Research Article: 2022 Vol: 21 Issue: 4S

The Role of Opportunity Exploration, Exploitation, And Entrepreneurial Intentions of the People in the Mekong River Delta

Phan Anh Tu, Can Tho University

Tran Thi Hoang Mai, Vinh University

Nguyen Van Song, Vietnam National University of Agriculture (VNUA)

Chau Thi Le Duyen, Can Tho University

Tran Thi My Phuong, An Giang University, Viet Nam Nguyen Dang Que, National Academy of Public Administration

Nguyen Cong Tiep, Vietnam National University of Agriculture (VNUA)

Nguyen Thi Xuan Huong, Vietnam National University of Forestry (VNUF)

Citation Information: Tu, P.A., Mai, T.T.H., Song, N.V., Duyen, C.L.T., Phuong,T.T.M., Que, N.D., & Huong, N.T.X. (2022). The role of opportunity exploration, exploitation, and entrepreneurial intentions of the people in the mekong river delta. Academy of Strategic Management Journal, 21(S4), 1-17.

Abstract

The business environment always contains opportunities that affect almost the entire entrepreneurship process. Several scholars have been researching how to take advantage of opportunities in creating a business. This study analyzes determinants of the exploration, business opportunity exploitation, and entrepreneurial intentions of 447 people who have never started a place in the Mekong River Delta. Based on the opportunity-based theory and applied the Structural Equation Model (SEM) results, we find strong evidence that opportunity exploration positively impacts opportunity exploitation. At the same time, opportunity exploitation has a positive effect on entrepreneurial intention. This study aims to arouse the people's entrepreneurial spirit in particular and support the policymakers in devising the locality's entrepreneurship policy in general.

Keywords

Entrepreneurial Intention, Opportunity Exploration, Exploitation, Mekong River Delta (MRD)

Introduction

Entrepreneurship has gained economists and the government's attention from the central to local levels, educational institutions, and especially researchers. If in the world, countries such as the US, Australia, Venezuela, and Peru lead in start-up activities, then in Asia, the Philippines, China, and India are the three countries with the highest rate of starting a business. In Vietnam, as reported by GEM Vietnam (2017), the rate of business activity in the start-up period has increased significantly, reaching 23.3%, higher than the average of 16.4% in countries developing based on resources. This also shows that in recent years, Vietnam's business environment is getting more and more prosperous. More and more people intend to start businesses to create jobs for themselves, increase income sources, and eliminate unemployment when the job market is getting more difficult.

However, the business environment always contains many (new) opportunities and challenges that entrepreneurs need to identify, promptly grasp, and exploit opportunities well, thereby promoting their competitive advantage and growth in their start-ups (Burgelman & Grove, 2007). Venkataraman (1997) defines entrepreneurship as the discovery, evaluation, and well-exploitation of opportunities to develop products and services in the future. Opportunity exploration and exploitation are two independent concepts. According to March (1991), opportunity exploration refers to finding new opportunities, experimenting, and finding differences, while opportunity exploitation refers to investing in internal resources, organizational knowledge, and learning resources, transforming organizational structure to increase adaptability (Michailova et al., 2013).

Although psychological theory, in particular Ajzen (1991) 's theory of planning behavior, does emphasize the vital role of personal characteristics of entrepreneurs such as attitudes, subjective norms, and behavior control influencing on entrepreneurial intentions and that is researched in many places such as in Vietnam (Phan Anh Tu & Giang Thi Cam Tien, 2014), South Africa (Nieuwenhuizen & Swanepoel, 2015), Malaysia (Kadir et al., 2012), Scandinavia and the United States (Autio et al., 2001), or Norway (Kolvereid, 1996). However, this theory neglects or mentions little about the vital role of context factors, for example, the business environment (Kolvereid, 1996; Carr & Sequeira, 2007; Walter & Dohse, 2009). Entrepreneurship competence theory emphasizes the importance of entrepreneurial motivation based on necessity (instead of starting a business because of available opportunity). In which, the hypothesis is proposed that intentions and chances are two particular components. This theory also states that entrepreneurship will develop entrepreneurial meanings depending on the accumulated capacity from a self-awareness of thinking and action and adapting to the business environment. From that, it is possible to improve the capacity to explore and exploit opportunities. The higher adaptive capacity will lead to a higher ability to explore and exploit opportunities and higher entrepreneurial intentions (Mishra & Zachary, 2014).

Therefore, based on the theory of opportunity-based entrepreneurship, we argue that opportunity comes before the intention when considering opportunity as an exogenous factor and whether an individual can grasp the opportunities, explore and exploit opportunities to realize entrepreneurial intentions will depend on the individual's cognitive ability. This also implies that the ability to recognize opportunities may is a constituent component of entrepreneurial competence. In summary, this study aims to analyze factors affecting the ability to explore and exploit business opportunities and people's entrepreneurial intentions in the Mekong River Delta (Mekong Delta). The research results have at least two crucial theoretical and practical contributions. First, the research emphasizes the importance of business environment characteristics impacting exploring and exploiting business opportunities. Second, it contributes more empirical data and expands the theory of opportunity-based entrepreneurship by highlighting how the opportunity exploration process affects entrepreneurial intentions mediated by the role of opportunity exploitation.

The structure of this paper consists of four parts. Part one is an introduction. Part two is a theoretical basis. Next come the results and discussion. The conclusion is the last part.

Literature Review and Hypothesis Development

Opportunity-Based Theory

This theory emphasizes that business opportunities are situations where goods, services, materials, markets, and other business organizational methods are created for for-profit purposes (Shane & Venkataraman, 2000). This depends a lot on the entrepreneur, especially the ability to identify the most profitable opportunity and utilize resources to exploit opportunities most effectively.

The opportunity also has its unique characteristics and affects almost the entire entrepreneurship process. For example, some of the opportunities related to modern science are relatively complex, so they are fertile ground for a few entrepreneurs with the potential to see and evaluate the profits that it brings (Zucker et al., 2002). Also, opportunities affect the organizational processes of the business. For example, an extremely capital-intensive opportunity (e.g. car production) requires massive capital mobilization to launch products, compared to a shirt-making company that only needs a few small capitals. This affects car manufacturers' organizational processes that require many papers and contracts with related parties and require many complicated policies and regulations. That is why, although opportunities can be identified, they are difficult to exploit. Many entrepreneurs can recognize the same business opportunity, but a few have enough abilities to exploit it.

