Research Article: 2021 Vol: 20 Issue: 2

The Moderating Effects of Corporate Governance on the Relationship between CEO Pay and Risk Taking

Hussam A. Al-Shammari, Indiana University of Pennsylvania

Abstract

Using an agency theory framework, we investigate the relationship between CEO option pay and CEO risk-taking behavior. We integrate the incentive alignment and monitoring approaches to reducing principal-agent conflicts by considering them simultaneously. We develop and test hypotheses that suggest that aspects of the governance system of a firm moderate the relationship between CEO option pay and CEO risk-taking. Results based on data collected from 204 Fortune 1000 U.S. manufacturing firms revealed a strong, positive relationship between CEO option pay and CEO risk-taking. Further, moderating effects were found for CEO duality, blockholder ownership, institutional ownership, and insider ownership. However, empirical analyses fail to provide adequate evidence to support the expected moderating effect of board independence.

Keywords

CEO Compensation, Corporate Governance, CEO Risk-Taking Behavior.

Introduction

The relationships between executive compensation and organizational outcomes have attracted increasing attention from researchers in various disciplines (Al-Shammari, 2021; Al Shammari, 2018; Boyd, Santos, & Shen, 2009; Elsilä et al., 2013; Sun & Cahan, 2009; Conyon & He, 2012; Sakawa et al., 2012). Generally speaking, this stream of research views executive compensation as a powerful mechanism to mitigate agency costs associated with the agency relationship between managers and owners, and empirically investigates the incentive alignment argument. Despite a large number of empirical studies, the consensus however is that, “as a whole, very limited progress has been made” (Gomez-Mejia & Wiseman, 1997) and little can be said with certainty about the nature and direction of this relationship. Further, the results of this stream of research have been described as “meager, misguided, and myopic” (Heneman & Judge, 2000), “remains in the melting pot” (Pass, 2003), and highlight the need to shift research and discussion to a more strategic level (Boyd et al., 2012).

Along with incentive alignment, the monitoring argument has also received increasing attention from strategy researchers over the last decade. Agency literature has begun to recognize the corporate governance structure as one of several mechanisms that can mitigate agency conflicts within the firm (Schiehll & Martins, 2016; Kumar & Zattoni, 2013; Lo & Wu, 2016). Monks & Minow (2001) defined corporate governance as an interaction among the various participants in determining the direction and performance of corporations, including shareholders and board of directors. A set of internal and external governance mechanisms have been identified to perform this role including leadership structure, board composition, and firm’s ownership structure (Bathala & Rao, 1995; Mayers et al., 1997). Testing the efficacy of these various governance mechanisms in resolving or reducing agency conflict has resulted in different lines of work, each corresponding to a particular element of the corporate governance structure. Taken as a whole, the results of this line of research confirm the ability of strong governance systems to balance the interests of executives with those of the owners (Dess et al., 2004).

Although past research has examined the incentive alignment and monitoring mechanisms separately, their joint effects have seldom been examined in prior research. Given that most organizations use a mix of both, the possible interaction between agency conflict resolution mechanisms, namely, incentive alignment (through executive compensation) and monitoring (through the various components of the corporate governance system) is a very promising research avenue and constitutes the subject of this study.

Unlike prior research which has primarily focused on the direct links between executive compensation and organizational outcomes, the present study is a move away from the examination of the simple bivariate relationship between executive compensation and firm performance. This study strives towards a more sophisticated understanding of the consequences of CEO option pay in two ways. First, we investigate the moderating role played by characteristics of the governance system in the relationship between executive compensation and organizational outcomes. The simultaneous examination of incentive alignment and monitoring mechanisms is expected to overcome the limitations of the more simplistic approaches followed in prior research with regard to this complex relationship. Given that incentive alignment and monitoring can both substitute and complement each other and that all organizations employ a mix of both, we believe that their joint consideration is likely to provide a richer understanding of the effectiveness for executive compensation packages. Second, instead of focusing on the impact of option pay on organizational performance which can also be impacted by a number of external and internal factors, we focus on a more proximate outcome, namely, executive risk taking behavior. The overwhelming majority of prior work on executive compensation outcomes has focused exclusively on firm performance (Barkema & Gomez-Mejia, 1998). Although equally important, only recently has CEO risk taking behavior started to capture the attention of researchers in strategy literature (Sanders, 2001; Simsek, 2007; Wright et al., 2007). Therefore, our primary question is “When and under what circumstances will executive compensation (i.e. stock options) positively impact firm risk?” To answer this question, the remainder of this paper is organized as follows: In the next section, we review the literature and develop our conceptual model and hypotheses. This is followed by a description of the methodology used in this study. We then conclude by discussing the results and the limitations of this study.

Theoretical Framework and Hypotheses Development

The impact of compensation on individual attitudes and subsequent behaviors is well established in previous literature in human resources management and organizational behavior. However, the behavioral implications of compensation at executive level are still largely unexplored (Gilley et al. 2004), even though they have been emphasized and documented since the early part of the last century (Taussig & Baker, 1925). So far, only limited efforts have been made to explore the effects of executive compensation structure on CEO behavior (Finkelstein et al., 1996), especially with respect to executive’s investment decisions and risk-taking behavior (Gilley et al. 2004). Over the past decade, the ability of executive compensation and its components to align CEO and shareholders’ interests has received increasing attention among researchers. According to agency theory, agents and shareholders diverge in terms of risk attitudes and preferences. Agency theory posits that agents are risk averse. On the other hand, it suggests that shareholders are risk seekers as they already have a diversified portfolio of investments. Confronted with this situation, the incentive alignment perspective advanced by agency theory posits that some executive compensation components such as stock options could be utilized to reduce managerial opportunism and induce shareholder wealth maximizing corporate investment decisions and behaviors, which presumably would result in higher levels of firm performance (Jensen & Meckling, 1976; Jensen & Murphy, 1990).

To test this prescription, a number of studies have been conducted. DeFusco et al. (1990) provided preliminary support to the incentive alignment argument when they found that for firms announcing changes in executive stock option plans, a significant increase in implicit stock price variance and stock return variance was found indicating that executives undertook more risky investment opportunities. Contrary to these findings, Hoskisson et al. (1993) reported no significant relationship between executive long-term incentives and firm risk measured by R&D intensity. Similar counter-intuitive results were reported by Gray & Cannella (1997) and Balkin et al. (2000). Both these studies found a negative or no relationships between executive compensation and firm risk.

Sanders (2001) examined the effects of stock option pay on firms’ corporate decisions such as acquisition and divestiture propensity. This study found that that stock option pay had a significantly positive effect on acquisition activity. With respect to divestiture activity, a positive and significant effect for stock option pay was reported. Although Sanders (2001) interpreted these results as support for the argument that stock option pay reinforces risk-seeking behavior by managers, such interpretation, we are afraid, is inconsistent with evidence from prior research on diversification. The general consensus emerging from diversification literature is that agents have the motive to pursue excessive diversification that goes beyond the optimal level for shareholders because diversification is one of the means through which they can reduce their employment risk (Amihud & Lev, 1981). From a shareholder’s perspective, diversification and acquisition are not beneficial due to the low cost of portfolio diversification in the external capital market (Amihud & Lev, 1981). Therefore, more acquisition activity associated with stock option pay found in this study is more an indicator of interest misalignment than an evidence of alignment. Very recently, Gilley et al. (2004) presented empirical evidence that shed further doubt on whether agency theory’s stock options prescriptions achieve their CEO-shareholder alignment goals.

The growing interest in the strategy field in business risk, its antecedents, and outcomes, has been driven by its presumed and salient effects on subsequent firm performance (Bromiley, 1991; Miller & Bromiley, 1990; Ruefli et al., 1999). As an increasingly critical component of executive compensation (Gogoi, 1999), that has salient effects on the level of risk executives are willing to assume (Chen et al., 2001; Sanders, 2001; Zajac & Westphal, 1994), research addressing antecedents of business risk has recently turned attention to executive stock options pay. As outlined earlier, a basic premise of agency theory is that people are inclined to avoid both work and risk. Therefore, an appropriate compensation system, according to agency theorists, should balance an agent’s effort and risk aversion attitudes (Eisenhardt, 1989; Jensen, 1983). In other words, an appropriately designed executive compensation system should reduce managerial opportunism and promote positive risk taking attitudes on the executives’ side and induce shareholder wealth maximizing investment strategies, decisions, and behaviors that presumably would enhance firm performance (Jensen & Murphy, 1990). Thus, from an incentive alignment perspective, executives who are paid large amounts of stock should be reluctant to engage in investments that do not increase shareholders wealth (Amihud & Lev, 1981; Jensen & Murphy, 1990; Sanders, 2001). Empirical evidence indicates that the magnitude of stock owned by top executives promotes congruence in management and shareholder risk preferences, which in turn encourages executives to become less risk averse, providing support to incentive alignment arguments (Agrawal & Mandelker, 1987; Hill & Hansen, 1991).

Based on the fact that stock options pay induces executives to engage in desirable risk taking behavior, especially with respect to corporate investment decisions, we argue that it will positively affect overall business risk. This part of our argument reflects the shareholders perspective in which they want agents to make higher-risk decisions to maximize their wealth in a given company, as they already have a diversified portfolio (Gilley et al., 2004). This leads to the following hypothesis:

H1 CEO option pay is positively related to firm strategic risk.

