Research Article: 2022 Vol: 25 Issue: 1

The Role of the Compliance Observer in Maintaining Banking Secrecy: An Applied Research in a Sample of Iraqi Banks

Sundus Ali Khalifa Al-Saadi, Ministry of Higher Education and Scientific Research

Hamza Faeq Wheib Al-Zubaidi, University of Baghdad

Citation Information: Al-Saadi, S.A.K., & Al-Zubaidi, H.F.W. (2022). The role of the compliance observer in maintaining banking secrecy: An applied research in a sample of Iraqi banks. Journal of Legal, Ethical and Regulatory Issues, 25(1), 1-16

Abstract

The main objective of the research focuses on clarifying the concept of banking secrecy and its importance and the scope of those covered by its preservation, including the compliance observer and his commitment to maintaining banking secrecy and not revealing it except to the authorized parties, as he is one of the persons familiar with all the work and activities of the bank. This is because his work is based on a showing whether the bank is committed to the laws, instructions, regulations and decisions of the Central Bank of Iraq. Maintaining the bank's secrets by those authorized to see them, including compliance observers, leads to the bank continuing its work properly and not being subjected to legal accountability and the payment of compensations. The research population was represented in the Iraqi banking system. The Central Bank of Iraq and some of the governmental and private banks were selected as a research sample. In addition to the Central Bank of Iraq, the research sample also included Al-Rafidain Bank, Ashur Bank, and Development Bank. The research covered the period from (1/11/2016 to 30/4/2018). The research relied on two basic hypotheses, the first "there is a significant relationship between the work of compliance observers and the maintenance of banking secrecy" and the second "there is a significant effect of the work of compliance observers in maintaining banking secrecy". The descriptive approach was used in the theoretical aspect and the statistical analytical approach in the practical aspect of the research. The values of Spearman's coefficient and regression coefficients were used in the statistical analyses.

Keywords

Compliance Observer, Banking Secrecy, Iraqi Banks.

Introduction

Banking secrecy is one of the priorities of banking work because of its effect on the activity of the bank and its proper and sound functioning in light of good and fair competition in the money market. The importance of banking secrecy emerges from viewing many authorized persons the work and activity of banks, including compliance observers, as they are the party that has the right to see the activities of the bank, in order to know the extent of the bank’s commitment to implement laws, instructions, decisions and regulations issued by the Central Bank of Iraq. This is because the bank’s commitment serves its work and ensures that it remains in the money market and provides the best services to its customers. The breach and disclosure of banking secrecy to unauthorized parties leads to legal accountability for the bank and its employees, including the compliance observer if this is proven. These may also cause the bank to lose some of its customers, which affects its financial position and reputation.

Literature Review

In the study of confidentiality in banks "banking secret" it is seen that banks are considered the engine of economic policy so it is necessary to exercise caution, and confidentiality in their transactions in order not to harm its customers،The concept of banking secrecy concerns the ethics of the profession, which in turn raises legal obligations.

The principle of bank secrecy involves many aspects including protect interests other than the customer's own interests, which are imposed by the requirements to exercise control over the banking system and to exchange information between banks, whether at home or abroad.

The banking secret is built primarily on the interest of the customer without wasting the public interest, which requires stability in banking transactions and modern banking policy in line with international developments.

In the study of bank secrecy as a competitive advantage applied research in a sample of public and private banks it is seen that a statement of the extent of the success of Iraqi banks in complying with banking secrecy, to clarify the relationship between the commitment to banking secrecy and the achievement of competitive advantage.

States that apply the principle of commitment to banking secrecy thus help to raise the economic level of the country through the non-leakage of funds out and exploitation of investments within the country. The customers depend in choosing the bank to deal with on several features, including the extent of preserving the secrets and operations at the bank.

Encouraging national investment by maintaining bank secrecy and ensuring that the money does not leak abroad ccompetent staff should be selected to provide services to customers.

The Role of the Compliance Observer in the Work of Banks

Concept and definition of the compliance observer’s job: The objective of the compliance observer’s job is to know the extent to which banks comply with the laws, as well as the instructions and controls issued by the CBI. This is what Article (40) of the CBI Law No. 56 of 2004 indicated, which stipulates that the CBI shall have the sole authority and not others the authority to take all necessary measures to license and regulate the work of banks and to supervise them and their branches in order for all of them to comply with the provisions of this law and the banking law. It also has the authority to review outside the headquarters of the bank and its branches, and the authority to examine and inspect license holders and their subsidiaries at their work sites in the manner chosen by the CBI at the time of its choosing. In addition, the CBI alone has the power to require the banks and their branches to provide all information related to the affairs of the bank, its branches and its customers that the CBI may need. Furthermore, the CBI has the authority to take corrective action in accordance with what is provided for in this law and the banking law in order to implement the bodies licensed bodies and their affiliate branches to those laws and their compliance with any regulations, standards, guidelines, or prudent directives that the CBI has issued in connection with its implementation of such laws, and no action taken by any government entity other than the CBI in relation to regulating the lending and credit activities of banks shall have any legal status. Article (99-b) of the Jordanian Banks Law defines the job of the compliance observer as an independent job aiming to ensure the bank’s compliance and its internal policy with all laws, regulations, instructions, orders, codes of conduct, standards and sound banking practices issued by local and international supervisory authorities that identify, evaluate, provide advice and guidance, monitor and submit reports to the board of directors about the extent of the bank's compliance (Instructions of the Compliance Observer, 33/2006, 1).

