Research Article: 2021 Vol: 20 Issue: 6S

The Sustainability of Financial Institutions in Asia and Europe during and Before Covid-19

Ibrahem Mohamed Ali, University of Al Hamdaniya

Aymen Raheem Abdulaali Almayyahi, Southern Technical University Basrah

Ali Khazaal Jabbar, University of Misan

Keywords

Covid 19, Financial Institutions, Sustainability, Microfinance Financial Institutions

Abstract

This study aims at assessing how Covid-19 has affected the sustainability of financial institutions in Asia and Europe through assessing their sustainability during and before the outbreak of this pandemic. The study targets different financial institutions and especially banks in both Asia and Europe that have been forced to change their ways of doing this to ensure their sustainability during this pandemic. This is because the sustainability of the financial institutions across the world is threatened by the probability that there will be a very steady increase in the number of non-performing loans from the high levels of eleven percent in the year 2019. Additionally, banks fear that borrowers across different business scales and sectors are likely to be affected as decreases in revenue and income implies that they will not have the ability to meet their loan obligations. As a result, individual institutions will remain susceptible to failure.

Introduction

Also referred to as Covid-19, Coronavirus has led to a raging shock to the sustainability of financial institutions across the world (Goodell, 2020). This is because there remains substantial ambiguity around the pathway of this epidemic, the speed and the means of any economic recovery as well as what structural alterations especially to the capital and trade’s globalization it is likely to bring in long-term (Su?kowski, 2020). This is because this pandemic is worsening the economic point of view for various parts of the world with the growth being projected to collapse to about negative 1.6% as well as a real per capital decrease of 3.9% making the year 2020 the worst year since the year 1970 for the world’s economic growth (Nicola et al., 2020). Additionally, poverty is expected to increase by about 2% of the world’s population. For instance, in Africa, about 26 million individuals are expected to fall below the poverty line thus erasing the 5 years progress in poverty eradication.

Fortunately, from the execution of Basel III to the strengthening of the capital base of the analytically essential institutions as well as the decreasing of the base rate, regulation in many parts of the world has become better over the last few years. Policy measures have also been formulated. Some of these policy measures include lowing the base rate to affect the abilities of the households to service their debts and the aggregate demand positively, lowering the ratios of the bank cash reserve, banks’ debt moratorium and the buying programs for government bonds (Bohoslavsky & Rulli, 2020). The subsequent literature discusses the sustainability of financial institutions in Asia and Europe during and before corona.

Literature Review

However, the sustainability of the financial institutions across the world is threatened by the probability that there will be a very steady increase in the number of non-performing loans from the high levels of eleven percent in the year 2019. Borrowers across different business scales and sectors are likely to be affected as decreases in revenue and income implies that they will not have the ability to meet their loan obligations (Li, Strahan & Zhang, 2020). As a result, individual institutions will remain susceptible to failure. For instance, the portfolios of Microfinance Financial Institutions (MFI) will experience stress due to their lending to family units with no assets and unstable income. As a result, some of these financial institutions may lack the ability to maintain solvency. Some of the institutions that are at risk include those with interbank liabilities, short-term funding or hard-currency or those that main concentrate in sectors that are predominantly affected by the Corona shock. Such problems are likely to lead to a “credit crunch” with sharp cutbacks in new leading as well as the hoarding of capital and liquidity. This implies that the financial institutions will add to the already recessionary forces in the economies of different regions across the world.

If the microfinance financial institutions undergo some stress, this credit crunch is likely to affect both the small and the medium-sized enterprises as well as micro businesses leading to the fluctuation of their accounting profit systems and reducing the ability of low-income family units to maintain their livelihood even in the informal sector (Andersen et al., 2020). Credit crunch leads to the fluctuation of the accounting profit systems in SMEs through decreasing the sales value or the level of the sales activities (Oudah & Almayyahi). Some of the policy measures that have been put in place to help in mitigating credit crunch include reducing the rates of interest and capital ratios. These measures are expected to help in financing growth and balancing financial stability. Additionally, in case the recovery process is not fast, financial institutions are also at a risk of becoming “zombie” firms and banks. This implies financial institutions that are effectively in bankrupt, but their insolvency cannot be crystallized due to policy forbearance (Baldwin & Weder di Mauro, 2020). Both before and after corona, financial institutions in Asia and Europe have been able to maintain their sustainability. The subsequent literature discusses the sustainability of financial institutions in Asia and Europe during and before corona.

