Research Article: 2022 Vol: 21 Issue: 1

Togetherness Create Synergizing Intergeneration Conflict Resolution, New Family Business Value Creation, and Family Business Sustainability: Sustainable Family Business Theory (SFBT) Approach

Elia Ardyan, Universitas Ciputra Surabaya

Timotius F.C.W. Sutrisno, Universitas Ciputra Surabaya

Liestya Padmawidjaja, Universitas Ciputra Surabaya

Citation Information: Ardyan, E., Sutrisno, T.F.C.W., & Padmawidjaja, L. (2022) Togetherness create synergizing intergeneration conflict resolution, new family business value creation, and family business sustainability: Sustainable family business theory (SFBT) approach. Academy of Strategic Management Journal, 21(S1), 1-14.

Abstract

This study examines the role of parent-children togetherness to create synergizing intergeneration conflict resolution, new family business value creation, and family business sustainability. Sustainable family business theory (SFBT) is the approach used in this study. The respondents used were 216 family business owners. The analysis used is PLS-SEM and uses WarpPls version 7 to process the data. This study shows how family togetherness can affect synergizing intergeneration conflict resolution, new family business value creation, and family business sustainability. Other results show synergizing intergeneration conflict resolution has a positive effect on new family business value creation. New family business value creation will significantly increase family business sustainability. This study has an impact on sustainable family business theory, where the role of intergeneration togetherness (as part of social capital resources) will have an impact on new family business value creation (as part of human capital resources) and sustainability of family business.

Keywords

Parent-Children Togetherness, Synergizing Intergeneration Conflict Resolution, New Family Business Value Creation, Family Business Sustainability.

Introduction

A family business is a unique business entity. This uniqueness can be seen from the complexity in managing resources (Mikušová et al., 2020) and the overlap between business and family subsystems (Sundaramurthy & Kreiner, 2008). The family subsystem consists of emotional and multigenerational units that have dependencies between family members and others (Zellweger & Astrachan, 2008). In the family subsystem, some family members do not have good competence, so they can become a source of problems in the future. Nepotism activities become the negative side of the family subsystem (Bellow, 2004; Jaskiewicz et al., 2013). In contrast to the family subsystem, the business subsystem consists of people recruited based on a competency-based recruitment system (Goel, 2013) and focuses on performance appraisal (Jaskiewicz et al., 2013). Overlapping between business and family subsystems is a dilemma in family businesses (Sundaramurthy & Kreiner, 2008). The inability to harmonize each role in the family and business will trigger conflicts which will have an impact on the sustainability of the family business. Clarity of roles, as well as the ability to synergize various contradictory matters, will greatly impact long-term performance (Neff, 2015). Therefore, family businesses must harmonize business and family subsystems.

Conflict in the family business has been the concern of many researchers ( Alderson, 2015; Kanadl et al., 2020; Kellermanns & Eddleston, 2006, 2007; Machek & Kubíček, 2019; Nosé et al., 2016; Rhodes & Lansky, 2013). Conflict is an unavoidable part of the family business. Rhodes & Lansky (2013) Elia ardyan explained that managing conflicts that occur in family businesses are a challenge that must be faced. A family business is not managed by one family member alone but involves two or more family members. Conflict is often caused by jealousy, bitterness, inattention, injustice ( Alderson, 2015), hatred, frustration, hate (Paskewitz, 2021), children's desire to distinguish themselves from their parents, marital discord (Eddleston & Kellermanns, 2007), lack of the relationship between family members (Morris et al., 1997), and identity boundaries (Sundaramurthy & Kreiner, 2008). Conflict can have a positive or negative impact on a business (Eddleston & Kellermanns, 2007). Various studies have found the impact of conflict on performance (Kanadlı et al., 2020; Kellermanns & Eddleston, 2007; Morck & Yeung, 2003), productivity, and longevity/sustainability (Gudmunson & Danes, 2013; Loignon et al., 2016).

Another uniqueness of family businesses is the culture and values that are different from non-family businesses. Every family business has different values. In a family business, values are an identity (Parada & Viladás, 2010) and a view of life that drives the failure and success of a family business. Values give family businesses hope to meet business challenges and obstacles. Values are the basis of business and the behavior that business conducts (Parada et al., 2019). Families will face guilt if they don't live up to the values they set in advance.

