Research Article: 2019 Vol: 18 Issue: 4

The Spatial Integration of Crumb Rubber Markets within ASEAN Countries

Ansofino, STKIP PGRI Sumatera Barat

Zusmelia, STKIP PGRI Sumatera Barat

Yola Malinda, STKIP PGRI Sumatera Barat

Lovelly Dwinda Dahen, STKIP PGRI Sumatera Barat

Abstract

Keywords

Rubber Market Integration, Regional Integration, Rubber Markets, ASEAN countries.

JEL Classifications

O11, Q02

Introduction

Market integration for rubber commodities has become a necessity in the local, national and regional rubber trading system. The rubber products in the form of derivative industries have become trade commodities among the developed industrial countries in the world with a high profits and margin. Meanwhile, the rubber farmers are in the lowest chain of the profit margins receipient of the rubber trading system. They are mostly in poor condition, entangled in a trading system that not provide optimum benefit to them and not able to manage to be out of the system (Gnangnon, 2019; Yen et al., 2013; Greenaway et al., 2015).

Regional trading cooperation has become one of the focus of research interest especially the topic of trading integration between the central and hinterland region (Hansen & Jørgensen 2001; Ahmed & Ghani 2008; Ansofino 2017; Farida et al., 2017; Orcalli 2017). Lack of integration of the markets into the regions and low connectivity of the commodities and major products of a country’s products may cause the isolation for the country, low trading value, acute poverty, low quality and services of trade goods. Conversely, the trading integration, connectivity and configuration between the regions would encourage rapid economic growth, high urbanization flows, rapid flow of goods and capital. Therefore the market integration and regional cooperation will open up the economic development in the region such as ASEAN region.

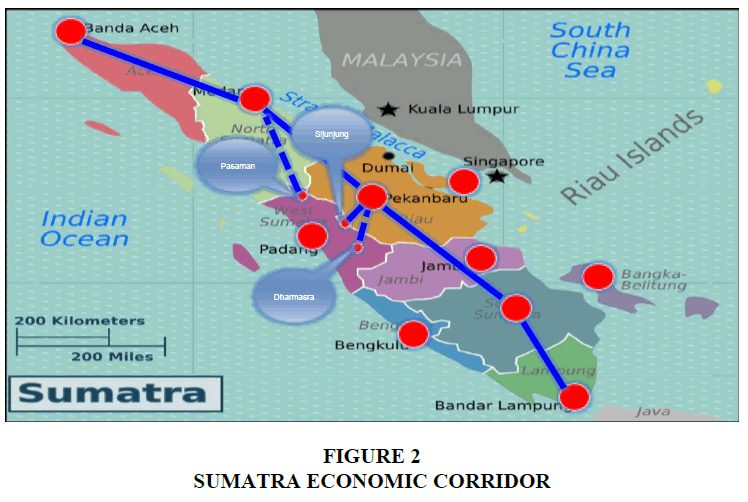

The West Sumatra province is part of the Sumatra corridor. It has advantages and potential as a center for the production and processing of national energy crops and barns such as rubber, oil palm, coal, iron and steel. The economy of West Sumatra had a strong base in natural resource management such as rubber and oil palm plantation. However, it has not yet able to encourage the economic developement towards an industry and innovation based economy. Therefore, it is necessary to develop toward economic based industry which mainly investment and innovation driven. The efforts to develop the economy of West Sumatra towards the Sumatra corridor is important since given the role of the West Sumatra region in the center of Sumatra island.

To achieve the high economic growth target of West Sumatra as industrial economics and innovation in 2025 need local competitive advantages connection to Sumatra Corridor. Therefore, the strengthening local and regional connectivity is important in efforts to develop the economy of West Sumatra towards the Sumatra corridor

Building the local economic connectivity between the regency and city in the West Sumatra region which have local advantages for various economic activities will support the potential and advantage of the Sumatra corridor. Local advatages centers in the West Sumatra province should be connected to through business, trade and economic networks with the main center of advantages within the province. Furthermore, Padang city as one of a national growth center should have connectivity with the Sumatra corridor network with nodes of Pekanbaru, Dumai, Medan, Jambi and Palembang, and Bandar Lampung. The West Sumatra province can be part of the Sumatra economic corridor as a buffer zone that synergizes with other growth centers. In the context of the acceleration and expansion of the economy of West Sumatra province, therefore it is necessary to determine and develop economic centers and industrial clusters.

This study is part to support the university's research strategic plan to focus on the field of social humanities research with the theme of economic and development for poverty alleviation. The research questions of the paper are:

1. What is the model of the market link between the main commodities of West Sumatra and the other central Sumatra economic corridors?

