Research Article: 2021 Vol: 20 Issue: 2

The Impact of Factors on the Intention to Apply IFRS for SMEs: Evidence from Vietnam

Dung Duc Nguyen, National Economics University

Thang Ngoc LE, National Economics University

Abstract

The purpose of this research is finding the instruction to adopt IFRS in Vietnamese SMEs by testing the impact of manager’s perception such as perceived usefulness, perceived ease of use, perceived behavioral control, subjective norm on the intention to apply IFRS. This paper focuses on finding the factors which influence the intention to apply IFRS for Vietnamese SMEs based on the mixed of Theory of Planning Behaviour (TPB) model and Technology Acceptance Model (TAM). The data is collected through a survey for 195 managers of SMEs. The research method applied in the study is a quantitative research method with checking the reliability of variable measurements with Cronbach’s Alpha, CFA and SEM technique. After that, this paper also provides suggestions to apply IFRS for Vietnamese SMEs for managers and state agencies. The result of research also shows that gender of manager moderates the perception and the intention to adopt IFRS.

Keywords

IFRS, Perceived Usefulness, Perceived Ease of Use, Perceived Behavioral Control, Perceived Risk.

JEL Classifications

D81, G11, M41.

Introduction

Globalization is the cause of the introduction of international financial reporting standards (IFRS). The application of IFRS is an issue concerned by many countries. The IFRS guarantees international cooperation thereby expanding the business of enterprise and nation. However, the application of IFRS in developing countries is proving ineffective because the number of small and medium enterprises (SMEs) in these countries has a large proportion and they consider whether the benefits outweigh the cost of IFRS application. In February 2007, IASB issued a draft IFRS for SMEs with the document “Basis for conclusion on the draft IFRS for SMEs”. The draft IFRS for SMEs was developed on basis of regular events in SMEs with about 50 employees. All regulations, principles, concepts, in and differences between this draft and IFRS were considered to not only meet the requirements of SMEs but also to balance the costs and benefits of application. By the end of 2007, IASB had received 161 feedback letters on the draft from researchers and professional organizations. At the same time, IASB also conducted many experiments with 116 SMEs in 20 different countries to identify the difficulties of SMEs in applying the draft IFRS for SMEs. According to the International Accounting Standard Board (IASB) reports, as of March 2017, there is 85 countries recognize and allow application IFRS for SMEs. In Vietnam, the application of IFRS for SMEs is also considering because this group has 90% of the number of enterprises and they provide up to 51% of jobs as well as contribute 40% GDP for the country. The IFRS application will bring opportunities to access international capital and improve the competitiveness and sustainable development of Vietnamese SMEs. However, the perceived ease of use perceived usefulness, and perceived behavioral control are still the constant fears of Vietnamese SMEs managers. Especially, when the Vietnamese ministry of finance issued a document No. 345/QD-BTC approving the IFRS application scheme in Vietnam and stating clearly the application roadmap, the urgency of the research topic is clearer. The writing includes Introduction; Brief Literature Review; Research model, hypotheses, and variable measurements, Research methodology, result, and discussion; Conclusion and Policy implication.

Literature Review

Regarding the factors promoting the harmonization process, it is argued that they are based on the interests of transnational corporations and multinational companies. In the process of global integration, it is necessary to reduce the costs related to financial statements Bohušová & Blašková (2013); Matseluh & Uniec (2013); Azarenkova et al. (2014) shows that using international accounting standards and international financial reporting standards (IAS/IFRS) can help improve the comparability of financial reporting information and thus reduce the investors’ costs and risks of using information. The process of integrating economies around the world, especially in the capital market, requires accounting-related regulations to be standardized. International accounting harmonization process also brings about overall benefits to all of stakeholders on a global basis. Especially, there have been many mergers and acquisitions in many countries recently; therefore, there is an urgent need for common corporate financial reporting standards.

