Research Article: 2018 Vol: 17 Issue: 3

Weakness of Financial Performance in Jordan Islamic Bank

Abdullah Ibrahim Nazal, Zarqa University

Fuad Suleiman Al-Fasfus, Zarqa University

Keywords

Financial, Jordan, Weakness, Islamic Bank, Auditing, Supervisory Islamic Board.

Introduction

Islamic banks have to apply Islamic rules of accounting and finance because it is Islamic organization. It may accept International Financial Report Standard (IFRS) or apply its Islamic rules standards but it have to apply law despite its opposition to the Islamic rules. Different of these standards will cause gap to understand financial performance. This study explains the weakness points of financial performance information based on the analysis of financial reports and weakness of accepted auditing level by law. It concentrates on Jordan Islamic bank and its companies as case study. It will show weakness factors of understand strategy success based on analysis weakness of auditor types, auditor report gap and auditing report value. Pittaway (2004) explained the problem of networking and found that firms that not cooperate and which do not formally or informally change knowledge limit their knowledge in long term. There is need to understand dynamics of relation.

Frederick & Scheherazade (2011) evaluated Islamic banking after it works in the west and found that traditional bank has competition ability better than Islamic bank because of developing technology but the last financial crises will success expansion Islamic bank industry as way to managing risk.

Jordan Islamic Bank annual report explained that Jordan Islamic bank may get in loses as any company. Some of Its assets include services as in traditional bank and other services include selling contract services, lease contract services, sharing contract services. Islamic bank may own companies. These cases help Jordan Islamic bank to sell goods of these companies to customers by Morabaha installments service in order to get profit. It can get goods by low cost as marketing organization without buying store cost in the bank also it can get from the company distributed net profit beside increasing its shares price in market because of these companies' profit.

Jordanian Islamic banks are three in 2017 which are: Jordan Islamic Bank, the Arab International Islamic Bank and the Jordan Dubai Islamic Bank. Jordanian Islamic bank has specialized law. It is the bank which does not deal by loan with interest and apply Islamic rules. Kamal (1986) said that price of service must be fixed in contract after signing and must not be changed up to time or default or it will cause Reba. Its service must be based on Islamic rules of contract type. Al Khaiat (2000) was one of (SIB) in Jordan Islamic Bank. It ordered to cancel the contract that does not meet Islamic rules even the employee said he did not know the Fiqh principles and canceled returns because Islamic rules face ignorance and harm.

Islamic rules impacts, Islamic bank assets because every service must be accepted by Islamic rule. By comparing between Islamic banks and traditional banks, Hasan (2008) showed that interest rate lead Traditional Banks to increase profit than Islamic banks as result to get financial leverage. Hassan & Bashir (2003) showed that Islamic bank must have big capital to achieve suitable profit because it avoids loan with interest and deals with direct investing to obligate deferent standards of (capital/assets) ratio. Bullen & Kel-Ann (2010) explained that the strong growth of international financial reporting standards is affected by environment of human resources accounting. Avazzadehfath & Raiashekar (2011) found that employees can give information and details fairly, therefore Islamic bank employees must understand Islamic rules impact on contracts accounting.

Auditor type, auditing report gaps and auditing reports value are impact weakness of financial performance report in Jordan Islamic bank. Weakness of financial performance reports may come currently or in future or historically.

Auditor Type

Internal auditor is the supervisor of all accountants in every branch and in Islamic bank sharing in companies assets as direct investing or indirect investing also make sure that all contracts meet law then it gives the financial statements based on International Financial Report Standards (IFRS). Accounting data has problem of changing: IFAC (2010) explained problem that "Accounting data standards can be changed from year to year. There are no limit standards ruling government companies, international companies and local companies". Lucouw (2013) explained problem of weak disclosure because of future changing impact on contracts results and suggested model to increase disclosure by recalculates financial statement figures to what it could have been.

Jordan Islamic bank Shari'ah Fatwa explained that (SIB) is responsible to show the Islamic rules of every contract and explaining its impact on service acceptance conditions, developing, steps, accounting and to be certain that all contracts meet Islamic rules as Shari'ah auditor. Atmeh & Abu Serdaneh (2012) explained problem of needing experts in Islamic bank services contract because of Islamic rules that direct documenting account data and accepting. The problem comes as result to meet different accepting of Fiqh resources and the weighting between the jurisprudential views. Shari'ah Fatwa, Islamic bank Governance, Islamic bank rule and Jordanian Islamic banks law based on Jordanian center bank are factors impacted Islamic rules of any service.