Previous research focuses on values created by parents and transferred to their children (Parada et al., 2019; Tàpies & Moya, 2012). It is rare to discuss value creation that is carried out by children and parents together to create family business sustainability. This research also discusses parent-child togetherness as the main factor to increase the creation of new value. This is also rarely discussed in studies of family businesses. This study examines the role of parentchildren togetherness to create synergizing intergeneration conflict resolution, new family business value creation, and family business sustainability. This study will contribute to the sustainable family business theory.

Literature Review and Hypotheses

Sustainable Family Business Theory

Sustainable family business theory (SFBT) was originally proposed by Stafford et al., (1999) then developed by Danes & Brewton (2012). SFBT seeks “to identify the family and business resources and constraints, processes and transactions that are most likely to lead to the achievement of sustainable business and family and family business” (Stafford et al., 1999). Danes & Brewton (2012) revealed that SFBT is derived from general system theory, where a behavior-oriented systems theory explains the integration between business systems, family systems, and the interaction of the two systems. Family members are considered as a system that always interacts between family members. The main principle of SFBT is that equal recognition is given to families and companies and that each system takes available resources and constraints and transforms them through interpersonal transactions and resources into achievements (Danes & Brewton, 2012)). Family climate is a resource inherent in the family and business sub-systems that are part of the bonding family social capital (Nosé et al., 2016). Family climate is a resource inherent in the family and business sub-systems that are part of the bonding family social capital (Gudmunson & Danes, 2013).

Sustainable Family Business Theory and Family Business Sustainability

SFBT is used to achieve long-term family business sustainability (Danes & Brewton, 2012); Danes et al., 2008; Danes et al., 2009). Danes et al. (2008) stated that SFBT is trying to understand its resources and constraints. Financial capital, social capital, and human capital are critical resources needed by family businesses (Chang et al., 2009; Danes et al., 2009). Family capital will have an impact on family business sustainability (Danes et al., 2009) and the level of impact varies according to the type of family capital. Human capital is an important part of family business growth and can increase competitive advantage (Mallon et al., 2018). One example of human capital is tacit knowledge, and tacit knowledge cannot be imitated by other companies (Barney, 1991). In conclusion, SFBT can be used to predict long-term family business viability

Parent-Children Togetherness

Togetherness is a challenge that must be considered in a family business. Lack of togetherness will encourage conflicts that endanger the sustainability of the family business. Togetherness will make the family business able to face challenges both internal and external. Of course, togetherness will make parents and children able to find various alternative solutions to problems. Togetherness will have an impact on the synergy of problem-solving due to conflicts that occur. The openness between founder and son will benefit the family business, which will reduce conflict and improve performance (Jehn, 1995). Family members try to discuss ideas to find the best solution to resolve the conflict (Kellermanns & Eddleston, 2006). In togetherness there is trust. It is this trust that will reduce the transaction costs of the exchange (Steier, 2001) so that the founder and his son can synergize various solutions to the problems they face.

H1: Parent-children togetherness will enhance synergizing intergeneration conflict resolution significantly.

The desire to give and take is a result of being together in the family business. Reciprocity among family members is explained as the desire of family members to provide feedback, shared ideas, and hopes for each other (Kellermanns & Eddleston, 2007). The emotional side contributes to value destruction or value creation in a family business (Berrone et al., 2012; Kammerlander et al., 2015). Creating an intimate emotional bond is one of the business strategies in a family business ( Kellermanns et al., 2014). Emotional bonds unite interpersonal relationships between family members. The emotional bond drives the next generation to continue the business that their parents have built. The emotional bond will encourage both parents and the next generation to achieve family business goals. Peterson & Distelberg (2011) stated values tend to be created by family councils.

H2: Parent-Children togetherness will enhance new family business value creation significantly

The relationship between parent and child has been studied by many researchers, especially the relationship between parent and child in the family business. The interaction between parent and child becomes more complex (Dyer, 1986). Children start working in the family business from adolescence, and this has an impact on the parent-child relationship (Houshmand et al., 2017). Togetherness between children and parents will be closer and increase the closeness of the emotional bond. Starting from their teens, they have built a business together with their parents (Telling & Goulding, 2020). The togetherness of parents and children in developing a family business will create better communication and interaction. This interaction and communication will affect sustainability. Danes & Brewton (2012)) explained that interpersonal interaction (relationship or communication) has an impact on family business sustainability.

