Research Article: 2019 Vol: 18 Issue: 1

The Implication of Business Partnership, Company Asset and Strategic Innovation to Business Valuation of Digital Industry in Indonesia

Edi Witjara, Universitas Padjadjaran Bandung

Sulaeman R. Nidar, Universitas Padjadjaran Bandung

Aldrin Herwany, Universitas Padjadjaran Bandung

Setyanto P. Santosa, Universitas Padjadjaran Bandung

Abstract

It was predicted that between 2013-2020 the revenue growth of global operator especially voice and data services would be decline. However, there will be an increase in automated (Non-Human intervention) data services and digital service (content, video, ecommerce, etc.). It also predicted that the presence of digital product in Telco will be able to recover negative revenue growth become positive one. Nevertheless, the business valuation of the digital companies is fluctuating within the last nine years due to the volatility caused by several factors. The poor valuation of digital industry is allegedly due to the implementation of strategic innovation has not been completely implemented. It is associated with problems in the development of the company's assets and business partnership that has been initiated. This study aims to assess the influence of company assets and business partnership on strategic innovation and its implications on the business valuation of digital industry in Indonesia. The study uses a quantitative approach with the analysis unit is digital companies in Indonesia. We are using 200 respondents that comprise of various strategic position personal of digital companies and processed the analysis by using simple random sampling technique. The results of the study has pointed out that strategic innovation has a greatest effect on business valuation. Strategic Innovation is mostly affected by company asset rather than business partnership. Company asset and business partnership effect on business valuation both directly and indirectly through Strategic Innovation.

Keywords

Industry Environment, Company Asset, Strategic Innovation, Business Valuation, Digital Industry.

Introduction

Research Background

The rapid development of digital technology today has had a very broad impact. It only takes three decades for information technology and creativity to bring the digital age to its peak in revolutionizing industry and all aspects of human life. This digital revolution has fundamentally changed the efforts of many companies in managing their business. This change has forced companies to change business models that are commonly used to gain profits and massively further create an increasingly competitive industrial landscape full of uncertainty (Hitt et al., 2015).

A list submitted by Fortune 500 stated that the major digital players are now among the highest value growth that surpass the growth of existing historical giants (Fortune, 2016). This condition will require companies to transform their business to avoid disruption from new entrants (Christensen, 1997). Unfortunately, legacy products of Digital companies are among the high margin portfolio that currently sustain the company value (Statista, 2017). Therefore, today Digital companies should overcome the major challenge in entering digital business while maintaining their value to pertain their existence in the market and ensuring their sustainability. Regardless the high pace of transformation that has been initiated for years by Digital companies, Business Valuation of Digital Companies in Indonesia generally are not optimal. Our observation in major Digital companies in Indonesia in 2016 shows that the values are fluctuating within a nine-years period (Table 1) allegedly caused by several factors. The unclear implementation of Strategic Innovation is believed as one of the major factor.

| Table 1 Business Valuation Of Digital Companies In Indonesia |

|||||||||

| Business Valuation | Year | ||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Enterprise Value | 33.753 | 32.171 | 31.192 | 35.592 | 37.422 | 32.228 | 41.377 | 40.708 | 39.236 |

| Market Capital | 30.858 | 29.705 | 28.948 | 32.561 | 34.522 | 33.478 | 33.293 | 32.328 | 32.1 71 |

| EBITDA | 4.491 | 5.437 | 4.915 | 6.215 | 6.828 | 5.8 08 | 5.493 | 5.351 | 5.234 |

| Revenue | 17.321 | 19.392 | 18.866 | 21.225 | 21.020 | 20.568 | 21.797 | 20.811 | 20.522 |

Source: Processed from various source.

The table shows the fluctuating business valuation of Digital companies in Indonesia over the last nine years from 2007 to 2015 that occurs by several factors.

This condition previously stated by Gupta & Shapiro (2014) that one of four main characteristic of Indian company that has been adopted as lessons learn in global business is favoring organic growth, partnership and value-chain innovation. A study conducted by Dauderstadt (2013), stated that according to Schumpeter (1942) Innovative Capability is a key determinant that enable company to secure its position in market. New innovation and technology lead the disruptions of the existing market. In the last decade, innovation and Research & Development (R&D) has incorporated by business strategy and become one of major part.