The Influence of Perceived Usefulness and Perceived Ease of Use

According to Joshi et al. (2008), the perception of accountants and auditors is an important factor that has the influence to apply IFRS in business. By asking 24 accountants from the companies listed on the Bahrain Stock Exchange and 28 auditors, the found the difference between each group about the adoption of IFRS. For example, the higher job experience respondents tend to support IFRS application because of fairly and objectively. Meanwhile, the auditors suppose that the cost of IFRS adoption is over the benefit stronger than the accountants. As the result, the authors suggest that the perception of IFRS benefit is the important factor influence deciding to apply IFRS in business or not. Following this approach, the research of Bozkurt & Oz (2013) also researches the relationship between the perception of auditors and accountants about IFRS and the advantages expected from these standards. Using a questionnaires survey with a sample of 430 auditors and accountants in Turkey, Bozkurt & Oz (2013) hypothesized that the advantages of IFRS come from 4 factors including: Perception, Utility, Interpretation, and Responsibility. However, the result of Bozkurt’s study only showed the positive relationship between the utility and advantages of IFRS but insignificant. Besides, the perception shows the negative impact and insignificant on the advantage of IFRS, and only interpretation shows a significant relationship with p_value < 0.05. In this research Bozkurt & Oz (2013) suggest using a Likert 5-degree to measure all variables in model research but they do not show the theoretical foundation for the model research.

On another approach, many researchers applied Technology Acceptance Model (TAM) of Davis et al. (1989) to explain the reason for the intention to apply IFRS like Rezaee et al. (2010) and Moqbel et al. (2013); Pylypenko (2016). Based on the attitude definition of Ajzen (1991), Rezaee et al. (2010) found the positive and significant influence from two elements of attitude on the intention to apply IFRS which are perceived usefulness and perceived ease of use. More recently, the research of Moqbel et al. (2013) also proved that applying IFRS intention was influenced by perceived usefulness and perceived ease of use as well as risk aversion. In the research of Moqbel et al. (2013) Structural Equation Modeling (SEM) was applied to find out the positive and significant influence from all perception of usefulness, ease of use, control, and subjective norm to applying IFRS intention. Though, the sample size of the research is 84, too small to guarantee for SEM technique. Meanwhile, the sample size for SEM with 5 group factors should be from 150 to 300 observes (Hair et al., 2014). In short, based on the overview of previous researches described above, this paper will continue testing the influence from perceived usefulness and perceived ease of use to intention to apply IFRS in the new context research, the Vietnamese SMEs.

The Influence of Perceived Behavioral Control and Subjective Norm

Many previous researches show that not only perceived usefulness and perceived ease of use but also the perceived control and subjective norm have a positive influence on applying IFRS intention. According to Ajzen (1985), the subjective norm is the belief of a person or group of people who have a huge influence on other people will support a particular behavior. As the result, subjective norm shows the social pressure in an individual and it is the motivation of his activities. On another hand, perceived behavioral control is an individual’s perceived ease or difficulty of performing the particular activities and it can be determined by the total set of accessible control beliefs (Ajzen, 1985). The perceived behavioral control and subjective norm are the keys to the theory of planning behavior (TPB) of Ajzen (1985) which made the differences between TPB and theory of reasoned action (TRA). Applying TPB of Ajzen (1985), the research of Djatej et al. (2015) of Eastern Washington University proved that the subjective norm and perceived behavioral control have a positive and significant impact on the intention to apply IFRS of professional accountants who has a CPA certificate. In the research, the measurement of all variables is a Likert scale with 7 degrees from very disagrees to very agree like original research of Ajzen (1985). However, the research of Djatej et al. (2015) could not show the significant impact from the third factor in the TPB model on the intention to apply IFRS that is the manager’s attitude. Also, the context of the research is the US; the country does not apply IAS before. The authors also do not concern with the role of contingency factors such as sex, culture, leadership style which can control or mediate the relationship between attitude, perceived control, subjective norm and intention to apply IFRS.

In Vietnam, many previous studies also concerned the influence from perceived behavioral control and subjective norm but the studies have more concentration on many contingency factors such as the difference of culture, law system, political institution. For example research of Nguyen (2019), the author concern about the impact of the law system and professional organizations on intention to apply IFRS in Vietnamese SMEs. The law system and professional organizations can be represented for subjective norm because of the higher degree of legalization the stronger intention to apply IFRS. Inherited from previous studies, this paper also will test the influence of perceived behavioral control and subjective norm to applying IFRS intention in Vietnam the new context research.

