Research Article: 2021 Vol: 20 Issue: 1

Upstream Supply Chain Collaboration (SCC): A Case Study in Danang City, Viet Nam

Thi Minh Hang Le, University of Economics-The Univeristy of Danang

Thuy Hang Nguyen, University of Economics-The Univeristy of Danang

Nguyen Le Dinh Quy, FPT University

Abstract

The basis of global competition has changed. Nowadays, it no longer is the race between companies versus other companies, but rather the competition between supply chains, which are simply defined as processes involving the constant flow of information, materials and finance across multiple functional areas both within and between chain members. To have an efficient supply chain, collaboration is considered as a prerequisite, which has been supported by many scholars through their researches that it can bring extensive benefits and advantages to SC partners. From our reference base, most of the previous findings focused on measuring the collaboration situation in the whole chain, from upstream to downstream, however, we suppose that the collaboration nature differs among upstream and downstream region. In addition to that, as mentioned by Monczka, many features that make firm’s way into final products originate with suppliers. The supply base is an important part of the SC because supplier capabilities can help differentiate a producer’s final good or service. Nevertheless, in Vietnam, both the number of paper and the manager’s knowledge about this sector still are limited. Due to this acknowledgement, in the research processing, we aim to explore the collaboration state in the upstream part of the local small and medium entrepreneurs (SMEs)’ supply chain, which in turn might help firms realize their present condition and quickly make some improvements.

Keywords

SC Management, Collaboration, Upstream, Case Study, Danang.

Introduction

In the 80s of the last century, most companies realized that strategies and manufacture techniques could help them cut cost and enhance their competitive advantages in different markets. After successfully applied Just-in-time (JIT), Kanban, Lean manufacturing or Total quality control (TQM), companies move to supply chain (SC) management as the next step in growing market share as well as firm’s long-term profitability. SC is a network in which there is the participation of many firms, including suppliers, manufacturers, transporters, intermediaries, taking up one or some work phrase (such as marketing, finance…) and collaborating to create the final product/service, through information flow, physical flow, and finance flow. The participant uses his own core competencies to make the product, with the aim of meeting the demand of final customers, maximizing the SC surplus.

Stem from that intricate structure, with many participants, each firm pursues different business goals, with unlike strategy, before deeply engaging in those complicated relationships, the important decisions which have a great impact on either the survival of each firm or the whole chain, managers should establish and maintain the collaboration relationships inner SC to gain the efficiency, flexibility and competitive advantages (Nyaga et al., 2010; Hudnurkar et al., 2014) by long-term contracts, using their core competencies to create a better achievement, which might be hard to complete if each firm work independently as the competitive ability of firms is directly linked to the ability to collaborate with their partners Su et al. (2008).

From that perception, there are many pieces of research about SCC have been conducted. Most researches were conducted in developed countries; the SC mentioned in these papers belonged to the multinational corporation, with the long-time of development. In Vietnam, SCC is still a new concept with most firms, especially small and medium enterprises (SMEs), which account for 98.1% of the total number of enterprises. These firms have limited change to enter the professional and big international supply chains, while the region/local supply chains are still not “what supply chains really are”, firm and their partner just cooperate in business transactions without trusting each other. For these reasons, it is not quite suitable to apply those findings in Vietnam. Nevertheless, the number of empirical researches about this domain in Vietnam is inadequate, in addition to that, the previous papers mentioned the index of SCC measurement for the whole chain while through the pilot research, the writers assume that there might be differences in the collaboration extend between the upstream and downstream part of the supply chain. As mentioned by Monczka et al. (2015) the supply base is critical in product differentiating, creating high-quality, competitive products.

Therefore, to improve the level of SCC of Vietnamese firms, there is a need of empirical research, which firstly could describe the collaboration situation in chain. This paper would focus on measuring the collaboration extend between firm and its main suppliers, based on the verified indexes, which in turn might help firms realize their present condition and quickly make some improvements. The objectives of this paper are: (1) Synthesize the relative theories; perspectives about supply chain, SC management, and SC collaboration, (2) Synthesize the SCC index, (3) Measure the collaboration extend between firms and their supply partners.