Fransman (2014) said there is a symbiotic relationship of elements within the Information Communication Technology (ICT) ecosystem. In the symbiotic relationship there are at least four dimensions involved: Financial Flow (flow of selling-buying), Material Flow (flow of goods), Information Flow (information flow) and Input flow into Innovation Process (input for improvement/innovation). In this Fransman theory, the journey of interaction between elementsthe flow of money, goods and information can produce lessons learned that trigger further improvement of this relation. The ICT ecosystem theory contains elements of partnership, innovation, investment and a business environment where symbiotic relationships occur between these elements.

Problems in maximizing Business Valuation of the Digital Company in Indonesia are as follows:

1. Non-optimal exploitation of their Assets particularly their intangibles, some indications including limited working capital and proprietary technology resources constraints that lead to this non-optimal condition. Miloud et al. (2012) suggest that firm resources, external ties and market opportunities jointly determine firm performance.

2. Not yet maximizing the potential of Business Partnership to strengthen the Strategic Innovation such as the absence of close partnership with the lateral (e.g. Government) or even a competitor. In addition, internal partnership was not optimally implemented on cross-functional coordination. Some weaknesses in supplier relationship also come into surface that severely hit the valuation result.

Literature Review

Grand theory in this research was management strategic. According to Hitt et al. (2015) management strategic is a set of commitment, decision and action necessary company to reach competitiveness strategic and obtain the rate of return above average. The first step that company did is analysing external environment and environment internal core to determine resources, capabilities and competence the point as a source of input strategic.

Hitt et al. (2015) suggest that capabilities and core competencies are the foundation for competitive advantage. Hubbard & Beamish (2008) suggest a definition of alliances as “a cooperative, non-controlling decision, making relationship between two (or more) organizations for the purposes of securing a competitive advantage”. Cravens & Nigel (2013) stated that partnership is an effort to cooperate with stakeholders, where strategic alliances are used by many companies that compete worldwide. Partnership includes the vertical relationship that comprises of relationships with suppliers and customers as well as horizontal relationship consisting of lateral and internal partnerships.

Robinson & Richard (2012) stated that firms possess a unique “bundle” of tangible and intangible assets and the organizational capabilities to make use of those assets. Hubbard & Beamish (2008) also stated that company resources is consist of tangible asset that is easily to be identified such as land, building, tools, etc. and intangible asset that is non-easy to be identified such as organizational experience, brand, intellectual capital, etc. Hitt et al. (2015) stated that organization is a collection of unique resources and capabilities that form the basis of the formulation of the company's strategy and its ability to obtain results above average. Thompson et al. (2014) suggests that company resources are inputs or assets that are competitive for the company. Company Assets in this study is organized into a construct that is “a series of tangible assets and intangible assets as productive inputs for the company in formulating strategies to achieve competitive positions in the industry”.

Tidd et al. (2005) suggest that innovation is always associated with a change related to: Product innovation (changes in the things (products/services) that an organization offers), Process innovation (changes in the ways in which they are created and delivered), Position innovation (changes in the context in which the products/services are introduced) and Paradigm innovation (changes in the underlying mental models which frame what the organization does). Trott (2011) explained the type of innovations that must be considered by a company: Product Innovation, Process Innovation, Organisational Innovation, Management Innovation, Production Innovation, Commercial/Marketing Innovation, and Service Innovation.

In assessing the performance-based business valuation model, Reddy et al. (2013) use free cash flow, replacement value, and liquidation value. Meanwhile, Vintila & Gherghina (2012) measure the performance by using operational performance (return on equity, net profit margin and sales growth), assessment (Tobin's Q) and the shareholder pay-out (dividend yield and the share buyback).

Previous research showed the relationship between these factors. Acccording to Albahussin & El-garaihy (2013) the practice of human resource management is an important factor of organizational culture, knowledge management, and organizational innovation, which in turn positively related to organizational performance. Kuznetsov (2014) shows that companies with innovation get a broad customer base, competitive prices, high level of service, high quality of innovation services offered, availability of their own innovation developments and highly skilled staff. Dalota (2013) found empirical evidence that the choice of innovation strategy drives a human resource framework. Yahya (2013) concluded about relationships between unique resources, innovation management, partnership and business performance.

Research Objectives

Based on the research background and literature review, the purpose of this study is to assess:

1. The influence of Company Asset and Business Partnership to Strategic Innovation in digital industry companies in Indonesia.

2. The influence of Company Asset and Business Partnership to Business Valuation in digital industry companies in Indonesia.