Explore and exploit business opportunities. Stevenson, et al., (1985) concluded that exploring and exploiting business opportunities is an entrepreneur's most important capability to build a successful business. Business opportunities can exist in any environment and at any time. Entrepreneurs need to explore new opportunities for their products and services and create and experience breakthrough ideas. Business opportunity exploration is also described as actively participating in business-related jobs, for example, experimenting with new methods and processes or researching and improving products or services. Or they are looking for new markets and new opportunities (Laureiro-Martínez, Brusoni & Zollo, 2010). Therefore, a person who wants to explore opportunity is inseparable from experience, and it is a process that an entrepreneur has to engage in difficulties to generate ideas.

Therefore, exploiting a business opportunity is not instantaneous. Still, the result of pursuit is the preparation that sometimes the results may not be as expected when the opportunity does not come at the right time. According to Casson (1982), to exploit the opportunity, an entrepreneur must believe that the value of resources combined by each means will be much more efficient than exploited in current methods. In general, exploring and exploiting business opportunities is one of the first and most important factors in starting a successful business. To explore and exploit the right business opportunity, it is necessary to have the right combination of business resources at a particular time.

Entrepreneurial Intentions

Entrepreneurial behavior is challenging to observe, as it is time-lagging and unpredictable (Souitaris, Zerbinati & Al Laham, 2007). Intention also shows an individual's motivation to take action according to a pre-perceived plan (or decision) (Conner & Armitage, 1998). The intention is often used as a behavioural prognostic variable in sociological psychology and the first step to start a business (Krueger, 1993). Furthermore, it is essential to understand the process of generating an entrepreneurial intention before observing the entrepreneurial action, especially in line with efforts to promote entrepreneurship (Linan & Chen, 2009; Kibler, 2013).

Entrepreneurial intention is defined as an individual's intention to start a business, a state that motivates the individual to decide to create a new business (Li et al., 2008; Miranda et al., 2017). Entrepreneurial intentions are the intentions of an individual who intends to participate in entrepreneurial behaviours. Entrepreneurship intention is considered an essential ingredient in understanding the process of starting a new business (Ao & Liu, 2014). The entrepreneurial process is considered to be the activities that individual efforts to explore opportunities, build a business plan, gather the necessary resources and relationships and seek the right environment to create a business venture. Entrepreneurial intention is crucial for understanding the entrepreneurial process and creating business risks with durability and sustainability (Bird, 1988; Kolvereid, 2016).

Therefore, the intention is considered as an important bridge between the dream of entrepreneurship. Besides, the realization of that dream still shows that trend despite being worse or better. Without intention, an opportunity is either meaningless or otherwise. However, an individual's entrepreneurial intention or a group is often assumed to be independent and separate from entrepreneurial opportunity (Mishra & Zachary, 2014). Moreover, instead of individual characteristics or perceptions, the social context strongly impacts entrepreneurial intention, especially the suitability of each individual's adaptability in specific social contexts (Linksvayer & Janssen, 2008).

Hypothesis DevelopmentMany empirical studies have found the impact of the macroeconomic environment and market fluctuations, that the development of technology is the origin of business opportunity (Schumpeter, 1934; Sheperd et al., 2007). According to Aldrich (1979), factors from the external environment include (1) The dynamism of the market, (2) the complexity of the market, and (3) The munificence of the market.

Market Dynamics

Researchers characterize the dynamic environment to include rapid and unpredictable changes, which increase uncertainty for individuals and businesses operating in that environment (Duncan, 1972). In line with this view, Dess & Beard (1984) argued that market turbulence originated from the market's dynamics and complexity due to unforeseen consumer demand changes. The market's dynamism firstly causes many disadvantages for entrepreneurs and businesses because it is difficult to predict the next market movement accurately, and the response plan is only temporary. This is also the barrier to market entry for some enterprises (Zahra, 1991). On the other hand, Shane & Venkaraman (2000) argued that the dynamic environment is a favourable condition to generate business opportunities. Therefore, the more active the environment is the more opportunities there are, and the higher the ability to identify business opportunities is.

Hypothesis H1: Market dynamism positively impacts business opportunity exploration of the people in the Mekong River Delta.

Market Munificence

The market's munificence refers to the preference of the business's environment in terms of providing available opportunities and resources (Aldrich, 1979; Dess & Beard, 1984). So this feature is always sought by companies to serve their needs for stability and growth. This is because resources in this environment influence firms' ability to enter the market (Randolph & Dess, 1984). If the market's munificence is too low, there will be few resources for businesses to use and fewer business opportunities.

Consequently, this affects the survival of the business. In turn, the more munificent the market is, the more resources will be available for businesses to exploit. Similarly, the more opportunities there are in the munificent market, the easier it is for businesses to explore business opportunities.

Hypothesis H2: Market munificence has a positive impact on the Mekong River Delta people's business opportunity exploration.

Funding support

Resource-Based Entrepreneurship Theories stated that founders' access to resources is an essential predictor of entrepreneurial behaviour since opportunity and growth come from integrating (new) resources (Alvarez & Busenitz, 2001). According to The Financial Capital/Liquidity Theory), people with financial capital are more likely to acquire the resources to exploit business opportunities and start companies effectively (Davidson & Honing, 2003).

The majority of financial support focuses on existing businesses with the convenient operation; little funds are available to the nascent businesses (National Venture Capital Association, 2007). Meanwhile, capital is an indispensable factor that motivates entrepreneurs to pursue their entrepreneurial dream confidently. An unstable financial status will not help entrepreneurs to conduct market research to find new opportunities and trends. Therefore, financial support from governmental agencies, private organizations, individuals, and families will enable entrepreneurs to identify business opportunities.

Hypothesis H3: Funding support positively impacts business opportunity exploration of the people in the Mekong River Delta.

Market Diversification

Mintzberge (1979) defines market diversification or complexity as the number and abundance of information sources, knowledge, resources, and competencies required to operate a business successfully in an environment. For this reason, when entering the market, each enterprise must be flexible in its operational system, manufacturing, and marketing activities to meet customers' shopping habits in that target market (Zahra et al., 1999). On the other hand, a diversified market is also an advantage for well-prepared businesses. Complicated markets promote the exploration of entrepreneurial opportunities (Aldrich, 1979).