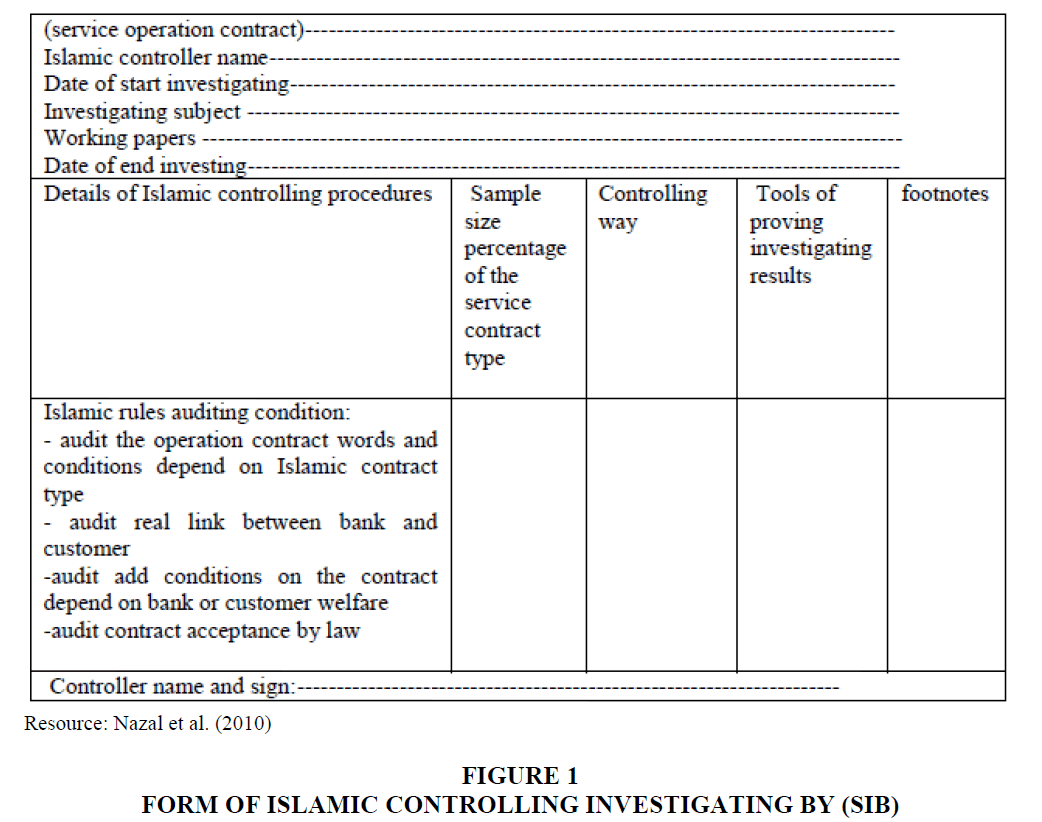

Supervisory Islamic board is working based on form to audit any Islamic bank service contract, as in the Figure 1:

Jordan Islamic bank has four specialized persons in Fiqh and Islamic rules. They are the (SIB) members. (SIB) members are: Mahmood Al-Sartawy, Abed Al Satar Abu Ghouda, Mohamad al kha'ier Al Easa and Abed Al Rahman Al Kilany (Jordan Islamic bank annual report, 2016). Jaber & Nazal (2016) had explained relationship between (SIB) and External auditor in Jordanian Islamic banks. (SIB) report must be the first step then the external auditor report will be fair up to the (SIB) acceptance. This arrange of steps is obligatory as result to accept contract by Islamic rule then accept account data.

This arranges becomes weak when employee in Jordan Islamic bank applies traditional service contract conditions or traditional service without Islamic rules. This case is practically. It comes because employee wants to reduce bank transport cost, also it is accepted by law and (SIB) has weak control for every service.

External auditor investigates financial statements acceptance by Islamic rules, Jordan law and (IFRS) also investigate the Islamic future success by estimating the future financial statements. External auditor has problem of big size of accounting data and limit time. In spite of that problem, Heinze et al. (2014) explained that a company which faces crises can reestablish trust with shareholders by announcing an independent investigation of third part as external auditor. It adds more trust to the accounting results and financial managing results.

In 2013 there were conferences of auditing discussion in Jordan. It showed the accounting case, (see Table 1):

| Table 1: Results Of Accounting In Jordan | |

| Searchers | His results |

|---|---|

| Sameah Beano (leader of anti-Corruption authority) | There were controlling of Corruption types which are legal, management and finance in boards of directors of public shareholding companies but it was less controlling in public sector because of different control organization as financial ministry |

| Muhannud Atma and Ziad Al Zoubi (Accountants) | Applied IFRS will cause financial cheat in statements because it depends on principles not rules. This will cause impact of managing on account because it is not role by details |

| Reem Oqab (accounting teachers) | Auditor has new responsibility which is to find money laundering |

| Mohammed muter and Abed al Naser Nour(accounting teachers) | Finding tricks based on earnings managements are challenges for auditor |

| Hisham abu hasheesh(auditor) | Forensic auditor idea is way to find Corruption based on doubt. |

Resource: Auditor Journal (2014).

In Jordan external auditor must follow the moral rules of auditing licenses which direct auditor to find frauds and help court in judgment; also it gives training for accountant to be legal auditor. Jordan has rules to accept external auditor as legal expert. Auditor has to get (JCPA) certified after test and after two years of working in auditing with legal expert auditor, he becomes legal auditor and owns his stamp to work alone as expert auditor. In 2016 there was more than (580) legal expert auditors. Law obligates all organization that has return more than (200000) JD to give financial statements with expert legal auditor stamping every year which ends in 31/April/every year.

Expect Problem of Auditing

Expect problem of auditing comes as result to that expert auditors are not enough to auditing numbers of companies. Some legal expert's auditors try to get return from the company by stamping accepted reports without care about frauds, Ex: A legal expert auditor stamped 3000 report for 3000 organization in 2016. The amount was not accepted by auditor legal society. The amount was not practical. They stopped the auditor to work as result to expect frauds accepting or find that auditor did not do the usual effort as auditor.