Literature Review

Supply Chain

The concept of “supply chain” has been defined by many scholars over the last 30 years, with different viewpoint or way of expression. Lummus et al. (1999) hold the belief that SC comprised all the activities occurred in chain, which turn raw material into the final product, including supplier assessment and evaluation, material supply, inventory management, order handling, distribution, and the necessary information systems to manage these activities. Considering SC as a business activity, Lambert & Cooper (2000) defined SC as the interaction activity between many firms within the SC with the aim to increase the customer value, these firms may directly or indirectly take part in the work of creating surplus value for the customers, that why the shape of SC looks like a roof network rather than a straight pipe. Kumar & Rahman (2015) viewed SC as a process, which involves many work phrases; each has a comparative impact on the product quality.

Supply Chain Management

SC management is a scientific management method, in which firms focus on achieving SC goals rather than emphasize on its individual goals. This integrates process create more surplus value for customer (such as cut down cost, increase the customer service…) through planning, managing 3 flows (product, information and finance) from supplier to the final customer (Ramanathan, 2014). (Lummus et al., 1999) explained the mechanism of SC management that managers not only care about their company success but also the success of the whole chain, all the SC participants. These managers work together to create SC competitive advantages. Together they make a “information exchange” on which the information about market, competitors is shared, jointly find suppliers, manufacture and fulfil the customer demand.

Upstream Supply Chain Management

In this competitive environment, firms need to enhance customer perceived value by improving firm’s performance through purchasing and SC management. This trend can be explained by the following motives. First at all, many features that make their way into final products originate with suppliers. Supplier capabilities could help differentiate a producer’s final good or service. Secondly, SC management or supplier management in particular could make cost reduction, coming in different forms: bargain, bulk discount, or saving joint pulling costs out of the product or service by building relations with suppliers. Thirdly, purchasing and supply management also has a major impact on product and service quality. In many cases, companies are seeking to increase the proportion of parts, components, and services they outsource in order to concentrate on their own areas of specialization and competence. Last but not least, purchasing, acting as the liaison between suppliers and engineers, can also help improve product and process designs. Thus involving suppliers early in the design process is a way purchasing can begin to add new value ideas, and contribute to increasing their competitiveness Monczka et al. (2015) because of the fact that the sellers have the better understanding out their material than the buyers (Shapiro, 1985). As listed by Monczka et al. (2015), one of the important objectives of upstream SCC is to find the competitive suppliers and build the long-term collaborative relationship with them. To do that, there is the need of 2-way effort to enhance the present production capacity as well as develop new competencies.

Supply Chain Collaboration

Before deeply engaging in how to manage the supply chain, the first thing needs to be considered by the managers is how to build and continuously maintain the collaborative relationship between SC partners, as SCC play an important role in the turbulent business environment (Inaam et al., 2016). SCC is often defined as two or more chain members working together to create a competitive advantage, which result from a greater profitability of satisfying end customer needs than acting alone (Simatupang & Sridharan, 2002). Vieira et al. (2009) hold the belief that SCC happens when SC partners jointly work based on the mutual trust toward better make use of the unused resources, better performance. Many scholars have stated that SCC has a positive effect on SC performance, to be more specific, all the SC partners gain benefits as a result of good collaboration (Simatupang & Sridharan, 2005a). That why there are many researches aim to measure to collaboration index, both theoretical and empirical, have been conducted in recent years, overall there are 2 ways of measurement: attitude/action or both.

Simatupang & Sridharan (2005b) in “An Integrative Framework for SC Collaboration” make an index formed by 5 dimensions, including collaborative process improvement, information sharing, decision synchronization, incentive alignment, and integrated supply-chain processes. Which then was shortened into information sharing, decision synchronization, incentive alignment in (Simatpung, 2006)? Another index configured by top management commitment, information sharing, trust, incentive alignment and long-term relationship was built by Anbanandam, Banwet, và Shankar (2011) to measure the collaboration extend in Indian retail industry. Meng (2010) formed a collaboration index with procurement, objective, communication, problem-solving and risk allocation. Cao & Zhang (2011) in “SC collaboration: Impact on collaborative advantage and firm performance” defined 7 aspects of SC collaboration, including information sharing, goal congruence, decision congruence, incentives alignment, resources sharing, collaborative communication and joint knowledge creation.

Research Methodology

Measurement

Base on the literature background, after synthesizing, an instrument to measure SCC was conceptualized using 6 dimensions, namely information sharing, goal congruence, decision congruence, incentive alignment, resource sharing, and joint knowledge creation (Appendix).