Nevertheless, counterarguments exist. Questions remain about whether or not these types of incentives actually work as prescribed and alter executive risk preferences or decisions (Sanders, 2001). Some authors argue that executives are immune to incentive compensation effects (Donaldson & Lorsch, 1983). A number of studies provide support to this argument (Balkin et al., 2000; Gray & Cannella, 1997; Hoskisson et al., 1993). This led Gilley et al. (2004) to conclude that a complete understanding of how and when incentive compensation, including stock option pay, results in interest alignment between agents and shareholders is far from complete. Further, the issue of whether CEOs have the ability to shift risk back to the shareholders also requires investigation. We believe that in order to explain these inconsistent findings and to understand the context specificity of this complex relationship, it would be beneficial to simultaneously consider incentive compensation and the extent to which managers are monitored.

Previous research on the relationship between executive compensation and organizational outcomes has by and large examined this relationship in terms of direct cause-effect models. What seems to be missing in previous research is the exploration of this relationship within the context of the governance system in place in a particular firm. Wiseman & Gomez-Mejia (1998) extended traditional agency theory to incorporate the contingent nature of executive risk behavior and advanced what they termed behavioral agency theory. This extended version of agency theory suggests a contingency-based view of risk behavior at the executive level. According to this perspective, various risk seeking behaviors are possible, depending on a set of internal and external contextual factors within which these actions and behaviors take place. Several arguments have been advanced, which suggest that corporate governance systems play a major role in the design of executive compensation packages (Gomez-Mejia, 1994; Gomez-Mejia & Wiseman, 1997). Further, even after a compensation package has been designed, there is ongoing monitoring of the management by the board and major shareholders of the firm. Yet, surprisingly, these factors are seldom considered by compensation researchers when empirically examining the relationship between executive compensation and organizational outcomes.

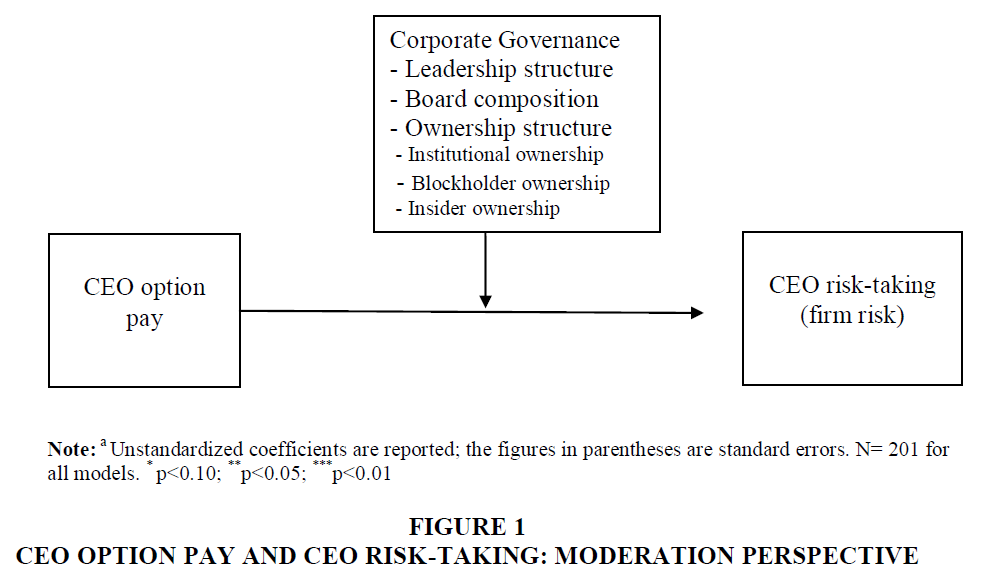

Our study attempts to integrate both the incentive alignment and monitoring approaches to reduce principal-agent conflicts. We study the implications of incentive compensation in the context of the governance system of a firm. The conceptual model underlying our study is presented in Figure 1 and developed in the following paragraphs.

Board Composition

The board of directors has long been the subject of considerable research in the governance literature (Westphal & Zajac, 1995). The composition of the board is considered a critical determinant of its vigilance and efficacy in limiting managerial discretion and safeguarding shareholders interests. The most commonly used indicator of board composition has been the ratio of outside directors to inside directors. Determining the appropriate structure or mix of the board of directors has been a subject of debate between two competing theoretical perspectives: stewardship and agency theories (Dalton et al., 1998 & 2003). Central to the first perspective is the assumption that “managers are good stewards of the corporation and diligently work to attain high levels of corporate profit and shareholder returns” (Donaldson & Davis, 1994: 159). According to this perspective a vigilant board is one that includes more insiders than outsiders. This argument is based on the reasoning that inside directors are trustworthy and have better access to information than outside directors (Baysinger & Hoskisson, 1990). Empirical support for this perspective is found in Baysinger & Hoskisson (1990); Boyd (1994); Hoskisson et al. (1994) and Donaldson & Davis (1991).

Contrary to the stewardship theory perspective, agency theory perspective favors the inclusion of a larger proportion of outside directors on the board as opposed to inside directors (Beatty & Zajac, 1994; Fama & Jensen, 1983; Westphal & Zajac, 1995). The argument is that outside directors are more inclined to fulfill their monitoring tasks and are less likely to allow executives to expropriate shareholders’ wealth (Beasley, 1996; Beatty & Zajac, 1994). The agency perspective has found strong support in numerous empirical studies. It has been found that firms with more outside directors on the board tend to have more value (Lee et al., 1992), resist greenmail payments (Kosnik, 1987), have better stock return (Rosenstein & Wyatt, 1990), are less likely to go bankrupt (Hambrick & D’Aveni, 1992; Daily & Dalton, 1994 a & b), and demonstrate better performance (Ezzamel & Watson, 1993; Baysinger & Butler, 1985; Pearce & Zahra, 1992).

The emerging consensus in governance research is that the presence of outside/independent directors on the board leads to a stronger board, which, in turn, will enhance the ability of the board to constrain CEO’s power and advance shareholder preferences. CEOs of firms with higher proportions of independent directors have less discretionary power. Consequently, shareholder preferences are more likely to be reflected in their decisions and actions. That is, they are more likely to adopt risk-increasing strategies. This clearly suggests a moderating role for board composition in the incentive compensation – firm risk relationship. Accordingly, our next hypothesis is:

H2 Board independence moderates the relationship between CEO option pay and firm risk, with the relationship being stronger in firms with more independent directors.

Leadership Structure

Leadership structure is the next corporate governance element that follows board composition in terms of importance. Commonly known as CEO duality in the extant literature, leadership structure has received increasing attention by researchers in the strategy literature (Daily & Dalton, 1994; Hambrick & D’Aveni, 1992; Mallette & Fowler, 1992). Two alternative leadership structures are common among publicly held companies. The first scenario is referred to in the literature as CEO duality, in which “the CEO of the firm wears two hats- a CEO hat and a chairperson of the board of directors’ hat” (Baliga et al., 1996). The alternative is the separation of these two positions.

Arguments regarding which of these two arrangements is best are similar to those with respect to board composition. Interestingly, research indicates better governance when the positions are separated although CEO duality is the prevailing norm in most large corporations. Daily & Dalton (1994a) state that “there is near consensus among theoreticians concerning the best CEO-board chair structure - agreement that one individual should not simultaneously hold the roles of CEO and board chairperson”. Research addressing this aspect of corporate governance has examined the relationship between CEO duality and various organizational outcomes such as bankruptcy, adoption of poison pills, and firm performance. Results of this empirical research have concluded that firms with CEO duality are more likely to go bankrupt (Hambrick & D’Aveni, 1992; Daily & Dalton, 1994 a & b), adopt poison pills (Mallette & Fowler, 1992), have less profitability (Berg & Smith, 1978; Rechner & Dalton, 1991), and face unstable stock market performance (Harris & Helfat, 1998).

Taken together, prior empirical research suggests that CEO duality, when present, is often to be blamed as the primary cause of decline in firm performance (White & Ingrassia, 1992). Recently, CEO duality has come under strong criticism in the press and academic circles. Boyd (1995) predicted an increasing tendency to split these positions in the years to come. Agency theorists continue to argue that separating the CEO position and chairperson position will lead to more independent, powerful, and vigilant governance system in the organization than otherwise. Separation of the two positions can lead to better monitoring of the managers, thus restricting self-serving actions and behaviors and promoting more risk seeking at the firm level. This argument leads to the following hypothesis:

H3 CEO duality moderates the relationship between CEO option pay and firm risk, with the relationship being stronger in firms with separate CEO and chairperson positions.

Ownership Structure

Ownership structure is widely recognized to be an important component of the corporate governance system (Jensen, 1989; Jensen & Murphy, 1990; Kang & Shivdasani, 1995; Barkema & Gomez-Mejia, 1998; Shleifer & Vishny, 1986; Wruck, 1989). Three classes of ownership are of interest in this study: institutional ownership, blockholder ownership, and insider ownership. Examination of the effects of these three classes of owners on various organizational outcomes has produced an extensive body of research.

Blockholder and Institutional Ownership

Shleifer & Vishny (1986) and Jensen (1983) indicated that large blockholders have both the motive and voting power to control executive actions and behaviors. For example, Kang & Shivdasani (1995) and Denis & Serrano (1996) found that executive non-routine turnover that follows poor stock-price performance is higher in firms with high levels of blockholder ownership. Also, Gilson (1990) found that an increase in blockholder ownership is associated with an increase in outside director membership on the board of directors. Similar effects were reported in Bethel & Liebeskind (1993) who found that blockholder ownership is significantly associated with corporate restructuring of the firm.

