Research Article: 2019 Vol: 18 Issue: 5

The Impact of Profitability and Financial Performance on Improving Productive Efficiency in Jordanian Industrial Companies

Ayman Saleh Mustafa Harb, Zarqa University

Abstract

The study aims to identify the effect of profitability and financial performance on improving productive efficiency in Jordanian industrial companies. In order to achieve this objective, the researcher designed a questionnaire that was distributed to the study population that is composed of Jordanian industrial companies. In order to analyze the data collected some analysis instruments were used, namely: Cronbach alpha, multiple linear regression analysis, Sample t-Test analysis. Accordingly, the study found that there is a statistically significant impact of the profitability and financial performance on improving productive efficiency in Jordanian industrial companies. Based on that, the researcher presented some important recommendations to the Jordanian industrial companies: firstly, increasing the interest in profitability and financial performance to improve productive efficiency. Secondly, increasing the interest in the truthiness and reliability of financial data and statements that reflect the profitability, financial performance, and productive efficiency. Lastly, enhancing awareness among operators and management in relation to the impact of profitability and financial performance on improving productive efficiency to avoid the weaknesses and focus on the strength in the firm operations.

Keywords

Profitability, Financial Performance, Improving Productive Efficiency.

Introduction

The General Framework of Study

Many industrial companies are interested in achieving the best increase in profitability during the operational and productive years of the company. In this regard, Lundgren & Zhou (2017) pointed out that managements are focusing their efforts in attaining the best performance in the shortest time. In order to achieve this increase, companies must pay great attention to efficient productive and improve financial performance (Trojanowska et al., 2018).

Many companies are looking to increase profitability and improve financial performance without affect the productive efficiency of the company, while other companies seek to enhance efficiency of operations to improve the financial performance (Fan et al., 2017). In light of local and global competitions in the industrial sector, rapid technological progress, and the acceleration in modern technology have led to increase productivity and reduce costs in the production process (Fan et al., 2017).

On the other hand, Hasan et al. (2018) mentioned that there are many companies increase their productivity without affecting their profitability or the quality of production. According to Choudhary et al. (2018) the correlation of production and financial performance in achieving an annual increase in the profitability value over the productive life of the industrial company is of great importance in determining the productive policies in the present and future. As a result, companies avoid surprises that may occur in the future from the competitions, laws complexities, and local and global restrictions. In this vein, Fan et al. (2017) explained that industrial companies have to work on a production and financial line to achieve the maximum increase in annual profitability over their productive lives.

According to the aforementioned discussion, the current study intended to define the relationships among profitability and financial performance and productive efficiency in Jordanian industrial companies. Two main objectives are presented below.

Study Objectives

This study aims to achieve a set of objectives:

1. Determine the impact of profitability on improving productive efficiency in Jordanian industrial companies.

2. Determine the impact of financial performance on improving productive efficiency in Jordanian industrial companies.

Problem of Study

Companies are concerned in solving the problems that are associated with increasing the productive capacity efficiency of the industrial company through improving profitability and financial performance. The process of increasing profitability and raising the level of financial performance increases the efficiency and capabilities of the production process in the present and future.

Research Questions

The study attempts to answer the following questions:

1. What is the effect of profitability on improving productive efficiency in Jordanian industrial companies?

2. What is the effect of financial performance on improving productive efficiency in Jordanian industrial companies?

Importance of Study

The importance of current study is represented by the fact that most important policies to measure the strength and ability of companies to improve production efficiency in industrial companies are to focus on measuring profitability and financial performance to meet any difficulties present in the industrial sector in the present and future. Therefore, providing companies with explanations regarding the weaknesses and strengths in their operational systems that reflect on their profitability, financial performance, and productive efficiency could be a critical in their success.

Study Hypotheses

The main hypothesis of the study:

H0: There is no statistically significant effect of profitability and financial performance on improving productive efficiency in Jordanian industrial companies.

It has two sub-branches:

H01: There is no statistically significant effect of the profitability on improving productive efficiency in Jordanian industrial companies.

H02: There is no statistically significant effect of the financial performance on improving productive efficiency in Jordanian industrial companies.