Data Gathering and Analyzing

The email list was obtained from the database of Business Administration Faculty of Danang University of Economics, which contains the email address of companies where the former students of the faculty working at. We randomly chose 100 SMEs and sent out the final qualitative questionnaire to the 100 potential respondents in 3 waves. The informants involving in the supplier-buyer relationship were required to give a statement that best collaboration situation between firms and its main supplier. After 1 month the number of respondents was 76, after eliminating the incomplete or “off-topic” respondents, 62 respondents were used in the rest of this research.

Besides the descriptive statistics, the reliability analysis was used to make sure that the data was reliable. Because the index was synthesized from previous papers, which were carefully verified, the writers skipped the EFA method in the process.

Results

Overall, among 62 information proving companies, trading & service companies occupy a significantly high proportion (71%), that percentage of manufacturing & building companies and agriculture companies are 19.4% and 9.7%, respectively. Most of the suppliers mentioned by the informants have work with each other from 1 to 5 years.

Before analyzing the data, a reliability analysis was used to eliminate unreliable variances. From the analysis result, just 27 variances are used to describe the collaboration extend (Appendix).

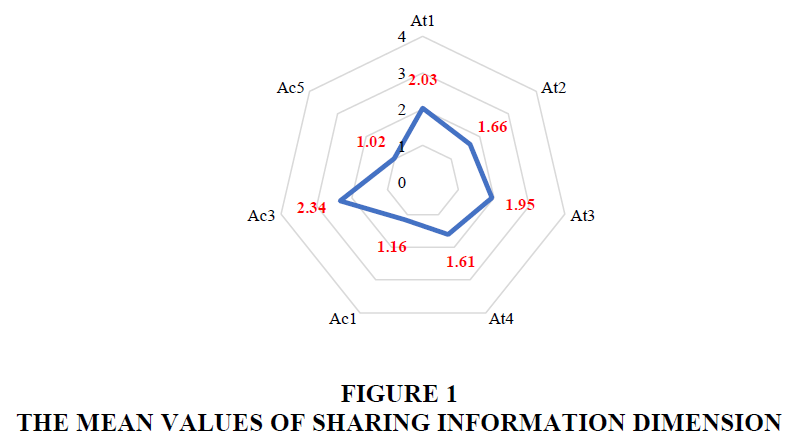

Information Sharing

Most companies share information with the comparatively high speed (2.03/3), with a quite high accuracy (1.66/2), and completeness (1.95/3). However, these firms seem to be quite reserved in sharing information like manufacturing planning, POS data and feedback of the customer (Figure 1).

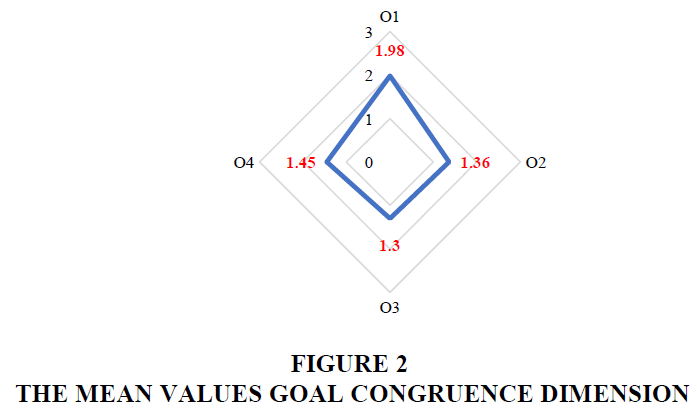

Goal Congruence

Most firms and their main supplier highly agree on the goal congruence dimension, the mean value of goal congruence is 1.98/3, to be more specific, the mean value of O2, O3, O4 is 1.36/2, 1.30/2 and 1.45/2, respectively (Figure 2).

