Research Article: 2021 Vol: 24 Issue: 2

Ulema Viewpoints on Corporate Waqf as Legal Entity

Miftahul Huda, Institut Agama Islam Negeri Ponorogo, Indonesia

Luqman Bin Haji Abdullah, University of Malaya, Malaysia

Lukman Santoso, Institut Agama Islam Negeri Ponorogo

Lia Noviana, Institut Agama Islam Negeri Ponorogo

Abstract

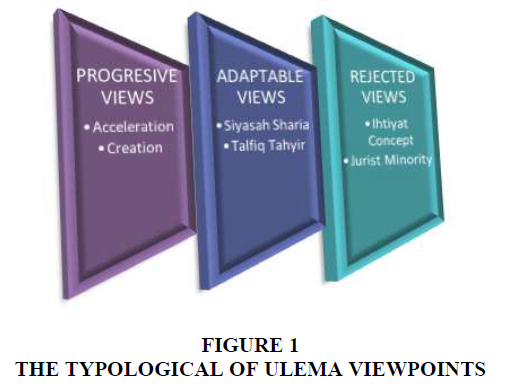

This research identifies ulema responses’ to develope corporate waqf. With its main focus on the diversity of Ulema views on legal and corporate waqf reform in Malaysia and Indonesia. This description is about Ulema views takes from in-depth interviews with the Mufties of the Islamic Religious Council in Malaysia and the Fatwa Commission and the National Sharia Council of the Majelis Ulama Indonesia (DSN-MUI). The description is analyzed with a typological study of thought which results in three variants of the ulema’s response to the development of corporate waqf. The three variants of the ulema’s response are progressive response, adaptive response and rejecting response. A progressive response places the waqf of the corporation as an waqf development entity that is carried out with acceleration and creativity. The adaptive response places Waqf Corporation as an endeavor for waqf development without neglecting fiqh concepts such as Islamic legal policy and the flexibility of Madhab thoughts. While the rejective response, the ulema understand the development of corporate waqf is difficult to maintance the permanence of assets with the concept of prudence. The three patterns of response to corporate waqf entities are the basis for creating a model of corporate waqf development in the modern Moslem world.

Keywords

Corporate Waqf, Majelis Ulama Indonesia, Siyasa Sharia, Islamic Law, Fatwa.

Introduction

Waqf is defined as every movable or immovable object which is provided for public necessity as waqf (Abdullah, 2020; Kuran, 2001). A corporation is an incorporated organization that conducts transactions or business (Ahlering & Deakin, 2007). The corporate waqf has been proven to be an Islamic philanthropic institution that develops both theoretically and practically. The appearance of actuating waqf assets, especially in company shares and cash applied in the quantity of Moslem countries, also affects the practices of corporate waqf in various countries. The corporate waqf has the simple arrangement of waqf assets and have the dispersion of waqf by business entities with collaboration for many parties. There are four definitions in waqf, namely: waqf assets and waqf management, continued distribution of waqf, corporate entities, and independents or cooperation with other parties (Huda, 2014; Yahya, 2008).

For developing contemporary waqf like the corporate waqf, the existence of fatwa is very important. The existence of a fatwa is emphasized as having an identity, so that it becomes interesting. Moreover, a growing number of legal cases are emerging that demand is relevant to the context of social change itself (Moustafa & Sachs, 2018). Fatwa should: First, as a result of an optimal transfer of knowledge. This means that an accurate and highly effective fatwa is a fatwa born out of the mobilization of ijtihad capabilities supported by other scientific devices (Khairudin, 2019). Second, the fatwa can be a response to modern reality (Muhamad et al., 2019). This means that personal or collective decisions must be able to maintain their authority in the production of the fatwa, not to be subject to the intimidation of the reality in modern society (Moustafa, 2013).