Variables

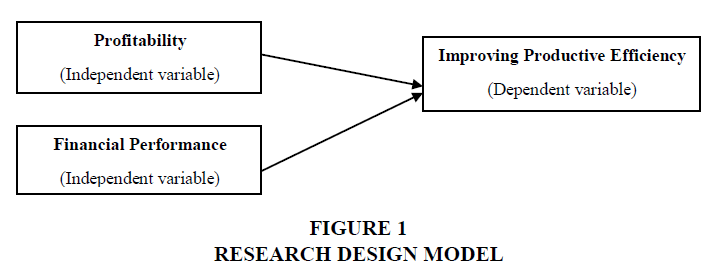

This study used three variables, two independent variables and one dependent variable. Profitability and financial performance as independent variables, and improving productive efficiency as dependent variable.

Research Design

The following research design model (Figure 1) describes the relationships among independent variables and dependent variable.

Literature Review

Over years, the profitability, financial performance, and productive efficiency issues have gained the attention of many researchers, which led to conduct many studies contributed in extending the edge of knowledge in these aspects. In this regard, Pashtawi & BaniTaha (2014) carried out a study focused on exploring the impact of intellectual capital on improving the profitability and performance of pharmaceutical companies. After collecting the required data by questionnaire and analyzing them through the SPSS software the researchers concluded that intellectual capital has a significant impact on improving the profitability of Jordanian pharmaceutical companies (Suleima, 2004). Despite the difference in population between the study of Pashtawi & BaniTaha (2014) and the study of Lundgren & Zhou (2017), but the latter also found a positive significant effect of management aspects on the firm performance and profitability in their study that focused on analyzing the interactions between the firm performance-productivity, energy efficiency, and environmental performance.

In the same line of Pashtawi & BaniTaha (2014), and Lundgren & Zhou (2017), Ragheb & Al-Ghussein (2014) performed a study aimed to explore the expected relationships between liquidity ratios, solvency, administrative efficiency and profitability ratios for insurance companies during the period (2009-2013). In order to perform their study, Ragheb & Al-Ghussein used statistical and financial methods. At the end, the researchers concluded that there are statistical significant relationships between liquidity and profitability, and between the ratios of administrative efficiency and profitability of insurance companies (2014). Similarly, despite the populations among studies are different, but the results of Ragheb & Al-Ghussein (2014) is constant with the results of Pashtawi & BaniTaha (2014) and Lundgren & Zhou (2017), which means that the relationships between the studied variables in the articles are almost constant.

On the other hand, Alsughayir (2013) has carried out a study to investigate the relationship between quality management, profitability and productivity in the Saudi industrial sector. Alsughair (2013) found that the productivity rate serves as an intermediary between profitability and quality management. Later on, Al-Sarti (2013) performed a study aimed to evaluate the performance in the modern manufacturing environment, and the accompanying developments in fields of production, processing, modern methods of productivity and their applicability in the industrial environment in Libya. After using a questionnaire to collect the required data and applying statistical methods to analyze them, Al-Sarti (2013) found that using modern methods of productivity is important for cost reduction in the manufacturing environment. As well, the researcher noted the importance and significant effect of using the cost targets and the financial and non-financial aspects (operational) in improving the production and manufacturing process. In the same context, Trojanowska et al. (2018) have conducted another study aimed to improve the manufacturing productivity through supporting the decision-making methodology in firms. By developing a methodology for decision making process and examining this methodology in a manufacturing company, the researchers found that the methodology could reduce the cycle of lot, reduce the number of changeovers and eliminating errors, which reflects on improving the profitability of firms. Through comparing the results among Alsughayir (2013) and Trojanowska et al. (2018) it seems clear that the effect is reciprocal between variables. From the point of view of researcher, this observation means that the results of studies support each other.

In addition, Abdul-Hussein (2009) has conducted a study aimed to explore the effect of working capital management variables on profitability. Through using a questionnaire, Abdul-Hussein has collected his data, and used statistical instruments to analyze them. At the end of study, the researcher found that there is a strong relationship between the variables of working capital management and the profitability of the company, as well a significant relationship between the size of the company and profitability. Further, Yaqub (2009) has carried out a study focused on identifying the effect of applying the production system on time in maximizing profitability in industrial companies, production quality; reduce damage, market competition and time. In order to perform his study, Yaqub (2009) has used a questionnaire and the statistical tests. The researcher concluded that there is a significant positive relationship among the production system on time and profitability in industrial companies. This conclusion of Yaqub (2009) supports the results of Abdul-Hussein (2009) regarding to the relationships between management practices (specifically productivity) and profitability of companies. In same line, Choudhary et al. (2018) have performed a study focused on evaluating the effect of Conservation agriculture-based management, precision water management on crop and water productivity, and economic profitability in rice-wheat and maize-wheat systems. By conducting a three-year field experiment study, the researchers concluded that conservation agriculture practice is a better alternative to rice-wheat system as it provides opportunities for saving water, enhancing crop and water productivity, respectively along with high economic benefits. Both Abdul-Hussein (2009) and Choudhary et al. (2018) indicated clearly that the profitability and productive efficiency are linked to each other.

