Research Article: 2021 Vol: 20 Issue: 2S

The Role of Technology for Activating the use Forensic Accounting in Financial Fraud Detection

BadiAlrawashdeh, Arab Open University, Saudi Arabia

Mohammad Kamal KamelAfaneh, Al Imam Mohammad Ibn Saud University

NawafAlfawareh, Al Imam Mohammad Ibn Saud University

AlaaMusatat, Arab Open University

Keywords:

Forensic Accounting, Financial Fraud, IT, Limitations, Activation

Abstract

The objective of this research is to investigate the limitations facing the use of IT in forensic accounting and the role of IT in activating the forensic accounting in discovering the financial fraud. To reach the objective of this research, questionnaire was used as a tool for data collection. The questionnaire composed of three parts. The first part designed to collect data about the demographic characteristics, while the second part designed to collect information about the limitations of using IT in forensic accounting, and the third part was designed to collect information about the role of IT in activating the forensic accounting and discovering financial fraud. The population was the auditors in public and private sectors. Simple random sample was selected of both sectors. The collected data was analyzed using SPSS. The results of this research have shown that the cost of IT infrastructure, the lack of training and the high cost of IT providers will affect the use of IT in forensic accounting. The results showed that IT will activate the role of forensic accounting in discovering financial fraud.

Introduction

The updated research concerned with the role of forensic accounting in minimizing the fraud crimes. The different results have approve that the application of forensic accounting in organized and with high capacity standards will facilitate its application and help discovering the financial crimes (KÖKSAL, 2019). Some research’s concentrated on national capacity building to empower the accountants to find the financial crimes. The capacity building, according to literature, should started at the university level and extended to the practical level toward high profession. The university capacity building concentrated on both the accounting and legal branches. Some university curriculum concentrated on the IT capabilities to practice the forensic accounting. This call increased over the past years as the technology tools can be used in practicing forensic accounting increased. On the other hand, the development of the used tool in accounting raised to increase care for the development of IT tools capabilities to meet these requirements. The regular audit work used IT tools to overcome all the recorded accounts and to have comprehensive auditing for all available accounting databases (Kranacher et al., 2008). The use of advanced auditing IT tools will facilitate the audit of different types of accounting systems of companies. The high knowledge of tools by the forensic accountant will ensure his independency when executing auditing using these tools (Pearson & Singleton, 2008). The tools applied could be arranged from tradition tools such Excel to more advanced tools designed for this purpose. The distribution of IT tools will depend mainly on the national interest to produce and develop these tools. The low interest and the lack of experiences will affect negatively the capacities of the forensic accountants to practice their jobs professionally. On the other hand, the price limitations for these tools will affect the ability of auditing offices to own these technologies and rely more on traditional methods. The auditing offices IT infrastructure may form a new obstacles to use the last hit technology in forensic accounting. The increase of interest of these offices and the IT support will enables these offices to have strong infrastructure that facilitate their work. In some countries, the development of IT infrastructure was a government and universities responsibilities. Other important issue that limits the abilities of the forensic accountant to practice forensic accounting is their abilities on data mining. The auditors usually receive high volumes of electronic data represent a year or more (Sharma & Kumar Panigrahi, 2012). The abilities of forensic accountant to mine data will improve his concentration on discovering mistakes and discovering frauds. Consequently, IT play a major role in the success of practice the forensic accounting. The role IT is limited to the surrounding circumstances. The objective of this paper is to investigate the role of IT in activating the role of forensic accounting in discovering fraud.