2. How is the model of the market link between the main commodities of the Sumatra economic corridor and ASEAN countries within the framework of the ASEAN Economic Community (AEC)?

3. How is the development of regional economic cooperation between the Sumatra economic corridor and the ASEAN MEA?

Research on regional cooperation carried out by one of regional development planning experts was with the topic of making regional cooperation work for South Asia's Poor (Ahmed & Ghani, 2008). The study concluded that the South Asian Region is less integrated with other regions in the world. South Asian countries have opened up to the outside world, but this effort has still not succeeded because they are still closed to the neighboring countries. The lack of regional market integration, low connectivity, and the historical background of the existence of disputes and conflicts have caused the South Asian regions to be divided into two. First one as dynamic South Asian countries with fast growth, rapid urbanization and taking advantage of global integration. The second one is that the “rural” South Asian countries with acute poverty and least developed resulting in the divergence of South Asian countries.

The policy makers in South Asia have seen that their countries could not grow in the isolation. The uniqueness of geography (distance and density) is the potential to increase the growth through increasing the flow of labor, capital, science and technology, goods and services between regions. Regional cooperation and market integration will open the development of disadvantaged areas in South Asia. This research will use the same framework with the research of Ahmad & Ghanie (2008) about the need to develop economic cooperation between provinces in the Sumatra economic corridor, before heading to trading cooperation with other national regions, ASEAN and Global. Therefore, regional cooperation and market integration are important points in the provincial cooperation in the Sumatra corridor region.

Furthermore, Goto (1997) research on regional economic integration and agricultural trade analyzes the economic impact of regional integration on trade in agricultural goods. Its study used the Krugman-type model with product differentiation, where it derived two propositions about the impact of regionalization on trade flows. The first proposition was about the higher degree of protection because of the the impact of regional integration and the lower degree of product differentiation will lead to greater impact on regional integration. The second proposition predicts that regionalization will have more impact on agricultural trade than industry since the initial level of protection is lower in agricultural products. This Goto (1997) study was conducted also in European Economic Community and APEC countries. It used two different analysis called ex post and ex ante analysis. To test the size of the intra-industry trade then Goto (1997) used the Industrial Industry Index (ITI) for agricultural products and industrial goods trading between regions. Goto (1997) found that agricultural products trading must be analyzed within the framework of product differentiation rather than homogeneous products. It is because all agricultural products were homogeneous then the index would be zero.

Goto (1997) also used the regional general equilibrium analysis as a representative across integrated regions that trade in agricultural and industrial products. The used of a simple trading model within the regions with product differentiation impacting regional integration of agricultural products trading compared to the impact of manufacturing products trading. The impacts of agricultural and industrial products trading among the regions depend on two parameters: the degree of initial protection and the degree of product differentiation. The research on the Sumatra Economic Corridor will also use a trading model between the centers of the Sumatra economic corridor and its hinterland areas, and how to integrate the centers of the Sumatra economic corridor with the global and national world.

Referred to Deichmann et al. (2008) research on spatial specialization and farm-non farm linkages. This study presents empirical evidence of the importance of the relationship between urban and rural agriculture for rural nonfarm labor. He used two approaches to understand the interrelationships of urban-rural linkages. He focussed on the growth of non-farm activities in rural areas is directed by the rapid growth of agricultural productivity at least in the early stages. Melor (1976); Ranis & Stuart (1973); Hazell & Readon (2006); Deichmann et al. (2008), state that the diversity in production, consumption and linkages work related to the development of the non-farm and farm creates a dual effect for the growth of regional agricultural productivity.

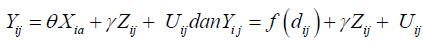

The second approach used by Deichmann in his research is to study the urban-rural linkages from the new economic geography. City demand pressure has different influences comapred to type of activity in rural areas (Fujita et al., 1999; Henderson et al., 2001; Renkow, 2006; Deichmann et al., 2008). The agglomeration of economies and congestion dis economies inter-play has determined the location of activities on space that have produced different regional concentration patterns around large urban centers. This difference in specialization patterns is not only caused by agriculture, but also by differences in the types of non-agricultural activities. Agricultural linkages are captured by crop suitability index. Whereas urban linkages are proxied with the index of access to the city center measured by the minimum arc distance. This farm-non farm linkages model forms the reduced form equation, with the following specifications:

Where Yij is income or labor activities in non agriculture j at location of I; Xia adalah income atau labor activities in agriculture at location I; dij adalah distance of location I with the city center; Zij is vector variable to explain the rural-urban linkage, dan Uij is the error term.

