Research Article: 2021 Vol: 20 Issue: 6S

The Impact of Information Technology Investment on the Financial Performance of the Banks

Mohammad Naser Hamdan, Al al-Bayt University

Omar Khlaif Gharaibeh, Al al-Bayt University

Ali Zakariya Al- Quran, Al al-Bayt University

Nawras M. Nusairat, Applied Science Private University

Keywords

Software and Hardware Costing, Banking Activities

Abstract

The aim of this paper is to investigate the impact of information technology investment on the financial performance of the Jordanian commercial banks over the period of 11 years from 2009 to 2019. The paper uses the feasible generalized least square regression technique. The results indicated that there is a positive relationship between (Number of ATM machines, Internet Banking Services (IBN) and financial performance, on the other hand, a negative relationship between (Cyber branches (CYB), phone banking services (PHB), and financial performance. However, there is no relationship between Software and Hardware Costing (SOHA) and financial performance. This paper recommends the managers of commercial banks in Jordan to expand the use of ATMs and Internet banking services (IBN) because it has a direct impact on increasing the profitability of these banks and improving their performance.

Introduction

The business world is growing rapidly, especially after the digital revolution and social computing. This has led to an increased Competitive Challenges in Global business environment. One of the most important factors that have affected development and competition in recent years is information technology (IT). Investment in IT has helped in developing the level of performance for commercial banks, increasing their profits and providing quick service to their customers using electronic networks effect that at the same time reduces costs. IT has also contributed to increasing competitiveness among banks through decision support and management information systems. The various IT applications used in banks are the key to the financial engineering process. In this rapidly changing world, conducting banking activities online has helped banks survive, thrive. Therefore, banks must manage and master IT to ensure their competitiveness. Jordanian banks, like other banks in the world, are the link between many parties and deal with various information. They deal with information related to the Central Bank, which represents monetary policy, as well as the Ministry of Finance, which represents fiscal policy. In addition, Jordanian banks deal with competitor information in order to increase competitiveness, and with the market Funds that consist of intermediaries, depositors and users. Jordanian banks must provide financial information to customers and facilitate payment processes. Therefore, the presence of IT facilitates the management of information with high efficiency in the bank, so it is assumed that IT contributes significantly to improving the performance level of banks.

For banks, IT applications offer rapid and inexpensive strategy to acquire customers, saving cost and time. In addition, it is sometimes difficult to use, this prompted banks to adopt IT. The question arises whether or not investment in IT enhances the profitability of the Jordanian banks. This current study is an extension of previous studies looking at the impact of IT investment on the performance of Jordanian commercial banks at the level of short and long-term using Return on assets (ROA) and Tobin’s Q (TQ). In particular, does investment in IT measured by Phone banking (PHB), Cyber branch (CYB), Automated Teller Machines (ATM), Internet-Banking Services (IBN), and Software & hardware affect the profitability of banks? The question posed in this study is of great importance to bank managers and academics. This study also studies an important period in the development of technology using all Jordanian commercial banks and covers a long period of time from 2009 to 2019. This study is motivated for various reasons. First, some previous literature has shown that the impact of investment in information technology has a positive impact on the performance of banks such as Barua, Kriebel, & Mukhopadhyay (1991), Vikram & Gayathri (2018), and Gul & Ellahi (2021) while other very limited studies have found that investment in IT had a negative impact on the performance of banks such as Prasad and Harker (1997) and Brynjolfsson & Hitt (1996). It is useful to know the impact of investment in information technology, positive or negative. Thus, the search for more evidence continues required to support the current literature.

This study contributes to enriching the previous literature in several ways. Firstly, most previous studies measure the impact of IT on the financial performance of banks through ROA, ROE, or other ratios, few studies measure the impact of financial performance on the short and long-term levels. Therefore, this study will add new dimension to current literature by measuring the impact of IT on the financial performance of Jordanian banks in the short and long-term represented by the ROA and Tobin’s Q, respectively. Secondly, there are limited studies on the impact of IT on the banking sector in the USA and Europe. However, this study, according to the researcher's knowledge, is considered one of the first studies in Jordan along with the study of Jalal Karim and Hamdan (2010). Therefore, this study updates and add a new dimension to the existing literature of impact of IT investment in Jordanian commercial banks by adding new independent variables such as Phone banking (PHB), Cyber branch (CYB), and Internet-Banking Services (IBN), as well as it is possible to generalize the results of this study to developing countries and emerging economies that are similar to Jordan.

