Research Article: 2021 Vol: 20 Issue: 6S

The State of the Russian Pharmaceutical Market from the Beginning of the Sanctions War to the Pandemic

Danil A. Zyukin, Kursk State Agricultural Academy named after I.I. Ivanov Kursk

Tatyana A. Oleinikova, Kursk State Medical University

Alla I. Ovod, Kursk State Medical University

Natalya M. Sergeeva, Kursk State Medical University

Elena V. Reprintseva, Kursk State Medical University

Olga V. Vlasova, Kursk State Medical University

Abstract

The paper analyzes the state of the Russian pharmaceutical market between 2014 and 2019, after the start of the sanctions war until the outbreak of the COVID-19 pandemic. The Russian pharmaceutical market trends were examined in physical and value terms, and the market structure was explored in terms of its major sectors. The period under discussion was selected in view of the current political and socio-economic transformations taking place in Russia. No significant structural changes were shown to have occurred in the Russian pharmaceutical market over the past six years despite the sanctions. The total value of the market is growing, which is due, among other things, to medicinal drug price increases and the depreciation of the local currency in recent years. The situation in the Russian pharmaceutical industry on the eve of the global COVID-19 pandemic can be described as stable and reflecting the latest trends in the development of the industry under consideration.

Keywords

Pharmaceutical Industry, Pharmaceutical Market, Provision of Medication, Pandemic, COVID-19

Introduction

The pharmaceutical industry is of paramount importance in ensuring Russia’s drug safety, as it provides all necessary medicines and other pharmaceutical goods to the Russian population and the health system (Reprintseva, 2019; Zyukin et al., 2020; Prosalova et al., 2020). Over the past years, the issue of ensuring Russia’s drug safety has become increasingly relevant, given political tensions following the 2014 events and the conflict with Ukraine resulting in a number of economic sanctions affecting the pharmaceutical market, among others (Ruchkina, 2019; Krasilnikova & Baskakov, 2019).

What is specific about the Russian pharmaceutical market is that over 70% of available pharmaceuticals are imported (Rezgo, 2019). Deteriorated foreign trade relations have led to a serious shortage of some imported medicines, which pointed to the importance of strengthening Russia’s pharmaceutical capacity (Lesykh, 2020). In practice, however, a quick substitution of pharmaceuticals turned out to be impossible owing to the lack of modern developments and technologies in this sector and to low investment activity on account of lengthy payback periods of such projects (Reprintseva, 2020; Sergeyeva, 2020). Sanctions imposed on Russia worsened its economic situation, affected not only by financial sanctions but also by the deepening structural crisis of Russia’s economy. This decelerated calculations across all the links of the production chain, considerably aggravating the situation for Russian producers, in general, and in the pharmaceutical industry, in particular. As a result, business activity in the pharmaceutical market has decreased and receivables, including overdue receivables, have grown (Reprintseva, 2017; Marelino, 2014).

One of the solutions to the given situation was active dissemination, on the market, of generics or cheaper equivalents of original medicines produced by major European pharmaceutical companies (Ovod, 2020; Oleynikova & Pozhidayeva, 2018). Imported to Russia (often from India), generics are treated and packaged in local pharmaceutical enterprises (Prosalova et al., 2020). No considerable changes took place in the Russian pharmaceutical market in 2020. The import substitution strategy has not been implemented fully in this sector; and, finally, some major international pharmaceutical companies resumed their activity in the Russian market by setting up production within Russia (Sitnikova et al., 2020; Berezovskaya & Gatiyatulin, 2020).

Materials and Methods

Based on data from DSM Group’s analytical reports on the 2014-2019 development of Russia’s pharmaceutical market, the present study examined the trends and structure of Russia’s pharmaceutical industry in terms of volume and value (in current prices). The choice of this period stemmed from current political and socio-economic transformations in Russia. The year 2014 was chosen as the base year, since it marked the start of the sanctions war against the background of the Ukraine conflict and affected the development of Russia’s foreign trade relations with many countries. The research period is limited to the year 2019, as it reflects the state of affairs preceding the outbreak of the COVID-19 pandemic, thereby contributing to increased pressure on Russia’s pharmaceutical market. Research into the state of Russia’s pharmaceutical market was conducted using a wide range of methods and approaches, most importantly trend analysis as well as comparative and logical analysis.