Hypothesis H4: Market diversification has a positive impact on the Mekong River Delta people's business opportunity exploration.

Opportunity Exploration

Exploring a business opportunity depends upon one's abilities and cognitive processes, which is the diligence to analyze and process new information and carefully investigate market needs (Gielnik et al., 2014). If a business opportunity has not been explored yet, individuals or businesses cannot propose a suitable method to exploit that opportunity effectively. March (1991) emphasizes that selection, implementation, and efficiency are used to explore the sustainable elements; unknown ones must be explored by searching, experimentation, and transformation. Entrepreneurs who increase the degree of proactively exploring the environment will be more likely to identify new opportunities and exploit or modify their existing business ideas. Therefore, identified business opportunities will be the foundation for exploiting business opportunities.

Hypothesis H5: Opportunity exploration has a positive impact on the Mekong River Delta people's opportunity exploitation.

Opportunity Exploitation

If we just stop exploring business opportunities, there will be many vague ideas, many undeveloped capabilities (March, 1991). Focusing on exploiting opportunities will utilize the resources available in the business and the market to create outstanding changes and improvements for the business. Edelman & Yli-Renko (2010) also conclude that the stronger the perception of opportunity will increase the intention to create a new business. In other words, opportunity exploitation is a factor that stimulates individuals to build their own business.

Hypothesis H6: Opportunities Exploitation positively impacts people's entrepreneurial intentions in the Mekong River Delta.

Methodology

Data

This study was conducted with two main steps, (1) preliminary research and (2) formal survey. Before we conducted an official survey for the fourth province, we performed different surveys on graduates from Can Tho University, Can Tho University of Technology, and An Giang University. Such a pilot study helps us modify questionnaires concerning logical sense, coherent and understandable issues, and measurements. Next, survey samples were collected in four provinces/cities, including Can Tho, Kiên Giang (Rach Gia City), Soc Trang, and Ca Mau from 2016 to 2018. These provinces have successful entrepreneurship models. Moreover, they are also considered as places with rapid growth in the entrepreneurship movement in recent years. Respondents are people who have never started a business, including students, governmental staff, and workers. The direct interview method (face-to-face) was used for a sample size of 447 respondents with sufficient information. A convenient sample method was conducted in this study by the non-probabilistic method, and the sample size fluctuates due to objective factors such as costs and accessibility to respondents. In each province/city, the sample is selected according to the non-probability sampling method by the judgment method with the proportion of the population living in the area. According to the non-probability sampling method, the selection is consistent with the probability of entrepreneurship of people anywhere. The hypothesis is proposed when natural conditions and socio-economic development policies of localities in the Mekong River Delta are quite similar.

Measurement and Analysis

This study uses a linear Structural Equation Model (SEM) to test mediated effects of the complex relationship between opportunity-exploration, opportunity-exploitation, and entreprenurial intention. By doing so, the scale reliability by Cronbach's Alpha coefficients, Factor Analysis (EFA), Confirmation Factor Analysis (CFA), and Linear Structural Model (SEM) are conducted. We use the 5-level Likert scales (from 1-Strongly disagree to 5-Strongly agree) to measure variables (see Tables 2-8, section 4.2).

The research model includes multidirectional research concepts. The study tests the reliability of the scale, and if Cronbach's Alpha is>or=0.6, then it is an acceptable scale (Nunnally & Berndstein, 1994). Next, the study analyzes EFA. It is essential to consider some factors in EFA analysis results: the number of factors extracted and the factor loading coefficient of the variables must be ≥ 0.5 (Hair et al., 1998). Furthermore, 0.5 ≤ KMO ≤ 1 indicates that EFA analysis is appropriate (Kaiser, 1974). Next, Bartlett's test must have a sig coefficient<0.05 (indicating that the observed variables are compatible in the population). Finally, the total variance extracted must be ≥ 50% (Anderson & Gerbing, 1988).

After performing the EFA analysis, the study conducted a CFA confirmation factor analysis. The next was a linear structural model test (CB-SEM), including convergent value testing and the scale's distinguishing value to measure the model's appropriateness in the study area. Establishing the validity and reliability of scales in Confirmation Factor Analysis (CFA) is based on the following values: Composite Reliability (CR), Average Variance Extracted (AVE), Maximum Shared Variance (MSV) and Average Shared Variance (ASV). The thresholds for these values should meet the following requirements: CR> 0.7; AVE> 0.5; MSV<AVE and the square root of AVE> correlations between the two concepts (Hair et al., 2010).

Testing the results of the SEM model is also based on CFI (Comparative Fit Index), GFI (Goodness of Fix Index) and TLI (Tucker & Lewis Index), which are recommended to be greater than or equal to 0.9 (Bentler & Bonett, 1980) and RMSEA (Root Mean Square Error Approximation) less than 0.08 (Rex B Kline, 2005) and Chi-square/df (cmin/df)<3 is good,<5 acceptable sometimes (Hair et al., 2010). The results of the linear structural equation model will explain the direct, indirect, positive, and opposite relationships of the research concepts in the research model.

Results and Discussion

Cronbach’s Alpha Testing

The study surveyed people in the Mekong River Delta. Specifically, observations were collected in four provinces/cities, including Can Tho, Kien Giang (Rach Gia City), Soc Trang, and Ca Mau. The number of observations concentrated most in Can Tho city, which accounted for more than 43%, followed by Ca Mau city with 29% and finally Soc Trang city and Kien Giang (Rach Gia city) 13% province. The observation distribution with the above proportion is mainly due to the convenient non-probability sampling method assuming that the probability of entrepreneurship is not too different when the number of new enterprises tends to concentrate in big cities.