This paper is organized as follows. Section 2 reviews the literature regarding of IT. Section 3 outlines the research methodology. Section 4 discusses the empirical results and discussions, while Section 5 concludes the paper.

Theoretical Foundation

This section provides several theories that explain the impact of IT investment on the financial performance of banks and firms. These theories are the theory of technology acceptance, resource-based theory and investment management. The first theory is technology acceptance, which posits that the connection between acceptance of use for any innovative material and apparent use is positive. The theory suggests that numerous factors determine the decision on the manner and the time that a technological tool or device should be utilized. These factors are the apparent convenience and implied user-friendliness of a certain technology (Mohammad et al, 2020). The technology acceptance model can be used in the clarification and envision of actions of IT product customers. The theory relies on and is applied in determining the effectiveness of IT in proving the financial performance of organizations, particularly banks (Mohammad et al., 2020). It is relevant for this study as the adoption of ICT by commercial banks can be rationalized. That is, it can be used to determine how the user reaction to the introduction of new technology can improve the financial performance of a firm (Winarmo &Putra, 2020). That is, the theory can connect the effectiveness of CIT and users’ perspectives then connected to the financial performance of a bank.

The second resource-based theory states that when an organization possesses the strategic resources, including IT, it creates a competitive edge over its competitors, allowing it to achieve higher profits (Shaw et al., 2013). Strategic resources are an imperative asset for any company. Firms should match their resources, knowledge, and skill into their core competencies to gain a competitive advantage over their rivals (Hitt et al., 2016). In this case, the core competencies are operations that organizations can conduct better than their competitors. A strategy is an imperative aspect for achieving organizational goals and objectives. It is also a plan of action that connects the objectives and policies of the firm to enable it to achieve its vision. An approach that matches with the organizational goals and objectives is essential for the accumulation and allotment of an organization’s wealth to a productive course (Shaw et al., 2013). Thus, firms can consider IT as a strategy to achieving higher financial performance by increasing profits.

The third theory of investment management involves the processes of controlling money. The goal of investing is to manage money in an efficient manner with the hope of making a profit in the future. The use of IT is one of the most helpful factors in managing money in an efficient manner. For example, a company that invests in IT intends to speed up its activities so that it can double or triple its returns (Farouk & DanDago, 2015). On the other hand, the same company can invest in IT so that it can secure its transactions and minimize cost or pilferage.

Through the previous theoretical framework, we note that IT has an impact on improving the efficiency by increasing the profits, reducing costs with less effort and a short period of time for companies and banks. In other words, efficiency is the capability to attain a ROA with the lowest resources (Alshatti, 2015). Therefore, this study came to examine the impact of IT on the performance of Jordanian banks as measured by ROA and Tobin’s q.

Literature Review

Paul Strassmann (1990) concluded that there is no relationship between IT investment and profitability. Others such as (Brynjolfsson & Hitt, 1996 and Prasad and Harker, 1997) show that IT investment is negatively related to profitability. DanDago (2015) examine the effect of investment in IT measured ATM, hardware and software on financial performance. Their result using the panel regression shows that the financial performance is negatively affected by IT investment. Farouk & DanDago (2015) find that the financial performance is negatively affected by TC, while positivity affected by TR. Beccalli, (2006) indicates that the role of IT as a strategic necessity rather than factor in support of competitive advantage. Ho & Mallick (2006) who find that negative relationship between IT spending and profits. In particular, they point out that increased IT investment in the U.S. during 1985 to 2005 could lead to existing network effects and reducing profits. In addition, Ekata (2012) show that increase customer satisfaction in Nigeria is positively affected by IT investment, while performance of the banking sector is negatively affected of IT investment because a product decreases in value if fewer people use the product.