Results and Discussion

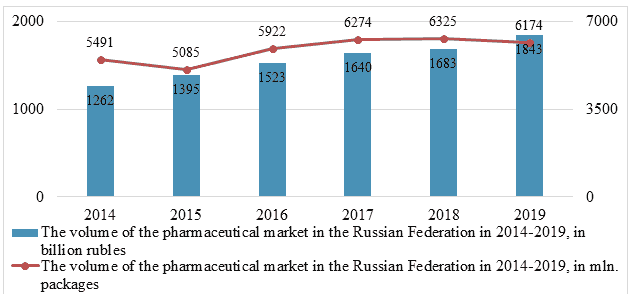

The total value of the Russian pharmaceutical market shows a steady growth rate for the period under review. The total market size of Russia was 1262 billion rubles in 2014, increasing by 30% and reaching 1640 billion rubles in 2017 and, by 2019, it was up 12% attaining a level of 1843 billion rubles; the overall increase was 46% for the period under review. The growing value of the pharmaceutical market is due to both its overall development and inflation in economy (Figure 1).

Figure 1: The Volume of the Pharmaceutical Market in the Russian Federation in 2014-2019, in Billion Rubles And Mln. Packages

When considering the trends of the Russian pharmaceutical market in physical terms, it is apparent that the actual volume of market development is not stable, as evidenced by the wave-like nature of the indicator. For example, the volume of the Russian pharmaceutical market was 5491 million packages in 2014, decreasing to 5085 million packages in 2015 due to political changes in Russia. Consequently, it seems that, in view of the events in 2014, the physical volume of the pharmaceutical market went down and some foreign producers withdrew from the market. That said, an increase in the market’s value results from the rising cost of medicines and the depreciation of the Russian ruble. The growth of the pharmaceutical market’s physical volume in the following years is due to its adaptation to the changed conditions. As a result, the market’s volume amounted to 6325 million packages in 2018. In 2019, another downward trend in the market’s physical volume explains a drop to 6174 million of packages, which, combined with a considerable growth of the market’s physical volume during this period, points to a rise in pharmaceutical prices. This is likely to be due to a high rate of the market’s import dependency and the depreciation of the local currency.

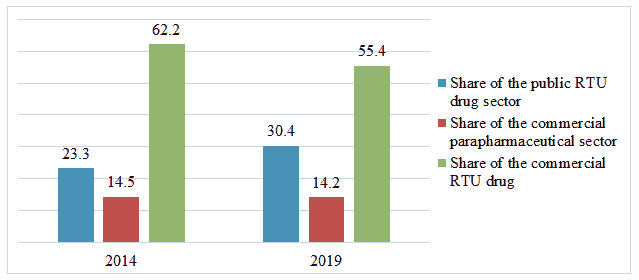

The Russian pharmaceutical market is composed of three major sectors: the public pharmaceutical drug sector, the commercial pharmaceutical drug sector and the commercial parapharmaceutical sector. While the commercial drug sector made up 62.2% of the market share in 2014, it decreased to 55.4% in 2019. In its turn, the share of the public drug sector grew from 23.3% to 30.4% during the period under consideration, and there was little change in the share of the parapharmaceutical sector. The above suggests that currently, as in the past, Russia’s pharmaceutical market is mostly occupied by the largest of the sectors, the commercial one (Figure 2).

