

| 2006 | 95587954.8 | 29.99 | 55.6 | 55.5 | 49.3 |

| 2007 | 111455813.4 | 16.6 | 66.7 | 53.2 | 46.5 |

| 2008 | 157026061.6 | 40.88 | 87.9 | 55.7 | 44.7 |

| 2009 | 130643200.4 | -16.8 | 59.4 | 43.3 | 45.6 |

| 2010 | 162064565.5 | 24.04 | 75.6 | 45.4 | 48.3 |

| 2011 | 217327107.4 | 34.09 | 105 | 53.3 | 48 |

| 2012 | 254225490.7 | 15.91 | 106 | 50 | 48.4 |

| 2013 | 273587529.2 | 6.14 | 102.3 | 46.2 | 50.5 |

| 2014 | 266420384.5 | -4.02 | 91.6 | 44.1 | 48.3 |

| 2015 | 199715699.9 | -25.03 | 44.72 | 30.1 | 40.9 |

| 2016 | 203869832.2 | -1.9 | 36.09 | 30.7 | 35.5 |

| 2017 | 225995179.1 | 10.8 | 34.5 | 31.2 | 38.4 |

Iraq lacks a state of similarity between the national income and the national product, as are the rentier countries, as the oil sector is the main source in the gross domestic product, in exchange for that it absorbs a small number of manpower in the economy, and therefore government spending from the income from oil will lead to creating inflationary pressures in prices, which requires an increase in imports from abroad until the national product of goods and services increases.

The gross domestic product during the research period is highly rentier, as the rentier resource (oil) constitutes the largest proportion of it, the highest of which reached in the years 2004 and 2005, as the share of the oil sector to the gross domestic product accounted for a rate of (58%), compared to the low contribution rate of the rest sectors, and this means that Iraq relies mainly on a single source of income, as a result of the lack of interest in the rest of the sources that work to a large extent on providing job opportunities, goods and services for the economy, which is reflected in the balance and stability in the Iraqi economy.

The gross domestic product witnessed a fluctuation in growth during the period 2009-2017, due to fluctuations in oil prices, and the low percentage of the contribution of the non-oil economic sectors to the output, in addition to the political and security conditions that prevented the attraction of private domestic and foreign investments in the real sectors that would increase the GDP, and the continued increased of output up to 2009, when the output witnessed a decline, as it recorded negative growth of (-16.80%)(Table 1), due to the decrease in oil prices due to the repercussions of the global crisis, as oil prices fell to (59.4) dollars a barrel after they were (87.9) in 2008, GDP increased again with the global economy recovering and gradually graduating from the crisis, coupled with the rise in global oil prices. The output recorded its highest growth rate in 2011, as its growth rate reached (34.09%), due to the rise in oil prices above ($ 100) per barrel, driven by the persistent state of geopolitical uncertainty, and the decrease in the reserve supply. The annual growth rate of gross domestic product reached (15.9%) for the period 2003-2014.

In 2015, the gross domestic product witnessed a noticeable decline, as it recorded a negative growth rate of (25.03-%), due to the contraction of public liquidity due to the decrease in public revenues (Table 2), resulting from the decline in oil prices, whose decline had the greatest impact on the Iraqi economy, and the public budget in particular. The large budget deficit has led to the restructuring of public expenditures in a way that secures the current budget and certainly sacrifices the investment budget, hence the recession indicators clearly appeared in the activities of economic sectors through a low rate of growth of domestic product and high rates of total unemployment, which recorded a percentage (13.2%) of the total workforce (Central Bank of Iraq, 2016).