The Influence from Contingencies Factor to IFRS for SMEs Applying Intention

In fact, the studies related to intention to apply IFRS are implemented in several countries but the results are very different because of the impact of many contingencies factor such as culture, sex of managers, accountant degree or leadership style…For example, the study of Salter & Niswander (1995) shows that the countries having risk aversion culture normally have a lower intention to applied IFRS for SMEs. The result of Salter & Niswander’s research (1995) was based on Hofstede's cultural dimensions theory. According to Hofstede (1980), the individual’s behavior can be influenced by society’s culture that includes power distance, individualism, uncertainty avoidance, masculinity, orientation, indulgence. In fact, several authors are founding the gap of research relate to IFRS application by testing the role of the society’s culture dimensions such as Salter & Niswander (1995); Masca (2012); Moqbel et al. (2013) and Phuong & Richard (2011). For example, the research of Moqbel et al. (2013) measured the influence of the manager’s risk aversion on IFRS adoption in the US. The manager’s risk aversion is another way to describe uncertainty avoidance. Besides we also concern about the difference of intention to apply IFRS between male and female SMEs managers as suggest of Hofstede (1980) about masculinity. It is the gap of research still not be solved by previous research. In Vietnam, Phuong & Richard (2011) Vietnam has a difference in the political environment, the legal system, business environment, culture, and education compare to the developed countries so IFRS still not be applied immediately. Following the approach of previous research, this paper will focus on the role of risk aversion in the intention to apply IFRS in Vietnamese SMEs.

Methodology

Research Model and Hypotheses

Following the content of the theoretical framework above, the research model in this paper is built by mixed of TPB, TAM, and Hofstede's cultural dimensions theory. Theory TPB states that there are three core components, namely; attitude, subjective norm, and perceived behavioral control, which together shape an individual's behavioral intentions. TAM replaces many of TRA's attitude measures with the two technology acceptance measures-ease of use, and usefulness. TRA and TAM, both of which have strong behavioural elements, assume that when someone forms an intention to act, that they will be free to act without limitation. In turn, behavioral intention is assumed to be the most proximal determinant of human social behavior.

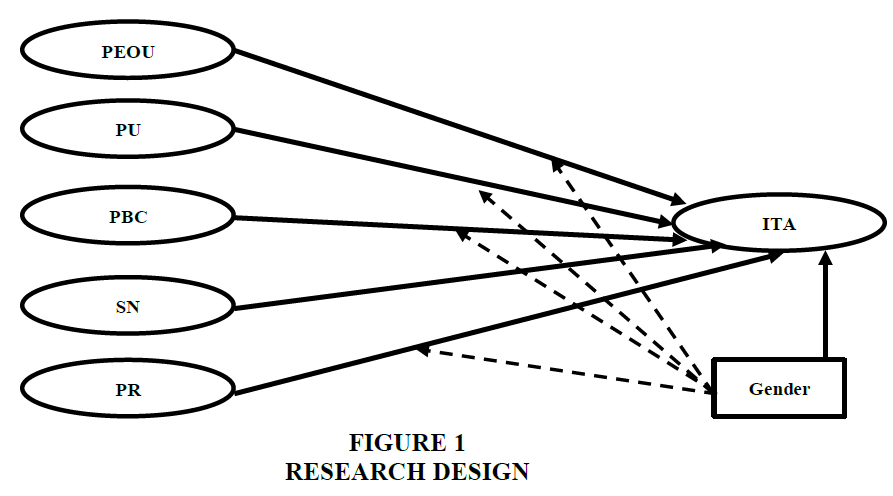

Based on TPB and TAM, the manager’s attitude in TPB is replaced by perceived usefulness and perceived ease of use and 04 hypotheses H1, H2, H3, and H4 are stated:

H1 Manager’s perceived usefulness of IFRS has positive impact on the intention to apply IFRS

H2 Manager’s perceived ease of use of IFRS has positive impact on the intention to apply IFRS

H3 Manager’s perceived behavioral control has positive impact on the intention to apply IFRS

H4 Subjective norm has a positive impact on the intention to apply IFRS

Based on Hofstede's cultural dimensions theory, we add two more hypotheses H5 and H6 to find out the role of risk aversion and gender in the relationship between the manager’s perception and the intention to apply IFRS.