The results of econometric calculations show that the high returns on labor wages and labor in nonfarm activities cluster around the main city. The negative effect of isolation on the high wages is big on locations with greater agricultural potential. The low income of non-farm activities is mainly respond of local demand which is not significant to spatial variations. The result of the analysis confirms that there is a need to improve connectivity between regions with higher agricultural potential to urban centers for non-farm development in Bangladesh.

The analytical method to analyze the interrelationship between intra-farm and nonagricultural between regions is simple reduced form specification:

Where: Yij is income or labor activities in non agriculture j at location of I

Xia adalah income atau labor activities in agriculture at location I

dij adalah distance of location I with the city center

Zij is vector variable to explain the rural-urban linkage

Uij is the error term.

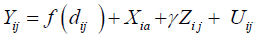

To analyze the inter-relationship of non-farm activities with farms in and inter-territories used Goto (1997) model based on the Krugman-type model see Lanaspa & Sanz (1999); Marjit (1991); Wang & Xie (2004). To test the size of intra-industry trade, we used the Intra Industry Index (ITI) see Bhattacharyya (2002); Bernhofen (1999) and Lefilleur & Maurel (2010), for describing agricultural and industrial products trading between intra and inter-industrial activities in the Sumatra corridor.

The research on the model of economic improvement in West Sumatra region through the growth centers approach will use the Deichmann model by modifying it to variables relevant to the regions in the Sumatra Economic Corridor. The data bases were taken from 10 provinces in Sumatra economic corridor. This research will also be supported by the results of the author's activities with the development planning agency of West Sumatra Province in 2017. These results will be followed by an analysis of the linkages with other provinces.

Research Method

Research on the economic improvement model of West Sumatra region through a growth center approach is to build the connectivity with the centers of the Sumatra economic corridor using a regional economic approach. Regional economic approaches is able to provide a theoretical framework for rural-urban and farm-nonfarm linkages which will be manifested in the center of the Sumatra economic corridor and the linkages of main commodities and industry with the central economic corridors and the hinterland region. Empirical data of this study are in the form of primary and secondary data. Primary data is obtained by observation and interviews with leading commodity business actors and other stakeholders in the industrial centers. Secondary data is obtained from each province from the provincial statisical bureau. The research location is in West Sumatra province specially the region of the main commodities and industrial producers.

The steps in our research are: the analysis phase to find main commodities and industries in the West Sumatra region and other provinces then his next stage is to analyze market integration and regional cooperation between leading regions within and inter centers of the Sumatra corridor.

The cointegration relationship between the two data series has been developed by Johansen (1998) with the method of maximum likelihood estimation with the model form as follows:

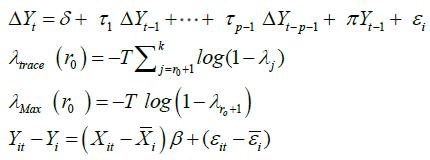

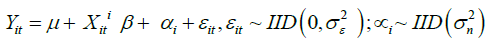

Two forms of cointegration testing of the two data series above are traces of statistics and maximum eigenvalue, if it is significant, then the two data series have a long-term, or cointegrated relationship. A number of variables used have a cointegration relationship, then proceed with testing the panel data regression to explain the factors that influence the occurrence of the cointegration relationship in the long run. There are two testing models used, namely fixed effect and random effect, which take the form of the following model:

Ordinary least square estimator for β obtained from this transformed model is often called the within estimator or fixed effect estimator. This model is able to explain the difference in rubber exports in the current period (t) with the future period (t +1) having the same effect, whether it changes from one time period to another, or from one region to another. Then using the assumption of random factor is independently and identically distributed over individual variable, this can be written with random effect model as follows:

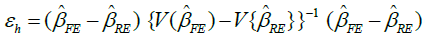

The testing the best model between the fixed effect model and the random effect model in rubber market between the Sumatra economic corridor and ASEAN countries, using the Hausman test which takes the form of the following model:

The Hausman test thus tests whether the fixed effect and random effect estimator are significantly different.

Results and Discussion

Trading Integration of West Sumatra with Its Regencies

The integration of West Sumatra’s trading with its regency (12) and city (7) was analyzed using panel data regression. The integration is measured by the large and small trading values of gross regional product of West Sumatra and its respective regencies and cities. This trading integration is influenced by a number of variables such as economic growth, income per capita, and accessibility. Accessibility is related to the length of the road since most of trading traffic intensity depends on the land transportation in West Sumatra region.