3. The influence of Strategic Innovation to the Business Valuation in digital industry companies in Indonesia.

4. The influence of Company Asset and Business Partnership to Business Valuation in digital industry companies in Indonesia through Strategic Innovation.

Methodology

This research uses Quantitative Method, which is a design research that approaches empirical study to collect, analyse and provide data in numerical form and try to make accurate measurement against something (Cooper & Schindler, 2014).

The observations were conducted by using time horizon which had cross section/one shot attribute, it means the information or data obtained was the results of research conducted at certain time. The observations were conducted in 2017.

The unit of analysis is the digital industry companies in Indonesia with the unit of observation is the management and strategic position of the company. Analytical and technical approach in this research was done by using Structural Equation Modelling (SEM). The use of SEM refers to the purpose and paradigm and the research model, which is testing the causal model between latent variables (unobservable variables).

There were 334 digital industry companies in Indonesia taken as population in this research. Some 200 respondents were taken as sample according to the theory of minimum required sample size to reduce bias in SEM (Loehlin, 1998). The sample distribution of digital industry in Indonesia showed in Table 2 below.

| Table2 Sample Distribution Of Digital Industry In Indonesia |

||

| Digital Industry | Population (N) | Sample Distribution (n) |

| Total | 334 | 200 |

Source: Compiled from several sources, 2016.

Results And Discussion

Fit Model Testing

This section will discuss the results of hypothesis testing using Structural Equation Modelling (SEM). The Goodness of fit model aims to test whether the resulting model could describe the actual conditions.

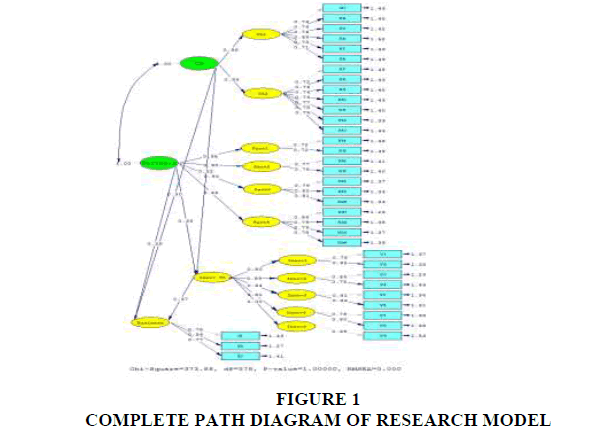

Calculations by LISREL obtained the complete results as follows:

In Table 3 above p-value>0.05. Thus, it could be concluded that the research model is fit. In addition, the same result obtained from Goodness of Fit Indices (GFI) and as well as Root Mean Square Error of Approximation (RMSEA)<0.05 that explain that the research model is fit with the empirical condition.

| Table 3 Goodness Of Fit |

||||

| No. | Measurement of Degree of Fit | Value | Acceptable Measurement of Degree of Fit | Description |

| 1 | Chi Square | 373.88 | P -value>0.05 | Close Fit |

| Normed Chi Square (x2/df) | P-value=1.000 | |||

| 2 | Goodness of Fit Index (GFI) | 0.91 | >0.8 | Close fit |

| 3 | Root Mean Square Error of Approximation (RMSEA) | 0.000 | RMSEA ≤ 0.08 (good fit) RMSEA< 0.05 (close-fit) |

Close fit |

Source: Output LISREL 8.7.

Measurement model

Measurement model of latent variables on the dimensions explain the extent of the validity of the dimensions. There are several measures to measure validity of the dimensions. One of them is convergent validity, Construct Reliability (CR) and Average Variance Extracted (AVE) (Ghozali, 2008). Convergent validity can be seen from the value of the loading factor. Standardize loading (λ) of 0.50 or more is considered to have strong enough validation to explain latent dimensions (Hair et al., 2010; Ghozali, 2008). Another requirement that must be fulfilled is the loading factor must be significant where tcount>ttable and or loading factor>0.5 and more ideal if loading factor>0.7.

