Research Article: 2019 Vol: 18 Issue: 6

The Quality of Financial Education as the Basis of Proper Human Resources for Economic Security Strategic Management

Zachosova Nataliia, Bohdan Khmelnytsky National University of Cherkasy

Bilyk Victoriia, Bohdan Khmelnytsky National University of Cherkasy

Kutsenko Dmytro, Bohdan Khmelnytsky National University of Cherkasy

Abstract

The article substantiates the importance of high level of financial literacy of management personnel for professional fulfillment of tasks of ensuring financial and economic security of economic entities. Strategic management of all, without exception, directions of economic activity of enterprises in the conditions of expansion of models of knowledge economy and information economy, will not have the necessary effect without the proper human resources. The development of this hypothesis made it possible to identify problems in the education system that impedes the acquisition of the necessary knowledge and skills by future managers. The authors offer a step-by-step financial education model to train financial and economic security professionals focused on achieving the strategic goals of companies in the risk-filled business environment.

Keywords

Strategic Management, Economic Security, Human Resources, Education.

JEL Classifications

A2, I25, L1, J5, M12

Introduction

The quality of professional training for specialists in various areas of the economic system remains insufficient. More and more companies are reluctant to hire college and university graduates with no work experience or compulsory internships, which prove to be lengthy and not always remunerative. However, if for the lack of vocational training and applied skills that are usually formed in the workplace, modern universities can be forgiven, then the fact that young people ? the economic potential of the nation's development ? do not receive basic knowledge in the financial field ? cannot be rationally explained. Without basic financial literacy, a modern person cannot be considered well educated and ready for personal and professional life. However, training programs for philological, psychological, technical, and other non-economic fields’ specialists rarely include disciplines related to the development of financial thinking. Unfortunately, even in the education process of management specialists, financial training is gradually replaced by a purely academic basis ? management development history, management decision-making concepts, etc.

Literature Review

At the beginning of the last century, scientists determined the peculiarities of education for business management (Bowie, 1930). The issue of financial education of managers is particularly relevant. More and more information is starting to emerge about the need to get a financial education and improve financial literacy not only for company executives, but for every individual (Trunk et al., 2014; Choi, 2009; Arthur, 2012). The issue of financial literacy is widely debated by experts, including civil servants, analysts, financial experts, in the context of attempts to overcome the negative potential inherent in the financial system by the power of human resources potential (Mason & Wilson, 2000; Lewis & Messy, 2012). Management training to ensure the functionality of various vectors of activity of modern companies should take into account the specific features of each individual business area. So, strategic management has its own peculiarities (Ansoff, 1980), economic security management ? own methods and technologies (D’yakonova et al., 2018, Zhyvko, 2013, Economic security: Theory, methodology, practice, 2016), and their acquisition for future managers should begin at the high education stage. Particular attention should be paid to the quality of education of financial and economic security management professionals, as this area of professional training of higher education institutions was started only recently, but the need for human resources able to minimize the risks of financial and economic activity of business structures, to approach systematically the issue of preventing the impact of dangers on state of the resources of companies and to organize comprehensive protection of business owners' interests against external and internal threats (Zachosova et al., 2018) – is extremely high.

Hypothesis

Strategic management of financial and economic security of business entities requires human resources, consisting of the specialists who have critical thinking skills in the area of distribution of limited economic resources of the company while maintaining the balance of financial interests of all categories of its stakeholders. This type of top executives must possess the skills of financial planning, forecasting, risk management, as well as the ability to select quality financial products and services, the use of which in the future will not lead to the loss of financial stability or financial sovereignty by the company. Therefore, the process of training such specialists should include, along with the acquisition of management disciplines, the study of the basics of financial literacy, i.e., obtaining a financial education.

Methodology

The theoretical and methodological basis of the study was the combination of the paradigms of financial and economic security management and strategic management. The empirical basis for the study was the results of the expert method. The interview method was used to obtain information on problems in the training system for financial and economic security professionals. The study involved 50 respondents. Telephone interviewing, analysis of publicly disclosed information, data from the Internet were used. The study lasted for 2016-2019. Respondents' answers were systematized, summarized and processed using analysis and synthesis methods. The method of theoretical generalization was used in the process of formulating the conclusions of the study.

