Research Article: 2021 Vol: 20 Issue: 4S

The Relationship Between Audit Fees and the Size of the Audit Sample and Their Effect on the Audit Report

Omer Ali Kamil, Al-Nahrain University

Abstract

This research aims at determining the sort of the reciprocal relationship between the audit fees and the size of the audit sample and demonstrate their effect on the audit report. The audit fees represent the engine of the audit profession, whereas the size and type of audit samples represent the content and essence of the audit work. As for the audit report, it represents the final result of the audit process. The process of linking these three basic variables within the profession of auditing is the goal of the present study. This goal can be achieved through testing and attempting to prove the two research hypotheses. The two hypotheses predict that there is a positive relationship between the audit fees and the size of the audit sample on one hand, and the presence of the significant impact of each on the audit report on the other hand.

Keywords:

Audit Fees, Audit Sample, Audit Report, Audit Standards, Audit Quality, Audit Risk

Introduction and Methodology

Over the past decades, present time and certainly into the future, there has been a gradual increase in the curve of the auditing science and profession importance. This increase is due to the growing demand of society and the business world for auditing (assurance) and non-auditing (advisory) services provided by the auditing profession at the local, regional and global levels. The auditing profession provides beneficiaries or decision-makers the required and reassuring guarantee regarding the integrity of the financial statements of companies. In other words, it provides them confidence or a seal of quality and validity to use it or rely on it to make decisions of all kinds. As these financial statements become meaningless and useless without being audited by the certified auditor.

The audit report is considered the summary, result and purpose of the auditors’ work in which they express their opinion on the financial statements subject to the audit. The audit report also provides beneficiaries of decision-makers additional disclosure with explanatory information that will assist them in making their various economic decisions.

There are several variables that may affect the audit report. Some of which may be the size of the audit samples that the auditor takes in his audit work and the audit fees charged for this work. Each of these two variables may determine the size of the other variable. This is because the size of the audit work is determined by its fees, and the fee of the auditor is determined by the complexity and size of their work. Each of them will have an impact on the quality of the output of this audit work, which is represented by the audit report.

Based on these interrelated, reciprocal and complex relationships, the idea of carrying out this research has come out. The importance of the research has emerged from the importance of its variables, goals and results that delineate and determine the form and extent of the relationship between the audit fees and the size of the audit sample on the one hand, and between these two variables together and the audit report on the other hand . Subsequently, the research problem can be summarized as follow: Firstly, the levels of audit fees have not been determined internationally yet, and at the level of many countries. Secondly, the difficulty of linking the levels of audit fees to the size of the audit sample, and finally how to prove their impact on the audit report. The present research is based on the following two hypotheses are posed:

H1: There is a relationship between the audit fee and the size of the audit sample.

H2: There is an effect of both the audit fees and the size of the audit sample on the audit report.

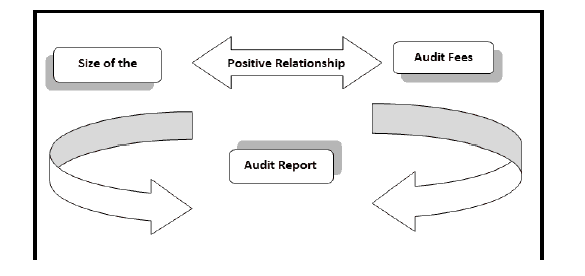

In addition, the aim of the present research is twofold: Firstly, to prove and determine the form of the relationship between the audit fees and the size of the audit sample and the extent of the impact of each one on each other. Secondly, to establish and determine the extent and how do they affect the audit report. Accordingly, the default research scheme is as follow: as shows in Figure 1.

Audit Fees

Audit fee is the economic remuneration for auditors who provide audit services, which are an agency fee according to certain standards (Liu, 2017). As agreed at an annual general meeting by the shareholders, the company pays fees to its auditors. The audit fees will be compensation that the client (the audited entity) pays to the auditor for the services s/he performs. Audit fees are divided into two categories: The first category is the audit business fee of the total audit fees paid by the customer. The second is the non-audit fee which is the cost of other services, provided by the auditor, that are paid out of a total audit fees (Adeniyi, 2018).