Table 4 presents the results of the analysis of the measurement model for the latent variables on each dimension.

| Table 4 Loading Factor Between Latent Variable-Dimension And Dimension-Indicator |

|||

| Latent Variable-Dimension | Dimension-Indicator | λ | t-value |

| Company Asset → CA1 | 0.96 | 6.37* | |

| CA1 → X1 | 0.73 | - | |

| CA1 → X2 | 0.74 | 5.26* | |

| CA1 → X3 | 0.76 | 5.33* | |

| CA1 → X4 | 0.69 | 5.02* | |

| CA1 → X5 | 0.73 | 5.22* | |

| CA1 → X6 | 0.71 | 5.11* | |

| Company Asset → CA2 | 0.86 | 6.06* | |

| CA2 → X7 | 0.72 | - | |

| CA2 → X8 | 0.76 | 5.29* | |

| CA2 → X9 | 0.74 | 5.24* | |

| CA2 → X10 | 0.76 | 5.29* | |

| CA2 → X11 | 0.77 | 5.36* | |

| CA2 → X12 | 0.78 | 5.39* | |

| CA2 → X13 | 0.75 | 5.25* | |

| Business Partnership → Part1 | 0.95 | 6.35* | |

| Part1 → X14 | 0.72 | - | |

| Part1 → X15 | 0.72 | 4.84* | |

| Business Partnership → Part2 | 0.90 | 6.35* | |

| Part1 → X16 | 0.77 | - | |

| Part1 → X17 | 0.78 | 5.02* | |

| Business Partnership → Part3 | 0.90 | 6.74* | |

| Part1 → X18 | 0.79 | - | |

| Part1 → X19 | 0.82 | 5.58* | |

| Part1 → X20 | 0.81 | 5.55* | |

| Business Partnership → Part4 | 0.88 | 6.74* | |

| Part1 → X21 | 0.86 | - | |

| Part1 → X22 | 0.79 | 5.88* | |

| Part1 → X23 | 0.79 | 5.90* | |

| Part1 → X24 | 0.78 | 5.85* | |

| Strategic Innovation → Innov1 | 0.80 | 5.24* | |

| Innov1 → Y1 | 0.79 | - | |

| Innov1 → Y2 | 0.82 | 4.71* | |

| Strategic Innovation → Innov2 | 0.89 | 6.10* | |

| Innov2 → Y3 | 0.84 | - | |

| Innov2 → Y4 | 0.75 | 5.11* | |

| Strategic Innovation → Innov3 | 0.84 | 5.60* | |

| Innov3 → Y5 | 0.81 | - | |

| Innov3 → Y6 | 0.83 | 5.08* | |

| Strategic Innovation → Innov4 | 0.81 | 5.26* | |

| Innov4 → Y7 | 0.78 | - | |

| Innov4 → Y8 | 0.80 | 4.66* | |

| Strategic Innovation → Innov5 | 1 | 5.72* | |

| Innov5 → Y9 | 0.69 | - | |

| Business Valuation | |||

| Business Values → Z1 | 0.75 | - | |

| Business Values → Z2 | 0.86 | 5.28* | |

| Business Values → Z3 | 0.77 | 5.00* | |

Note: *Significant on α=0.05 (t-table=1.96).

The result shows that all dimensions and indicators are valid which has t-value<1.96 (ttable at α=0.05).

Structural model analysis

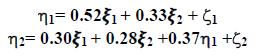

This research model essentially discloses that Company Asset  and Business Partnership

and Business Partnership  are exogenous variables that directly affect Business Valuation

are exogenous variables that directly affect Business Valuation  dan Strategic Innovation

dan Strategic Innovation  . Based on the framework, the structural model in this study can be presented in equation below:

. Based on the framework, the structural model in this study can be presented in equation below:

Where,

= Business Valuation.

= Business Valuation.

= Strategic Innovation.

= Strategic Innovation.

Company Asset.

Company Asset.

Business Partnership.

Business Partnership.

Residual.

Residual.

The following Figure 1 shows the results of the complete path diagram.

Hypothesis Testing

The effect of company asset and business partnership on strategic innovation

According to the Table 5, at 95% table degree of confidence (α=0.05 the Company Asset and Business Partnership simultaneously influenced Strategic Innovation as much as 49% (the rest of 51% by other factors that did not examined).

| Table 5 Simultaneous Testing Of Hypothesis 1 |

|||

| Hypothesis | R2 | F value | Conclusion |

| Company Asset and Business Partnership → Strategic Innovation | 0.49 | 136.22* | Hypothesis supported |

Note: *Significant at α=0.05 (F-table=3.04).