Figure 2: Structure of the Russian Pharmaceutical Market by Major Sectors in Value Terms in 2014 and 2019, in Percentage

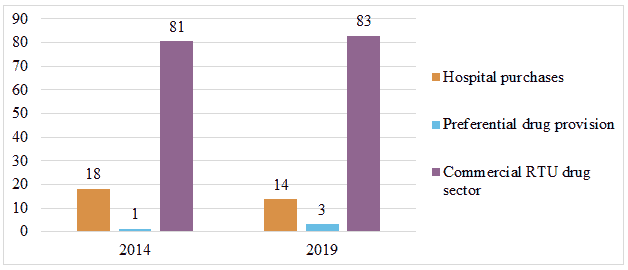

The physical volume of the Russian pharmaceutical market is represented by the commercial drug sector, hospital procurement and preferential drug provision. A comparison between the market structure in 2014 and 2019 reveals that the commercial sector had 80% of the market’s physical volume. Furthermore, there is a trend towards an increase in the commercial segment’s share from 81% to 83%. Hospital procurement accounted for 18% in 2015, down 14% in 2019, whereas the share of preferential drug provision grew from 1% to 3% of the market’s total physical volume (Figure 3).

Figure 3: Structure of the Russian Pharmaceutical Market by Major Sectors in Physical Terms in 2014 and 2019, in Percentages

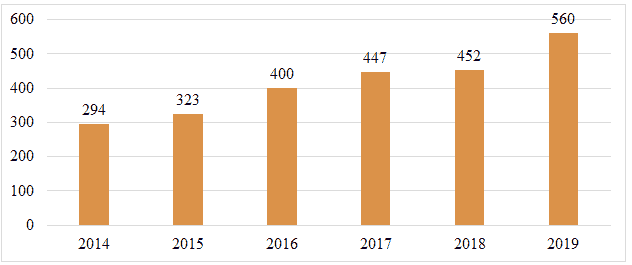

A more detailed study of development trends in the public sector of the Russian pharmaceutical market shows that this sector had high growth rates between 2014 and 2016, with an increase of 36%. The market’s public sector showed no considerable growth between 2016 and 2018, and the indicator achieved an explosive 24-percent growth in 2019, the total volume of the public sector recording 560 billion rubles (Figure 4).

Figure 4: Dynamics of the Public RTU Drug Sector of the Pharmaceutical Market of the Russian Federation in 2014-2019, in Billion Rubles

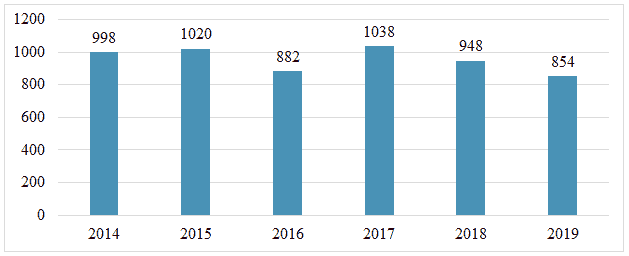

The physical volume of hospital procurement in the Russian pharmaceutical market has fluctuated over the past six years, with a steady downward trend. For example, periods of growth were recorded in 2015 and 2017 when the rate increased to more than 1 billion packages. At the same time, down periods were recorded in 2016 when the total volume of hospital procurement was 882 million packages, dropping 13.5% below the level achieved the previous year, and in the last two years (2018 and 2019), with the volume of hospital procurement tumbling to a record low of 852 million packages. The decreased physical volume of hospital procurement by 2019 may be due to a reduced need of the health care system in certain medicines, and also to the changing list of medicines in favor of those producing a therapeutic effect while requiring lower medication intake (Figure 5).

Figure 5: Dynamics of Hospital Purchases in the Pharmaceutical Market of the Russian Federation in 2014-2019, Mln. Packages

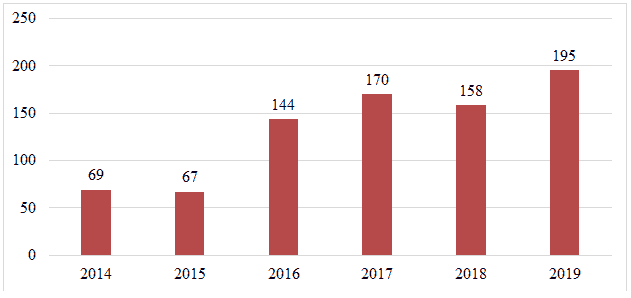

The volume of preferential drug provision has shown a soaring trend in the past six years: this volume was below 70 million packages in 2014 and 2015, doubling in 2016 for a total of 144 million packages. Despite a decrease in the volume of preferential drug provision by 2019, another upward trend was recorded in 2019, with a total volume of preferential drug provision reaching a record high of 195 million packages for the period under review, which points to a successful implementation of the preferential drug provision program in Russia (Figure 6).

