Research Article: 2025 Vol: 28 Issue: 2S

The Impact of the Number of Restaurant Business Actors, Foreign Investment, Domestic Investment, Per Capita Consumption and Digital Transactions on the Culinary Industry in Indonesia

Pudji Astuty, Borobudur University Jakarta, Indonesia

Citation Information: Astuty, P. (2025). The impact of the number of restaurant business actors, foreign investment, domestic investment, per capita consumption and digital transactions on the culinary industry in Indonesia.

Journal of Legal, Ethical and Regulatory Issues, 28(S2), 1-13.

Abstract

In the upcoming years, the culinary industry is expected to continue to be one of the key industries fostering the expansion of the national economy. The steady and substantial contribution this key sector makes to the non-oil and gas industry's GDP and the rise in investment realization demonstrate its vital importance. The growth of the Indonesian restaurant industry was spurred by the country's abundance of eateries, which in turn gave rise to the idea of a culinary franchise. One element that is equally crucial to the growth of the culinary business is the investment factor. It is anticipated that investment in the culinary sector will rebound in accordance with the post- pandemic conditions of people's consumption and purchasing power. One factor that will benefit Indonesia's culinary business is people's consumption of food categories. The food industry relies heavily on digital technologies to boost its business rate. In order to boost the competitiveness and potential of business operators in the culinary industry, it is imperative to promote equal digitization and literacy. The goal of the study is to examine how the Indonesian culinary business is impacted by the number of restaurant owners, domestic and foreign investment, per capita food consumption, and digital transactions. This study's research methodology combines a Vector Error Correction Model approach with Vector Autoregression (VAR). (VECM) The findings of the study indicate that (1) the number of restaurant owners, local and foreign investment, per capita food consumption, and digital transactions all significantly affect the Indonesian culinary business at the same time. (2) The Indonesian culinary business is significantly and favorably impacted by the number of restaurant owners, domestic and foreign investment, per capita food consumption, and digital transactions.

Keywords

Culinary Industry, Number of Restaurant Business Actors, Foreign Investment, Domestic Investment, Food Consumption Per Capita, Digital Transactions.

Introduction

In Indonesia and even around the world, the culinary business is now expanding quickly. The restaurant and dining sector is currently flourishing as the economy bounces back from the COVID-19 pandemic. The restaurant and diner industry sector grew by 3.68% in 2022, according to the Ministry of Industry. This percentage increased from 2021's 2.95%. In the meantime, the Republic of Indonesia's Ministry of Tourism and Creative Economy stated that the largest contributor to the creative economy's GDP is the culinary industry. In 2020, the creative economy's total GDP was Rp 1,134 trillion, of which Rp 455.44 trillion, or around 41%, came from the culinary subsector (Agmasari, 2021).

In the upcoming years, the culinary industry is expected to continue to be one of the key industries fostering the expansion of the national economy. The steady and substantial contribution this strategic sector makes to the GDP of the non-oil and gas industry, along with the rise in investment realization, demonstrate its crucial importance. In order for the food and beverage industry to grow more productive and globally competitive, the government thus keeps working to ensure that raw materials are available. Furthermore, the downstream process must be guaranteed because this industry is built on added value. The government keeps pushing national firms in the culinary industry to capitalize on the potential of the home market in order to sustain the rapid growth of this sector. With a population of 278 million, Indonesia has emerged as a highly potential market.

With the second-highest biodiversity in the world, Indonesia is a megabiodiversity nation. The development of a varied culinary scene that is healthful, distinctive, unusual, and flavorful is based on this biodiversity. Given the variety of its cuisine, it is no surprise that Indonesia is known as the "kitchen of the world." To strengthen the food industry's creative economy, this abundance of biodiversity must be investigated and developed. Over the past few years, Indonesia's culinary industry has grown steadily. There are currently 5.5 million people working in the culinary industry, and this sector employs up to 8.8 million people.

The rise of restaurant enterprises is one of the elements driving the culinary industry's expansion. A restaurant is a business that offers food and beverage services out of a permanent structure. Small, medium, and large restaurants are among the many different kinds of restaurants. Other sorts of restaurants include cafés, fast food, fast casual dining, casual dining, and fine dining (Cicilia, 2021).

According to data published in June 2022 by the Central Statistics Agency (BPS), 11,223 culinary companies operated throughout Indonesia in 2020. 269 businesses (2.40 percent) provide catering services, 8,042 businesses (71.65 percent) are restaurants or eateries, and the remaining 2,912 businesses (25.95 percent) are in other categories. However, according to company location, malls are home to over half, or 53.85%, of Indonesian culinary businesses. Furthermore, Indonesian culinary enterprises are dispersed throughout tourist destinations, hotels, culinary hubs, and industrial locations. Residents in the surrounding area make up 60.11 percent of the culinary business's clientele. In the meantime, one-time customers make up 18.05 percent and clients from outside the district/city make up 21.84 percent (Marcellin & Wijaya, 2019).