However, at the level of non-banking sectors, many studies such as (Strassmann, 1985, 1990; Ahituv and Giladi, 1993; Shin, 2001) show that profitability measured by ROA is affected by IT investment, while others (Tam, 1998; Alpar and Kim, 1990) show that profitability measured by ROE is affected by IT investment. Brynjolfsson and Hitt, (2000) and Jorgenson and Stiroh (2000) confirmed previous result and find that IT leads to increase the profitability in the most of the U.S. industries except of banking industry. In the U.S. using panel data on 12 American banks covering nine years, Shu & Strassmann (2005) have shown a positive impact of IT on banks performance. Gupta, Raychaudhuri & Haldar (2018) confirm that investment in IT enhance the profitability in the Indian banking sector from 2006-2013.Using Random effect panel estimation on 32 banks in Pakistan from 2010 to 2019 and following Müller, Fay, and Vom Brocke (2018), Gul & Ellahi (2021) measure data analytics as a dummy variable; one in the year and the subsequent years when a bank starts working with data analytics and zero otherwise. Gul & Ellahi (2021) find that productivity of banks can be increased by 10% by investment in data analytics.

Using simple random sampling method based on 183 responded to the questionnaire of the staff experts of IT, Sadeghimanesh & Samadi (2014) find that financial performance of the banks are statistically affected by IT dimensions on Tehran Stock Exchange. Their results also indicated that infrastructure of IT ranked first, while knowledge of IT and IT operations ranked second and third, respectively. In the Nigerian Stock Exchange (NSE), Dandago, Farouk, & Usman (2012) show that financial performance of Nigeria banks have positively and statistically significant by MIS surrogates. They suggest that if Nigeria banks need to enhance their profitability, they should increase investment in IT. Similar results have been documented by Ali, Gueyié & Okou (2021) in Niger, they show that investment in IT has a positive and statistically significant impact on financial performance. They justified this by the fact that information technology leads to an increase in the speed of task execution, reduces the frequency of operational errors, reduces operational costs, and increasing the possibility of achieving greater financial profits. Jesudasan, Pinto & Prabhu (2013) show that an increase the investment in the number of ATM’s and hardware improve profitability in Karnataka Bank. They also find that Internet Banking enhance the market value added of equity.

At the level of Arab countries, in Oman, Alwashahi (2016) show that the banking sector is increasingly using IT. This led to acceleration of the performance of commercial banks. Using multivariate OLS model based on 50 Lebanese banks for the period 2009-2016, Mahboub (2018) find that performance of banks measured by CAMELS model in Lebanon are significantly affected by the application of mobile banking (MB) and offering debit and credit cards (BC) to customers. However, the adoption of automated teller machines (ATM), internet banking (IB), telephone banking (TB) and point of sale terminals does not significantly affect banks performance. More recently, using dynamic panel regression models at the level of 15 Tunisian banks over the period 2001-2019, Romdhane (2021) investigates the impact of information technology investment (IT) on the profitability. Three measures for profitability were used return on assets ratio (ROA), return on equity ratio (ROE), and net interest margin (NIM). Share of IT/Equity ratio was used to measure the IT investments. In particular, intangible (software), tangible (material), maintenance and training investments related to the bank’s equity are used as independent variable. They confirm the relationship between IT investment and profitability. At the level of Jordan, using Pooled Least Square Manner, Jalal-Karim & Hamdan (2010) investigate the impact of IT on the performance of 15 Jordanian banks for a period of 5 years from 2003 to 2007. They find that financial performance of Jordanian banks measured by earning per share and market value added, as well as operational performance measured by return on assets and net profit margin are statistically influenced by the MIS measured by the use of Cyber branches, banking via SMS, phone banking, internet banking, Hardware, Software, number of ATMs. Romdhane (2021) confirmed that profitability represented by ROA and NIM ratios of Jordanian banks are positively affected by IT investments, while IN investments have negative effect on profitability measured by ROE. Based on the previous discussions, the following hypothesis was proposed:

H1: There is a significant impact of AIS dimensions, Phone banking (PHB), Cyber Branch (CYB), number of Automated Teller Machines (ATM), Internet-Banking Services (IBN), and Software and Hardware on short term banks performance measured by ROA.

