Research Article: 2021 Vol: 24 Issue: 1S

The Stock Markets Response during the Coronavirus: Evidence from Saudi Banking Sector

Rimel Kouki, College of Business Administration, Taibah University

Lubna Sameer Khalaf, College of Business Administration, Taibah University

Rami Mohammad Abu Wadi, College of Business and Finance, Ahlia University

Abstract

The aim of this study is to examine the short term effect of COVID-19 on the stock performance of banks listed on the Saudi Stock Exchange (“Tadawul”). Banks were selected according to their market capitalization. The study period was classified into pre-crisis period and Covid 19 crisis period. The data consist of 193 daily price observations of the banking sector. The period of study is ranging from 25th August 2019 to 31st May 2020. Findings reveal that momentum effect is persisting with banking stocks as the baking stocks are moving in accordance with the general benchmarking index.

Keywords

COVID-19, Stock Price, Banking Sector, Saudi Arabia

Introduction

Stock markets are highly volatile and rapidly respond to economic and political shocks. This study focuses on the differential effect of the outbreak of COVID-19, 1 the virus caused by SARS CoV-2, 2 on the Tadawul. Earlier pandemics have had varying impacts on stock markets (Donadelli, Kizys & Riedel, 2017); these conflicting results create confusion for modern investors in the time of COVID-19.

In addition to the historically deadly 1918 influenza pandemic, two other influenza pandemics in 1957 and 1968 occurred during the 20th century. Four pandemics have already occurred in the 21st century: Severe Acute Respiratory Syndrome (SARS) in 2002, H1N1 influenza in 2009, Middle East Respiratory Syndrome (MERS) in 2012, and Ebola virus disease 2013 (Baldwin & Weder di Mauro, 2020).

In December 2019, SARS-CoV-2 and the disease it causes, COVID-19, first emerged in Wuhan, China. COVID-19 soon spread to every corner of the globe, and was declared a pandemic by the World Health Organization on March 12, 2020. The daily increase in deaths from COVID-19 has caused international panic, which undoubtedly has long term effects on national economies and financial markets.

COVID-19 can be as contagious economically as it is medically. Numerous articles have discussed the hypothetical and actual impacts of the COVID-19 pandemic on industries such as tourism, travel (particularly air travel), and entertainment. A great deal of research has also been conducted on the impacts of the pandemic on financial markets. Although some researchers have paid attention to the effect of coronavirus outbreak on several industries and factors affecting stock market returns during coronavirus in many countries and regions (Okorie & Lin, 2020; Al-Awadhi et al., 2020; Liu et al., 2020; Ngwakwe, 2020; Aravind & Manojkrishnan, 2020; Papadamou et al., 2020).

The COVID-19 pandemic and associated efforts to “flatten the curve” of the epidemic continue to disturb economies and financial markets worldwide. Saudi Arabia’s membership in the Group of Twenty, and its position as the Arab world’s largest economy, mean that the Saudi stock exchange especially publicly-traded Saudi banks are particularly affected by increased global volatility.

Because the pandemic increases risk, it also affects investor behaviour. Short-and long-term investments in stock markets aim to maximize investor returns. Investor efforts to balance risk and return subsequently impact stock prices.

However, the recent effects of the COVID-19 pandemic on investments in the Saudi banking sector remain unknown. Our study uniquely examines key factors behind the pandemic and decisions by Saudi regulatory authorities. Subsequently, we sample all banks listed on the Saudi stock exchange in an attempt to determine to what extent the COVID-19 crisis has influenced the banks’ stock returns. Further, this paper examines the potential implications of changes in investor behaviour on Saudi regulatory policy. Section two of the paper presents related literature and provides theoretical background, section three describes the variables examined in the study and lays out its methodology, section four presents and discusses the results of the study, and section five concludes the article.

Literature Review

Numerous studies have examined the influence of the COVID-19 pandemic on stock market returns in various countries. Okorie & Lin (2020) use the Detrended Moving Cross-correlation Analysis (DMCA) and Detrended Cross-Correlation Analysis (DCCA) techniques to investigate the fractal contagion effect of the COVID-19 pandemic on 32 coronavirus-affected economies. The study’s examination of stock market returns ex-ante and ex-post the COVID-19 pandemic suggests that the pandemic has a fractal contagion effect on stock markets, and that this effect disappears over the middle- and long-run for market returns and volatility.

Aldrin, et al., (2021) study the impact of the COVID-19 pandemic on the Indonesia Stock Exchange (IDX) using OLS regression and find a negative and significant relationship between the COVID-19 pandemic and market returns.