Despite the fluctuations in the restaurant market, MSME players in the culinary sector continue to have bright futures. The culinary industry is one MSME sector that is here to stay. One of the main forces behind Indonesia's creative industry's comeback is the culinary arts. Due to mobility limitations and measures to reduce crowds, restaurants had to temporarily close during the pandemic, which had a moderate impact on food business owners with food booths. The ability of MSMEs to employ 97% of the workforce and to attract up to 60.4% of total investment is one of their contributions to the Indonesian economy (Rosmitha, 2022).

As seen by Indonesia's GDP growth over the previous eight years, the country's rising consumption, in this case total household consumption expenditure, plays a major role in economic expansion. Household consumption expenditures account for an average of 54.37 percent of GDP, according to BPS data. According to the Central Statistics Agency's (BPS) National Socio-Economic Survey (Susenas), the average monthly food expenditure for Indonesians living in both urban and rural areas is Rp 631.6 thousand per capita. In this group, processed foods and drinks account for the biggest consumption expenditure, followed by cereals and tobacco and tobacco products. On the other hand, tuber commodities have the lowest food expense (Statistik & BPS, 2020).

According to BPS data, community consumption of the food category, one of the factors used to calculate GDP, accounts for more than half of GDP annually. This indicates that the biggest factor influencing the Indonesian economy is household consumption. The Indonesian culinary business would undoubtedly benefit from changes in the components of household consumption expenditure, particularly in the food group (BPS RI, 2021).

Equally significant aspects in the growth of the culinary business are investment factors. Following the pandemic, it is anticipated that investment in the culinary sector will increase in tandem with the public's growing spending power and consumption. The first semester of 2023 saw IDR 26.7 trillion in domestic investment (PMDN) in the culinary sector, compared to a forecast of IDR 5.4 trillion and USD 1.11 billion from foreign investment (PMA), according to data from the Investment Coordinating Board (BKPM). Because there is so much good mood, the trend of investment growth in the culinary business continues at the start of 2025. Only the mining sector (IDR 39.3 trillion), the housing, office, and industrial area sector (IDR 37.8 trillion), and the transportation, warehousing, and telecommunications sector (IDR 32.4 trillion) surpass the culinary industry sector in terms of domestic investment realization. With a value of USD 1.11 billion, the culinary industry comes in seventh place for foreign investment realization, much behind the USD 2.2 billion forecast (Alpianto & Masruroh, 2019).

The culinary industry sector is under strain due to growing concerns about climate change. The total sustainability score of the culinary business is 48.9, lower than that of the construction industry (49.4) and the finance, law, and consulting sectors (51,1), according to research done by the ESG consultant EcoVadis. In order to create sustainable processes and products, many businesses are focusing their research and development efforts on agricultural technology, and 55% of executives in the culinary industry say they are investing more in environmental sustainability. But there is still a long way to go. Food and beverage firms need to improve in many areas, and stakeholders, investors, and consumers are putting pressure on them to speed up their sustainable transition (Humas, 2021).

Technology is another element that is currently having a significant impact on how the food sector develops. The culinary industry relies heavily on digital technologies to accelerate its operations. Therefore, in order to improve competitiveness and the potential of business players, particularly in the current period of globalization and market openness, it is imperative to encourage the equal distribution of digitization and literacy among businesses in the culinary industry. Order creation, point of sale (POS), delivery, and the capacity to handle online payments with many method options to accommodate customer preferences are a few examples of technology that a culinary business can use. Commitment through a technology ecosystem and integrated technology, namely all-in-one culinary firms, can help the culinary industry adjust to the present changes in societal lifestyles (Susilo et al., 2021).

It's true that the COVID-19 pandemic has compelled people to experiment with new digital technologies. Nowadays, housewives and millennial young are not the only ones using the internet world. Despite the fact that the digital industry is very new, they are attempting to operate their firm in a digital manner. Their battling spirit has been rekindled by the powerful and ardent encouragement, particularly from moms. Restaurants, tiny eateries, and street food are all becoming more digital incorporating online channels for customer engagement, communication, and food and beverage services. The awareness of markets, social media, and payment platforms among culinary entrepreneurs is indicative of the digitalization of the industry. The BPS survey revealed that 85.55 percent of culinary businesses in Indonesia already offer online sales services. Although the percentage of online sales still stands at 23.70 percent, online sales are considered promising in line with the massive digital transformation, especially due to the Covid-19 pandemic. As for third-party ordering services such as GoFood, GrabFood, and ShopeeFood, they have become the most widely used online sales channels by culinary entrepreneurs, with a percentage of 61.69 percent. Meanwhile, 49.69 percent of culinary entrepreneurs conduct online sales through social media, and the remaining 17.62 percent through websites.