Methodology

For the purpose of this study, the researcher relied on secondary data. Secondary data refers to the data that has already been collected through the use of primary sources and made available for the other scholars to use in their studies. This implies that the researcher relied on journal articles to obtain data.

Results & Discussion

The sustainability of financial institutions in Asia before Covid-19

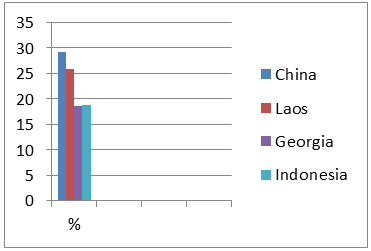

Traditionally, most of the financial institution in Asia looked up on the west for service and product ideas as well as business models to ensure their sustainability. However, this changed in the last five years as the economy of this region started growing dramatically. This implies that in the past 5 years, scale, profitability and growth have been substantial leading to sustainability in this sector. (Figure 1)

Figure 1: GDP Growth of Some Countries in Asia in the Last 5 Years.

Retrieved from: https://www.globalpropertyguide.com/Asia/gdp-per-capita-growth-5-year

Other factors that have led to the sustainability of this sector include the fact that before corona, this region was ranked as largest regional marketing in the world producing pre-tax profits of more than $700 billion and accounting for more than 37% of the world’s banking profit pools (Buehler et al., 2020). Additionally, over 40 of the globe’s 100 largest banks in terms of assets are Asian. These banks account for about 50 percent of the market capitalization of the world’s top 100. Furthermore, before corona, the middle class in this region grew to include about two-thirds of the Asian family units. This growth led to an increase in the total financial assets in different financial institutions in this region.

The Sustainability of Financial Institutions in Asia during Covid-19

Like other regions, countries in Asia have been affected by the outbreak of Covid-19. For instance, Iraq has faced any crises and difficulties leading to the destruction of many sectors (Aymen, Alhamzah & Bilal, 2019). As a way of ensuring their sustainability during corona, financial institutions in Asia focused one major imperative. This imperative involves ensuring business survival to guarantee the sustainability of these financial institutions.

Ensuring Business Survival

As a way of ensuring their sustainability during the coronavirus pandemic, financial institutions in Asia moved rapidly to shore up their operations and also implemented some approaches to help in mitigating the operational disruptions associated with this pandemic (Wójcik & Ioannou, 2020). This implies that these institutions prioritized some areas to identify obstacles or issues to the continuity of their operations. Some of these areas include.

Confirming the Flexibility of Internal Operations

As a way of ensuring their sustainability, different financial institutions in this region came up with a response management team made up of cross-functional and executive level teams. These teams were given the role of coming up with major decisions and communicating responses to this pandemic across the organization effectively and quickly. Additionally, banks shifted to remote working for most of their workers. This move required IT to make sure that both the systems and infrastructure could support this shift. For instance, following the outbreak of Covid-19, the Bahrain Islamic Bank instructed more than 60% of its workers to work from home (Park, Tayag & Rosenkranz, 2020). This measure was taken in efforts to protect both the customers and the employees from any form of health risk associated with corona while still ensuring a smooth running of the bank’s operations. While defining work-from-home and remote setups, these financial institutions considered the number of human interactions gained for some tasks and the level to which certain tasks can be individualized and segmented.

For instance, the contact-center employees do not need a high interaction level with their coworkers but most of the banks lacked the needed technology level to ensure that remote working is feasible. Nevertheless, product-development teams that are digitally enabled are more equipped to take part in remote working as compared to the traditional teams. Executives also had to ensure that the solutions made had the ability to balance the elements of technology, structure, processes and people. For examples, the Southeast Asian bank moved a total of 125 members of its product development team from the bank’s normal work setup off-site. First, this team implemented no-regret moves like strengthening best practices in dealing with data and later delineated a set of actions across major operation models to facilitate remote working fully. These actions were created by different scenarios in business-continuity planning ensuring operational stability while still supporting the same productivity levels.