The Shawawra (2007) study, focused on evaluating the privatization in financial performance of the Arab Potash Company's by analyze decisions and financial results achieved in light of changes nature which results from investment financial decisions and their financial results in liquidity and profitability to improve efficiency and increase productivity.

The Zhang et al. (2002), advised to re-evaluating and repairing property by examining the impact of ownership on profitability and productivity performance in Chinese industrial enterprises. This study concluded that capital structure and tax burdens affect the achievement and financial performance of industrial enterprises In China.

Expected Contribution of the Present Study

Most of the previous research focused on profitability, productivity and financial performance. The current study will be a new addition that includes profitability, financial performance and productivity together in Jordanian industrial companies.

Theoretical Framework

With the acceleration of life, technical and technological progress and ease of transportation and communication, industrial companies have become interested in improving the efficiency of productivity in any commodity, so not to affect the return of profitability that can be achieved in financial statements. Hence, there is a coherent relationship between profitability, financial performance and improving profitability efficiency. (Al-Raie & Al-Harazin, 2016).

The researcher believes that profitability is to reach above the break-even point between revenues and expenses, so that revenues exceed expenses to demonstrate the efficiency of the company financial performance.

The researcher believes that the financial performance is the efficiency of the company's financial statements' performance away from distortion and misinformation in financial and accounting values, so that disclosure statement of all financial and accounting values in a more detailed and understandable in the final statements of the company.

The researcher believes that improving productive efficiency is the quality of productivity while achieving the highest proportion of productivity that achieves the company's highest rate of return and revenue.

The researcher claims that the productivity has a great importance to the industrial company in producing the largest possible quantities for the company at a lower cost and less effort, follows modern developments and technological and technical progress, and achieving the greatest return and profit for the company.

Methodology

Study Population and Sample

The study population consists of Jordanian industrial companies listed on the Amman Stock Exchange by the end of 2018. The study sample included (15) Jordanian industrial companies which was selected randomly. The study sample consists of individuals working in the Jordanian industrial companies (130), (N=130). The simple random sample of the study population included (15) Jordanian industrial companies, limited to:

1. Al - Quds Company for Concrete Industries

2. Al Hayat Pharmaceutical Industries

3. Arab Co. For Metal Pipes Manufacturing

4. Arabian Electrical Industries Co

5. El Zay Ready Made Garments company

6. Jordan Cement Factories Company

7. Jordan Pipes Manufacturing Company

8. Jordan Slaughterhouse Company

9. Jordan Vegetable Oil Industries Company

10. Jordan Wood Industries Company (Jawico)

11. National Aluminum Industries Company

12. National Poultry Company

13. Pearl Paper Manufacturing Company

14. United Cable Industries Co

15. United Iron & Steel Manufacturing Company

The researcher used questionnaires as a research methodology. The participants of the study were employees working in Jordanian industrial companies. The reason for choosing those that the researcher believes that this category of employees is the subject of the study. Questionnaires are distributed to the following categories:

The Study Sample

1. Managers and heads of industrial companies

2. Heads of accounting departments and accountants in industrial companies

3. Financial managers in industrial companies

4. Department of Internal Audit in industrial companies

A simple random sample was used to select the study sample. One hundred and thirty questionnaires were distributed to the members of the sample. As for the study time period, it was at the end of (31/12/2018).

Type of study

This study is analytical and field descriptive, because it tests, analyzes and describes the impact of profitability and financial performance on improving productive efficiency in Jordanian industrial companies.

Data Sources

Data were collected from primary, secondary sources and personal experience of the researcher in the field of Jordanian industrial companies, as follows:

A) Secondary sources: Of references, periodicals and previous studies, and annual reports issued by Jordanian industrial companies.

