Research Article: 2019 Vol: 18 Issue: 6

Types, Forms and Models of Public-Private Partnerships and Their Application in the Kazakhstani Practice

Liman Kazbekova, Korkyt Ata Kyzylorda State University

Azat Dosmailov, Korkyt Ata Kyzylorda State University

Madina Yelpanova, Korkyt Ata Kyzylorda State University

Abstract

Public-private partnership (PPP) projects in various forms are becoming popular in many countries as a tool for creating new infrastructure facilities and providing services for the organization of public works. Despite the fact that this phenomenon has been presented in recent decades as a kind of invention, PPP has a long tradition in many countries around the world. Recent years for Kazakhstan have been a period of struggle for sustainable economic development and increased competitiveness. As a result, there has been a growing interest from the state to the private sector in terms of using its potential for financing, creating and implementing PPP projects. In the modern context, Kazakhstan’s private sector has become more involved in financing infrastructure projects, and this trend may become one of the most important components of the modernization of strategically important sectors of the economy.

Keywords

Public-Private Partnership, Economic Development, Modernization, Private Sector.

Introduction and Literature Review

A special form of interaction between business and government has emerged in the economies of a number of developed and recently developing countries; a public private partnership (PPP) (Hoeppner & Gerstlberger, 2003). PPP is an institutional and organizational alliance of state power and private business with the aim of implementing socially significant projects in a wide range of areas from the development of strategic sectors of the economy to the provision of public services throughout the country or individual territories (Osborne, 2000). The rapid development of diverse PPP forms in all regions of the world and their widespread distribution in various sectors of the economy make it possible to interpret this form of interaction between the state and business as a characteristic feature of the modern economy (Tolstolesova et al., 2019; Martynova et al., 2019).

The use of PPPs provides a number of advantages both for the state and for business development. For the private sector, there are new investment opportunities, and accordingly, new sources of income and the opportunity to participate in large projects (Deryabina, 2008). When implementing PPP projects, it is important to choose the right PPP form, that is, the legal basis on which specific PPP models are implemented. There are several main PPP forms: leases, contracts, concessions, production sharing agreements, and joint ventures (Varnavsky, 2005).

Contracts, as administrative agreements, are concluded between the state and a private firm for the implementation of certain socially significant activities. The most common are contracts for the execution of works, for the provision of public services, for management, for the supply of products for state needs, for the provision of technical assistance. At the same time, property rights are not transferred to the private partner; the costs and risks are fully borne by the state. The interest of private partners is that under the contract they are entitled to the specified share of income, profit or payments collected. As a rule, contracts with a state or municipal body are very attractive for a private entrepreneur, since they guarantee a stable market and income, besides prestige, as well as possible benefits and preferences (Dubauskas & Balius, 2015; Vasconcelos et al., 2019).

Rent is considered in its traditional form (rental agreements) and in the form of leasing. The peculiarity of rental relations lies in the fact that state-owned property is transferred to the private partner for temporary use and for a certain fee under conditions specified by the contract. Traditional rental agreements assume the return of the object of rental relations, and the authority to dispose of property remains with the owner, rather than transferred to the private partner. In some specified cases, rental relations may result in the purchase of rented property. In the case of a lease agreement, the lessee always has the right to purchase state property.

Concession (concession agreement) is a specific form of relations between the state and the private partner, which is becoming more widespread. Its peculiarity lies in the fact that the state, in the framework of partnerships, while remaining the full owner of property constituting the object of the concession agreement, authorizes the private partner to perform the functions specified in the agreement for a certain period of time and endows him with the corresponding powers necessary for the concession object functioning. The concessionaire pays for the use of state property under the conditions specified in the concession agreement.

The main characteristics of concession are as follows:

1. The concession object is always state property;

2. One of the subjects of the concession agreement is the state; the goal is to satisfy public needs and requirements;

3. Concession always has a contractual basis (concession agreement) and is based on the return of the subject of the agreement;

4. The concession object is provided to the private partner for a fee, specified in the agreement;

5. Concession has become widespread in infrastructure industries, where the inflow of private investment and highly qualified management are especially urgent.

Production sharing agreements differ from concessions in that in concessions the concessionaire owns all the products released under the agreement, while in production sharing agreements the partner of the state owns only a part of them. Production sharing between the state and the investor, its conditions and order are determined in production sharing agreements, used in the field of exploration and production of mineral raw materials and other related work in the oil business.