De-Risking the Traditional Channels of Distribution

During the outbreak, banks in Asia swiftly took actions to make sure that their normal operations did not lead to the spread of the corona virus among their employees and customers. As the basic setting for facial interaction, branches were considered to be a major priority. Within these branches, cleaning and hygienic protocols in both the ATM and commercial areas were enhanced and the bank notes were repeatedly disinfected and quarantined for a period of not less than two weeks to minimize the risk of transmitting this virus through cash (Bidder, Krainer & Shapiro, 2020). Temperature test was executed for all visitors, employees and customers entering the bank branches and premises. Additionally, institutions started providing their employees and customers with the aid kits such as general medicines, masks, hand sanitizers and thermometers. For instance, the Central Bank of Iraq provided it employees with protective gears and hand sanitizers enabling this bank to cab the spread of this virus among its employees by 74%. The tellers were also instructed to wash their hands regularly and to wear their masks always.

This way, banks were able to ensure their sustainability since their branches started operating and the staffing also changed. For instance, banks shorted their operating hours, the number of employees reduced, and some employees were relocated to offices in other areas. Additionally, banks proactively limited the number of visitors and customers in a branch and also encouraged maintaining physical distance. Furthermore, some banks halted various high-risk activities such as limiting transmission through the use of foreign notes by closing the currency exchange booths countrywide and discounting in different in-branch transactions and especially those involving foreign currencies. For instance, to contain the transmission of the coronavirus, the Central Bank of Iraq advocated for the use of electronic modes of payment and instructed all the vendors to eradicate the commissions of these types of payments within a period of six months (PHAM & DOAN, 2020).

These measures well also extended to other operational areas with high employees’ concentration at a particular location like call centers. For instance, the South Korean bank introduced a platoon system for its about 450 call-center workers, permitting more than employees to work from the comfort of their houses at a time. Voice over the laptops and the internet protocols equipped with the company’s software were set up in the employees’ homes. These employees were allowed to handle only generic questions and questions from new customers as a way of avoiding employees from compromising susceptible customer information. The banks ensured that all calls that required the employee to access customer data were forwarded to the call centers on the bank premises. In these premises, the workspaces were changed through heightening the partition walls the space between one employee and the other.

Shifting to Digital

To some extent, this pandemic forced different financial institutions in Asia to considerably speed up their transformation to the digital channels to increase their sustainability. This is because for instance, most of the financial institutions in this region not only leaned heavily on the already existing digital channels to enhance the engagement of their contactless customers but also speeded up the processes of digitized core-banking like online document submission, digital signature collection and electronic Know Your Customer (Mehta, Patel & Mehta, 2016). For instance, since the outbreak of Coronavirus, the Trade Bank of Iraq embraced the use of accredited electronic payment cards as well as the use of electronic Know Your Customer.

Additionally, different financial institutions provided their customers with a wide range of online services as a way of reducing the call for in-person banking (Rasheed et al., 2019). For instance, as part of its initiatives to control corona, the Ping an Bank in Iraq introduced the “Do It At Home” campaign to offer its customers with smart and contactless services. Through the use of this initiative, customers were able to complete different financial services through the use of this bank’s app. Some of the services that the customers were able to get through the use of this app include investor education, family trust or private bank, foreign exchange, insurance, wealth management and the primary banking transactions. Artificial intelligence was also launched to help in providing all-time consultation even when face to face communication was not possible and after the closing of all centers. Following this initiative, over three million customers had made more than 11 million transactions and more than 400,000 clients had viewed their online lectures on taxation, financial laws, PE investment and mutual funds within a period of two weeks.

As a way of responding to the spread of this pandemic, DBS Singapore came up with different support measure to facilitate the stability of the financial institutions in this country. For instance, it provided financial support to the affected clients as complimentary insurance coverage. It also offered home-loan-payment relief to all the employees in the affected sectors. Additionally, both the small and the medium-sized businesses were given different support measures. These measures include a property-loan principal deferment for six months, collateral free loans for businesses, next-day, digital account opening, extension of the import facilities for a period of up to 60 days and temporary bridging of the loan for the affected businesses.