Analyses of Chinese stock market returns by Al-Awadhi, et al., (2020) and of 21 leading stock market indices around the world by Liu, et al., (2020) indicate that the COVID-19 pandemic has had a negative effect on stock market returns. Al-Awadhi, et al., (2020) analyse panel data to examine the relative performances of stocks in light of the spread of COVID-19. The paper finds that both the daily growth in total confirmed cases of and fatalities from COVID-19 have significant negative effects on stock returns. Liu, et al., (2020) evaluate the short-term impact of the SARS-CoV-2 outbreak on 21 leading stock market indices in Japan, Korea, Singapore, the USA, Germany, Italy, and the UK. The study, which uses an event study method, likewise shows that returns in the observed indices fell rapidly following the outbreak of the virus. Liu et al. find that Asian indices had more negative abnormal returns relative to other affected countries. The authors’ analysis of fixed-effect panel regression supports the theory that the adverse effect of rising COVID-19 case numbers on stock market returns is derived from investors’ increasingly pessimistic outlook as they observe the epidemic curve’s upward trajectory.

In contrast, Ngwakwe (2020) finds that the COVID-19 pandemic’s effect on index performance has not been entirely negative. The study presents analyses SSE composite indices in China, Euronext 100 indices, the S&P 500, and the Dow Jones Industrial Average (DJIA). While the COVID-19 pandemic negatively affected the mean DJIA stock price, it positively affected Chinese SSE composite indices; the S&P 500 and Euronext 100 indices showed no statistically-significant difference in mean stock prices.

Aravind & Manojkrishnan (2020) indicates that pharmaceutical stocks, which continue to move in accordance with the general benchmarking index, remain subject to the momentum effect. The authors further note that companies with strong brand reputations were seemed to sustain performance during epidemic peaks despite negative market returns overall. Data examined in the study consisted of 123 daily price observations (made before and during the COVID-19 pandemic) of 10 pharmaceutical companies publicly traded on the National Stock Exchange of India.

Papadamou, et al., (2020) examines the correlation of Google searches related to COVID-19 with the implied volatility of thirteen major stock markets. The study, which also performs robustness tests of various models used to analyse the data, finds that an increase in COVID-19-associated search terms positively correlates with implied stock market volatility. The study suggests that an increase in anxiety about COVID-19 (as shown by increased COVID-19-associated Google searches) in turn heightens the negative affect of market volatility on market performance.

According to the theoretical model proposed by Fama (1970), market information plays a significant role in shaping investment decisions. Based on this theory we can identify two kinds of investment strategies: contrarian strategy and momentum strategy. Contrarian strategy suggests that the investors will rapidly overreact to the market information, while momentum strategy suggests that the investors will react to market information at a slower, more measured pace.

Several strategies for addressing market volatility and irrational investor behavior have been proposed, with each strategy also advancing its own theory for the causes of stock price swings. According to the contrarian investment strategy, changes in stock prices are caused by hasty investor reactions to information. The momentum investment strategy, in contrast, suggests that investors react more slowly to information (Aravind, 2016).

In his study of the effects of contrarian and momentum strategies on the Spanish stock market in the short- and long-term, Forner (2003) observes that the momentum strategy is effective over the long-term and the contrarian strategy effective in the short-term.

Sami, et al., (2020) finds several banks, which can be converted to financially unsustainable because the simulations show the possibility of negative profitability, unacceptably low capital ratios and potential for heavy credit losses during the current situation due to the COVID-19 pandemic.

Paskevicius (2011) analyses the results of pursuing a contrarian strategy to NASDAQ OMX Vilnius stocks over the period 2003–2010, dividing the sample of stock return information into pre- and post-2008 crisis groups. The results show that the momentum strategy does not produce any considerable holding period return during a declining period; however, the contrarian strategy appears to be a better option than a standard market index-based portfolio during conditions of rapid growth, when stocks are typically overvalued.

Therefore, we propose the main hypothesis as follows:

Bank stocks will move against the general market trend (contrarian effect).

Banking Sector in the Kingdom of Saudi Arabia

Saudi banks, some of the oldest in the region, play a crucial role in the Saudi economy through financing domestic production, trade, and investment. As a result of this role, the banking sector has become an essential partner in advancing the Saudi government’s economic and social development goals, including those related to sustainable development.