H3: Parent-Children togetherness will enhance family business sustainability

Synergizing Intergeneration Conflict Resolution

Conflicts that occur between parents and their successors always involve emotions (Fahed-Sreih, 2018). Conflict affects the running of the family business and business performance (Kellermanns & Eddleston, 2007). Conflicts that occur are usually personal problems (Schultze, Lubatkin, & Dino, 2003). Causes of conflict include emotionally charged interpersonal clashes and task Disagreement (Davis & Harveston, 2001; Jehn, 1995; Parayitam et al., 2010). First, emotionally charged interpersonal clashes. Personal animosity issues in family businesses usually occur due to personal incompatibility between family members (Amason & Schweiger, 1994) and often have an impact on the negative emotion (McMillan et al., 2012), such as annoyance, irritation (Kellermanns & Eddleston, 2004), anger, frustration, and distrust (Davis & Harveston, 2001). Relationship conflicts can be resolved by bringing younger family members into the company and listening to their ideas (Cater, 2006). Second, task disagreement. Task conflict focused on work (Hoelscher, 2014) where there are inconsistencies, differing points of view, and opinions among group members regarding the task (Amason & Schweiger, 1994). Third, Process (Jehn, 1995). Paskewitz (2021) explains process conflict into several indicators, including task responsibilities, conflicts related to resource allocation, and differences of opinion about who should carry out activities.

Conflicts should be resolved in various ways (Hoelscher, 2014). Conflict can destroy a family business. Parents and their successors must be able to resolve conflicts well. Together, they seek and synergize solutions to resolve conflicts in the family business. In this study, the concept of "Synergizing intergeneration conflict resolution" is defined as an activity to synergize various alternative solutions in resolving conflicts between generations or between families to produce the best solution.

Gersick et al., (1997) state in the third generation, several cousins have different goals and values. Often this will be a problem in the family business. Conflicts between families occur because of differences in goals and values. Conflict can also occur because of poor succession (Ward, 1987) so that the next generation does not pass on the business values created by their parents. These things require conflict resolution between generations. Conflict resolution is an approach that aims to resolve conflict through constructive problem solving (Miller & King, 2005). Everyone has their pattern to solve problems (Thomas & Kilmann, 1975) to create new ideas, activities, and philosophy.

H4: Synergizing intergeneration conflict resolution will enhance new family business value creation significantly.

New Family Business Value Creation and Family Business Sustainability

The ability to create intergenerational value in family businesses in the form of strategic sustainability is an important part (Salvato & Melin, 2008). Values are ethical, standards, moral principles, behavioral norms (Koiranen, 2002), our commitments to personal and organizational goals, and our response to others (Dumas & Blodgett, 1999). Values are the driving force of the family business in achieving its goals (Peterson & Distelberg, 2011), shape the way businesses behave, develop identity (Marqués et al., 2014), their business strategy (Aronoff & Ward, 2011), and improve high performance (Dyer, 2006; Miller & Le Breton-Miller, 2004).

Family businesses should focus on value creation to achieve competitive advantage (Tàpies & Moya, 2012) and family firms’ long-term value-creating potential (Salvato & Melin, 2008). Parents and children should strive to create good values that will have an impact on longevity in the family business. Values such as altruism, immoral familism (Dyer, 2006), nepotism (Schulze et al., 2001), and adverse selection tend to damage longevity (De Vries et al., 2010; Miller & Le Breton-Miller, 2004). Conformity between family values and governance structure is a driving factor for family business sustainability (Sharma & Nordqvist, 2008). Values such as a long-term approach, a strong family culture, individual and collective mentality, and external orientation contribute to sustainability from generation to generation (Sorensen, 2014). Sustainability is generally discussed in the context of business growth, business continuity, trans-generational entrepreneurship, socio-emotional wealth (Beckhard & Dyer, 1983; Schulze et al., 2003)

H5: New Family Business Value creation will enhance family business sustainability significantly.