Literature Review

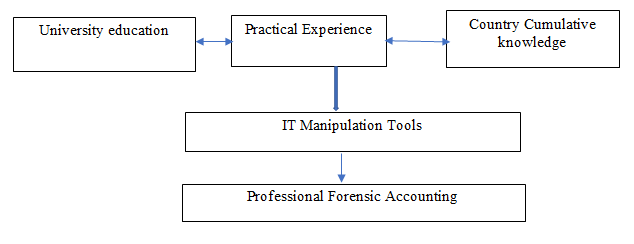

Pearson & Singleton (2008) studied the forensic accounting in digital environment. The study concentrated on discussing the role of IT and digital environment in discovering the fraud. The researched discussed that the use of IT will facilitate the fraud detection. The paper discussed that to meet the use of IT to hold fraud requires the use of effective IT to discover the fraud. Grubor, et al., (2013) have shown the IT is very beneficial in the electronic business environment. Despite the different forms of fraud using electronic tools, still the availability of required IT will facilitate discovering such frauds. Koksal (2019) discussed the use of forensic accounting in discovering fraud in digital environment. The author has found that the new techniques used in fraud and the application of technology will require high technology tools to discover this fraud. Simeon (2018) discussed the role of technology in developing different sectors and its role in developing the forensic accounting sector as well. The author shows that the training is considered very important to improve the capabilities of the auditors to use IT in forensic accounting. Chukwu, et al., (2019) showed that the IT use capabilities are very important to improve the efficiency for discovering the financial frauds. The author discussed the importance of having high capabilities to prevent the advanced technology crimes. The literature has shown that there are many factors that form the major factors that help building the capacities of the forensic accountants. These tools include universities, training through practical experience and the cumulative knowledge about fraud crimes in the country (Figure 1). These sources will determine the manipulation tools required to reach professional forensic accountants (Awolowo, 2019).

Figure 1: The Position of it in The Factors of Forensic Accounting Success (Source: Prepared by Researcher)

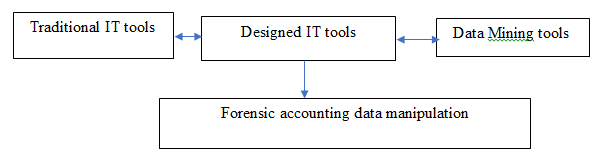

Akinbowale, et al., (2020) have shown that different types of tools required to use IT to practice forensic accounting professionally. The results of this paper showed that the traditional IT tools are very important to discover the financial fraud. To integrate the use of these tools designed required and tested tools will improve the efficiency of using IT in discovering financial fraud. The tools used for data mining and the experience in this field is very important to reach the data needed to discover fraud. Ragan, et al., (2008) have discussed some traditional methods to analyze the financial statements. They discussed the use of Excel to discover the fraud in financial statements. They have found that even IT traditional methods are important to discover the financial fraud.

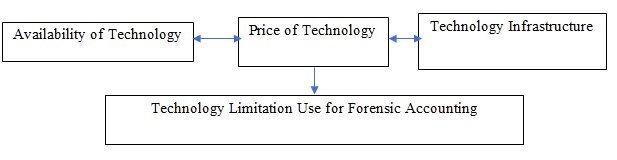

Different literature disccused the limitations of using IT in forensic accounting. This literature concentrated on the availability of technology and price of technology and the technology infrastructure in the country. These literatures have shown the importance of the integration of these elements to reach integrated IT system to fight financial crime in all it forms.

Methodology

The objective of this research is to investigate the role and limitations of technology use in activation of forensic accounting in discovering fraud. The questionnaire was used as tool for data collection. The questionnaire composed of four parts. The first part designed to collect the demographic data of the sample. The second part was designed to collect information about the constraints that affect the use of technology in forensic accounting, while the last part was used to design to collect information about the role of IT in facilitating the discovery of financial frauds through the application of forensic accounting. The questionnaire used five Likert scale to answer the different items of the questionnaire (Figure 4).

The questionnaire was tested using a pilot sample composed of 30 auditors outside the study original sample. The questionnaire was validated and modified according to the pilot sample feedback. Reliability analysis using Cronbach’s alpha was measured to determine the extent of questionnaire reliability (Table 1). The results of reliability analysis showed that the Cronbach’s alpha value was more than the threshold limit 0.6 indicating that all the variables of this study were reliable (Hair et al., 2007). The study population included the auditors in public and private sectors. The random sample was selected to facilitate the distribution and data collection for this research. The sample included 300 auditors from both sectors. The questionnaires distribution and collection was executed through the emails. The collected data was entered to SPSS version 21 for analysis. Frequencies and percentages used to reach the demographic characteristics of the sample. Means and standard deviation were used to measure the trend of the sample for the different paragraphs of the questionnaire. Inferential statistics was used to test the effect of demographic characteristics on the limitations of using IT and the role of IT in activating forensic accounting. Also, the inferential statistics was used to test the effect of limitations on the role of IT in activating forensic accounting.

| Table 1 Reliability Analysis Using Cronbach’s Alpha |

|

|---|---|

| Variable | Reliability |

| IT limitations | 0.93 |

| Infrastructure | 0.9 |

| FA IT Availability | 0.85 |

| Cost | 0.75 |

| Role of IT in activating FA | 0.93 |

| Data accessibility | 0.91 |

| Figuring Contradictions | 0.83 |

| History comparison | 0.81 |

| Tool | 0.95 |

Results and Discussion

Demographic Characteristics of the Sample

The demographic characteristics of the sample show that most of the sample are males (95.2%) and the most dominant educational level is the bachelor level (74.1%), while the dominant sector is the private sector (94.4%). The highest experience category was for 5-10 years (45.8%), and the most of the sample (88.8%) (Figure 5).