The number of observations detailed for each province is shown in the following Table 1:

| Table 1 Statistics by province/city |

||

|---|---|---|

| Province | Frequency | Percentage |

| Ca Mau | 130 | 29.1 |

| Can Tho | 195 | 43.6 |

| Kien Giang | 60 | 13.4 |

| Soc Trang | 62 | 13.9 |

| Total | 447 | 100.0 |

Source: Own survey (2019)

Also, the study classified the observations interviewed in the survey region with the same gender ratio. The female observations account for 53.7%, and male observations account for 46.3%. There is not much difference in gender in the sample.

| Table 2 Sample statistics by gender |

||

|---|---|---|

| Gender | Frequency | Percentage |

| Male | 207 | 46.3 |

| Female | 240 | 53.7 |

| Total | 447 | 100.0 |

Source: Own survey (2019)

After describing the research sample, then the study tests each step according to the research process. First, the study conducts a Cronbach’s Alpha test for each concept

| Table 3 Cronbach’s alpha reliability test |

|

|---|---|

| Variables | Cronbach’s Alpha |

| Entrepreneurial Intention | 0.822 |

| EO1 | 0.788 |

| EO2 | 0.794 |

| EO3 | 0.777 |

| EO4 | 0.783 |

| EO5 | 0.784 |

| Opportunity exploitation | 0.694 |

| KT2 | 0.555 |

| KT4 | 0.736 |

| KT1 | 0.649 |

| KT3 | 0.537 |

| Market dynamics | 0.642 |

| ND10 | 0.614 |

| ND8 | 0.767 |

| ND12 | 0.613 |

| ND2 | 0.61 |

| Market munificence | 0.695 |

| M4 | 0.809 |

| M3 | 0.761 |

| Funding support | 0.642 |

| V1 | 0.745 |

| V2 | 0.912 |

| V3 | 0.784 |

| Market diversification | 0.813 |

| DD2 | 0.791 |

| DD30 | 0.745 |

| DD4 | 0.747 |

| DD1 | 0.769 |

| Opportunity exploration | 0.657 |

| NDD2 | 0.623 |

| NDD1 | 0.646 |

| NDD4 | 0.64 |

Source: Own survey (2019)

Cronbach's alpha analysis results of seven research concepts are presented in Table 3. It shows that the scales of the research concepts all meet the requirements with the smallest total variable correlation coefficient of 0.537 and the largest is. 0.912. The scales are sequentially satisfactory; in particular, the scale of the entrepreneurial intention has an alpha coefficient of 0.822, business opportunities exploitation with an alpha coefficient of 0.694, the dynamics of the market with an alpha coefficient of 0.642, the munificence of market with an alpha coefficient of 0.695, funding support with an alpha coefficient of 0.642, the complexity of market with an alpha coefficient of 0.813, and business opportunity exploitation with an alpha coefficient of 0.657.

Next, before we conduct exploratory factor analysis we applied Harman’s (1967) single factor test to assess whether or not our data feature significant common variance. The result of unrotated factor analysis using the Eigen-value-greater-than-one criterion revealed seven factors with the first factor explaining 15.63% smaller than 50% threshold value. If a substantial amount of common-method variance were presence, the factor analysis may lead to a single factor accounting for the majority of the covariance among the variables. Therefore, common-method bias does not matter in our case.

After testing common-method bias, we conducted the exploratory factor analysis for the sample, followed by the confirmation factor analysis and finally the linear structural model (SEM) analysis to test research hypotheses and research models on entrepreneurship intentions of people in the Mekong River Delta with relevant concepts.

Results of Exploratory Factor Analysis

Exploratory factor analysis is conducted on the dynamics of the market, business opportunity exploration, the market's munificence, the funding support, the complexity of the market, the business opportunity exploitation, and entrepreneurial intention. The factor groups are extracted, and obtain the appropriate factor weights.

First, the concept of market dynamics is assessed by exploratory factor analysis EFA.

The Market Dynamics

| Table 4 The factor weights of the market dynamics |

|

|---|---|

| Variables | Factors |

| ND10 | 0.735 |

| ND8 | 0.722 |

| ND12 | 0.625 |

| ND2 | 0.567 |

| P value (Bartlett Testing) | 0.000 |

| KMO | 0.668 |

| Eigenvalue | 1.775 |

| Extracted variance (%) | 54.366 |

Source: Own survey (2019)

The EFA results show four factors extracted in Eigenvalue 1,775, and the total variance extracted is 54.36%. The factor weights of the scales are satisfactory (> .50). Thus, the concept of Market dynamics is measured by the following Five-point Likert-scales:

ND10. Price competition in the entrepreneurship industry is fierce.

ND8. The business industry is hazardous, so that a wrong decision will threaten the survival of your business.

ND12. There are many changes in technological and technical innovations in the industry.

ND2. The failure rate in your upcoming startup is high.

Opportunity Exploration

Research continues to analyze the exploring factor for the concept of Business opportunity exploration. The three extracted factors with Eigenvalue are 2.101> 1, and the variance is 70.05%. The factor coefficients are all greater than 0.50. The scale is satisfactory (Table 5).

| Table 5 The factor weights of opportunity exploration |

|

|---|---|

| Variables | Factors |

| NDD2 | 0.843 |

| NDD1 | 0.837 |

| NDD4 | 0.831 |

| Pvalue (Bartlett testing) | 0.000 |

| KMO | 0.706 |

| Eigenvalue | 2.101 |

| Extracted variance (%) | 70.046 |

Source: Own survey (2019)

And thus, the concept of Business opportunity exploration is measured by the following Five-point Likert-scales:

NDD2. I can explore a variety of business opportunities and make a plan to seize them.

NDD1. I can recognize new business opportunities in the industry and areas that I have never experienced before.

NDD4. I can identify new product and service opportunities in new markets.

The Munificence of the Market

Similarly, the concept of Market munificence includes two factors in which the factor weight is greater than 0.50, and Eigenvalue is 1.533> 1, a variance is 76.65%. The scale is satisfactory (Table 6).

| Table 6 The factor weights of the market munificence |

|

|---|---|

| Variables | Factors |

| M4 | 0.876 |

| M3 | 0.876 |

| P value (Bartlett testing) | 0.000 |

| KMO | 0.500 |

| Eigenvalue | 1.533 |

| Extracted variance (%) | 76.653 |

Source: Own survey (2019)

And thus, the concept of Market munificence is measured by the following Five-point Likert-scales scales:

M4. Law encourages the establishment of new businesses.

M3. The city government always has the right policies to facilitate the development of businesses/businesses.