Joint ventures are a form of partnership between the state and private business that can act as both joint-stock companies and joint ventures on a shared basis. In joint-stock companies, government agencies and private investors act as shareholders. The degree of participation in the activities of the enterprise and the risks of the parties are largely determined by the share capital. Here, in contrast to concessions, the private partner’s independence and freedom in decision making is significantly reduced. In case of nationalization of a joint-stock company with the participation of the state, it is obliged to reimburse the concessionaire for the cost of invested capital, as well as to pay compensation for the loss of profits (Trafford & Proctor, 2006; Choi et al., 2018).

The sectoral specificity of PPP projects has recently undergone significant changes. If concession agreements were originally used in the construction of infrastructure facilities, such as highways, parking lots, centralized heat supply facilities, now their scope has spread to social security facilities (education, cultural facilities, healthcare) (Martynova & Tsymbal, 2014; Badalov et al., 2017). PPP models can have the following forms:

1. The public sector provides the land, property or facilities controlled to the private person (with or without payment) usually based on an agreement;

2. The private sector builds, provides or repairs the object;

3. The public sector delegates object maintenance tasks;

4. The private sector provides certain services using government facilities for a specified period of time (usually, management and pricing standards are clearly defined);

5. The private investor undertakes to transfer the object to the state (with or without payment) at the end of the agreement.

The main PPP models can be classified by increasing the autonomy of the private sector, starting with the model of full state control and ending with the most autonomous private sector when the object is transferred in full.

Results and Discussion

Earlier, only one PPP form was used in Kazakhstan-a concession based on the model “Build-Transfer-Operate” (BTO). Its essence lies in the fact that the private sector builds, transfers the object to the state, and subsequently receives the right to operate and charge for use.

At the same time, on July 4, 2013, the Law of the Republic of Kazakhstan “On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on Introducing New Forms of Public-Private Partnership and Expanding the Spheres of Their Application” was adopted (Law of the Republic of Kazakhstan, 2015), which implies the introduction of the following PPP contracts (Mataev, 2011).

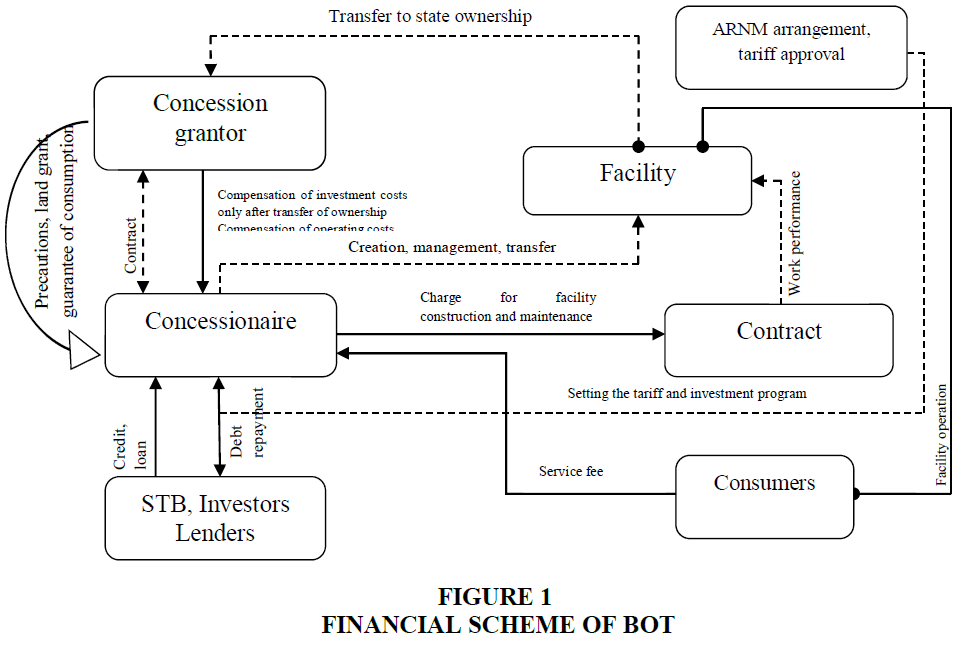

The essence of BOT (Build-Operate-Transfer) is that the private company builds a facility and manages/operates it for a period specified in the contract, after which the facility is transferred to the state (see Figure 1). The private company has the authority to use, but not to own this object. In this type of contract, measures of state support are a natural grant and a guarantee of consumption; sources of reimbursement for the concessionaire’s costs are compensation for operating costs, while compensation for investment costs is paid only after the transfer of the concession object to state ownership. The concessionaire receives income from the operation of the facility, charging users or consumers of services.