Job description of the compliance observer: The supervisory controls No. 306 of 2016 in the CBI, Compliance Department directed to all licensed banks and non-bank financial institutions identified the job description of the compliance observer, which are as follows:

1. Clarifying the general responsibilities of the business fields and the banking products and services they cover.

2. Determining a list of tasks that the compliance observers should perform according to instructions issued later.

3. Determining the authorities of the compliance observer and his work relationship with other departments of the bank. It is preferable that he be an expert or an assistant general manager or an assistant managing director, provided that he participates in the meetings of the bank’s board of directors

4. Helping to solve problems while continuing to follow up on their solution and contributing to the training of employees.

5. Working alongside the auditors and inspectors in order to contribute to the development of good control methods to avoid obstacles in the future.

Duties and tasks of compliance observers: The compliance department and the compliance observer have many tasks stipulated in Article (72) of the instructions for implementing the Banking Law No. (94) For the year 2004 that the compliance observer in banks must perform, these are as follows:

1. To be responsible for the extent of the bank’s compliance with the decisions of the board of directors and internal policies as well as the procedures established under the laws and instructions issued by the CBI, and to attend the meetings of the bank’s board of directors as an observer.

2. To have knowledge of banking services in Iraq and in line with the requirements of the advanced Iraqi economy.

3. Knowing all the laws, regulations, and instructions related to banking activity, this may include requirements that may not appear directly related to banking activity and banking operations, and the legal department in the bank can provide support to the compliance observer in this task.

4. He reviews all policies, procedures and a decision of top management related to the bank’s activities, determines their consistency with the relevant laws, regulations, and organizational instructions, and submits observations in this regard.

5. Suggesting the necessary policies and procedures for banking operations based on the requirements of the development of banking activity and the bank’s relations, and their approval by the bank’s board of directors.

Theoretical Framework for Banking Secrecy

Concept and definition of banking secrecy: Many laws and regulations stipulate the obligation of certain persons to preserve the secrets of others that come to their knowledge during the course of their work. Before we know the meaning of banking secrecy, we must first know that it is a secret of the profession. Law, medicine, etc. and other professions and that compliance with them have a moral ethical obligation above all, and confidentiality does not become valid and valuable if not specified by the legislator. It is also the responsibility of the bank as a general rule to abide by confidentiality and confidentiality of private information and data of all its clients without exception, but the bank adheres to this confidentiality even The Bank shall maintain confidentiality in all matters related to customer accounts. The Bank shall maintain confidentiality in all matters related to customer accounts, deposits and trusts and funds in which they deposit their holdings (funds). It is prohibited to give any statements of the foregoing directly or indirectly, except with the written consent of the client or in the case of the death of the client with the consent of his legal representative or one of his heirs the, client or one of them recommended or by a competent judicial authority Or from the public prosecutor Or the existence of one of the cases allowed under the provisions of this law and remains this urban standing even if the relationship between the client and the bank for any reason (Iraqi Banking Law, 2004 Article/49), and the English believes that the obligation to confidentiality in respect of information about the client Arises from the contract that binds the parties since the special character of their relationship appears in particular in all transactions that enter the account and to guarantee this account (Awad, 2000; Suelem, 2014) defined "Banking secrecy" is any matter or fact that reaches the knowledge of the bank whether in the exercise of its activity or because of this activity and whether the customer himself trusts him or reaches the bank through third parties and the customer has an interest in his secrecy, Of the bank on his client, which reassures the borrower about his financial position or what would scare him to deal with him or gain and strengthen confidence in him.

Importance of banking secrecy: Banking secrecy is an essential element of the general investment climate that must be provided for the establishment of a sound economic, financial and banking situation in the presence of a state that secures stability, justice and political and social security. Its main objective is to attract capital, protect deposits from legitimate sources, and provide protection to depositors with legal and legitimate proceeds, so that the bank that discloses information is subject to prosecution (Regulation, 2007). The interest came in keeping the professional secret and not disclosing it as it is a duty in the case of any contract that requires mutual trust between its parties. Accordingly, the bank is the first in this secrecy, and in turn the bank’s employees are obligated to preserve all the information they see about the customer by virtue of their job, so their commitment is negative, which is to refrain from disclosing the secrets of the customer and a legal duty because the laws are regulated this commitment. As banks usually seek to attract more customers, to increase the bank’s resources, through the services it provides to them, as is the case in banking contracts, which are services that the bank guarantees to the customer with confidentiality. In addition, because the trust that work imposes among banks and their customers does not exist except within a framework of secrecy, especially when it comes to the secrets entrusted to the bank from customers (Shaker, 2015).

