Research Article: 2021 Vol: 24 Issue: 6S

World Experience in Venture Entrepreneurship and Probability Model for Risk Assessment of a Venture Project

Elena Rostislavovna Schislyaeva, Saint Petersburg State Marine Technical University

Olga Anatolievna Saychenko, Saint Petersburg State Marine Technical University

Abstract

This article covers the directions and methods of state support for venture entrepreneurship. This study reviews the experience of the USA, Israel, South Korea, Japan, and China. The purpose of the study is to identify the key principles of state support for venture entrepreneurship in order to propose future recommendations for development of domestic practice of support of venture activities. In the course of the study, the authors have drafted a set of principles for implementation of effective state support of venture entrepreneurship. The result of the study is the development of a stochastic economic and mathematical model for assessing profit from the sale of innovative goods, technologies, programs, patents and other outcomes of intellectual activities. The developed mathematical model of the study is based on probabilistic principles. The authors draw up a mathematical description using the theory of stochastic processes, only approximate estimation of demand for the results of venture research and development by the consumer pool in advance is possible. In addition, it is possible to estimate the possible profit from the sale of innovative goods, technologies, programs, patents and other outcomes of intellectual activities only from a probabilistic point of view.

Keywords

Innovation, Venture Entrepreneurship, Venture Mechanisms, Government Support, Technology Park

Introduction

Innovation activity is a complex multilevel concept. It includes not only development of a new technology, original ideas and creation of a new product. The following is also extremely important: diffusion (distribution) of innovations (Barykin et al., 2021a), creation of new market sectors, adaptation of new products and technologies for other areas.

Currently, there is a tendency towards decreasing the level of dependence of economic systems of most developed countries and large developing countries of the world on raw materials. At the same time, the economies of these countries are increasingly becoming intelligent (Barykin et al., 2021e). This is manifested by the growing demand of economic systems for such new phenomena as cluster organization of entrepreneurial activity, production and global outsourcing of various services, technologization and digitalization of financial instruments, as well as the venture capital.

In addition, today, knowledge and new entrepreneurial ideas that ensure production of globally competitive intellectual products are the determining factor in development of production both globally and nationally. Thus, the entrepreneurial structures of various countries are anchored in the high-tech sectors of the global world economy.

One of the fundamental elements of the modern knowledge-based economy is the venture capital, in terms of which small innovative enterprises get an opportunity to obtain funding for development and marketing of innovative technologies. In this regard, the venture segment of the financial market needs certain conditions for effective functioning, including the availability of state support.

The mathematical model applied in this study is based on probabilistic principles. Since only approximate estimation of demand for the results of venture research and development by the consumer pool in advance is possible, we draw up a mathematical description using the theory of stochastic processes. Also, estimation of the possible profit from the sale of innovative goods, technologies, programs, patents and other outcomes of intellectual activities is possible only from a probabilistic point of view.

Investment in a venture enterprise implies entering the consumer market with an innovative product in order to displace the previous generation of the product through the use of new technologies or through possession of other consumer functionality. Accordingly, it is also necessary to take into account the consumers’ inertia and the resistance from other competing participants in this segment of market offer.

The mathematical formalisms we apply thus contain a probabilistic matrix, the elements of which are obtained on the basis of statistics of consumer demand for the previous product and a forecast of demand for the innovation. We will also determine the periodicity of product turnover when a consumer is looking for replacement due to either natural wear and tear or non-compliance of characteristics with modern requirements. The duration of such periods, according to the Markets and Markets research, ranges from one month for FMCG up to several years. The reasons for turnover are also various. For example, for computer software, obsolescence is most often associated with increasing requirements to processor performance and memory capacity, as well as with the operating system generation change, which requires the development of new applications. Household appliances are becoming more cost efficient with the development of technology, smart devices are in trend, and the desire of consumers to update the design of their homes plays the decisive role. For a wide range of electronic devices, the turnover period is even shorter and is determined by constantly increasing minimum characteristics for operation of new applications and application programs.