Many of the previous studies have relied exclusively on ROE and ROA of firms and banks performance, which largely tend to ignore the long-run performance dimension of bank value typically measured by Tobin’s q. The q ratio was first suggested by James Tobin in 1969 by anticipating the company's future investments (Tobin, 1969). Notably, few studies have examined the impact of IT on the long-term performance of banks using Tobin’s q, for example, Hitt and Brynjolfsson, (1996) performed an exploratory analysis of IT’s contribution employing the Tobin’s q method. Based on their initial exploration, they report promising results and a greater percentage of explained variance using the Tobin’s q. Using data from 1988 to 1993, Bharadwaj, Bharadwaj and Konsynski (1999) find that IT investment is positively and statistically significant related to Tobin’s q ratio.

Bardhan, Krishnan & Lin (2013) indicate that the effect of the relationship between R&D and IT on Tobin’s q is positive and significant after controlling for other industry- and company specific influences. Using data from more than 300 companies in the U.S., Mithas and Rust )2016) confirm previous findings and find that investing in IT companies will have a greater market value as measured by Tobin's q than companies with revenue or cost focus. They have shown that IT focus plays an important role in moderating the relationship between company performance and IT investments. Despite increasing ample proof that (IT) assets enhance firms and banks performance measured by ROA and ROE ratios, there are limited studies investigating the impact of IT investments on banks performance measured by Tobin's q. Therefore, this study came to fill this gap and examine the impact of investment in IT on the long run performance of Jordanian banks using Tobin’s q. Therefore, the following hypothesis was proposed:

H2: There is a significant positive impact of AIS dimensions, Phone banking (PHB), Cyber Branch (CYB), number of Automated Teller Machines (ATM), Internet-Banking Services (IBN), and Software and Hardware on long term banks performance measured by Tobin’s q.

Research Methodology

This section covers the study's sample, instruments, and data collecting techniques, as well as the variables measurement, empirical model, and research design.

Data collection and sample selection

Sample includes commercial banks listed on the Amman Stock Exchange (ASE) over the period of 11 years from 2009 to 2019. Islamic banks are excluded due to the difference in the type of financial reports. A total of 13 commercial banks were included in the final sample as shown in Table 1. Data on investing in information technology characteristics was manually gathered from annual reports obtained from the banks' websites. Financial information was obtained from the ASE website's company’s guide.

Variable measurement

The dependent variable of Bank performance. In this paper, measured by return on assets (ROA) and Tobin's Q. where, the independent variables of investing in IT was measured by hardware and software cost to total assets, dummy variable of phone banking service that take a value of 1 if the bank advance a phone banking services and 0 otherwise, dummy variable of cyber branch service that take a value of 1 if the bank have a Cyber branch services and 0 otherwise, dummy variable of Ibank service that take a value of 1 if the bank advance an online banking transactions services and 0 otherwise, and number of automated teller machines (ATM) distributed in Jordan as shown in Table 2.

| Table 1 Study Sample |

|

|---|---|

| Sampling | N. of Companies |

| Banking sector | 16 |

| Islamic banks | -3 |

| Final sample | 13 |

| Period | 11 Years |

| Total observations | 132 |

| Table 2 Variable Measurements |

||||||

|---|---|---|---|---|---|---|

| Abbreviation | Variable | Measurement | ||||

| ROA | Return on Assets | |||||

| TQ | Tobin's Q value | |||||

| SOHA | Software and Hardware Cost |

|||||

| PHB | Phone Banking Services |

A dummy variable that take a value of 1 if the bank advance a phone banking services and 0 otherwise. | ||||

| CYB | Cyber Branch | A dummy variable that take a value of 1 if the bank has a Cyber branch services and 0 otherwise. | ||||

| IBN | Internet-Banking Services | A dummy variable that take a value of 1 if the bank advance an online banking transactions services and 0 otherwise. | ||||

| ATM | Automated Teller Machines | The number of automated teller machines (ATM's). | ||||

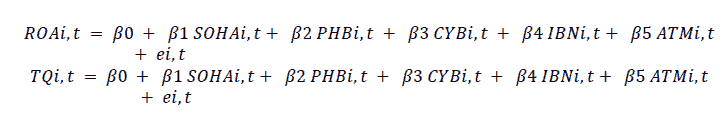

Model Design

We use a panel regression analysis of a sample of 13 banks listed on the Amman Stock Exchange for eleven years (2009-2019). The model is used in this study which testing research hypotheses formulated is as follows:

Return on assets (ROA) of bank i for period t, Tobin's Q (TQ) of bank i for period t, Software and hardware of bank i for period t (Rasheed, Sohail, & Nafees), Phone banking (PHB) of bank i for period t, Cyber branch (CYB) of bank i for period t, Internet-Banking Services (IBN) of bank i for period t, Automated Teller Machines (ATM) of bank i for period t.  is intercept, while

is intercept, while  are coefficients of each variables.

are coefficients of each variables.  indicated residual errors.

indicated residual errors.