Funding Support

| Table 7 The factor weights of funding support |

|

|---|---|

| Variables | Factors |

| V1 | 0.858 |

| V2 | 0.839 |

| V3 | 0.578 |

| Pvalue (Bartlett testing) | 0.000 |

| KMO | 0.577 |

| Eigenvalue | 1.775 |

| Extracted variance (%) | 59.165 |

Source: Own survey (2019)

The EFA results show three factors extracted in Eigenvalue 1,775, and the total variance extracted is 59.16%. The factor weights of the scales are satisfactory (> 0.50). As such, the concept of funding support is measured by the following Five-point Likert-scales:

V1. It's easy to get business capital from friends and relatives

V2. Small business households can be supported with loans by banks, credit funds, and other financial institutions in many ways.

V3. Banks are willing to loan start-up capital.

Market Diversification

The EFA results of the concept of Market diversification show that four factors extracted in Eigenvalue are 1,775, and the total variance extracted is 59.16%. The factor weights of the scales are satisfactory (Table 8).

| Table 8 The factor weights of the market diversification |

|

|---|---|

| Variables | Factors |

| DD2 | 0.829 |

| DD3 | 0.825 |

| DD4 | 0.791 |

| DD1 | 0.755 |

| P value (Bartlett testing) | 0.000 |

| KMO | 0.801 |

| Eigenvalue | 2.564 |

| Extracted variance (%) | 64.110 |

Source: Own survey (2019)

And thus, the concept of Market diversification is measured by the following Five-point Likert-scales:

DD2. Customers have different shopping and consuming habits.

DD3. Activities and types of business in the current market are quite diversified.

DD4. Every entrepreneur targets different groups of customers based on their shopping and consumption preferences.

DD1. Every entrepreneur has different advertising and marketing plans to promote their image.

Opportunity Exploitation

| Table 9 The factor weights of opportunity exploitation |

|

|---|---|

| Variables | Factors |

| KT2 | 0.730 |

| KT4 | 0.714 |

| KT1 | 0.705 |

| KT3 | 0.670 |

| P value (Bartlett testing) | 0.000 |

| KMO | 0.686 |

| Eigenvalue | 1.989 |

| Extracted variance (%) | 49.728 |

Source: Own survey (2019)

EFA analysis of the concept of business opportunity exploitation shows that three factors extracted in Eigenvalue are 1,775, and the total variance is 59.16%. The factor weights of the scales are satisfactory (> 0.50). Thus, the concept of Business opportunity exploitation is measured by the following Five-point Likert-scales:

KT2. I always know how to please customers.

KT4. It takes basic knowledge to start a business, such as finance, marketing, and management.

KT1. I have extensive market insights, such as supplier relationships.

KT3. I am used to dealing with the problems my customers come across.

Entrepreneurial Intention

The last of the exploratory factor analysis of EFA is the concept of entrepreneurial intention consisting of five factors, which are extracted as follows (Table 10):

| Table 10 The factor weights of entrepreneurial intention |

|

|---|---|

| Variables | Factors |

| EO1 | 0.788 |

| EO2 | 0.767 |

| EO3 | 0.766 |

| EO4 | 0.757 |

| EO5 | 0.741 |

| Pvalue (Bartlett testing) | 0.000 |

| KMO | 0.840 |

| Eigenvalue | 2.918 |

| Extracted variance (%) | 58.376 |

Source: Own survey (2019)

KMO and Bartlett's testing presents that the concept Entrepreneurial intention with Eigenvalue=2,918> 1 and the variance extracted is 58,376> 50%. This shows that the concept of Entrepreneurial intention is a latent variable measured by five observed variables from EO1 to EO5, converging on a group. The survey data values show that the concept is appropriate for the theory based on the survey data in the research market (the people of the Mekong River Delta)

Thus, the concept of entrepreneurial intention is measured by the following Five-point Likert-scales:

EO1. I made every effort to start and run my own business.

EO2. My career goal is to become an entrepreneur.

EO3. I was seriously thinking about starting a business.

EO4. I am sure to start a business in the future regardless of whether I already have a business.

EO5. I am ready to do anything to start a business.

After conducting the exploratory factor analysis, the study continued a confirmation factor analysis for the concepts in the research model to reconfirm whether the scale of research concepts is consistent with the market data or not and to consider uni-direction, convergence values, and discriminant values of scales on the Mekong River Delta data set.

Confirming Factor Analysis Results (CFA)

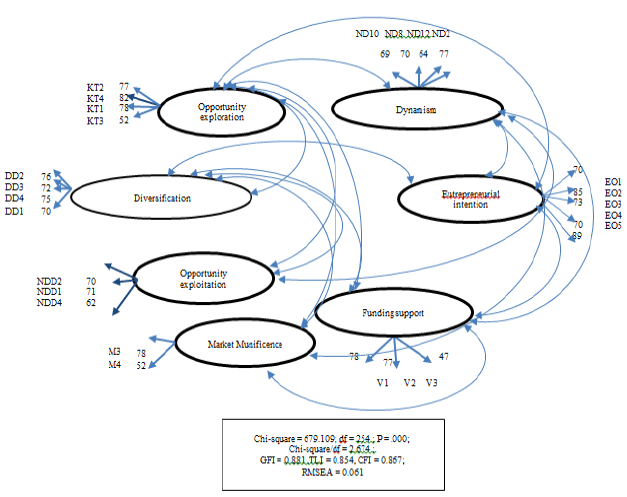

Testing the discriminatory value of the component concepts in each concept shows good discrimination of the model's concepts. CFA results of the critical measurement model are shown in the figure below with the following results: the model has Chi-square=679.109 (p=0.000), CMIN/df=2.674<3. The indicators: TLI, CFI: 0.881, 0.854, and 0.867, all greater than 0.8, are considered an appropriate model. If the coefficients are greater than 0.9, the model is considered to be satisfactory. ; and RSMEA=0.056<0.08 according to Hair, et al., (2010); Forza & Filippini (1998); Greenspoon & Saklofske (1998); Awang (2012). The study concludes that the model is consistent with market data.