Practically legal expert auditors in Jordan are three types:

Moral auditor

He accepts company financial statements with frauds. He believes that his work is important to keep trust with him and protect company from rumors.

Moral auditor but he has weakness

He uses moral legal experts or auditors and he will not accept company financial statements with frauds.

Immoral auditor

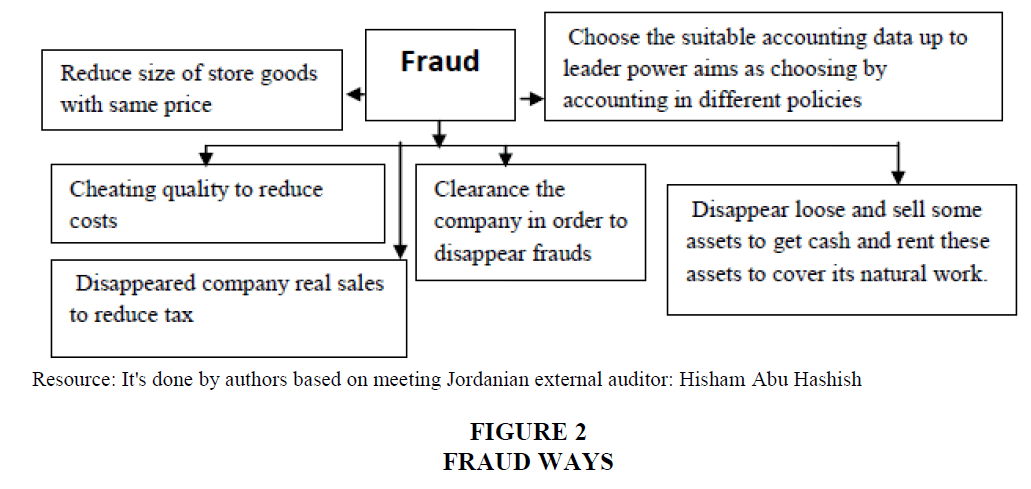

Helps organization to disappear frauds therefore he cause mistakes. Their reasons are to get high returns and avoid problem of court as witness against other auditors because court will take time and causes facing the other legal auditor which lead to lose each other. Fraud has ways as in Figure 2:

Cases of Understanding Service Contract Accounting

Financial statements analyst has acceptance accounting data. Problems are increased by fast dealing and developing tools as saving tools, investing tools and financing tools also problem increased as result to ignorance because of gap between fast dealing and real result of dealing documentary. Jordan Islamic bank annual report (2016) showed that external auditor gives financial reports reasonable degree. It is not gives 100% of assurance, also the word substantial shows that result comes in general without details of every contract as weak point. Some countries try to solve frauds by expert controlling of companies operation steps. Winson (2014) explained that they are led by courts to follow expect steps of fraud before cheater complete frauds operation.

Auditing Report Gaps

There are expecting ways to protect external auditor's weakness. External auditor gives opinion about financial statements correcting in Islamic bank and its share in companies. This responsible will get auditor in court problem if it is false as result to dealer decision based on this false and get in lose.

Auditor Ways to Limit his Responsibility

Auditor protects himself by the following ways:

1. He gives the opinion based on limit time to show that he is not responsible about any changing of account data after the limit time.

2. He uses limit words depending on his effort of investigating and experience which is different from auditor to other. These words give different result of correcting degree. User of the auditor result has to understand this degree, as: accept with clear result which is equal more than 90% correcting or accept with sensible result which is equal not more than 75% correcting. This comes as result to big amount of documents and big cost of investigating. When auditor uses statically way depending on sample of account data documents he will not cover all account data documents. This way will reduce some documents of investigating. Gupta & Gill (2012) explained solving problem of many auditing accounting data with short time by computer analysis may discover some frauds but it has limits.

3. He uses other auditor as result to experiences and time limit to transfer risk of auditing on other auditor responsibility.

Auditor Problems

External auditor problem cases come as result of the big amount of account data documents, limit time, different usage of accounting standards and different usage of account polices. By meeting in date: 4/2017 in Amman some external auditors and some accountants talked about external auditor ways of dealing with financial statements practically: Hisham abu Hashish, Ahmad Abu Hashish and Ahmad Makhloof gave idea about auditor behavior as follow:

1. Auditors face that cases by giving opinion based on company reputation in market and collect the company legal problems to find its ability of buying liabilities in time.

2. Auditors refuse to audit the company.

3. Auditors use doubt of accounting data until they get proof from the company which proves correcting the account data.

4. Auditors get in group of auditors to investigate.

5. Auditor said that: company is my customer from years and I stamp correcting of their financial statements because of trust.

6. Auditor tries to adjust the company's financial statements to be accepted to keep company as customer and get his its return.

Misunderstanding of service in Islamic bank will impact the correcting of account data. This misunderstanding comes because of developing service. Islamic bank may give new service or adjust the service or merge much service to be given as one service with one cost and one return or sell investing (Sukuk) as investing certified with percentage of profit which comes as result to derivative many Islamic bank investing projects. Auditing needs disclosure without complexity as work in suitable certain environment. In Jordan disclosure has problems as follow:

Accounting Disclosure Problems

There is problem to find methodology of applying accounting standards in Islamic banks to give fair accounting by suitable amount, suitable time and suitable place. Atmeh & Alzabi (2014) explained problem of discloser because of international financial reports standards follow Principles not rules which leads to apply the manager rules on accounting data. Jarhi (2003) explained that Basel rules are not suitable for Islamic banks because there is different between Islamic banks and traditional bank. Islamic bank shares investing deposits with loss and profit because it is not loan as in traditional banks which show difference of accepting standards of loan default risks.