H5 Manager’s risk aversion has negative impact on the intention to apply IFRS

H6 Gender of manager moderates the impact of manager’s perception of IFRS on the intention to apply IFRS

As the result, the model research is shown in Figure 1 below:

Note: PEOU: Perceived ease of use of IFRS; PU: Perceived usefulness of IFRS; PBC: Perceived behavioral control of IFRS; PR: Perceived risk (risk aversion) of IFRS application; SN: Subjective norm; ITA: Intention to apply IFRS

Variable Measurements

In this paper, the variable measurements are almost inherited from the previous research which was shown in the theoretical framework above and we synthesized it in the following Table 1 below. The items of variable measurements will be described in Appendix A.

| Table 1 Variable Measurements | |||

| Variable measurement | No. of items | Authors | Code |

| Perceived ease of use of IFRS | 05 | Davis et al. (1989) | PEOU |

| Perceived usefulness of IFRS | 05 | Davis et al. (1989) | PU |

| Perceived behavioral control of IFRS | 05 | Ajzen (1991) | PBC |

| Perceived risk of IFRS application | 03 | Authors self-design | PR |

| Subjective norm | 04 | Ajzen (1991) | SN |

| Intention to apply IFRS | 03 | Davis et al. (1992) | ITA |

Results

The research method applied in the study is a quantitative research method with two steps. Pilot research is the first step with the purpose is checking the reliability of variable measurements with Cronbach’s Alpha technique. After standardized variable measurements, the hypotheses are tested by the CFA and SEM technique based on the data collected from the questionnaire survey in the second quarter of 2020.

Sample

The data for this study mainly is collected by distributed questionnaires for managers of SMEs who study in National Economic University master’s program in accounting. Besides the questionnaire also send by email to managers of SMEs through tax authorities. In total, 324 questionnaires were distributed but 211 were recovered and of which 195 could be used for analysis. The response rate is around 60%. However, the sample size still enough for analysis because the minimum size to apply SEM is 150 observes with 06 variables. Beside SPSS 25.0 and Amos 22.0 software is used in the study to run Cronbach’s Alpha, EFA, CFA, and SEM.

Data Analysis

In pilot research, the Cronbach’s Alpha technique is applied with 52 observes and the result has shown that 02 items of PEOU and 01 item of SN disqualified because the total correlation is lower than 0.3 (Hair et al., 2014). In the 2nd step, Cronbach’s Alpha test result is similar to pilot research. After that, the EFA technique is applied to reduce bad items in variable measurements and the result presented in Table 2 shows that all items converge in 06 variables as synthesized with sig of KMO test < 0.05. The extraction method in EFA is principal axis factoring and rotation method is promax with format sort blank is 0.5.

| Table 2 Result of EFA | |||||||

| KMO and Bartlett's Test | |||||||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.802 | ||||||

| Bartlett's Test of Sphericity | Approx. Chi-Square | 2016.438 | |||||

| df | 231 | ||||||

| Sig. | 0.000 | ||||||

| Pattern Matrixa | |||||||

| Factor | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| PU2 | 0.798 | ||||||

| PU3 | 0.761 | ||||||

| PU1 | 0.718 | ||||||

| PU4 | 0.710 | ||||||

| PU5 | 0.663 | ||||||

| PBC2 | 0.777 | ||||||

| PBC1 | 0.755 | ||||||

| PBC3 | 0.690 | ||||||

| PBC4 | 0.687 | ||||||

| PBC5 | 0.82 | ||||||

| SN4 | 0.891 | ||||||

| SN3 | 0.819 | ||||||

| SN2 | 0.794 | ||||||

| PR1 | 0.957 | ||||||

| PR3 | 0.767 | ||||||

| PR2 | 0.703 | ||||||

| PEOU2 | 0.903 | ||||||

| PEOU4 | 0.738 | ||||||

| PEOU3 | 0.582 | ||||||

| ITA1 | 0.852 | ||||||

| ITA2 | 0.766 | ||||||

| ITA3 | 0.574 | ||||||

a. Rotation converged in 6 iterations.

In the following step, the CFA technique is applied to confirm the suitable for data from surveys to model research. CFA must be done before testing the hypotheses by SEM and the result of CFA is guaranteed because all indicators satisfy the condition: Chi-square/df = 1.547 ≤ 2 (p_value < 0.05); GFI = 0.879 > 0.85; LTI = 0.933, CFI = 0.943 > 0.9 and RMSEA = 0.053 ≤ 0.08 (Hair et al., 2014). Beside all validity of CFA (discriminant, convergent, reliability) calculated from regression weights, correlations and covariances also satisfy the condition.

