Research Article: 2021 Vol: 24 Issue: 1S

The Potential of Listed Companies to Finance the Sustainable Development Goals

Nicolás Gambetta, Universidad ORT Uruguay

Inés García Fronti, Universidad de Buenos Aires

Valeska V. Geldres-Weiss, Universidad de La Frontera

Mauricio Gómez-Villegas, Universidad Nacional de Colombia

Marcela Jaramillo Jaramillo, Universidad Autónoma del Estado de México

Keywords:

Sustainable Development Goals, Sustainable Development Financing, Private Sector, Ethical Imperative, Emerging Economies, Latin America, Sustainability

Abstract

This study aims to gain an understanding of how the listed companies can contribute to finance the Sustainable Development Goals in the Latin America. The private sector should play a highly relevant role, working together with the public sector and the communities to achieve the SDGs. We focus this study on Mexico and aim to identify the gap between the SDGs in which the most relevant industry sectors have the highest potential to contribute to the 2030 Agenda and the level of achievement of the country in these SDGs and then, using content analysis we identify the SDGs that concentrate the communication effort of the listed Mexican companies in the sustainability reports and compare this with the gaps identified in the analysis described before. This study shows that the private sector is not yet contributing to the SDGs in which they are supposed to be in a better position to contribute for being part of a specific industry sector. Additional efforts are needed from the private sector as they have an ethical imperative in sustainability and in creating positive externalities to the society and the environment.

Introduction

On 25 September 2015, 196 countries set ambitious objectives that aim to end poverty, to protect the planet and ensure that all human beings can enjoy prosperous and fulfilling lives (United Nations, 2015). The 17 Sustainable Development Goals (SDGs) and the 169 targets of the 2030 Agenda for the sustainable development create the framework for the countries to make the effort to eradicate poverty, reduce inequalities and to fight against climate change.

All the countries acknowledge that these initiatives should be coupled with strategies to fuel economic growth, address social needs such as education, health and employment opportunities and protect the environment. Although the SDGs are not legally binding, governments are expected to adopt them by establishing national frameworks to achieve the 17 goals with its respective targets.

Considering that the SDGs address a wide range of complex interrelated challenges they cannot be attained without the joint effort and collaboration of governments, organizations, the public and private sector, the community, and the academia.

This research aims to gain an understanding of how the listed companies can contribute to finance the Sustainable Development Goals in the Latin American countries that conducted Voluntary National Reviews (VNRs) in 2016 and 2017 and presented their reports to the High-level Political Forum (HLPF). We do this by linking the achievement level of each SDGs in Mexico, one of the largest economies in Latin America, with the potential of the most relevant industry sectors in the country to finance the SDGs that are directly related to these industries’ core business. The research question of the study is whether the SDGs more related to the industrial sectors that dominate the stock exchange in the Latin American countries, more specifically in Mexico, are linked to the SDGs in which the countries have a better or a worse performance.

We first understand the SDGs in which the most relevant industry sectors in the country have the highest potential to contribute to their achievement using the PwC SDG Engagement Survey 2015 methodology (PwC, 2015) and compare it with the SDG achievement level of each country according to the SDG Index 2017 (Sustainable Development Solutions Network, 2017). Then, using content analysis we identify the SDGs that concentrate the communication effort of the Mexican companies in the sustainability reports that were issued by them in 2017 and compare this with the gaps identified in the analysis described before.

The topic addressed in this research is relevant as the Latin American countries are predominantly emerging economies with scarce resources and significant economic challenges, so the resources need to be allocated efficiently to achieve the 2030 Agenda. To the best of our understanding this is the first study to address this research question.

The private sector in Latin America should play a highly relevant role, working together with the public sector and the communities to achieve the SDGs. Latin American countries show indicators that are below the developed countries’ average regarding the SDG Index (Sustainable Development Solutions Network, 2017) and the Social Progress Index (Porter et al., 2017). The alignment of the public and the private sector efforts is essential, so knowing the potential contribution of the listed companies to the SDGs achievement is relevant to understand if this can fulfill the financing gaps left by the public sector in the sustainable development financing.

