Research Article: 2021 Vol: 20 Issue: 6S

The Impact of Social Media Applications on Predicting Stocks Prices and Exchange Volume: The Case of Jordan

Sulaiman Weshah, Al-Balqa Applied University

Essa Alazzam, Toledo College

Qasem Aldabbas, Al-Balqa Applied University

Ziad Obeidat, World Islamic Science and Education University

Mohammad Humeedat, Al-Balqa Applied University

Yahya AlQudah, Electricity Distribution Company

Abstract

Social media applications now a days are a primary source of many studies, also is primary information source for many users to make their decisions depending on the easily available information. The present study aims to examines the impact of social media applications on stock’s prices predicting and exchange volume for the three classifications in Amman Stock Exchange - ASE (first, second and third market) as one of developing countries exchange markets. By using a designed and developed questionnaire as a study primary tool and descriptive analytical approach, the questionnaire distributed on intermediation companies’ employees in Amman Stock Exchange (ASE), the results showed significant impact of social media applications on predicting stock’s prices and exchange volume of the first market, but intermediate impact of the second and third market. The study recommending the necessarily for management of intermediation companies to employ dedicated and qualified employees with technological predictive skills and train employees on technology not only for how to collect data, but also about analyzing and understanding to follow up the data workflow and its impact. In addition, the stock’s investors need to take into consideration the impact of social media users to affect and lead the decisions of buying or selling specific stocks.

Keywords

Social Media Applications, Prediction, Stock’s Exchange Volume, Stock’s Prices, Amman Stock Exchange (ASE), Jordan

Introduction

Stock movements prediction is a highly challenging study for research and industry (Liu et al., 2019) and the internet has become an unlimited source of information about almost any topic. Its spreading in every aspect of our lives, allow us to access data in real-time, everywhere we are (Mirco, 2016).

Social media applications as one of internet products are using widely and by all kinds of users that are building their online platforms to communicating, sharing and exchanging all kinds of information and data.

Social media are cost-effective and easily available information exchange networks for private and commercial purposes beyond a geographical barrier. They are wide source of shared creation values to which participants contribute to evaluation and improvement visualizations (Kaplan & Haenlein, 2010) and the impact of social media on financial market liquidity and thus on trading costs needs to be explored (Guijarro et al., 2019).

This kind of social media applications has positive and negative impacts on it is users. It may become as opportunity from one side and may become a threat from other side (Akram & Kumar, 2017).

Social media considered now a day as one of most important sources of information and a powerful tool, within this era of big data, decision makers should take into their consideration the role of social media data and it is impact on decision making process. The volume and importance of such data needed to be evaluated and estimated as one of applicable using in exchange data and information within social media regarding trading stocks.

There are six types of social media which summarized by (Guijarro et al., 2019) as the following: Social networking websites, blogs and micro blogs, collaborative projects, virtual game community, content communities and virtual communities.

3.8 billion are using social media regarding to digital 2020 reports (Kemp, 2020) and 3.96 billion (50.64%% of the world’s total population which is 7.83 billion) in 2021 as per digital 2021 reports with about 99% of social media users access the websites or apps through a mobile device, with only 1.32% access platforms exclusively via desktop and with average person has 8.6 social media accounts in 2020 (Dean, 2021; Kemp, 2021). Social media and it is applications may within the coming future will replace the traditional news channels and tools.

Also (Dean, 2021) added the following statistics related to social media up to 2020: by region, social media growth in 2019-2020 is led by Asia: +16.98%, Africa +13.92%, South America +8.00%, North America +6.96%, Europe +4.32%, and Australasia +4.9%. For the active users per month for every application, Facebook is the leading social network at (2.7 billion monthly active users|), followed by YouTube (2.2 billion users), WhatsApp (2 billion users), Facebook Messenger (1.3 billion users), WeChat (1.2 billion users), Instagram (1.08 billion users), Tik Tok (0.8 billion users), QQ (0.69 billion users), Sina Weibo (0.55 billion users), Qzone (0.51 billion users), Reddit (0.43 billion users), Kuaishou (0.40 billion users), Snapchat (0.39 billion users), Pinterest (0.36 billion users) and Twitter (0.32 billion users). The average time of a person spending on social media in daily base is 2 hours 24 minutes.