The audit fee includes the total cost of audit versus the total audit and non-audit work provided by the auditor (Liu, 2017). Auditors take into their consideration the cost of the provided auditing services and the quality of these services when they are priced in the same way as other professional services such as doctors, lawyers, and others. The current audit pricing models have been developed and expanded so that the audit fees are equal to the audit costs in case of competitive equilibrium. They are function of: (Choi et al., 2010)

1. Client characteristics: Such as the size, complexity, and risk of the client. The relationship will be positive between the audit fee and the client’s characteristics. Hossain, et al., (2013) state that the client’s attributes (i.e., size, complexity, and inherent risks) have the greatest impact on audit fees. Moreover, recent studies have adopted other important features of the client like the quality of internal control and corporate governance (attributes of the board of directors and the audit committee) as determinants of audit fees. Zadeh (2017) has emphasized that the complexity of the audited company (audit client) is one of the factors that contribute to increasing the auditors' fees, as the company's extensive and complex business leads to the increased demand for monitoring and controlling the financial reporting process. Therefore, companies with complex operations require a lot of audit services and subsequently, they pay more fees to audit firms or offices.

2. Auditor characteristics: Such as the size of the company or the audit office and the industrial experience office nationwide. It is believed that the size of the office affects audit fees through its impact on the cost of the provided audit services and/or the quality of audit. On the one hand, large offices have cost advantages in producing auditing services of similar quality because of economies of scale, which enable them to impose lower prices compared to small offices, so the relationship between auditing fees and the size of the audit office or company is negative. On the other hand, if large audit offices, by virtue of their expertise and capabilities, provide a higher quality of audit than small offices, then the relationship is positive between the audit fees and the size of the office. Hossain, et al., (2013, p.8) believes that the professional qualifications of members of the audit team may be an important variable to demonstrate the difference in audit fees. This is because the professional skills and qualifications of auditors and their employees in the audit team determine the level of auditing fees based on the audit efforts made by this audit team.

Simunic (1980) has proposed a model in which auditors can determine their fees based on both the cost of completing the audit and the anticipated loss of litigation. The auditor bears both direct costs (auditing cost) and indirect costs (potential auditor liability) (Muzatko & Teclezion, 2016). Thus, due to the phenomenon of auditors negligence in performing their duties towards clients, especially those who pay high fees to them, professional bodies should issue instructions regarding fees to be collected by audit firms or offices for the purpose of reducing and limiting this issue of auditors negligence (Adeniyi, 2018).

The Association of Accountants and Auditors in Iraq, for instance, has already determined (through a local rule of professional conduct of the auditor and issued by it that governs the ethical behavior) the remuneration that the external auditor deserves according to the principles of the works distribution, which are predetermined to guarantee their rights. However, the remuneration should not be related to the results of the auditing process. Accordingly, the remuneration can be calculated as follow: (AlUbaidi & Harees, 2017)

1. Fees should be calculated on a reasonable scale, as stated in the System of Practice for Monitoring and Auditing No. 3 of 1999.

2. The external auditor is not permitted to accept fees according to which the result of the professional work is determined except for control cases or when the fees are determined by the court.

3. It is strictly forbidden to participate in tenders to determine the audit fees, directly or indirectly.

4. It is strictly forbidden to grant commissions to any person who has, or has affected, finding clients for the external auditor.

5. The worksheets must include a list of actual working hours to complete the audit

Audit fees do not only affect the quality of the audit, but also affect the development of the accounting and auditing firms and the audit industry (sector). As evidence of the impact of the audit fee on its quality, the chief accountant of the Securities Exchange Commission (SEC) expressed his concerns that a lower audit fee may lead to a lower quality of the audit. The audit literature has recently confirmed that the audit fee is only an agent (proxy) or representative of the quality of the audit (Muzatko & Teclezion, 2016).

Nozarpour (2014) believes that increasing the quality of the audit will increase its fees rate. As large companies such as (Big4) have a larger number of employees involved in the audit work and spend more time to implement the audit plan as well as its reputation and specialization in the audit sector, which achieves a higher audit quality and enables it to obtain higher audit fees. Pham, et al., (2017) state that there are some interpretations for the positive relationship between audit fees and its quality. For example, the reduction in the audit fees that may occur during the economic downturn is positively related to the presence of accounting errors due to the reduction in the number of auditors and the audit work period.

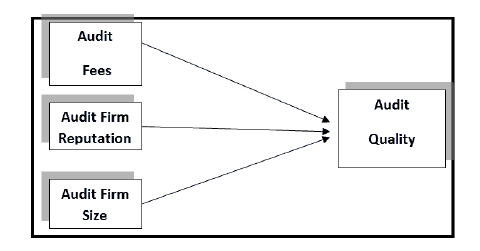

Higher fees may encourage auditors to increase their efforts, which in turn will have a positive impact on the quality of the audit work provided by them. The following figure shows the factors related to the auditor which affects the quality of the audit, perhaps the most important of which is the audit fees: as shows in Figure 2.