According to the Table 6, at 95% degree of confidence (α=0.05), partially there is a significant influence of Company Asset and Business Partnership on Strategic Innovation where Company Asset gives a greater effect.

| Table 6 Partial Testing Of Hypothesis 1 |

||||

| Hypothesis | γ | t value | R2 | Conclusion |

| Company Asset → Strategic Innovation | 0.52 | 4.45* | 0.33 | Hypothesis supported |

| Business Partnership → Strategic Innovation | 0.33 | 3.28* | 0.17 | Hypothesis supported |

Note: *Significant at α=0.05 (t-table=1.96).

According to the Table 7, at 95% degree of confidence (α=0.05), simultaneously Company Asset and Business Partnership simultaneously influence Business Valuation with 22% (rest of 78% influenced by other factors).

| Table 7 Simultaneous Testing Of Hypothesis 2 |

|||

| Hypothesis | R2 | F value | Conclusion |

| Company Asset and Business Partnership → Business Valuation | 0.22 | 50.05* | Hypothesis supported |

Note: *Significant at a=0.05 (F-table=3.04).

According to the Table 8, it is known that at the degree of confidence of 95% (α=0.05), partially Company Asset and Business Partnership influence Business Valuation where Company Asset gives bigger effect.

| Table 8 Partial Testing Of Hypothesis 2 |

||||

| Hypothesis | γ | t value | R2 | Conclusion |

| Company Asset → Business Valuation | 0.30 | 2.14* | 0.12 | Hypothesis supported |

| Business Partnership →Business Valuation | 0.28 | 2.38* | 0.10 | Hypothesis supported |

Note: *Significant at α=0.05 (t-table=1.96)

The effect of strategic innovation on business valuation

According to the Table 9, it is known that at the degree of confidence of 95% (α=0.05), there is a significant influence of Strategic Innovation on Business Valuation.

| Table 9 Partial Testing Of Hypothesis 3 |

||||

| Hypothesis | β | t value | R2 | Conclusion |

| Strategic Innovation → Business Valuation | 0.37 | 2.25* | 0.14 | Hypothesis supported |

Note: *Significant at α=0.05 (t-table=1.96)

The effect of company asset and business partnership on business valuation through strategic innovation

According to the Table 10, it is known that at the degree of confidence of 95% (α=0.05), simultaneously Company Asset and Business Partnership influence Business Valuation through Strategic Innovation with 38%.

| Table 10 Simultaneous Testing Of Hypothesis 4 |

|||

| Hypothesis | R2 | F Value | Conclusion |

| Company Asset and Business Partnership → Business Valuation through Strategic Innovation | 0.32 | 74.83* | Hypothesis supported |

Note: *Significant at α=0.05 (F-table=2.65).

According to the Table 11, it is known that at the degree of confidence of 95% (α=0.05), partially Company Asset and Business Partnership influence Business Valuation though Strategic Innovation.

| Table 11 Partial Testing Of Hypothesis 4 |

||||

| Hypothesis | γβ | t value | R2 | Conclusion |

| Company Asset ®Strategic Innovation → Business Valuation | 0.192 | 2.14* | 0.196 | Hypothesis supported |

| Business Partnership® Strategic Innovation → Business Valuation | 0.122 | 1.98* | 0.124 | Hypothesis supported |

Note: *Significant at α=0.05 (t-table=1.96) with sobel test.

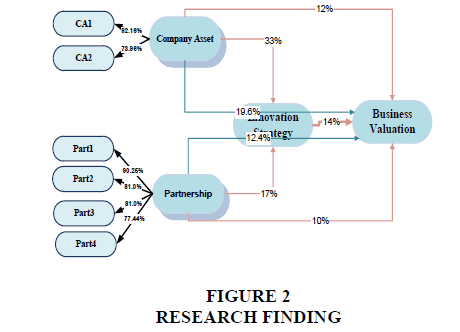

Based on the result of hypothesis testing, the research finding Figure 2 as below.

The finding shows that Business Valuation of digital industry companies in Indonesia mostly affected by the development of Strategic Innovation as hypothesis testing showed that Strategic Innovation influence on Business Valuation. Company Asset plays a greater effect compares to Business Partnership in doing so. Therefore, the improvement of Strategic Innovation should be started by the improvement of tangible asset including strategic location, financial capital, hardware, software, network, as well as the availability of data and information digitally.