There are sixties beneficiaries of waqf proceeds in Turkey. The participants of corporate entities include management, distribution, and establishment. The first corporate is Koc Holdings to establish and manage waqf properties as early as 1969 (Cizakca, 2011). The implementation in mobilizing of huge potential through cash waqf has inspired since got the certificate in 1997 as the founded the cash waqf namely Islamic Bank Bangladesh Limited (IBBL) (Mannan, 1999). The implicate of IBBL is the important finance in arranging and systematic Waqf assets as the form of cash. The accumulated cash waqf certificates got from waqf funds and channels that proceeds from the betterment of underprivileged Moslems. As the respect, IBBL becomes a pioneer to establish and manage cash waqf instruments globally. In 1993, the viewpoint of the people about the management of waqf in Indonesia was adapted from Dompet Dhuafa Republika. The organization does not have the profit that created of waqf fund and its accumulations in professionally. Its cash waqf fund by Waqf Indonesia Tubes (Candra & Rahman, 2010).

The appearance of actuating waqf assets are a form of the share’s the company and cash. Moslem countries get influencing waqf practice in Malaysia (Ismail, 2009; Laallam et al., 2020). In 2006, Johor Corporation (JCorp) is founded on corporate waqf has reformed waqf practice in Malaysia. This is the first time used waqf assets as the form of share’s company. This is a new issue by the corporate body. As the founder; Tan Sri Muhammad Ali Hashim has the valuable idea in creating corporate waqf. Actually, this comes from the notion of jihad business pioneered with the prime agenda namely in improving the socio-economic wellbeing of Malay society by him (Hashim, 2006).

From discussion shows that corporate entities from different moslem in the world such as Turkey, Indonesia, Malaysia, and Bangladesh have performed an important role in improving and management of waqf properties. It is valuable in getting the note and focuses in studied adapt from kinds of waqf assets (particular, shares and cash). Underprivileged as the current issue. In Waqf activities, it could enhance and make the available in living standard. The Waqf activities are performed by Moslems society from several countries. Generally, it studies of cash waqf and productive. As referring to the study, it can be explained that the studies about corporating waqf are still lack relevance. So that, it is very important to study more and deeper focus on realizing the contemporary waqf (Saad, 2019).

There are some considerations in observing the corporate waqf from the point of view of the waqf in Islamic law. The considerations are as follows: share asset as mauquf bih, corporate became nazir, al-waqif establishes for itself, hybrid waqf, and istibdal waqf consideration (Ramli & Jalil, 2013). Waqf practicing framework should be analysed from the establishment of waqf involving corporate entities. As result, the corporate waqf is the valuable actualization in practicing of modern waqf on the basis of the natural potency and agile role for participation in management professionally. The article intends to carry out a typological study of the views of muftis in Indonesia and Malaysia on the legal basis used in the development of corporate waqf.

Literature Review

As the participants from corporate entities are the establishment, management, and distribution. In Turkey, waqf has proceeded in sixties beneficiaries. In early 1969, Koc Holdings get the corporate bodies involve in the establishment and administration of waqf properties (Cizakca, 2011). It is about 10,000 shares of grace from the Koc Holdings to KOc Foundation as the trustee (nazir). They believed that it can have well-being progress for the future. Most of the waqf funds are managed by the Koc Foundation channels to build educational institutions, for example, Koc University (Prasetia & Huda, 2017).

To get inspired by Islami Bank Limited (BBL) with a certificate in 1997, most of Moslem Society has effect in socio-economic (Mannan, 1999). IBBL is an important financial institution in managing and administrating waqf assets. To accumulate waqf funds and channels is from the underprivileged Moslems. This is respect in the defining and execution of cash waqf instruments is a global issue. In 1993, Dompet Dhuafa Republika has consistency in modifying from the viewpoint of the public about waqf management in Indonesia. Dompet Dhuafa Republika is a non-profit organization in managing the waqf fund accumulating professionally. Tabung Waqf Indonesia is the cash waqf fund. Every year, Tabung Waqf Indonesia has increased and shows progress with strong management and accountability. The progress of waqf has beneficiaries in increasing of socio-economic as designated (Candra & Rahman, 2010).