Furthermore, the audit fees may affect the independence of the auditors. As the auditor, when receiving high audit fees from his clients, may allow the client to interfere in the management of the profits in his favor. Higher audit fees may become more like bribery, as they make auditors more economically dependent on their clients, which may affect their independence and thus the quality of their audit work (Pham et al., 2017).

Stewart & Kent (2006) have reported that the relationship between audit and external audit committees is complex, stemming from both the demand for audit services by the client and the presentation or provision of audit services by the external auditor. The presence of an audit committee may have a positive relationship with audit fees through ensuring that the audit hours are not reduced to a level that harms the quality of the audit. Members of the Independent Audit Committee may demand a higher level of assurance or warranty as well as supporting the auditor's request for more tests, which will increase the audit fee. Finally, there is a negative relationship between the audit fees and the extent to which the internal audit contributes to the external audit, as evidenced by the decrease in the audit fees when the external auditor depends on the work, efficiency, and strength of the internal audit, and vice versa (Stewart & Kent,2006).

Size of the Audit Sample

Audit risks are the risks that an auditor may issue an unreserved opinion when the accounts contain material errors (European Commission, 2017). The term of the auditors’ risk includes their reliance risk on their assessment of control risk, not the control risk itself. In order to assess the risks that the auditor may face when carrying out an audit work, it may be considered that it includes three components: (Chen et al., 2014)

1-The audit risks: The risks that the auditors may unintentionally fail to modify their opinion appropriately on financial statements that are materially misstated.

2-The business risks: These are the risks to which the audit firm is exposed through engagement with the client. They consist of the risks of potential litigation costs and their impact on the audit firm's reputation and other cost risks (not related to litigation) such as problems with fee realization (bad debts).

3-Audito’s personal risk: It is the risk of damage to the reputation of the independent auditor as a result of his association with the client. Auditor's personal risk differs from the risk that may affect the audit firm in general.

Mei, et al., (2019) consider that, according to the audit risk model, (audit risk=material misstatement risk × inspection risk). They also confirm that this risk model has focused on the audit risks arising from the auditors' errors. As for the European Commission (2017), they believe that the Audit Risk (AR) involve (Inherent Risk - IR), (Control Risk - CR) and (Detection Risk - DR). This leads to formulating the audit risk model according to the following:

AR=IR×CR×DR.

Although there are multiple models and components of audit risks, it is clear that audit risks cannot be avoided because it is not possible to obtain absolute confirmation that all significant errors have been discovered without examining 100% of the transactions.

The audit risks are considered an important factor affecting the use of samples for auditing. The risk identification process is very accurate and difficult, but the risk assessment procedures do not provide sufficient and appropriate audit evidence upon which the auditor's opinion can be based.

In order to express an opinion, the risk identification procedures are supplemented by other auditing procedures such as control tests and detail tests. These last procedures are based on samples (Danescu & Oana, 2012).

The American Institute of Certified Public Accountants-AICPA defined statistical samples as: A sampling method has the following characteristics: (Michigan Department of Treasury Tax Compliance Bureau, 2015)

a. Random selection of sample items.

b. Use appropriate statistical technique to assess sample results, including measuring the risk of sampling. This is a non-statistical sampling method without the characteristics A and B above.

An audit of economic establishments deals with a large and broad set of data, and usually involves auditing of financial statements for a specific fiscal year. An ideal situation might involve checking all components of society from the accounting cycle, account balances and documents, but this will take time, effort, and very high cost. Without the use of the sampling technique, the audited unit must pay more to the auditors than usual.

Therefore, if the community audit procedures as a whole will be the effective strategy, then this will require more time, effort and higher cost, and that affects the efficiency of the audit. This makes audit sampling is necessary and essential to improve and develop the audit function (Danescu & Oana, 2012).

Samples are widely used in auditing as they provide the auditor the opportunity to obtain a sufficient and adequate minimum of audit evidence to form valid conclusions about the community. It is also known that taking audit samples reduces the risk of "excessive audit" in some areas, and allows for more efficient review of working papers in the audit phase of the audit work (ACCA, 2011). IFAC (2007) emphasizes that the auditor should infer whether the use of audit samples have provided, in the light of risk assessment and other completed procedures, a suitable basis for conclusions regarding the community examined and tested. If the auditor concludes that the use of audit samples did not provide a suitable basis for conclusions about the community, he should obtain additional audit evidence in the sense of increasing the size of the audit samples taken. Here ACCA (2011) concludes that the risk of samples is only the risk that the auditor’s conclusions will differ based on an auditing sample from his conclusions as to whether society as a whole is subject to the same auditing procedures.