Method

Sample

The context of our study is a company managed using the family business concept. Family business not only consists of large companies, but also SMEs (Curado & Mota, 2021). The focus of our study is family business with small and medium scale. Data were obtained by conducting questionnaires. The distribution of the questionnaires was carried out online and offline. The reason for the spread is done offline and online because the Covid-19 pandemic causes researchers not to be free to move to get data directly. The total number of respondents who filled incorrectly until the beginning of August was 216 respondents. Male respondents amounted to 111 respondents (51.39%) while female respondents amounted to 105 (48.61%). Respondents came from several cities in Indonesia, including Surabaya (25%), Klaten (22.22%), Sukoharjo (12.5%), Solo (9.26%), Makassar (2.78%), and other cities (28.25%). Respondents who filled out the most were the 2nd generation respondents (69.44%), the average age of the respondents was 33.43 years while the average age of the family business was 17.64 years.

Measurement

Synergizing intergeneration conflict resolution is an activity to synergize various alternative solutions in resolving conflicts between generations or between families to produce the best solution. The items were phrased as follow (Mohr & Spekman, 1994): Parents and children collaborate in making decisions to find solutions to problems in the event of a conflict (SCIR1), parents and children compromise if there are differences of opinion when resolving conflicts (SCIR2), people allow children to provide suggestions in the event of a conflict (SCIR3), people parents do not control children in making solutions to resolve conflicts (SCIR4), parents try to avoid the desire to prioritize their solutions (SCIR5), no one dominates when making solutions to the conflicts they face (SCIR6). All questions were asked separately to the business owner on a Likert scale by 1 and 5.

Parent-Children Togetherness is a condition where parents and children have a close relationship and together do many activities to get closer to each other. The items were phrased as follow: parents and children have a strong emotional bond (FST1), parents and children have good communication (FST2), parents and children have a shared vision in running a business (FST3), parents and children routine knowledge sharing (FST4), parents and children have a philosophy in running a business (FST5), routine meetings between family members (FST6), and actions to foster family harmony (FST7). All questions were asked separately to the business owner on a Likert scale by 1 and 5

New family business value creation is an activity to create new values and culture by parents and children that will move the family business towards the best performance. The items were phrased as follow: some new values or goals are created together between father and son (NVC1), there is an improvement in the values of the family business carried out by children (NVC2), children add certain values to the family business (NVC3), and the child is allowed to change the value of the family business that has been set by his predecessor (NVC4). All questions were asked separately to the business owner on a Likert scale by 1 and 5.

Family business sustainability is the long-term sustainability of the family business. The items were phrased as follow: Children commit to continue the family business (FBS1), Business does not stop only in the first generation (FBS2), Family businesses always earn profits for the long term (FBS3), Prospective successors can foster a sense of harmonization between siblings in running a family business (FBS4), and Prospective successors can foster a sense of harmonization with employees or employees (FBS5). All questions were asked separately to the business owner on a Likert scale by 1 and 5.

Data Analysis

This study has built a model that has a complex relationship between latent variables. Therefore, this study uses Structural Equation Modeling (Hair et al., 2011) with the Partial Least Square (PLS) approach. PLS-SEM estimates the creation of indicator variables for exogenous constructs based on their predictions of endogenous constructs (Hair et al., 2011). PLS is used because it has more benefits than covariance-based structural equation modeling (Sarstedt et al., 2017; Lowry & Gaskin, 2014). In addition, PLS-SEM can be used for abnormally distributed data (Limayem et al., 2007; Nadkarni & Gupta, 2007) and consider non-parametric techniques (Hair et al., 2014). To process the data, this study uses WarpPls version 7. The use of PLS-SEM will go through two stages, namely the measurement model and the structural model (Sarstedt et al., 2017; Henseler et al., 2009).

Result

The measurement model is a test of validity (convergent validity and discriminant validity) and reliability (internal consistency). The results of testing the validity and reliability can be seen in Table 1. Testing the validity using the loading factor, AVE, and discriminant validity. The required factor loading value is a minimum of 0.6 (Gefen & Straub, 2005). From the loading factor of each tested construct, there were several that did not meet the requirements, including FST6, FST7, SCIR4, and FBS5. The five indicators whose loading factor value is below 0.6 will be deleted from the analysis. The required AVE value must be above 0.5 (Sarstedt et al., 2017; Henseler et al., 2009), so it can be concluded that all AVE values are above 0.5. The determinant validity tests whether the square root of AVE has a value that is more than the correlation between constructs. Table 2 shows that the value of the square root of AVE is greater than the correlation value between constructs. So, it can be concluded that the proposed instrument is valid.