Results and Discussion

Given into account the circumstances in which modern business entities operate, financial and economic security management should be considered an independent and important area of management, and not be implemented by staff as one of the functions of financial management or risk management. Strategic Financial and Economic Security Management is a coordinated, long-term planning of a set of management actions for a specific object, aimed at ensuring the maximum level of satisfaction of the financial and economic interests of all categories of its stakeholders in the conditions of continuous and constant application of measures to protect economic resources from the negative impact of existing and potential threats. Successful implementation of such a set of measures requires the proper human resources.

The problematic aspects of educational background of managers, including young professionals in financial and economic security management sphere, were investigated from the standpoint of three categories of stakeholders: employers (business owners), higher education institutions involved in the formation of human resources for management at different levels of socio-economic education systems and applicants (Table 1).

| Table 1 Problem Aspects of Educational Background of Human Resources in Management Sphere | ||

| Employers, Business Owners, Top Management | Higher Education Institutions | Students and Future Management Professionals |

| Low level of practical training (87%) | Low level of basic training of applicants (34%) | Low number of classroom hours (22%) |

| Lack of modern knowledge; their obsolescence and separation from economic realities (52%) | Lack of financial capacity to provide practical training (94%) | Formal organization of practical training (69%) |

| Low level of financial education (66%) | Lack of motivation and interest in learning (21%) | The illusion of choosing optional professional training courses (54%) |

| Lack of necessary management skills (28%) | Lack of adequate financial support (95%) | Absence of management practitioners among teachers (74%) |

| Narrow specialization, lack of diversified management skills (22%) | Inability to respond in time to changing market needs due to government requirements and restrictions (41%) | Excessive general training courses (31%) |

The problem of lack of proper human resources to run the processes of management of companies is present because graduates of institutions of higher education of management specialties demonstrate: lack of practical training, weak skills of strategic thinking, inability to be part of a team, lack of leadership skills, inability to properly use the management tools, misunderstanding of the tasks of a professional manager, inability to make decisions independently. Lack of financial training or poor quality of financial education is a significant problem in the management training process. The main disadvantages of financial education in the training of future management staff nowadays are: lack of special courses on improving the level of financial literacy, neglecting the need to develop planning and allocation of financial resources, leaving behind the practice of developing skills to ensure own and corporate financial security through mechanisms of financial inclusion, misuse of financial products and services, inability to accomplish financial management tasks in a space of digital economy and so on. Table 2 shows a set of indicators for the diagnosis of financial education, and assumes the pathways to be chosen in the pedagogical plane to ensure the quality of financial education in the future. Now, by the end of 2019, not all Bachelor's and Master's degree management programs have a financial education component. This leads to the entry into the labor market human resources that are not ready for the challenges, risk and needs of a nowadays economy.

| Table 2 Measures of Human Resources Financial Education Quality Condition | ||

| Parameters of Financial Education Quality | Measurement Indicator | Ways to Improve |

| Level of financial inclusion | Number of used financial products and services | Organization of presentations of financial institutions services |

| Level of financial literacy | Basic knowledge of finance theory | Increasing the number of hours of financial courses in educational institutions |

| Level of proper use of financial management tools | The number of tools that are actively used | Organization of practical training in the financial departments of companies |

| Level of financial discipline | Number of violations of the rules of financial work | Study of financial legislation |

| Level of satisfaction of financial interests (own and company) | Achieving financial goals (tactical and strategic) | Acquisition of skills to build the matrix of financial interests |

Recommendations

The survey among the 50 top management representatives of different size and type of economic activity companies demonstrates the fact that there is no awareness of the need to use professional staff and specially trained employees to perform the tasks of financial and economic security management. To a large extent, this is explained by the lack of proper human resources in the labor market, as well as the low level of professional training of managers to perform specific functions and tasks in the field of security-oriented management.