Similar arguments have been made with respect to the role of institutional ownership as well. Useem (1996) found that institutional ownership has increased from 16 percent to 57 percent in U.S. equity markets. David et al. (1998) indicated that institutional owners had strong influence on both the level and design of CEO compensation. Their results also showed that the presence of institutional owners led to higher ratio of long-term incentives in executive total compensation. In another study from Japan, Prowse (1990) showed that Japanese financial institutions have strong impact on investment decisions and help in reducing agency costs. It has also been found that firms with ties to a main bank are more likely to remove top executives for poor performance than firms without a main bank (Kang & Shivdasani, 1995).

Consistent with the monitoring hypothesis, evidence suggests that institutional owners and blockholders can play an important monitoring role in firms and limit executive’s discretion from pursuing a self-serving agenda. Building on this evidence, we present the following hypotheses:

H4 Blockholder ownership moderates the relationship between CEO option pay and firm strategic risk, with the relationship being stronger in firms with higher levels of blockholder ownership.

H5 Institutional ownership moderates the relationship between CEO option pay and firm strategic risk, with the relationship being stronger in firms with higher levels of institutional ownership.

Insider Ownership

Research on the impact of insider ownership on firm outcomes has been guided by two competing hypotheses: convergence of interest and entrenchment hypotheses. According to the convergence hypothesis, as insider ownership increases, the conflict of interests between managers and shareholders is likely to decrease, and this, in turn, will lead to an increase in firm value (De Miguel et al., 2004). On the other hand, the entrenchment hypothesis predicts that when insiders own a substantial amount of equity in the firm, this may lead them to satisfy their own non-value maximizing objectives in a way that does not endanger their employment and salary (Amihud & Lev, 1981 &1999). Therefore, top managers may prefer risk-reduction strategies. This is because they can not diversify their human capital invested in the firm (Bergh, 1995; Wright & Ferris, 1997; Wright et al., 2002) and because they have less flexibility in diversifying their personal wealth (Capozza & Seguin, 2003; Wright et al., 2002). Previous research has provided mixed results on whether insider ownership promotes alignment of interest between managers and shareholders (Chung & Pruitt, 1996; Palia & Lichtenberg, 1999; Core & Larcker, 2002; Demsetz & Villalonga, 2001; Wright et al., 2002; De Miguel et al., 2004; Sanders, 2001). We argue that increase in insider ownership is likely to make CEOs risk averse because a significant part of their net worth is tied to the company. Eventually, this will lead to lower firm risk. Therefore,

H6 Insider ownership moderates the relationship between CEO option pay and firm risk, with the relationship being weaker in firms with higher levels of insider ownership.

Methods

Sample and Data Collection

Our sample frame included all manufacturing firms listed on the Fortune. A total of 347 manufacturing firms were identified. To eliminate highly diversified firms, we followed Datta et al. (2005) by limiting our sample to firms deriving at least 60 percent of sales revenues from activities classified under a single four digit NAICS code. A total of 283 companies met this criterion. Our final sample size was created by matching CEO compensation data from EXECUCOMP Database, financial data and R&D spending from COMPUSTAT Database, and corporate governance characteristics from firm’s proxy statements. Firms are not legally required to itemize the disclosure of their R&D spending according to the SEC regulations. Therefore, after dropping firms for which R&D spending and CEO compensation data are not available; our final sample consisted of 201 manufacturing firms.

Variables and Measures

Independent variable

Stock option pay was measured using the weight of stock options in the CEO’s pay mix. Following Sanders & Hambrick (2007) and Stroh et al. (1996), CEO option pay was obtained by calculating the proportion of the CEO’s compensation that was comprised of stock options. Stock options were valued using the Black-Scholes options pricing model (Black & Scholes, 2019), which has been extensively used and validated in previous literature (Sanders & Hamrick, 2007).

Dependent variable

The conceptualization of risk and its measurement in the field of strategic management has been described as “ambiguous” (Sanders & Hambrick, 2007) and “underdeveloped” (Wiseman & Gomez-Mejia, 1998). Much of the confusion on the definition and operationalization of risk is attributed, according to Ruefli et al. (1999), to strategy research heavily relying on risk measures developed in adjacent disciplines. Surprisingly, researchers in the field of strategic management have not devoted serious attention to the development of measures more pertinent to strategy research. Given that risk is a multidimensional construct and that there is a multitude of risk measures, it is unclear which of these measures is appropriate for strategy research (Ruefli et al., 1999), especially for a study such as this. For example, Jemison (1987) argued that “risk is an elusive concept” that has different interpretations and concerns, depending on the perspective from which it is viewed. Further, risk could be either ex ante or ex post risk. Failure to differentiate between these two types of risk can lead to inconsistent finding and erroneous conclusions in strategy research (Ruefli et al., 1999). For example, since one can not use ex post variation in return as an indicator of the risk that exists ex ante (Jemison, 1987), it is unsound to use ex post measures of risk to explain current or future firm actions and/or outcomes, including current or future risk.

In line with Ruefli’s et al. (1999) call for more theory development on risk and its measurement in strategy research, Sanders & Hambrick (2007), recently proposed a more comprehensive conceptualization of risk in the context of strategy research. Following Larcker (1983), they argued that the most basic element of risk is the size of the R&D investment outlay. The bigger the R&D investment outlay, the bigger is the firm’s risk exposure. Conversely, smaller R&D spending will result in less exposure and hence yield lower levels of risk. Following Sanders & Hambrick (2007), this study employs R&D investment spending to assess managerial risk-taking behavior. This measure has also been used and validated in prior work (Hoskisson et al., 1993; Larcker, 1983). Further, the utilization of this measure as an ex ante measure is consistent with the objective of our study. We operationalized R&D investment outlay as R&D intensity, which is the ratio of R&D expenditures to sales.

Moderating variables

Following previous literature (Daily & Dalton, 1994 a & b), and using New York Stock Exchange (NYSE) and Securities and Exchange Commission (SEC) rules, this study classified board members as either independent or dependent. Board independence was calculated as the proportion of independent directors to total directors. CEO duality was operationalized as a dichotomous variable. If an individual simultaneously hold the positions of CEO and chairman of the board, it is coded as 1. Otherwise, it is coded as 0. Institutional ownership measures stock holdings of institutional investors including pension funds, insurance companies, banks, etc. This variable was measured by calculating the percentage of total shares held by institutions. Blockholder ownership was measured by calculating the percentage of outstanding shares of blockholders who hold at least 5 percent of outstanding shares and are not affiliated with management. Insider ownership was measured as the percentage of outstanding shares held by insiders, who are officers and founders and their family members.

Control variables

Based on prior literature, this study employed several control variables, all measured one year prior to the dependent variable measurement. First, firm size has been found to be the most clearly influential factor in determining CEO compensation (Tosi et al., 2000). Therefore, we controlled for firm size, which was measured as the natural log of the firm’s sales. Second, prior research indicated that past performance is an important antecedent of strategic change in organizations, including turnaround and diversification posture, which has subsequent implications for business risk (Hambrick & Schechter, 1983; Tushman & Romanelli, 1985; Tushman et al., 1989). Therefore, this study controlled for the effect of this variable by averaging the return on assets (ROA) for the three-year period from 2001 to 2003. Third, it has also been found that there is a positive relationship of CEO tenure to the amount of power he/she has over decision making and the board (Finkelstein & Hamrick, 1989; Ocasio, 1994), as well as the level of compensation he/she receives (Finkelstein & Boyd, 1994 & 1998; Westphal & Zajac, 1993). Building on this evidence, this study controlled for the effects of executive tenure. Executive tenure was measured as the number of years an executive has been in his/her current position as CEO. Fourth, consistent with previous research on CEO compensation and firm risk (Lewellen et al., 1987; Gibbons & Murphy, 1992; Harvey & Shrieves, 2001), the study controlled for CEO age. CEO age has been found to be an important antecedent of CEOs’ attitudes and behaviors, especially in regard to their risk-taking propensity (Davidson et al., 2006; McKnight et al., 2000). Fifth, Sanders (2001) reported that executive ownership plays an important role in executive risk-taking appetite. Drawing on this evidence, this study controlled for the effect of this important variable. Executive ownership was measured as the percentage of shares outstanding held by the CEO in 2003. Sixth, the debt-to-equity ratio was included as a control variable following Sanders (2001). Seventh, we also included board size as a control variable consistent with Pearce & Zahra (1992) and Pfeffer (1983). Finally, we controlled for the effects of industry using the standard 2-digit code.