Persons covered by the obligation to bank secrecy: The persons covered by the obligation of banking secrecy are the ones who have access to the data and information included in the text of Article (50) of the Banking Law, which governs their work or their qualities, and they are:

The Central Bank of Iraq

1. Central Bank of Iraq: The CBI receives data, information and reports on banks for various purposes, as Article (41 / first / c) of the Banking Law stipulates that each bank must provide the CBI, in the relevant periods, "information or statistics on its various accounts and activities, including information regarding deposits, banking facilities, credit plans, credit plans, or contingent obligations granted to its customers". Also, Article (53/ third) of the same law stipulates that the Central Bank of Iraq may, at any time, conduct an on-site inspection to a bank carried out by one or more officials, another person or any other persons appointed by the CBI for this purpose.

2. Bank employees: The laws relating to the secrecy of banks have identified their employees who are obligated to keep of secret book, records, transactions and bank correspondences. The second article of the Lebanese Banking Secrecy Law issued on 3/9/1956 stipulates what is meant by the employees, managers and employees of banks and everyone who has knowledge by virtue of his capacity or position in any way whatsoever on the records, books, transactions and banking correspondences, they are obliged to keep the banking secret absolutely for the benefit of the customers of this bank. So did the Syrian Banking Secrecy Law No. 34 of 2005 in its third article, which states that employees of the banks referred to in the first article of this law, mentioned above, and everyone who was familiar with the virtue of his capacity or position in any way whatsoever on the books, records, transactions, correspondences and Investment certificates are obligated to keep the secret of these restrictions for the benefit of the bank and its customers. They may not, in any way, disclose what they know about the names of the dealers and their money and everything related to their deposits and banking affairs to any person, whether an individual, an administrative or a judicial body, and this prohibition remains in place even after the end of the relationship between dealers and the bank. It is noted that the obligation to keep confidentiality includes all employees in working banks without exception, regardless of their rank or category of work, as well as whoever has access, by virtue of his position or capacity, in any way whatsoever, to the banking entries in the books, transactions, correspondences and investment certificates. For example, among them are the bank’s financial and legal advisors, lawyers, judges, and bank account inspectors, who are not allowed and have no right to disclose banking secrets, even to shareholders, regarding facts they saw, heard, discovered or extracted while doing their work (Mayala & Mahrezi, 2011).

3. Customer: The customer is the person who deals with the bank. Therefore, the customer is the natural or legal person who enters into banking transactions or operations with the bank by his own will, and the bank accepts what the will of this person is directed to. However, shareholders, employees, and members of the board of directors are outside the scope of the customer’s capacity, and therefore they are not covered by the protection of banking secrecy unless they are covered by the umbrella of secrecy because they are customers as shareholders or employees. A tourist or a traveler is also considered a customer, while a customer is someone who enters into negotiations with the bank to complete banking transactions, even if they are not carried out for any reason. It is worth noting that the shareholders, employees and members of the board of directors, with regard to their tasks or job relationships, are not considered banking secrets, although they may be included among other secrets, unless they enter into banking transactions with the bank Such as opening accounts or submitting checks or bonds to withdraw them in cash or opening credits (Shaker, 2015).

4. Banks: One of the traditions of banking work is intense attention, accuracy and care in dealing with the public. If a bank employee makes a statement or behavior that indicates negligence or indifference, and this leads to disclosing the secret of one of the customers, this makes the bank responsible before the customer (Alam, 2001). The legislation also specified that all banks operating in the Syrian Arab Republic, including banks operating in the Syrian Free Zones, are subject to the provisions of the banking profession' secrecy. In addition, Banks have the right to open for their clients numbered deposit accounts whose owners are known only by the manager in charge of managing the bank or his legal representative. Moreover, these banks have the right to rent special iron safes to depositors. The identity of the numbered account holders or the iron safes and the value of their accounts or assets shall not be announced except with the written permission of the depositors, their legal heirs, the legatees, if they are duly declared bankrupt, or if a lawsuit is instituted related to banking transactions among banks and those dealing with them, based on a request from the authority looking into this lawsuit (The Syrian Banking Law, No. 34, 2005, Articles 1 and 2).

Cases of lifting bank secrecy: There are exceptional cases in which banking secrecy is lifted and as necessary mentioned in (Central Bank of Iraq Law No. 56 of 2004 / Article 22), (Regulation, 2007) and the Syrian Legislative Decree No. 30 (Law, 2010). of the Law Banking secrecy. These are as follows:

1. The CBI may exchange information related to supervision, preferably on the basis of a memorandum of understanding with central banks and financial supervisory authorities.