The International Auditing and Assurance Standards Board - IAASB indicates in International Standard Auditing No. (ISA-530) that when specifying the sample size, the auditor should make it sufficient to reduce the risk of samples to the lowest acceptable level (IAASB, 2018). As the sample size is affected by the level of risk of the audit samples that the auditor wishes to accept. The lower the risk that the auditor wishes to accept, the greater the sample size will be (Auditing and Assurance Standards Board, 2006)

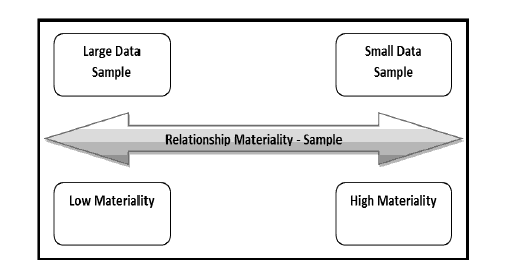

Danescu & Oana (2012) believe that Materiality is the permissible level of error that is acceptable when examining and reviewing account balances. Materialism is one of the factors that affect the sample size. The relationship between materialism and sample size is inverse, as the lower material determines a larger sample of data and the higher material leads to a smaller data sample in the audit. The following figure shows this relationship: as shows in Figure 3.

There is a risk that the audit evidence gathered by sampling methods may not be sufficient, appropriate, or effective. Here, the sample size should be increased, modified and developed so that the collected audit evidence is qualitative, relevant and sufficient.

Auditors must also benefit from judgment and professional experience to ensure that the opinion in the financial statements is fair, as there is a risk that the opinion given by the auditor is not correct or fair. Because if auditors do not obtain sufficient and appropriate evidence, there is a risk of not diagnosing physical errors or fraud. This causes an insufficient and unfair opinion from the auditor, which negatively affects the behavior and decisions of shareholders, investors, creditors, the public and other beneficiaries. This results in the auditors losing their prestige and negatively affecting the reputation of the audit firm (Danescu & Oana, 2012)

When designing an audit sample, the auditor must consider the aims of the audit procedures and the characteristics of the community from which the sample will be extracted (Auditing and Assurance Standards Board, 2006). The size of the audit sample can be determined by applying the statistical formula or by practicing professional judgment. There are several different factors that qualitatively affect the determination of the sample size - some of them have a positive effect and the other are negative in the sample size – which have similar effect when conditions are the same (IAASB, 2018). Perhaps the most important factors that affect the sample size are the materiality, audit risks, and community specifications.

The Audit Report

Duijm (2009) defines audit as the process of accumulating and evaluating evidence regarding the accounting information included in the financial statements to determine and report the degree of compatibility between that information and specific accounting standards. The audit falls within the broader concept of assurance or warranty service. Such a service is considered a professional service that improves the quality of information for decision makers who are the users of audited financial statements. Distorted accounting information resulting from intentionally biased reports makes the decision-making process for investors and creditors more difficult since the information become unreliable. Moreover, the use of unreliable information in the decision-making process can lead to substandard decisions by investors and creditors. That is, to enter the information risk zone. Against this risk, investors and creditors tend to demand an increase in their investment returns (dividends) and their loans (interest).

Therefore, the greater the information risks, the higher the capital costs (financing costs) of the companies issuing the financial reports. The audit of the financial statements supports the decision-making process for investors, creditors and others by improving the reliability of the accounting information used in this process. When users of financial reports consider that the

financial information is reliable, they will base their expectations - regarding future economic benefits from investment or lending activities - on the accounting information in these reports and use this information as it is in its full content in their decision-making process effectively and thus leading to increase the efficiency of the capital market. In addition, this will lead to lower risk levels and thus lower financing costs. In short, auditing financial statements increases the efficiency of the capital market and lowers its cost (Duijm, 2009). This gives the auditors a justification for raising their fees. Li, et al., (2008) believes that audit firms in developed economies may run a high risk of litigation when audit failures occur. Listed companies in China, for example, face increased litigation risks since the early 2000s, putting low-quality audit firms at risk due to government sanctions or complaints from investors and lenders. As it became available to them to file lawsuits enabling them to sue the audit firms due to any misleading disclosures. These recent legal developments have increased the risk of audit firms losing their wealth and reputation in the market.