Figure 6: Dynamics of Preferential Drug Provision in the Pharmaceutical Market of the Russian Federation in 2014-2019, Mln. Packages

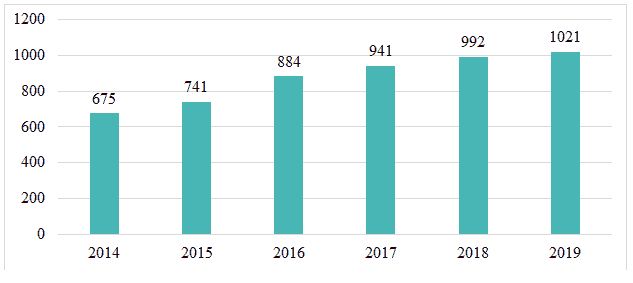

The value of the commercial segment of the Russian pharmaceutical market was 675 billion rubles in 2014 and grew to 1021 billion rubles in 2019, showing an almost two-fold increase over the six years. Since 2016, there has been an accelerated growth of the Russian pharmaceutical market’s commercial sector, with a rate of 884 billion rubles. In the past three years, it has shown a decreased growth rate due to the overall market stagnation (Figure 7).

Figure 7: Dynamics of Commercial RTU Drug of the Pharmaceutical Market of the Russian Federation in 2014-2019, in Billion Rubles

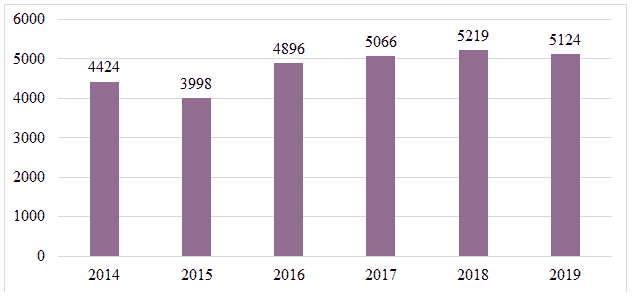

Trend estimation of the commercial sector in physical terms revealed the wave-like nature of changes occurring in it. The commercial sector recorded a 10-percent decrease in volume in 2015 and, as a result, the physical volume of the commercial sector was slightly below 4 billion packages. Between 2016 and 2018, the physical volume of the pharmaceutical market’s commercial sector grew to 5129 million packages, dropping to 5124 million packages in 2019 (Figure 8).

Figure 8: Dynamics of Commercial Rtu Drug Sector in The Pharmaceutical Market of the Russian Federation in 2014-2019, Mln. Packages

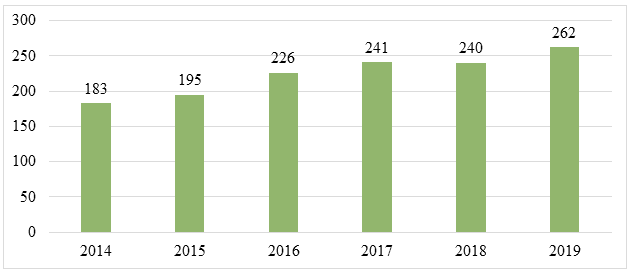

For its part, the volume of the commercial parapharmaceutical sector grew from 183 billion to 262 billion rubles in six years, the growth rate being 43%. An explosive growth was recorded in 2015 and 2016 when the sector’s volume grew from 195 billion to 226 billion rubles, the growth rate being 16%. Broadly speaking, the findings suggest that this sector of the Russian pharmaceutical market continues to develop at a rather slow rate, which may be due to the lesser importance of this kind of pharmaceutical products compared to actual medicinal drugs (Figure 9).