| Table 1 Validity and Reliability Testing | ||||

| V ariable and Indicator | Factor Loading | AVE | Composite Reliability | Cronbach Alpha |

| Parent-Children Togetherness FST1 FST2 FST3 FST4 FST5 |

0.758 0.855 0.865 0.904 0.895 |

0.724 | 0.929 | 0.903 |

| Synergizing intergeneration conflict resolution SCIR1 SCIR2 SCIR3 SCIR5 SCIR6 |

0.839 0.886 0.862 0.733 0.743 |

0.664 | 0.908 | 0.872 |

| New Family Business Value Creation NVC1 NVC2 NVC3 NVC4 |

0.804 0.884 0.828 0.617 |

0.632 | 0.867 | 0.729 |

| Family Business Sustainability FBS1 FBS2 FBS3 FBS4 |

0.817 0.915 0.890 0.896 |

0.798 | 0.941 | 0.916 |

| Table 2 Discriminant Validity | ||||

| SCIR | FST | NVC | FBS | |

| Synergizing intergeneration conflict resolution (SCIR) | (0.815) | 0.801 | 0.705 | 0.705 |

| Parent-Children Togetherness (FST) | 0.801 | (0.851) | 0.638 | 0.800 |

| New Family Business Value Creation (NVC) | 0.705 | 0.638 | (0.790) | 0.681 |

| Family Business Sustainability (FBS) | 0.705 | 0.800 | 0.681 | (0.893) |

This study uses composite reliability and Cronbach alpha to test the reliability of the instrument. Composite reliability is used to test internal consistency. All composite reliability values are above 0.7 (Henseler et al., 2009), while the Cronbach alpha value was above 0.6. So it can be concluded that all the proposed instruments are reliable.

The goodness of fit of a statistical model describes how well the model fits a series of observations made. The goodness of fit measure usually summarizes the difference between the observed value and the expected value in the model. The following are the results of the goodness of fit model measurement:

• Average path coefficient (APC)=0.495, P<0.001

• Average R-squared (ARS)=0.623, P<0.001

• Average adjusted R-squared (AARS)=0.620, P<0.001

• Average block VIF (AVIF)=2.238, acceptable if <= 5, ideally <= 3.3

• Average full collinearity VIF (AFVIF)=3.237, acceptable if <= 5, ideally <= 3.3

• Tenenhaus GoF (GoF)=0.661, small >= 0.1, medium >= 0.25, large >= 0.36

• Sympson's paradox ratio (SPR)=1.000, acceptable if >= 0.7, ideally = 1

• R-squared contribution ratio (RSCR)=1.000, acceptable if >= 0.9, ideally = 1

• Statistical suppression ratio (SSR)=1.000, acceptable if >= 0.7

• Nonlinear bivariate causality direction ratio (NLBCDR)=1.000, acceptable if >= 0.7

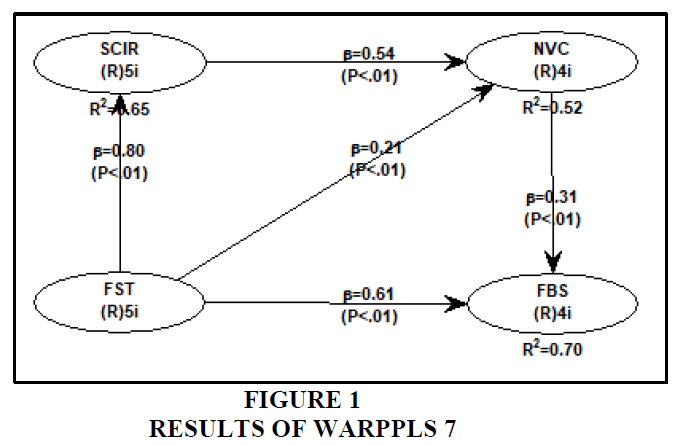

This study proposes 5 hypotheses. After testing the hypothesis, it was found that all hypotheses were accepted. Parent-children togetherness can increase synergizing intergeneration conflict resolution (β=0.805; <0.001), new family business value creation (β=0.208; <0.001) and family business sustainability (β=0.605; ρ<0.001). So H1, H2, and H3 are accepted. Synergizing intergeneration conflict resolution can increase new family business value creation (β=0.543; <0.001). So H4 is accepted. New family business value creation has a positive and significant effect on family business sustainability (β=0.312; <0.0010). So H5 is accepted. The results of hypothesis testing can be seen in Table 3 and Figure 1.