| Table 2 Evolution of Public Expenditures and Public Revenues in Iraq for the Period 2004-2017 (Million Dinars) |

||||

|---|---|---|---|---|

| Years | Public expenditures | Public revenues | Growth rate of public expenditures % | Growth rate of public revenues% |

| 2004 | 32117491 | 32982739 | --- | --- |

| 2005 | 26375175 | 40502890 | 17.9- | 22.8 |

| 2006 | 38076795 | 49063361 | 44.3 | 21.1 |

| 2007 | 39031232 | 54599451 | 2.5 | 11.3 |

| 2008 | 59403375 | 80252182 | 52.2 | 47 |

| 2009 | 52567025 | 55209353 | 11.5- | 31.2- |

| 2010 | 70134201 | 70178223 | 33.4 | 27.1 |

| 2011 | 78757666 | 108807392 | 12.3 | 55 |

| 2012 | 105139576 | 119817224 | 33.5 | 10.1 |

| 2013 | 119127556 | 113840076 | 13.3 | 5.0- |

| 2014 | 113473517 | 105609846 | 4.7- | 7.2- |

| 2015 | 70397515 | 66470252 | 37.9- | 37- |

| 2016 | 67067437 | 54409270 | 4.7- | 18.1- |

| 2017 | 75490235 | 77422235 | 10.5 | 32.2 |

Source: The table is prepared by researchers, relying on data of the Central Bank of Iraq, economic publications for several years.

The Second Requirement: An Analysis of the Reality of the Iraqi Labor Market After 2003

A. Indicator of the Rate of Participation in Economic Activity

One of the most important areas indicating the relationship between population and development, as two variables that affect each other, is the rates of the economic activity of the population and its pattern, and this indicator is used to denote the general level of population participation in working life, as it indicates the relative importance of the labor force ready to work in various economic sectors, and the rate of participation in economic activity means "that number of the economically active population who are looking for work". The higher the rate of participation of this group in economic activity, it is conclusive evidence of the efficiency of the economy, and the expansion of its absorptive capacity for investment in order to achieve growth in output and income as shows in Table 3.

| Table 3 The Rate of Economic Activity , and the Percentage of Workers in the Productive Sectors in Iraq for the Period 2004-2017 |

|||||

|---|---|---|---|---|---|

| Years | Economic Activity Rate% | Agricultural Sector % | Oil Sector | Industry Sector | Services Sector |

| % | % | % | |||

| 2004 | 48.5 | 8.78 | 2.08 | 15.99 | 73.17 |

| 2005 | 49.5 | 5.33 | 2.13 | 10.89 | 81.66 |

| 2006 | 49.7 | 6.6 | 2.2 | 9.6 | 81.65 |

| 2007 | 49.8 | 7.86 | 2.41 | 13.1 | 76.69 |

| 2008 | 47.3 | 8.16 | 2.59 | 15.37 | 73.9 |

| 2009 | 46 | 4.21 | 2.55 | 8.51 | 84.72 |

| 2010 | 43.5 | 7.1 | 2.58 | 9.94 | 80.39 |

| 2011 | 42.4 | 7.6 | 2.56 | 10.81 | 78.99 |

| 2012 | 42.9 | 8.1 | 2.68 | 10.39 | 78.89 |

| 2013 | 42.8 | 8.3 | 2.99 | 10.74 | 77.98 |

| 2014 | 42.7 | 8.52 | 3.4 | 11.3 | 76.87 |

| 2015 | 43.2 | 9.04 | 3.18 | 11.64 | 76.14 |

| 2016 | 43.2 | 9.33 | 3.22 | 12.25 | 75.2 |

| 2017 | 42 | 8.87 | 3.36 | 12.21 | 75.56 |

The data of the above table indicates that the economic activity rate for both genders reached (48.5%) in 2004, as the rate was low due to the events that passed in Iraq after 2003, but in subsequent years it started to rise to reach (49.7%) in 2006, due to the employment policy that followed by the government since 2005, that led to an increase in the number of workers in the state's agencies and departments, and then the rates returned to decrease to (47.3%) in 2008, and to (38.4%) in 2009, due to the such abnormal conditions that accompanied the preparation of the budget for that year as the decline in oil prices and the decrease in demand for it, after it was at the top in 2008, then the rate of economic activity rose again in subsequent years, but it is also considered low from 2008 until it reached (42.7%) in 2014, due to the difficult circumstances that affected Iraq in large areas of Iraqi lands, security, economic and social instability, misty directions of economic policy, low investment expenditures and efficient implementation, low state of the infrastructure of the economy, weak services provided to citizens, and weak sectoral and spontaneous operating interconnections, as the data of Table (3) indicates that there is an imbalance "in the structure of the workforce between the commodity, distribution and service sectors in Iraq, as the demand for work in favor of the activities of the distribution and service sectors tends, and this is due to several reasons that can be summed up as follows: (Al-Halfi, 2008)

• Low productivity in the agricultural and industrial sectors.