B) Primary sources: A questionnaire distributed to employees working in Jordanian industrial companies. The questionnaire addressed all research objectives, which were designed in the light of secondary data. Therefore, 130 questionnaires were distributed to individuals working in Jordanian industrial companies.

Number of distributed questionnaires=130

Number of returned questionnaires=104

Number of questionnaires that did not returned=26

The response rate is equal to (104/130=80%).

Data analysis

For statistical analysis, the researcher used statistical procedures in this study: SPSS statistics software, Cronbach alpha, multiple linear regression analysis, Sample t-Test analysis.

A) Descriptive statistics include the use of arithmetic mean, standard deviation, Cronbach Alpha method and percentage.

B) Inductive statistics in (T-Test) and multiple regression analysis.

C) VIF test.

D) SPSS statistics software.

Table 1 presents the results of the stability of the field of profitability and financial performance in improving the productive efficiency of the Jordanian industrial companies in the manner of (Cronbach Alpha) for internal consistency:

| Table 1 Cronbach's Alpha Testing | |||

| No | Field | No of Questions | Cronbach's Alpha Value |

| 1 | Profitability | 10 | 0.843 |

| (Independent variable) | |||

| 2 | Financial Performance | 10 | 0.826 |

| (Independent variable) | |||

| 3 | Improve the Productive Efficiency | 10 | 0.84 |

| (Dependent variable) | |||

| 4 | Total | 30 | 0.906 |

Table 1 shows that the value of Cronbach's alpha ranged from (0.826to 0.843); this high value indicates a high consistency between the questions of the study, and indicates the high confidence of the study results. As for the value of Cronbach's alpha for combined questions, it was 0.906, which is a high value.

Descriptive Statistics

Table 2 displays the means and standard deviations for the independent variable (Profitability) fields and total mean calculated.

| Table 2 Means and Standard Deviations for Each Profitability Field and Overall Fields | ||||||

| NO | Profitability Fields | Mean | Std. Deviation | Relative Importance | Agreement Degree | Rank |

| 9 | Management is interested in investment portfolio to achieve returns and gains | 4.1 | 0.78 | 82 | High | 1 |

| 7 | Management is concerned with the institutional control of the company's revenues | 4.05 | 0.63 | 81 | High | 2 |

| 1 | Management is interested in achieving the highest return for the company | 4.04 | 0.81 | 80.8 | High | 3 |

| 8 | Management monitors liquidity risk in achieving returns | 3.9 | 0.67 | 78 | High | 4 |

| 3 | The company works to open internal and external markets to achieve profitable returns for the company | 3.88 | 0.84 | 77.6 | High | 5 |

| 4 | Management is interested in distributing dividends to shareholders | 3.88 | 0.79 | 77.6 | High | 5 |

| 5 | Management discloses the real profits and returns of company | 3.86 | 0.84 | 77.2 | High | 6 |

| 6 | There is a correlation between revenues and expenses in achieving returns | 3.85 | 0.82 | 77 | High | 7 |

| 2 | Company follows investment policies to achieve a greater return | 3.79 | 0.83 | 75.8 | High | 8 |

| 10 | Management is concerned with the existence of an audit committee to maintain the level of credibility of the data that is disclosed about the profitability and revenues achieved by parties related to the company | 3.77 | 0.82 | 75.4 | High | 10 |

| Profitability | 3.91 | 0.51 | 78.2 | High | ||

The researcher used the taxonomic scale for the values of the arithmetic mean that were reached. The effect of some values (less than 2.33) mean low effect, and (2.33-3.67) medium effect, and from (3.67-5.00) means a high effect.

Table 2 shows that the highest mean is (4.10) for “Management is interested in investment portfolio to achieve returns and gains” has the highest agreement degree, and the lowest mean is (3.77) for “Management is concerned with the existence of an audit committee to maintain the level of credibility of the data that is disclosed about the profitability and revenues achieved by parties related to the company” with a high agreement degree.

The total mean score is (3.91) for overall Profitability fields with a high agreement degree.