Empirical Results and Discussion

The descriptive statistics will be presented first, followed by the correlation analysis, and finally the regression analysis findings will be shown and analyzed to determine if the hypotheses are correct or not.

Descriptive statistics

Table III provides a summary of the test variables that were utilized in our regression. The descriptive statistics of the continuous variables (the mean, standard deviation, maximum and minimum value) are presented in Panel A of Table 3, while the descriptive statistics of the dichotomous and dummy variables for the firms are presented in Panel B of Table 3:

| Table 3. Descriptive Statistics | |||||

|---|---|---|---|---|---|

| Panel A: Summary statistics for continuous variables | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| TQ | 132 | 1.045 | 0.424 | 0.54 | 2.57 |

| ROA | 132 | 1.19 | 0.483 | -0.17 | 2.51 |

| SOHA | 132 | 0.662 | 0.072 | 0.423 | 0.783 |

| ATM | 132 | 86.573 | 62.253 | 11 | 246 |

| Panel B: Summary statistics for dichotomous variables | |||||

| Variable | Value | Frequency | % | ||

| PHB | 0 | 111 | 77.6 | ||

| 1 | 32 | 22.4 | |||

| IBN | 0 | 70 | 49 | ||

| 1 | 73 | 51 | |||

| CYB | 0 | 132 | 92.3 | ||

| 1 | 11 | 7.7 | |||

Panel A shows that the minimum values for TQ and ROA are 0.54 and -0.17 respectively, the maximum values are 2.57 and 2.51 respectively, where the mean values 1.045 and 1.19 respectively, the standard deviation values were 0.424 and 0.483 respectively. As for the independent variables, SOHA and ATM minimum values 0.423 and 11 respectively, the maximum values 0.783 and 246 respectively, the mean values reach 0.662 and ~87 respectively, where the standard deviation values 0.072 and ~62 respectively. The descriptive statistics of dichotomous (dummy) variables reported in Panel B of Table 3 shows that 22.4 percent of the sample of commercial banks has phone banking services whereas 77.6 percent of the banks is not provided this service. In addition, 51 percent of the sample of commercial banks has internet banking services whereas 49 percent of the banks is not provided this service. Finally, 7.7 percent of the sample of commercial banks has cyber branch whereas 92.3 percent of the banks is not provided this service.

Correlation analysis (Multi-Collinearity)

A multi-collinearity problem occurs, according to Hair et al. (2010) and Tabachnick and Fidell (2007), when the correlation between independent variables is greater than 0.80 or VIF value higher than 10. In this study's model, multicollinearity issues are discovered using two methods: The Variance Inflation Factor (VIF) and Correlation (correlation matrix) as proved in Table 4.

| Table 4 Collinearity Statistics |

||||||

|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | VIF |

| (1) SOHA | 1.000 | 1.04 | ||||

| (2) PHB | -0.063 | 1.000 | 1.55 | |||

| (3) IBN | 0.097 | 0.324** | 1.000 | 1.17 | ||

| (4) CYB | -0.120 | 0.538** | 0.230** | 1.000 | 1.44 | |

| (5) ATM | -0.065 | 0.315** | 0.247** | 0.235** | 1.000 | 1.15 |

Table 4 prove that all R-values (correlations) are less than 0.80, on the other hand, all VIF values are less than 10, which can be conclude that there is no problem of multicollinearity in the study variables.