• Mismatch and harmony between educational systems and the need of economic sectors, that is, a mismatch between the specific flow of education and training apparatus outputs with the need for economic activity.

• The employment and labour movement is linked to economic activity, because it is personal, which led to an increase in the qualitative waste in the workforce.

B. The Development of the Unemployment Rate in Iraq

One of the most important indicators of human security verification, according to the United Nations, is economic security, which in turn includes two channels, namely the job security channel that represents the main source of income and the income security channel, which is linked to the first channel and income security represents the other side of unemployment, as lack of income and work security means that many people suffer from unemployment. Unemployment in Iraq is one of the most serious economic problems, and its roots go back to more than a quarter of a century, and its forms differed according to the different political and economic conditions that Iraq witnessed, as the real reasons for the phenomenon of lack of employment are due to the transformation of the Iraqi economy from a development economy in the seventies to a war economy in the eighties,to an economy of financial speculation in the nineties and to the economy of the public sector, expelling the private sector, and boosting the phenomenon of persuasive unemployment and underemployment in the third millennium (Al-Halfi, 2008) as shows in Table 4.

| Table 4 Population and Unemployment Rates in Iraq for the Period 2004-2017 |

|||

|---|---|---|---|

| Years | Total Population | Unemployment % Central Agency | World Bank estimates |

| 2004 | 27139 | -- | 26.8 |

| 2005 | 27963 | 17.9 | 18 |

| 2006 | 28810 | 17.5 | 17.5 |

| 2007 | 29682 | 17.5 | 16.9 |

| 2008 | 31895 | 15.3 | 15.3 |

| 2009 | 31664 | 14.9 | 15.2 |

| 2010 | 32490 | 12.8 | 15.2 |

| 2011 | 33338 | 11.1 | 15.2 |

| 2012 | 34208 | 11.9 | 15.3 |

| 2013 | 35096 | 12.1 | 15.1 |

| 2014 | 35005 | 12.8 | 15 |

| 2015 | 35212.6 | 13.2 | 15 |

| 2016 | 36169.1 | 11.6 | 15.1 |

| 2017 | 37139.5 | 14 | 15.1 |

- Republic of Iraq, Ministry of Planning, Central Agency for Statistics and Information Technology.

- Republic of Iraq, Ministry of Planning, Central Agency for Statistics and Information Technology, National Accounts Directorate, statistical indicators on the economic and social situation in Iraq for the period (2009-2017).

It is clear from the above table that Iraq possesses a great human power, as the compound population growth rate during the period 2004-2017 reached about (2.6%), which is a high percentage indicating the rapid increase of the Iraqi population, which generates an increase in the job supply and an aggravation of the unemployment problem.

It is also noted from the table that the unemployment rate began to rise in 2004, when it reached (26.8%), which is the year following the war year where the stoppage was almost complete for the private sector and the public, but in subsequent years, unemployment rates decreased, and the reason for this rate decline is due to the nature of employment politics adopted by the government, and reform programs after 2005 aimed at increasing the number of workers, instate agencies and services in general, and the security services in particular, in addition to the increasing numbers of migrant workers to work outside Iraq, and the unemployment rate continued to decrease slightly to settle at a rate of (11.1, 11.9%) in 2011 and 2012, and then increased again to reach (13.2%) in 2015, due to the significant drop in oil prices in 2014, which led to the government adopting a policy of rationalization and austerity in public spending, decreased in 2016 and resumed the rise in 2017. Despite the fluctuation in unemployment rates, they are high rates that reflect the seriousness of this phenomenon.