The appearance of exchanged from waqf assets. Form of shares is the particular the company and cash implemented in different Moslem; for instance, Malaysia (Ismail, 2009; Sulaiman & Alhaji Zakari, 2019). In Malaysia, the ascertaining of corporate waqf in 2006 by Johor Corporation (JCorp) is changed. Tan Sri Muhammad Ali Hashim as the founder, created the valuable ide to increase the waqf assets in form of shares from the company, it is jihad business pioneered in corporate waqf. The improving of the socio-economic well-being of Malaysia society (Hashim, 2006). It explained that the system of corporate waqf started with the pledging thing in share's amount RM200 million as waqf to WANCORP; a secondary of Jcorp as a nazir (trustee). WANCORP arranges and distributes waqf progress to the beneficiaries (Ramli & Jalil, 2013).

Bank Muamalat Malaysia Berhad (BMMB) and Perbadanan Wakaf Selangor (PWS) make collaborated as introduced a cash waqf scheme known as Wakaf Selangor Muamalat in September 2011 (WSM) (Ramli & Jalil, 2013). Both parties make an agreement for arranging and executing of waqf assets in the form of cash deposited in BMMB branches. The activity of waqf in education and health will be connected in designated. BMMB be the vital financial institution to arrange and organize waqf assets in Malaysia.

The explanation above shows that the corporate entities as the biggest Moslem countries include Indonesia, Bangladesh, Malaysia, and Turkey. They are as the doer in rolling major of waqf properties in development and management. The important thing for institutions is to focus on developing waqf assets, share, particular, and cash. The waqf activities are given to underprivileged Moslem in many Moslem countries as the enhance and getting the better life standardly. It is the current state for participant corporate bodies. Generally, the research about cash Waqf and productive Waqf is needed to give some information about waqf fund or the systematic of waqf in several Moslem countries. Basically, this is still a lack of study about corporate waqf, so that it is very important to conduct a focus on contemporary waqf. The relevance studied is needed to explain more about Waqf. The relevant study not only able to help to solve of problem about management and systematic of Waqf, but also it can attempt to refund the function and role of Waqf about socio-economic society.

Methods

This article identifies typological perspectives on corporate waqf Entity. To answer this formula, the method used was field research by conducting a series of in-depth interviews with seven experts in Islamic legal authority in two countries, Malaysia and Indonesia. In Indonesia with the Fatwa Commission of the Indonesian Ulema Council (MUI) and the National Sharia Council (DSN) of the Indonesian Ulema Council, while in Malaysia with Malaysian muftis in Negeri Selangor, Johor, and the Territory for three months from July, August to September 2019. The method of documenting the results of fatwas from the muftis was also carried out to strengthen the research findings from extracting the data, then analysed qualitatively descriptively using Miles-Huberman data analysis, both data reduction, display, conclusions, and data verification (Miles et al., 1994).

Results and Discussion

Snapshot of Corporate Waqf

As the important in corporate waqf, it will be created waqf assets by using assets in the corporate entity. Waqf and or Al-Waqif are the creator of the corporate entity. A cash or stock (non-financial) asset is the founder of financial assets in waqf. In this time, the business entity as the nominates responsible of Islamic people included managing, maintaining, and investing waqf assets. It means that, waqf assets are the nazir or mutawalli from the corporate entity (Ramli & Jalil, 2013). The profit of waqf is flexible to manage and use of the fund, it is one of nominated in the corporate entity. This practice has been allowed by many Islamic jurists (Ahmed, 2007). The fund is dispersed to the final and appropriate beneficiaries include poor people, Islamic institutions, and so on. The used and managed of waqf productivity result, this plot gives the suppleness in corporate entities. The most important is flexibility in attracting the corporate entities to corporate waqf practices. It means that, the suppleness of funds in creatively and productively that needed of the entity and community could the corporate entities can arrange and plan in the distribution of funds at that moment. They can be used the Waqf funds as the needless in distributing, it views from the bad situation in economic factor and difficult financial conditions (Simpson & Piquero, 2002). Aspects of this corporate waqf aspect will involve elements of business interests into the concept of waqf entrepreneurship.