Results

Descriptive Statistics

Table 1 presents the means, standard deviations, and zero-order correlations among all study variables. Descriptive statistics showed that the average percentage of stock options granted in 2003 approximated 46% of the average CEO’s total compensation for that year. It was also found that 75% of the firms have a leadership structure in which the CEO is also the chairperson of the board of directors. Also, 80% of directors on the board are independent in terms of the rules of the SEC and the NYSE’s corporate governance listing standards, with an average board size of 10. With respect to the ownership structure of the sample firms, the average percentages of institutional, blockholder, insiders, and CEO ownership are 74, 14, 6, and 2%, respectively.

| Table 1 Means, Standard Deviations, and Correlations Among all Variables | |||||||||||||||

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| 1 | Firm Size | 1 | |||||||||||||

| 2 | Firm Performanc e |

-0.011 | 1.00** * |

||||||||||||

| 3 | Firm Leverage | 0.205*** | - 0.021 | 1.00** * |

|||||||||||

| 4 | Board Size | .298*** | .128* | .224** * |

1.00** * |

||||||||||

| 5 | CEO Age | 0.111 | - 0.103 |

0.043 | 0.072 | 1 | |||||||||

| 6 | CEO Tenure |

-0.077 | .135** | -.133* | -.124* | .310** * |

1 | ||||||||

| 7 | CEO Ownership |

-0.107 | 0.103 | - 0.091 | -0.11 | - .136** |

.246** * |

1 | |||||||

| 8 | Option Pay | 0.06 | 0.053 | - .221** * |

-0.07 | - 0.019 | 0.088 | 0.006 | 1 | ||||||

| 9 | CEO Duality |

0.102 | .124* | .176** * |

0.046 | .161** | .278** * |

- 0.006 | - 0.053 | 1 | |||||

| 1 0 |

Insider Ownership | - .184*** |

0.036 | - 0.047 | - 0.095 | - 0.066 | .117* | .515** * |

-.126* | - .137** |

1 | ||||

| 1 1 |

Board Independen ce | 0.031 | 0.085 | 0.02 | -0.06 | - 0.101 | 0.077 | - 0.065 | 0.013 | .345** * |

- .218** * |

1 | |||

| 1 2 |

Institutional Ownership | -0.103 | - 0.074 | .169** | -.116* | -0.07 | -0.11 | -.116* | - 0.037 | 0.025 | - .273** * |

.237** * |

1 | ||

| 1 3 |

Blockholder Ownership | -0.109 | 0.011 | 0.092 | 0.081 | - 0.105 | - 0.019 | .163** | - 0.012 | 0.099 | .240** * |

0.016 | 0.02 3 |

1 | |

| 1 4 |

R&D | -0.054 | - 0.059 | - .291** * |

- .178** * |

0.06 | 0.086 | - 0.089 | .545** * |

- 0.053 | -.126* | 0.013 | - 0.03 7 |

- 0.01 2 |

1 |

| Mean | 8034.8 | 4.49 | 0.25 | 10.17 | 55.28 | 6.52 | 0.017 | 0.46 | 0.75 | 0.06 | 0.8 | 0.74 | 0.14 | 0.0 6 |

|

| S.D. | 18210. 2 |

8.03 | 0.15 | 2.25 | 6.91 | 5.26 | 0.034 | 0.22 | 0.43 | 0.08 | 0.11 | 0.15 | 0.14 | 0.0 7 |

|

The correlation matrix was used to examine bivariate correlations among independent, control, and moderator variables. The magnitude of the highest correlation among these variables was 0.51. Thus, multicollinearity is unlikely to be a serious threat to our analyses of these data in Hypothesis 1 (Tsui et al., 1995). However, when testing Hypotheses 2-6, issues of multicollinearity arising from the interaction terms being highly correlated with their constituent variables called for remedial measures. Following Aiken et al. (1991) suggested procedures that have been adopted in a similar situation (Datta et al., 2005) the direct terms used to construct interaction terms were centered by subtracting the mean of each variable from observed values. Data centering of the direct terms also allows for an easier interpretation of results (Chin et al., 2003). In addition, the variance inflation factors (VIFs) were computed to assess whether multicollinearity was still a problem. None of the VIFs approached the threshold value of 10 identified by Netter et al. (1996).

Hypothesis 1 predicts positive effects for CEO option pay on firm’s strategic risk. The hypothesis is consistent with the incentive alignment argument grounded in agency theory. Agency theory posits that introducing stock options in executive pay packages promotes congruence in management and shareholder risk preferences, which, in turn, encourages executives to become less risk averse and engage in more risk seeking-behavior. This will, eventually, be reflected in higher levels of firm strategic risk. Multiple ordinary least squares (OLS) regression analyses were used to test Hypothesis 1. Table 2 presents these results. Model 1, which included the control variables, explained nearly 14 percent of the variance in firm strategic risk. In Model 2, we introduced the CEO option pay measure. Consistent with Hypothesis 1 prediction, results indicated a significant, positive relationship between CEO option pay and firm strategic risk (β =0.17, p<0.01; R2=0.38, p<0.01). The introduction of the CEO option pay variable explained an additional 24 % of the variance in firm strategic risk (p<0.01).

| Table 2 Results of Hierarchical Regression Analyses: Testing Moderation Effects on Firm Strategic Riska | |||||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | |

| Control | Industry | 0.021* (0.011) |

0.016 (0.010) |

0.015 (0.010) |

0.014 (0.010) |

| Firm Size | -0.016 (0.012) |

-0.021** (0.010) |

-0.027** (0.012) |

-0.026** (0.011) |

|

| Firm Performance | -0.000 (0.000) |

-0.001 (0.000) |

-0.001 (0.000) |

-0.001 (0.000) |

|

| Firm Leverage | -0.141*** (0.034) |

-0.086*** (0.030) |

-0.084*** (0.032) |

-0.088*** (0.031) |

|

| Board Size | -0.003 (0.002) |

-0.002 (0.002) |

-0.001 (0.002) |

-0.001 (0.002) |

|

| CEO Age | 0.000 (0.001) |

0.001 (0.001) |

0.000 (0.001) |

0.000 (0.001) |

|

| CEO Tenure | 0.001 (0.001) |

0.000 (0.001) |

0.000 (0.001) |

-0.000 (0.001) |

|

| CEO Ownership | -0.338** (0.161) | -0.318** (0.137) | -0.257* (0.156) | -0.191 (0.163) |

|

| Independent | |||||

| CEO Option Pay | 0.171*** (0.019) |

0.169*** (0.021) |

0.251*** (0.041) |

||

| Moderator | |||||

| CEO Duality | -0.003 (0.012) |

0.003 (0.012) |

|||

| Insider Ownership | -0.064 (0.076) |

-0.087 (0.081) |

|||

| Board Independence | 0.052 (0.045) |

0.065 (0.046) |

|||

| Institutional Ownership | -0.000 (0.000) |

-0.000 (0.000) |

|||

| Blockholder Ownership | -0.000 (0.000) |

0.000 (0.000) |

|||

| Interaction | |||||

| CEO Duality*CEO Option Pay | -0.108** (0.049) |

||||

| Insider Ownership*CEO Option Pay | -0.743*** (0.296) |

||||

| Board Independence*CEO Option Pay | 0.282 (0.209) |

||||

| Institutional Ownership*CEO Option Pay | -0.004*** (0.001) |

||||

| Blockholder Ownership*CEO Option Pay | 0.003** (0.001) |

||||

| Intercept | 0.144*** (0.039) |

0.154*** (0.034) |

.172*** (0.037) |

.160*** (0.036) |

|

| R2 | 0.14*** | 0.38*** | 0.39*** | 0.44*** | |

| F | 3.58 | 11.91 | 7.62 | 6.92 | |

| ? R2 | 0.24*** | 0.01 | 0.05*** | ||

| F for ? R2 | 36.39 | 0.90 | 3.32 | ||

Hierarchical ordinary least squares (OLS) regression analyses were used to test Hypotheses 2-6. Control variables, CEO option pay, and moderator variables were first entered as main effect predictors of firm’s strategic risk (see Model 3 of Table 2). Next, we created moderator terms by multiplying each of the moderator variables by CEO option pay. When the interaction terms were entered into the regression equation (see Model 4 of Table 2), there was a significant increase in model fit for regression equations that predict firm strategic risk (ΔR2 =0.05; p<0.01).

Hypothesis 2 suggests a moderating effect for board independence on the relationship between CEO option pay and the firm’s strategic risk. As independent directors are more inclined to fulfill their monitoring task, we argued that in firms with higher proportion of independent directors, executives are more likely to get involved in risk-seeking behavior. We hypothesized a stronger positive relationship between CEO option pay and a firm’s strategic risk in firms with a higher ratio of independent directors. The lack of significant regression coefficients for the multiplicative interaction terms of CEO option pay and board independence did not provide support for this hypothesis. Results of these analyses can be seen in Model 4 of Table 2.

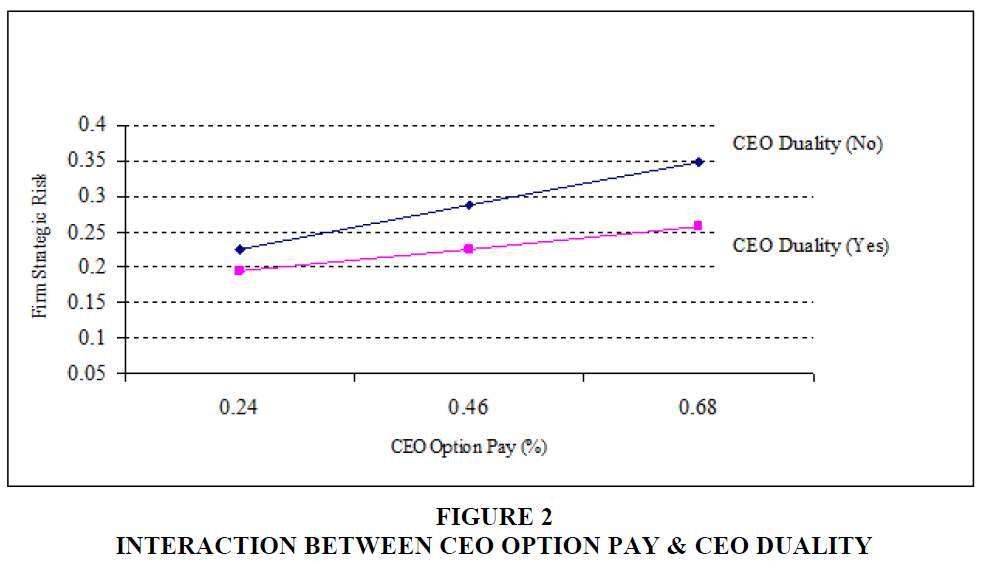

Hypothesis 3 predicts that leadership structure will moderate the relationship between CEO option pay and firm strategic risk, with the relationship being stronger in firms with separated CEO and chairperson positions. Separation of the CEO and chairperson positions will lead to a more independent and vigilant governance system, thus encouraging a more optimal level of risk seeking behavior on the part of the executives. As indicated in Model 4 of Table 2, the interaction term of CEO option pay and CEO duality had a negative and significant coefficient in the regression equation predicting firm strategic risk (β =-0.11, p<0.05). This suggests that CEO duality moderates the relationship. The positive effect of CEO option pay on firm strategic risk weakens with CEO duality. This supports Hypothesis 3, and is graphically presented in Figure 2.