Strengthening the Liquidity Position

During the Covid-19 period, financial institutions in Asia were also forced to prepare for possible changes in the customers withdrawals and borrowing needs. As a result, executives in different institutions were forced to assess the positions of their institutions to guarantee satisfactory liquidity. This practice involved identifying some of the major risks to liquidity from the demand and the supply point of view like additional drawdowns in retail and commercial businesses as well as huge withdrawals (Mirzaei, Saad & Emrouznejad, 2020). Additionally, some of the fast-acting financial institutions came up with a short-term liquidity plan and restructured their contingency plans, developed total transparency on the liquidity position through the use of an intra-day dashboard, identified some of the key accounts in terms of materiality and started negotiating with their customers. Depending on how severe the situation was, other financial institutions included other actions such as trade compression, cancelling transactions, trading both non-trading and trading assets to be used as collateral, and using support provided by the government programs.

The Sustainability of Financial Institutions in Europe before Corona

Following the financial crisis that took place in Europe in the year 2008, much has been achieved to ensure the stability of the financial institutions. For example, management accounting applications have been established and employed. This is because study indicates that management accounting applications contribute considerably towards the achievement of sustainable performance in financial institutions through relieving the pressure on human resources reflected in their behaviours and attitudes since employee perceptions are formed (Ali, Abdulaali & ALmashkor). For instance, before the outbreak of the coronavirus, this region has had more than 2100 persons working full-time in the financial sector supervision at the European level. Market and prudential rules of conduct had been harmonized and the banks’ soundness could be compared instantly. Additionally, the rules provided for responding to different adverse events well as easing the capital buffers as announced by the SSM. SSM is a member of the ECB which permits for the immediate sharing of information as well as the understanding of liquidity distress in the banking segment with the financial policy authorities. However, even before corona, there was a lot of unfinished business in the banking sector and especially on the initiatives associated with the capital market unions. For instance, in the banking side, the bank back-stop and the EDIS are initially considered to be the most important but the immediate reaction to the constraints of the local credit was more important. As part of the region’s aid competences, the European Commission worked towards making sure all the approaches were followed in the entire union.

The Sustainability of Financial Institutions in Europe during Corona

Following the outbreak of the Coronavirus, leaders in different financial institutions including banks have demonstrated resilience and resolve moving fast to protect the health of the customers and employees, guaranteeing the continuity of the basic services provided by banks as well as building up liquidity, capital and the cost buffers to help in strengthening their institutions (Claeys, 2020). Additionally, this pandemic has led to so many changes especially on how financial institutions operate. Some of the changes that have been witnessed include how staffs work, how customers engage, their financial needs and the society’s expectations of the financial institutions. As a result, this industry is expected to experience a prolonged era of economic crisis and the actions undertaken by the financial institutions in the coming months will establish their performance path for the coming years. However, during lockdown, financial institutions have been able to maintain their sustainability through showing things that are possible in terms of innovation and speed. The Covid-19 period has also proven to be the time for the executives in different financial institutions across Europe to re-imagine how their institutions work (Claeys, 2020). Disciplined execution of different imperatives and bold vision are some of the factors that will help in differentiating leaders from laggards as this crisis continues to abate.

Some of the imperatives that financial institutions in Europe have implemented to ensure their sustainability during the Corona period include.

Innovating New Products and Propositions

Coronavirus has triggered the emergence of a wide range of novel financial needs that are yet to be addressed. For instance, liquidity has suddenly turned out to be a major concern and especially for many business and retail customers. As a result, financial institutions have been forced to advance their analytical skills to identify the customers that they can serve feasibly and then come up with a personalized offer for these customers. For instance, following the outbreak of this pandemic, the HSBC bank rolled out the “Choose What You Love” campaign. The “Choose What You Love” campaign is a data-driven interactive campaign that helps the bank’s customers to choose a personalized credit card. It is also designed to investigate different ways for the customers to find out more about the offerings provided by this bank. Small businesses have also developed some interest in the liquidity advice provided as a contribution service.