There are experiences show Islamic bank rules of accounting as Asian Oceania Standards Setter Group (AOSSG). It discussed differences between Islamic accounting standards and international accounting standards. Amin (2011) explained that some leaders said that there are no different because it units accounting standards round the world but there is need to add new standard as Zakat accounting standard. The idea had been agreed with Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) in Qatar and Bahrain which apply (IFRS) International financial Report Standards in Islamic banks, while other leaders not accepted international accounting standards because some items not accepted in Islamic law (AOSSG, 2010).

Accounting and Auditing Controls for Islamic Financial Institutions Standards, (2000) explained that efforts was done to make Islamic accounting standards up to Islamic selling contracts, sharing contracts, working contracts, renting contracts.

Problem comes because of different accounting policy, different accounting standards and its changing by time. Some auditors face problem of giving different financial statement for one company in one type but in different numbers. This comes as result to government accounting standards for applying tax it may be different than (IFRS). For example: government gives percentage of accepting depreciation on fixed assets as 20% yearly on cars as expenses to be reduced from tax. This depreciation percentage is not accepted to evaluate asset of cars in the company by (IFRS). Islamic rules evaluate cars based on its market price at time of evaluation. Difference of evaluate asset between government rule (IFRS) and Islamic rule will cause different financial tables based on each rule. It will give three different results. Some auditor's makes three type of financial tables based on three rules. He will give financial tables based on (IFRS) for international needs and give financial tables based on government rule for local government needs also he will give financial tables based on Islamic rules for Islamic controlling needs by (SIB). Different of result will be as in Table 2.

| Table 2: Depreciation Impact On Assets And Operation Cost | ||

| Accounting rule | Rule Impact | Results |

|---|---|---|

| Islamic rules | Reduce cars value when cars market price reduced and increase cars value when cars market increase (Al Sarghasy) | It gives fair value of asset and operation cost |

| (IFRS) | Reduced based on accounting policies based on cars life cycle until it becomes scrap. There are many choices but it must be sensible choose comparing by asset life cycle. | It gives flexibility to reduce asset and increase operation cost without show impact of possibility of increasing car prices to increase assets and reduce operation cost |

| Government | It obligates fixed percentage to reduce depreciation for tax reason. It obligates 10% of car depreciation in order to reduce tax. | It gives fixed reduced of asset and fixed increasing of operation cost |

Resource: Authors

Jaber & Nazal (2016) explained that there is an employee misunderstanding of (SIB) rules which cause unaccepted services contracts by Islamic rules and lose profit.

Changing of accounting data based on accounting policy or other changing in results from time to time in one year is other problem. The manufacture of material pipes is company annual report (2016) explained that the Jordan Islamic bank has more than 40% of its shares. This company make adjusted of accounting policy in annual report. Equities were 14298370 JD in 2015 in the annual report of 2015 but in annual report of 2016 there was adjusted to compare 2016 with 2015. The equities changed to be 13856743 JD, also current liabilities adjusted in 2015 from 2626577 JD to be 863162 JD. The notes in the annual report of 2016 showed that changes in accounting estimated are recognized in the year and the years that changes are affected.

Financial Disclosure Problem

Investing tools, financing tools and saving tools in Islamic bank may be developed by time and need new accounting standards. Financial disclosure needs time because it is related to future and not fixed as accounting data.

Ways of developing must meet Islamic rules. (SIB) is responsible to accept adjusted of contract or merge of contracts or collecting of contracts. Ex: Cash flow of Jordan Islamic bank sharing service is impacted by sharing service developing, (see Table 3).

| Table 3: Cash Flow Of Jordan Islamic Bank Sharing Service In 2005 | ||

| Service | Amount | Expect developed types |

|---|---|---|

| Sharing service in assets | Reduced (415.549) JD than 2014 | Sharing contract by capital in project as partner between the bank and other company or individual or government. After the contract time ended, bank and the partner share in profit but this will come after they get their capital. |

| Reducing Sharing contract. It is sharing contract but one of the partner will buy the partner sharing capital of project from his sharing distributed profit. | ||

| Sharing as (Sukuk). It is sharing investing by capital and profit. (Sukuk) can be sold in financial market based on its expect value before contract time ended. | ||

Resource: Jordan Islamic bank annual report

There is need to understand type of sharing that cause losing of cash flow. Developing causes ignorance and need disclosure. Al Fatawa Al Sharia limited adjusted of contract conditions as obligates Jordan Islamic bank to fixed changing of price, commissions, profit. After sign the contract Jordan Islamic bank must not make any change without customer accepted also it limit ways of managing risk as insurance against trickery and theft.

Misunderstanding of Risk: By comparing between Islamic bank and traditional bank, risk and managing risk have two results. It is similar in some operation as working services because it has the same rules in law and Islamic banking and applied practically with Islamic rules, Ex: Bank transfer of cash and currently exchange currencies. Basel standards must be obligate to protect saving and investing which obligate same risk tables evaluating and same risk managing ways evaluating.