Model Specification Tests

We ran numerous model specification tests in order to select the best estimating technique. To identify whether the estimates will be obtained using the ordinary least squares (OLS) technique or panel data, the Breusch and Pagan Lagrangian multiplier test (L-M test) is used, all of the models have a probability of 0.000 as a result of the test. As a result, the null hypothesis of no specific effects may be ruled out. As a result, individual specific effects exist, and the data used is panel data Table 5. After that, we use the Hausman test to distinguish between random and fixed effects. Table 5 shows that, because the probability value for both models is higher than 0.05, the Random Effects Model is preferred and the Fixed Effects Model is rejected. We also perform the Panel Groupwise Heteroscedasticity Wald test, which shows that heteroscedasticity exists in all of the models. The results in Table 5 demonstrate that the models are heteroscedastic (the Wald test appears to be noticeably significant at 1% level). Serial correlation can skew standard errors and impair the efficiency of findings in linear panel data models (random and fixed effects) (Wooldridge, 2002). The Wooldridge test is used to evaluate the hypothesis of autocorrelation of errors. Heteroscedasticity and serial correlation are evident in all cases as prove in Table 5. Finally, when dealing with both heteroskedastic error structures and error autocorrelation, the feasible generalized least squares estimator is the best choice (FGLS).

| Table 5 Specification Test |

||||

|---|---|---|---|---|

| Tests | Pooled Vs. Panel | Specification Test | Heteroscedasticity Test | Autocorrelation Test |

| Models | L-M Test | Hausman Test | Breush Pagan test | Wooldridge test |

| Model 1 (TQ) | 254.58 (0.0000)*** | 7.29 (0.2948) | 5.4 e+4 (0.0000)*** | 51.01 (0.0000)*** |

| Model 2 (ROA) | 99.13 (0.0000)*** | 1.94 (0.8575) | 2.4 e+4 (0.0000)*** | 49.222 (0.0000)*** |

Table 6 shows the impact of information technology investment on the ROA and Tobin's Q. The R2 for the first model (ROA) is 12.7 percent. In the Tobin's Q model, the R2 is equivalent to 41.0 percent.

| Table 6 Regression Results Fgls |

||||

|---|---|---|---|---|

| Panel: Investment in Information Technology Characteristics | ||||

| Model 1 (ROA) | Model 2 (Tobin's Q) | |||

| Variable | Coefficient | P-Value | Coefficient | P-Value |

| SOHA | 0.788 | 0.150 | -0.035 | 0.927 |

| PHB | -0.069 | 0.551 | -0.147 | 0.070* |

| IBN | 0.069 | 0.412 | 0.112 | 0.057* |

| CYB | -0.091 | 0.601 | -0.337 | 0.006*** |

| ATM | 0.002 | 0.003*** | 0.004 | 0.000*** |

| Constant | 0.483 | 0.191 | 0.698 | 0.007 |

| R2 | 0.127 | 0.410 | ||

| Wald Chi2 | 13.03 | 99.37 | ||

| Prob> Chi2 | 0.0231 | 0.0000 | ||

| Log likelihood | -92.1595 | -41.9455 | ||

Table 6 indicates that at the 1% level, the number of ATM'S (ATM) is significantly and positively related to ROA and Tobin's Q for the two model regressions (Coef. = 0.002 and 0.004 Respectively, P-Value = 0.003 and 0.000 respectively). on the other hand, at the 1% level, the Cyber Branch (CYB) is significantly and negatively related to Tobin's Q regression (Coef. = -0.337, P-Value = 0.006). where at the 10% level, the Internet Banking Services (IBN) is significantly and positively related to Tobin's Q regression (Coef. = 0.112, P-Value = 0.057). As for the Phone banking services (PHB) there is a significant and negatively relationship with Tobin's Q at 10% level (Coef. = -0.147, P-Value = 0.070). Finally, the Software and Hardware costs (Rasheed, et al.) in not related to ROA and Tobin's Q for the two model regressions (Coef. = 0.788 and -0.035 Respectively, P-Value = 0.150 and 0.927 respectively).

Discuss the Results

These positive results are consistent with previous studies such as Winarmo and Putra (2020) who demonstrated that adoption of new technology leads to improved financial performance of a company. Acceptance of technology theory assumes a positive relationship between acceptance of the use of any innovative substance and apparent use (Mohammad et al., 2020). The acceptance of technology theory links the effectiveness of IT with users' perspectives and their implications for the bank's financial performance. Moreover, this positive relationship is consistent with the resource-based theory according to which an organization owns strategic resources, including information technology, creates a competitive advantage over its competitors, allowing it to achieve higher profits (Shaw et al., 2013). Finally, the investment management theory is confirmed by this positive relationship which assumes that the use of IT is one of the most helpful factors in managing money in an efficient manner. A company that invests in IT intends to speed up its activities so that it can double or triple its returns (Farouk & DanDago, 2015).