Hajer, et al., (2015) argue that the SDGs “have the potential to become the guiding vision for governmental, corporate and civil society action for a shared and lasting prosperity” while Bebbington & Unerman (2018) state that the SDGs represent the “state of the art” thinking of governments around the globe and show the challenges that face the world as well as the mechanisms by which these challenges might start to be addressed. Gambetta, et al., (2019) finds that the prioritized SDGs in the Latin American countries’ VNRs are not fully aligned with the resources allocation done by the governments in these SDGs, suggesting that governments need to allocate efficiently the resources in the SDGs that require higher effort to achieve and that they should provide information to the private sector to help them focus their resources where are needed the most. We aim to build on this literature as this study identifies the SDGs in which the different industry sectors have the potential to contribute when these SDGs require highest effort in the country to be achieved and whether the companies in these industry sectors concentrate their disclosure effort on that specific SDGs or not.

Literature Review

The Capital Market Structure and the Countries’ 2030 Agenda Performance

“Well-functioning capital markets help ensure the financial system’s efficiency, stability and risk management, preventing costly crises and helping channel savings toward capital that is essential for economic development and poverty reduction” (World Bank Group, 2016).

Capital markets comprise both public sector and private corporate issuers, who issue securities instruments such as bonds, or fixed-income securities; stocks or equities which are risk-sharing. Well-functioning markets require sound market infrastructure, including aspects such as laws, regulations, and corporate governance. There are some capital markets instruments that aimed to finance the real sector, including infrastructure and the environment (World Bank Group, 2016).

Prior studies illustrate the link between financial depth and economic growth. Research shows that bank-based structures tend to dominate in the early stages of growth while with increasing economic development; countries tend to develop the capital market. Sound financial development help to benefit the incomes of the poorest. Ötker-Robe & Podpiera (2013) show that incidents of economic crisis may have severe effects on poverty.

Since 2009, the Sustainable Stock Exchanges (SSE) initiative has been working in partnership with stock exchanges to develop more sustainable capital markets. To create these markets, sustainable development must be integrated into the mainstream economy. Financial markets have an internationally framework for contributing to the creation of sustainable markets and society (Sustainable Stock Exchange Initiative, 2016).

Achieving the SDGs requires significant financing, estimated at US$5-7 trillion per year (UNCTAD, 2014). The public funding and development assistance remains important to achieve the SDGs, but these complex challenges require the flow of private capital. As the intersection between companies and investors, stock exchanges are well positioned to contribute to the SDGs (Sustainable Stock Exchange Initiative, 2016).

Considering the relevant role that capital markets play to achieve the SDGs, the research question of this study is to understand whether the industry sector where the largest number of listed companies is concentrated in the Latin American countries are related to the SDGs in which the countries have a better or a worse performance.

RQ1: Are the industrial sectors where the largest number of listed companies is concentrated in the Latin American countries linked to the SDGs in which the countries have a better or a worse performance?

Sustainability Disclosures and Prioritized SDGs in the Industry Sector

The concept of Sustainable Development emerges because of the negative impacts of productive and business activity on the social, environmental, and economic dimensions (Brundtland, 1987). The evidence of crises in such dimensions promoted an awareness on the part of citizens, governments, and companies, raising the need to transform the management of public and private affairs and human relations with the environment. In this context, Corporate Social Responsibility (CSR) is expanded and positioned to identify and manage the negative impacts of business activity on the natural environment and society (Garriga & Melé, 2004). All this created the conditions for the United Nations to propose the Millennium Development Goals, (MDG), in the year 2000.

CSR has been incorporated into companies with positions ranging from pragmatic and utilitarian views, which simply perform philanthropy or seek financial profitability with such actions, to political and ethical visions that aim to transform the conception and operation of the company, to positively impact in the environment (Garriga & Melé, 2004). In line with this, academic research has identified: a) a positive association between CSR actions, business results, the generation of value and the remuneration of managers (López, García & Rodríguez, 2007; Emerton & Jones, 2019); b) the implementation of CSR with reputational objectives to face social and environmental risks (Nikolaeva & Bicho, 2011); and c) the use of CSR for legitimization purposes (Moneva, Archel & Correa, 2006; Bebbington, Larrinaga & Moneva, 2008). It has been suggested that understanding the factors related to the implementation of CSR policies and actions by companies in emerging countries requires further research (Ali, Frynas & Mahmood, 2017).

Management has different ethical motivations to sustainability and they lead them to carry on different operational activities to achieve sustainability and they have different effects on the company’s economic performance (Schaltegger & Burritt, 2018). Sustainability is a frequently used concept by organizations in relation to business ethics and the responsibility and impact of business activities in the society and on the environment (Krishna et al., 2011).