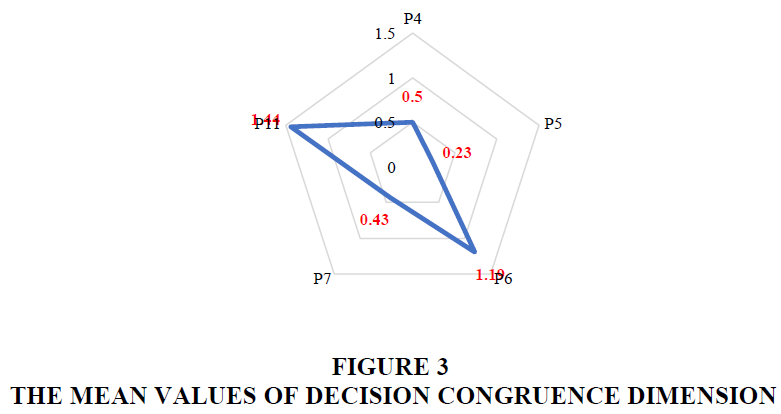

Decision Congruence

Firms and their partners show a good collaboration on problem-solving (1.19/2) and conflict tackle (1.44/2), however, in other aspects the collaboration between parties is quite loose, as the mean value of joint product assortment planning, joint new product development and joint material requirement planning are 0.5/2, 0.23/3 and 0.43/2, respectively (Figure 3).

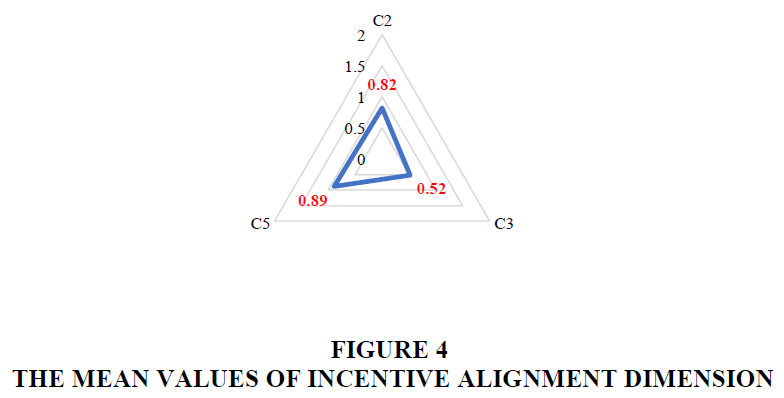

Incentive Alignment

Firms and their suppliers collaboration in incentive alignment is limited, as shown in the analysis result, the mean value of C2, C3 and C5 are 0.82/2, 0.52/2 and 0.89/2, respectively (Figure 4).

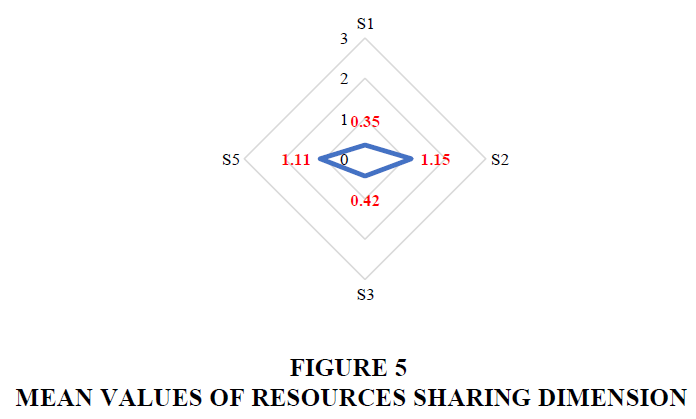

Resource Sharing

In resource sharing dimension, the collaboration extend between firms and their main suppliers is still inadequate, especially in joint process design and improvement (0.35/1), supportive techniques sharing (0.42/1) and resource sharing (1.11/3) (Figure 5).

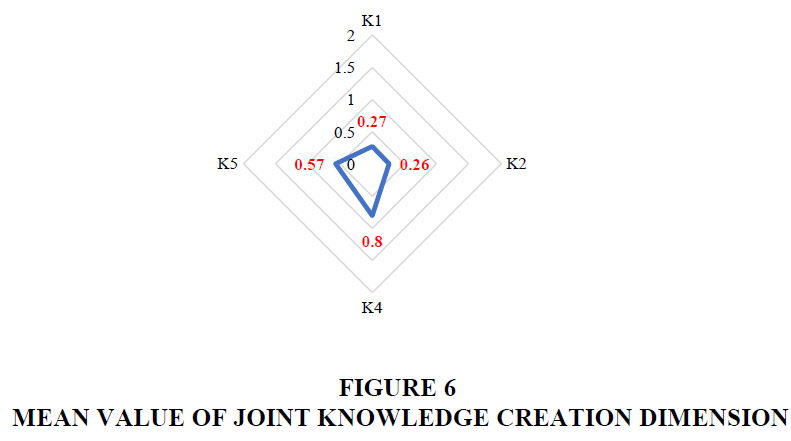

Joint Knowledge Creation

This is the dimension in which firms and their supplier show the loosest collaboration extend, especially in joint new knowledge searching and learning (0.27/2), joint new knowledge application (0.26/2) and joint competitor analysis (0.57/2), when all the mean values are far lower than the average level (Figure 6).