Source: Own survey (2019)

The analysis results in Table 11 on the model's discriminatory validity testing show that all relationships in the model, the p-values of the remaining associations varied from 0.000 to 0.012. All less than 0.05, so the correlation coefficients of these pairs of concepts differ from 1 at 95% confidence level, so they achieve discriminatory validity (Table 12).

| Table 11 Results of discriminatory validity testing of the full model |

||||||

|---|---|---|---|---|---|---|

| Relationships | Estimates | SE | CR | P-value | ||

| ND | ó | M | 0.086 | 0.021 | 4.076 | *** |

| ND | ó | V | 0.044 | 0.017 | 2.655 | 0.008 |

| ND | ó | DD | 0.097 | 0.021 | 4.572 | *** |

| ND | ó | NDD | 0.14 | 0.028 | 4.959 | *** |

| ND | ó | KT | 0.037 | 0.015 | 2.501 | 0.012 |

| ND | ó | EO | 0.061 | 0.017 | 3.551 | *** |

| V | ó | M | 0.179 | 0.033 | 5.386 | *** |

| DD | ó | M | 0.112 | 0.027 | 4.1 | *** |

| M | ó | NDD | 0.217 | 0.036 | 6.094 | *** |

| M | ó | KT | 0.117 | 0.027 | 4.288 | *** |

| M | ó | EO | 0.151 | 0.029 | 5.125 | *** |

| V | ó | DD | 0.08 | 0.026 | 3.118 | 0.002 |

| V | ó | NDD | 0.137 | 0.032 | 4.306 | *** |

| V | ó | KT | 0.19 | 0.031 | 6.161 | *** |

| V | ó | EO | 0.11 | 0.027 | 4.009 | *** |

| DD | ó | NDD | 0.155 | 0.03 | 5.258 | *** |

| DD | ó | KT | 0.225 | 0.03 | 7.513 | *** |

| DD | ó | EO | 0.24 | 0.031 | 7.728 | *** |

| NDD | ó | KT | 0.116 | 0.028 | 4.139 | *** |

| NDD | ó | EO | 0.216 | 0.033 | 6.628 | *** |

| KT | ó | EO | 0.216 | 0.03 | 7.281 | *** |

Source: Own survey (2019)

| Table 12 The results of testing the reliability, convergence value and differentiating value of the scale |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| CR | AVE | MSV | SQRTAVE | EO | ND | M | V | DD | NDD | KT | |

| EO | 0.821 | 0.580 | 0.361 | 0.761 | 1.000 | ||||||

| ND | 0.775 | 0.559 | 0.370 | 0.748 | 0.599 | 1.000 | |||||

| M | 0.795 | 0.533 | 0.217 | 0.730 | 0.564 | 0.621 | 1.000 | ||||

| V | 0.786 | 0.543 | 0.265 | 0.737 | 0.558 | 0.509 | 0.420 | 1.000 | |||

| DD | 0.815 | 0.525 | 0.423 | 0.724 | 0.599 | 0.689 | 0.579 | 0.595 | 1.000 | ||

| NDD | 0.786 | 0.551 | 0.370 | 0.742 | 0.662 | 0.608 | 0.666 | 0.586 | 0.545 | 1.000 | |

| KT | 0.760 | 0.528 | 0.423 | 0.727 | 0.601 | 0.507 | 0.526 | 0.515 | 0.650 | 0.589 | 1.000 |

Source: Own survey (2019)

According to the research data, the scales' reliability, convergence value, and discriminant value are presented in Table 10. The results show that the scale gains reliability with CR (Composite Reliability) criteria.>0.7, convergence is shown in the coefficient of AVE (Average Variance Extracted)> 0.5. The discriminant value is met (Hair et al., 2010). Therefore, the study concludes that the research model's concepts all gain reliability, discriminant value, and convergent value.

In general, the model CFA results measured the relationship between entrepreneurial intention, market complexity, market munificence, funding support, market dynamics, business opportunity exploration and exploitation, and all are consistent with the market data collected in the Mekong River Delta.

SEM Result

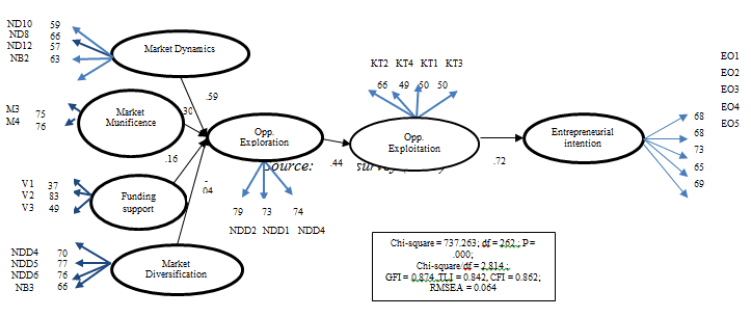

Therefore, based on the discussions above, the scales in this research’s theoretical model have been evaluated, resulting in consistent market data. The following is the test of the research model at the same time by the SEM linear structure model (See Figure 2)

Figure 2 shows the results of testing the theoretical model with 262 degrees of freedom, chi-square=737.263; df=262; P=0.000; Chi-square/df=2.814; The indexes are GFI=0.874, TLI=0.842, CFI=0.862; all greater than 0.8 are considered as an appropriate model, if the coefficients are greater than 0.9, the model is considered satisfactory; and RSMEA=0.064<0.08 according to Hair, et al., (2010), Forza & Filippini (1998); Greenspoon & Saklofske (1998); Awang (2012). This result confirms the model to be consistent with the market data.

Testing the Hypotheses

The relationship between the factors in the research model is presented in Table 13.

| Table 13 Regression Coefficients |

||||||

|---|---|---|---|---|---|---|

| Theory | Relationships | Estimates | P | Hypo-theses | ||

| SEM | ||||||

| H1 | Opportunity exploration | <--- | Market dynamics | 0.586 | *** | accepted |

| H2 | Opportunity exploration | <--- | Market munificence | 0.297 | *** | accepted |

| H3 | Opportunity exploration | <--- | Funding support | 0.157 | 0.016 | accepted |

| H4 | Opportunity exploration | <--- | Market diversification | -0.045 | 0.593 | rejected |

| H5 | Opportunity exploitation | <--- | Opportunity exploration | 0.438 | *** | accepted |

| H6 | Entrepreneurial intention | <--- | Opportunity exploitation | 0.717 | *** | accepted |

Source: Own survey (2019)

Table 13 shows the factor’s specific effects as follows: market dynamics, market munificence, and funding support all affect business opportunity exploration with a regression weight of 0.586, 0.297, 0.157, all have significance levels. Market complexity hurts the exploration of business opportunities and does not reach the required level of meaning. Besides, business opportunity exploration has a positive effect on business opportunity exploitation, and business opportunity exploitation has a positive and significant impact on entrepreneurial intentions.