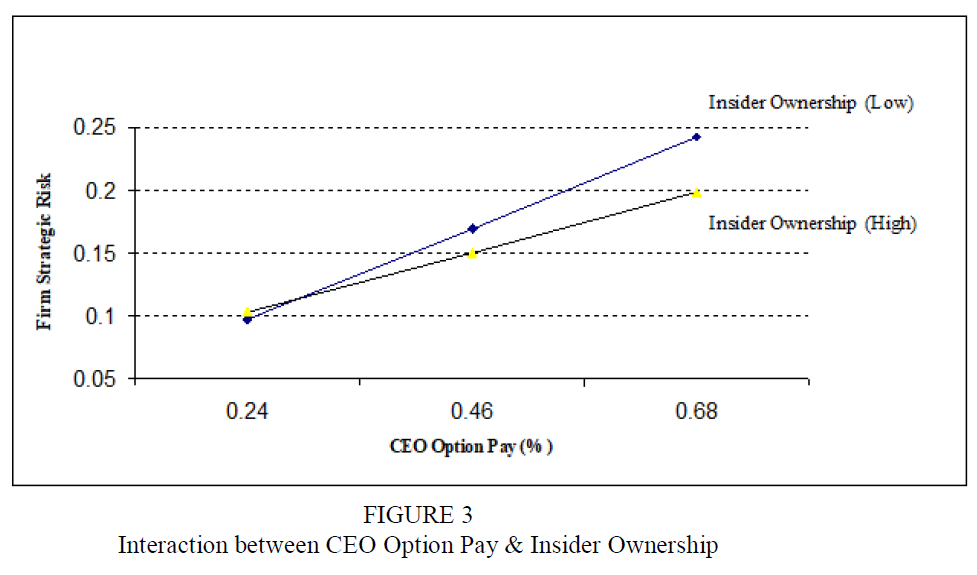

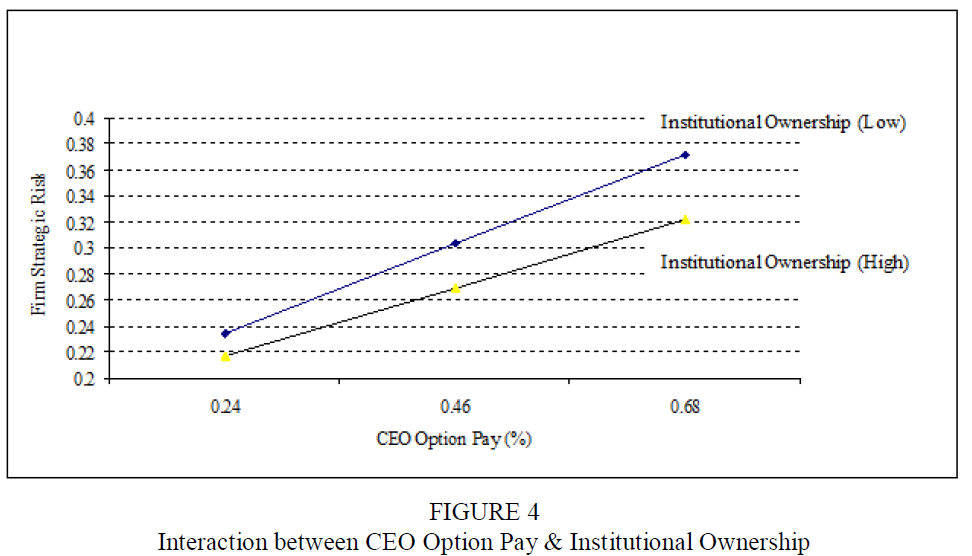

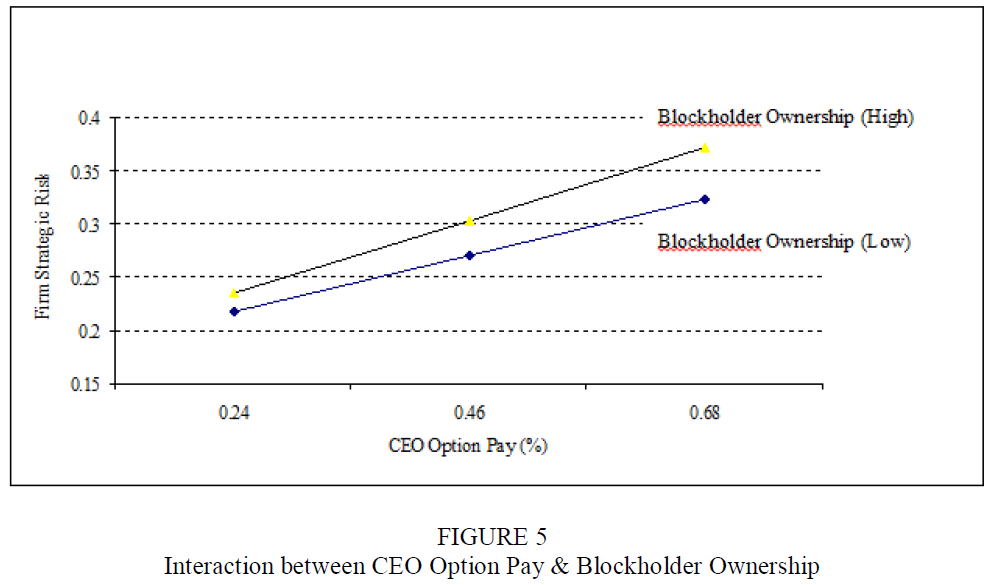

The next set of hypotheses investigated the moderating role of three classes of ownership: institutional, blockholder, and insider ownership. Consistent with agency theory’s monitoring arguments, a high concentration of a firm’s equity ownership in the hands of institutional investors and blockholders increases external monitoring. This limits executive discretion in pursuing their personal agenda. Hypotheses 4 and 5 predict that blockholder and institutional ownership will moderate the relationship between CEO option pay and the firm’s strategic risk, with the relationships being stronger in firms with higher levels of institutional and blockholder ownership. Regression results support Hypothesis 4. The positive and significant interaction term comprised of CEO option pay and blockholder ownership renders support to our prediction (β =0.003, p<0.05). Figure 3 illustrates this relationship and confirms our interpretation. With respect to Hypothesis 5, regression analyses produced evidence that runs counter to our expectations. The negative and significant regression coefficient indicates that CEOs in firms with higher levels of institutional ownership exhibits less risk seeking behavior than firms with lower levels of institutional ownership (β=-0.004, p<0.01). Figure 4 illustrates this interpretation.

Hypothesis 6 states that the size of ownership stake of inside investors is expected to have a moderating effect on the relationship between CEO option pay and firm risk. Specifically, this relationship will be weaker in firms with higher levels of inside investors’ ownership. As indicated in Model 4 of Table 2, the interaction term comprised of CEO option pay and insider ownership was significant, suggesting that insider ownership moderates the relationship between CEO option pay and firm strategic risk (β =-0.74; p<0.01). The positive effect of CEO option pay on firm strategic risk weakened as insider ownership increased. The results provide support for Hypothesis 5. Figure 5 graphically illustrates this relationship.

Discussion and Conclusion

Motivated by recent academic and public policy debates on executive compensation, the focus of our study was to investigate the relationship between CEO option pay and CEO risk taking behavior. The moderating effects of various governance factors on the relationship between CEO option pay and firm risk were also evaluated. The study sought to answer two research questions. First, is there a significant positive relationship between CEO option pay and firm strategic risk? Second, what moderating role is played by a firm’s corporate governance system in the relationship between CEO pay and firm risk?

To answer these questions, within an agency framework, we considered both incentive alignment and monitoring arguments to derive hypotheses. The first hypothesis was derived using the incentive alignment argument. This hypothesis predicted that introducing stock option grants in CEO compensation package will induce risk-seeking behavior by executives and subsequently lead to higher levels of firm risk. The remaining five hypotheses were developed integrating the incentive alignment and monitoring arguments. Hypotheses 2-6 suggest that various components of a firm’s governance system moderate the relationship between CEO pay and firm risk.

Based on the results of this study, the answer to the first research question is a clear “yes”. Multiple regression analyses yielded strong support for agency theory’s incentive alignment argument expressed in Hypothesis 1. Consistent with our predictions, it was found that introducing stock option grants in CEO compensation package elicited desirable risk-taking behavior from executives, which eventually led to higher levels of risk at the firm strategic level. Although somewhat at variance with earlier findings in this regard (Hoskisson et al., 1993; Gray & Cannella, 1997; Balkin et al., 2000), the results provide evidence for the positive effects of stock option grants on firm risk and confirm the ability of this mechanism to align managers’ interests with those of shareholders as predicted by agency theory (Jensen & Meckling, 1976) and empirically supported by DeFusco et al. (1990).