Within covid-19 pandemic and stay-at-home orders the relationship with internet in general and with social media applications specifically. Social media within times of pandemic circumstances as (Fernandes et al., 2020; Wong et al., 2020) concluded that generally users in many countries have increased their use of social media sites and streaming services related to the pandemic. A particular benefit to the use of social media for health communication within times of pandemic circumstances where many related requirements such as physical distancing, time urgency and the need to widely distribute information have compelled us to find alternative ways of working and learning. Social media applications bring a new dimension to healthcare by providing a common channel for healthcare professionals, patients and the public to communicate regarding health issues, with the potential to improve health outcomes. In addition, it also providing a powerful tool for social interaction and continuing education for schools and high education levels, in general it is facilitating collaboration between all types of it is users.

This study is investigating the impact of social media applications on stock price predicting and stock exchange volume in Amman Stock Exchange (ASE). The sections of this study after the Introduction are as the following: Literature Review and Study Problem, Amman Stock Exchange (ASE) Background, Study Chart, Method, Results, Discussion and Final Conclusions.

Literature Review and Study Problem

Social Media is a group of Internet-based applications which build on technological foundations of Web 2.0 and allow to create and exchange of content that generated by users (Kaplan & Haenlein, 2010).

Consumers use platforms to exchange information, which is social media, can influence the reputation, sales, and the survival of the company. However, many businessmen avoid or ignore social media because they are not aware of its effects in the future (Gémar & Jiménez-Quintero, 2015) and the increasing use of social media has removed spatial and temporal restrictions between real and virtual worlds (Zafarani et al., 2014).

The Jordan Times journal mentioned on that Facebook is one of social media are using by Jordanian, and many studies illustrated the role and importance of social media for decision makers such as (Fu, 2018; Shafique & Qaiser, 2014; Huber et al., 2018) in understanding business data, preparing data, modeling, evaluation and data publishing. More specifically in extracting and the role of social media information to track stock exchange market, the following Table (1) summarized some of these studies’ results and recommendations:

| Table 1 Studies on Role of Social Media in Tracking Stock Exchange Markets |

|||

|---|---|---|---|

| Study Title | Year | Author(s) | Main Related Results |

| Identification of the Challenges of Media Start up Creation in Iran | 2021 | Salamzadeh and Tajpour | Human capital challenges are one of six categories of challenges of media start up creation |

| Investigating the Role of Customer Co-Creation Behavior on Social Media Platforms in Rendering Innovative Services | 2020 | Moghadamzadeh et al., | customer citizenship behavior and customer participation behavior on social media platforms positively affect the rendering of innovative services |

| The Effect of Media Convergence on Exploitation of Entrepreneurial Opportunities | 2019 | Salamzadeh et al., | Medias affect exploitation of entrepreneurial opportunities in small and medium sized media firms |

| Stock Market Prediction Using Data Mining Techniques. | 2019 | Gupta et al., | Data mining could be used as a guide for investor’s decisions related to forecast companies’ stock prices depending on social media text. |

| Analyzing Stock Market Trends Using Social Media User Moods and Social Influence | 2019 | Li et al., | The findings support the existing behavioural financial theory and can help to understand short-term rises and falls in a stock market. |

| Liquidity Risk and Investors’ Mood: Linking the Financial Market Liquidity to Sentiment Analysis through Twitter in the S&P500 Index | 2019 | Guijarro et al., | On a daily basis, they found there is a positive regression in Linking the Financial Market Liquidity to Sentiment Analysis through Twitter in the S&P500 Index |

| Tehran Stock Exchange (TSE) Prediction Using Sentiment Analysis of Online Textual Opinions | 2018 | Ghahfarrokhi & Shamsfard | By extracting information from online comments, the researchers conducted sentiment in predictability of various stocks in (TSE) is different depending on stock attributes. In addition, the study indicates that for predicting the closing price only comments volume, but for predicting the daily return both the volume and the sentiment of the comments could be useful. |

| Predicting the Effects of News Sentiments on the Stock Market | 2018 | Shah et al., | Many studies shown that there is a vast amount of information online social media. In addition, the study clarified that stock prediction is very important for businesses activates planning. |

| Predicting Stock Market Behavior using Data Mining Technique and News Sentiment Analysis | 2017 | Khedr et al., | There is an imminent need to uncover the stock market future behaviour in order to avoid investment risks. The large amount of data generated by the stock market is considered a treasure of knowledge for investors. |

| Influence of Social Media over the Stock Market | 2017 | Piñeiro et al., | The profile of investors has important role in explaining the influence of social media on stock market and particularly, the combination of holding period with experience in technical investors contributes to avoiding a raise in market risk. |

| Extracting Information from Social Media to Track Financial Markets | 2016 | Guidi, Mirco | The volume of social information has a positive correlation with stock trading volume. |

| Social Media, News Media and the Stock Market | 2016 | Jiao et al., | On monthly base, Stocks that have high coverage within social media in one-month will have high trading volume in the following month. |