The regression results of trading integration data between the West Sumatra province with its regencies and cities has the fixed effect methods (FEM) with indicated by the value of X2 = 55.53 which is greater than the value of X2 (19. 0.05) of 30.14. It describe the changes in the economic growth variables, income per capita and the length of roads in the regencies and cities will affect the occurrence of trading integration with constant value of 207832.8 unit.

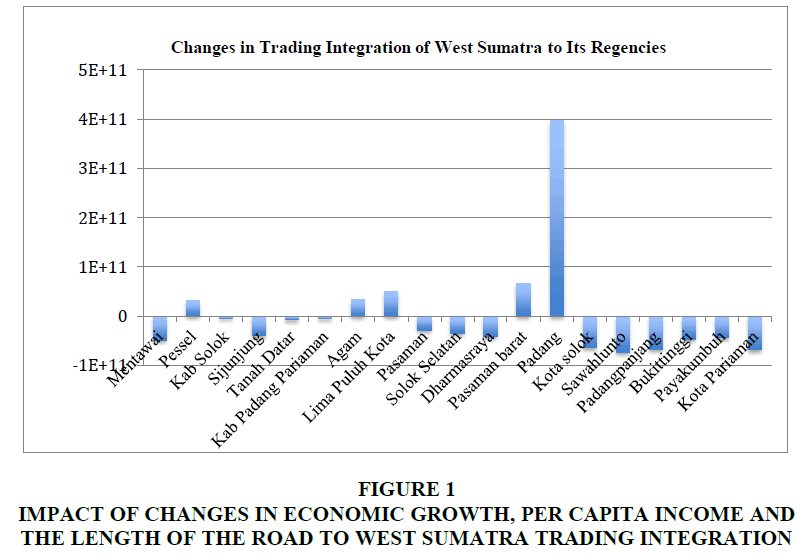

The positive impact of the change in trading integration occurred in the Padang, West Pasaman, 50 Kota, Agam and South Pesisir, while the remaining regencies and cities experience the effects of negative changes. The biggest impact of the occurrence of trading integration in West Sumatra is Padang, West Pasaman and 50 Kota. Meanwhile, Sijunjung, Dharmasraya and Pasaman as the centers of rubber production are less integrated with West Sumatra’s trading. It is because of the increased of accessibility of these three districts with their neighboring provinces such as Jambi, Riau and North Sumatra (Figure 1).

Figure 1 Impact of Changes in Economic Growth, Per Capita Income and the Length of the Road to West Sumatra Trading Integration

Figure 2 illustrates that trading integration is decreasing in line with changes in economic growth, per capita income and increased of accessibility, especially in the regencies of rubber production centers. The reduced of trading integration with West Sumatra’s trading centers reflected from the low competitiveness of rubber exports compared to the neighboring provinces.

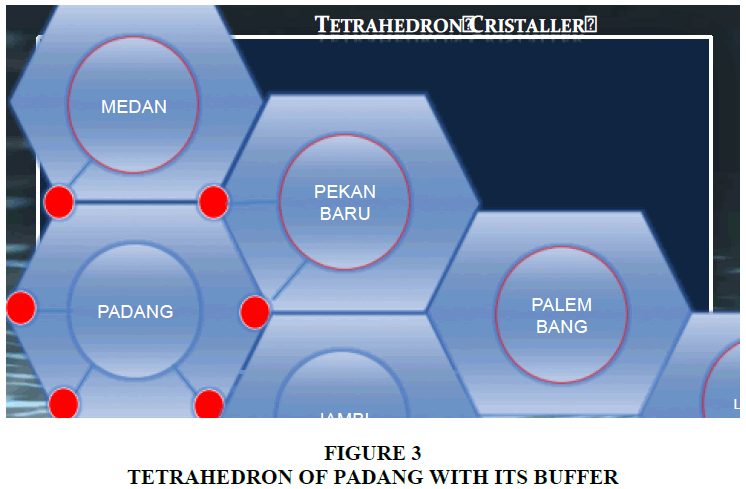

The Four regencies as rubber production centers in West Sumatra were found to be less integrated with Padang as a national activity center. They are more integrated to Pekanbaru, Palembang and Medan. This means those regencies are buffer zones for processing rubber industries in the center of Sumatra corridors.

Sijunjung and Dharmasraya are the buffer zone for the Pekanbaru’s rubber processing center, while Pasaman are more related to Medan rubber industry. These three rubber production centers are weak in the relation of rubber trading with Padang as the trading center of West Sumatra. The trading integration between Padang and its buffer zone only occurs with Pasaman Barat, 50 Kota, Agam and Pesisir Selatan.