One of the causes of unemployment in Iraq is its lack of a clear economic and social strategy to address this phenomenon, and the weak effectiveness of the public sector in generating more job opportunities, due to the exposure of many facilities to looting and looting after April 2003, and the failure to provide the necessary supplies for production and the dissolution of some ministries such as defense, interior, and media, as well as the reduced role of the private sector to carry out projects as a result of the need for funding and insecurity, as well as the absence of coordination between education outputs and the Iraqi labor market, as poor planning made some specialties suffer from a surplus in the supply of employment, while others suffer from a significant shortage in employment, as well as administrative, financial and patronage corruption, all of these reasons exacerbated the problem of unemployment. The economic shocks to which the Iraqi economy was exposed as a result of the decline in oil prices, in addition to the weak contribution of the productive sectors in the gross domestic product, has entered the economy in a severe and long recession cycle and thus made the growth rates of the macro economic variables negative and in light of such economic declines it will be difficult to make the necessary structural transformations in the economy, that capable of absorbing a growing number of manpower.

Measuring the Impact of Economic Shocks on Unemployment and Employment in Iraq

First: Description of Research Variables

It is known that Iraq has huge potentials from natural resources, which is an important element in enriching the Iraqi economy and supporting its strength. Iraq, like other oil states, is not immune from the dangers of economic shocks, in light of the presence of a channel that works to transfer the impact of these shocks through oil prices, on the performance of economic activity, the manifestations of which appear on employment rates, so the primary goal behind this topic is to analyze and study the effects that economic shocks can have on the Iraqi labor market, and to express the labor market (the dependent variable), the unemployment variable (UN) will be used as the variable that expresses the compatibility between supply and demand in the labor market. Explanatory variables also included a number of indicators to express economic shocks, as follows:

• The rate of growth in global output (X1), as one of the indicators of global shocks.

• The growth rate of world oil prices (X2), as a variable that reflects economic shocks.

• Growth rate in gross domestic product (X3), which is the main channel for the transmission of the impact of shocks to the labor market.

• The ratio of current spending to gross domestic product (X4), as an indicator that reflects fiscal policy shocks or demand shocks.

• Interest Rate (X5) for expressing monetary policy.

• Money-to-GDP ratio (X6) to express monetary policy shocks.

* Exchange rate variable (X7) to express exchange rate fluctuations.

Building an Econometric Model for the Impact of Economic Shocks on the Labor Market

After defining the economic variables that determine the response of unemployment or employment to economic shocks in each of the explanatory variables previously mentioned, the functional form of the model will be as follows: -

UN=f (X1, X2, X3, X4, X5, X6, X7)

The econometric model will be estimated using the self- or auto-regression vector model (VAR), which is a multivariate model on the basis of which the current value of the variable is interpreted by the past values of the same variable and other variables in the model, and the estimate of the model will be based on the following steps:

1. Test the stationarity of the time series of the variables included in the model.

2. Shock calculation was done by means of the historical disassociation method for shocks, and this method of measuring shocks does not require causality tests or joint integration.

Second: Displaying and Analyzing the Results of the Econometric Model

The eViews 10 statistical program will be used to analyze the impact of economic shocks on the variables used in this research. The data has been transferred from yearly to quarterly (Appendix 1).

1. Stationarity Test of Variables

The first step must be to test the stability of the model variables, and know whether the variables are stable or not, and this is done through the application of the Unit Root Test of Augmented Dicky Fuller(ADF).

• Unemployment (UN): stable at the first difference.

• Global consumption (X1): stable at the first difference.

• Oil prices (X2): stable at the first difference.

• GDP(X3): stable at level.

• Public Expenditure/GDP (X4): stable at the first difference.

• Interest Rate (X6): Stable at level.

• Money supply/GDP (X6): stable at level.

• Exchange rate (X7): stable at level.

2. The Optimum Delay or Slowdown Time Period for the Estimated Models was Chosen as Follows:

First: The impact of the shock of all variables on unemployment

• D (UN)=F (DX1): optimum delay period is 5.

• D (UN)=F (DX2):optimum delay period is 8.

• D (UN)=F (X3):optimum delay period is 5.

• D (UN)=F (X4):optimum delay period is 5.

• D (UN)=F (X5):optimum delay period is 4.

• D (UN)=F (X6):optimum delay period is 8.

• D (UN)=F (X7):optimum delay period is 8.