Another challenge that has emerged as a result of this pandemic is the retirement savings. In Europe, retirement savings are considered to be a nest egg of many individuals and especially those over the age of 40 years. During this market turmoil, this egg nest has shrunk considerably igniting high demand for guaranteed, affordable and simple investment products. Due to the interest margins’ pressure, the look for alternative sources for fee income has intensified. For instance, banks have been forced to create extended services around their core products like mortgages through assisting their customers to open a home equity line, to manage building maintenance, get home insurance or enhance their credit scores.

Importantly, financial institutions have realized that innovation cannot be incremental. This is because they have realized that establishing a novel digital business like New 10 by ABN Amro, Marcus by Goldman Sachs or Yolt by ING can assist banks in entering into attractive businesses and segments. An alternative to establishing a new business is getting one. Europe is termed as the home to more than 4000 fintechs ad especially those that have incubated the disruptive propositions. However, most of these fintechs have experienced stress in the wake of this pandemic since the VC funding to this sector has dropped by 30% in this year’s first quarter. To ensure their sustainability, various incumbent banks have purchased these innovative concepts and scaled them rapidly. For instance, the second largest bank in Europe, BBVA, has acquired several fintechs. For instance, this bank acquired Holvi, a Finnish provider of banking services to small businesses in this year March.

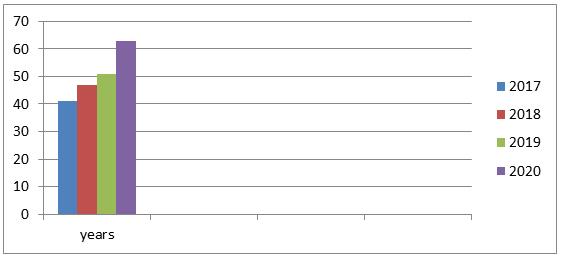

Locking in the Change to Digital Services and Sales and Reshaping Physical Distribution

Following the outbreak of the Coronavirus in Europe, the adoption of digital banking among customers has experienced a forward leap as compared to the past few years. A recent customer survey indicated that a 10% to 20% increase in the use of digital banking across Europe as shown on Figure 2. As a result, many Italian banks such as ABI and Banca Credito Italiano have been striving to ensure that their customers are able to use this form of banking. This jump in adoption has opened the door for many banks in this continent to turn their digital channels into channels for real sales and not just tools for convenient self-service.

Figure 2: Increase in the Use of Digital Banking Across Europe Within the Last Four Years

Retrieved from: https://www.emarketer.com/content/seven-charts-the-state-of-digital-banking-in-2020

However, the turnover side of this surge in digital adoption that have taken place among the European financial institutions have led to a reduction in the branch capacity by 20% to 30% during the lockdown. To ensure their sustainability, banks have decided to revamp their physical footprint. This implies rethinking the roles played by these branches and coming up with new formats. Banks have also been forced to revaluate the manner in which they convey personal advice. This is because individuals across different age groups have been forced to embrace the use of video platforms making it easier for the financial institutions to start rolling out secluded advice for some of the complex products even in markets that are more branches focused.

Creating a Structurally Scalable and Learner Cost Base

As a way of offsetting the effects of slothful income and spiking risk costs as well as to free up various resources for creating digital capabilities, banks have been forced to aim at a cost enhancement of between 25% and 30% over the next two years (Bénassy-Quéré et al., 2020). Although the cost levers are known, changes in customer behavior as well as their working ways have changed how and what banks can implement during this pandemic to ensure their sustainability. Due to the associated uncertainty, the costs should go down and become more scalable. Additionally, banks have been forced to move from IT infrastructure to workplace or business functions as well as from fixed cost to the pay as you go models.

Resting both the Technology and the Organization for Speed

During the lockdown period, most of the banks teams were forced to become agile overnight and to deliver the impossible like enabling most of their employees to perform their responsibilities while at home or to deploy a completely new digital journey within a short time. To ensure their sustainability, these banks have been forced to act as per this speed and to empower their workers through resetting their businesses from a grubby setup to one that is oriented around the customers’ value such as value streams like cards and daily banking with understandable links to the responsibilities of P&L. This implies merging business with IT and operations allowing them to react to the external changes faster.