The results of this study provided mixed answers to our second research question. Board of directors’ independence did not show a moderating effect on the CEO option pay-risk relationship. Theoretically, there are reasons to believe that directors’ independence may still be a critical antecedent of board activism and, eventually, a powerful governance system (Beasley, 1996; Fama & Jensen, 1983; Westphal & Zajac, 1995). The fact that no empirical support was found for this argument in this study does not mean that independence is of less consequence. Prior research shows strong support for the argument that board independence leads to good governance. The lack of significant results for board independence, as hypothesized, may be partially attributable to its operationalization. Scarborough (2004) concluded that “efforts to operationalize this construct, however, as the proportion of outside directors or the proportion of independent directors as defined by SEC guidelines may fail to tap its true theoretical significance, i.e., a lack of conflicted self-interest”. Van den Berghe & Baelden (2005) differentiated between director independence using a box-ticking approach and director independence of mind, thought, action, and judgment. Instead of relying on the formal “hard” elements of independence, more attention should be paid to the “soft” aspects of board independence. They concluded that for directors to have the right attitude of independence “each director should have the ability as well as the willingness to be a critical thinker, with an independent mind, however, the environment should also be such as to facilitate directors to display this attitude” (Van den Berghe & Baelden, 2005).

Consistent with our prediction, CEO duality moderated the relationship between CEO option pay and firm strategic risk, with the relationship being weaker in firms having a dual leadership structure. This result is consistent with the agency perspective and previous research findings arguing that separating the CEO and chairperson positions will lead to a stronger and more independent governance system (Daily & Dalton, 1994 a & b; Kim, 2005). Further, this finding provides support for recent calls from the advocates of governance reform to separate these two positions. Similarly, the results of this study reports a moderating effect for blockholder ownership on the CEO option pay-firm risk relationship. This evidence is again consistent with agency theory predictions that high concentrations of equity in the hands of blockholder investors increases external monitoring and contributes positively to a strong governance system (Sundaramurthy et al., 2005).

Based on the results of this study, we were unable to provide support for the predicted moderating effect of institutional ownership on the relationship between CEO option pay and firm risk. Over the past three decades, institutional stakes in public companies have increased from 16 percent in the early 1980s to more than 56 percent in the early 1990s (Useem, 1996). In our sample, more than 76% of the shares are owned by institutions. According to agency theory, high concentrations of equity in the hands of institutional and blockholder investors increases external monitoring and contributes positively to a strong governance system (Sundaramurthy et al., 2005). However, like other studies of corporate governance, the empirical research on institutional and blockholder ownership has yielded inconsistent findings (Kang & Shivdasani, 1995; Denis & Serrano, 1996; Bethel & Liebeskind, 1993; David et al., 1998; Prowse, 1990; Graves, 1988). Our results do not lend support to the active investor hypothesis, which predicts institutional investors to proactively monitor managerial actions (Hawley, 1995). This finding is consistent with the “efficiency abatement hypothesis” which predicts institutional investors to be passive, collusive, and myopic (Roe, 1990; Black, 1992; Bushee, 1998).

In a recent meta-analysis of 229 empirical studies on the relationship between equity ownership and firm performance, Dalton et al. (2003) reported very little support for agency theory. They encouraged future research to consider alternative perspectives when addressing corporate governance research. According to them, substitution theory, which addresses issues of management-ownership separation in public firms, provides a useful theoretical framework to guide future research. This theory posits that “ownership structure is one governance mechanism to be considered among a range of governance mechanisms. Ownership categories may effectively substitute for one another. Also, alternative governance mechanisms may substitute for ownership structure”.

The results of our study provide support for the moderating effect of insider ownership on the relationship between CEO option pay and firm strategic risk. Higher levels of insider ownership constrain risk seeking behavior induced by stock option grants. This result is consistent with Capozza & Seguin’s (2003) finding that firms with greater insider ownership tend to invest in assets with lower systematic risk. According to Capozza & Seguin (2003), unlike outside owners who can easily and efficiently diversify, wealth-constrained owner-managers assume large amounts of idiosyncratic risk when their compensation, wealth, and nondiversifiable human capital are concentrated in the firm they manage or work for. To reduce this risk, insider owner-managers may become risk-averse and choose to engage in actions that lower the risk level of the firm.

Limitations and Future Research

One limitation of this study is its use of large, U.S.-based manufacturing firms. Future research should be expanded to include smaller companies, as well as non-manufacturing industries. Further, like most other research on executive compensation, we also relied exclusively on U.S. data sources. Inclusion of samples from other countries will help to expand our understanding of this particular phenomenon (Barkema & Gomez-Mejia, 1998). Replicating this study in other settings with different governance structures, cultures, and so on can enrich our appreciation of this important subject.

A review of prior empirical work, including this research, shows that most studies have implicitly assumed a linear relationship between executive compensation and firm risk or risk-taking behavior and have, therefore, relied on linear estimation techniques. However, according to Zajac & Westphal (1994), there is reason to believe that the assumption of linearity may hold true only within relatively narrow ranges. They argue that increasing levels of incentive compensation may not be associated with concomitant increases in executive risk-taking behavior, at least through the entire relevant continuum. For example, Holmstrom (1987) indicated that excessive contingent compensation such as stock option grants can cause a manager to bear more risk as he/she has already invested most of his/her nondiversifiable and nontradable human capital in the firm. It follows that it becomes costly for him/her to get engaged in any risk-bearing activity and, therefore, may lead to risk-avoiding behavior and be overly concerned with job security. Therefore, it is entirely possible that the actual relationship follows an inverted U-curve pattern when considered over the entire range. That is, the marginal costs of stock option grants increases rapidly as they hit high levels, with risk preferences decreasing beyond that point. The examination of this possible curvilinear relationship using appropriate estimation techniques can yield valuable insights about the optimal level of CEO stock option compensation.

Incentive alignment, monitoring, and bonding are three mechanisms agency theory suggests to reduce agency problems and costs. There is a valid concern as to whether these mechanisms work in a compensatory or complementary mode with respect to their impact on firm outcomes such as firm risk. Boal & Bryson (1987) offered alternate models to depict these types of possible relationships among three constructs. First, independent effects model assumes no relationship between CEO compensation and corporate governance. Each of these variables, according to this model, explains a unique portion of the variance in firm risk. Second, an interaction effects model assumes that CEO compensation and corporate governance are strongly related to each other and that they jointly affect firm risk. Third, the moderating effects model predicts that corporate governance moderates the relationship between CEO compensation and firm risk. It suggests that there is a systematic variation in the strength and form of the relationship between CEO compensation and firm risk contingent on variations in corporate governance. In this study, we followed the moderating effects model. The fact that this study provided moderate support to the moderating effects of corporate governance on the relationship between CEO option pay and firm risk factors indicates that there is a need to examine the independent and interaction effects models.

Although the results of our study are consistent with the premises of agency theory, previous research has indicated that agency theory has limitations, especially with respect to its assumptions of wealth utility (Hirsch et al., 1990) and the risk-aversion behavior of the agent (Wiseman & Gomez-Mejia, 1998). Consistent with the research traditions of strategic management, the use of additional theories to answer questions pertinent to executive compensation is a promising direction for future research. This is not to suggest that researchers abandon agency theory in their investigations. Instead, interdisciplinary, integrative, and comprehensive approaches to the examination of the complex relationship between executive compensation and various firm outcomes are needed to provide insightful answers to unresolved issues. Institutional theory (DiMaggio & Powell, 1983) and prospect theory (Kahneman & Tversky, 1979) are promising theoretical paradigms to frame future research on this subject.

The results of this study suggest that CEO option pay has significant effects on risk taking. This evidence lends support for the applicability of the incentive alignment mechanism embedded in agency theory. Contrary to the recent calls to cut the “big fat CEO paycheck”, this study provides some support for the 1990s trend among U.S. corporations to increasingly tie executives’ fortunes to those of shareholders through issuing stock option grants. However, the results also provide partial support for the monitoring argument that advocates the need for strong governance systems reflected in independent boards and balanced ownership structure of the firm. The lack of strong empirical evidence to support this argument in this study raises some concerns on the applicability of this mechanism in mitigating agency conflict among managers and shareholders. The results are also inconsistent with the recent calls to reform governance systems of corporations through more active boards and investors. However, one needs to interpret these results with caution. Any questioning of the ability of the board in monitoring CEO actions and decisions needs to be informed by an understanding of the role that boards of directors play in the monitoring process. It is possible that the role of the board is limited to the design of the CEOs’ compensation package. Further empirical investigation is necessary before we can advance normative prescriptions about either the design of compensation packages for senior executives or the structure of the board. Given the recent revelations about top management fraud and the rising chorus of complaints about excessive executive pay, the need for additional research can not be overemphasized.

References

- Agrawal, A., & Mandelker, G.N. (1987). Managerial incentives and corporate investment and financing decisions. The Journal of Finance, 42(4), 823-837.

- Aiken, L.S., West, S.G., & Reno, R.R. (1991). Multiple regression: Testing and interpreting interactions. Sage.

- Al Shammari, H. (2018). CEO Incentive compensation and risk-taking behavior: The moderating role of CEO characteristics. Academy of Strategic Management Journal, 17(3), 1-15.

- Al-Shammari, H.A. (2021). CEO compensation and firm performance: The mediating effects of CEO risk taking behaviour. Cogent Business & Management, 8(1), 1894893.

- Amihud, Y., & Lev, B. (1981). Risk reduction as a managerial motive for conglomerate mergers. The Bell Journal of Economics, 605-617.