As trade and investment, the founded of the whole person do the income-generating is Corporate Waqf. These entities are also required to apply corporate governance ethics to accountability, transparency, and professionalism in accumulating and distributing waqf assets. In accordance with the structure of state law, business entities can be independently established, manage and distribute the results of waqf to beneficiaries (Perez et al., 2009). Tun Sri Ali Hasyim describes six corporate waqf models that can be organized, among others, (1) business entities or companies, (2) banking and financial institutions, (3) universities, (4) foundations, (5) cooperatives, and (6) hospital or clinic. There are many payments to examine of corporate waqf from the point of view of waqf (Ramli & Jalil, 2013). The corporate waqf explains the surrender of assets namely: cash, shares, profits, and dividends by the accountants consisting of individuals, companies, corporations, organizations, or institutions as well as the sustainable distribution of benefits for the benefits of the community (Mohsin et al., 2016).

Through this definition, the company will be directly involved in the three aspects of the establishment of waqf assets, management of waqf assets, and also the distribution of benefits of waqf to recipients that have been determined based on waqf arguments. There are four main features of corporate waqf, namely the establishment and management of waqf assets, distribution of waqf benefits, the donor, consists of the company itself, and also the involvement of the company with or without cooperation from other parties. Awqaf Holdings as a corporate waqf entity has also used the terminology of corporate waqf to explain the concept of corporate waqf which was introduced as contained in Awqaf Memorandum (Ramli & Jalil, 2013).

Typology of Ulema Perspective on Corporate Waqf

There are three variant views obtained regarding the development of waqf assets from corporations in Malaysia and Indonesia. The three typologies of this view are; (1) progressive response, (2) adaptive response; and (3) rejection response. Progressive responses place corporate waqf as acceleration and creativity. This was stated by Khairudin (2019), the form of acceleration is manifested in ibdal waqf, waqf mushtarak, and waqf linafsih Waqf. Meanwhile, creativity is manifested in shares as mauquf bih, corporations as nazir, sharing waqf administration, and corporate waqf management. The principle of al-aslu fi al-muamalah al-ibahah becomes important in the development, according to Sharakhsi a person's actions as long as not violating according to what he wants, waqf is the importance of legal objectives (maqasid) and material welfare for the receiving community. The actions of a person and the parties are allowed according to their wishes as long as they do not violate Islamic principles (Sarakhsi, 1993).

On the other hand, there are muftis and Islamic legal experts who respond adaptively to develop of corporate waqf. Jaih (2019) and Hairul (2019) said that corporate waqf could be developed by adapting to the political policies of Islamic law or the siyasa sharia concept and the flexibility of Islamic juris or talfiq-tahyir methods. The form of siyasa sharia manifests itself in the administration of waqf shares, corporations as nadzir, and management of corporate waqf. Whereas the form of talfiq - tahyir manifests in ibdal waqf, waqf linafsih, waqf musytarak, while shares as mauquf bih.

The opinion of corporate waqf entities cannot be developed yet. They consider corporate waqf as a corporation without fixed assets and the concept of ihtiyath, which was formed as part of waqf and ibdal waqf. This is because there are no fatwa products regarding corporations as waqf entities, waqf stock administration, and corporate waqf management. Whereas at the level of lack of recognition by the majority of waqf ulama scholars. This is manifested in hybrid waqf (mushtarak) and self waqf institution (waqf linafsih).

Understanding the concept of Islamic law has two dimensions that are always explained, the Islamic law of divine essence is believed to be the source of the teachings of Allah Almighty, the perfect and the true, the qath’i (absolute). To be understood as a very wide-ranging Sharia is not only limited to fiction in the meaning of terminology, it also includes creed (theology), and morals (Moustafa & Sachs, 2018). Islamic law has dimensions of accommodation effort to the sacred values of religion by adopting the divine and maqashid approach. This dimension explains that Islamic law is understood as a product of thought made by various approaches called ijtihad or more technically called istinbath al-ahkam. Islamic law in the animated dimension gives rise to various terms including jurisprudence and fatwa (Dakhoir, 2019). There are four types of Islamic law thinking products that we know in Islamic law history, books of religion, religious court decisions, regulations moslem countries, and moslem scholars (Mudzhar, 2003).