Different responses for the limitations of using IT in forensic accounting. The highest positive attitude was for the possess of enough number of computers at offices (m=4.8, st.dev=0.51). The second positive agreement was for the availability to some extent of infrastructure to use for data exchange (m=3.2, st.dev= 1.2). The sample has negative attitudes for the availability of operating systems that facilitate the use of forensic software (m=2.8, st.dev= 1.3). The least agreement was for the availability of tools to facilitate testing digital fraud and the existence of contracts to have software continuous updates (m=2.1, st.dev=1.6) (Table 2). Concerning the availability of IT for forensic accounting, the results showed that the staff realized the importance of IT in forensic accounting (m=3.8, st. dev.=0.90). The agreement dropped to negative attitudes for the agreement of the trained staff to use the updated software for digital forensic accounting (m=2.9, st. dev.=1.4). The results showed that the legal framework to use IT tools for forensic accounting in not available by law (m=2.1, st.dev= 1.7). The responses were negative for the cooperation with IT enterprises and the hiring of IT staff (m=1.3, st.dev=1.8). The respondents showed that the IT tools are expensive to be used from its sources (m=3.9, st.dev= 0.7). Also, the use of IT tools requires hiring IT staff which increases the running cost of work (m=3.6, st.dev=1.4), also, the respondents agreed that the revenues are not meeting the high cost of IT that will be used (m=3.1, st.dev=1.2). The responses were negative for the running of IT cost is reasonable to use it in forensic accounting (m=2.8, st.dev=1.1). Also, the cost of infrastructure is not reasonable to use IT in forensic accounting (m=2.1, st. dev.=1.3).

M

| Table 2

|

||

|---|---|---|

| Trend for The Limitations of Using it in Forensic Accounting | ||

| Variable | Mean | Sd. Dev. |

| Infrastructure | ||

| Our offices have enough computers for work | 4.8 | 0.51 |

| The infrastructure allows network connections to facilitate data exchange | 3.2 | 1.2 |

| Operating systems facilitate the use of forensic software | 2.8 | 1.3 |

| The available tools facilitate testing digital fraud | 2.1 | 1.5 |

| The office has continuous contracts for software updates | 2.1 | 1.6 |

| Forensic accounting IT availability | ||

| The staff realize the importance of IT in forensic accounting | 3.8 | 0.9 |

| The staff is highly trained to use updated software for digital forensic accounting | 2.9 | 1.4 |

| The legal framework is available to IT use in forensic accounting | 2.1 | 1.7 |

| The office cooperates with IT enterprises to improve IT capacity | 1.3 | 1.7 |

| The use of IT staff to manage office IT work | 1.3 | 1.8 |

| Cost | ||

| The external IT tools are expensive from providers | 3.9 | 0.7 |

| The use of IT requires hiring IT staff which increases the running cost | 3.6 | 1.4 |

| The revenues match the expenses on IT to use in forensic accounting | 3.1 | 1.2 |

| The running of IT cost is reasonable to use it in forensic accounting | 2.8 | 1.1 |

| The cost of IT tools infrastructure is reasonable to use in forensic accounting | 2.1 | 1.3 |

Trends for the Role of IT in Forensic Accounting Activation The trends were positive for data accessibility (Table 3). The respondents agreed that IT tools facilitate the exchange of accounting data with the working teams (m=4.3, st. dev.=0.81), also the variety of IT tools facilitate testing the data using different methods (m=4.1, st. dev.= 0.63). The agreement was positive but less for IT facilitates the discovery of digital frauds online (m=3.8, st. dev.=1.10), also, IT facilitates the integration of data for auditing purposes (m=3.6, st.dev=0.91). The least positive agreement was for IT tools facilitate the reach of detailed data about the accounting system (m=3.5, st. dev.=0.61). Pearson and Singleton (2008) have shown that the experience of IT will facilitate its professional use to discover the financial fraud. For discovering out contradictions, the results showed that the highest agreement was for the role of professional IT software to facilitate reaching the complicate accounting software (m=4.3, st. dev.=0.11), followed by the agreement that smart contradictions can be detected through professional FA software (m=4.1, st. dev.=0.51). Also, auditors agreed that different IT tools facilitate discovering the data contradictions (m=4.1 , st. dev.=0.61). On the other hand, the agreement was positive and less for the availability of training staff for discovering accounting contradiction through software (m=3.8, st.dev= 0.81). The least positive agreement was for forensic accounting IT accumulative experience facilitates figuring the accounting contradiction (m=3.1, st. dev.=0.82). For historical comparisons, the results showed that forensic accounting IT tools facilitates the online digital fraud discovery overtime (m=4.2, st. dev.=0.11). Also, forensic accounting IT helps historical data contradictions (m=4.1, st. dev.=0.12). Also, the trends were positive for historical auditing facilitates determining the tools updates required (m=3.6, st. dev.= 0.21). The least positive agreement was for the IT tools in forensic accounting facilitates the integration of historical data and the IT facilitates the data comparison historically. Koksal (2019) has shown that the IT will facilitate the discover the fraud in electronic environments. The advanced IT tools will facilitate the discovery of such financial fraud. Simeon (2018) has found that the IT will improve the discovery of financial fraud. The study recommended the training of the people working in forensic accounting to improve their capacity in using IT.