Among the six research hypotheses, only one hypothesis that does not reach the necessary significance is hypothesis H4. The rest of the hypotheses, H1, H2, H3, H5, and H6, meet the significance required level.

In short, entrepreneurial intention is affected by business opportunity exploitation. However, business opportunity exploitation is influenced by business opportunity exploration, and business opportunity exploration is positively impacted by market dynamics, market munificence, and funding support. This is supported by opportunity-based theory, in which opportunity-exploration and opportunity-exploitation processes may occur before the entrepreneurial intention is established. Thus, the opportunity-exploration process can be independent and separate from entrepreneurial intention (Mishra & Zachary, 2014). Therefore, to explore and exploit the right business opportunity, it is necessary to have the right combination of business resources at a particular time.

In line with Shane & Venkaraman's (2000) argument, we suggest that the more active business environment will bring more opportunities for entrepreneurs to seek and reap benefits. Second, the more opportunities there are in the munificent market, the easier it is for businesses to explore business opportunities. The more munificent the market is; the more resources will be available for businesses to exploit. Third, available resources such as financial support from governmental agencies, private organizations, individuals, and families will enable entrepreneurs to identify business opportunities and exploit them to develop their competitive advantage.

The main findings can be helpful for researchers of entrepreneurship in emerging economies, particularly in Vietnam. In line with Michailova, et al., (2013), we have proposed a conceptual model of Entrepreneurial Intentions (EI), which includes 04 key elements associated with the opportunity-seeking (exploration) and advantage-seeking (exploitation) behaviors. A major practical implication of the study is the identification of some factors increasing EI. Whenever entrepreneurs can seek opportunity, combine available resources to their advantage, and utilize it as best in practice, they are likely to start up their business. It is also essential to notice that not all opportunity-exploration processes can have immediate positive results on the opportunity-exploitation process, thereby influencing EI. Also, it may show an uneven impact on EI via the opportunity-exploitation process. Hence, EI may require time and capabilities so that entrepreneurs are more likely to develop competitive advantage, risk tolerance, and figure out cost-and-benefits before they decide to start-up. Moreover, exploration’s success is up to the entrepreneur’s ability to create well-awareness of both external factors such as business environment, potential resources, and internal factors such as creativity, innovativeness, proactivity, and risk-taking. At the same time, the opportunity-exploitation process requires entrepreneurs’ knowledge and capabilities.

Conclusion

The study examined the relationship between factors of the external environment including (1) The dynamics of the market, (2) the diversification of the market, (3) the munificence of the market, and (4) funding support, which has an impact on the exploration and exploitation of business opportunities of individuals intending to start a business. Survey results have shown that environmental factors have a positive effect on the exploration of business opportunities. However, the complexity of the market has not demonstrated a clear impact. In other words, the more dynamic, munificent business environment is, and the more funding support available to entrepreneurs, the easier and faster business opportunities for entrepreneurs could be explored. Next, business opportunities exploration has a positive impact on business opportunity exploitation. Exploration will be a springboard to motivate entrepreneurs to utilize the right resources to develop business opportunities. At the same time, business opportunity exploitation has a positive impact on entrepreneurial intentions. The more effective business opportunity exploitation is, the stronger the entrepreneurial intention is, and the entrepreneurial behaviour will soon occur.

Therefore, to stimulate entrepreneurship in the Mekong River Delta, it is necessary to have timely and accessible funding support policies for the people. Finally, people need to study and research the market to discover attractive opportunities, thereby seizing the opportunities and using their available resources and the environment to start the enterprise. In particular, this research result opens a new door for further studies on the relationship between business opportunity exploration and exploitation. Future studies can further develop this research model by observing the impact of external environment factors on exploring and exploiting business opportunities.

References

Ajzen, I. (1991). The theory of planned behaviour.Organizational behavior and human decision processes, 50(2), 179-211.

Aldrich, H.E. (1979). Organizations and environments. Englewood Cliffs, NJ: Prentice-Hall, Inc.

Alvarez, S., & Busenitz, L. (2001), “The entrepreneurship of resource based theory”. Journal of Management, 27,755-775.

Anderson, J.C., & Gerbing, D.W. (1988). Structural equation modeling in practice: A review and recommended two-step approach.Psychological Bulletin.

Ao, J., & Liu, Z. (2014). What impact entrepreneurial intention? Cultural, environmental, and educational factors.Journal of Management Analytics, 1(3), 224-239.

Autio, E.H., Keeley, R., Klofsten, M., Parker, G., & Hay, M. (2001). Entrepreneurial intent among students in Scandinavia and in the USA.Enterprise and Innovation Management Studies, 2(2), 145-160.

Awang, Z. (2012). Analyzing the m In A Handbook on Structural Equation Modeling (SEM) using Amos.

Bentler, P.M., & Bonett, D.G. (1980). Significance tests and goodness of fit in the analysis of covariance structures.Psychological Bulletin.

Bird, B. (1988). Implementing entrepreneurial ideas: The case for intention.Academy of management Review, 13(3), 442-453.

Burgelman, R.A., & Grove, A.S. (2007). Let chaos reign, then rein in chaos—repeatedly: Managing strategic dynamics for corporate longevity.Strategic management journal, 28(10), 965-979.

Carr, J.C., & Sequeira, J.M. (2007). Prior family business exposure as intergenerational influence and entrepreneurial intent: A theory of planned behavior approach.Journal of business research, 60(10), 1090-1098.

Casson, M. (1982).The entrepreneur: An economic theory.Rowman & Littlefield.

Conner, M., & Armitage, C.J. (1998). Extending the theory of planned behavior: A review and avenues for further research. Journal of Applied Social Psychology, 28, 1429–1464.

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of business venturing, 18(3), 301-331.

Dess, G.G., & Beard, D.W. (1984). Dimensions of organizational task environments. Administrative science quarterly, 52-73.

Duncan, R.B., 1972. Characteristics of organizational environments and perceived environmental uncertainty.Administrative Science Quarterly 17, 313–327.

Forza, C., & Filippini, R. (1998). TQM impact on quality conformance and customer satisfaction: A causal model.International journal of production economics, 55(1), 1-20.

Gielnik, M.M., Kramer, A.C., Kappel, B., & Frese, M. (2014). Antecedents of business opportunity identification and innovation: Investigating the interplay of information processing and information acquisition.Applied Psychology: An International Review, 63, 344-381.