Materials and Methods

The Review of the World Experience

The problem of provision of state support to venture entrepreneurship is discussed by many researchers. Avnimelech & Harel review the development of the venture industry in Israel and assess the effectiveness of state venture activities (Avnimelech & Harel, 2012).

Chen S. also reviews the processes of development of the Chinese venture industry, identifying the principles of state support for venture entrepreneurship at the present stage (Chen, 2020).

Dalal compares the basic principles of operation of the venture market in China and Japan, and also compares their effectiveness (Dalal, 2020).

Kuratko & Hornsby investigate options for state participation in venture activities in developed and developing countries, as well as directions of financial support for innovative entrepreneurship (Kuratko & Hornsby, 2020).

Paterno V. reviews the experience of the Asia-Pacific countries in formation of the venture industry and the support it receives from the state (Paterno, 2019).

Thus, the problem of state support for venture entrepreneurship attracts the interest of scientists in different countries.

The authors prove that the innovative development of the national economy can be considered a key factor contributing to achievement of a balanced and stable nation-wide socio-economic growth. In this regard, the need for large-scale and sustainable innovative development shall be noted, which should be distinguished by sufficient dynamism in accordance with the pace of changes in the external environment.

To carry out innovative activities and achieve sustainability and large scale of innovative development, an appropriate innovation infrastructure is necessary. The innovation infrastructure includes a set of channels for dissemination of various types of information (patent information, market information, scientific and technical information), as well as organizational methods and financial tools for enhancing this type of activity.

The key components of implementation of innovative activities in modern conditions are entrepreneurship, new technologies and financial resources. The active development of small innovative enterprises today is based on lowering of institutional and other barriers to enter the market, under the conditions of the dynamic market environment which encourages enterprises to constantly search for new market niches.

In turn, the active development of technologies in modern conditions is happening in the context of rapid accumulation of a wide range of knowledge, which acts as a source to increase the level of entrepreneurial activity, including small business. Technological breakthroughs create opportunities for capitalization growth based on the productive use of a set of new knowledge gained. In addition, in modern conditions, financing of entrepreneurial initiative is carried out in the context of active liberalization of the financial market. It was venture mechanisms that made it possible to achieve such liberalization by lowering the financial barrier for small innovative enterprises to enter the market (Ibrahim, 2018).

Obviously, in order for venture mechanisms to fully operate within the national economy, it is necessary to observe a set of conditions that provide a favorable investment climate for all participants in the capital market and for venture investors. Let’s outline the key conditions:

- A developed stock market;

- The presence of “long-term money” in the economy;

- The presence of tolerance to possible failures of innovators;

- A network of channels and platforms to exchange information between investors and researchers;

- Tnspiration for generating new ideas and innovative products;

- A developed system for protection of intellectual property.

In addition, a favorable tax climate facilitates the development of venture mechanisms.

The United States of America can be considered the origin of venture financing for innovative activities, as well as the most striking example of active development of venture mechanisms and the positive impact of venture entrepreneurship on the development of the national economy. It was in the United States in the mid-50s of the twentieth century where the formation of the first mechanisms and institutions for implementation of venture investment in innovative enterprises started.

It should be noted that the concepts of “venture” or “venture financing” did not exist in the middle of the twentieth century. Moreover, most investors were not interested in risky investments in innovative enterprises and did not believe in justification of such investments.

The establishing of American Research & Development (ARD), the first private equity fund, can be considered the official starting point for development of venture entrepreneurship in the United States (Berger & Hottenrott, 2020). The purpose of this fund was to invest in high-risk innovative enterprises. The institutional investors participating in the fund activities included various investment companies, trust funds, insurance companies, as well as individual universities, for example, the Massachusetts Institute of Technology, the University of Pennsylvania and others.