3. The Results of the Shock Assessment were Done by Means of a Historical Shock Decomposition Method

Illustration of graphs: These figures contain the structural residues of the variable that causes the shock, expressed in a graphical example (DX1, DX2, ...... X7). These forms also contain shocks for the variable receiving the shock, which is either the unemployment rate (UN) and expresses (Shocks) with rectangular graphics to show the amount of shock.

First: The Impact of a Group of Economic Shocks on the Unemployment Rate

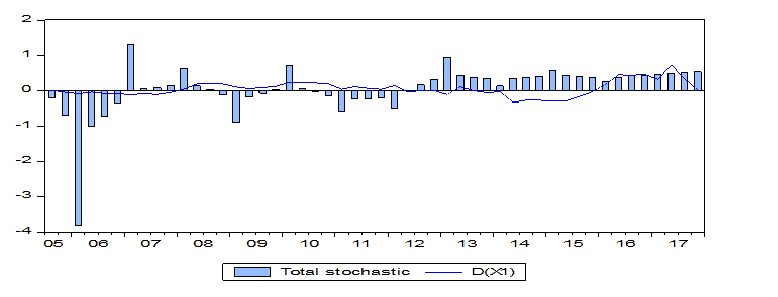

1. The Impact of the Global Consumption Shock on the Unemployment Rate as ahows in Figure 2.

Figure 2: Historical Decomposition Using Cholesky (D.F.Adjusted) Weights D(Un) From D(X1)

Source: The figure is prepared by researchers, using the EViews10 program.

The figure above indicates that global consumption (X1) has a positive impact on unemployment un in the first quarter of 2007, as the negative shock in global consumption leads to a positive shock in unemployment represented by low oil revenues that contribute significantly to financing the budget, and thus reducing the size of public jobs in addition to the low investment budget, which has emerged clearly since 2011 to continue until the end of the research period.

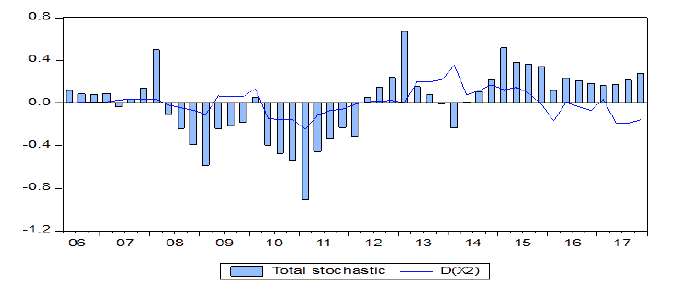

Second: Unemployment Shock Due to Oil Prices as ahows in Figure 3.

Figure 3: Historical Decomposition Using Cholesky (D.F.Adjusted) Weights D(Un) From D(X2)

Source: The figure is prepared by researchers, using the EViews 10 program.

It is noted from the above figure that low oil prices generate positive shocks in unemployment represented by high unemployment rates, especially in the years that witnessed oil shocks in 2009 and 2014, which negatively affected government spending that resulted in lower investment spending to unprecedented levels, and thus lower levels of employment.

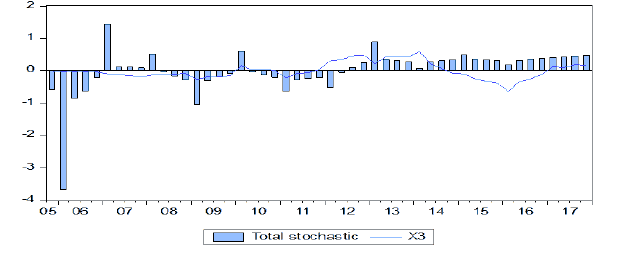

Third: The Impact of the GDP Shock on the Unemployment Rate as shows in Figure 4.

Figure 4: Historical Decomposition Using Cholesky (D.F.Adjusted) Weights D(Un) From D(X3)

Source: The figure is prepared by researchers, using the EViews10 program.

The previous figure provides an explanation of the impact of the GDP shock on the unemployment rate, as GDP growth was linked to an increase in oil exports and revenues, and not output growth in the real sectors, and therefore any negative shock in oil revenues, due to fluctuating oil prices globally, will lead to a decrease in GDP, andhence the decrease in public revenues, and consequently the weak ability of the public sector to provide job opportunities for the unemployed.