The Saudi economy ranks the 23rd among the major 25 world economies, and the first in the Middle East and North Africa in terms of ease of business execution according to the 2013 “Business Practice” report issued by the International Finance Corporation, a division of the World Bank (Eyas, 2014). One of the major assumptions of modern economics is that finance is good for growth (Cecchetti & Kharroubi, 2012).

Al Mahish (2016) provides robust proof of the positive impact of financing on economic growth in Saudi Arabia. Samargandi, et al., (2013) examining the effect of financial sector development on Saudi economic growth across all sectors of the economy, finds that financial sector development has a significant positive impact on the growth of non-oil sectors of the economy; however, this development’s impact on oil-sector and total GDP growth is either negative or statistically insignificant.

The Saudi banking sector and Saudi stock exchange are regulated by the Saudi Arabian Monetary Authority (SAMA), the kingdom’s central bank and main financial regulator. In addition to its lending responsibilities, SAMA is responsible for regulating Saudi banks, capital markets, and broker-dealers, including the publicly-traded banks that are the focus of this study.

In SAMA’s 2019 Financial Stability Report, it claimed credit for the kingdom’s improved financial fortunes Fitch upgraded the Kingdom’s sovereign credit rating to a in 2019 from AA-in 2009 with a stable outlook in the said year (Trading Economics, 2020). The Saudi banking sector also significantly expanded over the same period, with the number of commercial bank branches increasing by 36% (Argaam, 2020).

Such banks can adjust some component of the capital ratio by breaking down them into balance sheet items (Jalaludeen et al., 2020).

Table (1) shows the financial statements of the 11 Saudi banks in this study for the years 2019 and 2018, arranged according to total assets. The banking sector show good performance in 2019. Total assets of the 11 Saudi banks increased 2,445,075 billion riyals at the end of the second quarter of 2019 compared to 2,183,569 billion riyals in 2018, and deposits amounted to about 1,544,121 billion while in 2018 deposits amounted 1,575,462. As for loans, they amounted to about 1,464,013 billion at the end of 2019 and 1,366,256 billion at the end of 2018. In 2019 equity was approximately 462,829 billion and 420,980 billion at the end of 2018. Finally, the profits of the 11 Saudi banks reached about 94,655 billion at the end of 2019 compared to 86,701 at the end of 2018.

| Table 1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Parts Of Financial Statements Of Saudi Arabia Banks | ||||||||||

| Banks | Total Assets | Deposits | Loans | Equity | Profit | |||||

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| Saudi Investment Bank | 100,815 | 96,070 | 69,058 | 2,824 | 13,406 | 59,413 | 14,070 | 13,438 | 2,906 | 2,824 |

| Al Rajhi Bank | 384,086 | 364,030 | 48,305 | 293,909 | 18,496 | 20,853 | 51,191 | 48,305 | 11,326 | 10,296 |

| Aljazira Bank | 86,544 | 73,003 | 62,697 | 51,804 | 49,660 | 40,897 | 11,590 | 11,245 | 2,977 | 2,664 |

| Alinma Bank | 131,839 | 121,537 | 102,062 | 90,128 | 94,801 | 83,889 | 21,297 | 22,444 | 5,610 | 4,844 |

| Riyad Bank | 265,788 | 229,899 | 194,517 | 169,822 | 173,981 | 151,024 | 40,571 | 36,774 | 10,717 | 8,967 |

| National Commercial Bank | 507,263 | 452,176 | 353,389 | 318,701 | 282,288 | 265,061 | 69,788 | 65,668 | 20,607 | 18,927 |

| Samba Financial Group | 255,603 | 229,938 | 180,165 | 170,170 | 141,595 | 113,708 | 45,448 | 42,305 | 8,600 | 8,156 |

| Albilad Bank | 86,075 | 73,636 | 66,797 | 57,175 | 59,362 | 50,588 | 9,425 | 7,832 | 3,945 | 3,416 |

| Saudi British Bank | 265,472 | 174,676 | 192,166 | 130,506 | 154,676 | 110,325 | 56,160 | 32,575 | 9,397 | 7,322 |

| Arab National Bank | 183,442 | 178,354 | 142,128 | 142,055 | 118,837 | 121,038 | 28,343 | 26,556 | 3,540 | 3,299 |

| Saudi Fransi Bank | 178,148 | 190,250 | 132,837 | 148,368 | 125,725 | 120,631 | 32,946 | 30,861 | 6,872 | 6,798 |

Research Methodology

Population and Sample

The population of the study covers daily return data from August 26th, 2019 to May 31st, 2020 of eleven Saudi Arabia bank's stocks. They are Al Rajhi Bank, Aljazira Bank, Alinma Bank, Riyad Bank, National Commercial Bank, Samba Financial Group, Albilad Bank, Saudi British Bank, Arab National Bank, Saudi Fransi Bank, Saudi Investment Bank. The banks were chosen because they are the largest Saudi banks by market capitalization. 193 daily price observations of the listed banks were made over the studied period; the TASI return for the above time period was similarly calculated. We decomposed our sample into pre-crisis and crisis periods—25 August to 26 December 2019 and 29 December 2019 to 31 May 2020, respectively.