The essence of BOO (Build-Own-Operate) lies in the fact that the private investor undertakes the building and operation of a facility, in exchange for a state guarantee of consumption, compensation for operating costs or rental charge (Figure 2).

Build Lease Transfer (BLT) assumes that the private investor builds a new infrastructure facility, taking his own risks, transfers the finished facility to the state, then rents and operates it, taking all the risks until the end of the lease term and taking advantage of the facility’s operation (Figure 3).

Management Contract (MC) differs in that the state pays the private company for its asset management costs. Operational risks are borne by the state; investments are made by the state.

Lease Contracts (LC) assume that the private company has control over or rents property owned by the state for a certain period of time. In the lease contract, the state receives the rent from the tenant, and the operational risk falls on the private company. At the same time, the right of ownership and the obligation of financing remain with the state.

Design Build Finance Operate (DBFO) Life Cycle Contract with regard to the terms of the contract, a fee for using the facility may be charged directly to consumers or paid by the concession grantor to the concessionaire and depends on the fulfillment of the functional requirements on the principle “no service - no payment”.

These models make it possible to trace the increase in the degree of the actual participation of private entrepreneurship in joint public-private projects, depending on the chosen form of partnership and the scale of transfer of the owner’s powers to a private enterprise.

Isolated cases are simple contractual relations (contracts for works and services) with each partner fully preserving all the powers of property, on the one hand, and with full privatization, i.e. the full transfer of property rights from the state to a private entrepreneur, on the other. Between them, there are many possible PPP options and forms, based on varying degrees of assignment of the owner’s certain powers from the state to a private entrepreneur for the term and conditions stipulated by the relevant partnership agreement (Lukmanova & Mishlanova, 2015).

At the same time, at all stages of the implementation of PPP projects, a very important tool and the main success factor is a well-designed and adequate financial and economic model. Basically, it is a representation of a future investment project in the form of cash flows.

In the process of implementing a PPP project, the financial and economic model can serve as a tool for operational budgeting and be used by investors as a base of original assumptions in the process of considering the expected changes in the long-term prospects of the project and forming a new position. In other words, the financial and economic model of a PPP project can be called a “basic development scenario”. Kazakhstan has adopted the World Bank's classification, in accordance with which there are five groups of contracts between the state and the private sector, depending on the degree of private capital participation, as well as the degree of risk imposed on the private sector (Delmon, 2017; World Development Report, 1997): provision of services; management and maintenance; operation and maintenance; design, construction, financing and operation; full privatization.

According to this classification, cooperation between the public and private sector will not be considered as a PPP, if all risks and responsibilities are imposed on one of the parties. PPPs do not include, for example, service contracts, where risks are almost completely covered by the public sector, or privatization contracts, where risks are fully covered by the private sector (Tastulekov et al., 2019).

In turn, according to the World Bank’s methodology, an investment project can be considered a PPP project only if the private company assumes part of operational risks along with operational costs and corresponding risks (Martynova et al., 2017). This does not depend on whether the private company operates the state-owned infrastructure facility independently or together with a government agency through ownership of a stock of shares of the holding company or in another way. For example, in the models of the first group (“management and rental contracts”), the transfer of part of operational risks to the private company is usually carried out through the mechanism of contractual obligations. In the models of the third and fourth groups of obligations (risks) under the contract, the method of transfer is used through the acquisition of a stock of shares of the holding company by the private investor (Cui et al., 2018).

It should be noted that the majority of investment projects with private participation can be attributed to one of the PPP model groups considered above. However, in accordance with the World Bank, the boundaries between these groups and PPP models are not always well defined, and some projects can be attributed to more than one PPP model. In this case, the project is considered to belong to the model that best reflects the risks of the private sector.