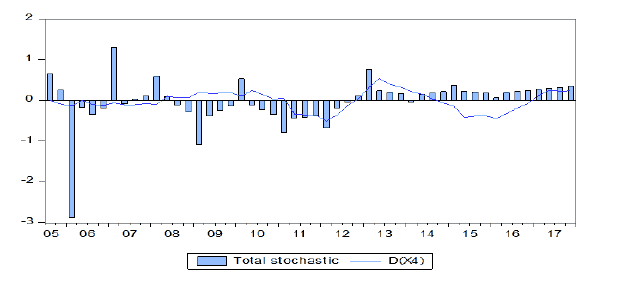

Fourth: The Impact of the Shock (Public Spending/Gross Domestic Product) on the Unemployment Rate as shows in Figure 5.

Figure 5: Historical Decomposition Using Cholesky (D.F.Adjusted) Weights D(Un) From D(X4)

Source: The figure is prepared by researchers, using the EViews10 program.

The figure above shows that a shock in the ratio of spending to gross domestic product had a negative impact on unemployment rates, especially in years that witnessed oil shocks due to lower oil prices, to show the strength of public spending response to economic shocks and this reflects the fragility of the Iraqi economy as a result of its severe rentier.

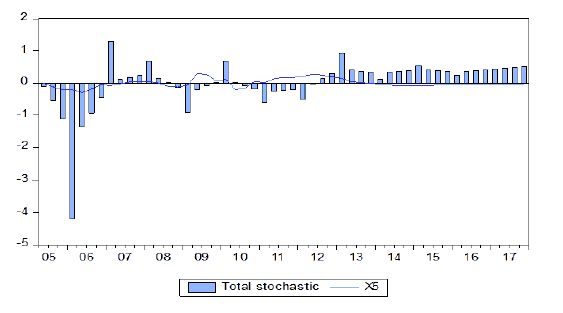

Fifth: The Impact of the Interest Rate Shock on the Unemployment Rate as shows in Figure 6.

Figure 6: Historical Decomposition using Cholesky (D.F.Adjusted) Weights D(UN) From D(X5)

Source: The figure is prepared by researchers, using the EViews10 program.

The occurrence of a shock in the interest rates leads to positive shocks in unemployment, within specific periods and at a weak value for the response factor or coefficient, as the relationship between the interest rate and unemployment is the opposite in theory, given the negative impact of high interest rates on production and investment.

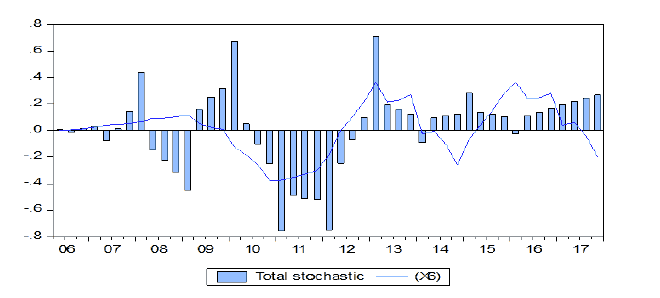

Sixth: The Impact of the Shock (Money Supply/GDP) on the Unemployment Rate as shows in Figure 7.

Figure 7: Historical Decomposition using Cholesky (D.F.Adjusted) Weights D(UN) From D(X6)

Source: The figure is prepared by researchers, using the EViews10 program.

A positive shock in the money supply, i.e., the use of an expansionary monetary or financial policy, will lead to a decrease in the interest rate, which supports investments that lead to a negative shock to unemployment due to the increase in the demand for workers, and this results in a decrease in the level of unemployment, and the previous figure shows that the occurrence of a negativeshock in ratio of public spending to GDP will lead to a positive shock in unemployment, a reflection of the dominance of the public sector in economic activity.