2. The CBI may arrange memoranda of understanding with other central banks or with financial supervision bodies that include clarification of the scope of information exchange, exchange procedures and other details in this regard in a previous agreement with customers or with their written permissions.

3. With the permission of the competent judge, the heirs or legatees are allowed to share a common part of the inheritance or part of its collection related to the money deposited with the financial institution.

4. Declaring the bankruptcy of the financial institution or the customer.

5. The customer submits a request for a protective composition to the competent court.

6. The emergence of a dispute related to banking transactions between the bank and its customers, the case of illicit enrichment, executive seizure.

Penalties for disclosing and violating banking secrets: Since banking secrecy is an obligation that must be maintained by the employees of the bank and the bank itself, the Iraqi legislator has dealt with the criminal responsibility for disclosing banking secrets according to Article 437 of the Iraqi Penal Code No. 111 of 1969, which states that "whoever knows by virtue of his position, profession, industry, art or nature of work a secret that he discloses in other than the circumstances authorized by law, or uses it for his benefit or the benefit of another person, shall be punished by imprisonment for a period not exceeding two years and a fine not exceeding two hundred dinars, or by one of these two penalties. However, there is no punishment if the person concerned authorized the disclosure of the secret, or if disclosure was intended to inform about a felony or misdemeanor, or to prevent its commission".

Research Methodology

This section addresses problem, importance, objectives, hypotheses, population, sample, Spatial and temporal limits of the research as follows:

Problem of the Research

The Iraqi legislator obligated all persons working in the banking sector to maintain banking secrecy, whether they are natural or legal persons, and that banks are legally obligated to maintain banking secrecy. The basis for the success of the banks work lies in the extent to which they maintain their secrets and the competitive policy that they follow in the performance of their work to provide their services to their customers, whether in the public, private or mixed sectors. In addition, any disclosure of the banking secret may lead to the bank losing some of its customers and then regressing in its work and loss, which effects on its profits because there are several internal and external parties that have access to banks’ business and information covered by the scope of the banking secret, including compliance observers. Therefore, the research problem revolves around the role of the compliance observers in maintaining the secrets of banks in which they work and their commitment to banking secrecy. This leads us to raise the following questions:

1. Is the compliance observer included to maintaining banking secrecy?

2. Is the information that the Compliance Controller sees considered banking secret that is prohibited from divulging?

3. What is the effect of the compliance observer’s work on maintaining the bank’s secrets?

4. Does the breach of bank secrecy by compliance observers negatively affect the performance of the bank's work?

Importance of the Research

Importance of maintaining the bank’s secrets by those authorized to access them, including compliance observers, and what they obtain of data and information related to the bank’s work and activities, and also related to customers’ accounts and deposits, require from them not to disclose it directly or indirectly.

Objectives of the Research

The research aims to achieve the following objectives:

1. Discussing the concept of banking secrecy, its importance and those involved to maintain it.

2. Explaining the compliance auditor’s framework and obligations and their connection to banking secrecy.

Population and Sample of the Research

The research population consists of the Iraqi banking system in general, and the (Central Bank of Iraq) and the banks (Al-Rafidain, Ashur and Development) were selected as a research sample.

Spatial and Temporal Limits of the Research

1. Spatial limits: The spatial limits of the research are represented in the compliance observer department in the Central Bank of Iraq and some Iraqi public and private banks represented by the Rafidain Bank, Ashur Bank and Development bank.

2. Temporal limits: The temporal limits of the research cover the period from 1/11/2016 to 30/4/2018.

Hypotheses of the Research

H1: There is a significant relationship between the work of compliance observers and maintaining banking secrecy.

H2: There is a significant effect of the work of compliance observers on maintaining banking secrecy.

Practical Aspect of the Research

First: Field research procedures

This section includes a description of the research population and the mechanism of selecting a sample from it and an explanation of how to prepare the questionnaire as well as the presentation of the results, analyze and interpret them based on some statistical methods.

Research Tool

The research relied on the questionnaire as one of the basic scientific means to complete the research. So, a questionnaire was prepared that included all the factors and variables that are directly related to the subject of the research. Then, the questionnaire’s paragraphs were organized into specific axes that included the demographic axis and two main axes:

1. The work of compliance observers.

2. Maintaining banking secrecy.

Research Population and Sample

To achieve the objectives of the research, (Central Bank of Iraq, Rafidain Bank, Ashur Bank, Development Bank) were selected as spatial limits for the research. Field visits were made to those banks and the respondents’ opinions were thoroughly investigated as a research population. Then, the prepared questionnaire was distributed to a part of that population and included (47) respondents. When the questionnaires were subjected to the audit stage, it was found that one questionnaire was not suitable to be in the stage of statistical analysis, so it was excluded. Thus, the size of the research sample within the stage of statistical analysis was (46) respondents whose responses were later subjected to a test of reliability and validity. Then, the results of their responses were analyzed statistically using the Statistical Package for Social Sciences (SPSS). Finally, the results were interpreted in order to test the research hypotheses and draw conclusions and recommendations from those results.