On other hand, it is different in some operations because Islamic bank use selling goods without dealing with interest as sharing services and selling services. These operations have Islamic rules to be accepted. Center bank responsible to control its steps, time and size of capital, returns and contract conditions based on law and Islamic rules.

Center bank responsibility of Islamic rules control may be different from country to country. In this case, applying operations in Islamic bank practically with law without Islamic rules will cause similar impact in Islamic bank as Traditional bank. In this case there must be applied the same accounting standards, evaluating tables, models and financial tables. Basel standards must be obligate to protect saving and investing which obligate same risk tables evaluating and same risk managing ways evaluating.

Center bank obligate Jordan Islamic bank to use the highest part of assets by deferred sales receivable service, as Morabaha installments because it is easy to apply risk form controlling as in traditional bank. Morabaha installments accounting is show capital and profit in Jordan Islamic bank as the capital and interest of loan contract in traditional bank. Deferred sales receivable services and other receivables was 54% from assets in 2015 while it was 49% in 2014 and became 49% in 2016.

Misunderstanding of Managing Risk: The problem increased by misunderstanding of managing risk ways as avoid risk or transfer risk or reduce risk by ways as: "Box of Facing Investing Sharing Accounts Risk" to cover loss of investing sharing accounts also using Insurance contract to reduce or avoid risk of Morabaha installments default by customer in Jordan Islamic bank. Customers misunderstanding come because of misunderstanding amount of installments' numbers to get risk and rule of Box of Facing Investing Sharing Accounts Risk. The rule obligates to take 10%-15% from profit of Investing Sharing Accounts before customer get his part of profit, this rule reduces his profit, see Jordan Islamic Bank annual report. Accountant must understand the time and amount of losing that covered by this box to avoid tricky possibility. Developing finance or investing or savings services is other problem of accounting. Developing has reasons, as reduce cost. When accountant document account data without understanding developing reason he will not show reduce of cost. The gap between cost of service before developing and cost of service after developing gives amount could be used as tricks.

Developing tools is way of managing risk. It must be successful to meet Islamic bank problems and must be measured by accounting data amount, time and place in financial statement. In 2006 there was study of developing Simple Morabaha Service to be Morabaha Based on Order. Developing reason comes as result to avoid store goods cost. Nazal (2006) explained the reason of applied Morabaha Based on Order and its success in Jordanian Islamic banks to meet installment buying default, cost and liquidity. He used questioner and found that Morabaha Based on Order did not success as expecting.

Ways of managing risk as transfer risk or reduce risk is impacted portfolio of Sukuk. Jordan Islamic bank. It had increased his Sukuk risk in 2016 than 2015, it added other portfolio with risk degree equal BB-but it was in 2015 two portfolios with risk degree equal A and BB, see Table 4:

| Table 4: Sukuk Risk In Jordan Islamic Bank By S&P In 2016 | ||

| Sukuk classified of risk amount | Organization of classified risk | Risk degree |

|---|---|---|

| 4608500 | S&P | A |

| 10475744 | S&P | BB |

| 37760000 | S&P | BB- |

Resource: Jordan Islamic Bank annual report (2016)

Risky of assets will reduce his credit classification and obligate rules to reduce amount of investing in order to reduce risk.

Managing Disclosure Problem

There is change of service cost and return because of managing ways and organization structure changing. Islamic bank is increasing its investing structure of increased type of investing in companies and project besides financial market investing, (see Table 5):

| Table 5: Jordan Islamic Bank Investing In Companies | |

| Company name | Company type |

|---|---|

| International Commerce Jordan Center Company | Commerce |

| Aqarko Company | Building |

| Al Ameen Investing Company | Services |

| Islamic Insurance Company | Insurance |

| Al Rizq commerce Company | Commerce |

| Al Omaria Schools Company | Education |

| Future Technical Applied Company | Services |

| Al Samaha Building Company | Building |

Resource: Jordan Islamic bank annual report.

Structure of invest risk and profit will be impacted by every type of Islamic bank investing. Structure of investing is divided to invest in the bank by bank services and invest out the bank by sharing investing in companies. Managing investing mix structure must be profitability. Islamic bank evaluation depends on success of this mix, therefore Jordan Islamic bank accounting must understand Islamic bank service cost and profit impact of Islamic bank investing in that companies. This risk comes to change investing structure as in sharing in Arab company of Metal Pipes Manufacturing Industry which is cost reduce of the Jordan Islamic bank evaluation after loss and to reduce the equities value of company. Its equities reduced from 3910589 JD in 2014 to be 3716488 JD in 2015, see Jordan Islamic Bank annual report (2015).