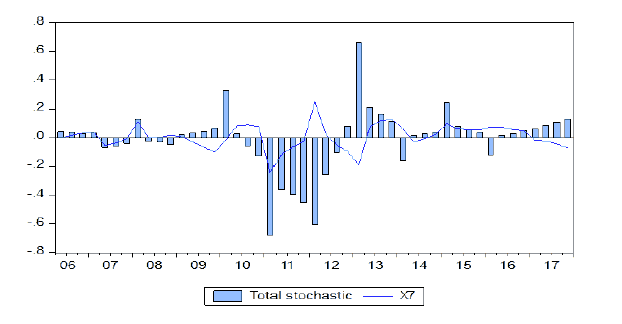

Seven: The Impact of the Exchange Rate Shock on the Unemployment Rate as shows in Figure 8.

Figure 8: Historical Decomposition using Cholesky (D.F.Adjusted) Weights D(UN) From D(X7)

Source: The figure is prepared by researchers, using the EViews10 program.

The exchange rate shock fluctuates between a negative positive, where a positive shock in the exchange rates results in a negative shock in the unemployment rates in the first four years of the research years, and it turns into a positive effect until 2009, when the fixed exchange rates were approved by the Central Bank, and thus reduced its effect on unemployment rates.

Based on the foregoing, it is clear from the analysis of shocks that the unemployment rate in the Iraqi economy has been affected by internal and external shocks in varying proportions, where the impact of the variables varied between negative and positive, as the time range for the continuation of the shock ranged between two years as a minimum, and four years as a maximum, and that oil priceshocksare one of the most impact shocks of the heavy dependence on the oil sector as a near-single source of public revenue, while monetary policy shocks (exchange rates, interest rate) were the least impact shocks on unemployment, due to the dominance of fiscal policy over monetary policy.

Conclusions

The research aimed at measuring and analyzing the impact of external and internal economic shocks on the Iraqi labor market, using the historical dismantling of shocks method. The most important research findings are summarized in the following:

1. The Iraqi economy was exposed to a set of external economic shocks (through oil prices), during the research years the first was a negative shock in 2009, due to the global crisis, and this shock did not show the significant impact on unemployment, due to financing the public budget from the financial surpluses achieved from previous highs Oil prices, and the other negative shock, when the major decline in oil prices in mid-2014, which affected a positive shock on unemployment as a result of the government's adoption of a policy of rationalization and austerity in public spending, and the reason for the severe impact of these shocks is the disruption of the structure of GDP and the dominance of the oil sector, with a decline contribution of other economic sectors.

2. The Iraqi economy was subjected to internal shocks, and was the result of the abnormal conditions that Iraq experienced after 2003, which were represented by positive shocks resulting from the increase in public spending, resulting from the instability of the security situation and the increase in wages, salaries and allocations, and growth rates in the money supply have been increasing steadily with the increase in the rates of public spending growth, and negative shocks represented by the decrease in public spending as a result of the decrease in revenues, which led to the concentration of expenditures in the current side at the expense of the decline in the importance of investment expenditures to establish the consumer nature of public sector activities (predominance of wages and salaries mainly).

3. The results of the shock assessment indicated the existence of significant responses from the unemployment side towards the shocks in the economic variables, where the results showed that the positive shocks of the ratio of public spending to the gross domestic product, and the supply of money to the positive GDP, negatively affected the unemployment rate, and led to its decline, as the high government revenues associated with oil revenues stimulated the increase in government spending, which in turn led to an increase in the money supply below the exchange rate, the ability of the central bank to maintain the level of the exchange rate, through the foreign currency auction.

4. Oil prices in the global markets are affected by economic and non-economic factors that lead to high and low oil prices. Therefore, the shock of oil prices affects the Iraqi economy by affecting the public budget through (oil revenues), which in turn affects the financing of public expenditures, so the shock of global consumption and oil prices has a clear impact on unemployment rates.

5. The heavy dependence on oil revenues to finance government expenditures resulting from the rentier nature of the economy will steal the monetary policy a lot from its effectiveness, while making fiscal policy an important role in determining the course of macroeconomic variables, and this explains the modest impact of exchange rate shocks and interest rates on unemployment rates.

6. The dominance of the public sector over the detailed economic activity, and not allowing the private sector to play its role in the economy under the auspices of the public sector, which made the private sector confined to small production or service projects limited and unable to absorb large numbers of the workforce.