Over time, Islamic law has gained access to demand for renewal. The impetus for reforming is deeply embedded in Islamic law. Certainly, the discourse of reform implies a change in the realm of jurisprudence and the ruling. Rulings are considered irrelevant in addressing the legal needs of society and demanding reforms tailored to social change. Similarly, new laws are required to be interpreted as legal requirements that accommodate such social change, and thus there is a strong correlation between fatwa and social change Figure 1 (Moustafa & Sachs, 2018).

Waqf instruments are no less strategic for community empowerment, national economic development, and social welfare (Kuran, 2001). The strategic value of waqf can also be seen from the management side. The results of the management of waqf can be used by various levels of society, without classifications, for social welfare, empowerment, and building the civilization of the people. Therefore, the virtue of waqf lies in its intact or eternal wealth, and its benefits which continue to multiply and flow forever (Huda, 2019). Therefore, the rewards of waqfs will not be interrupted even though the waqf has passed away. Thus, waqf has two inseparable benefit dimensions, namely improving the quality of people's lives by distributing the results of management and downloading the results of investment investments that are planted in the world to be picked up in the hereafter. Therefore, waqfs are also referred to as social worship. This is a type of worship that is more oriented to human relations with humans and their environment, or commonly called social piety. To represent a Moslem is a realization of worship to Allah through his possessions, namely by releasing the objects he owns (private benefit) for the public benefit (social benefit). It is, at this point that the reward of waqf continues to flow (Obaidullah, 2016).

Like other forms of productive waqfs, share as goods move deemed able to stimulate the results-results that can be used for the benefits of the people. In fact, with large capital, stocks are able to make a large contribution compared to other types of trading commodities (Perez et al., 2009). In a corporation, an entrepreneur can specialize the allocation of a portion of his shares as waqf property whose results/dividends are focused on the benefits of the people. Waqf shares may also be taken from the profits of all shares owned by the owner. It all depends on the wishes and wishes of the shareholder. Therefore, what matters is not large nominal-small stock results, but rather on the waqf alignment commitment to the welfare of the Moslems.

Waqf shares have several legal consequences, namely: first, the origin of shares represented permanent, which represented profits from shares and not traded on a stock exchange, then it may not transact except for benefits or in accordance with the conditions submitted waqfs. He is the subject of the sharia law which is known in the ownership change procedures. Second, if the corporate pays off or pays the price of its securities, it may replace it with another principal waqf such as buildings, shares, and other securities with the conditions given waqf or based on the benefit returned to the representative. Third, if the waqf is temporarily based on the wish of the waqf then it will be fulfilled according to the conditions; Fourth, if the money is invested to purchase the shares or other securities or the other (Khairi et al., 2014).

If we return to the opinion of the earlier Jurisprudence scholars, the discussion of the waqfs of this stock can go into the benefits of waqf. Benefit Waqf is if what is represented is in the form of benefits owned by other than the owner of the goods, such as in leasing. Scholars differ about this benefit waqf. Madhhab Hanafi and Ahmad ibn Hanbal argued: a tenant cannot endow the benefits of the goods represented, because they require permanence of ownership in the membership, while rentals are temporary and not forever. Syafi'i argues that the benefit owners other than slaves such as those who rent and those who inherit receive illegitimate benefits with those benefits, but if the tenant endows the building or tree planted on the land that is leased, then the waqf is valid, and the waqf continues until the landowner demolishes the building or uproots the tree represented because the lease period has expired (Abidin & Ibn-Umar, 1992). Maliki argues that the tenant may endorse the benefits of the leased goods during the agreed rental period because they do not require permanence or permanence according to them. Even the waqfs are valid for a certain period. But those who rent goods cannot end themselves for goods that are rented because when they are leased, the goods are not theirs (Hanna, 2018). However, according to the Hanafi and Ahmad Ibn Hanbal schools, the owner of the leased property may end the leased property, therefore the waqf is owned, while the tenant is sufficient to utilize the benefits of the leased goods until the lease term expires.