Sources of Data on Measured Variables

Data pertaining to the studied variables was obtained through Saudi stock exchange records and the annual reports of the 11 publicly-traded Saudi banks.

Table (2) provides information about variables included in the study and their measurements.

| Table 2 Variables And Their Measurements |

||

|---|---|---|

| Variable | Code | Measurement |

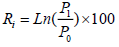

| The daily return | Ri |  |

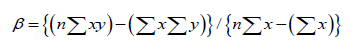

| Beta: Is a co-efficient used for measuring the sensitivity of the stocks returns over market returns. | ?i |  |

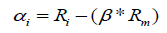

| Abnormal gain earned by individual stocks over the benchmarking index |

?i |  |

Data Analysis and Findings

To investigate the effect of the COVID-19 pandemic on the returns of banks listed on the Saudi stock exchange (Tadawul), we first calculated the stocks’ daily return pre-pandemic, and subsequently calculated their returns during the pandemic.

The daily return data of TASI as well as banks stocks, were calculated using the following formula:

In this equation, represents the price of the current trading day, represents the previous day’s price, and represents the return of individual stocks.

Table (3) shows the daily returns of various bank stocks before and during the COVID-19 pandemic. Remarkably the pre-pandemic short-term return trends for Riyad Bank, National Commercial Bank and Saudi British Bank were not promising; during the pre-pandemic period, those banks because reported returns of -0.070%, -0.020% and -0.006%, respectively. During the studied pandemic period (i.e., 29 December 2019 to 31 May 2020), all 11 observed banks reported negative returns.

| Table 3 | ||

|---|---|---|

| Returns of Saudi Arabia Stocks During Covid 19 Crisis | ||

| Bank | Pre- Crisis Period (25 August 2019 to 26 December 2019) | Crisis Period (29 December 2019 to 31 May 2020) |

| Al Rajhi Bank | 0.00% | -0.12% |

| Aljazira Bank | 0.06% | -0.25% |

| Alinma Bank | 0.14% | -0.23% |

| Riyad Bank | -0.07% | -0.31% |

| National Commercial Bank | -0.02% | -0.17% |

| Samba Financial Group | 0.13% | -0.31% |

| Albilad Bank | 0.04% | -0.19% |

| Saudi British Bank | -0.01% | -0.34% |

| Arab National Bank | 0.17% | -0.32% |

| Saudi Fransi Bank | 0.03% | -0.20% |

| Saudi Investment Bank | 0.10% | -0.31% |

Source: Computed Daily Return from Tadawul

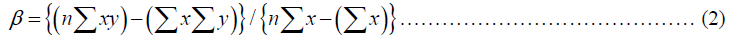

Next, we calculated Beta. Beta is a co-efficient used for computing the sensitivity of the stocks’ returns over market returns.

In the above equation, n denotes the number of observations, x denotes independent returns (TASI) and y denotes the return of dependent variables (Return of bank stocks).

At this equation designates the regression results of bank stocks returns with the return of the benchmarking index (TASI).

Regression results are reported in Table 5, it is clear that the probability values of the test statistics falling within the critical value of 0.01 at 1% level of significance (P values>0.01). Hence, it is inferred that computed beta values are statistically significant; thereby, it can be applied directly for further analysis.

| Table 4 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Regression Analysis Result of Bank Stocks With Tasi | ||||||||

| Stock | Prior to Crisis | Crisis Period | ||||||

| β | t-Statistic | Prob. | R Square | Β | t-Statistic | Prob. | R Square | |

| Al Rajhi Bank | 1.286 | 15.569 | 0 | 0.738 | 0.95 | 28.77 | 0 | 0.88 |

| Bank Aljazira | 0.785 | 8.608 | 0 | 0.462 | 1.083 | 32.029 | 0 | 0.907 |

| Alinma Bank | 1.119 | 9.329 | 0 | 0.503 | 1.021 | 16.865 | 0 | 0.732 |

| Riyad Bank | 1.176 | 8.008 | 0 | 0.427 | 1.106 | 16.829 | 0 | 0.731 |

| National Commercial Bank | 1.517 | 12.608 | 0 | 0.648 | 1.053 | 19.792 | 0 | 0.79 |