| Table 3 Hypothesis Testing | ||

| Hypothesis | Result | |

| H1: Parent-Children Togetherness à Synergizing intergeneration conflict resolution | β=0.805; ρ<0.001 | H1 Supported |

| H2: Parent-Children Togetherness à New Family Business Value Creation | β=0.208; ρ<0.001 | H2 Supported |

| H3: Parent-Children Togetherness à Family Business Sustainability | β=0.605; ρ<0.001 | H3 Supported |

| H4: Synergizing intergeneration conflict resolution à New Family Business Value Creation | β=0.543; ρ<0.001 | H4 Supported |

| H5: New Family Business Value Creation à Family Business Sustainability | β=0.312; ρ<0.001 | H5 Supported |

Discussion

Togetherness is an emotional bond that families have both in times of joy and sorrow. The family will show a high commitment, empathy, and concern for the welfare of each family member. Several factors reduce the level of togetherness in the family, including the entry of new family members into the business, distribution of wealth, business planning, retirement, and various problems faced between family members. Togetherness requires intense communication. Regular exchange of ideas will assist family members in bringing about the necessary mindset changes and create space for each other's points of view. When there are big problems between generations, good communication is needed within the family. Each family member sits in a room and together looks for a solution to the problem. Each family tries to synergize various opinions to get solutions to solve problems together.

The togetherness of parents and children can create new family business values. Every day the family always gathers and interacts (Alderson, 2015). Togetherness should bring all family members to respect each other, understand and accommodate each other's ambitions and aspirations. Parents have values in developing a family business. Often the values of the family business are at odds with the values desired by the children. The development of the times made the child believe that there must be a change in the value of the family business. It is this difference in vision and values that often cause conflicts, and in most cases, children do not want to continue the family business because of different visions and values. Togetherness should have a good influence on the development of the vision and values of the family business. Good communication and mutual trust make parents want to listen to their children's opinions and try to adjust the values proposed by their children. So that togetherness in the family will have an impact on changing the value of the family business into new values created by parents and children. The creation of new values in the family business and togetherness in the family will have an impact on the sustainability of the family business.

Togetherness in the family will be able to increase family business sustainability. Hategan et al. (2019) explained that the orientation of internal processes will have an impact on sustainability, one of which is to pay attention to the togetherness factor in the family business. Togetherness will create good communication in running a family business. Communication is the most important and required attribute in a family business that has an impact on success and longevity (Ward, 2016). Alderson (2015) explains that families communicate with love, understanding, respect, and forgiveness. This communication will have an impact on the running of the family business. The togetherness that is well established will reduce conflict and make the family business will continue to grow. Togetherness will encourage kinship-based interpersonal relationships. Kinship-based interpersonal relationships will increase strong commitment (Eddleston & Morgan, 2014), business success, and sustainability (Jin et al., 2021).

Synergizing various alternative conflict solutions will have an impact on new family business value creation. Uniting the vision, values, and desires between generations is not an easy thing to do. Various conflicts will arise because of differences in vision, values, and desires. Both parents and children must work together to find solutions so that these differences will not result in greater conflicts and problems in the future. They must synergize various alternative solutions to overcome these differences. Conflict resolution will usually result in an agreement regarding the vision, values, or desires in running a family business. Even conflict resolution will result in creating new values that are made based on the agreement of parents and children. This new value will be used in running a family business.

Value is a critical element in a family business. Values are a resource for dealing with crises in families and businesses and are used as a basis for decision-making (Fletcher et al., 2012). Parents and children must have an agreement in using family business values. Usually, parents/founders already have very strong values in running their family business. However, often these values are not following the times. When a child is entrusted with a family business, the child will try to propose new values according to the times. If these values are agreed upon, then parents and children have created new values for the sustainability of their family business. Tàpies & Moya (2012) emphasize the importance of value to support business family longevity.

This study contributes to SFBT. Family capital resources become an important part of explaining SFBT. Family capital resources can be described as financial capital, social capital, and human capital (Danes & Brewton, 2012). Danes et al. (2009) explained that the ownership of family capital will have an impact on long-term sustainability. There are several theoretical implications in this study.