The limited achievements in the MDGs in 2015 carried out the Sustainable Development Goals. According to the diagnosis of the United Nations, the involvement of the largest companies, among other actors, must be greater to obtain the goals proposed in the 2030 Agenda. Likewise, more information is needed on the strategies and progress for the part of the users and companies to obtain the SDGs (UN, 2015). This translates into the human, technological and financial resources that drive the innovations and the necessary social and technological reforms. In this context, the financing of sustainable development, as well as the participation of companies in this process, becomes a key issue (Ferreira, Sobreiro, Kimura & Barboza, 2016; UNDP, 2018; ITFFD, 2019). There are arguments that point out the institutional possibilities and weaknesses for financial markets that contribute to sustainable development (Waygood, 2011).

The achievement of SDGs requires a commitment on the part of companies, managers, and investors. This implies integrating the objectives in the business strategy and in the mechanisms of resources allocation, such as the financial markets in which the companies operate (Ferreira et al., 2016; PWC, 2018). Sustainability reports are the most used instruments to communicate the strategy, actions, and results in terms of Corporate Social Responsibility. It is also a means for investors and other agents to know and evaluate the risks, efforts, and achievements of organizations regarding sustainability (Waygood, 2011; Dienes, Sassen & Fischer, 2016; Schaltegger, Álvarez & Ortas, 2017).

The guidelines and standards of the Global Reporting Initiative (GRI) have become the international benchmark in the production of sustainability reports. These reports are an expression, mostly non-financial, of corporate information. There is an emerging literature that study the role of sustainability reports to account for the planning, implementation, measurement, and communication of business efforts in the SDGs (Schaltegger, Álvarez & Ortas, 2017; Rosati & Faria, 2019). There is also literature that doubts the possibility of these reports to contribute to sustainability (Moneva, Archel & Correa, 2006; Fonseca, McAllister & Fitzpatrick, 2014)

In this line, PwC (2018) carried out a study with 700 global companies to analyze their commitment to the SDGs. For this, they analyze the corporate reports and the sustainability reports of such companies, seeking to identify if the SDGs have been incorporated into the business strategy. The report found that 72% of companies mention the SDGs in their annual sustainability reports. 50% of companies have identified priority SDGs; 54% of those companies that prioritized an SDG have incorporated them into their business strategy; 19% of the presidents' letters in the annual reports mention the SDGs and 23% of the companies disclosed key performance indicators related to the SDGs. Likewise, the study identifies that SDGs 8, 13, 12, 3 and 9, have been the SDGs that show the highest priority in the reports of the companies under study. A better characterization of the business commitment with sustainability will require identifying the sectors or industries that have a greater impact and direct interrelations with the SDGs. In this sense, the Corporate Citizenship report (2016) advances in a characterization and association of the different sectors and industries with each of the SDGs.

The role of large, listed companies can be decisive in mobilizing resources towards the SDGs. These companies make the largest investments in R&D, which is necessary to achieve innovations that allow sustainability, thanks to their ability to attract investment. Large, listed companies can impact the value chain to achieve sustainability in the processes and practices of suppliers, customers, and consumers. Likewise, their participation in socially and environmentally sensitive sectors would allow to strengthen strategies and actions aligned with the SDGs to achieve better impacts.

Based on this background, our work seeks to identify the commitment of listed companies in Mexico, one of the largest economies in Latin America, to the SDGs, analyzing their sustainability reports. We intend to identify the SDGs prioritized in the reports of the companies and their relationship with the sectors and industries in which they operate, to raise the implications of this in the mobilization of financial resources and in their real commitment to Sustainable Development.

RQ2: Are the SDGs that concentrate the communicative effort of the Mexican listed companies the SDGs to which its industrial sectors are more prepared to have direct impact?

Data Sources and Sample Selection

To understand the current situation during the first year of the 2030 Agenda, the Latin American countries under study are those that issued their first VNR either in 2016 or in 2017: Argentina (2017), Brazil (2017), Chile (2017), Colombia (2016), México (2016), Peru (2017) and Uruguay (2017). The financial information comes from the Orbis Database and the capital market structure comes from The World Bank data. The 2017 sustainability report of the Mexican companies come from the GRI database. When the report was not available in the GRI database we search the company website to find the corresponding sustainability report. The 2017 SDG Index is used to understand the achievement level of Mexico in the SDGs. The final sample comprises 109 listed companies in 2017 in Mexico, excluding the financial sector.