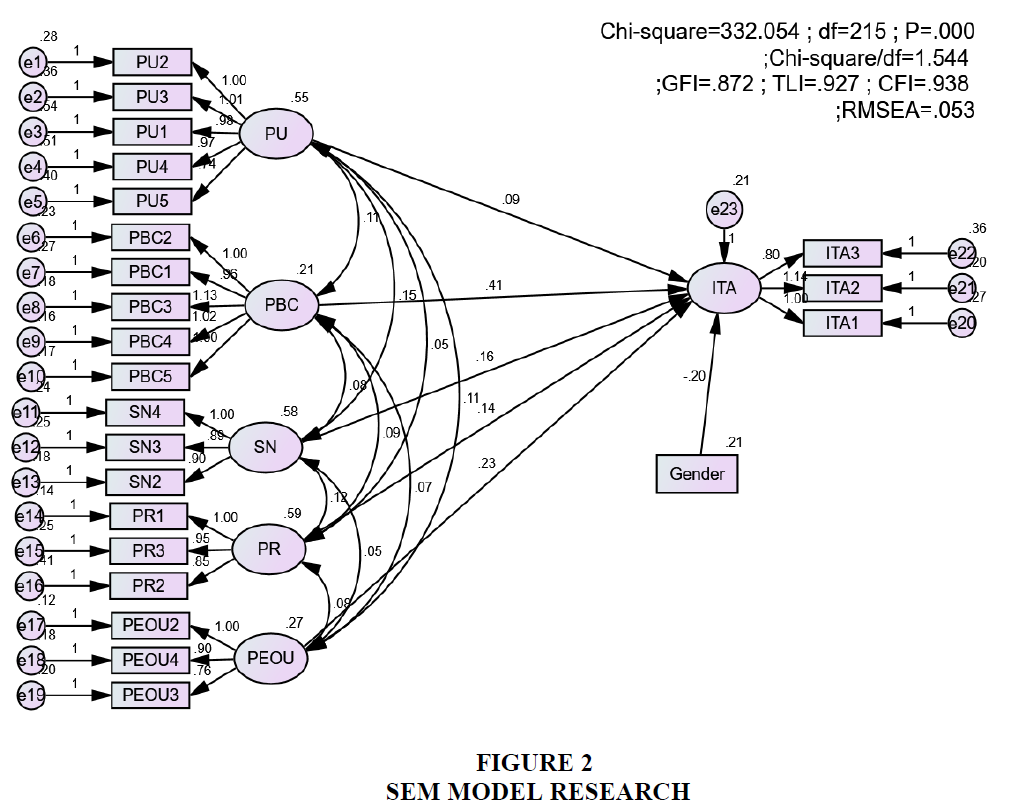

Finally, the hypotheses are testing by the SEM technique and the results are shown in Figure 2. Similar to CFA testing, Figure 2 firstly prove that the data collected is fit with the model according to Hair et al. (2014).

As the regression weights and standardized regression weights shown in Table 3, all hypotheses are accepted except H1. Perceived usefulness of Vietnamese, SMEs managers have no impact on the intention to apply IFRS because the relationship between the variables are insignificant (p_value = 0.155 > 0.05).

| Table 3 Output of SEM | ||||||||

| Estimate | S.E. | C.R. | P | Estimate (Standardized) |

Hypotheses | |||

| ITA | <--- | PU | 0.094 | 0.066 | 1.422 | 0.155 | 0.115 | H1 (Rejected) |

| ITA | <--- | PBC | 0.412 | 0.115 | 3.564 | *** | 0.311 | H2 (Accepted) |

| ITA | <--- | SN | 0.160 | 0.062 | 2.587 | 0.010 | 0.200 | H4 (Accepted) |

| ITA | <--- | PR | 0.144 | 0.060 | 2.387 | 0.017 | 0.183 | H5 (Accepted) |

| ITA | <--- | PEOU | 0.234 | 0.096 | 2.437 | 0.015 | 0.201 | H3 (Accepted) |

| ITA | <--- | Gender | -0.202 | 0.087 | -2.316 | 0.021 | -0.153 | H6 (Accepted) |

| … | … | … | … | … | … | |||

The result from Table 3 also shown that not only perceived ease of use, subjective norm perceived behavioral control but also perceived risk of IFRS has an impact on the intention to apply IFRS in Vietnamese SMEs. It is similar to previous research of Moqbel et al. (2013). In addition, Table 3 also proves that the gender of managers has an influence on the intention to adopt IFRS but the influence is negative (male=0 and female=1). For testing the different results between the male group and the female group, multigroup moderation is applied. The result presented in Table 4 shows that male managers have perceived usefulness of IFRS stronger than female managers and the difference between the two groups is significant (z-score=-2421). Besides the perceived risk of IFRS of male managers is less than twice female managers however the difference is insignificant.