When broken down by percentage, the GoFood platform accounts for 40.46 percent of all food and beverage sales, followed by GrabFood with 33.57 percent and other platforms with 25.97 percent. However, with a rate of 71.34 percent, cash payment, often known as cash on delivery (COD), is the most popular payment option. Debit cards or online bank transfers (45.94 percent), electronic money (43.14 percent), credit cards or online credit (38.05 percent), and other ways are also often utilized (Rizkiyah et al., 2021).

The researcher cites a number of theoretical studies and earlier research on the culinary sector from international journals published by Elsevier, which are indexed in Scopus. These studies were carried out by foreign researchers on a range of research topics. The 2020 study "Innovation Models In Food Industry: A Review Of The Literature," by Barbara Bigliardi, Giovanna Ferraro, Serena Filippelli, and Francesco Galati, found that innovation is regarded as one of the key components of a business's success. The food business, which is typically seen as a slow-moving, fairly mature sector, has also begun to play a significant role in recent years (Bigliardi et al., 2020).

The Meaning of Applied Creativity in the Culinary Industry, a 2016 study by Pearl M.C. Lin and Tom Baum, then reveals that the evolution of Taiwanese cuisine has been significantly influenced by the use of applied creativity in the culinary industry. Time restrictions and market acceptance are two examples of the various traits of culinary innovation that can be acquired through professional training and experience. Understanding the function of applied creativity in the culinary sector is aided by this study (Lin & Baum, 2016).

The Influence of Digital Technology on the Culinary Industry is a 2022 study by N. Nugraha, O. Rukmana, D. S. Mulyati, R. Pamungkas, and A. Satriani. The findings of the study demonstrate how digital technology has been used to execute labor procedures in the culinary industry, namely at M-Resto. 68% of respondents strongly agreed that technology has an impact on the culinary business, according to the research findings, which also show that technology use accounts for the highest contribution. To sum up, digital technology has an impact on the culinary sector, especially at M-Resto (Nugraha et al., 2022).

In 2019, Maria C. B. Manteiro and Enos Kabu carried out a second study called "Model of Creative Economic Development for Micro, Small and Medium-sized Culinary Industries in Kupang City, Indonesia." The study's findings indicate that maximizing the contribution of micro, small, and medium-sized businesses to the creative industry is one way the city administration of Kupang, Indonesia, can sustain economic growth (UMKM). The food industry is one of the SMEs that is flourishing in Kupang. It's interesting to note that, rather than conserving the distinctive, creatively prepared cuisine of East Nusa Tenggara region, about 70% of the city's culinary business is dominated by menu items from outside. Policymakers and other business actors, like travel agents and the media, are not yet fully incorporated into this industry's commercial development model, which tends to be incomplete (Manteiro & Kabu, 2019).

There is a research gap in this study, which can be explained as follows based on the presentation of prior research findings:

1. According to this study, the number of restaurant owners, local and foreign investment, per capita consumption, and digital transactions all have an impact on Indonesia's culinary sector. The combination of these determinant variables has not been employed by any academics and is different from a number of other studies.

2. To determine the most and least important determinant factors on the culinary sector, both in the short and long term equilibrium, this study employs the Vector Auto Regression (VAR) and Vector Error Correction Model (VECM) analysis methodologies.

Due to a number of research gaps, this study is an inventory study and is unique since it looks at correlations between variables that haven't been investigated before, leading to fresh discoveries (state of the art / novelty).

Research Methodology

Using quarterly data, the sample employed in this study covers the years 2014–2023, yielding 40 (40) samples in total. Using quarterly data, the sample employed in this study covers the years 2014–2023, yielding 40 (40) samples in total.

Explanatory research analysis, also known as hypothesis testing by explanation, is the research design employed in this study. An analytical method for elucidating causal links between variables through hypothesis testing is explanatory research. According to the opinion, explanatory research employs hypothesis testing using inferential statistics (for hypothesis testing) since the explanatory format aims to explain a generalization or the link between one variable and another (Bungin, 2019).