To understand if the companies under study concentrate their communicative effort on the SDGs in which the industry where they operate are in a better position to contribute to finance, this study uses content analysis, a common approach in sustainability reporting (Guidry and Patten 2010). We explore the disclosures done in the sustainability report by each company regarding the 17 SDGs and, following PwC (2018) we assign a score to each SDG based on the following criteria:

1. The company makes a statement about the SDG and its importance but does not include any specific aspirations or ambitions

2. The company makes a statement about the SDG and includes a qualitative ambition or aspiration on achieving it.

3. The company identifies a quantitative KPIs for its relevant SDG

4. The company identifies a quantitative KPIs and targets for its relevant SDG

5. The company links its SDG KPIs to its societal impact

Using this information we identify the level of achievement of each SDGs by the country under study, the industry sectors that predominate in the financial market in each country and their potential to contribute to finance the SDGs and the relevance for each SDG given by the Mexican companies in the sustainability report.

Results

The Industry Sectors and the SDGs

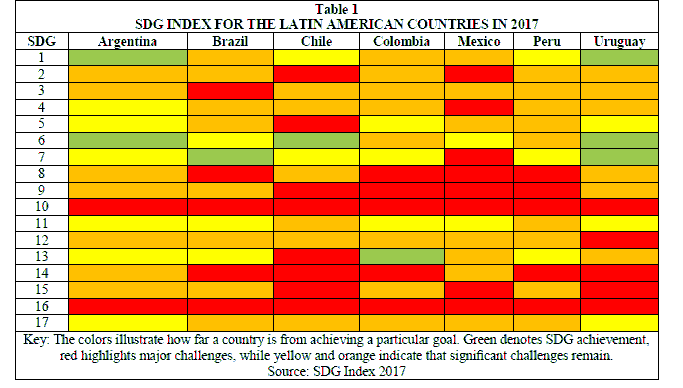

Table 1 shows the 2017 SDG Index (SDSN, 2017) for the Latin American countries under study.

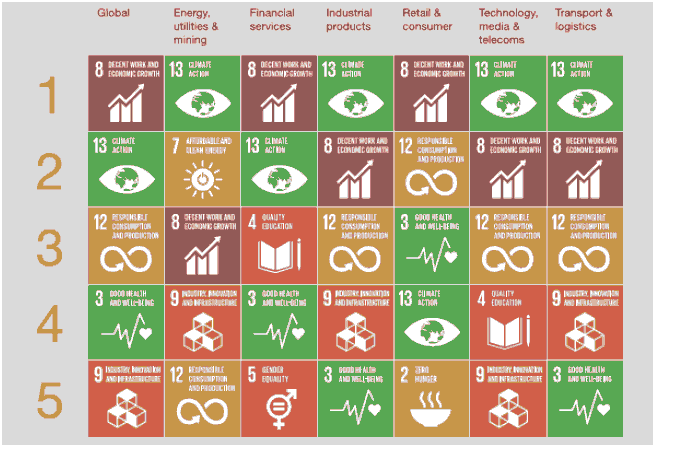

Figure 1 Shows the top prioritized SDGs by industry according to PwC (2018):

Table 2 shows the 2017 structure of the Latin American countries’ GDP according to The World Bank Data.

| Table 2 Structure of Latin American Countries’ GDP in 2017 (% Gdp) |

|||||

|---|---|---|---|---|---|

| Country | Agriculture | Industry Without Manufacturing | Manufacturing | Services | Total |

| Argentina | 8 | 11 | 16 | 65 | 100 |

| Brazil | 5 | 9 | 12 | 74 | 100 |

| Chile | 4 | 19 | 12 | 65 | 100 |

| Colombia | 7 | 20 | 13 | 60 | 100 |

| Mexico | 4 | 14 | 19 | 63 | 100 |

| Peru | 8 | 19 | 14 | 59 | 100 |

| Uruguay | 7 | 15 | 14 | 64 | 100 |

| Average | 6.14 | 15.29 | 14.29 | 64.29 | |

Argentina and Peru are the countries that show the highest participation of Agriculture in the GDP (8%), Colombia shows the highest participation of industry without manufacturing (20%), Mexico shows the highest participation of Manufacturing (19%). Services represent the highest participation in the Latin American countries, showing on average a 64.29% share.