From the moment of its establishment, the ARD Fund has carried out a very strict selection of companies for investment through a thorough review of their business plans. As the result, the ARD Fund invested annually no more than 4% of the total number of companies that applied for funding. For almost 30 years of the history of the ARD Fund, 126 different business projects have received funding. 13 funded business projects related to the chemical industry, 16 funded projects were involved in manufacturing of industrial equipment, and 14 funded projects were involved in electronics manufacturing. The capital of the ARD Fund grew at approximately 7.4% per year (Murray, 2021).

The actual creation of the first venture fund was followed by the development of a system for legal regulation of the innovative business investment practice. The US government implemented legislative reforms and in 1958 adopted an innovative development program which was based on the activities of the institutions of Small Business Investment Companies (SBIC). SBIC institutions were supposed to act as functioning institutions to support small innovative businesses. SBIC’s functions included provision of financing and loans to small businesses and consulting support to small innovative businesses.

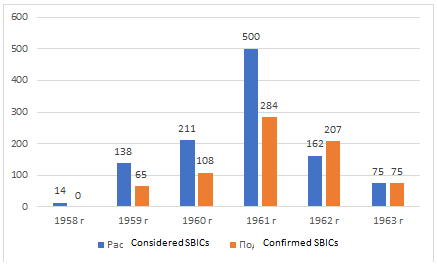

Figure 1 is drawn up by the authors on the basis of data (Dursteler, 1966) and illustrates the dynamics of establishing of new SBIC institutions in 1958-1963.

Figure 1: Dynamics of the Number of Applications for Establishing of New Sbic and Confirmed Licenses for Establishing of Sbic

The number of applications for establishing of new SBIC institutions peaked in 1961 when it amounted to 500. The number of SBICs established also peaked in 1961, when it amounted to 284. The structure and principles of SBIC operation assumed that any small innovative enterprise can, if necessary, apply to a SBIC branch of any state and, based on the results of the application, get several different financing options to choose from. In addition, an innovative enterprise with high potential for future growth could be offered favorable financing terms by several different SBICs at the same time.

The most common funding model used by SBIC institutions was that a SBIC institution gained a certain share of capital of an innovative enterprise that had received funding. In such a case, the size of this capital share varied depending on a set of various factors that were considered markers of the risk of investment in a particular enterprise.

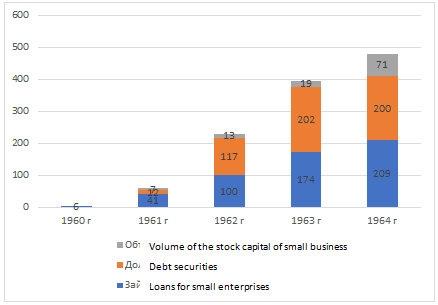

The investment portfolio of an average SBIC institution usually included a variety of innovative businesses, both high-risk enterprises and innovative enterprises that could count on stable market growth. The volume of loan portfolios of all SBIC institutions is illustrated in Figure 2 (drawn up by the authors on the basis of data (Dursteler, 1966). In five years, it increased from $ 6 million to $ 480 million.

It should be noted that the financial crisis that broke out in 1962, which led to a noticeable contraction of the American economy, had little effect on the dynamics of SBIC investments. One of the factors in maintaining the positive dynamics of investment in small innovative business was the fact that SBIC institutions covered 80% of capital invested in small enterprises at the expense of private investors, without relying on state support.

At the end of the 90s of the twentieth century, the modern stage of development of the American venture market began. Over the past years, the culture of venture investment, institutions supporting venture entrepreneurship and governmental programs aimed at developing small innovative businesses have formed in the United States. The rapid development of information technology and globalization processes have determined a sharp growth in the American venture capital financing market. The rapid growth of venture investments in small innovative businesses led to the active development of the high-tech economy sector. For example, in 2000 the share of the high-tech sector in the US GDP amounted to 20%, by 2020 it increased to 27%.

Let’s proceed to the analysis of Israel’s experience in development of venture entrepreneurship through state support (Table 1, drawn up by the authors on the basis of data (Avnimelech & Harel, 2012).