Recommendations

1. Working to separate the relationship between economic shocks resulting from fluctuations in the oil sector and fluctuations in public expenditures, and the reflection of these fluctuations on economic variables, including the labor market, by setting a long-term strategy to save surplus in times of positive economic shocks, and benefit from it in times of negative shocks, as well as developing the structure of public revenues, and reducing dependence on oil revenue, which can be directed towards investment spending to revitalize the agricultural and industrial productive sectors, as well as providing the necessary protection from external competition, provided that this program is gradual over certain time periods, as the growth of non-oil sectors contributes to reducing dependence on oil revenues, and thus reducing exposure to economic shocks.

2. Reducing government interference in the economy, and allowing the private sector to lead the economy by maintaining a ratio of public expenditures to gross domestic product within reasonable ratios to achieve economic stability, and reducing fluctuations in public spending on economic activity, as well as attracting local investments in productive sectors through the construction of pivotal structures that maximize the level of production and economic efficiency of private and public projects, and their legal protection.

3. Follow an integrated system of economic policies to address the problem of unemployment, and perhaps the most important measures required to achieve this at the level of the Iraqi economy to reduce or address unemployment:

A. Emphasizing the rapid development of economic sectors and infrastructure, because this creates new job opportunities that contribute to the employment of the unemployed, especially young people of working age, and this works to reduce unemployment substantially.

B. Providing a suitable environment for local and foreign investment, which increases investment and employment opportunities, especially directing investment to industries that provide real (labor-intensive) employment opportunities that are able to absorb a large part of the workforce and thus reduce unemployment rates.

4. Encouraging the participation or contribution of the private sector in providing job opportunities, through providing governmental support to this sector in its various forms of soft loans and transparent laws, which means establishing and expanding existing projects and thus creating new job opportunities that contribute to solving the problem of unemployment.

5. The need for educational institutions to focus on aligning their outputs with the needs and requirements of labor market institutions to meet those needs on the one hand, and to ensure that graduates obtain employment opportunities appropriate to their specializations and qualifications, on the other hand.

Endnote

Calculate the growth rate as follows (population last year/population first year)/number of years * 100. In Iraq, as noted from Table (3), there is a discrepancy between the estimates of the World Bank and the estimates of the Central Bureau of Statistics, and usually the estimates of the World Bank are higher than those of the Central Bureau of Statistics, and this may be due to the fact that the Central Bureau of Statistics did not conduct surveys on employment and unemployment and was Dependence on the economic and social survey of Iraqi families.

References

- Alani, T., & Al-Nasheh, A.K. (2010). New competitiveness and restructuring of the Iraqi labor market. Administration and Economics Journal, University of Baghdad, (82).

- Al-Halfi, A.J.A. (2008). Unemployment in Iraq with special reference to youth unemployment. Arab Economic Research Magazine, 43-44.

- Energy, M., & Ajlan, H. (2008). Business economics, (first edition). Ithraa for publishing and distribution, Amman-Jordan, 2008.

- Nasser, A.M. (2007). External shocks and their impact on the Yemeni economy. Damascus, PhD dissertation.

- The annual economic report of the Central Bank of Iraq for the years, 2010-2017.

- The republic of Iraq, ministry of planning and development cooperation. Central Agency for Statistics and Information Technology, Directorate of National Accounts.

- Ministry of planning, central statistical organization, consumer price indices for the year (2017). Department of Indices.

- The republic of Iraq, the ministry of planning, the central agency for statistics and information technology, the national accounts directorate, statistical indicators on the economic and social situation in Iraq for the period (2009-2017).

- Hattacharya, B.B., & Sabyas, C. (2010). Shocks, economic growth and the Indian economy.

- Campbell, R.M., & Stanly, L.B. (2002). Economic Principles, proplems and policies, (15th Edition). New York.

- Luca, A. (2011). Fiscal policy discretion, private spending, and crisis episodes, bank of france.

- Borjas, G.J. (1996). "Labor Economics" The Mc Grawhill Companies, INC, International Edition, 1996.

- Werner, E. (2010). The impact of the crisis on employment and the role of labor market institutions. International Labor Organization.