When we look into the industry distribution of listed companies in the Latin American countries in Table 3, we find that Manufacturing is the industry with the highest share of companies (38%). This industry only contributes with a 14.29% in the Latin American countries GDP.

| Table 3 Latin American Countries’ Capital Market Structure in 2017 (Number of Companies) |

||||||||

|---|---|---|---|---|---|---|---|---|

| Industry | AR | % | BR | % | CL | % | CO | % |

| Agriculture, Forestry and Fishing | 5 | 6% | 7 | 3% | 13 | 9% | 7 | 13% |

| Construction | 7 | 8% | 15 | 5% | 6 | 4% | 3 | 6% |

| Manufacturing | 35 | 42% | 109 | 39% | 44 | 30% | 20 | 38% |

| Mining | 4 | 5% | 10 | 4% | 3 | 2% | 1 | 2% |

| Retal Trade | 3 | 4% | 17 | 6% | 13 | 9% | 2 | 4% |

| Services | 5 | 6% | 42 | 15% | 28 | 19% | 2 | 4% |

| Wholesale Trade | 2 | 2% | 5 | 2% | 2 | 1% | 1 | 2% |

| Communications | 3 | 4% | 5 | 2% | 2 | 1% | 5 | 10% |

| Electric, Gas and Sanitary Services | 19 | 23% | 50 | 18% | 24 | 16% | 10 | 19% |

| Transportation | 1 | 1% | 19 | 7% | 13 | 9% | 1 | 2% |

| TOTAL | 84 | 100% | 279 | 100% | 148 | 100% | 52 | 100% |

| Industry | MX | % | PE | % | UY | % | TOTAL | % |

| Agriculture, Forestry and Fishing | 1 | 1% | 11 | 9% | 2 | 25% | 46 | 6% |

| Construction | 15 | 14% | 4 | 3% | 0% | 50 | 6% | |

| Manufacturing | 46 | 42% | 45 | 37% | 3 | 38% | 302 | 38% |

| Mining | 4 | 4% | 15 | 12% | 1 | 13% | 38 | 5% |

| Retal Trade | 1 | 9% | 3 | 2% | 0% | 48 | 6% | |

| Services | 12 | 11% | 12 | 10% | 1 | 13% | 102 | 13% |

| Wholesale Trade | 4 | 4% | 6 | 5% | 0% | 20 | 2% | |

| Communications | 8 | 7% | 3 | 2% | 0% | 26 | 3% | |

| Electric, Gas and Sanitary Services | 1 | 1% | 20 | 16% | 1 | 13% | 125 | 16% |

| Transportation | 8 | 7% | 4 | 3% | 0% | 46 | 6% | |

| TOTAL | 109 | 100% | 123 | 100% | 8 | 100% | 803 | 100% |

Companies in the Electric, gas and sanitary services represent 16% of the total listed companies. This industry sector, together with mining and construction contributes with a 15.29% to the Latin American countries’ GDP (Industry without manufacturing).

Companies in the Services industry represent 13% of the total listed companies. This industry sector, together with wholesale and retail trade (including hotels and restaurants), transport, and government, financial, professional, and personal services such as education, health care, and real estate services contributes with a 64.29% to the Latin American countries’ GDP (Services).

The listed companies in these countries will play a relevant role in financing the SDGs, so it is important to understand the type of contribution they will do and how this matches with the different SDGs.

Understanding the GDP structure is also important as it shows the profile of the Latin American countries and hence, the relevance that the different SDGs have among them.

Industry Sectors’ Prioritize SDGs and the SDG Index: The Case of Mexico

The top 3 industry sectors that concentrate most of the listed companies in Mexico are the Manufacturing industry (42%), Construction (14%) and Services (11%). According to PwC (2018), the Manufacturing and Construction industry have identified as priority SDGs the following: SDG 13, SDG 8, SDG 12, SDG 9 and SDG 3, while the Services industry has identified the following: SDG 8, SDG 12, SDG 3, SDG 13 and SDG 2. All the SDGs which these industries have identify as the ones they are in a better position to contribute are in red and orange in the 2017 Mexico SDG Index, meaning that Mexico needs to make a significant effort to achieve them.

In the VNR issued by Mexico in 2016, the country concentrates the communicative efforts in SDG 17, SDG 8 and SDG 2. According to Gambetta et al (2019), Mexico is one of the three countries among the Latin American countries that issued a VNR in 2016 or 2017 that allocate more resources in SDG 17 and SDG 8, meaning that the country aligns the speech (the communicative effort in the VNR) and the reality (public expenditure allocation in the budget) in these two SDGs.

According to this analysis the private and the public sectors in Mexico coincide in prioritizing SDG 8 and SDG 2, among others.