Economic Disclosure Problem

As result to Islamic bank invest in real projects and companies in different types of economic sectors as industry, commercial, services and agriculture there was problem of increasing resources costs as oil, government electrical services, government water service and tax. increasing of cost without increasing return cause losing, also The Impact of Foreign Direct Investment on business organizations success in Jordan is not supporting growth of local economic because of local companies cleared from the market. See changes based on Jordan center bank data as in Tables 6 & 7:

| Table 6: Registered Companies By Economic Activity Based On The Capital Of Company Changing (Capital In Millions Of Jd) | ||||||

| Market sector | 2010 | 2011 | 2012 | 2013 | 2014 | result |

|---|---|---|---|---|---|---|

| Companies year | ||||||

| Agriculture | 100.9 | 332.1 | 35.3 | 29.3 | 30.4 | reduced |

| Industry | 88.5 | 25.9 | 60.1 | 163.3 | 58.2 | reduced |

| Commercial | 70.8 | 204.9 | 63.5 | 53.8 | 43.1 | reduced |

| Services | 82.5 | 54.3 | 64 | 81 | 52.9 | reduced |

Resource: Jordan center bank statically monthly announcement (2015).

The last Table 6 shows reducing of capital between 2010-2014 which means there was risk of losing capital in companies within Agriculture, industry, commercial and service fields. This risk increase by increasing tax as in the next Table 7:

| Table 7: Central Government Domestic Revenues In Jordan (Tax In Million Of Jd) | ||||||

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | Result |

|---|---|---|---|---|---|---|

| Tax revenues | 2986 | 3062.2 | 3351.4 | 3652.4 | 4037.1 | increased |

Resource: Jordan center bank statically monthly announcement (2015).

The Table 7 shows that the increase of tax from 2010-2014 happened in spite of reducing local Jordan companies' capital which means that: There is misunderstanding of economic disclosure.

Auditing Reports Value

In Jordan all companies are responsible to give correct financial statements based on the international accounting standards as obligatory disclosure but it is not their responsibility to give all accounting data as footnotes because of its secrets. This type of disclosure is voluntary based on company promotion to show organization success and support its shares demand in financial market. Financial analyst accepts the financial statements which stamp by legal external auditor as trust to avoid frauds. Practically, financing, investing and saving are evaluated by accounting data in financial statements. Success of financial analysis is impacted by degree of accounting data acceptance which never reaches correctly with 100%.

Auditing Reports Value for Direct Investing

Jordan Islamic bank supports his asset risk to keep its value in suitable amount. Jordan Islamic bank owned Sanabel Al-Khier Company for Financial Investing. There was reducing of return in spite of increasing equities to support this company. Equities were in 2008 equal 9418125 JD and because of crises in 2010 the bank support equities increasing to meet crises. It became in 2016 it had equities equal 12950329 JD but return was reduced, see Sanabel Al-Khier Company for Financial Investing annual report (2016).

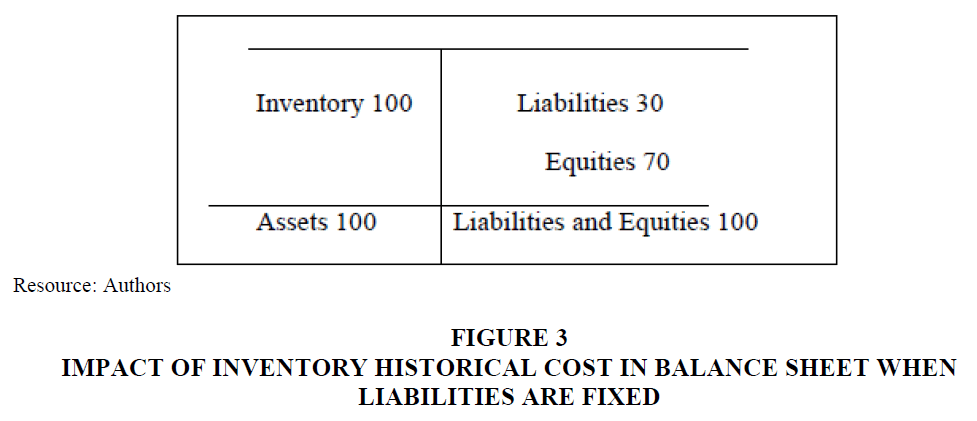

Islamic rules impacts accounting policy in financial tables. It obligates to give market value as fairly value. By comparing between historical cost of inventory and market price of inventory, there will be different information to make different decision, (see Figure 3):

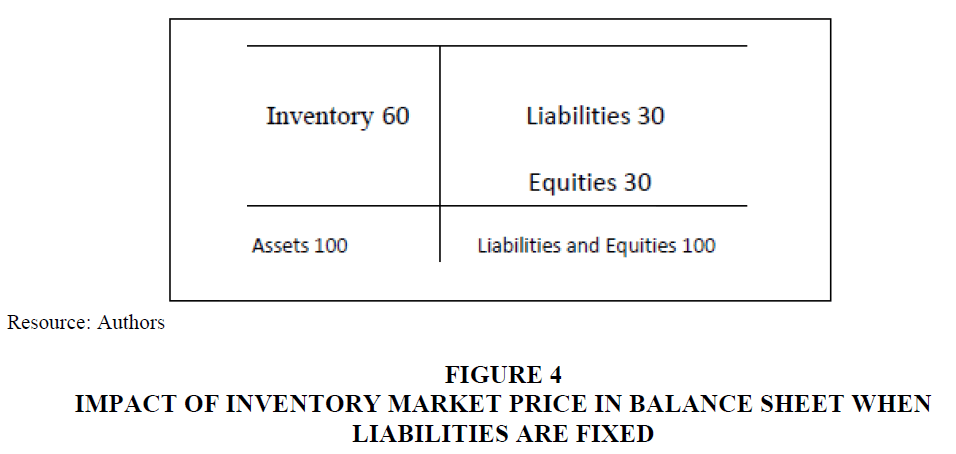

Suppose the inventory market value became 60. This will effect on the balance sheet to be changed by reduce equities when liabilities are fixed, (see Figure 4):

By comparing between Figures 3 & 4, the auditing information in Figure 3 will courage investor to buy the company shares but Figure 4 will courage investor to avoid deal with this company because of losing equities?