Statistical Methods and Treatments

1. Percentages and frequencies: Frequencies reflect the extent to which responses are focused and gathered around a particular option, as well as weighting those frequencies with the corresponding percentage by dividing the repetition product of a particular phenomenon by the total number of frequencies and multiplying the outcome by 100%.

2. Correlation analysis: It is a statistical tool that reveals the extent of the existence of a significant correlation between two or more variables. Spearman correlation coefficient of rank correlation was adopted in the statistical analysis, because the replies are in a qualitative and descriptive form (always, sometimes, and rarely) through a t-test by comparing the computed t value with its tabular counterpart.

3. Linear regression analysis: Linear regression method is the most prominent statistical methods and tools that show the extent to which there is an effect of one or more independent variables on the dependent variable. The simple linear regression model was adopted in studying the extent to which there was an effect of the work of compliance observers in maintaining banking secrecy through the use of F-test extracted from the analysis of variance table by comparing the calculated (F) value with its tabular counterpart.

Test the Reliability of the Data

1. Content validity: It is one of the necessary foundations for building any scale. Perhaps the content validity is one of the most important of those criteria, which lies in presenting the questionnaire's paragraphs to a group of experts and arbitrators. Therefore, the questionnaire was presented to a number of arbitrators, who provided their observations and opinions in order to make the questionnaire more appropriate with the desired objectives of the research.

2. The questionnaire’s paragraphs were quoted for the independent variable (the work of compliance observers) and the dependent variable (maintaining banking secrecy) according to the theoretical literature. So, the questionnaire was distributed to (12) arbitrators with competence and knowledge, and the distribution included (2) arbitrators from the College of Administration and Economics, University of Baghdad, (3) arbitrators also from the College of Administration and Economics, Al-Mustansiriya University, (3) arbitrators from the Higher Institute of Financial and Accounting Studies, (2) arbitrators from the College of Administration and Economics, Iraqi University, (1) arbitrator from the College of Education for Girls of the Iraqi University, and (1) arbitrator from the College of Administration and Economics, University of Kufa. The questionnaire was returned to the arbitrators after modification in accordance with all the arbitrators’ opinions. The percentage of agreement reached comprehensively (93.05%), which is an excellent percentage with high validity. This indicated result reflects the extent of the validity of the questionnaire's content and its eligibility to take its course in the field of scientific research in order to extract results and analyze them later Qalioubi (2016).

3. Reliability: The concept of reliability refers to the extent of consistency in the results of the scale, as the strength of the reliability coefficient is whenever the results of the application converge or are equal in two different time periods on the same individuals targeted in the study. The reliability coefficient was calculated according to two methods:

Half-split method: The questionnaire was divided into two homogeneous halves using all the questionnaires paragraphs of the research sample, which amounted to (46). The questionnaire's (21) paragraphs were also divided into two equal homogeneous halves. The first half included the odd paragraphs, while the second half included the even paragraphs, ignoring the middle paragraph. By calculating the Pearson correlation coefficient between the two halves of (0.83) and using the Spearman-Brown corrective equation, the value of the stability coefficient according to the half-split method was (0.91) for the first half and (0.88) for the second half. This result reflects excellent reliability values that call for the adoption of the research results and their generalization in studies future.

Internal reliability method: This method depends on the consistency of the answers of the same respondent from one paragraph to another. All the forty-six questionnaires of the research sample were used and the Alpha-Cronbach coefficient was calculated for each of the axes of the questionnaire as well as the general reliability coefficient for all the paragraphs of the questionnaire. The result of the test showed that the value of the reliability coefficient (Alpha - Cronbach) for the research questionnaire reached (0.94), which was an excellent percentage with a high degree of reliability for the results of the questionnaire in this study and subsequent future studies. Table 1 shows the results.

| Table 1 The Reliability Coefficient Values of the Research Questionnaire | |

| Questionnaire axes | Alpha-Cronbach coefficient value |

| Work of Compliance observers axis | 0.91 |

| Maintaining bank secrecy axis | 0.92 |

| All axes | 0.94 |

Analysis of the Characteristics of the Research Population

Demographic axis: The research sample was characterized by the age group (less than 30 years) topping the order of the distribution of age groups, as this group constituted nearly half of the respondents in the banks under study with a representation rate of (47.8%), followed by the age group (31-40 years) with a representation rate of nearly a third of the research sample amounted to (32.6%), and then the age group (41-50) years ranked third, with a representation rate of (15.2%), the remaining percentage (4.3%) represented bank employees within the age group (51-60) years. While, there were no respondents within the age group (more than 60) years, as shown in Table 2. These results reflect a diversity in the age groups of the respondents, which combines the experience of the older ages with the youthful energies of the younger ages that can quote those accumulated experiences of those who preceded them in banking.