The lack of integration of Padang with its buffer zone in the rubber trading has caused the economic rent is still not be part to West Sumatra economy. It shows by the small contribution of the rubber trading value into economic growth. This is because of Sijunjung, Dharmasraya and Pasaman are integrated to North Sumatra, Riau and South Sumatra.

The result of panel data regression for factors that affect the trading linkages between the regencies of rubber production centers with economic growth using the Pooled OLS Method (PLS). The assumption of the PLS method is that each regency have the same intercept and slope dimension in time series, therefore the regression results can be apply to each regency’s trading.

Table 1 describes that per capita income and economic growth factors positively and significantly affect the trading linkages of the regencies with the growth center of Padang (centre for national activity). The variable length of the road has a negative sign on the trade linkages of the regencies with their centre for national activity but this variable is not significant at the 5% level.

| Table 1 The Result of Panel data Regression 2007-2016 with Pls | |||

| Variabel | Coefficient | T Statistik | Prob |

| C | -1357803 | -1.9658 | 0.0509 |

| Income Perkapita (X1?) | 33273.41 | 5.850052 | 0.0000 |

| Economic growth (X2?) | 265533.7 | 2.292941 | 0.0231 |

| Length of the road (X3?) | -2.068879 | -1.316150 | 0.1899 |

| R2 | 0.181114 | ||

| R2 Adjusted | 0.166831 | ||

| F count | 12.68049 | ||

The F test also shows that all independent variables influence the trade interrelationship simultaneously between Padang and the regencies in West Sumatra. However, the length of the road as the most important variable influences the trading integration of Sijunjung, Dharmasraya, and Pasaman is not statistically significant. A negative sign shows that the decreasing length of the road will lead to higher levels of trading integration between Padang and its buffer zone and vice versa.

It turns out that the relationship between the length of the road and the degree of trading integration is not significant in the case of the rubber trading of Padang and its hinterland area. The rubber trading transactions between village level traders in Sijunjung and Dharmasraya regencies are more dominantly occured with regency level traders from Indra Giri Hilir regency, especially from Rengat, Kuala Enok and Kuala Tungkal of Jambi province.

The factors causing the dominance of the rubber trading flow of Sijunjung and Dharmasraya regencies to the Riau and Jambi provinces were caused by: 1). shorter distance and efficient transportation cost between the village market to Riau and Jambi provinces, 2). The monopsony market - only one regency level trader that directly obtained a supplier license from the rubber company in the Dharmasraya area like company Abaisiat, and company State plantation V in west Rengat of Indragiri Hilir regency.

This condition is not profitable in efforts to strengthen West Sumatra regional development, but it profitable when it viewed from the point of you of the Sumatra corridor economic growth. At the other side, that it is a necessity since the hinterland region can be a great support of its central region (Pekanbaru, Medan and Palembang).

Figure 3 illustrates the imaginary picture of the tetrahedron model from Cristaller on the development of regional growth centers always related to the buffer zone or hinterland and it is in line with the findings of (Pant & Paul, 2018). It shows that the growth centers in the Sumatra economic corridor like Pekanbaru is able to attract its buffer zones (Sijunjung and Dharmasraya) to Pekanbaru, Medan and Palembang.

The gate of West Sumatra's rubber trading to the markets of ASEAN countries is mainly played by North Sumatra, South Sumatra and Jambi. This can be indicating by the significance of the Trace Statistics value of 5% (3.84) in the export relations of the Sumatra economic corridor with the import of ASEAN trading partners.

Trading Integration of Sumatra Corridor with ASEAN Regional Area

The most dominant partner in the rubber trading of the Sumatra economic corridor is Singapore since most of the Sumatra economic corridor is trading closely with Singapore as importer, this is inline with Hamid & Faiz (2017). Bengkulu and Jambi provinces have a less relations for export-import with Singapore. However, Malaysia has strong rubber trading partners with Aceh, North Sumatra and Lampung. This is indicated by the trace statistic values (Varela et al., 2012) that exceed the critical value at 5%. For more details, can be seen in Table 2.