- Amihud, Y., & Lev, B. (1999). Does corporate ownership structure affect its strategy towards diversification?. Strategic Management Journal, 20(11), 1063-1069.

- Baliga, B.R., Moyer, R.C., & Rao, R.S. (1996). CEO duality and firm performance: What's the fuss?. Strategic Management Journal, 17(1), 41-53.

- Balkin, D.B., Markman, G.D., & Gomez-Mejia, L.R. (2000). Is CEO pay in high-technology firms related to innovation?. Academy of Management Journal, 43(6), 1118-1129.

- Barkema, G.G., & Gomez-Mejia, L.R. (1998). Managerial compensation and firm performance: A general research framework. Academy of Management Journal, 41, 135-145.

- Bathala, C.T., & Rao, R.P. (1995). The determinants of board composition: An agency theory perspective. Managerial and Decision Economics, 16(1), 59-69.

- Baysinger, B., & Hoskisson, R.E. (1990). The composition of boards of directors and strategic control: Effects on corporate strategy. Academy of Management Review, 15(1), 72-87.

- Baysinger, B.D., & Butler, H.N. (1985). Corporate governance and the board of directors: Performance effects of changes in board composition. Journal of Law, Economics, & Organization, 1(1), 101-124.

- Beasley, M.S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review, 443-465.

- Beatty, R.P., & Zajac, E.J. (1994). Managerial incentives, monitoring, and risk bearing: A study of executive compensation, ownership, and board structure in initial public offerings. Administrative Science Quarterly, 313-335.

- Berg, S.V., & Smith, S.K. (1978). CEO and board chairman: A quantitative study of dual vs. unitary board leadership. Directors and Boards, 3(1), 34-39.

- Bergh D. (1995). Size and relatedness of units sold: an agency theory and resource-based perspective. Strategic Management Journal, 16 (3), 221-239.

- Bethel, J.E., & Liebeskind, J. (1993). The effects of ownership structure on corporate restructuring. Strategic Management Journal, 14(S1), 15-31.

- Black, B.S. (1992). Institutional investors and corporate governance: The case for institutional voice. Journal of Applied Corporate Finance, 5(3), 19-32.

- Black, F., & Scholes, M. (2019). The pricing of options and corporate liabilities. In World Scientific Reference on Contingent Claims Analysis in Corporate Finance: Volume 1: Foundations of CCA and Equity Valuation.

- Boal, K.B., & Bryson, J.M. (1987). Representation, testing and policy implications of planning processes. Strategic Management Journal, 8(3), 211-231.

- Boyd, B.K. (1994). Board control and CEO compensation. Strategic Management Journal, 15(5), 335-344.

- Boyd, B.K. (1995). CEO duality and firm performance: A contingency model. Strategic Management Journal, 16(4), 301-312.

- Boyd, B.K., Franco Santos, M., & Shen, W. (2012). International developments in executive compensation. Bromiley, P. (1991). Testing a causal model of corporate risk taking and performance. Academy of Management

- Journal, 34(1), 37-59.

- Bushee, B.J. (1998). The influence of institutional investors on myopic R&D investment behavior. Accounting Review, 305-333.

- Capozza, D.R., & Seguin, P.J. (2003). Inside ownership, risk sharing and Tobin's Q?ratios: Evidence from REITs. Real Estate Economics, 31(3), 367-404.

- Chen, C.R., Steiner, T.L., & White, A.M. (2001). Risk taking behaviour and managerial ownership in the United States life insurance industry. Applied Financial Economics, 11(2), 165-171.

- Chin, W.W., Marcolin, B.L., & Newsted, P.R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research, 14(2), 189-217.

- Chung, K.H., & Pruitt, S.W. (1996). Executive ownership, corporate value, and executive compensation: A unifying framework. Journal of Banking & Finance, 20(7), 1135-1159.

- Conyon, M.J., & He, L. (2012). CEO Compensation and Corporate Governance in C hina. Corporate Governance: An International Review, 20(6), 575-592.

- Core, J.E., & Larcker, D.F. (2002). Performance consequences of mandatory increases in executive stock ownership. Journal of Financial Economics, 64(3), 317-340.

- Daily, C.M., & Dalton, D.R. (1994). Bankruptcy and corporate governance: The impact of board composition and structure. Academy of Management Journal, 37(6), 1603-1617.

- Daily, C.M., & Dalton, D.R. (1994). Corporate governance and the bankrupt firm: An empirical assessment. Strategic Management Journal, 15(8), 643-654.

- Dalton, D.R., Daily, C.M., Certo, S.T., & Roengpitya, R. (2003). Meta-analyses of financial performance and equity: fusion or confusion?. Academy of Management Journal, 46(1), 13-26.

- Dalton, D.R., Daily, C.M., Ellstrand, A.E., & Johnson, J.L. (1998). Meta?analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal, 19(3), 269-290.

- Datta, D.K., Guthrie, J.P., & Wright, P.M. (2005). Human resource management and labor productivity: does industry matter?. Academy of Management Journal, 48(1), 135-145.

- David, P., Kochhar, R., & Levitas, E. (1998). The effect of institutional investors on the level and mix of CEO compensation. Academy of Management Journal, 41(2), 200-208.

- Davidson, W.N., Nemec, C., & Worrell, D.L. (2006). Determinants of CEO age at succession. Journal of Management & Governance, 10(1), 35-57.

- De Miguel, A., Pindado, J., & De la Torre, C. (2004). Ownership structure and firm value: New evidence from Spain. Strategic Management Journal, 25(12), 1199-1207.

- DeFusco, R.A., Johnson, R.R., & Zorn, T.S. (1990). The effect of executive stock option plans on stockholders and bondholders. The Journal of Finance, 45(2), 617-627.

- Demsetz, H., & Villalonga, B. (2001). Ownership structure and corporate performance. Journal of Corporate Finance, 7(3), 209-233.

- Denis, D.J., & Serrano, J.M. (1996). Active investors and management turnover following unsuccessful control contests. Journal of Financial Economics, 40(2), 239-266.

- Dess, G.G., Lumpkin, G.T., & Taylor, M.L. (2004). Strategic management: Text & cases; Boston.

- DiMaggio, P.J., & Powell, W.W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 147-160.

- Donaldson, G.A., & Lorsch, J.W. (1983). Decision making at the top. New York: Basic Books.

- Donaldson, L., & Davis, J.H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49-64.

- Eisenhardt, K.M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57- 74.

- Elsilä, A., Kallunki, J.P., Nilsson, H., & Sahlström, P. (2013). CEO personal wealth, equity incentives and firm performance. Corporate Governance: An International Review, 21(1), 26-41.

- Ezzamel, M., & Watson, R. (1993). Organizational form, ownership structure and corporate performance: A contextual empirical analysis of uk companies 1. British Journal of Management, 4(3), 161-176.

- Fama, E.F., & Jensen, M.C. (1983). Separation of ownership and control. The journal of law and Economics, 26(2), 301-325.

- Finkelstein, S., & Boyd, B.K. (1998). How much does the CEO matter? The role of managerial discretion in the setting of CEO compensation. Academy of Management Journal, 41(2), 179-199.

- Finkelstein, S., & D'aveni, R.A. (1994). CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command. Academy of Management Journal, 37(5), 1079-1108.

- Finkelstein, S., & Hambrick, D.C. (1989). Chief executive compensation: A study of the intersection of markets and political processes. Strategic Management Journal, 10(2), 121-134.

- Finkelstein, S., Hambrick, D., & Cannella, A.A. (1996). Strategic leadership. St. Paul: West Educational Publishing.

- Gibbons, R., & Murphy, K.J. (1992). Optimal incentive contracts in the presence of career concerns: Theory and evidence. Journal of Political Economy, 100(3), 468-505.

- Gilley, K.M., Coombs, J.E., Parayitam, S., & Summers, E.L. (2004). CEO stock options and subsequent stock risk. In Oklahoma State University, Paper presented at the Academy of Management, Conference (August), New Orleans.

- Gilson, S.C. (1990). Bankruptcy, boards, banks, and blockholders: Evidence on changes in corporate ownership and control when firms default. Journal of Financial Economics, 27(2), 355-387.

- Gogoi, P. (1999). False impressions. Wall Street Journal.

- Gomez-Mejia, L., & Wiseman, R.M. (1997). Reframing execufive compensation: An assessment and outlook. Journal of Management, 23(3), 291-374.

- Gomez-Mejia, L.R. (1994). Executive compensation: A reassessment and a future research agenda. Research in personnel and Human Resources Management, 12(2), 161-222.

- Graves, S.B. (1988). Institutional ownership and corporate R&D in the computer industry. Academy of Management Journal, 31(2), 417-428.

- Gray, S.R., & Cannella Jr, A.A. (1997). The role of risk in executive compensation. Journal of Management, 23(4), 517-540.

- Hambrick, D.C., & D'Aveni, R.A. (1992). Top team deterioration as part of the downward spiral of large corporate bankruptcies. Management Science, 38(10), 1445-1466.

- Harris, D., & Helfat, C.E. (1998). CEO duality, succession, capabilities and agency theory: Commentary and research agenda. Strategic Management Journal, 19(9), 901-904.

- Harvey, K.D., & Shrieves, R.E. (2001). Executive compensation structure and corporate governance choices. Journal of Financial Research, 24(4), 495-512.

- Hawley, J.P. (1995). Political voice, fiduciary activism, and the institutional ownership of US corporations: The role of public and noncorporate pension funds. Sociological Perspectives, 38(3), 415-435.