Before 1985, no policy of developing private R&D initiatives existed in Israel. Budget funds were applied towards development of state-owned enterprises and scientific and technical institutes, and the support of innovative business was of selective nature and was carried out through provision of grants to innovative enterprises.

In 1985, the Industrial R&D Promotion Act was adopted. It assumed establishing of an institution for supporting innovative business, and the Main Scientific Directorate acted as such institution.

| Table 1 Indicators of The High Technology Sector In Israel, 1969-2000 |

|||

|---|---|---|---|

| Indicators | 1969-1984 | 1985-1992 | 1993-2000 |

| Number of new enterprises in the high-tech sector | 136 | 297 | 2224 |

| Number of venture funds | 0 | 2 | 61 |

| Capital raised by venture companies, million dollars | 0 | 85 | 7155 |

| Number of IPOs in the US and the EU | 14 | 19 | 133 |

| Number of significant buyouts by strategic investors | 0 | 2 | 91 |

| % of ICT in total industrial exports | 14 | 28 | 53 |

| % of foreign investment in financing of startups | - | - | 67 |

| Share of R&D in GDP | 2.4 | 2.6 | 4.5 |

Under the patronage of the Main Scientific Directorate, in Israel 2 venture funds were established, which invested in small innovative enterprises and in 8 years managed to raise capital in the amount of 85 million dollars. At the same time, foreign investors were not allowed to finance startups at the early stages. The reforms started in 1985 led to the active development of the high-tech sector of the Israeli economy, which intensified even more in the period from 1993 to 2000.

In 1992, under the leadership of the Israeli Ministry of Industry and Trade and the Main Scientific Directorate, a special Yozma program was launched to support small innovative businesses. The program was aimed at creating a business community that will engage primarily in innovative entrepreneurship.

Principles of operation of the Yozma program:

- Stimulating high-tech Israeli exports;

- Accelerated creation of the most competitive and efficient environment in all available segments and sectors of the innovative economy in Israel;

- Non-interference of the state in the current activities of venture funds.

Yozma is a kind of “fund of funds” that finances a number of lower-level venture funds, which are controlled by the parent fund. Each of the lower-level venture funds can receive $ 20 million from the parent fund (Avnimelech, 2002). For this, a venture fund must fulfill a number of prerequisites: attracting at least one Israeli investor and one American or European investor having a good reputation in the venture market.

The parent fund provides financing to the subordinate funds free of charge. In turn, lower-level funds invest in small innovative enterprises, and the state’s share in the capital of enterprises that received funding amounts to 5-7% (Razin, 2018). In prospect, the funds are not obliged to reimburse the parent fund for the amount of investments that haven’t brought any profit. At the same time, funds can buy out the state’s share in the capital of innovative enterprises that are showing growth.

The design of Israel’s Yozma program assumed that opening the Israeli venture market to foreign investors through a network of venture funds would entail attracting many highly qualified professionals in the venture industry to the Israeli venture market. Thus, the Yozma program served as a platform for informal consulting of Israeli venture funds and small innovative enterprises.

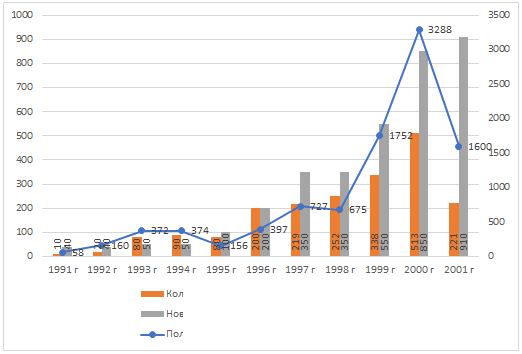

Figure 3 is drawn up by the authors on the basis of data (Avnimelech, 2002) and illustrates the dynamics of development of the Israeli venture market in 1991-2001.