| Table 2 The Statistic Trace of Sumatra Corridor with the Five Asean Traders Partner | |||||

| Sumatra Corridor center | Singapore | Malaysia | Thailand | Vietnam | Philipine |

| Aceh | 9.17 | 5.63 | 2.22 | 0.23 | 0.53 |

| Sumut | 4.19 | 7.64 | 3.76 | 1.45 | 5.26 |

| Riau | 4.80 | 1.79 | 0.48 | 5.41 | 0.89 |

| Sumbar | 4.86 | 1.47 | 0.04 | 5.11 | 1.38 |

| Sumsel | 4.79 | 4.88 | 2.48 | 6.87 | 0.18 |

| Lampung | 6.86 | 10.29 | 0.05 | 3.71 | 1.99 |

| Jambi | 3.57 | 1.60 | 3.18 | 7.48 | 8.52 |

| Bengkulu | 0 | 0 | 0 | 0 | 0 |

| Babel | 4.88 | 2.78 | 0.03 | 6.17 | 1.31 |

| Kepri | 6.88 | 2.67 | 0.32 | 5.77 | 1.03 |

Figure 4 provides information that among the most dominant of export and import activities for rubber commodities with three ASEAN countries are North Sumatra (Sumut) and South Sumatra (Sumsel). While, the rest of the province only have long term trading relations with two ASEAN countries. Singapore and Vietnam have import trading with more than six provinces in Sumatra corridor. This means that there is a long-term trading relationship between the Sumatra corridor and ASEAN by Singapore and Vietnam. The Sumatra Region has a long-term relationship with the ASEAN region (Pant & Paul 2018).

Furthermore, the factors that influence the occurrence of long-term trade relations between the central economic corridor of Sumatra and ASEAN countries are raised. Panel data regression is used to describe the behavior of long-term trade relations between the centers of the Sumatra economic corridor and ASEAN countries over a period of 2014-2016.

The dependent variable is trading integration that is calculated from the value of trace statistics from the rubber export data of each province in the economic corridor of Sumatra, Verbeek (2008). The trace value of statistics shows the long-term mutual relations of rubber export activities in a province with ASEAN countries such as Singapore, Malaysia, Thailand, etc (Table 2). Panel data regression used a fixed effect approach where intercept on regression can be distinguished between individual regions since it has considered to have its own characteristics, Ahcar & Siroën (2017) (Table 3).

| Table 3 The Result of Panel Data Regression for Trading Integration of Sumatra Economic Corridor with Asean Countries | |||||

| Variable | Singapore | Malaysia | Thailand | Vietnam | Philipine |

| Constant | 3.67 | -3.30 | 9.70 | ||

| Economic growth (X1) | 41990811 | 42062540 | 10150583 | - | - |

| Currency values (X2) (Fixed effect) | 7.2664 (2.91)** | 8,2932 (2.91)** | 9.3989 (2.91)** | 9.6359 (2.91)** | 11.9264 (2.91)** |

| Currency Values (X2) (Random effect) | 1.13 (1.99)*** | 1.29 (1.99)*** | 1.46 (1.99)*** | 1.50 (1.99)*** | 1.86 (1.99)*** |

| Farmer Exhange rate (X7) | -40311738 | 1472494 | -10084196 | - | - |

| Percapita income (X8) | -5201.99 | 1767.285 | 1438.538 | - | - |

| Fixed Effect (Cross) | Random effect (Cross) | Random effect (cross) | - | - | |