This study use the Vector Auto Regression (VAR) or Vector Error Correction Model (VECM) approaches in conjunction with quantitative regression analysis. This study's application of the VAR or VECM model is helpful in taking into account current theories to represent current economic occurrences. Eviews 12 was the software utilized in this study to process the data that was gathered. Because the explanations of current theories are too complex to account for the facts that are happening now, not all theories are able to adequately describe the links between economic variables. The Vector Autoregression (VAR) approach is used for time series data that is neither structural nor theoretical, according to Cristoper A. Sims (1980). One model that can examine the connections between time series variables is the VAR model (Muhammad & Karolina, 2018).

If the initial difference, which has a unit root and is cointegrated, is stationar, the VECM approach can be used. Although there are short-term changes, VECM explains the long-term behavioral linkages that arise between variables to have a cointegrated relationship. By doing an Impulse Response Function (IRF) analysis and Variance Janomposition (VD), VECM can be utilized to observe changes that are already occurring. Gujarati (2013) explains that the following are some of the benefits of employing the VECM method: (Gohil & Patel, 2019).

a. Can be applied to direct regression and non-stationary time series variable

b. Can be applied to assess how well an empirical model aligns with current econometric

c. Possible to employ additional variables in both short- and long-term economic

Result and Discussion

1. Test of Stationarity

The unit root test, also known as the stationarity of the data for each variable that will be used in the research, should be performed first when employing regression. The probability value of the ADF can be used to assess whether or not the data is stationary. If the ADF value is less than 0.05 or 5%, the data is deemed stationary; if it is greater than 0.05 or 5%, the data is considered non-stationary (Table 1).

| Table 1 Stationarity Test Outcomes | ||||

| Variable | Level | 1st Difference | ||

| ADF Prob | Explanation | ADF Prob | Explanation | |

| Culinary Industry | 0,4191 | Not stationary | 0,0001 | Stationary |

| Number of restaurant actors | 0,8776 | Not stationary | 0,0002 | Stationary |

| Foreign investment | 0,1667 | Not stationary | 0,0000 | Stationary |

| Domestic investment | 0,4418 | Not stationary | 0,0000 | Stationary |

| Consumption per capita | 0,4706 | Not stationary | 0,0000 | Stationary |

| Digital transaction | 0,4048 | Not stationary | 0,0001 | Stationary |

| Short -term residual | 0,0102 | Stasionary | - | - |

A first difference test must be performed since, as Table 1 demonstrates, the ADF statistical test results for every variable employed in this study do not satisfy the stationarity requirements at the level level. The null hypothesis is rejected, according to the first difference test results; that is, after one difference, the data for every variable become stationary with less than a 0.05 probability value. With the exception of the short-term residual, which necessitates that the variables be stationary at the Level and have satisfied the requirements to use the Vector Error Correction Model analysis, all of these variables now have stationary data conditions at the first difference level and are free of unit root issues.

2. Test of the Ideal Lag Length Criteria

The lag length of the data used has a significant impact on VECM estimate. The influence of each variable's time taken on its previous variable is ascertained using lag length. The ideal Lag length test results are shown here (Table 2).

| Table 2 Test of the Ideal Lag Length Criteria | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 158.2016 | NA | 8.57e-12 | -8.455644 | -8.191725* | -8.363529 |

| 1 | 165.5596 | 11.85463 | 4.34e-11 | -6.864425 | -5.016986 | -6.219619 |

| 2 | 173.1788 | 9.735616 | 2.50e-10 | -5.287712 | -1.856755 | -4.090216 |

| 3 | 320.7224 | 139.3467* | 8.44e-13* | -11.48458* | -6.470102 | -9.734392* |

The ideal lag length is at lag 3, which has the highest value of the sequential modified LR test statistic, 139.3467, as shown in table 2 above. Thus, lag 3 is the best latency to employ in this model 1. Since 3 have been selected as the ideal lag duration, lag 3 must also be used in the following test. After determining the ideal lag time, additional testing can be carried out.

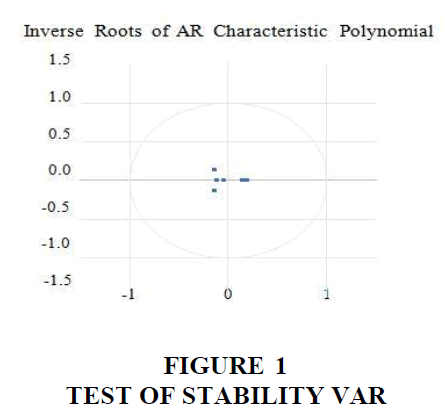

3. Test of Stability

The next step before utilizing VECM estimates is to test the model's stability. Impulse response and variance Janomposition are tested for validity using model stability testing. If the modulus of a VAR model's roots is less than one, the model can be regarded as stable. The VAR model stability test results are shown here (Table 3) & (Figure 1).

| Table 3 Test of Stability VAR | |

| Root | Modulus |

| -0,140312 - 0,135603i | 0,195130 |

| -0,140312 + 0,135603i | 0,195130 |

| 0,193330 | 0,193330 |

| 0,150342 | 0,150342 |

| -0,113554 | 0,113554 |

| -0,039107 | 0,039107 |

The VAR estimation in figure 1, which will be used to test and assess impulse response and variance Janomposition, is stable, according to the findings of the VAR model stability test mentioned above. This is because the VAR model above is stable due to the unit root values in the above table having a modulus of less than one.