| Samba Financial Group | 1.562 | 11.757 | 0 | 0.616 | 1.265 | 18.251 | 0 | 0.762 |

| Bank Albilad | 1.304 | 8.005 | 0 | 0.427 | 1.101 | 16.216 | 0 | 0.716 |

| Saudi British Bank | 1.058 | 5.117 | 0 | 0.233 | 1.294 | 14.117 | 0 | 0.657 |

| Arab National Bank | 0.736 | 4.559 | 0 | 0.194 | 1.211 | 14.654 | 0 | 0.673 |

| Banque Saudi Fransi | 1.308 | 7.371 | 0 | 0.387 | 1.19 | 12.276 | 0 | 0.591 |

| Saudi Investment Bank | 0.756 | 6.519 | 0 | 0.335 | 0.831 | 12.457 | 0 | 0.598 |

We then computed the abnormal gain earned by individual stocks over the benchmarking index.

Here, represents a stock’s the abnormal gain over the TASI," " denotes individual stock return and ’Rm’ represents the TASI return.

Portfolios reporting a positive return over the benchmarking index (TASI) were classified as winner portfolios, while those reporting a negative return were classified as loser portfolios. and those which have a negative return on benchmarking index (TASI) were classified as loser portfolios (see Table 5).

| Table 5 | |||||

|---|---|---|---|---|---|

| Return Trend And Direction Of Movement | |||||

| Stocks | Prior to crisis | Crisis Period | Movement | ||

| Stock Return | Abnormal Return | Stock Return | Abnormal Return | ||

| Al Rajhi Bank | 0,0034 | 0,0006 | -0,1152 | -0,1215 | Contrarian |

| Bank Aljazira | 0,0606 | 0,0588 | -0,2519 | -0,2582 | Contrarian |

| Alinma Bank | 0,1350 | 0,1326 | -0,2313 | -0,2380 | Contrarian |

| Riyad Bank | -0,0705 | -0,0732 | -0,3134 | -0,3207 | Momentum |

| National Commercial Bank | -0,0206 | -0,0240 | -0,1698 | -0,1768 | Momentum |

| Samba Financial Group | 0,1310 | 0,1275 | -0,3105 | -0,3189 | Contrarian |

| Bank Albilad | 0,0362 | 0,0333 | -0,1881 | -0,1954 | Contrarian |

| Saudi British Bank | -0,0065 | -0,0088 | -0,3399 | -0,3485 | Momentum |

| Arab National Bank | 0,1657 | 0,1640 | -0,3240 | -0,3320 | Contrarian |

| Banque Saudi Fransi | 0,0309 | 0,0280 | -0,1963 | -0,2042 | Contrarian |

| Saudi Investment Bank | 0,1045 | 0,1029 | -0,3058 | -0,3113 | Contrarian |

Source: Computed Daily Return from Tadawul

From table 5 it can be observed that banks like Al Rajhi, Aljazira, Alinma, Samba, Albilad, Arab, Fransi and Investment reported to have a positive abnormal return over the market index. Thereby these stocks can be classified as winner stocks prior to the crises period. All other stocks were categorized as loser stocks.

During the crises period all the winner banks reported a negative abnormal return over the market index. This signifies the contrarian effect attributed with these stocks. In other words, during the period of crises, the investors consider investment in banking sector as risky and they have diverted their investment to alternative sectors. All other loser stocks seen to maintain the same momentum during the crises period.

Conclusion

Global events often have tangible impacts on the performance of economies at large and stock markets. Given the high sensitivity of stock markets to significant events, efforts are always made to establish the influence patterns certain events have on stock markets’ performance and understanding the reasons behind those impacts so as to enable effective responses and inform relevant decision-making. The COVID-19 pandemic outbreak is a significant contemporary global event that has shaken the global economy towards the end of 2019. The ongoing outbreak presented numerous challenges to efforts aimed at identifying the extent to which it has affected stock markets and economies at large. The aim of this study is to examine the effect of COVID-19 on the stock performance of banks on the Saudi Stock Exchange from the period dated 25th August 2019 to 31st May 2020. In order to understand the changing effect of the pandemic over time, we divide sample period into pre-crisis period and Covid 19 crisis period. This study signifies that the banking stocks are maintaining a general momentum with the benchmarking index Tadawul.