Opinion shopping indicates the client's desire to ask other auditing firms to obtain a more acquiescent position when the current audit firm is likely to issue an unwanted audit opinion or when there are disputes regarding specific accounting issues. After successful achievement of opinion shopping activities, the client's management can dismiss its current audit firm - thereby preventing the possibility of issuing an unwanted audit opinion - and appoint a more subjective audit firm. However, when a mandatory period is determined for the audit firms, these firms have no longer need to worry about the disagreement with the customer’s management on specific accounting issues as a tenure guarantees secured for limited years. The required mandatory period can reduce the ability of the client company to threaten the current audit company with its dismissal. Shopping opinion will only pose a threat of intimidation to those parties who fear losing the customer. Generally speaking, opinion shopping does not currently constitute a threat to the major audit firms because of the large number of clients it has. It will inevitably not bother with losing one customer (Duijm, 2009).

The Satisfaction Index for Users of Accounting Information is regarded a measure of audit quality. That is, whenever the satisfaction of those users is sufficient with that accounting information, it indicates a high audit quality. The concept of external audit quality is multifaceted and gets the attention of all parties in the external audit environment. They are reporters of financial statements, their users, professional bodies, members of the accounting and auditing profession, and audit firms. As each of these parties has a concept on the quality of external audit that differs from the other party’s concept in terms of its goals and directions. The quality of the audit is generally defined as the degree of confidence that the external auditor provides to the users of the financial statements (AlUbaidi & Harees, 2017).

Pham (2017,) believes that there are various ideas and directions for setting definitions of audit quality, as the directions of these definitions can be classified into two approaches, namely: 1) auditors' probability of discovering and reporting errors, and 2) compliance level with auditing standards. The audit report is a statement of disclaimer from an independent external auditor, and issued by them as a result of the external audit. It is a confirmation or guarantee service that enables the user to make decisions based on the results of the audit work included in the audit report ①

Many entities rely on auditors' reports to validate their information in order to attract investors, obtain loans, and improve the company's overall appearance. It has been emphasized that financial information without an auditor's report is "fundamentally worthless" for investment purposes and others. It should be noted that the auditor's reports on the financial statements are neither an assessment nor a measure of the company's revenue capacity during the period nor a judgment used to evaluate the companies in order to make a decision. However, the report is merely an opinion of whether the information provided is correct and free of fundamental errors, while all other decisions are left for the user to decide. The external auditor's report is nothing but a written letter from him containing an opinion as to whether the company's financial statements conform to the accepted accounting principles in general. it is only a measure of the reliability of the financial statements, and this report is usually published with the company's annual report ②

Investors use audit reports and audited financial statements to assess the financial performance of the company and the financial position of their investment opportunity. It is also used by the government agency to assess the completeness and accuracy of the tax declaration. Shareholders and the Board of Directors also use the audit report to assess the integrity of the management and the transparency of the financial statements.The auditor's report is the evidence and guarantor that can prove to the government that the company is complying with the law. The auditor is required to determine in their report the extent of the company's continued existence and work or not. This includes potential financial and non-financial problems that could lead the company to face bankruptcy and liquidation in the expected future period following the date of the audit report.

The different types of audit reports contain different opinions of the auditors due to the different errors in the financial statements. That is, the different types of audit reports represent different levels of assurance provided to the beneficiaries.

Auditors must have the full right to access any kind of information that could assist them in obtaining audit evidence to express their opinion properly. In practice, however, time constraints may be considered one of the most important constraints or limitations facing auditors. As they do not have sufficient time to perform full tests and collect a lot of evidence, they are forced to use the auditing samples method.③

Due to the importance of the audit report; The International Auditing and Assurance Standards Board-IAASB has assigned a set of auditing standards no. (700-799) to the results of the Audit Conclusions and Reporting. They contained six standards in numbers (720,710,706,705,701,700) addressed all the details related to the results of the auditing process and the auditor's conclusions included in the audit report which represents the goal and purpose of the auditing process and the reason for the existence of the auditing profession.

Testing Research Hypotheses

To test the research hypotheses and achieve its goal, a questionnaire was designed to take opinions of the external auditors working in different auditing offices and companies in Iraq. The total number of the research sample was (20) first-class external auditors, who were randomly chosen. The questionnaire was distributed and collected personally by the researcher. The questionnaire consisted of (20) items distributed equally on two axes. Each of which tests one of the two research hypotheses. To reject or accept the two research hypotheses, data was collected and analyzed as follow:

Testing the First Hypothesis: (There is a Relationship between the Audit Fees and the Size of the Audit Sample)

This hypothesis has been tested by relying on the first ten questionnaire items of the first axis, from (1) to (10). The answers of the respondents can be summarized by analyzing the frequencies and ratios of those answers according to the average and the standard deviation for each of them and for the total (see Table 1) to check the extent of proving or rejecting the first hypothesis:

| Table 1 |

|---|