Table 3 displays means and standard deviations for the independent variable (Financial performance) fields and total mean calculated.

| Table 3 Means and Standard Deviations for Each Financial Performance Field and Overall Fields | ||||||

| NO | Financial Performance Fields | Mean | Std. Deviation | Relative Importance | Agreement Degree | Rank |

| 6 | Management uses highly qualified financial and accounting department staff with scientific and practical qualifications | 4.14 | 0.74 | 82.8 | High | 1 |

| 7 | The financial and accounting department use technology in financial and accounting processes | 4.04 | 0.71 | 80.8 | High | 2 |

| 2 | The financial statements are clearly disclosed | 3.94 | 0.86 | 78.8 | High | 3 |

| 10 | Management is concerned with financial and non-financial indicators to assess the performance of the financial and accounting department | 3.91 | 0.8 | 78.2 | High | 4 |

| 8 | Internal control is performed on the financial and accounting statements without being affected by management | 3.87 | 0.76 | 77.4 | High | 5 |

| 3 | The company's future plans are presented in the company's annual reports | 3.83 | 0.81 | 76.6 | High | 6 |

| 4 | profits financial statements are compared over the years to compare percentages of profitability values | 3.8 | 0.93 | 76 | High | 7 |

| 1 | Management follows international accounting standards in the preparation of financial and accounting statements | 3.79 | 0.87 | 75.8 | High | 8 |

| 5 | Follow the accounting methods throughout the financial year without leaving them without a convincing reason | 3.77 | 1.01 | 75.4 | High | 9 |

| 9 | Companies get the receivables on the third party on time, which reduces the amounts owed by others | 3.72 | 0.88 | 74.4 | High | 10 |

| Financial performance | 3.88 | 0.53 | 77.6 | High | ||

The total mean score is (3.88) for overall Financial performance fields with a high agreement degree.

Table 3 shows that the highest mean is (4.14) for “Management uses highly qualified financial and accounting department staff with scientific and practical qualifications” has the highest agreement degree, and the lowest mean is (3.72) for “Companies get the receivables on the third party on time, which reduces the amounts owed by others” with a high agreement degree.

Table 4 displays the means and standard deviations for the dependent variable (Improving productive efficiency) fields and total mean calculated.

| Table 4 Means and Standard Deviations for Eachimproving Productive Efficiency Field and Overall Fields | ||||||

| NO | Improving productive efficiency fields | Mean | Std. Deviation | Relative Importance | Agreement Degree | Rank |

| 6 | Management catalyzes employees in production departments to raise their spirits | 4.29 | 0.9 | 85.8 | High | 1 |

| 5 | Company uses high quality raw materials in production | 3.88 | 0.85 | 77.6 | High | 2 |

| 4 | Productivity is linked to company's profitability | 3.85 | 0.81 | 77 | High | 3 |

| 9 | Management has a strong relationship with the company's employees and with internal and external markets | 3.8 | 0.74 | 76 | High | 4 |

| 10 | Management is interested in research and development of products to meet the strong competition | 3.78 | 0.75 | 75.6 | High | 5 |

| 2 | The company uses advanced technology in productivity | 3.77 | 0.84 | 75.4 | High | 6 |

| 3 | Training courses are held for employees in production | 3.76 | 0.78 | 75.2 | High | 7 |

| 8 | Increase in production capacity to reduce production costs | 3.74 | 0.84 | 74.8 | High | 8 |

| 1 | Management is concerned with improving products' quality | 3.49 | 0.77 | 69.8 | High | 9 |

| 7 | Periodic maintenance for machines in production departments | 3.48 | 0.95 | 69.6 | Medium | 10 |

| Improving productive efficiency | 3.79 | 0.53 | 75.8 | High | ||

Table 4 shows that the highest mean is (4.29) for “Management catalyzes employees in production departments to raise their spirits” has the highest agreement degree, and the lowest mean is (3.48) for “Periodic maintenance for machines in production departments” with a high agreement degree.

The total mean score is (3.79) for overall Improving productive efficiency fields with a high agreement degree.

Hypotheses Testing

To ensure the credibility of results, it has been required to apply multiple regression analysis, and linear regression analysis to verify certain basic conditions. The natural distribution of data (independent variables) is one of the most important conditions, also it's important to ensure that there is no strong overlap or correlation between independent variables (multiple linear correlations). Therefore, the researcher made sure that these two conditions were met before adopting the results of the linear regression analysis.