| Table 4 Multigroup Moderation | |||||||

| Male | Female | ||||||

| Estimate | P | Estimate | P | z-score | |||

| ITA | <--- | PR | 0.162 | 0.013 | 0.083 | 0.273 | -0.792 |

| ITA | <--- | PEOU | 0.222 | 0.060 | 0.211 | 0.040 | -0.065 |

| ITA | <--- | SN | 0.173 | 0.035 | 0.184 | 0.010 | 0.100 |

| ITA | <--- | PBC | 0.318 | 0.000 | 0.305 | 0.025 | -0.083 |

| ITA | <--- | PU | 0.349 | 0.000 | 0.051 | 0.473 | -2421*** |

Discussion

Following the information presented in Table 3 and Table 4, the result of this study is similar to many previous researches. Based on the result of our research, we agree with Davis et al. (1989); Djatej et al. (2015), and Moqbel et al. (2013) that the intention to apply IFRS in Vietnamese SMEs is influenced by manager’s perception of aspect risk aversion, ease of use, behavioral control and subjective norm when hypotheses H2, H3, H4, and H5 are accepted. Manager’s perceived ease of use of IFRS has positive impact on the intention to apply IFRS. Manager’s perceived behavioral control has positive impact on the intention to apply IFRS. Subjective norm has a positive impact on the intention to apply IFRS and Manager’s risk aversion has negative impact on the intention to apply IFRS

Though, this paper failed to prove that the perceived usefulness of IFRS has a positive impact on the intention to apply IFRS in Vietnamese SMEs. On another hand, Table 4 also explains that the relationship between perceived usefulness and intention to apply IFRS is moderated by the manager’s gender. Female managers have a weaker perception of the IFRS usefulness but they account for a larger proportion. In fact, most of the accountants are usually female.

Conclusion

The result of this paper not only contributes to the knowledge about IFRS but also supplies a good instruction to adopt IFRS in Vietnam. The research results show that the application of TPB model and the extended TPB model for the application of IFRS in the context of Vietnam is appropriate. To implement IFRS in Vietnam, the authorities such as the Ministry of finance need to focus on specifying the ease of use of IFRS, the ability to control IFRS, the global IFRS adoption trends instead of communicating the usefulness of IFRS. An urgent issue in applying international financial reporting standards for SMEs is the application of fair value approach instead of historical cost approach. According to Carlin et al. (2014) under IAS/IFRS, fair value is used more and more in financial reporting elements. Therefore, it is necessary to promote the harmonization of IFRS for SMEs system which addresses the use of fair value as a key measurement to enhance the appropriateness of information presented in the financial statements. At the same time, Vietnam should establish regulations on fair value measurement, in which, unifying fair values as “output values” of assets or liabilities instead of VAS 1, which only relying historical cost approach, as the use of historical cost as the primary measurement may gain credibility but reduce the relevance of information provided in the financial statements. A difference of the article compared to the studies that preceded the same research problem is that the persons surveyed in this article are all people working in the enterprises, this will make the research results becomes closer to companies than previous studies which tested various objects in the research model.

However, the paper still has limitations like sample only focus on Vietnamese SMEs. In addition, the squared multiple correlations of the model are 0.432 that mean 06 factors only explain 43% intention to apply IFRS in Vietnamese SMEs. Therefore, subsequent studies can supplement this paper by expanding the sample or adding more factors of model research in the future.

Acknowledgement

This research is funded by the National Economics University (NEU), Hanoi, Vietnam. The author thank anonymous referees for their contributions and the NEU for funding this research

Appendix A

Questionnaire Items of Independent Variables

Perceived usefulness

• Applying IFRS would help me make financial reporting more quickly and quality

• Applying IFRS would help me to better manage and keep track of business operations

• Applying IFRS would help me to decide precisely and effectively

• Applying IFRS would promotes the quality of human resources in business.