Greenspoon, P.J., & Saklofske, D.H. (1998). Confirmatory factor analysis of the multidimensional students’ life satisfaction scale.Personality and Individual Differences, 25(5), 965-971.

Hair, J., Anderson, R., Tatham, R., & Black, W. (1998). Multivariate data analysis, (5th Edition). Prentice Hall, New Jersey.

Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (2010). Multivariate data analysis (6th Edition). Pearson Prentice Hall. New Jersey.

Kadir, M.B.A., Salim, M., & Kamarudin, H. (2012). The relationship between educational support and entrepreneurial intentions in Malaysian higher learning institution.Procedia-Social and Behavioral Sciences, 69, 2164-2173.

Kadir, M.B.A., Salim, M., & Kamarudin, H. (2012). The relationship between educational support and entrepreneurial intentions in Malaysian higher learning institution. Procedia-Social and Behavioral Sciences, 69, 2164-2173.

Kaiser, H.F. (1974). An index of factorial simplicity.Psychometrika.

Kibler, E. (2013). Formation of entrepreneurial intentions in a regional context. Entrepreneurship & Regional Development, 25(3-4), 293-323.

Kline, R.B. (2005). How to fool yourself with SEM. In Principles and Practice of Structural Equation Modeling.

Kolvereid, L. (1996). Organizational employment versus self-employment: Reasons for career choice intentions.Entrepreneurship Theory and Practice, 20(3), 23-31.

Krueger, N. (1993). The impact of prior entrepreneurial exposure on perceptions of new venture feasibility and desirability.Entrepreneurship theory and practice, 18(1), 5-21.

Laureiro-Martínez, D., Brusoni, S., & Zollo, M. (2010). The neuroscientific foundations of the exploration− exploitation dilemma.Journal of Neuroscience, Psychology, and Economics, 3(2), 95.

Linan, F., & Chen, Y.W. (2009). Development and cross–cultural application of a specific instrument to measure entrepreneurial intentions. Entrepreneurship theory and Practice, 33(3), 593-617.

Linksvayer, T.A., & Janssen, M.A. (2009). Traits underlying the capacity of ant colonies to adapt to disturbance and stress regimes.Systems Research and Behavioral Science: The OfficialJournal of the International Federation for Systems Research, 26(3), 315-329.

March, J.G. (1991). Exploration and exploitation in organizational learning.Organization science, 2(1), 71-87.

Michailova, S., McCarthy, D.J., Puffer, S. M., Shirokova, G., Vega, G., & Sokolova, L. (2013). Performance of Russian SMEs: Exploration, exploitation and strategic entrepreneurship.Critical perspectives on international business.

Mintzberg, H. (1979). The structuring of organizations. Englewood Cliffs, NJ: Prentice-Hall.

Miranda, F.J., Chamorro-Mera, A., & Rubio, S. (2017). Academic entrepreneurship in Spanish universities: An analysis of the determinants of entrepreneurial intention.European research on management and business economics, 23(2), 113-122.

Mishra, C.S., & Zachary, R. (2014). The theory of entrepreneurship: Creating and sustaining entrepreneurial value.

National Venture Capital Association (2007). National Venture Capital Association Yearbook 2007. Arlington, VA: National Venture Capital Association.

Nieuwenhuizen, C., & Swanepoel, E. (2015). Comparison of the entrepreneurial intent of master's business students in developing countries: South Africa and Poland.Acta Commercii, 15(1), 1-10.

Nunnally, J., & Bernstein, I. (1994). Psychometric theory, (3rd edition). McGraw-Hill, New York.

Phan, A.T., & Tien, G.T.C. (2015). Factors affecting the intention to start a business: Student of Economics and Business Administration, Can Tho University. Science Journal of Can Tho University, 59-66.

Randolph, W.A., & Dess, G.G. (1984). The congruence perspective of organization design: A conceptual model and multivariate research approach.Academy of Management review, 9(1), 114-127.

Schumpeter, J.A. (1934, 1980). The Theory of Economic Development. Oxford University Press: London.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research.Academy of management review, 25(1), 217-226.

Shepherd, D.A., McMullen, J.S., & Jennings, P.D. (2007). The formation of opportunity beliefs: Overcoming ignorance and reducing doubt.Strategic Entrepreneurship Journal, 1(1‐2), 75-95.

Souitaris, V., Zerbinati, S., & Al-Laham, A. (2007). Do entrepreneurship programmes raise entrepreneurial intention of science and engineering students? The effect of learning inspiration and resources.Journal of Business Venturing, 22, 566–591.

Stevenson, H.H., Roberts, M.J., & Grousbeck, H.I. (1985). New business ventures and the entrepreneur. Irwin, Homewood, IL

Venkataraman, S. (2019). The distinctive domain of entrepreneurship research. InSeminal ideas for the next twenty-five years of advances. Emerald Publishing Limited.

Vietnam Chamber of Commerce and Industry. (2018). Entrepreneurship index report. The Youth Publisher.

Walter, S.G., & Dohse, D. (2009). The interplay between entrepreneurship education and regional knowledge potential in forming entrepreneurial intentions(No. 1549). Kiel working paper.

Li, J., Wu, S., & Wu, L. (2008). The impact of higher education on entrepreneurial intentions of university students in China.Journal of small business and enterprise development. 15(4), 752-7

Zahra, S.A. (1991). Predictors and financial outcomes of corporate entrepreneurship: An exploratory study.Journal of business venturing, 6(4), 259-285.

Zahra, S.A., Nielsen, A.P., & Bogner, W.C. (1999). Corporate entrepreneurship, knowledge, and competence development.Entrepreneurship theory and practice, 23(3), 169-189.

Zucker, L.G., Darby, M.R., & Armstrong, J.S. (2002). Commercializing knowledge: University science, knowledge capture, and firm performance in biotechnology. Management science, 48(1), 138-153.

Received: 24-Dec-2021, Manuscript No. ASMJ-21-9620; Editor assigned: 26-Dec-2021, PreQC No. ASMJ-21-9620 (PQ); Reviewed: 07-Jan-2021, QC No. ASMJ-21-9620; Revised: 20-Jan-2022, Manuscript No. ASMJ-21-9620 (R); Published: 25-Jan-2022