A major element of ensuring that a business reacts to changes rapidly is the ability to redeploy the employees as the demands for various banking activities continues to fluctuate (Mack, 2020). Estimates indicate that with the right reskilling, 50% to 60% of the workforce of an average retail bank can be redeployed when need arises. Different banks have started working with AI-based platforms to help in facilitating such redeployment. For instance, the Spanish Bank Caixa Bank has started using the Robo-advice automated platforms to provide their employees with algorithm-driven investment and financial management advice. This platform creates a better customer-experience during this pandemic since through the help of the bank’s employees; customers are able to enhance their digital interaction and to adopt a “do-it-yourself” approach. Additionally, during this crisis, many banks were forced redefine their target and especially on remote working. This is because the expectations suggested that between 10% and 40% of the employees could be forced to remain off-premises permanently. Additionally, as the speed turns out to be one of the major differentiators, banks have been forced to ensure their sustainability through establishing new architectural paradigms facilitated by cloud-based infrastructure and platform to modernize the key technology systems in a cost-effective way.

Doubling Down Capital and Risk Management

Over the next few years, credit losses will be considered the defining performance differentiator. Proactive interventions and early detection are important in managing the non-performing loans (Bénassy-Quéré & Weder di Mauro, 2020). After putting this under control, the other challenge that banks are likely to experience following this pandemic is how to steer through the coming wave of recapitalization. In the depth of the Corona crisis, regulators in the banking sectors were forced to relax the CET1 ratio requirements. Banks were also forced to their rapid processes of loan origination used under the relied program into business-as-usual. This called for sophisticated decisioning in digital credit as well as a huge step up in “time to yes” and decision accuracy.

Rebalancing the Business Mix and Seeking Targeted M&A Agreements

After crisis, the landscapes of any industry are repeatedly redrawn. According to the Global Banking Annual Reviews that were released by McKinsey, following the corona pandemic, about a half of the banks in Europe had a return on equity lower than their cost of equity by the end of the first quarter of 2020 (Heinemann, 2020). As the pressure on the return on equity continues to build up, most of the banks have been forced by carving out most of their noncore assets and especially those that drive cost or complexity or those that do not add any value. Although M&A might seem far off today, it remains one of the best paths to acquiring new abilities or rapid cost savings.

Conclusion

From the literature above, it is evident the Covid-19 affected the stability of financial institutions in both Asia and Europe. This is because following the outbreak of these pandemic, financial institutions in these two regions were forced to change their ways of doing thing to ensure their sustainability. For instance, financial institutions in Europe were forced to implement some imperatives to ensure their sustainability. Some of the imperatives that these institutions implemented to ensure their sustainability include coming up with new products and propositions, locking in the change to digital services and sales and reshaping physical distribution, creating a structurally scalable and learner cost base, resting both the technology and the organization for speed, doubling down capital and risk management and rebalancing the business mix and seeking targeted M&A agreements. According to scholars, disciplined execution of different imperatives and bold vision are some of the factors that will help in differentiating leaders from laggards as this crisis continues to abate. Similarly, financial institutions in Asia were also forced to one major imperative. This imperative involves ensuring business survival to guarantee the sustainability of these financial institutions. This imperative involves ensuring that financial institutions are able to move rapidly to shore up their operations and also to implement some approaches to help in mitigating the operational disruptions associated with this pandemic. This implies that these institutions prioritized some areas to identify obstacles or issues to the continuity of their operations.

Recommendations

From the literature above, it is evident that as a way of preparing for such a crisis in future, financial institutions across the world should come up with policy measures to mitigate the associated risks. Some of these policy measures include lowing the base rate to affect the abilities of the households to service their debts and the aggregate demand positively, lowering the ratios of the bank cash reserve, banks’ debt moratorium and the buying programs for government bonds.

References

- Ali, J.H., Abdulaali, A.R., & ALmashkor, I.A. (2020). The impact of managerial accounting applications on sustainable performance: An applied study on several private sector companies in Basra Governorate.

- Andersen, A.L., Hansen, E.T., Johannesen, N., & Sheridan, A. (2020). Consumer responses to the COVID-19 crisis: Evidence from bank account transaction data. Available at SSRN 3609814.