| Table 2 Distribution of the Respondents in Terms of Age | ||

| Age | Number \ Frequency | Percentage |

| Less than 30 years | 22 | 47.8 |

| 40-31 years | 15 | 32.6 |

| 50-41 years | 7 | 15.2 |

| 60-51 years | 2 | 4.3 |

The results shown in Table 3 regarding the educational qualifications of the respondents in the banks included in the research sample indicated that slightly more than two thirds of those employees (69.6%) hold a bachelor’s degree, while (17.4%) of them hold a master’s degree or its equivalent. As for the percentage of respondents obtaining a higher diploma reached (8.7%), while the remaining small percentage (4.4%) represented those who hold a doctorate degree or its equivalent. These results reflect the dominance of holders of a bachelor’s degree as well as the scientific and knowledge diversity for other academic qualifications.

| Table 3 Distribution of the Respondents in Terms of Scientific Qualification | ||

| Scientific Qualifications | Number \ Frequency | Percentage |

| Bachelor degree | 32 | 69.6 |

| Higher Diploma | 4 | 8.7 |

| Master or equivalent | 8 | 17.4 |

| PhD or equivalent | 1 | 2.2 |

| Total | 46 | 100 |

The results of the statistical analysis on the specialization of the research sample indicated that a little more than a third of the respondents (34.8%) are specialized in financial and banking sciences, and that nearly a quarter of the respondents (23.9%) are specialized in accounting. In addition, a similar percentage of the respondents reached (21.7%) are specialized in business economics, while (10.9%) of the sample members are specialized in business administration, (6.5%) of the respondents are specialized in law, and the rest of the respondents, with a small percentage, (2.2%) are specialized in statistics. These results reflect the optimum distribution of specialists in the banking field, which means graduates from specialists, as shown in Table 4.

| Table 4 Distribution of the Respondents in Terms of Specialization | ||

| Specialization | Number \ Frequency | Percentage |

| Banking and Financial Sciences | 16 | 34.8 |

| Law | 3 | 6.5 |

| Business Administration | 5 | 10.9 |

| Accounting | 11 | 23.9 |

| Business Economics | 10 | 21.7 |

| statistics | 1 | 2.2 |

| Total | 46 | 100 |

In line with what was stated in paragraph (2), the results of the statistical analysis regarding the period of service years of the research sample shown in Table 5 showed that slightly more than half of the employees in the banks under study (58.7%) have a service period of (less than 10 years), and a little more than a quarter of the respondents (28.3%) have a service period ranging from (10 years to less than 15) years. While, the remaining percentage was divided equally for respondents whose service period ranged between (15 years to less than 20 years) and (20 years and over) amounted to (6.5%) for each. These results reflect the compatibility between the number of years of service of the respondents and their ages in paragraph (2) in terms of categorical diversity in years of experience.

| Table 5 Distribution of the Respondents in Terms of Length of Service in the Current Job | ||

| Years of Experience | Number \ Frequency | Percentage |

| Less than 10 years | 27 | 58.7 |

| 10 years - less than 15 | 13 | 28.3 |

| 15 years - less than 20 years |

3 | 6.5 |

| 20 years and above | 3 | 6.5 |

| Total | 46 | 100 |

When respondents were asked about the places where they worked, the results of Table 6 showed that a little more than half of those respondents (52.2%) had worked in a private bank, and a little more than a third of the respondents (34.8%) had worked in The Central Bank of Iraq, and that a percentage of (6.5%) of them have worked in a government bank. While (4.3%) of the respondents worked in all kinds of banking sectors, and the remaining small percentage (2.2%) indicated that they had worked in The Central Bank of Iraq and one of the private banks. These results give an impression of the efficiency and experience of the respondents in the private and governmental banking work (The Central Bank of Iraq, 2016 & 2004).

| Table 6 Distribution of the Respondents in Terms of Participation in Training Courses | ||

| Workplace | Number \ Frequency | Percentage |

| The Central Bank of Iraq | 16 | 34.8 |

| One of the government banks | 3 | 6.5 |

| One of the private banks | 24 | 52.2 |

| The Central Bank of Iraq and one of the private banks | 1 | 2.2 |

| All banking sectors | 2 | 4.3 |

| Total | 46 | 100 |

The employees of the targeted banks were also asked in the questionnaire for the nature of the work they practice. The results of the statistical analysis shown in Table 7 indicated that a little more than a quarter of those respondents are staff (28.3%), and a percentage close to the previous one is (26.1) %) of the respondents work as compliance observers. While, of the sample members (13%) work as inspectors, the percentage of those working as managers is (10.9%) of the total sample, and (8.7%) of the sample members work as observers and auditors. Finally, the percentage of assistant manager reaches (6.5%) and the same percentage for respondents who work as compliance observers.