Reporting Quality Scores for Each SDG in Listed Companies in Mexico

Table 4 shows that out of the 109 listed companies in Mexico with available financial information in 2017, only 43 issued a sustainability report in that year. The result of the content analysis performed shows that 21 companies mention the SDGs in their sustainability report.

<

| Table 4 Reporting Quality Scores For Each SDG In Listed Companies (2017) - Mexico |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SUST Report? |

SDG Mention? |

Industry | # | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

| No | Agriculture, Forestry and Fishing |

1 | |||||||||||||||||||

| Construction | 11 | ||||||||||||||||||||

| Manufacturing | 24 | ||||||||||||||||||||

| Mining | 1 | ||||||||||||||||||||

| Retail Trade | 9 | ||||||||||||||||||||

| Services | 8 | ||||||||||||||||||||

| Wholesale Trade | 3 | ||||||||||||||||||||

| Communications | 5 | ||||||||||||||||||||

| Transportation | 4 | ||||||||||||||||||||

| Total No SUST Report | 66 | ||||||||||||||||||||

| Yes | No | Construction | 4 | ||||||||||||||||||

| Manufacturing | 12 | ||||||||||||||||||||

| Mining | 1 | ||||||||||||||||||||

| Services | 1 | ||||||||||||||||||||

| Wholesale Trade | 1 | ||||||||||||||||||||

| Communications | 1 | ||||||||||||||||||||

| Transportation | 2 | ||||||||||||||||||||

| Total No SDG Mention | 22 | ||||||||||||||||||||

| Yes | Manufacturing | 10 | 2.0 | 1.4 | 1.8 | 2.2 | 1.6 | 2.0 | 1.8 | 1.9 | 2.0 | 1.4 | 2.0 | 1.9 | 2.7 | 2 | 3.7 | 2.7 | 2.0 | ||

| Mining | 2 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 1.0 | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 3.0 | 3.0 | 1.0 | 1.0 | |||

| Retal Trade | 1 | 5.0 | 2.0 | 2.0 | 3.0 | 2.0 | 3.0 | 3.0 | 3.0 | 3.0 | 2.0 | 3.0 | 3.0 | 5.0 | 1.0 | 2.0 | 1.0 | 1.0 | |||

| Services | 3 | 2.0 | 5.0 | 3.5 | 5.0 | 3.0 | 5.0 | 5.0 | 3.5 | 5.0 | 3.5 | 3.5 | |||||||||

| Communications | 2 | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 1.5 | 2.0 | 1.5 | 2.0 | 2.0 | 2.0 | 1.5 | 1.5 | 1.0 | 1.0 | |||||

| Electric, Gas and Sanitary Services |

1 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | |||||||||||

| Transportation | 2 | 1.0 | 1.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 1.0 | 1.0 | 2.0 | 1.0 | 1.0 | 4.0 | 1.0 | 5.0 | 1.0 | 2.0 | |||

| Total Yes SDG Mention | 21 | 1.9 | 1.3 | 1.9 | 2.4 | 2.0 | 2.1 | 2.3 | 1.9 | 2.1 | 1.8 | 1.8 | 1.9 | 2.9 | 2.1 | 3.1 | 1.6 | 2.0 | |||

| Total Yes SUST Report | 43 | ||||||||||||||||||||

| Total Companies | 109 | ||||||||||||||||||||

Regarding the industry sectors that concentrate the largest number of listed companies in Mexico, only 22% of the Manufacturing companies (10) and the 25% of the Services companies (3) mention the SDGs in the sustainability report.

When we look at the SDGs prioritized by these industries, the results show that in the Manufacturing industry the reporting quality score for SDG 3 is 1.8, for SDG 8 is 1.9, for SDG 9 is 2.0, for SDG 12 is 1.9 and for SDG 13 is 2.7. As the average scores for all these SDGs are below 3, this means that the listed companies in the Manufacturing industry do not identify a quantitative KPIs for its relevant SDGs.

In the case of the listed companies in the Services sector, the reporting quality score for SDG 3 is 2.0, for SDG 8 is 3.0 and for SDG 13 is 3.5. These companies do not mention the prioritized SDGs 2 and 12. This shows that for SDG 3 the companies mention a qualitative aspiration while for SDGs 8 and 13 they are identifying quantitative KPIs for these prioritize SDGs.

The results show that in the Manufacturing industry and in the Services sector, there is a gap between the prioritization that companies do for certain SDGs and the reporting quality of these SDGs in the sustainability report.