- Aymen, R.A., Alhamzah, A., & Bilal, E. (2019). A multi-level study of influence financial knowledge management small and medium enterprises. Polish Journal of Management Studies, 19.

- Baldwin, R., & Weder di Mauro, B. (2020). Economics in the Time of COVID-19.

- Bandara, H.H. (2016). Digital banking: Enhancing customer value. In 28th Anniversary Convention (123-133).

- Bénassy-Quéré, A., & Weder di Mauro, B. (2020). Europe in the time of Covid-19: A new crash test and a new opportunity. Europe in the Time of Covid, 19, 1-20.

- Bénassy-Quéré, A., Marimon, R., Pisani-Ferry, J., Reichlin, L., Schoenmaker, D., & di Mauro, B.W. (2020). 16 COVID-19: Europe needs a catastrophe relief plan. Europe in the Time of Covid-19, 103.

- Bidder, R.M., Krainer, J.R., & Shapiro, A.H., (2020). De-leveraging or de-risking? How banks cope with loss. Review of Economic Dynamics.

- Bohoslavsky, J.P., & Rulli, M. (2020). Covid-19, International financial institutions and the continuity of androcentric policies in Latin America. Journal of Feminist Studies, 28(2).

- Buehler, K., Conjeaud, O., Giudici, V., Samandari, H., Serino, L., Vettori, M., & White, O. (2020). Leadership in the time of coronavirus: COVID-19 response and implications for banks. McKinsey Insights.

- Claeys, G. (2020). The European central bank in the COVID-19 crisis: Whatever it takes, within its mandate. Bruegel Policy Contribution, 9.

- Goodell, J.W. (2020). COVID-19 and finance: Agendas for future research. Finance Research Letters, 101512.

- Heinemann, F. (2020). The search for the right European financing instruments in the Corona pandemic: ESM liquidity assistance versus Corona bonds (26). EconPol Policy Brief.

- Li, L., Strahan, P.E., & Zhang, S. (2020). Banks as lenders of first resort: Evidence from the Covid-19 crisis. The Review of Corporate Finance Studies.

- Mack, S. (2020). EU banks’ vulnerabilities-Capital conservation key to withstanding Corona crisis.

- Mehta, S., Patel, K., & Mehta, K. (2016). Demonetization: Shifting gears from physical cash to digital cash. Voice of Research, 5(3), 47-50.

- Mirzaei, A., Saad, M., & Emrouznejad, A. (2020). Bank stock performance during the covid-19 crisis: Does efficiency explain why islamic banks fared relatively better? Available at SSRN 3702116.

- Nicola, M., Alsafi, Z., Sohrabi, C., Kerwan, A., Al-Jabir, A., Iosifidis, C., Agha, M., & Agha, R. (2020). The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International journal of surgery (London, England), 78, 185.

- Oudah, A.A., & Almayyahi, A.R.A. (2020). Factors affecting the fluctuation of accounting profits system in SMEs industrial: A field study on a group of companies in Basra, southern Iraq.

- Ozili, P.K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18(4), pp.329-340.

- Park, C.Y., Tayag, M.C., & Rosenkranz, P. (2020). COVID-19 exposes Asian banks’ vulnerability to US Dollar funding.

- Pham, M.H., & Doan, T.P.L. (2020). The impact of financial inclusion on financial stability in Asian countries. The Journal of Asian Finance, Economics, and Business, 7(6), 47-59.

- Rasheed, R., Siddiqui, S.H., Mahmood, I., & Khan, S.N. (2019). Financial inclusion for SMEs: Role of digital micro-financial services. Review of Economics and Development Studies, 5(3), 571-580.

- Seetharaman, P. (2020). Business models shifts: Impact of Covid-19. International Journal of Information Management, 54, 102173.

- Su?kowski, ?. (2020). Covid-19 pandemic; recession, virtual revolution leading to de-globalization? Journal of Intercultural Management, 12(1), 1-11.

- Wójcik, D., & Ioannou, S. (2020). COVID?19 and Finance: Market developments so far and potential impacts on the financial sector and centres. Magazine for economical and social geography, 111(3), 387-40.