First, togetherness as a critical part of social capital can create family business value and family business sustainability. High social capital creates a feeling of trust that encourages teamwork and collaboration (Bourdieu, 1986). Togetherness is part of the social capital of a family business. In togetherness, there is trust and intense communication. Togetherness as part of social capital will greatly impact the sustainability of the family business. This study also proves that there is an influence between parent-child togetherness on the sustainability of the family business. Togetherness as part of social capital also has an impact on human capital resources (value creation). Social capital is a latent resource that is normally consumed only when needed, and when consumed, it facilitates action and creates value (Bubolz, 2001).

Second, family business values as part of human capital can have an impact on family business sustainability. Danes & Brewton (2012) explained that the family business value is part of the stock of human capital resources. The attributes of human capital can increase the company's level of success ( Astrachan & Kolenko, 1994). What distinguishes this research from previous research is the process of unifying the mindset by creating family business value together between parents and children. The creation of new business value has an impact on family business sustainability.

Another implication is the driving factor for family business sustainability. This study does not focus on family business sustainability as revenue. This is following the opinion Danes & Brewton (2012). Two driving factors can create sustainability that is more than just generating income. The two driving factors are parent-child togetherness and the creation of new family business values. Both of them are part of the family business capital which has an impact on family business sustainability.

Conclusion

The managerial implication in this study is related to communication within the parentchild relationship. Communication is an important part of family togetherness. Families should establish a forum or platform for open communication where members can freely express their thoughts, opinions and voice their concerns and differences. These forums should be made effective by adopting follow-up and feedback mechanisms so that members view them as genuine mechanisms dealing with controversial issues. Open and continuous communication will help family members understand each other's points of view, thereby minimizing differences between them and strengthening family togetherness.

Conflict must be managed properly. These conflicts can destroy the family business. Synergizing conflict resolution is a conflict resolution model that has an impact on the creation of shared value and will ultimately create sustainability in the family business. Some things that must be done to create conflict resolution are by doing: Parents and children collaborate in making decisions to find solutions to problems in the event of a conflict, parents, and children compromise if there are differences of opinion when resolving conflicts, people allow children to provide suggestions in the event of a conflict, parents try to avoid the desire to prioritize their solutions, no one dominates when making solutions to the conflicts they face.

This study has limitations. The Covid-19 pandemic that occurred in Indonesia caused the distribution of questionnaires to be uneven. We can't go directly to the field because there are regional restrictions, so we use an enumerator that makes a lot of mistakes so there's a lot of data that we can't use. In this study, some are still the first generation. Parents and children run their businesses together, so we decided to use them as respondents.

Future work will analyze emotional bonds and tacit knowledge-sharing activities to influence energizing intergeneration conflict resolution and family business performance. The emotional and cognitive aspects need to be seen how they affect the resolution of intergenerational conflicts and their impact on business performance. The outcome of further research is expected to be more on the financial and revenue side of the performance of the family business.

Acknowledgment

The authors gratefully acknowledge financial support through the Directorate of Resources -- Directorate General of Higher Education, Ministry of Education, Culture, Research, and Technology.

References

Amason, A.C., & Schweiger, D.M. (1994). Resolving the paradox of conflict, strategic decision making, and organizational performance. International Journal of Conflict Management, 5(3), 239-253.

Aronoff, C.E., & Ward, J.L. (2011). Family business values: How to assure a legacy of continuity and success. Palgrave Macmillan.

Beckhard, R., & Dyer Jr, W.G. (1983). Managing continuity in the family-owned business. Organizational dynamics, 12(1), 5-12.

Bellow, A. (2004). In praise of nepotism: A history of family enterprise from King David to George W. Bush. Anchor.

Bourdieu, P., & Richardson, J. G. (1986). Handbook of Theory and Research for the Sociology of Education.

Cater III, J.J. (2006). Stepping out of the shadow: The leadership qualities of successors in family business. Louisiana State University and Agricultural & Mechanical College.

Danes, S.M., & Brewton, K.E. (2012). Follow the capital: Benefits of tracking family capital across family and business systems. In Understanding family businesses. Springer, New York, NY, 227-250.

Davis, P.S., & Harveston, P.D. (2001). The phenomenon of substantive conflict in the family firm: A cross‐generational study. Journal of Small Business Management, 39(1), 14-30.