Recently, social media playing a critical role and dimension inside Wall Street stock market and beat hedge funds, (Rechel, 2021) mentioned that GameStop shares within one year (from the beginning of 2020 until the beginning of 2021) had increased 689% (from 4.28$ per share to 345$ per share) in a sparked way because of a group of social media users decided to invest in this company share and to rise it is share price, so it is an important to see how social media influenced this extreme volatility and how social listening can help financial institutions and corporate issuers gain visibility into real time analysis. Piven (2021) describes GameStop shares as a skyrocket because of some retail traders using social media and beating Wall Street in United States of America’s equity market for unlikely company has found itself at the center of a much-heralded sea change in investment trends.

Also, as per E-paper on The Economic Times (2021) where Elon Musk (The Tesla Inc. CEO) tweet “Use Signal” in Tweeter as one of social applications instead of WhatsApp. Thus, Signal Inc. shares as tsunami went up from 37 cents to 7.2 dollars in a few days, more than 5,100% within three trading days. Here is the power full of social media appearing clearly.

Problem Statement

Based on previous studies presentation and related results, researchers can conclude that generated data by social media application’s users could be considered as a key of guide for investor’s decisions and could be used as a source to predict stock’s behaviors inside stock markets. Therefore, it is necessary to enhance research field with extended researches in order to enhance our knowledge of why and how the data exchange within social media can be tracked and used to predict financial markets.

Amman Stock Exchange (ASE) Background

The Jordanian economy is distinguished as a developing economy and depending mainly on local production and under support providing by foreign aid and remittances from Jordanian expatriates working abroad. The market rankings are divided into first, second and third markets as a part of secondary market where securities are governed by special listing instructions, there is also additional ranking markets. The following is explaining for all market rankings:

- The First Market: it is a part of the secondary market through which securities are dealt with that are governed by special listing conditions in accordance with the securities listing instructions.

- The Second Market: It is the part of the secondary market through which securities are dealt with that are governed by special listing conditions in accordance with the securities listing instructions.

- The Third Market: it is a part of the secondary market through which securities are dealt with that are governed by special listing conditions in accordance with the instructions for listing securities on the Amman Stock Exchange.

Users of Social Media in Jordan

Jordan in 2016 has become in first on social media usage based on Pew Research Centre as per Alghad News Paper reported in 2016, where 7.2 million internet users out of 8 million internet users connected through social media internet applications (more than 90 percent of internet users). Also, Jordan Times News Paper reported in 2016 that Facebook as one of social media sites is the most popular social media site in Jordan.

Methodology

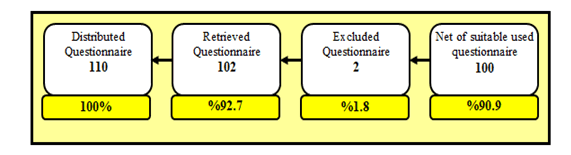

A questionnaire was developed and distributed on (110) intermediation companies in Amman Stock Exchange (ASE), The framework of this study consisted of all (110) intermediation companies with net of (100) suitable questionnaires for analysis and concluding results by using SPSS, and the following Figure 2 shows questionnaire distributing process details:

Results and Discussion

Stock’s Price Prediction

| Table 2 Test Results of Social Media Applications on Stock Price Predict for the First Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Price Predict | 0.591 | 0.35 | Social Media | 0.074 | 9.275 | 1.96 | 0.00* |

Table (2) indicates that there is a statistically significant effect of the use of social media on stock price prediction within the first market in intermediation companies in (ASE) through the calculated value of T (9,275) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.350) indicates that social media has interpreted (35%) of the change in stock price prediction. The correlation coefficient R=(59.1%), which indicates a significant correlation between social media and stock price prediction within the first market in (ASE).

| Table 3 Test Results of Social Media Applications on Stock Price Predict for The Second Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Price Predict | 0.354 | 0.125 | Social Media | 0.102 | 4.79 | 1.96 | 0.00* |

Table (3) indicates that there is a statistically significant effect of the use of social media on stock price prediction within the second market in intermediation companies in (ASE) through the calculated value of T (4.790) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.125) indicates that social media has interpreted (12.5%) of the change in stock price prediction. The correlation coefficient R=(35.4%), which indicates an intermediate correlation between social media and stock price prediction within the second market in (ASE).