Table 5 presents the values of the skewness as well as the variance inflation test (VIF) to verify these two basic conditions.

| Table 5 Skewness and VIF Values ??for Independent Variables and Dependent Variable | ||||

| Variables | Fields | Skewness Coefficient | VIF | Tolerance |

| Independent variables | Profitability | -0.022 | 1.122 | 0.891 |

| Financial performance | -0.558 | 1.122 | 0.891 | |

| Dependent variable | Improving productive efficiency | -0.497 | ||

Table 5 shows that all VIF values are less than (10) for all independent variables (Profitability, Financial performance), which shows the lack of a linear duplication between variables of the study; whereas, VIF values over 10 will suggest the presence of multicollinearity. It also shows that the tolerance coefficient is greater than (0.05) for all independent variables which is acceptable for the application of the study. The tolerance measures the influence of one independent variable on all other independent variables.

Table 5 shows that all skewness values are between -1 and 1 for all independent and dependent variables, these values are within the acceptable range of skewness coefficients.

Main hypothesis

H0: There is no statistically significant effect of profitability and financial performance on improving productive efficiency in Jordanian industrial companies.

Table 6 shows the test of this hypothesis. Linear regression analysis was used to study the effect of profitability and financial performance on improving productive efficiency in Jordanian industrial companies as follows:

| Table 6 Results of Linear Regression Analysis | |||||

| Source of Contrast | Sum of Squares | Degrees of Freedom | Mean Square | F | Significance Level |

| Regression | 14.05 | 2 | 7.025 | 49.47 | 0 |

| Residual | 13.78 | 97 | 0.142 | ||

| Total | 27.83 | 99 | |||

There is a statistically significant effect of profitability and financial performance on improving productive efficiency in Jordanian industrial companies. F value (49.467) at significance (0.000), there was a positive statistically significant relationship at a significant level (P≤0.05) between the profitability and financial performance and improving productive efficiency in Jordanian industrial companies. This result indicates the impact of profitability and financial performance on improving productive efficiency in Jordanian industrial companies.

Table 7 shows the quality indicators of the multiple linear regression models, as follows:

| Table 7 Quality Indicators of the Multiple Linear Regressions | |||

| Independent Variables | R | R2 | Adjusted R2 |

| Profitability | 0.71 | 0.51 | 0.495 |

1. There is a statistically significant relationship between profitability and financial performance to predict the value of the dependent variable (improving productivity efficiency in the Jordanian industrial companies), where the value of the relationship between the variables (0.711).

2. The value of R2 indicates the percentage variation in the dependent variable, which can be predicted by the independent variable. This ratio is 50.5%. This indicates the independent variable's ability to predict the dependent variable.

3. The null hypothesis wasrejected and the alternative hypothesis were accepted.

Sub-Hypothesis

The researcher based on the results of multiple linear regression analysis to test the effect of sub-hypothesis of the study.

Table 8 shows the values of the standard and non-standard effects and their statistical significance in the effect of profitability and financial performance in improving the productive efficiency of Jordanian industrial companies, as

| Table 8 Standard and Non-Standard Effects and their Statistical Significance | |||||

| Independent Variables | Non-Standard β | Standard β | SE | t | Sig t |

| Profitability | 0.3 | 0.29 | 0.079 | 3.823 | 0 |

| Financial performance | 0.56 | 0.56 | 0.076 | 7.409 | 0 |

1. The non-standard (β) values show the effect of the variable (profitability) on the dependent variable, where the value (0.303) is a statistical function value, because the value of t-test function (0.000) was less than (0.05). This means that there is a linear importance for this variable. Based on the value of t-test level, the null hypothesis of the study is rejected.

2. The non-standard (β) values show the effect of the variable (financial performance) on the dependent variable, where the value (0.564) is a statistical function value, because the value of t-test function (0.000) was less than (0.05). This means that there is a linear importance for this variable. Based on the value of the t-test level, the null hypothesis of the study is rejected.

Conclusion

This study investigated the effect of profitability and financial performance on improving productive in Jordanian industrial companies. Study hypotheses were verified in order to obtain the purpose of the study. The main conclusions are as follows:

1. The results were positive for increasing interest in profitability and financial performance to improve productive efficiency.

2. Profitability and financial performance affect the attractiveness of investments and increase the volume and efficiency of production and industrial performance.