Another thing that must be considered in the waqf of shares is that the shares represented must be shares for companies engaged in the fields allowed by religion. His corporate is not engaged in disobedience matters. Then it cannot be related to shares of companies engaged in the production of liquor, for example. Waqf assets can be used for religious goals, it is still considered in the current situation. For example, the construction of mosques, cemetery complexes, orphanages, and education. The value of worship does not have to be tangible as such. It is possible that on a waqf land a shopping centre will be built, the benefit of which will later be given as scholarships for scientific research, children needed, or free health services (Huda, 2015). Besides, the understanding of waqf items is also still narrow. Treasures can be explained that there are limited understood inconsistent objects, for example, is land. Though waqf can also be in the form of changing objects, including money, precious metals, securities, vehicles, intellectual property rights, and rental rights (Kuran, 2001).

Conclusion

The views of the Malaysian and Indonesian Ulemas on the corporate waqf above occurring in a diversity of perspectives. There is even a paradigm-shifting from a legal administrative procedure perspective to a governance perspective that is full of creation and acceleration. This is proven by the Ulemas who have a progressive perspective that goes beyond the basic legal basis of the majority. Even so, there is still a perspective of adaptive corporate waqf and even rejects it because it is not by the legal viewpoint of waqf maintenance. This diversity shows that sharia or Islamic law can provide relaxation or flexibility to new entities called corporate waqf.

Acknowledgment

This Research was funded by the Special Research "Global / International Applied" from the Ministry of Religion of the Republic of Indonesia (2019) and we would like to thank to the Ministry of Religion of the Republic of Indonesia for the financing provided.

References

- Abdullah, M. (2020). Classical waqf, juristic analogy and framework of awq?f doctrines. ISRA International Journal of Islamic Finance, 12(2), 281-296.

- Abidin, I., & Ibn-Umar, M.A. (1992). Sensual response to the Mukhtar.

- Ahlering, B., & Deakin, S. (2007). Labor regulation, corporate governance, and legal origin: A case of institutional complementarity? Law & Society Review, 41(4), 865-908.

- Ahmed, H. (2007). Waqf-based microfinance: Realizing the social role of Islamic finance. World Bank.

- Candra, H., & Rahman, A. (2010). Waqf investment: A case study of dompet Dhuafa Republika, Indonesia. Jurnal Syariah, 18(1), 163-190.

- Cizakca, M. (2011). The Islamic gold dinar–Myths and reality. ISRA International Journal of Islamic Finance, 3(1), 49-63.

- Dakhoir, A. (2019). The fatwa authorities of National syaria council of Majelis Ulama Indonesia in supporting the principle if Syariah Compliance. Journal of Legal, Ethical and Regulatory Issues, 22(1), 1-6.

- Hairul. (2019). Personal communication. Kuala Lumpur.

- Hanna, S. (2018). Wakaf Saham in the perspective of Islamic law. Mizan: Journal of Islamic Law, 3(1), 1-11.

- Hashim, T.S.M.A. (2006). Corporate Waqf–a proposal for corporate reform.

- Huda, M. (2014). Waqf Fundraising Management. Justicia Islamica, 11(1), 95-118.

- Huda, M. (2015). Streamlining the benefits of waqf: A portrait of the development of waqf law and governance in Indonesia. Gramata Publishing.

- Huda, M. (2019). Models of waqffund raising management in Indonesia. Moslem Heritage, 4(1), 1-15.

- Ismail, A.M.M. (2009). Cash waqf: A new financial product. Prentice Hall.

- Jaih, M. (2019). Personal communication. Jakarta

- Khairi, K.F., Aziz, M., Laili, N., Nooh, M., Sabri, H., Basah, A., & Yazis, M. (2014). Share waqf (corporate waqf) as an alternative financial instrument in improving the communities and nation welfare.