| Table 4 Test Results of Social Media Applications on Stock Price Predict for the Third Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Price Predict | 0.366 | 0.134 | Social Media | 0.085 | 4.98 | 1.96 | 0.00* |

Table (4) indicates that there is a statistically significant effect of the use of social media on stock price prediction within the third market in intermediation companies in (ASE) through the calculated value of T (4.790) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.134) indicates that social media has interpreted (13.4%) of the change in stock price prediction. The correlation coefficient R=(35.4%), which indicates an intermediate correlation between social media and stock price prediction within the third market in (ASE).

Stock’s Exchange Volume:

| Table 5 Test Results of Social Media Applications on Stock Exchange Volume for the First Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Exchange Volume | 0.769 | 0.592 | Social Media | 0.041 | 2.202 | 1.96 | 0.00* |

Table (5) indicates that there is a statistically significant effect of the use of social media on stock exchange volume within the first market in intermediation companies in (ASE) through the calculated value of T (2,202) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.592) indicates that social media has interpreted (59.2%) of the change in stock exchange volume. The correlation coefficient R=(76.9%), which indicates a significant correlation between social media and stock exchange volume within the first market in (ASE).

| Table 6 Test Results of Social Media Applications on Stock Exchange Volume for The Second Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Exchange Volume | 0.326 | 0.106 | Social Media | 0.044 | 2.134 | 1.96 | 0.00* |

Table (6) indicates that there is a statistically significant effect of the use of social media on stock exchange volume within the first market in intermediation companies in (ASE) through the calculated value of T (2,134) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.106) indicates that social media has interpreted (10.6%) of the change in stock exchange volume. The correlation coefficient R=(32.6%), which indicates an intermediate correlation between social media and stock exchange volume within the second market in (ASE).

| Table 7 Test Results of Social Media Applications on Stock Exchange Volume for the Third Market |

|||||||

|---|---|---|---|---|---|---|---|

| Dependent | Model Summary | Coefficients | |||||

| Variable | R | R2 | Remarks | Std Error | T Calculated | T Scheduled | T Sig |

| Stock Exchange Volume | 0.488 | 0.238 | Social Media | 0.058 | 2.903 | 1.96 | 0.00* |

The table (7) indicates that there is a statistically significant effect of the use of social media on stock exchange volume within the first market in intermediation companies in (ASE) through the calculated value of T (2,903) which is a significant value at the level of significance (α≤0.05), and greater than its scheduled value which is (1.96) which also represents the significance of this model at one degree. The value of R2 (0.238) indicates that social media has interpreted (23.8%) of the change in stock exchange volume. The correlation coefficient R=(48.8%), which indicates an intermediate correlation between social media and stock exchange volume within the second market in (ASE).

Conclusions and Recommendations

The study concluded and showed a significant impact of social media applications on prediction and exchange volume of the first market, but intermediate impact of the second and third market. This may back to the importance of trading stocks related to common companies listed on the first market because this level contains large companies, and the less importance of trading stocks related to companies listed within the second and third markets (usually small and medium companies). This agreed with (Gupta et al., 2019; Mirco, 2016).

The study recommended benefiting from the employees whom expertise in social media applications, also the necessarily of intermediation companies to employ dedicated and qualified human resources with technological predictive skills and/or train employees on technology not only for how to collect data, but also about analyzing and understanding to follow up the workflow to be used as a base to predict the stock’s behavior. This is also concluded by (Salamzadeh & Tajpour, 2021) for human capital challenges.

In addition, investors in stocks specifically and financial statements users’ generally needs to take into consideration the impact of roamers inside social media applications who use them to lead the decisions of buying or selling specific stocks.

References

- Akram, W. (2018). A study on positive and negative effects of social media on society. International Journal of Computer Sciences and Engineering, 5.

- Alghad News Paper Report (2016). Jordan Comes in First on Social Media Usage Index.

- Brian, D. (2021). Statistics: How many people use social media in 2021?

- Dev, S., Haruna, I., & Farhana, Z. (2018). Predicting the effects of news sentiments on the stock market. In 2018 IEEE International Conference on Big Data (Big Data), pages 4705–4708. IEEE.

- The Economic Times E-tech (2021). Another Signal gains after Elon Musk’s tweet.