Figure 9: Dynamics of Commercial Parapharmaceutical Sector of the Pharmaceutical Market of the Russian Federation in 2014-2019, in Billion Rubles

In view of the above, before the outbreak of the COVID-19 pandemic the Russian pharmaceutical market was developing at a steady yet slow rate. Despite the fact that the market is showing a faster growth in value terms, assessment of data in physical terms reveals that the market’s nominal growth results from an increase in the price of pharmaceuticals.

According to the authors (Prozherina, 2020; Spasennikov, 2020), the coronavirus pandemic is expected to have a catalytic effect on the evolution of the pharmaceutical market, including through enhanced public procurement. That said, increased pressure on the pharmaceutical industry could lead to a number of adverse consequences related to the market’s difficulty in handling a high demand for specific groups of medicines (antibiotics, antiviral and immunomodulatory drugs) and pharmaceutical products. This may cause a shortage of certain types of pharmaceutical products on the market, which, in addition to the possible negative impact on morbidity, the severity of diseases and the death rate, may result in an increase in prices (Kuptsova, 2020).

Furthermore, speaking of fundamental structural changes taking place in the sector in the pandemic context, it is worth mentioning that the flow of investment is expected to be redirected to fund new developments and the creation of a vaccine, which, in the present circumstances, is highly important in order to reduce morbidity and mortality due to COVID-19. Another big challenge is to reduce the time required to develop and implement them (Sheyan, 2020; Telnova, 2020).

In addition, the coronavirus pandemic and the subsequent self-isolation and distancing result in the need to introduce new sales management methods on the pharmaceutical market that have previously been underdeveloped in this industry and faced a number of technical and legal difficulties. Distance selling of medicines was legalized in Russia as late as March 2020 (Makarova, 2020; Sinyayeva, 2020).

Conclusion

No significant structural changes were shown to have occurred in the Russian pharmaceutical market over the past six years despite the sanctions. The total value of the market is growing due, among other things, to drug price increases and the depreciation of the local currency in recent years. The actual physical sales volume, however, had a sharp drop in 2015 owing to sanctions and a shortage of certain types of products in the market. At the same time, the physical sales volume in the pharmaceutical market recovered by 2016 after the market’s adaptation to new operational modalities.

As in the past, the market is mostly represented by the commercial sector having, in 2019, a share of more than 55% of the overall cost of goods sold and over 8% of the total number of packages sold. These figures are quite natural, given a high level of development of pharmacy business in Russia, despite a decline in sales of packages. Of great importance is the development of the pubic sector through which hospital procurement is carried out to meet the needs of the health care system. The value of procurement in the public sector doubled in six years whereas its physical volume fluctuates in a wave-like manner, which may be due to changing needs of the health public sector in certain types of medicines and to changes in the list of purchased goods. Consequently, substantial growth of public procurement in value terms results mostly from the rising cost of pharmaceutical products. This is a negative factor which may lead to a decline in the provision of the public health care system with necessary medicines.

The situation in the Russian pharma sector on the eve of the global COVID-19 pandemic can be described as stable and reflecting the latest trends in the development of the industry under consideration. Nonetheless, it should be understood that the emergence of this unprecedented threat will inevitably increase pressure on the pharmaceutical industry which may not fully lift it in the absence of necessary reserves and adaptation mechanisms. Yet it is safe to say that the coronavirus pandemic will give a mostly positive shake to the pharmaceutical industry as it will uncover existing problems and will create new development trends.

References

- Reprintseva, E.V. (2019). Trends in the development of the pharmaceutical industry in Russia’s federal districts. Karelian scientific journal, 8(26), 94-97.

- Zyukin, D.A., Oleinikova, T.A., Sergeeva, N.M., Reprintseva, E.V., Ulyanov, V.O., & Evstratov, A.V. (2020). Higher pharmaceutical education in Russia: economic assessment of accessibility and regional specifics. Systematic Reviews in Pharmacy, 11(2), 317-328.

- Ruchkina, D.A. (2019). Trends in the development of the Russian pharmaceutical market. Innovative Science, (5), 105-108.