While the negative results are consistent with results of previous studies such as (Beccalli, 2006; Ho & Mallick, 2006; Ekata, 2012). Beccalli, (2006) indicates that the role of IT as a strategic necessity rather than factor in support of competitive advantage. Ho and Mallick (2006) who find that negative relationship between IT spending and profits. In particular, they point out that increased IT investment in the U.S. during 1985 to 2005 could lead to existing network effects and reducing profits. In addition, Ekata (2012) show that increase customer satisfaction in Nigeria is positively affected by IT investment, while performance of the banking sector is negatively affected of IT investment because a product decreases in value if fewer people use the product.

Conclusion

The purpose of this paper is to investigate the impact of information technology investment on the financial performance of the banks. The sample includes 13 commercial banks listed on the Amman stock exchange from 2009 to 2019. The paper uses the feasible generalized least square regression technique to test the relationship between information technology investments and financial performance. Using return on assets (ROA) as a proxy for financial performance, the results indicated that there is a positive and significant relationship between number of ATM machines and financial performance. Using Tobin's Q value (TQ) as a proxy for financial performance, the results indicated that there is a positive and significant relationship between number of ATM machines and financial performance, a positive and significant relationship between internet banking services (IBN) and financial performance.

On the other hand, a negative and significant relationship between Cyber branches (CYB) and financial performance, and a negative and significant relationship between phone banking services (PHB) and financial performance. However, there is no significant relationship between software and hardware costing (SOHA) and financial performance. A literature review finds that fewer studies have investigated the relationship between information technology investment and the financial performance in the Jordanian context. Furthermore, no study yet has examined the impact of information technology investment on the financial performance of the banks in Jordan using Tobin’s q. A similar study can be conducted to find out the impact of investment in information technology on the financial performance of Jordanian Islamic banks, and then make a comparison between commercial banks and Islamic banks in terms of information technology investment.

References

- Ahituv, N., & Giladi, R. (1993). Business success and information technology: Are they really related? Tel Aviv University, Faculty of Management, the Leon Recanati Graduate.

- Ali, H., Gueyié, J.P., & Okou, C. (2021). Assessing the impact of information and communication technologies on the performance of microfinance institutions in Niger. Journal of Small Business & Entreprenurship, 33(1), 71-91.

- Alpar, P., & Kim, M. (1990). A microeconomic approach to the measurement of information technology value. Journal of Management Information Systems, 7(2), 55-69.

- Alshatti, A.S. (2015). The effect of the liquidity management on profitability in the Jordanian commercial banks. International Journal of Business and Management, 10(1), 62-71.

- Alwashahi, M.H. (2016). A study on the impact of Information Technology (IT) on the performance of commercial banks in Oman. Communications, 4, 38-40.

- Bardhan, I., Krishnan, V., & Lin, S. (2013). Research note business value of information technology: testing the interaction effect of IT and R&D on Tobin's Q. Information Systems Research, 24(4), 1147-1161.

- Barua, A., Kriebel, C.H., & Mukhopadhyay, T. (1991). An economic analysis of strategic information technology investments. MIS quarterly, 313-331.

- Bharadwaj, A.S., Bharadwaj, S.G., & Konsynski, B.R. (1999). Information technology effects on firm performance as measured by Tobin's q. Management science, 45(7), 1008-1024.

- Brynjolfsson, E., & Hitt, L. (1996). Paradox lost? Firm-level evidence on the returns to information systems spending. Management science, 42(4), 541-558.

- Dandago, K.I., Farouk, M., & Usman, B.K. (2012). Impact of investment in information technology on the return on assets of selected banks in Nigeria. International Journal of Arts and Commerce, 1(5).

- Elder, J., & Serletis, A. (2010). Oil price uncertainty. Journal of Money, Credit and Banking, 42(6), 1137-1159.