4. Test of Cointegration

Using the Johansen method, the following results were obtained for the cointegration test between the variables of the Indonesian culinary industry, the number of restaurant entrepreneurs, foreign and domestic investment, per capita food consumption, and digital transactions (Table 4):

| Table 4 Johansen Cointegration Test Results | |||

| Trace Statistic | 0,05 Critical Value | Probability | Keterangan |

| 109,4228 | 95,75366 | 0,0041 | Terkointegrasi |

| Max Eigen Statistic | 0,05 Critical Value | Probability | Keterangan |

| 47,79951 | 40,07757 | 0,0056 | Terkointegrasi |

The test above demonstrates that the Max Eigen Statistic value (47.79951) > Critical Value (40.07757) and the Probability value 0.0056 < 0.05, as well as the Trace Statistic value (109.4228) > Critical Value (95.75366) and the Probability value 0.0041 < 0.05, are all found in Table 4. Consequently, it can be said that the Indonesian food sector, the number of restaurant owners, domestic and foreign investment, per capita food consumption, and digital transactions are all cointegrated in the equation model over the long run.

5. Vector Error Correction Model (VECM) estimation

Given the long-term equilibrium and the results of the several prerequisite tests mentioned above, the Vector Error Correction Model (VECM) is the analysis that is employed. To display the short- and long-term relationships between variables, VECM estimation is used. Five percent is the significance threshold used in this investigation, and the t-ADF critical value for five percent is 1.946. This indicates that the variable has a considerable impact if the t- statistic value is higher than 1.946. The following are the outcomes of the VCEM estimation that was done (Table 5):

| Table 5 Vector Error Correction Model Estimation | ||||

| SHORT-TERM ESTIMATION | ||||

| Dependent Variable: Indonesian Culinary Industry | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 6,084423 | 0,449366 | 13,54002 | 0,0000 |

| D(Ln_RESTORAN) | 4,739167 | 0,601340 | 7,881008 | 0,0000 |

| D(Ln_PMA) | 0,069647 | 0,025171 | 2,766906 | 0,0093 |

| D(Ln_PMDN) | 0,758049 | 0,226877 | 3,341235 | 0,0021 |

| D(Ln_KONSUMSI) | 7,102580 | 0,381620 | 18,61167 | 0,0000 |

| D(Ln_TRANSAKSI) | 0,902174 | 0,056093 | 16,08349 | 0,0000 |

| RES(-1) | -0,261866 | 0,101501 | -2,579939 | 0,0147 |

| R-squared | 0,865225 | Prob(F-statistic) | 0,000000 | |

| AdjustedR-squared | 0,858705 | Durbin-Watsonstat | 1,745532 | |

| LONG-TERM ESTIMATION | ||||

| Dependent Variable: Indonesian Culinary Industry | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 75,39576 | 9,705802 | 7,768112 | 0,0000 |

| Ln_RESTORAN | 2,913796 | 0,475378 | 6,129428 | 0,0000 |

| Ln_PMA | 0,009776 | 0,003867 | 2,528232 | 0,0163 |

| LN_PMDN | 1,329063 | 0,302463 | 4,394131 | 0,0001 |

| Ln_KONSUMSI | 5,462717 | 0,839920 | 6,503858 | 0,0000 |

| Ln_TRANSAKSI | 0,626478 | 0,073720 | 8,498117 | 0,0000 |

| R-squared | 0,745549 | Prob(F-statistic) | 0,000000 | |

| AdjustedR-squared | 0,708130 | Durbin-Watsonstat | 1.959426 | |

Simultaneous F Test

To ascertain if the independent factors taken together have an impact on the dependent variable, the F-statistic test is employed. A significant effect is indicated by the data obtained in Table 5, which demonstrate a significance value of 0.0000 ≤ 0.05 for both short-term VECM estimation and long-term estimation. This indicates that Indonesia's culinary industry is significantly impacted by a number of factors, including the number of restaurant enterprises, domestic and foreign investment, per capita food consumption, and digital transactions. According to the economic interpretation, it can be demonstrated with certainty and significance that the number of restaurant businesses, foreign and domestic investment, per capita food consumption, and digital transactions all have an impact on Indonesia's culinary industry both in the short and long term.