Table 4 also shows that the Manufacturing and the Services companies report higher quality information for SDGs that are not prioritized by them. For example, the listed companies in the Manufacturing industry shows a reporting quality score of 3.7 in SDG 15, while listed companies in the Services sector show a reporting quality score of 5 in SDGs 4, 7, 9, 10 and 14, meaning these companies link its SDG KPIs to its societal impact.

Conclusion

This study reports the results of a content analysis performed to identify whether listed companies in Mexico report high quality information in the SDGs that are prioritized in the industry they operate. Additionally, we identify if the prioritized SDGs are goals where the country needs to make a significant effort to achieve.

Using content analysis to address the study’s research questions, we identify that in Mexico, the industries that concentrate the largest number of listed companies are Manufacturing, Construction and Services, but approximately only the 25% of the listed companies in the Manufacturing and Services industries mentioned the SDGs in the sustainability report.

We note a low reporting quality in the SDGs that are identified as priority in the most representative industries in Mexico and a higher reporting quality in SDGs that are not prioritized in those industries. This shows that the Mexican listed companies have not incorporated into their business strategy the SDGs in which the industry they operate is more prepared to contribute to the sustainable development financing. This is evident as these companies do not report KPIs linked to the prioritized SDGs, showing they are not measuring them. This shows a gap between the prioritized SDGs in these industries and the quality of the information reported in relation to them.

On the other hand, as they report higher quality information in the SDGs that are not a priority in the industry they operate, this means that they report the contribution thy are making to more general SDGs, for example in SDGs 4 (Quality education), 7 (Affordable and clean energy), 9 (Industry, innovation, and infrastructure), 10 (Reduced inequalities), 14 (Life below water) and 15 (Life on land). These SDGs are usually identified in the media as topics that concern the general public or are areas where the governments have difficulties to address. So, these topics are identified by the companies and reported in the sustainability reports to legitimize themselves in the eyes of the stakeholders.

This study shows that the private sector is not yet contributing to the SDGs in which they are supposed to be in a better position to contribute for being part of a specific industry sector. This situation could be worsened if the public sector is not allocating resources to these SDGs. Considering that business organizations have an ethical imperative to contribute to sustainability, they should focus on aligning their efforts to generate positive externalities for the society and the environment.

This study has some limitations. We consider only the listed companies in the country under study. The unlisted companies that operate in a specific industry sector are not considered as they are difficult to identify and usually there is no public information for them. Also, companies that are doing business in Mexico that are listed in a foreign stock exchange are not considered because are also difficult to identify. Also, some NGOs contribute to finance some SDGs but this is also difficult to identify. Finally, the negative impact the listed companies and the other companies mentioned before produce in some SDGs is not captured as this information is not usually reported.

This study contributes to the existent literature of sustainable development financing as it sheds some light on the potential of listed companies and industry sectors to finance the SDGs in Latin America, more specifically in Mexico. Studying this topic in Latin America is relevant as in emerging economies, the private sector contribution to finance sustainable development must be significant as the public sector has scarce resources to allocate. This situation is different in developed countries. Also, the relevance of the industry sectors among the listed companies is different, as the relative weight of some industries is predominant in this type of economies.

Acknowledgment

This work was supported by Asociación Española de Contabilidad y Administración de Empresas (AECA) (Project: Cátedra AECA Carlos Cubillo de Contabilidad y Auditoría. 5ª Edición. 2018-2019 – Capítulo Iberoamericano).

References

- Ali, W., Frynas, J.G., & Mahmood, Z. (2017). Determinants of Corporate Social Responsibility (CSR) disclosure in developed and developing countries: A literature review. Corporate Social Responsibility and Environmental Management, 24(4), 273-394.

- Bebbington, J., & Unerman, J. (2018). Achieving the United Nations sustainable development goals: An enabling role for accounting research. Accounting, Auditing & Accountability Journal, 31(1), 2-24.

- Bebbington, J., Larrinaga?González, C., & Moneva?Abadía, M. (2008). Legitimating reputation/the reputation of legitimacy theory. Accounting, Auditing & Accountability Journal, 21(3), 371-374.

- Brundtland, G. (1987). Our common future. World Commission on Environment and Development. New York. United Nations.

- Corporate Citizenship. (2016). SDGs & sectors: A review of the business opportunities. A Report for the Business & Sustainable Development Commission.