- Heneman, H.G. III, & Judge, T.A. (2000). Compensation attitudes. Compensation in organizations: Current Research and Practice, 61-103.

- Hill, C.W., & Hansen, G.S. (1991). A longitudinal study of the cause and consequences of changes in diversification in the US pharmaceutical industry 1977–1986. Strategic Management Journal, 12(3), 187-199.

- Hirsch, P.M., Friedman, R., & Koza, M.P. (1990). Collaboration or paradigm shift?: Caveat emptor and the risk of romance with economic models for strategy and policy research. Organization Science, 1(1), 87-97.

- Holmstrom, B. (1987). Incentive compensation: Practical design from a theory point of view. Incentives, Cooperation, and Risk Sharing, 176, 185.

- Hoskisson, R.E., Hitt, M.A., & Hill, C.W. (1993). Managerial incentives and investment in R&D in large multiproduct firms. Organization Science, 4(2), 325-341.

- Hoskisson, R.E., Johnson, R.A., & Moesel, D.D. (1994). Corporate divestiture intensity in restructuring firms: Effects of governance, strategy, and performance. Academy of Management Journal, 37(5), 1207-1251.

- Jemison, D.B. (1987). Risk and the relationship among strategy, organizational processes, and performance. Management Science, 33(9), 1087-1101.

- Jensen, M.C. (1983). Organization theory and methodology. Accounting Review, 319-339.

- Jensen, M.C. (1989). The eclipse of the public corporation, Harvard Business Review September-October.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Jensen, M.C., & Murphy, K.J. (1990). Performance pay and top-management incentives. Journal of Political Economy, 98(2), 225-264.

- Kahneman, D. (1979). Prospect theory: An analysis of decisions under risk. Econometrica, 47, 278.

- Kang, J.K., & Shivdasani, A. (1995). Firm performance, corporate governance, and top executive turnover in Japan. Journal of Financial Economics, 38(1), 29-58.

- Kim, K. (2005). CEO Duality: Double-edged Sword? Implicationof CEO Duality of Corporate Strategic Management. Unpublished doctoral dissertation, University of Texas at Arlington.

- Kosnik, R.D. (1987). Greenmail: A study of board performance in corporate governance. Administrative Science Quarterly, 163-185.

- Kumar, P., & Zattoni, A. (2013). Corporate governance, board of directors, and firm performance.

- Larcker, D.F. (1983). The association between performance plan adoption and corporate capital investment. Journal of Accounting and Economics, 5, 3-30.

- Lee, C.I., Rosenstein, S., Rangan, N., & Davidson III, W.N. (1992). Board composition and shareholder wealth: The case of management buyouts. Financial Management, 58-72.

- Lewellen, W., Loderer, C., & Martin, K. (1987). Executive compensation and executive incentive problems: An empirical analysis. Journal of Accounting and Economics, 9(3), 287-310.

- Lo, K., & Wu, S.S. (2016). Private information in executive compensation: The information role vs. the monitoring role of the board. Corporate Governance: An International Review, 24(1), 5-23.

- Mallette, P., & Fowler, K.L. (1992). Effects of board composition and stock ownership on the adoption of “poison pills”. Academy of Management Journal, 35(5), 1010-1035.

- Mayers, D., Shivdasani, A., & Smith Jr, C.W. (1997). Board composition and corporate control: Evidence from the insurance industry. Journal of Business, 33-62.

- McKnight, P.J., Tomkins, C., Weir, C., & Hobson, D. (2000). CEO age and top executive pay: A UK empirical study. Journal of Management and Governance, 4(3), 173-187.

- Miller, K.D., & Bromiley, P. (1990). Strategic risk and corporate performance: An analysis of alternative risk measures. Academy of Management Journal, 33(4), 756-779.

- Monks, A.G., & Minow, N. (2001). Corporate Governance, 2nd edn (Malden MA: Blackwell Business). Google Scholar.

- Ocasio, W. (1994). Political dynamics and the circulation of power: CEO succession in US industrial corporations, 1960-1990. Administrative Science Quarterly, 285-312.

- Palia, D., & Lichtenberg, F. (1999). Managerial ownership and firm performance: A re-examination using productivity measurement. Journal of Corporate Finance, 5(4), 323-339.

- Pass, C. (2003). Long?term incentive schemes, executive remuneration and corporate performance: an empirical study. Corporate Governance: The International Journal of Business in Society.

- Pearce, J.A., & Zahra, S.A. (1992). Board composition from a strategic contingency perspective. Journal of Management Studies, 29(4), 411-438.

- Prowse, S.D. (1990). Institutional investment patterns and corporate financial behavior in the United States and Japan. Journal of Financial Economics, 27(1), 43-66.

- Rechner, P.L., & Dalton, D.R. (1991). CEO duality and organizational performance: A longitudinal analysis. Strategic Management Journal, 12(2), 155-160.

- Roe, M.J. (1990). Political and legal restraints on ownership and control of public companies. Journal of Financial Economics, 27(1), 7-41.

- Rosenstein, S., & Wyatt, J.G. (1990). Outside directors, board independence, and shareholder wealth. Journal of Financial Economics, 26(2), 175-191.

- Ruefli, T.W., Collins, J.M., & Lacugna, J.R. (1999). Risk measures in strategic management research: Auld lang syne?. Strategic Management Journal, 20(2), 167-194.

- Sakawa, H., Moriyama, K., & Watanabel, N. (2012). Relation between Top Executive Compensation Structure and Corporate Governance: Evidence from J apanese Public Disclosed Data. Corporate Governance: An International Review, 20(6), 593-608.

- Sanders, W.G. (2001). Behavioral responses of CEOs to stock ownership and stock option pay. Academy of Management journal, 44(3), 477-492.

- Sanders, W.G., & Hambrick, D.C. (2007). Swinging for the fences: The effects of CEO stock options on company risk taking and performance. Academy of Management Journal, 50(5), 1055-1078.

- Scarborough, S.L. (2004). An empirical study of the antecedents of board activism: Knowledge domains, independence, and effort norms.

- Schiehll, E., & Martins, H.C. (2016). Cross?national governance research: A systematic review and assessment. Corporate Governance: An International Review, 24(3), 181-199.

- Shleifer, A., & Vishny, R.W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3, Part 1), 461-488.

- Simsek, Z. (2007). CEO tenure and organizational performance: An intervening model. Strategic Management Journal, 28(6), 653-662.

- Stroh, L.K., Brett, J.M., Baumann, J.P., & Reilly, A.H. (1996). Agency theory and variable pay compensation strategies. Academy of Management Journal, 39(3), 751-767.

- Sun, J., & Cahan, S. (2009). The effect of compensation committee quality on the association between CEO cash compensation and accounting performance. Corporate Governance: An International Review, 17(2), 193- 207.

- Sundaramurthy, C., Rhoades, D.L., & Rechner, P.L. (2005). A meta-analysis of the effects of executive and institutional ownership on firm performance. Journal of Managerial Issues, 494-510.

- Taussig, F.W., & Barker, W.S. (1925). American corporations and their executives: A statistical inquiry. The Quarterly Journal of Economics, 40(1), 1-51.

- Tosi, H.L., Werner, S., Katz, J.P., & Gomez-Mejia, L.R. (2000). How much does performance matter? A meta- analysis of CEO pay studies. Journal of Management, 26(2), 301-339.

- Tsui, A.S., Ashford, S.J., Clair, L.S., & Xin, K.R. (1995). Dealing with discrepant expectations: Response strategies and managerial effectiveness. Academy of Management Journal, 38(6), 1515-1543.

- Tushman, M.L., & Romanelli, E. (1985). Organizational evolution: A metamorphosis model of convergence and reorientation.

- Tushman, M.L., Virany, B., & Romanelli, E. (1989). Effects of CEO and executive team succession on subsequent organization performance. In Academy of Management meeting.

- Useem, M.A. (1996). Investor capitalism: How money managers are changing the face of corporate America. New York: Basic Books.

- Van den Berghe, L.A.A., & Baelden, T. (2005). The complex relation between director independence and board effectiveness. Corporate Governance: The International Journal of Business in Society.

- Westphal, J.D., & Zajac, E.J. (1993). Substance and symbolism in ceos long-term incentive plans. In Academy of Management Proceedings. Briarcliff Manor, NY 10510: Academy of Management.

- Westphal, J.D., & Zajac, E.J. (1995). Who shall govern? CEO/board power, demographic similarity, and new director selection. Administrative Science Quarterly, 60-83.

- White, J.W., & Ingrassia, P. (1992). Board ousts managers at GM; Takes control of crucial committee. The Wall Street Journal, 7, 1-8.

- Wiseman, R.M., & Gomez-Mejia, L.R. (1998). A behavioral agency model of managerial risk taking. Academy of Management Review, 23(1), 133-153.

- Wright, P., & Ferris, S.P. (1997). Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1), 77-83.

- Wright, P., Kroll, M., Krug, J.A., & Pettus, M. (2007). Influences of top management team incentives on firm risk taking. Strategic Management Journal, 28(1), 81-89.

- Wright, P., Kroll, M., Lado, A., & Van Ness, B. (2002). The structure of ownership and corporate acquisition strategies. Strategic Management Journal, 23(1), 41-53.

- Wruck, K.H. (1989). Equity ownership concentration and firm value: Evidence from private equity financings. Journal of Financial Economics, 23(1), 3-28.

- Zajac, E.J., & Westphal, J.D. (1994). The costs and benefits of managerial incentives and monitoring in large US corporations: When is more not better?. Strategic Management Journal, 15(S1), 121-142.