De Vries, M.F.K., & Carlock, R.S. (2010). Family business on the couch: A psychological Perspective. John Wiley & Sons.

Dumas, C., & Blodgett, M. (1999). Articulating values to inform decision making: Lessons from family firms around the world. International Journal of Value-Based Management, 12(3), 209-221.

Dyer Jr, W.G. (2006). Examining the “family effect” on firm performance. Family Business Review, 19(4), 253-273.

Dyer, W.G. (1986). Cultural Change in Family Firms: Anticipating and Managing Business and Family Transition. Jossey-Bass, San Francisco.

Fahed-Sreih, J. (2018). Conflict in family businesses. In Conflict in Family Businesses, Palgrave Macmillan, Cham, 53-78.

Gefen, & Straub. (2005). A practical guide to factorial validity using PLS-Graph: tutorial and annotated example. Communication of the Association for Information Systems, 16, 91-109.

Gersick, Davis, Hampton, & Lansberg. (1997). Generation to Generation: Life Cycles of the Family Business. Boston, MA: Harvard Business School Press.

Hair J.F., Hult, G.T.M., Ringle, C.M., & Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Sage Publications, Thousand Oaks.

Henseler, J., Ringle, C.M., & Sinkovics, R.R. (2009). The use of partial least squares path modeling in international marketing. In New challenges to international marketing. Emerald Group Publishing Limited, 20, 277-319.

Jehn, K.A. (1995). A multimethod examination of the benefits and detriments of intragroup conflict. Administrative Science Quarterly, 256-282.

Kellermanns, F.W., & Eddleston, K.A. (2004). Feuding families: When conflict does a family firm good. Entrepreneurship theory and Practice, 28(3), 209-228.

Kellermanns, F.W., & Eddleston, K.A. (2006). 19 Feuding families: the management of conflict in family firms. Handbook of Research on Family Business, 358.

Kellermanns, F.W., Dibrell, C., & Cruz, C. (2014). The role and impact of emotions in family business strategy: New approaches and paradigms. Journal of Family Business Strategy, 5(3), 277-279.

Loignon, A.C., Kellermanns, F.W., Eddleston, K.A., & Kidwell, R.E. (2016). Bad Blood in the Boardroom: Antecedents and Outcomes of Conict in Family Firms. In The Routledge Companion to Family Business, Routledge, 379-396.

McMillan, A., Chen, H., Richard, O.C., & Bhuian, S.N. (2012). A mediation model of task conflict in vertical dyads: Linking organizational culture, subordinate values, and subordinate outcomes. International Journal of Conflict Management, 23(3), 307-332.

Miller, C.A., & King, M.E. (2005). A glossary of terms and concepts in peace and conflict studies.

Miller, D., & Le Breton-Miller, I. (2005). Managing for the long run: Lessons in competitive advantage from great family businesses. Harvard Business Press.

Mohr, J., & Spekman, R. (1994). Characteristics of partnership success: partnership attributes, communication behavior, and conflict resolution techniques. Strategic Management Journal, 15(2), 135-152.

Morris, M.H., Williams, R.O., Allen, J.A., & Avila, R.A. (1997). Correlates of success in family business transitions. Journal of business venturing, 12(5), 385-401.

Neff, J.E. (2015). Shared vision pomotes family firm performance. Frontiers in Psychology, 6, 1-15.

Rhodes, K., & Lansky, D. (2013). Managing conflict in the family business: Understanding challenges at the intersection of family and business. Palgrave Macmillan.

Sarstedt, M., Ringle, C.M., & Hair, J.F. (2017). Partial least squares structural equation modeling. Handbook of market research, 26(1), 1-40.

Schulze, W.S., Lubatkin, M.H., & Dino, R.N. (2003). Toward a theory of agency and altruism in family firms. Journal of Business Venturing, 18(4), 473-490.

Sharma, P., & Nordqvist, M. (2008). A classification scheme for family firms: From family values to effective governance to firm performance. In Family Values and Value Creation. Palgrave Macmillan, London, 71-101.

Sorense, R.L. (2014). Values in family business. In Entrepreneur & Innovation Exchange: The Sage Handbook of Family Business.

Thomas, K.W., & Thomas, K.К. (1990). Kilmann conflict mode instrument. XICOM, inc.

Ward, J. (2016). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership. Springer.