End Notes

References

- Alawadhi, M.A., Alsaifi, K., Al-Awadhi, A., & Alhammadi, S. (2020). Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance, 27(1), 100326.

- Alber, N. (2013). Competitive advantages and performance of stock market: The case of Egypt. International Journal of Economics and Finance, 5(11).

- Alber, N. (2020). Finance in the time of Coronavirus during 100 Days of Isolation. The Case of the European Stock Markets. Available at SSRN 3631517.

- Alber, N. (2020). The effect of coronavirus spread on stock markets. The case of the worst 6 countries. Available at SSRN 3578080.

- Al-Darwish, M.A., Alghaith, N., Behar, M.A., Callen, M.T., Deb, M.P., ... & Qu, M.H. (2015). Saudi Arabia: Tackling emerging economic challenges to sustain strong growth. International Monetary Fund.

- Aldrin H., Erie F., Mokhamad A., & Ardi, G. (2021). The influence of the covid-19 pandemic on stock market returns in Indonesia stock exchange”. Journal of Asian Finance, Economics and Business, 8(3), 39-47.

- Al Mahish, A.M. (2016). The impact of financing on economic growth in Saudi Arabia. International Journal of Economics and Finance, 8(8).

- Al-Malki, A., & Al-Assaf, G. (2014). Investigating the effect of financial development on output growth using the ARDL bounds testing approach. International Journal of Economics and Finance, 6(9), 136-150.

- Aravind, M. (2016). Contrarian and momentum strategies: An investigation with reference to sectoral portfolios in NSE. NMIMS Management Review, 29, 102-117.

- Arvydas P., & Ru?ta M. (2011). Applicability of contrarian investment strategies in small capitalization markets. Evidence from Nasdaq Omx Vilnius.

- David, I.O., & Boqiang L. (2020). Stock markets and the COVID-19 fractal contagion effects. Finance Research Letters, 38(1), 101640.

- Donadelli, M., Kizys, R., & Max, R. (2017). Dangerous infectious diseases: Bad news for main street, good news for wall street? Journal of Financial Markets, 35, 84–103.

- Forner, C., & Marhuenda, J. (2003). Contrarian and momentum strategies in the Spanish stock market. European Financial Management, 9(1), 67-88.

- Liu, H., Manzoor, A., Wang, C., Zhang, L., & Manzoor, Z. (2020). The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), 2800.

- Jalaludeen N., Periyasamy D., & Daniel L. (2020). How have Indian banks adjusted their capital ratios to meet the regulatory requirements? An empirical analysis. Journal of Asian Finance, Economics and Business, 7(11), 1113–1122.

- Malkiel, B.G., & Fama, E.F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25(2), 383-417.

- Manojkrishnan, C.G., & Aravind, M. (2020). COVID 19: Effect on leading pharmaceutical stocks listed with NSE. International Journal of Research in Pharmaceutical Sciences, 11(S1), 31-36.

- Ngwakwe, C. (2020). Effect of COVID-19 pandemic on global stock market values: A differential analysis. Applications of Danube, 16(2), 1-10.

- Osman, E.G.A. (2014). The impact of private sector credit on Saudi Arabia economic growth (GDP): An econometrics model using (ARDL) approach to Co-integration. American International Journal of Social Science, 3(6), 109-117.

- Papadamou, S., Fassas, A., Kenourgios, D., & Dimitriou, D. (2020). Direct and indirect effects of COVID-19 pandemic on implied stock market volatility: Evidence from Panel Data Analysis. Munich Personal RePEc Archive (MPRA).

- Richard, B., & Beatrice, W.M. (2020). Economics in the time of COVID-19. A new eBook.

- Samargandi, N., Fidrmuc, J., & Ghosh, S. (20133). Financial development and economic growth in an oil-rich economy: The case of Saudi Arabia. Economic modelling, 43, 267-278.

- Sami, A.K., & Sree Rama, M. (2020). Financial stability of GCC banks in the COVID-19 crisis: A simulation approach. Journal of Asian Finance, Economics and Business, 7(12), 337–344

- Stephen, G., Cecchetti, G., & Enisse, K. (2012). Reassessing the impact of finance on growth. BIS working papers. 381.

- Capital Market Authority. (2019). The CMA measures in light of covid-19 impacts. Media Center.

- Trading Economics. (2021). Saudi Arabia-Credit rating.

- Arab Monetary Fund. (2021). Kingdom Saudi Arabia.

- Argaam. (2019). Bank branches in Saudi Arabia rise to 2,076 in 2019.