Partial Test

The Effect of the Number of Restaurant Business Actors (X1) on the Culinary Industry

In both short-term and long-term estimations, the statistical probability value of the number of restaurant entrepreneurs is smaller than α (0.0000 ≤ 0.05), according to the computation results shown in the estimation results table. Thus, it can be said that Indonesia's culinary industry is significantly and favorably impacted by the variable number of restaurant entrepreneurs (X1). The relevance indicates that the number of restaurant owners hypothesis can be substantially and persuasively demonstrated to have an impact on Indonesia's culinary industry. The positive interpretation, on the other hand, suggests that as the number of restaurant owners rises, so does Indonesia's culinary industry.

The Effect of Foreign Investment (X2) on the Culinary Industry

Statistically, the likelihood value of foreign investment is smaller than α (0.0093 ≤ 0.05) in the short-term estimate and α (0.0163 < 0.05) in the long-term estimate, according to the computation results shown in the estimation results table. Thus, it can be said that the foreign investment variable (X2) significantly and favorably affects Indonesia's culinary industry. The substantial significance suggests that it is possible to demonstrate the impact of foreign investment on Indonesia's culinary industry in a meaningful and persuasive way. In the meantime, the positive interpretation suggests that a rise in foreign investment is accompanied with a rise in Indonesia's culinary sector.

The Effect of Domestic Investment (X3) on the Culinary Industry

Statistically, the likelihood value of domestic investment is smaller than α (0.0021 ≤ 0.05) in the short-term estimate and α (0.0001 ≤ 0.05) in the long-term estimate, according to the computation results shown in the estimation results table. Thus, it can be said that the Indonesian culinary industry is significantly and favorably impacted by the domestic investment variable (X3). The important meaning suggests that it is possible to demonstrate the impact of the domestic investment hypothesis on Indonesia's culinary industry in a meaningful and persuasive way. In the meantime, the positive interpretation suggests that a rise in domestic investment is accompanied by a rise in Indonesia's culinary sector.

The Effect of Food Consumption Per capita (X4) on the Culinary Industry

The statistical analysis reveals that the probability value of per capita food intake is smaller than α (0.0000 < 0.05) in both short-term and long-term estimates, based on the computation results found in the estimation results table. Thus, it can be said that Indonesia's culinary industry is significantly and favorably impacted by the variable of per capita food consumption (X4). The importance indicates that it is possible to demonstrate with conviction and significance how the Indonesian culinary industry is impacted by the per capita food consumption hypothesis. Conversely, the positive interpretation suggests that an increase in Indonesia's culinary industry coincides with a rise in the country's per capita food consumption.

The Effect of Digital Transactions (X5) on the Culinary Industry

According to the estimation results table's calculation results, the digital transaction variable (X5) has a significant and positive impact on Indonesia's culinary industry because, statistically, the probability value of digital transactions is less than α (0.0000≤ 0.05) in both short-term and long-term estimates. The important meaning suggests that the impact of digital transactions on Indonesia's culinary industry can be demonstrated in a meaningful and persuasive way. In the meantime, the positive interpretation suggests that Indonesia's culinary industry is growing in tandem with the rise in digital transactions.

Coefficient of Determination (R-Squared)

The results of the coefficient of determination, which are Adjusted R Square = 0.858705 in the short-term VECM estimation and Adjusted R Square = 0.708130 in the long-term VECM estimation, show that the number of restaurant entrepreneurs, foreign and domestic investment, per capita food consumption, and digital transactions all have a significant impact on Indonesia's culinary industry at the same time, according to Table 5. This indicates that the number of restaurant owners, domestic and foreign investment, per capita food consumption, and digital transactions all have a significant impact on Indonesia's culinary industry at the same time, with the short-term estimate being 85.87 percent and the long-term estimate being 70.81 percent.

Impulse Response Culinary Industry to Foreign Investment

The culinary industry's reaction to shocks in the Foreign Investment variable is represented by the impulse response analysis in this VECM/VAR estimation. The aforementioned figure illustrates the unfavorable reaction of the culinary industry to foreign investment. It seems that the culinary sector variable has not yet responded to foreign investment in the first period; only in the second period does it provide a response. The value of the culinary industry will drop by -0.005059 percent when there is a shock to foreign investment in the sector, particularly during the second quarter. The culinary sector responds to shocks in the following eras until it achieves a point of equilibrium. In the ninth period, this reaction will be counterbalanced with a response 0.000562 percent.