Within the period from 1991 to 2001, the number of new startups emerging increased from 40 to 910 per year. And the number of startups supported by funds increased from 10 to 221. The amount of funds received by startups increased from 58 to 1600 million dollars.

Let’s review the experience of the newly industrialized countries of the Asia-Pacific Region in development of the venture market through state support (Paterno, 2019).

In Japan, the Japanese Ministry of Economy, Trade and Industry acts as the developer of the innovation development strategy in the small business sector. The Ministry took a number of institutional measures aimed at improving and developing the small innovative entrepreneurship sector. Within the framework of the legislative acts adopted in the period from 2000 to 2010, such measures as tax breaks for small innovative enterprises, provision of various preferential loans to science-driven startups (Dalal, 2020), as well as subsidies (Kwon, 2020) were provided. Moreover, for the most successful and promising innovative entrepreneurs in Japan, a special support infrastructure was established, which set of tools included a special insurance system for innovative enterprises against unforeseen situations.

In addition, the Japanese experience in creating such a legal environment that facilitates the attraction of private venture financing is remarkable. For example, a set of measures to activate venture entrepreneurship was provided for by the legislative act “The Law concerning the Promotion of Creative Activities of SMEs”. In particular, the establishing of the “Limited Partnership for Venture Capital Investment”, intended for investing in local innovative venture enterprises, was secured in legislation. The participants in these partnerships typically include a variety of interested companies. In addition, a special SMRJ agency must be present as one of the partners in the partnership.

Also, in Japan, special Venture Entrepreneurship Support Centers have been created, which provide information support to science-driven startups in various areas. In particular, they train entrepreneurs on subjects such as new industrial and information technologies, modern methods and practices of enterprise management, functioning of the securities market and the venture market (Reich, Robert & Mankin, 2017). Training of entrepreneurs is carried out in the form of online and offline lectures, as well as practical exercises. Besides, the centers provide advice to Japanese technology parks and Japanese business incubators. The centers provide advice on conducting of innovative business in modern conditions, expanding of sales networks of innovative enterprises and entering the foreign market. The centers also provide advice to entrepreneurs in the field of intellectual property rights and copyright protection. In addition, the Japanese Venture Entrepreneurship Support Centers are constantly collecting information about successful domestic entrepreneurs and various aspects of their activities.

In South Korea, the problems of innovative development, including the small business sector, have been considered since 2008 by two ministries, the Ministry of Knowledge Economy and the Ministry of Education, Science and Technology. These ministries provide small innovative enterprises with advice on priority areas for further development and also with loans and subsidies.

The practice of state support for small innovative businesses in South Korea provides for implementation of 8 different programs of technical support, as well as 35 different programs in the field of financial assistance for innovative enterprises (Paterno, 2019). In addition, a national venture fund called the “Small Business Corporation” was established to support domestic venture companies in South Korea. Its authorized capital in 2020 amounted to USD 250 million. This venture fund is actively involved in financing the seed stages of high-tech Japanese startups with high potential for economic growth. As the result, the share of such startups in the total investment portfolio of the national venture fund increased from 45.2% to 51.8% over the period from 2011 to 2020 (Paterno, 2019).

The Chinese revolution in the field of high technology began in 1988 when the Chinese Ministry of Science and Technology launched the national scientific and industrial program “Torch”. As the result, high-tech innovation areas have been created across the country to accumulate resources, money and talent.

However, by the mid-1990s, the system of supporting and stimulating venture capital existing in China at that moment proved to be ineffective. The reasons for such inefficiency of the established system of supporting the venture capital market were the lack of financial resources for investment and the lack of an effective and objective system for competitive selection of fairly promising projects. This was associated with the fact that banks were not interested in investing in high-risk projects at the initial stage of innovative development. As the result, universities and institutes were forced to allocate their own funds to finance promising technological projects. Besides, venture projects for provision of financial support were selected not in accordance with the principles and indicators of investment efficiency, but on the basis of a set of non-commercial parameters.