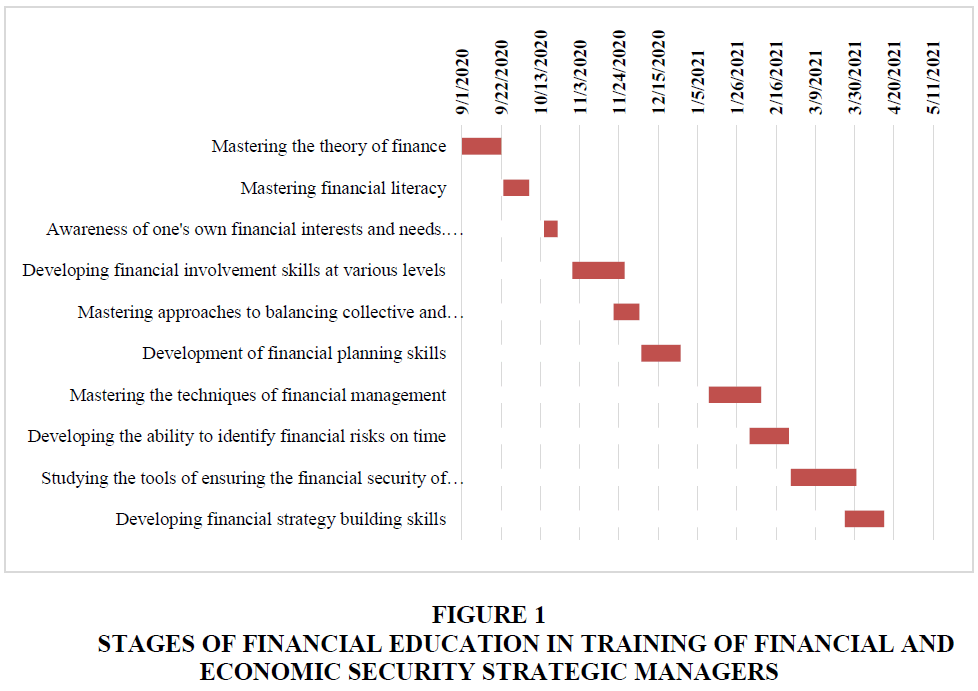

According to the surveys it is found out that in 36% of cases the function of financial and economic security management is performed by the financial director or the financial manager, in 23% of cases ? by the head of the company, in 16% of cases ? by the accountant, in 10% of cases ? by the economist, in 8% of cases ? by IT specialist, and in 6% of cases ? by security guard. Only 1% of companies hire a financial and economic security management professional. These survey results, as well as the shortcomings inherent in the process of giving by the universities educational background for managerial staff, have given impetus to the development of a phased approach to obtaining financial education for financial and economic security managers, which is planned to be implemented at the Bohdan Khmelnytsky National University Cherkasy (Ukraine) during the 2020-2021 academic year (Figure 1).

Figure 1 Stages of Financial Education in Training of Financial and Economic Security Strategic Managers

Conclusions

First, financial education should be an important and compulsory component of preparing an individual for an independent professional life providing by high education establishment, and the amount of such training should be determined by the peculiarities of chosen specialty and competencies expected in the labor market by a specialist in the relevant occupation. Second, strategic management of financial and economic security is an important parameter for companies to achieve competitive advantages and to ensure the own stability of functioning and development in the face of numerous economic risks for future financial and economic status. Therefore, in the personnel of companies, the position of financial and economic security professional manager should be provided, and it should be occupied by a person prepared for such type of work, and not by any other employee of a related position or profession person. Third, financial and economic security professionals must have a management education while having a high level of financial literacy. This can be achieved by integrating the financial education component into the managerial training process of high education establishment using a staged approach.

References

- Ansoff, H.I. (1980). Strategic issue management. Strategic Management Journal, 1(2), 131-148.

- Arthur, C. (2012). The origins of consumer financial literacy education. SensePublishers, Rotterdam.

- Bowie, J.A. (1930). Education for business management: The case for the further development of educational facilities. Oxford University Press, H. Milford.

- Choi, L. (2009). Financial education for a stable financial future. Community Investments, (Sum), 3-7.

- D’yakonova, I., Nikitina, A., & Gurvits, N. (2018). Improvement of the enterprise economic security management in global environment. Geopolitics under Globalization, 2(1), 19-26.

- Economic security: Theory, methodology, practice. (2016). Pegasus Publishing, Lisbon, Portugal. http://elibrary.kubg.edu.ua/id/eprint/15526/1/O_Akilina_Monografy_Econ_secur_FITU.pdf

- Lewis, S., & Messy, F.A. (2012). Financial Education, Savings and Investments.

- Mason, C.L., & Wilson, R. (2000). Conceptualising financial literacy. © Loughborough University.

- Trunk, A., Star?ek, S., Šircelj, M., Imobilia-Gbk, K., Novak, S.A., & Trunk, J. (2014). Financial education and financial literacy.

- Zachosova, N., Babina, N., & Zanora, V. (2018). Research and methodological framework for managing the economic security of financial intermediaries in Ukraine. Banks and Bank Systems, 13(4), 119-130.

- Zhyvko, Z.B. (2013). Enterprise economic security management under market conditions. Actual Problems of Economics, 10(148), 138-145.