| _Sumut | 2.70 | -67160895 | -62202147 | - | - |

| _Riau | 9.60 | -53027214 | -6442221 | - | - |

| _Sumbar | 2.94 | -70981525 | -48222588 | - | - |

| _Jambi | 5.85 | 3.85 | 3.87 | - | - |

| _Sumsel | -2.46 | -1.38 | -1.80 | - | - |

| _Lampung | 3.84 | -56130113 | -32619831 | - | - |

| Fixed effect (Period) | Fixed Effect (Period) | None | - | - | |

| 2014 | -27446060 | -1.24 | - | - | |

| 2015 | -72727254 | 75166249 | - | - | |

| 2016 | 1.00 | 48595371 | - | - | |

| Obs | 18 | 18 | - | - | |

| Prob.F | 0.042 | 0.7546 | - | - | |

| R2 | 0.8888 | 0.2336 | - | - | |

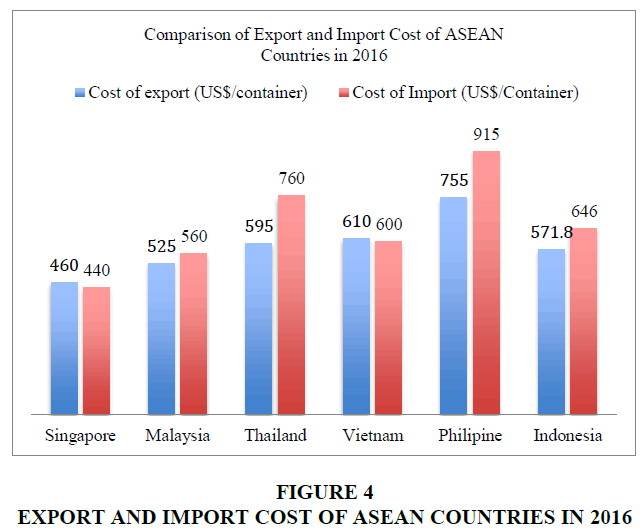

The selection of the rubber market integration model has done through the Chow statistical test or likelihood ratio test; with the null hypothesis statement (H0) the model follows the pool and alternative hypothesis (H1) model follows the fixed effect. The cross section F statistical test results of 8.23 and chi-square cross section of 32.69 are significant with probability of 0.0051 and 0.0000 respectively. Therefore that the rubber market integration model is the most appropriate to be estimated using the fixed effect model (FEM) compared to the pool least square (PLS) model. However, if the accuracy of the model between FEM and random effect (REM) is also tested based on Hausman statistics then it gave the Chi-squared value of 20.57 which is significant at one percent. The REM model is more appropriate than the FEM model but nevertheless that the two models were discussed.In FEM model that the currency exchange rate variable significantly influences the occurrence of trading integration between the Sumatra economic corridor and ASEAN countries. The coefficient value of Singapore as most integrated ASEAN country with Sumatra economic corridor is 7.2664 with t statistics of 2.91 and significant at the level of 5%. Vietnam has coefficient value of 9.6359 which significant at the 5% level. On the other hand, the currency exchange rate coefficient which has the greatest influence in the Philippines with a coefficient of 11.9264. This is because of the highest export costs is in the Philipine as US $ 755 per container and the lowest one is Singapore with US $ 460 per container.

Figure 4 provides information that Singapore has lower import and export costs compared to other ASEAN countries. Singapore and Vietnam has lower import costs than export costs. The Philippines is the country that has the highest import and export costs. This is one explanation why the Singapore trading integration is strong with the center of the Sumatra economic corridor.

Based on the FEM model that the highest individual effect of the integration of rubber trading is occurs in the Sumatra economic corridor. This due to a change in economic growth, currency exchange rates, farmer exchange rates and per capita income in Riau which reaches 13.37, followed by Jambi at 9.52, West Sumatra at 6.61, North Sumatra at 6.37 and South Sumatra at 1.21. These will lead to an increase in trading integration with ASEAN countries by 6.61%. in line with finding Gnangnon (2019) the impact of trade integration with ASEAN countries has benefited more than Indonesia.

In the REM model that a change in economic growth, currency exchange rates, farmer exchange rates and per capita income will lead Riau, North Sumatra and West Sumatra regions to have the highest individual influence on the occurrence of reducing of trading integration with the ASEAN region. It is indicated by the higher coefficient value. While a lower influence on trading integration is found in the Jambi and South Sumatra regions since these two regions have a long-term relationship with Vietnam and the Philippines which is the most sensitive country to changes in trading integration.

Conclusion

The main plantation and rubber production centers in West Sumatra are Sijunjung, Dharmasraya and Pasaman, but these regions have not yet integrated with the Padang City as national activity center. They are more integrating to Pekan Baru, Medan, Jambi and Palembang as national centers. Per capita income and economic growth greatly influence trading linkages, while accessibility is less influential on the integration of regency’s market with Padang. It turns out that market integration is formed following an efficient flow of costs and greater economic benefits from the rubber market of Medan, Pekanbaru, Jambi and Palembang in the Sumatra economic corridor region.

West Sumatra production center and rubber planting area had been cointegrated with the Riau, South Sumatra and North Sumatra regions in the rubber trading system (Zusmelia et al., 2019). The vertical integration of the rubber commodity market is created with this external region, especially with Riau and South Sumatra for farmers and rubber traders in Sijunjung and Dharmasraya districts, as well as with North Sumatra for the Pasaman region.

The gate of West Sumatra's rubber trade to the markets of ASEAN countries are North Sumatra, South Sumatra and Jambi. These indicated by the value of Statistics Trace of the long-term export relations of the Sumatra economic corridor centers with the import of ASEAN trade partner countries. Singapore has the highest rubber trade connectivity with the centers of the Sumatra economic corridor due to lower import costs and export costs compared to other ASEAN countries. The changes to strengthen and weaken the integration of the rubber trading market with Singapore and other ASEAN countries due to changes in economic growth and differences in currency exchange rates, farmer exchange rates and per capita income. The changes to these variables have increased the integration of the rubber markets of North Sumatra, Riau, Jambi and West Sumatra with Singapore. While, the changes on those variables South Sumatra and Lampung actually reduced the trading integration with other ASEAN countries. However, this is related to the high and low costs of imports and exports in the ASEAN countries. The lower cost of the import and export will make trading integration is getting stronger and vice versa.