- Farouk, B.K.U., & DanDago, K.I. (2015). Impact of investment in information technology on financial performance of Nigerian banks: is there a productivity paradox? The Journal of Internet Banking and Commerce, 20(1), 1-22.

- Gul, R., & Ellahi, N. (2021). The nexus between data analytics and firm performance. Cogent Business & Management, 8(1), 1923360.

- Gupta, S.D., Raychaudhuri, A., & Haldar, S.K. (2018). Information technology and profitability: evidence from Indian banking sector. International Journal of Emerging Markets.

- Hair Jr, J.F., Wolfinbarger, M., Money, A.H., Samouel, P., & Page, M.J. (2010). Essentials of business research methods. Routledge.

- Hitt, L.M., & Brynjolfsson, E. (1996). Productivity, business profitability, and consumer surplus: Three different measures of information technology value. MIS quarterly, 121-142.

- Hitt, M.A., Xu, K., & Carnes, C.M. (2016). Resource based theory in operations management research. Journal of Operations Management, 41, 77-94.

- Jalal-Karim, A., & Hamdan, A.M. (2010). The impact of information technology on improving banking performance matrix: Jordanian banks as case study.

- Jesudasan, S., Pinto, P., & Prabhu, R. (2013). Impact of investment in information technology on performance of banks and national economy: A study with respect to Karnataka bank Ltd. Gian Jyoti E-journal, 3(2), 94-103.

- Mahboub, R. (2018). The impact of information and communication technology investments on the performance of Lebanese banks. European Research Studies Journal, 21(4), 435-458.

- Mithas, S., & Rust, R.T. (2016). How information technology strategy and investments influence firm performance: Conjecture and empirical evidence. MIS quarterly, 40(1), 223-245.

- Mohammad Ebrahimzadeh Sepasgozar, F., Ramzani, U., Ebrahimzadeh, S., Sargolzae, S., & Sepasgozar, S. (2020). Technology acceptance in e-governance: A case of a finance organization. Journal of Risk and Financial Management, 13(7), 138.

- Müller, O., Fay, M., & Vom Brocke, J. (2018). The effect of big data and analytics on firm performance: An econometric analysis considering industry characteristics. Journal of Management Information Systems, 35(2), 488-509.

- Prasad, B., & Harker, P.T. (1997). Examining the contribution of information technology toward productivity and profitability in US retail banking. The Wharton financial institutions center working papers, 97(9), 1-31.

- Romdhane, S.B. (2021). Impact of Information Technologies' Investments on the Profitability of Tunisian Banks: Panel Data Analysis Indian. Journal of Finance and Banking, 5(2), 44-61.

- Sadeghimanesh, M., & Samadi, A. (2014). The effect of IT (Information Technology) on financial performance of the banks listed in Tehran Stock Exchange. European Online Journal of Natural and Social Sciences: Proceedings, 2(3), 2911-2919.

- Shaw, J.D., Park, T.Y., & Kim, E. (2013). A resource?based perspective on human capital losses, HRM investments, and organizational performance. Strategic Management Journal, 34(5), 572-589.

- Shin, N. (2001). The impact of information technology on financial performance: the importance of strategic choice. European Journal of Information Systems, 10(4), 227-236.

- Shu, W., & Strassmann, P.A. (2005). Does information technology provide banks with profit? Information & Management, 5(42), 781-787.

- Strassmann, P. A. (1985). Information payoff: The transformation of work in the electronic age: Strassmann, Inc.

- Strassmann, P. A. (1990). The business value of computers: an executive's guide: Information Economics Press.

- Tabachnick, B.G., Fidell, L.S., & Ullman, J.B. (2007). Using multivariate statistics (Vol. 5). Boston, MA: Pearson.

- Tam, K.Y. (1998). The impact of information technology investments on firm performance and evaluation: evidence from newly industrialized economies. Information Systems Research, 9(1), 85-98.

- Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking, 1(1), 15-29.

- Vikram, S., & Gayathri, G. (2018). Impact of Information Technology on the Profitability of Banks in India. International Journal of Pure and Applied Mathematics, 118(20), 225-232.

- Winarno, W.A., & Putra, H.S. (2020). Technology acceptance model of the Indonesian government financial reporting information systems. International Journal of Public Sector Performance Management, 6(1), 68-84.

- Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: MIT Press.