| Table 3 Trends for The Role of it in Forensic Accounting Activation |

||

|---|---|---|

| Variable | Mean | Sd. Dev. |

| Data accessibility | ||

| IT tools facilitate the exchange of accounting data with the working teams | 4.3 | 0.81 |

| The variety of IT tools facilitate testing the data using different methods | 4.1 | 0.63 |

| IT facilitates the discovery of digital frauds online | 3.8 | 1.1 |

| IT facilitates the integration of data for auditing purposes | 3.6 | 0.91 |

| IT tools facilitate the reach of detailed data about the accounting system | 3.5 | 0.61 |

| discovering contradictions | ||

| Professional IT software facilitates reaching the complicate accounting software | 4.3 | 0.11 |

| Smart contradictions can be detected through professional FA software | 4.1 | 0.51 |

| Different IT tools facilitate discovering the data contradictions | 4.1 | 0.61 |

| The staff well trained for discovering accounting contradiction through software | 3.8 | 0.81 |

| FA IT accumulative experience facilitates figuring the accounting contradiction | 3.1 | 0.82 |

| Historical comparisons | ||

| FA IT tools facilitates the online digital fraud discovery overtime | 4.2 | 0.11 |

| FA IT software helps historical data contradictions | 4.1 | 0.12 |

| Historical auditing facilitates determining the tools updates required | 3.6 | 0.21 |

| FA IT facilitates the integration of data historically | 3.7 | 0.41 |

| The availability of IT FA software facilitates the historical data comparison | 3.9 | 0.61 |

The Effect of Education and Experience on Evaluating the Limitations of it Use for Forensic Accounting

The results showed that the educational level affect judging the limitations of IT use for forensic accounting. The results showed that the least judging of limitations was for B.Sc. educational level (m=1.88, st. dev.=0.81). The highest judging of limitations was for Ph.D. educational level (m=3.50). These results may result of the type of courses and education course outlines received by different educational level. The new graduate students may receive higher attention for the forensic accounting and the tools needed to help the work in this field. The higher educational levels concentration was different from caring for the forensic accounting (Table 4). Moreover, the highest judging of limitations was for the experience category 5-10 years (m=3.56) reflecting that the fresh graduates received higher attention for forensic accounting which deepen thinking of the required tools needed to practice this type of accounting to prevent fraud. The higher experience levels did not give much attention for the limitations and this may resulted of the less concern and educational experience in forensic accounting as it is a new introduced topics at universities.

| Table 4 The Effect of Education and Experience on The Evaluation of Limitations of using it in Forensic Accounting |

||||

|---|---|---|---|---|

| Character | Mean | St. Dev | t-value | Prob. |

| Education | ||||

| B.Sc. | 1.88 | 0.81 | 5.61 | 0.001 |

| Master | 3.01 | |||

| Ph.D. | 3.5 | |||

| Experience | ||||

| Less than 5 years | 3.01 | 0.69 | 4.31 | 0.001 |

| 5-10 years | 3.56 | |||

| 11-15 years | 2.51 | |||

| > 15 years | 2.09 | |||

The Effect of Education and Experience on Evaluating the Role of it Use in Forensic Accounting Activation.