The main finding of this research is that Business Valuation of digital industry in Indonesia was largely affected by the development of Strategic Innovation. On the other hand, Company Asset gave a greater influence in developing Strategic Innovation compared to Industry Environment. Directly, Company Asset also has a significantt influence on Business Valuation, meanwhile Industry Environment had less significant influence on Business Valuation. The findings of this research support Akhavan (Akhavan et al., 2013), which showed that Strategic Innovation significantly influenced financial performance. The finding is also in line with Barnes and Hinton (Barnes & Hinton, 2012) who say that innovation will drive new understanding and potential to enhance Business Performance. The finding shows that enhancing Business Valuation of digital industry in Indonesia is much more affected by the development of Strategic Innovation.

digital industry, innovation is applied on people, not products. The ambition and potential factors are important in the development of people in digital industry. People involved must have Ten Volt Mindset in order to utilize limited resources to generate maximum business valuation and to develop a sustainable business development. Achieving maximum business valuation requires something fundamental, and it is in the development of people.

Meanwhile, in enhancing Strategic Innovation it has been proven that Company Asset gave a greater influence than Business Partnership. In digital business, before innovation, the first thing to consider is whether the business is ready to enter the industry, and whether it is supported by the ownership of the company's assets. Company Assets are formed in tangible and intangible assets. Tangible asset includes: strategic location, financial capital, hardware, software, network, and the availability of digital data and information. The intangible asset includes company experience, managerial capability of top management, the capability of top management in leadership, company reputation, and intellectual property (patent, license, copyright).

The findings of the research are in line with the previous study by Attwater, Wang, Parlikad, and Russell (Attwater et al., 2014), which showed the relationship between organizational management, asset management performance, and the performance of assets. It is also in line with (Akhavan et al., 2013), who found a significant positive relationship between innovations, in improving financial performance. On the other hand, the findings also proved the significant role of Company Asset as said by (Hitt et al., 2015) that the resources, capabilities, and core competencies were the foundation for competitive advantage, in this case as their effects on strategic innovation. These findings also supports (Sakchutchawan, 2009), who claimed that successful operational and financial performance were driven by the innovation implemented with appropriate knowledge management and technology.

As stated in findings, digital business is now need of consideration of a model that incorporates these aspects. In developing a model, there could be variations between portfolios from company to company. However, main factors should remain the same since innovation plays a major role in shaping business landscape. In addition, Company Asset as company resources and Industry Environment as external ties is the directive that can drive the innovation (Christensen, 1997; Dauderstadt, 2013; Miloud et al., 2012). The future research about this topic can be focused on detail portfolio contained in digital sector such as cloud, remittance, Internet of Things (IoT) and content delivery services. Since digital sector is interrelated to digital technology, ICT products and services are among the major industry that is prone to disruption. Therefore, digital industry should set a strategy to have a proper investment in proper portfolios.

The research suggests that digital industry must adapt Industry Environment and optimize the use of Company Asset to boost their Strategic Innovation since leveraging Company Asset by using business-as-usual strategy has lesser impact on Value of the Business. On the other hand, adapting Industry Environment must be aimed as the effort to boost strategic innovation in order to have better impact on Business Valuation. Thus, the findings of this research can be implemented by the management of digital industry in Indonesia to maximize the Business Valuation through the improvement of Strategic Innovation by smartly utilizing its Company Asset and adapting the Industry Environment.

Conclusions And Recommendations

Based on the findings, it can be concluded that Company Assets play a role in developing a Business Partnership in digital companies. Our model shows that as much as 33% of Company Asset affects Business Valuation through Strategic Innovation among other aspects. The model is also shown that as much as 17% of Business Partnership’s aspect influences Business Valuation through Strategic Innovation.

The company's ability to develop tangible assets (working capital, strategic business location, completeness of software, availability of networks and digital data and information, as well as hardware completeness) supported by the development of intangible assets (top management managerial ability, company reputation, patent ownership and license, top management capabilities in leadership, ownership of copyright, and company experience in the digital industry) are more important aspects in developing a Business Partnership.

Company Assets play a role in developing Strategic Innovation in digital companies. The company's ability to develop tangible assets supported by the development of intangible assets is an aspect that has a major role in developing Strategic Innovation. This is consistent with the results of the measurement of the relevance value of the variables between the variables of the study on the variables used in valuation.

Strategic Innovation plays a more dominant role than Business Partnerships in increasing Business Valuation in digital companies. The company’s ability to develop paradigm innovation which is supported by the development of process innovation, position innovation, product innovation and competitive tariffs are more important aspects in increasing business valuation. While on the Business Partnership side, the development of internal partnerships in the form of synergy and collaboration between parts has a greater role than partnerships with suppliers, partnerships with customers, and partnerships with lateral, in increasing business valuation.