Auditing Reports Value for Speculator

Speculators became three types as follow:

1. Speculator in local financial market by himself: he followed raising tricks of shares price as cattle and buy shares up to rumors in financial market which were in growing case. The impostor investor gave 25% of capital monthly to capital owner. That case courage customer to collect cash from friends, family and loan in order to give cash to the impostor investor. This step came after trust him to keep investing for months without get return in order to get the highest profit. The impostor investor gets millions and told his customers that he was lost all money. This was big crimes in Jordan in 2010.

2. Speculator in local financial market by authorized other speculator: he trusts some speculators and gave those capitals up to gamble. In 2010 there was Jordanian financial crises led to loss. This loss in Jordan came as result to Jordanian companies' weakness and speculating in international markets. Jordan Islamic bank owned Sanabel Al-Khier Company for Financial Investing. It is Brokerage Company in Jordan financial market. Its rule obligates to deal with common shares owned by companies that avoid interest on loan. It avoids derivatives. It is profit reduced because of losing trust in market but it not cleared in financial crises. The company annual report showed in 2008 net profit after tax equal 2105937J D and equities equal 9418125JD. (Sanabel Al-Khier Company for Financial Investing Annual Report, 2016). This showed ratio of (return/equities)=22.36% which showed strength point of return. By comparing between this result and result in 2016 there was reducing of return in spite of increasing equities. In 2016 it had equities equal 12950329 JD and profit after tax equal 253277 JD while in 2015 it had equities equal 12000691 JD and profit after tax equal 215710 JD, see Sanabel Al-Khier Company for Financial Investing annual report(2016). Ratio of (return/equities)=1.955% which showed weak of return. Reduced of ratio was after financial crises in 2008. This means Jordanian financial crises had taken time after the international financial crises in 2008 also in spite of applying Islamic rules and increasing equities in Sanabel Al-Khier Company for Financial Investing, It faced high reduced of profit after tax. Jordan Islamic bank has investing by own shares in associated companies. Its investing reduce from 15554640 JD in 2014 to be 15065698 in 2015, also it had been reduced to be 7658670 JD, see Jordan Islamic Bank annual report (2015) and Jordan Islamic Bank annual report (2016).

3. Speculator in international financial markets by them self or by other speculators: He used computer linking or internet, in 2008 there was international financial crises led to loose. This lost in Jordan came as result to international dealing by internet concentrating on future contracts. The speculator problem comes as result to unused financial statements' analysis which increases unexpected lose; also there were gaps between financial statements results and the company sharing price in the financial market. See the history study examples in Table 8.

| Table 8: Negative Gap Between Financial Statements In The Unsuccessful Company And Its Share Price In The Market | ||||||

| Financial Statements Items | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|

| Assets | 100000 | 108000 | 107000 | 107000 | 110000 | 115000 |

| Liabilities | 40000 | 45000 | 39000 | 39000 | 38000 | 38000 |

| Net profit after tax | 10100 | 10050 | 10040 | 10030 | 10030 | 10030 |

| Share Price | 10 | 7 | 6 | 4.4 | 4 | 3.5 |

Resource: Authors.

Dealer follow net profit increased regardless of losing investment by reducing assets value and increase liabilities. This case shows that speculation does not care about financial statements, therefore, they increase share price up to increase demand (Table 9).

| Table 9: Negative Gap Between Financial Statements In Successfully Company And Its Share Price In The Market | ||||||

| Financial Statements Items | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|

| Assets | 110000 | 108000 | 107000 | 107000 | 100000 | 100000 |

| Liabilities | 30000 | 33000 | 35000 | 36000 | 38000 | 38000 |

| Net profit after tax | 10000 | 10010 | 10000 | 10000 | 10010 | 10000 |

| Share Price | 5 | 6 | 7 | 7 | 8 | 8.5 |

Resource: Authors.

Speculators follow rumors. They do not read the financial statements and speculate by reducing demand which reduces the company share price. Rumors affect negatively on company reputation in spite of success. Speculators are not interested in the report result because the result of Islamic bank is announced in annual report and there needs is daily to cover their speculation.

In last financial crises in Jordan, speculators got profits in the first dealing and then they increased the speculation capital from friends, loan and family after that they lose as result to ignore and lose experience. They did not get advice from financial analyst as expert in speculation. Many dealers in the financial market do not know the financial statements or cannot read it. In 2016 there was low dealing in Jordan financial market because of losing trust and some companies was cleared.