The evaluation of the importance of IT to facilitate the practicing of forensic accounting was different. The Ph.D. educational level was the higher evaluators of the importance of IT in facilitating practicing the forensic accounting and its role in discovering fraud. The least evaluation for the role of IT in practicing the forensic accounting was for B.Sc. educational level. This category may consider the traditional procedures are enough to discover fraud without using high IT technology. On the contrary, the less the experience the higher attitudes for the role of IT in discovering fraud. The fresh graduates may be closer to technology than old, experienced people. On the other hand, the old, experienced people may prefer the traditional methods over the technology as they resist the change in this field.

| Table 5 The Effect of Education and Experience on The Evaluation of The Role of it in Activating Forensic Accounting. |

||||

|---|---|---|---|---|

| Character | Mean | St. Dev | t-value | Prob. |

| Education | ||||

| B.Sc. | 3.62 | 0.18 | 6.12 | 0.001 |

| Master | 3.92 | |||

| Ph.D. | 4.12 | |||

| Experience | ||||

| Less than 5 years | 4.61 | 0.32 | 5.96 | 0.001 |

| 5-10 years | 4.01 | |||

| 11-15 years | 3.71 | |||

| > 15 years | 3.21 | |||

Conclusion & Recommendations

The objective of this research is to investigate the limitations of applying IT in forensic accounting and the role of IT in discovering financial fraud. The research concentrated on the auditors in private and public sectors. The results showed that the limitations of using IT in forensic accounting is very high. The results revealed that the infrastructure, the experience of auditors in IT, and the cost of the technology limit its use by the auditors in forensic accounting. The results shows that the use of IT will require the hiring of IT people or using external sources to find software or hardware maintenance which will form additional expenses for the people working in forensic accounting. The results showed that revenues coming from forensic accounting did not cover the expenses needed to discover financial fraud. On the contrary, the auditors in both sectors are satisfied that the technology is very important in practicing the forensic accounting. The training on IT and the experience are very important to help in practicing IT. Moreover, the results showed that the use of IT will facilitate the comparison of financial data with the same periods and historically. The results showed that IT will facilitate the revision of financial history. The main conclusion of this research is that IT has very important role in facilitating the practice of forensic accounting, but the limitations of its use is very high and requires facilitations to make it available for use. The application of IT in forensic accounting requires extensive training of auditors and facilitations required to provide reasonable services for auditing offices to facilitate their work in forensic accounting and discovering fraud. These obstacles require the care of universities and IT companies to provide software and training to improve the capacities of auditors for using technology.

Future Research

The future research should concentrate on studying the IT corporations and their role in providing software in detecting fraud and practicing forensic accounting. Moreover, the role of universities to educate the students of the methods needed to discover fraud using IT and the concentration on online tools.

References

- Akinbowale, O.E., Klingelhöfer, H.E., &Zerihun, M.F. (2020).An innovative approach in combating economic crime using forensic accounting techniques.Journal of Financial Crime, 27(4).

- Awolowo, I.F. (2019). Financial Statement Fraud : The Need for a Paradigm Shift to Forensic Accounting Financial Statement Fraud : The Need for a Paradigm Shift to Forensic Accounting Ifedapo Francis,Awolowo A thesis submitted in partial fulfilment of the requirements of Sheff.

- Chukwu, N., Asaolu, T.O., Uwuigbe, O.R., Uwuigbe, U., Umukoro, O.E., Nassar, L., &Alabi, O. (2019).The impact of basic forensic accounting skills on financial reporting credibility among listed firms in Nigeria.IOP Conference Series: Earth and Environmental Science, 331(1).

- Grubor, G., Risti?, N., &Simeunovi?, N. (2013).Integrated forensic accounting investigative process model in digital environment. International Journal of Scientific and Research Publications, 3(12), 1–9.

- Hair, J., Celsi, M., Money, A., &Samouel, P. (2007).The essentials of Business Numeracy.John Wiley & Sons. Köksal, T.U.N.K.?. (2019). Dijitalortamdak?? F??nansalh??le kontrolündeadl?? Muhasebe: ba?imsizdenetç??lerüzer??ndeb??rAra?tirma. Journal of Turkish Studies, 14(3), 1609–1627.

- Kranacher, M., Morris, B.W., Pearson, T.A., & Riley, R.A. (2008).A model curriculum for education in fraud and forensic accounting.Issues in Accounting Education, 23(4), 505–519.

- Pearson, T., & Singleton, T. (2008).Fraud and forensic accounting in the digital environment.Issues in Accounting Education, 23(4), 545–559.

- Ragan, J.M., Joseph, S., Hadley, A.J., Joseph, S., Raymond, A.P., & Joseph, S. (2008). Star electronics, Inc.: An excel based case using financial statement analysis to detect fraud. Journal of Business Case Studies, 4(3), 53–70.

- Sharma, A., & Kumar P.P. (2012). A review of financial accounting fraud detection based on data mining techniques. International Journal of Computer Applications, 39(1), 37–47.

- Simeon, E. (2018). Fighting economic and financial crimes in Nigeria using forensic accounting: The moderating effect of technology.International Journal of Economics and Financial Research, 4(7), 235–241.