| Table 7 Distribution of the Respondents of the Nature of Work | ||

| Work Nature | Number\Frequency | Percentage |

| Compliance officer | 12 | 26.1 |

| Manager | 5 | 10.9 |

| Staff | 13 | 28.3 |

| Assistant Manager | 3 | 6.5 |

| Inspector | 6 | 13.0 |

| Compliance observer | 3 | 6.5 |

| Observers and advisors | 4 | 8.7 |

| Total | 46 | 100 |

The distribution of the respondents according to Table 8 showed that approximately one third of them (32.7%) work in Asur Bank. While, of the respondents (30.4%) work in the Central Bank of Iraq, and the same percentage work in the Development Bank. Finally, the remaining percentage (6.5%) represents the workers in the Rafidain Bank.

| Table 8 Distribution of the Respondents by Place of Work | ||

| Bank | Number\Frequency | Percentage |

| Ashur Bank | 15 | 32.7 |

| central bank | 14 | 30.4 |

| Al - Rafidain Bank | 3 | 6.5 |

| Development Bank | 14 | 30.4 |

| Total | 46 | 100 |

Statistical analysis of the relationship between the work of compliance observers and maintaining banking secrecy

In order to make a decision on the first hypothesis of the research, the relationship will be found by calculating the Spearman correlation coefficient for the rank correlation between the compliance observers’ work variable and maintaining banking secrecy variable, and then testing that relationship by using the (t) test to show the significance of the correlation coefficient calculated using SPSS as shown in Table 9 below. The interpretation of the results is as follows:

| Table 9 Spearman's Correlation Coefficient and (T) Test Values for the Significance of the Relationship Between The Work of Compliance Observers and Maintaining Banking Secrecy | |||||

| X | Y | Spearman correlation coefficient (r) |

Calculated (t) | (t) value | Significance |

| Maintaining the banking secret | Work of compliance observers | 0.448 | 3.323 | 2.015 | Significant |

The results shown in Table 9 indicated that the value of Spearman's correlation coefficient variable of compliance observers' work and the variable of maintaining banking secrecy amounted to (0.448), which is a positive direct value with statistical significance at the significance level (0.05) due to the fact that the calculated value of (t) (3.323) is greater than its tabular counterpart, which is equal to (2.015) at the significance level (0.05). The interpretation of this result is that whenever the work of compliance observers develops, this will lead to maintaining banking secrecy more in the banks under investigation. Therefore, the first hypothesis of the research is accepted, which states that there is a significant relationship between the work of compliance observers and maintaining banking secrecy.

Statistical analysis of the effect of compliance observers' work on maintaining banking secrecy

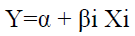

Table 10 shows some statistical terms that were used in analyzing the effect of compliance observers' work in maintaining banking secrecy. These were investigated by using the simple regression equation as follows:

| Table 10 Statistical Terms Used in Regression Analysis Table of Statistical Parameters | |

| Parameter/Function | Indicator |

| R Square | It refers to the value of the coefficient of determination that measures the quality of the regression model. So, the closer the value of the coefficient of determination is to 100%, the higher the quality of the regression model would be to represent the studied phenomenon. |

| F-Test | The value of this test is extracted from the analysis of variance (ANOVA) table, through which it is known whether the independent variable has an effect on the dependent variable or not by comparing that value with its tabulated counterpart and making the decision. |

| Α | It indicates the intersection of the regression line with the origin point, and represents the estimated Y value when the value of X equals 0. |

| β | It refers to the standard β value called the regression coefficient, which is more accurate and more understandable when interpreting the effect of the independent variable on the dependent variable. |

Where:

Y=Dependent variable (Maintaining bank secrecy).

X=Independent variable (Compliance Observer work).

α=Constant parameter.

β=Beta parameter (Regression coefficient).

i=An indication of the independent variable is equal (1, 2, 3, 4 ….46).

In order to make a decision on the second hypothesis of the research, the effect of the work of compliance observers on maintaining banking secrecy was studied by calculating a simple linear regression equation for the two variables using SPSS and interpreting the results shown in Table 11 as follows:

| Table 11 Results of Parameters Values Used to Measure the Effect of Compliance Observers' Work on Maintaining Banking Secrecy | |||||||

| Variables | Parameters | ||||||

| X | Y | Constant parameter α | Regression parameter β | Calculated value of (F) | Tabulated value (F) | Coefficient of determination (R2) | Significance |

| Maintaining banking secrecy |

Compliance Observers' work | 0.75 | 0.51 | 15.43 | 5.38 | 0.46 | Significant |

The results of the statistical analysis shown in Table 11 indicated that there is a statistically significant effect at the significance level (0.05) for the variable compliance observers' work on the variable maintaining banking secrecy because the calculated value of (F) amounting to (15.43) is greater than its tabular counterpart, which is equal to (5.38). Also, the independent variable (the work of compliance observers) was able to explain about half of the deviations in the values of the variable (maintaining banking secrecy), which is (46%) of the total deviations in the values of the dependent variable. This was reflected in the value of the coefficient of determination, and thus the estimated regression equation for the effect of the compliance observers’ work variable on the banking secrecy variable is as follows:

Maintain banking secrecy=0.75+(0.51) Work of compliance observer

The value of the regression coefficient of (0.51) indicates that an increase in the work of compliance observers in the surveyed banks by one unit is also be accompanied by an increase in maintaining banking secrecy by (51%). Thus, the second hypothesis of the research is accepted, which states that "there is a significant effect of the compliance monitors' work on maintaining banking secrecy".