In 1996, a law was adopted that allowed to create venture funds in China, that were entitled to operate in the country on a commercial basis. In addition, in 1996, the Chinese government independently created over 20 state venture funds (Chen, 2020). These venture funds were assumed to receive funding at the regional level. In addition, the Chinese government sent a special delegation to the United States to comprehensively study the American experience and practice of organizing venture investments in innovative enterprises. Already in 1997, the first foreign investors appeared in the Chinese venture capital market.

In 1999, the State Council of China established a special Innovation Fund, “Innofund”, to provide start-up funding to small and medium-sized innovative enterprises. This fund integrates the capital of local government bodies, various enterprises, investors, as well as financial institutions. Innofund funds were applied to support over 30,000 different venture projects. As the result, Chinese innovation enterprises received over 19 billion yuan from the fund. Today, Innofund continues to provide seed funding to Chinese innovative enterprises, using tools such as providing grants to high-tech startups, subsidizing all or part of the interest rates on loans provided, and investing in shares of small innovative enterprises (Chen, 2020). In 2007, the Chinese Ministry of Science and Technology established “management funds” to stimulate growth and raise capital for technology companies. The funds act as “fund of funds” investing in venture capital in industries of interest, as well as co-investors together with other venture investors. By 2018, in China no less than 2041 management funds have been operating, with a total investment of up to 5.3 trillion yuan (791.79 billion USD).

There is a large number of technology parks operating in China, within which the most promising companies and projects are continuously selected and nurtured.

Support and stimulation of venture capital in China comes from the legislative framework; also through the operation of free economic zones, scientific and technical industrial parks, productivity centers, technology business incubators and various types of venture funds, including management funds.

Methodology

To assess the likely economic impact of venture investments, data from the aggregate indicators of the marketing survey is required. The data can be obtained by statistical processing (Shmatko et al., 2021). For calculation, a planning period is required, associated, on the one hand, with the period of product turnover, and on the other hand, with the possibility of obtaining market reports on the demand for previous generations of the product, in the segment of which the targeted innovation and venture capital investments are carried out.

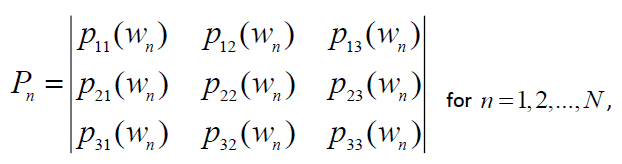

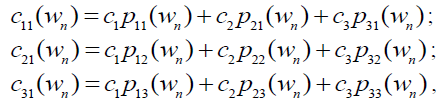

Statistical processing data are expressed as a set of consumer demand statistics matrices: {P1,P2,....,PN} Developing of such matrices is carried out by the method (Barykin et al., 2021b) of assessing random changes caused by many factors, such as a competitive market environment, changes in consumer preferences, economic and other (Barykin et al., 2021c) numerous reasons (Barykin et al., 2021d). After applying the expressions for processing statistical arrays, each of the matrices has the following form:

Where: Wn (at n = 1, 2, ....,N) is the value of a venture investment in a project.

Based on the presented formalisms of the probable market effect from interest in innovative products, as well as the consumers’ inertia, aimed at products of the previous generation, we will apply an algorithm for assessing the conversion of investments wn for n = 1,2,....,N in development and promotion of an innovative product (Sergeev & Kirillova, 2019).

This allows us to obtain forecast values for the dynamics of changes in consumer demand. As the result, the profitability of a venture investment can be estimated. Another advantage of this method is the ability to predict the development of the market presence and estimate the total profit from the simultaneous offer to the consumer of both generations of products in the case when investments are allocated to development of an enterprise producing the previous generation of a product. Since modern commerce is focused on consolidation into network structures (Golosnoy et al., 2019), then due to the growing scale of responsibility for spending funds on investments, such mathematical models have become an essential tool to support management decisions. In this context, the model allows to compare the risks of development and scaling of activities within the Spin-off concept, since upon launching an innovative venture enterprise within the parent company, this allows to reasonably plan the costs for developing industrial production of innovative products and for marketing. At the same time, it is possible to optimize competitiveness with a minimum of both financial and image risks.