Conclusion

Financial performance report of Jordan Islamic bank shows currently success in saving, investing, financing and estimating future success. Jordan Islamic bank financial performance report impact results of companies as customer and investing. Weakness will give false result and impact negatively Jordan Islamic Bank reputation, shares price, profitability and risky. Jordan Islamic bank faced reducing in his investing value and profitability which needs to find weak. It can be found by understanding auditor type, auditing reports gap and auditing reports value. Results found that there is gap in Jordan Islamic bank based on auditor types. Internal auditor, (SIB) and external auditor must have experiences and linking to balance between law accounting standards and Islamic rules in order to unit financial performance result in financial statements. Financial statements annual report gives generally financial performance result without give 100% of assurance. This auditing reports gap may come as result to transfer risk of auditing result to other auditor, using ignorance word in the report and misunderstanding of accounting disclosure, financial disclosure, management disclosure and economic disclosure. Auditing reports value depends on the user of auditing reports' result. Almost speculators in Jordan are not interested of the report result because result of Jordan Islamic bank and his sharing in companies is announced in annual report and their needs is daily to cover their speculation. On other hand, speculators in Jordan need experience to understand crises and tricks impact. It is important to make obligatory cooperation between (SIB), External auditor and internal auditor based on Islamic rule of currently market price in order to balance accounting data daily and to give daily financial table by internet or phone. There is need to apply Islamic rules standards of accounting and finance. It is more standard than law because of limit changing and show more explanations but it needs professional Fiqh contracts accountings and finance.

References

- Al Khaiat, A. (2000). Purposes of the law and jurisprudence. The commercial Dustor publisher, Amman, Jordan.

- Amin, M. (2011). What are AAOFI’s proper accounting standards rule? Islamic financial news magazine, Amazon co.UK.

- Asian Oceania Standards Setters Group (AOSSG). (2010). Financial reporting issues relating to Islamic finance. Second meeting of (AOSSG), Tokyo, Japan.

- Atmeh, M. & Abu Serdaneh, J. (2012). A proposed mode for accounting treatment of Ijrah, published by Canadian center of science and education. International Journal of Business and Management, 7(18), 51-53.

- Atmeh, M. & Alzabi, Z. (2014). The role of the audit profession in strengthening oversight and anti-corruption. 10th International Scientific Conference Professional, Magazine of Jordanian Society of Chartered Accountants.

- Auditor journal. (2014). The role of the auditing profession in strengthening supervision and combating corruption. 10th International Scientific and Professional Conference, Jordanian Association of Certified Public Accountants.

- Avazzadehfath, F. & Raiashekar, H. (2011). Decision-making based on human resource accounting information and its evaluation method. Asian Journal of Finance & Accounting, 3(1), 1-10.

- Bullen, M. & Kel-Ann, E. (2010). Human resource accounting and international developments: Implications for measurement of human capital. Journal of International Business and Cultural Studies, 3(1), 5-13.

- Frederick, V.P. & Scheherazade, S.R. (2011). Globalization of Islamic finance: Myth or reality? International Journal of Humanities and Social Science, 1(19), 117.

- Gupta, R. & Gill, N.S. (2012). Prevention and detection of financial statement fraud-an implementation of data mining framework. International Journal of Advanced Computer Science and Applications, 3(8), 152-154.

- Hasan, Z. (2008). Islamic banks: Profit sharing, equity, leverage and credit control.

- Hassan, M.K. & Bashir, A.H.M. (2003). Determinants of Islamic banking profitability. 10th ERF annual conference.

- Heinze, J., Diermeier, D. & Uhlmann, E. (2014). Unlikely allies: Credibility transfer during corporate crises. Journal of Applied Social Psychology, 44(5), 392-397.

- International Federation of Accounting (IFAC). (2010). International accounting standards in public sector.

- Jaber, R.J. & Nazal, A.I. (2016). The relationship between Sharia ’a supervisory board and external auditor: Evidence from Jordan. International Journal of Managerial Studies and Research, 4(11), 106-112.

- Jarhi, M. (2003). Monetary policy in the Islamic framework. Islamic Economic Studies, Kingdom of Saudi Arabia, 9(1-2), 62.

- Jordan center bank statically monthly announcement. (2015). Department of searching. Amman, Jordan.

- Jordan Islamic bank annual report. (2015). Retrieved from http://www.jordanislamicbank.com/usersfilenew/folder/files/report2015s2.pdf

- Jordan Islamic bank annual report. (2016). Retrieved from http://www.jordanislamicbank.com/sites/default/files/IB_AnnualReport_2016_8_10_LOW.pdf

- Kamal, Y. (1986). Zakat and rationalization of contemporary insurance. Dar Al Wafa Publisher.

- Lucouw, P. (2013). Interpreting financial statements. Journal of Finance and Investment Analysis, 2(1), 69-71.

- Nazal, A. (2006). Impact of Islamic rules on developing Islamic services in Jordanian Islamic banks-theoretically and practically study. Doctoral dissertation, Arab Academy of finance and banking sciences, Amman, Jordan.

- Nazal, A., Wadi, M. & Samhan, H. (2010). Relationship between center banks and Islamic banks. Al Wefaq publisher, Amman, Jordan.

- Pittaway, L., Robertson, M., Munir, K., Denyer, D. & Neely, A. (2004). Networking and innovation: A systematic review of the evidence. International Journal of Management Reviews, 5-6(3-4), 137-168.

- Sanabel Al-Khier company for financial investing annual report. (2016). Retrieved from http://www.ufico.com/aseAnouncements/1426485.pdf

- The manufacture of material pipes is company annual report. (2016). Retrieved from http://www.ufico.com/aseAnouncements/1431768.pdf