- Fernandes, B., Biswas, U.N., Tan-Mansukhani, R., Vallejo, A., & Cecilia, A.E. (2020). The impact of COVID-19 lockdown on internet use and escapism in adolescents. Journal of Clinical Psychology with Children and Adolescents, 7(3), 59-65.

- Fu, Y. (2018). Failure Demand, Master Thesis. The University of Edinburgh, Edinburgh, Scotland.

- Facebook most popular social media site in Jordan – Report. (2016). The Jordan Times.

- Gémar, G., & Jiménez-Quintero, J. (2015). Text mining social media for competitive analysis. Tourism and Management Studies, 11(1), 94-90.

- Ghahfarrokhi, A.H., & Mehrnoush, S. (2018). Tehran stock exchange prediction using sentiment analysis of online textual opinions. Faculty of Computer Engineering and Science, Shahid Beheshti University, Tehran, Iran.

- Guidi, M. (2016). Extracting information from social media to track financial markets. Unpublished thesis, Second Cycle Degree program in Accounting and Finance, Ca’ Foscar University of Venice, 2015-2016.

- Francisco, G., Moya-Clemente, I., & Jawad, S. (2019). Liquidity risk and investors’ mood: linking the financial market liquidity to sentiment analysis through twitter in the s&p500 index. Sustainability,11, 7048.

- Archana, G., Pranay, B., Kashyap, D., & Pritesh, J. (2019). Stock market prediction using data mining techniques. 2nd International Conference on Advances in Science & Technology (ICAST-2019) K.J. Somaiya Institute of Engineering & Information Technology, University of Mumbai, Maharashtra, India.

- Huber, S., Wiemer, H., Schneider, D., & Ihlenfeldt, S. (2018). DMME: Data Mining Methodology for Engineering Applications-A Holistic Extension to the CRISP-DM Model. Procedia CIRP Elsevier, 79, 403-408.

- Peiran, J., Andre, V., & Walther, A. (2016). Social media, news media and the stock market. SSRN Electronic Journal, 1-41.

- Jordanian Law No. (18). For the year 2017/Financial Securities Act.

- Jordan Times News Paper reporte (2016). Facebook is the most popular social media site in Jordan.

- Li, Daifeng., Wang, Y., Andrew, M., Ying, D., Jie, T., Gordon, G., … & Enguo, Z. (2019). Analyzing stock market trends using social media user moods and social influence. Journal of the Association for Information Science and Technology, 1–14.

- Liu, J., Liu, X., Lin, H., Xu, B., Ren, Y., Diao, Y., & Yang, L. (2019). Transformer-Based capsule network for stock movement prediction. In Proceedings of the First Workshop on Financial Technology and Natural Language Processing, Macao, China, 12 August 2019.

- Ali, M., Pejman, E., Soodabeh, R., Aidin, S., & Datis, K. (2020). Investigating the role of customer co-creation behavior on social media platforms in rendering innovative services. Sustainability, 12(17), 1-21.

- Juan, P., Vizcaíno-González, M., & Pérez-Pico, A.M. (2017). Influence of social media over the stock market.Psychology and Marketing, 34(1).

- Andreas, K., & Michael, H. (2010). Users of the World, Unite! The challenges and opportunities of social media. Business Horizons, 53(1), 59-68.

- Simon, K. (2020). Digital 2020 report.

- Ayman, E.K., Salama, S.E., & Yaseen, N. (2017). Predicting stock market behavior using data mining technique and news sentiment analysis. I.J. Intelligent Systems and Applications, 22-30.

- Aidin, S., & Mehdi, T. (2021). Identification of the challenges of media startup creation in Iran. Journal of Entrepreneurship Development, 13(4), 561-580.

- Aidin, S., Markovic, M.R., & Masjed, S.M. (2019). The effect of media convergence on exploitation of entrepreneurial opportunities. AD-Minister, 34(1), 59-76.

- Shafique, U., & Qaiser, H. (2014). A comparative study of data mining process models (KDD, CRISP-DM and SEMMA). International Journal of Innovation and Scientific Research, 12(1), 217-222.

- Rechel, J. (2021). How social media moves markets: Analyzing GameStop (GME) using social listening data.

- Adrian, W., Serene, S., Olusegun, O., Antonini, M.V., & David, L. (2020). The use of social media and online communications in times of pandemic COVID-19. Journal of the Intensive Care Society.

- Ben, P. (2021). GameStop: Why social media-driven traders are beating Wall Street.

- Zafarani, R., Abbasi, M.A., & Liu, H. (2014). Social Media Mining an introduction.