The findings of this study can be a reference for academics to develop further research related to the topic in this dissertation research by making these findings as part of the premise in the development of a framework of thinking and further research can conduct research related to increasing business valuation in digital companies by observing exogenous variables which is different from this research.

References

- Al-bahussin, S.A., & El-garaihy, W.H. (2013). The impact of human resource management practices, organisational culture, organisational innovation and knowledge management on organisational performance in large saudi organisations: Structural equation modeling with conceptual framework. International Journal of Business and Management, 8(22).

- Attwater, A., Wang, J.Q., Parlikad, A., & Russell, P. (2014). Measuring the performance of asset management systems. Asset Management Conference 2014.

- Barnes, D., & Hinton, C.M. (2012). Reconceptualising e-business performance measurement using an innovation adoption framework.International Journal of Productivity and Performance Management,61(5), 502-517.

- Beamish, H.R., Hubbard, G., & Rice, J. (2008). Strategic management, thinking analysis action.Australia: Pearson Education Australia, 85-95.

- Cooper, R.R., & Schindler, P.S. (2014). Business research methods, (12th edition). New York: McGraw-Hill International Edition.

- Cravens, D.W., & Nigel, F.P. (2013). Strategic marketing, (10th Edition). New York: McGraw-Hill.

- Dalota, M.D. (2013). SMS’s innovation and human resource management.Strategic Human Resource Management at Tertiary Level.

- Dauderstädt, M. (Ed.). (2013).Alternatives to austerity: Progressive growth strategies for Europe.

- Fransman, M. (2014). Models of innovation in global ICT firms: The emerging global innovation ecosystems.JRC Science and Policy Raport, University of Edinburgh.

- Ghozali, I. (2008).Structural equation modeling: Alternative method with partial least square (pls). Diponegoro University Publishing Agency.

- Gupta, S., & Shapiro, D. (2014). Building and transforming an emerging market global enterprise: Lessons from the Infosys journey.Business Horizons,57(2), 169-179.

- Hitt, M.A., Ireland, R.D., & Hoskisson, R.E. (2012).Strategic management cases: Competitiveness and globalization. Cengage Learning.

- Hitt, M.A., Ireland, R.D., & Hoskisson, R.E. (2015). Strategic management: Concepts: Competitiveness and globalization, chapter 3-The internal organization: Resources, capabilities, core competencies and competitive advantages.South Melbourne: South-Western Cengage Learning.

- Kuznetsov, N. (2014). Management innovation companies based business cost indicators.Asian Social Science,10(17), 101.

- Loehlin, J.C. (1998).Latent variable models: An introduction to factor, path, and structural analysis. Lawrence Erlbaum Associates Publishers.

- Miloud, T., Aspelund, A., & Cabrol, M. (2012). Startup valuation by venture capitalists: An empirical study.Venture Capital,14(2-3), 151-174.

- Pearce, J.A., Richard, B., & Robinson, Jr. (2015). Strategic management: Planning for domestic & global competition.International Edition, New York: McGraw Hill.

- Reddy, K.S., Agrawal, R., & Nangia, V.K. (2013). Reengineering, crafting and comparing business valuation models-the advisory exemplar.International Journal of Commerce and Management,23(3), 216-241.

- Robinson, J.A.P., & Richard, B. (2012). Strategic management: Planning for domestic & global competition.

- Sakchutchawan, S. (2009). An inquiry into the strict compliance of the international chamber of commerce trade rules in financing process.Global Journal of International Business Research,2(2).

- Schumpeter, J.A. (1942).Socialism, capitalism and democracy. Harper and Brothers.

- Thompson, A.A., Peteraf, M.A., Gamble, J.E., & Strickland, A.J. (2014). Crafting and executing strategy: The quest for competitive advantage, concepts and cases, (19th Ed.). England: McGraw Hill Education.

- Tidd, J., Bessant, J., & Pavitt, K. (2005).Managing innovation integrating technological, market and organizational change. John Wiley and Sons Ltd.

- Trott, P. (2011). Innovation management and new product development. Pearson education.

- Vintila, G., & Gherghina, S.C. (2012). An empirical examination of the relationship between corporate governance ratings and listed companies’ performance.International Journal of Business and Management,7(22), 46.

- Yahya, A. (2013). The effect of unique resource, innovation management and partnership on business performance at digital creative industry in Indonesia.International Journal of Innovations in Business,2(5), 444.