- Krasilnikova, E.A., & Baskakov, V.A. (2019). Russia’s pharmaceutical market: Challenges, assessments and prospects, Bulletin of the Altai Academy of Economics and Law, 4(2), 222-227.

- Rezgo, G.Y. (2019). The current state of the pharmaceutical market in Russia. Green corridor, 1(7), 18-22.

- Lesykh, A.V. (2020). Trends in the development of the Russian pharmaceutical market. Young scientist, 7 (297), 168-171.

- Reprintseva, E.V. (2020). Import dependency of the Russian pharmaceutical market as a threat to drug safety. Research Azimuth: Economics and Management, 9(30), 292-294.

- Sergeyeva, N.M. (2020). Research on trends in the development of the Russian medicinal drug market in times of economic crisis. Research Azimuth: Economics and Management, 9(31), 307-310.

- Ovod, A.I.O. (2020). The development of the Russian pharmaceutical market under sanctions. Research Azimuth: Economics and Management, 9(30), 252-255.

- Oleynikova, T.A. (2020). Monitoring fake, poor-quality and counterfeit medicines in the Russian pharmaceutical market: A monograph. Kursk: KGMU, 172.

- Oleynikova, T.A., & Pozhidayeva, D.N. (2018). Analysis of trends in the development of the Russian non-steroid anti-inflammatory drug market. The cure, (5), 14-20.

- Prosalova, V.S., Vetoshkevich, V.G., Getman, O.V., & Osipova, N.A. (2020). The pharmaceutical market in Russia: Today’s challenges. Economics and Entrepreneurship, 3(116), 208-212.

- Sitnikova, E.V., Goncharov, A.Y., & Lobacheva, D.D. (2020). Growth drivers of the domestic pharmaceutical industry. Production organizer, 28(3), 16-24.

- Berezovskaya, N.Y., & Gatiyatulin, S.N. (2020). The export and import potential of the Russian pharmaceutical industry during the COVID-19 pandemic. Forum. Series: Humanities and Economic Sciences, 3(19), 195-200.

- Prozherina, Yu. (2020). The global pharmaceutical market: The COVID trend. Journal on the Russian medical drug and equipment market, 9, 23-24.

- Mishchenko, M.A., Ponomaryova, A.A, Konyshkina, T.M., & Mishchenko, E.S. (2020). Analysis of the impact of the new COVID-19 pandemic on the pharmaceutical industry. Eurasian Scientific Association, 12(70), 201-204.

- Spasennikov, B.A. (2020). The COVID-19 pandemic: Some lessons. Bulletin of the N.A. Semashko National Research Institute of Public Health, 4, 52-57.

- Kuptsova, D.S. (2020). The investment potential of the Russian pharmaceutical market. International Journal of the Humanities and Natural Sciences, 9-1(48), 139-142.

- Sheyan, N.E. (2020). International experience in developing a COVID-19 vaccine. The medicine. Sociology. Philosophy. Applied research, 6, 41-43.

- Telnova, E.A., Shchepin, V.O., & Zagoruychenko, A.A. (2020). Vaccination as a challenge to COVID-19. Bulletin of the N. A. Semashko National Research Institute of Public Health, 3, 82-89.

- Makarova, Y.V. (2020). The COVID-19 pandemic as a growth driver of digital communication on the pharmaceutical market, Economic systems, 13(4), 52-58.

- Sinyayeva, I.M. (2020). Promotion strategies on the pharmaceutical market during the COVID-19 pandemic. Audit statements, 3, 96-99.

- Reprintseva, Y.V. (2017). Business activity as a factor for enhancing the effectiveness of pharmaceutical enterprises. Karelian scientific journal, 6(20), 131-133.

- Marelino, A. (2014). Customer satisfaction analysis based on customer relationship management. International Journal of New Practices in Management and Engineering, 3(01), 07-12.

- Reprintseva, Y.V. (2017). Optimizing the receivables of pharmaceutical enterprises. Karelian scientific journal, 6(20), 127-130.