Conclusion

Research has detailed synthesized the relative literature and proven the feasibility of applying an international protocol in the context of Vietnam. As an empirical research, the paper has succeeded in measuring the collaboration extend between SMEs and their main supplier, which help firms aware the present collaboration situation in the supply chain, as the first step to improve the SCC and SC efficiency, generally. As can be seen from the analysis result, the collaboration in the upstream region of supply chains is quite loose. In the dimension of goal congruence, firms show the significantly high agreement; however, this agreement seems to have no noticeable reality impacts. This is due to the fact that except for information sharing, which gains comparatively high value, the others are all lower than the acceptable level. In addition to that, firms trend to better collaborate on “solving activities” rather than “preventing activities”. Overall, upstream SCC is lack of explicit standard or action code that why the collaboration extends is still unstable, and show frequent change depends on the specific situations.

Despite having considerable contributions, there are several limitations. First, because of the small sample size, so the representativeness of the research is limited. Future research should enlarge the sample size or might investigate the collaboration extend difference in different business field/ sector.

References

- Anbanandam, R., Banwet, D.K., & Shankar, R. (2011). Evaluation of supply chain collaboration: a case of apparel retail industry in India. International Journal of Productivity and Performance Management, 60(2), 82-98.

- Cao, M., & Zhang, Q. (2011). Supply chain collaboration: Impact on collaborative advantage and firm performance. Journal of Operations Management, 29(3), 163-180.

- Hudnurkar, M., Jakhar, S., & Rathod, U. (2014). Factors affecting collaboration in supply chain: A literature review. Procedia-Social and Behavioral Sciences, 133, 189-202.

- Inaam, Z., Abderrahman, M., & Yasmina, H. (2016). A framework of performance assessment of collaborative supply chain. IFAC-PapersOnLine, 49(12), 845-850.

- Kumar, D., & Rahman, Z. (2015). Sustainability adoption through buyer supplier relationship across supply chain: A literature review and conceptual framework. International Strategic Management Review, 3(1-2), 110-127.

- Kumar, G., & Banerjee, R.N. (2014). Supply chain collaboration index: an instrument to measure the depth of collaboration. Benchmarking: An International Journal, 21 (2), 184-204.

- Lambert, D.M., & Cooper, M.C. (2000). Issues in supply chain management. Industrial Marketing Management, 29(1), 65-83.

- Lummus, R.R., & Vokurka, R.J. (1999). Defining supply chain management: a historical perspective and practical guidelines.

- Meng, X. (2010). Assessment framework for construction supply chain relationships: Development and evaluation. International Journal of Project Management, 28(7), 695-707.

- Monczka, R.M., Handfield, R.B., Giunipero, L.C., & Patterson, J.L. (2015). Purchasing and supply chain management. Cengage Learning.

- Nyaga, G.N., Whipple, J.M., & Lynch, D.F. (2010). Examining supply chain relationships: do buyer and supplier perspectives on collaborative relationships differ?. Journal of Operations Management, 28(2), 101-114. Shapiro, R.D. (1985). Toward effective supplier management: international comparisons. Division of Research, Harvard Business School.

- Simatupang, T.M., & Sridharan, R. (2005a). The collaboration index: a measure for supply chain collaboration. International Journal of Physical Distribution & Logistics Management, 35 (1), 44-62.

- Simatupang, T.M., & Sridharan, R. (2005b). An integrative framework for supply chain collaboration. The International Journal of Logistics Management, 16 (2), 257-274.

- Simatupang, T.M., & Sridharan, R. (2002). The collaborative supply chain. The International Journal of Logistics Management, 13(1), 15-30.

- Su, Q., Song, Y.T., Li, Z., & Dang, J.X. (2008). The impact of supply chain relationship quality on cooperative strategy. Journal of Purchasing and Supply Management, 14(4), 263-272.

- Vieira, J., Yoshizaki, H., & Ho, L. (2009). Collaboration intensity in the Brazilian supermarket retail chain. Supply Chain Management: An International Journal, 14 (1), 11-21.