Impulse Response of the Culinary Industry to Domestic investment

The culinary industry's reaction to shocks in the Domestic Investment variable is represented by the impulse response analysis in this VECM/VAR model. The aforementioned image illustrates how the food industry's reaction to domestic investment varies. It was noted that the culinary industry variable did not react to domestic investment in the first period; the response was only provided in the second period. The value of the culinary industry would rise by 0.001032 percent in the event of a shock to domestic investment in the sector, particularly during the second term. The culinary industry's reaction to a shock persisted in the following periods until it stabilized. In the sixth session, this response would level off with a response of 0.000615 percent.

Impulse Response Culinary Industry to Consumption of Food Per Capita

The culinary industry's reaction to the shock of the per capita food consumption variable is represented by the impulse response analysis in this VECM/VAR calculation. The aforementioned image illustrates how the culinary industry's reaction to the amount of food consumed per person varies. It is clear that the culinary industry variable has not yet responded to the amount of food consumed per capita in the first period; only in the second period does it do so. The culinary industry's value will rise by 0.004476 percent when there is a shock to the per capita food consumption, particularly during the second trimester. The culinary industry's reaction to a shock persists in the next phase until it reaches a point of equilibrium. The response will be balanced in the 8th period with a response of 0.003742 percent.

Impulse Response of the Culinary Industry to Digital Transaction

The culinary industry's reaction to the shock of the per capita food consumption variable is represented by the impulse response analysis in this VECM/VAR calculation. The aforementioned image illustrates how the culinary industry's reaction to the amount of food consumed per person varies. It is clear that the culinary industry variable has not yet responded to the amount of food consumed per capita in the first period; only in the second period does it do so. The culinary industry's value will rise by 0.004476 percent when there is a shock to the per capita food consumption, particularly during the second trimester. The culinary industry's reaction to a shock persists in the next phase until it reaches a point of equilibrium 0.000915 percent.

Variance Janomposition Test

The VECM study includes variance Janomposition (VD), which supports the findings of earlier investigations. With values expressed as percentages, VD offers estimates of how much a variable will contribute to changes in both that variable and other variables across a number of future periods. The variance Janomposition test, also known as Forecast Error Variance Janomposition (FEVD), is used to ascertain how a variable's variance is influenced by both its own contribution and the contribution of other variables. This allows for the identification of the variable that is anticipated to have the largest contribution to a particular variable. The next table, which displays the variables' contributions, displays the FEVD results from the VECM modeling.

The aforementioned VD results table indicates that the culinary industry's own contribution to the changes in the first period was 100% relevant. Then, during the next few years, other factors started to account for the culinary industry's contribution. The tenth period was when the contribution to other variables became apparent. The digital transaction variable contributed the most, at 21.32 percent, followed by the per capita.

Impulse Response Function (IRF) Test

The impact of shocks on one variable on another, both in the short and long term, is explained using IRF analysis. If the variable is shocked in this study, long-term reactions can be seen (Shock). Analysis of the Impulse Response Function is also used to determine the duration of the influence. In this instance, 40 periods total—40 quarters spread over 10 years—are employed in the IRF test. In the figure below, the horizontal axis displays the time period, with one period denoting a quarter. In the meantime, the vertical axis displays, in standard deviation units, how the culinary industry has changed in reaction to shocks from specific variables. (SD).

The culinary industry's reaction to shocks in the variable number of restaurant entrepreneurs is represented by the impulse response analysis in this VECM/VAR estimation. The aforementioned image illustrates how the culinary industry's reaction to the quantity of restaurant owners varies. It was found that the number of restaurant owners had no effect on the culinary industry variable during the first period; only during the second period did the variable show any response. The value of the culinary sector rose by 0.004020 percent during the second quarter, which was when there was a shock to the number of restaurant owners influencing the business. The reaction of the culinary sector to a shock becomes erratic in the following period until it stabilizes. With a reaction of 0.004453 percent, this response will stabilize in the eighth period.

Conclusion

The following are the study's conclusions, which are based on the research findings and discussion analysis:

1. The number of restaurant owners, domestic and foreign investment, per capita food consumption, and digital transactions all have an impact on Indonesia's culinary sector at the same The study's findings indicate that these five factors have a major influence on the growth of Indonesia's culinary sector;

2. The number of restaurant owners has a noteworthy and favorable influence on Indonesia's culinary sector. The growth of Indonesia's culinary industry is inextricably linked to restaurant entrepreneurs.

3. The Indonesian culinary sector is significantly and favorably impacted by foreign investment. The expansion and advancement of Indonesia's culinary sector are significantly influenced by foreign investment.

4. The Indonesian culinary industry is significantly and favorably impacted by domestic investment. Over the past 10 years, both international and domestic investments have made a substantial contribution to the growth of Indonesia's culinary industry.