3. The validity of the financial statements affects profitability results which increase the productive efficiency.

The study conclusions consist with Yaqub (2009) study which shows that applying the production system on time affected in profit and Alsughayir (2013) which concluded that the productivity rate serves as an intermediary between profitability and quality management.

Recommendations

Depending on the findings and conclusions, the researcher presents the following recommendations: Intensive concentration on the industrial sector because it has the power to attract capital on one hand and thus, the labor force on the other. This will lead to an increase in exports and a reduction in imports, and this cycle will also enhance the actual value of the currency (the dinar) and here will decrease the level of unemployment that we are suffering to this moment and here I mean unemployment itself, not disguised unemployment.

In addition, the researcher advice the industrial companies in Jordan to increase the interest in profitability and financial performance to improve productive efficiency. Further, increasing the interest in the truthiness and reliability of financial data and statements that reflect the profitability, financial performance, and productive efficiency. Moreover, enhancing awareness among operators and management in relation to the impact of profitability and financial performance on improving productive efficiency to avoid the weaknesses and focus on the strength in the firm operations. At the end, the researcher advice other researchers to expand the study population to include other sectors besides the industrial sector.

References

- Abdul-Hussein, R.H. (2009). The relationship between working capital and profitability in companies - an analytical study in a sample of Iraqi industrial companies for the period 1995-2002. Retrieved from https://www.iasj.net/iasj?func=fulltext&aId=13768

- Al-Raie, Hatem & Al-Harazin, M. (2016). Factor affecting labor productivity and wages in the manufacturing sector palestinian conflict during the period (1994-2012). Retrieved from https://www.asu.edu.jo/ar/Scientific-Research-and-Graduate-Studies/Pages/issues.aspx

- Al-Sarti, M.M. (2013). The extent to which performance indicators can be used in the modern manufacturing environment in the Libyan industrial sector. Retrieved from http://bulletin.zu.edu.ly/issue_n15_3/Contents/A_09.pdf

- Alsughayir, A. (2013). The impact of quality practices on productivity and profitability in the Saudi Arabian dried date industry. American Journal of Business and Management, 2(4), 340-346.

- Choudhary, K.M., Jat, H.S., Nandal, D.P., Bishnoi, D.K., Sutaliya, J.M., Choudhary, M., Sharma P.C., & Jat, M.L. (2018). Evaluating alternatives to rice-wheat system in western Indo-Gangetic Plains: crop yields, water productivity and economic profitability. Field Crops Research, 218, 1-10.

- Fan, L.W., Pan, S.J., Liu, G.Q., & Zhou, P. (2017). Does energy efficiency affect financial performance? Evidence from Chinese energy-intensive firms. Journal of Cleaner Production, 151, 53-59.

- Hasan, I., Kobeissi, N., Liu, L., & Wang, H. (2018). Corporate social responsibility and firm financial performance: The mediating role of productivity. Journal of Business Ethics, 149(3), 671-688. http://damascusuniversity.edu.sy/mag/law/old/economics/2007/23-2/9-%20shoiaora.pdf

- Lundgren, T., & Zhou, W. (2017). Firm performance and the role of environmental management. Journal of Environmental Management, 203, 330-341.

- Ragheb, L., & Al-Ghussein, Z. (2014). The impact of liquidity, solvency and administrative efficiency on the profitability of insurance companies. Retrieved from http://91.144.21.197/index.php/econlaw/article/viewFile/1018/976

- Shawawra, F. (2007). Assessment of the impact of privatization on the financial performance of the Arab potash company. Retrieved from

- Suleima, H., Al-Beshtawi, & Ismail, A., Bany Taha. (2004). The impact of intellectual capital on improving the profitability of Jordanian pharmaceutical companies. Retrieved from https://journals.ju.edu.jo/JJBA/article/view/6625

- Trojanowska, J., Kolinski, A., Galusik, D., Varela, M.L., & Machado, J. (2018). A methodology of improvement of manufacturing productivity through increasing operational efficiency of the production process.

- Yaqub, S. (2009). The effect of just-in-time application on maximizing the profitability of public joint stock companies in Jordan. Retrieved from http://www.alqashi.com/th/th35.pdf

- Zhang, A., Zhang, Y., & Zhao, R. (2002). Profitability and productivity of Chinese industrial firms: measurement and ownership implications. China Economic Review, 13(1), 65-88.