Conclusions

PPPs are implemented in the modern global economic space in various forms of their manifestation and in various spheres of production and economic activity, characterized by a set of basic models, characteristics, methods of interaction, and property relations. In Kazakhstan, in the context of growing public demand for infrastructure facilities and the quality of their services, as well as insufficient state financial resources to upgrade and create infrastructure facilities, the use of PPPs can ensure the fulfillment of a number of tasks in the sectors of traditional state responsibility, help to realize and develop the potential of private investors and attract funds from institutional investors. The use of PPP mechanisms in Kazakhstan will not only increase the resource supply of infrastructure projects while reducing budget expenditures, but also provide an opportunity to provide better services. The private sector, receiving the opportunity to participate in large projects, will discover both new investment opportunities and new sources of income. It should be noted that PPP is an important anti-crisis tool for overcoming the crisis through the mechanism of business stimulation and economic recovery.

References

- Badalov, L.M., Sedova, N.V., & Mishagina, M.V. (2017). Public-private partnership in the social infrastructure of the Russian Federation: Features, problems, strategic directions for implementation. Academy of Strategic Management Journal, 16(2), 1-7.

- Choi, Y., Chang, S., Choi, J., & Seong, Y. (2018). The partnership network scopes of social enterprises and their social value creation. International Journal of Entrepreneurship.

- Cui, C., Liu, Y., Hope, A., & Wang, J. (2018). Review of studies on the public–private partnerships (PPP) for infrastructure projects. International Journal of Project Management, 36(5), 773-794.

- Delmon, J. (2017). Public-private partnership projects in infrastructure: An essential guide for policy makers. Cambridge University Press.

- Deryabina, M. (2008). Public-private partnership: Theory and practice. Economic Issue, 8.

- Dubauskas, G., & Balius, R. (2015). Management of public private partnership in education: Aspects of public sector training sustainability issues. Journal of Security and Sustainability Issues, 4, 345-352.

- Hoeppner, R.R, & Gerstlberger, W. (2003). Public private partnership: A guide for public administration and entrepreneurs, 2.

- Law of the Republic of Kazakhstan: On public-private partnership (2015). Retrieved from https://online.zakon.kz/Document/?doc_id=34299090#activate_doc=2

- Lukmanova, I.G., & Mishlanova, M.Y. (2015). Determinant analysis of public–private partnership in Russia. International Journal of Economics and Financial Issues, 5(3S), 208-216.

- Martynova, S., Tabolin, V., & Sazonova, P. (2019). Legal support for participative decision-making as part of ‘service’ model of urban governance in Russia. Space and Culture, India, 7(2), 112-124.

- Martynova, S.E., & Tsymbal, L.G. (2014). Social background of the development of public service model in Russia. Ecology, Environment and Conservation, 20(4), 1875-1883.

- Martynova, S.E., Dmitriev, Y.G., Gajfullina, M.M., & Totskaya, Y.A. (2017). Service municipal administration as part of the development of youth entrepreneurship in Russia. Social Indicators Research, 133(3), 1151-1164.

- Mataev, T.M. (2011). Prospects of development of public-private partnership in the Republic of Kazakhstan. Journal of Russian Entrepreneurship, 12(12), 187-192.

- Osborne, S. (2000). Public-private partnerships: Theory and practice in international perspective. Routledge.

- Tastulekov, S.B., Shalbolova, U.Z., & Satova, R.K. (2019). Public-private partnership formation in Kazakhstan. Academy of Strategic Management Journal.

- Tolstolesova, L., Yumanova, N., Mazikova, E., Glukhikh, I., & Vorobieva, M. (2019). Realization of PPP projects in the sector of energetics as a condition of a sustainable development of macroregions. Entrepreneurship and Sustainability Issues, 7(1), 263-277.

- Trafford, S., & Proctor, T. (2006). Successful joint venture partnerships: public-private partnerships. International Journal of Public Sector Management, 19(2), 117-129.

- Varnavsky, V.G. (2005). Partnership of state and private sector: forms, projects and risks. M.: Nauka.

- Vasconcelos, V.S., Silva, F.Q., Rovai, R.L., & Rached, C.D.A. (2019). Identification of the main risk factors in infrastructure projects of transporting people on rail by public-private partnerships. International Journal of Entrepreneurship.

- World Development Report (1997). The state in a changing world. New York: Oxford University Press. Retrieved from https://gsdrc.org/document-library/world-development-report-1997-the-state-in-a-changing-world/