- Khairudin. (2019). Malaysia: Personal communication.

- Kuran, T. (2001). The provision of public goods under Islamic law: Origins, impact, and limitations of the waqf system. Law and Society Review, 20(1), 841-898.

- Laallam, A., Kassim, S., Engku Ali, E.R.A., & Saiti, B. (2020). Intellectual capital in non-profit organisations: Lessons learnt for waqf institutions. ISRA International Journal of Islamic Finance, 12(1), 27-48.

- Mannan, M.A. (1999). Cash-waqf certificate global opportunities for developing the social capital market in 21st-century voluntary-sector banking. Proceedings of the Third Harvard University Forum on Islamic Finance: Local Challenges, Global Opportunities Cambridge, Massachusetts. Center for Middle Eastern Studies, Harvard University.

- Miles, M.B., Huberman, A.M., Huberman, M.A., & Huberman, M. (1994). Qualitative data analysis: An expanded sourcebook. Sage.

- Mohsin, M.I., Dafterdar, H., Cizakca, M., Alhabshi, S.O., Razak, S.H.A., Sadr, S. K., Anwar, T., & Obaidullah, M. (2016). Financing the Development of Old Waqf Properties. Springer.

- Moustafa, T. (2013). Liberal rights versus Islamic law? The construction of a binary in Malaysian politics. Law & Society Review, 47(4), 771-802.

- Moustafa, T., & Sachs, J.A. (2018). Law and society review special issue Introduction: Islamic law, society, and the state. Law & Society Review, 52(3), 560-573.

- Mudzhar, M.A. (2003). Islam and Islamic law in Indonesia: A socio-historical approach. Office of Religious Research and Development and Training.

- Muhamad, N.H.N., Kamarudin, M.K., Abdullah, A.H., Sholehuddin, N., Hamid, M.F.A., Muhidin, I., & Karim, K.A. (2019). Islamic intervolves law challenges in Malaysia. Journal of Legal, Ethical and Regulatory Issues, 22(1), 1-6.

- Obaidullah, M. (2016). A framework for analysis of Islamic endowment (waqf) laws. International Journal of Not-for-Profit Law, 18(1), 54-69.

- Perez, O., Amichai-Hamburger, Y., & Shterental, T. (2009). The dynamic of corporate self-regulation: ISO 14001, environmental commitment, and organizational citizenship behavior. Law & Society Review, 43(3), 593-630.

- Prasetia, Y.S., & Huda, M. (2017). The relevance of management of turkish waqf to the development of productive waqf in Indonesia. Justicia Islamica: Journal of Legal and Social Studies, 14(2), 174-183.

- Ramli, A.M., & Jalil, A. (2013). Banking model of corporate waqf: An analysis of Wakaf Selangor Muamalat. International Accounting and Business Conference (IABC).

- Ramli, A.M., & Jalil, A. (2013). Corporate waqf model and its distinctive features: The future of islamic philanthropy. Dipresentasikan Pada Worlds Universities Islamic Philanthropy Conference Di Kuala Lumpur, Malaysia.

- Saad, A.I. (2019). The corporate waqf in law and practice. Berkeley Journal of Middle Eastern & Islamic Law, 10(1), 1-9.

- Sahar. (2019). Personal communication.

- Sarakhsi, I. (1993). Al-Mabsuth li as-Sarakhsi. Beirut: Dar Al-Kutub.

- Simpson, S.S., & Piquero, N.L. (2002). Low self-control, organizational theory, and corporate crime. Law and Society Review, 20(2), 509-548.

- Sulaiman, M., & Alhaji Zakari, M. (2019). Financial sustainability of state waqf institutions (SWIs) in Malaysia. Journal of Islamic Accounting and Business Research, 10(2), 236-258.

- Yahya, S.S. (2008). Financing social infrastructure and addressing poverty through wakf endowments: Experience from Kenya and Tanzania. Environment and Urbanization, 20(2), 427-444.