Conclusion

The research reached a number of the following most prominent conclusions related to the practical part:

1. Acceptance of the first hypothesis of the research, which states that “there is a significant relationship between the compliance observers' work and maintaining banking secrecy.”

2. Acceptance of the second hypothesis of the research, which states that “there is a significant effect of the work of compliance monitors' work on maintaining banking secrecy.”

3. There is diversity in the age groups of employees in the four banks targeted in the research, which gives them accumulated experiences and those who are involved in banking work, as well as young energies.

4. Bachelor’s degree holders are the most prominent employees in the banking sector, as well as a variety of other academic degrees, including higher degrees or their equivalent.

5. The scientific specializations of the employees in the banks under study are commensurate with the nature of the work, as it is noted that the leadership of those who are specialized in financial and banking sciences.

6. There is diversity in the level of expertise of the employees in the banks under discussion with accumulated experience, who give it to those who are in the beginning of their career to employ them in the future.

7. The employees of private banks constitute the largest proportion of the respondents.

8. The absence of legislation (regulation or instructions) to indicate the compliance observer’s procedures for ascertaining the extent to which the bank has implemented its commitment to banking secrecy.

Recommendation

After drawing on the main conclusions, the following recommendations were reached: After drawing on the most prominent conclusions, the following recommendations were reached:

1. Banks should not take an exaggerated prudence and caution towards the staff of compliance observers, as they maintain banking secrecy. They must deal with this job with all transparency and disclose it to the observers and make room for them, especially if those banks are committed to the laws and instructions of the Central Bank, so there is no reason for them to be afraid.

2. Creating an atmosphere of trust among banks' staff and those who are in the job of compliance observers because the work of the two affects each other, this is compliance with the laws and instructions of the Central Bank. Thus, this contributes to the good and sound performance of their work, which is in the interest of the staff and the bank and thus contributes to pushing economic development forward.

3. Putting young energies into a job as compliance observers in banks, as they enjoy the enthusiasm of young people and benefit from the experiences possessed by those who are older than them and have years of experience in the job.

4. Appointing those who hold higher degrees or their equivalent to the position of compliance observer as heads of departments and divisions, which contributes to the development of this job because of their academic experience.

5. Giving a greater opportunity for employees to be accepted into the position of compliance observer than those who hold specialized certificates that are commensurate with the nature of the work of that job.

6. The tendency by the banks to appoint those with accumulated experience in the field of banking work and those who are trustworthy and unquestionable, especially the job of compliance observers, as this is reflected in keeping the bank’s secrets and not revealing them except to the authorized authorities. They also train those with less experience, whether by holding training courses or providing financial and banking advice in particular, to enhance the performance and work of the job of compliance observers.

7. Assigning a larger number to the post of compliance observers in governmental and private banks, after checking their integrity, reputation and morals, professionally and personally, to ensure that they carry out their banking duties, commit to maintaining banking secrecy, and give this post importance due to the necessity it poses in the field of banking. The work of the observers is considered important to the Central Bank of Iraq to ensure that banks comply with the laws, instructions and directives of that bank. Thus, this contributes to building a sound banking system based on solid and correct procedures and laws.

8. The Central Bank of Iraq should issue legal instructions regarding the compliance observer procedures related to compliance with banking secrecy.

References

Alam, M.I. (2001). Encyclopedia of the acts of banks, both legally and practically. The Golden Eagle of Printing.

Awad, A.J.A. (2000). Legal operations of banks in the new trade law and Arab countries legislation. Dar Al-Nahda Al-Arabiya, Cairo.

Law. (2004). The Iraqi banking law no. 94.

Law. (2010). Syrian legislative decree no. 30 of 2010 banking secrecy law.

Qalioubi, S. (2016). The legal basis for banking operations. Ain Shams Library.

Regulation. (2007). The new in the work of banks from the legal and economic aspects. The annual scientific conference of the Faculty of Law, Beirut Arab University, Halabi rights publications, Beirut, Lebanon.

Shaker, H. (2015). Banking secrecy as a competitive advantage, applied research in a sample of public and private banks, which is part of the requirements of obtaining the high diploma equivalent to the Master of Banking, the Higher Institute of Accounting and Financial Studies.

Suelem, M.A. (2014). Banking operations/comparative study of the banking and criminal faculties. University Publications House.

The Central Bank of Iraq. (2004). The Central Bank of Iraq Law No. 56.

The Central Bank of Iraq. (2016). Directorate general of banking and credit control, department of issuing commercial bank instructions and licenses, instructions to change compliance observers and money laundering officials.