5. Indonesia's culinary business is significantly and favorably impacted by per capita food consumption. In the near term, per capita food consumption is one of the most important factors influencing the growth of Indonesia's culinary industry because food demands are a daily necessity for the population.

6. The Indonesian culinary business is significantly and favorably impacted by digital commerce. According to long-term estimates, digital transactions have emerged as one of the key factors influencing the expansion and advancement of the Indonesian culinary

Acknowledgement

This is a short text to acknowledge the contributions of specific colleagues, institutions, or agencies that aided the efforts of the authors.

References

Agmasari, S. (2021). Sektor kuliner penyumbang terbesar PDB ekonomi kreatif Indonesia. Kompas. com.

Alpianto, M., & Masruroh, N. A. (2019). Analisis Faktor Pengaruh Kesuksesan Pada Industri Kuliner Di Yogyakarta. CIEHIS Prosiding, 1(1), 86-90.

Bigliardi, B., Ferraro, G., Filippelli, S., & Galati, F. (2020). Innovation models in food industry: A review of the literature. Journal of technology management & innovation, 15(3), 97-107.

Indexed at, Google Scholar, Cross Ref

BPS RI. (2021). Pendapatan Nasional Indonesia BPS-Statistics Indonesia. 06 Agustus 2021.

Bungin, B. (2011). Metodologi penelitian kualitatif: Aktualisasi metodologis ke arah ragam varian kontemporer.

Cicilia, M. (2021). Menparekraf: Kuliner penyumbang terbesar PDB ekonomi kreatif.

Gohil, L., & Patel, D. (2019). A sentiment analysis of Gujarati text using Gujarati senti word net. International Journal of Innovative Technology and Exploring Engineering (IJITEE), 8(9), 2290-2293.

Indexed at, Google Scholar, Cross Ref

Humas BRIN. (2021). Gastrodiplomasi, Strategi Promosi Budaya Kuliner Indonesia ke Luar Negeri. Badan Riset Dan Inovasi Nasional.

Lin, P. M., & Baum, T. (2016). The meaning of applied creativity in the culinary industry. International Journal of Hospitality & Tourism Administration, 17(4), 429-448.

Indexed at, Google Scholar, Cross Ref

Manteiro, M. C., & Kabu, E. (2019). Model of creative economic development for micro, small and medium-sized culinary industries in Kupang City Indonesia. International Journal of Social Sciences and Humanities, 3(1), 143-152.

MARCELLIN, F. F., & WIJAYA, N. (2019). Perhitungan, Penyetoran dan Pelaporan Pajak Hotel dan Restoran serta Kontribusinya terhadap Pendapatan Asli Daerah. Jurnal Bisnis dan Akuntansi, 21(1a-2), 163-172.

Muhammad Feisal, A., & Karolina Br. Sebayang, L. (2018). Analysis of Effect of Capital Inflow Volatility and Macroeconomic Variables on Rupiah Exchange Rate. Economics Development Analysis Journal, 6(1), 1-7.

Nugraha, N., Rukmana, O., Mulyati, D. S., Pamungkas, R., & Satriani, A. (2022). The Influence of Digital Technology on the Culinary Industry. KnE Social Sciences, 147-156.

Rizkiyah, K., Nurmayanti, L., Macdhy, R. D. N., & Yusuf, A. (2021). Pengaruh digital payment terhadap perilaku konsumen di era revolusi industri 4.0 (Studi kasus pengguna platform digital payment OVO). Managament Insight: Jurnal Ilmiah Manajemen, 16(1), 107-126.

Rosmitha, S. N. (2022). Peran Digitalisasi Pemasaran Dalam Peningkatan Daya Saing Dan Sustainabilitas Umkm Kuliner Di Era New Normal Perspektif Etika Bisnis Islam.

Statistik, B. P., & BPS. (2020). Badan Pusat Statistik 2019. Badan Pusat Statistik, XXiI, 05 N(17/02/Th. XXIV).

Susilo, Y., Wijayanti, E., & Santoso, S. (2021). Penerapan Teknologi Digital Pada Ekonomi Kreatif Pada Bisnis Minuman Boba. Jurnal Ekonomi Manajemen Sistem Informasi, 2(4), 457-468.

Received: 02-Jan-2025 Manuscript No. JLERI-25-15562; Editor assigned: 03-Jan-2025 Pre QC No. JLERI-25-15562(PQ); Reviewed: 17-Jan-2025 QC No. JLERI-25-15562; Revised: 21-Jan-2025 Manuscript No. JLERI-25-15562(R); Published: 28-Jan-2025