Acknowledgement

This paper is funded by the Indonesian Ministry of Research, Technology and Higher Education DRPM through research sceme superior university basic research on 2018. Appreciation to enumerators and data collectors who have prepared primary and secondary data comprehensively. Our highly gratitude to colleagues at Aspropendo for their suggestions to sharpen the analysis part of the paper. We do hope this paper will give a positive and meaningful contribution about market and regional integration in regional trade.

References

- Ahcar, J., & Siroën, J.M. (2017). Deep integration: Considering the heterogeneity of free trade agreements.

- Ahmed, S., & Ghani, E. (2008). Making regional cooperation work for South Asia's poor. The World Bank.

- Ansofino, A. (2017). Cek Plagiarisme: Assessing the Climate Change Impact on Farmers Household Welfare According to West Sumatra Agro-Ecological Zone.

- Bernhofen, D.M. (1999). Intra-industry trade and strategic interaction: Theory and evidence. Journal of International Economics, 47(1), 225-244.

- Bhattacharyya, R. (2002). Vertical and horizontal intra industry trade in some asian and latin american less developed countries. Journal of Economic Integration, 273-296.

- Deichmann, U., Lall, S.V., Redding, S.J., & Venables, A.J. (2008). Industrial location in developing countries. The World Bank Research Observer, 23(2), 219-246.

- Deichmann, U., Shilpi, F., & Vakis, R. (2008). Spatial specialization and farm-nonfarm linkages. The World Bank.

- Farida, A., Ansofino, A., Rezki, A., & Malinda, Y. (2017). Assessing the climate change impact on farmers household welfare according to West Sumatra agro-ecological zone.

- Fujita, M., Krugman, P., & Venables, A. (1999). The Spatial Economy M Cities, Regions, and International Trade1.

- Gnangnon, S.K. (2019). Trade policy space, economic growth, and transitional convergence in terms of economic development. Journal of Economic Integration, 34(1), 1-37.

- Goto, J. (1997). Regional economic integration and agricultural trade. The World Bank.

- Greenaway, D., Hine, R., & Milner, C. (1995). Vertical and horizontal intra-industry trade: a cross industry analysis for the United Kingdom. The Economic Journal, 105(433), 1505-1518.

- Hamid, M.F.S., & Aslam, M. (2017). Intra-regional trade effects of ASEAN free trade area in the textile and clothing industry. Journal of Economic Integration, 32(3), 660-688.

- Hansen, J.D., & Jørgensen, J.G. (2001). Market integration and industrial specialization on a monopolistic competitive market. Journal of Economic Integration, 279-298.

- Henderson, J.V., Shalizi, Z., & Venables, A.J. (2001). Geography and development. Journal of Economic Geography, 1(1), 81-105.

- Lanaspa, L.F., & Sanz, F. (1999). Krugman's core-periphery model with heterogeneous quality of land. Urban Studies, 36(3), 499-507.

- Lefilleur, J., & Maurel, M. (2010). Inter-and intra-industry linkages as a determinant of FDI in Central and Eastern Europe. Economic systems, 34(3), 309-330.

- Marjit, S. (1991). Agro-based industry and rural-urban migration: a case for an urban employment subsidy. Journal of Development Economics, 35(2), 393-398.

- Orcalli, G. (2017). Market building through regional integration agreements: The EU and the ASEAN way. Journal of Economic Integration, 160-192.

- Pant, M., & Paul, A. (2018). The role of regional trade agreements: In the case of India. Journal of Economic Integration, 33(3), 538-571.

- Renkow, M. (2006). Employment growth and the allocation of new jobs: Evidence from the South. Review of Regional Studies, 36(1), 121-139.

- Varela, G., Aldaz-Carroll, E., & Iacovone, L. (2012). Determinants of market integration and price transmission in Indonesia. The World Bank.

- Verbeek, M. (2008). A guide to modern econometrics. John Wiley & Sons.

- Wang, P., & Xie, D. (2004). Activation of a modern industry. Journal of Development Economics, 74(2), 393-410.

- Szu-Wei, P., Tz-Li, W., Chun-Chen, H. (2013). Trade vertical specialization. econtent management ltd.

- Zusmelia, Z., Ansofino, A., Yolamalinda, Y., & Dahen, L. D. (2019). Analysis of rubber price difference in regency level and integrated market in west sumatera province. In Social and Humaniora Research Symposium (SoRes 2018). Atlantis Press, USA.