• Applying IFRS would increase my firm’s competitiveness and attract investment

Perceived ease of use

• Learning to use IFRS was easy for me.

• I found it easy to get IFRS to do what I want it to do to manage my business.

• Using IFRS was clear and understandable.

• I found IFRS to be flexible to use.

• It was easy for me to become skillful at using IFRS

Subjective norm

• The MOF approved the project “Applying IFRS in Vietnam”, so I need to apply.

• IFRS is a worldwide standard in making financial report, so I need to apply.

• Our business rivals in Vietnam are applying IFRS, so I need to apply.

• Our audit advisor advices us to apply.

Perceived Behavioral Control

• I can arrange time to study IFRS.

• I am confident to apply IFRS effectively and precisely in making financial report.

• I can afford to apply IFRS to my firm.

• I want to apply IFRS to my firm soon.

• I will be more motivated if I am aware of the usefulness of IFRS application soon.

• Perceived Risk

• I’m not afraid that IFRS too complex to appy and easy to cause errors

• I’m not afraid that my firm lack of resources to apply IFRS

• I’m not afraid that IFRS will not be suitable for Vietnamese economy.

Intentions

• I hope to apply IFRS to my firm.

• I have a plan to apply IFRS to my firm.

• I will study and consider applying IFRS to my firm.

References

- Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In Action control. Springer, Berlin, Heidelberg.

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211.

- Azarenkova, G., Moskalenko, O., & Piskunov, R. (2014). Influence of accounting information on the level of financial security of systemically important banks. ??????????? ???????-???, (9-10 (1)), 94-97.

- Bohušová, H., & Blašková, V. (2013). In what ways are countries which have already adopted IFRS for SMEs different. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 60(2), 37-44.

- Bozkurt, O., & Öz, Y. (2013). Perceptions of professionals interested in accounting and auditing about acceptance and adaptation of global financial reporting standards. Journal of Economics Finance and Administrative Science, 18(34), 16-23.

- Carlin, T.M., Finch, N., & Tran, D.M. (2010). IFRS compliance in the year of the pig: The practice of goodwill impairment testing among large Hong Kong firms during 2007.

- Davis, F.D., Bagozzi, R.P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982-1003.

- Djatej, A., Chen, Y., Eriksen, S., & Zhou, D. (2015). Understanding students' major choice in accounting: an application of the theory of reasoned action. Global Perspectives on Accounting Education, 12, 53-72.

- Hair Jr, J.F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V.G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review, 26(2), 106-121.

- Hofstede, G. (1980). Culture's consequences: 1nternational differences in workrelated values. Sage Publication.

- Joshi, P.L., Bremser, W.G., & Al-Ajmi, J. (2008). Perceptions of accounting professionals in the adoption and implementation of a single set of global accounting standards: Evidence from Bahrain. Advances in Accounting, 24(1), 41-48.

- Masca, E. (2012). Influence of cultural factors in adoption of the IFRS for SMEs. Procedia Economics and Finance, 3, 567-575.

- Matseluh, N., & Uninec, O. (2013). Forms and methods of small and medium business financing development. Economic Annals-XXI, 9-10(1-2), 38-41.

- Moqbel, M., Charoensukmongkol, P., & Bakay, A. (2013). Are US academics and professionals ready for IFRS? An explanation using technology acceptance model and theory of planned behavior. Journal of International Business Research, 12(2), 47-60.

- Nguyen, T.A.L (2019). Factors affecting the application of international financial reporting standard for small and medium enterprises in Vietnam. Unpublished doctoral dissertation, University of Economic Ho Chi Minh City.

- Phuong, N.C., & Richard, J. (2011). Economic transition and accounting system reform in Vietnam. European Accounting Review, 20(4), 693-725.

- Pylypenko, L. (2016). Accounting for derivatives and their representation in financial reporting: problems of methodology and procedure. Economic Annals-XXI, 156(1-2), 116-120.

- Rezaee, Z., Smith, L.M., & Szendi, J.Z. (2010). Convergence in accounting standards: Insights from academicians and practitioners. Advances in Accounting, 26(1), 142-154.

- Salter, S.B., & Niswander, F. (1995). Cultural influence on the development of accounting systems internationally: A test of Gray's [1988] theory. Journal of International Business Studies, 26(2), 379-397.