- Dienes, D., Sassen, R., & Fischer, J. (2016). What are the drivers of sustainability reporting? A systematic review. Sustainability Accounting, Management and Policy Journal, 7(2), 154-189

- Emerton, P., & Jones, A. (2019). Perceptions of the efficacy of sustainability-related performance conditions in executive pay schemes. Journal of Sustainable Finance & Investment, 9(1), 1-16.

- Ferreira, M.C., Sobreiro, V.A., Kimura, H., & Barboza F.L. (2016) A systematic review of literature about finance and sustainability. Journal of Sustainable Finance & Investment, 6(2), 112-147.

- Fonseca, A., McAllister, M.L., & Fitzpatrick, P. (2014). Sustainability reporting among mining corporations: a constructive critique of the GRI approach. Journal of Cleaner Production, 84(1), 70-83.

- Gambetta, N. (2019). The Latin American governments’ communication strategy in the 2030 Agenda Voluntary National Reviews: Is the speech aligned with the reality? Working paper

- Garriga, E., & Melé, D. (2004). Corporate social responsibility theories: Mapping the territory. Journal of Business Ethics, 53, 51-71.

- Guidry R., & Patten D. (2010). Market reactions to the first-time issuance of corporate sustainability reports: Evidence that quality matters. Sustainability, Accounting, Management and Policy Journal, 1(1), 33–50

- Hajer, M., Nilsson, M., Raworth, K., Bakker, P., Berkhout, F., de Boer, Y., Rockström, J., Ludwig, K., & Kok, M. (2015). “Beyond cockpit-ism: Four insights to enhance the transformative potential of the Sustainable Development Goals”. Sustainability, 7(2), 1651-1660.

- Inter-agency Task Force on Financing for Development, ITFFD (2019). Financing for sustainable development report 2019. Report of the Inter-agency Task Force on Financing for Development, United Nations. New York, NY, USA.

- Krishna, A., Dangayach, G.S., & Jainabc, R. (2011). Business ethics: A sustainability approach. Procedia-Social and Behavioral Sciences, 25, 281-286.

- López, M.V., Garcia, A., & Rodríguez, L. (2007). Sustainable development and corporate performance: A study based on the dow jones sustainability index. Journal of Business Ethics, 75(3), 285-300.

- Moneva, J.A., Archel, P., & Correa, C. (2006). GRI and the camouflaging of corporate unsustainability. Accounting Forum, 30(2), 121-137.

- Nikolaeva, R., & Bicho, M. (2011). The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. Journal of the Academy of Marketing Science, 39(1), pp 136-157.

- Porter, M., Stern, S., & Green, M. (2017). Social progress index. Social Progress Imperative.

- PWC (2018). From promise to reality: Does business really care about the SDGs? And what needs to happen to turn words into action. SDG Reporting Challenge 2018. Price Waterhouse Coopers.

- Rosati, F., & Faria, L.G.D. (2019). Addressing the SDGs in sustainability reports: The relationship with institutional factors. Journal of Cleaner Production, 215, 1312-1326.

- Schaltegger, S., & Burritt, R. (2018). Business cases and corporate engagement with sustainability: Differentiating ethical motivations. Journal of Business Ethics, 147(2), 241-259.

- Schaltegger, S., Álvarez, I., & Ortas, E. (2017). Innovating corporate accounting and reporting for sustainability – attributes and challenges. Sustainable Development, 25, 113-122.

- Sustainable Development Solutions Network (2017). SDG Index & Dashboards Report.

- Sustainable Stock Exchange Initiative (2016). 2016 Report on progress. Sustainable Stock Exchange Initiative.

- United Nations Development Program, UNDP (2018). Financing the 2030 Agenda - An Introductory Guidebook for UNDP Country Offices; UNDP: New York, NY, USA.

- United Nations, UN. (2015). The millennium development goals report 2015. New York, NY, USA.

- United Nations (2015). Transforming our world: The 2030 agenda for sustainable development. Resolution adopted by the General Assembly on 25 September 2015.

- United Nations Conference on Trade and Development, UNCTAD (2014). World Investment Report 2014: Investing in the SDGs: An Action Plan. United Nations, Switzerland.

- Waygood, S. (2011). How do the capital markets undermine sustainable development? What can be done to correct this? Journal of Sustainable Finance & Investment, 1(1), 81-87.

- World Bank Group (2016). The World Bank Group’s Support to Capital Market Development. International Bank for Reconstruction and Development/The World Bank.1818 H Street NW, Washington, DC 20433.