Results

The Description of the Economic Mathematical Model

Let’s introduce the concept of a vector of the state of market demand C? = { c1, c2, c3 } . The constituent elements C? reflect the following quantitative indicators: c1- the number of consumers of the previous generation of a product during the planning period T; c2- the predicted number of consumers of an innovative product during the planning period T; c3- the number of consumers who have lost interest in this product or those who are interested in it but did not purchase it during the planning period T.

For calculation, we identify the estimated planning horizon and divide it into periods. As a rule, a period is taken as a period of time, after expiration of which the summary reporting data is provided. It is recommended to carry out the calculation on short horizons of months. The reason for this is that the parameters of consumer demand can change significantly over long periods of time. Note that for an abstract mathematical model, specific duration values of the period are not essential.

Then the probable volume of demand taking into account innovative products for the next planning period is calculated by the formulas:

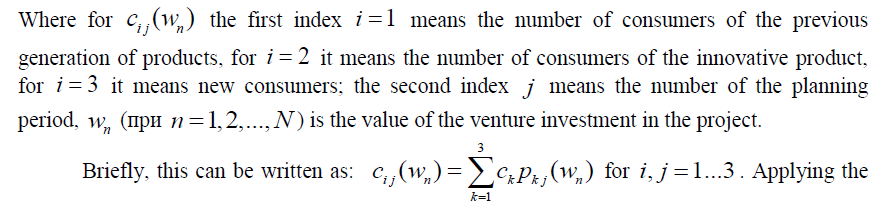

rules of matrix algebra, write this ratio in vector-matrix form convenient for programming and compiling algorithms:

rules of matrix algebra, write this ratio in vector-matrix form convenient for programming and compiling algorithms:

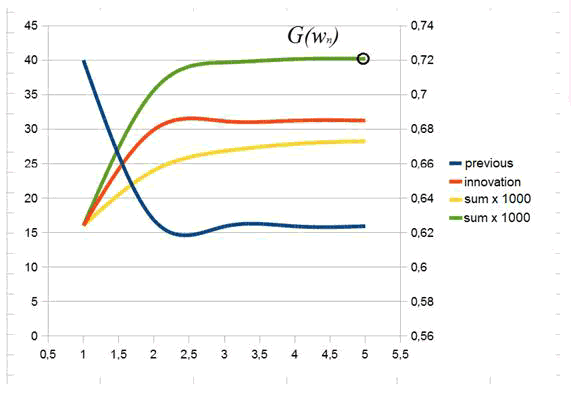

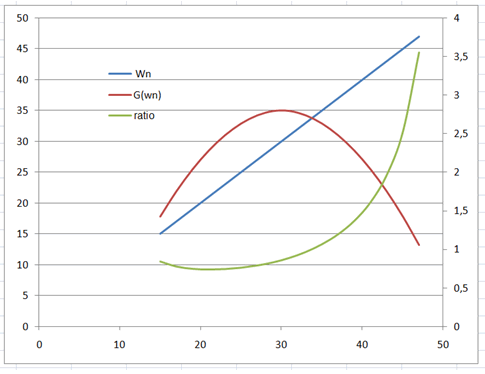

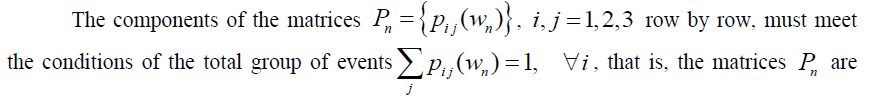

Figure 4 shows typical calculation results for one of the values of the consumer demand statistics matrix. In calculation, data were used from (Barykin et al., 2021a), using relative scalable variables.

Figure 4: Estimated Data on the Dynamics of Development of Demand for Innovation and for Anticipated Profit

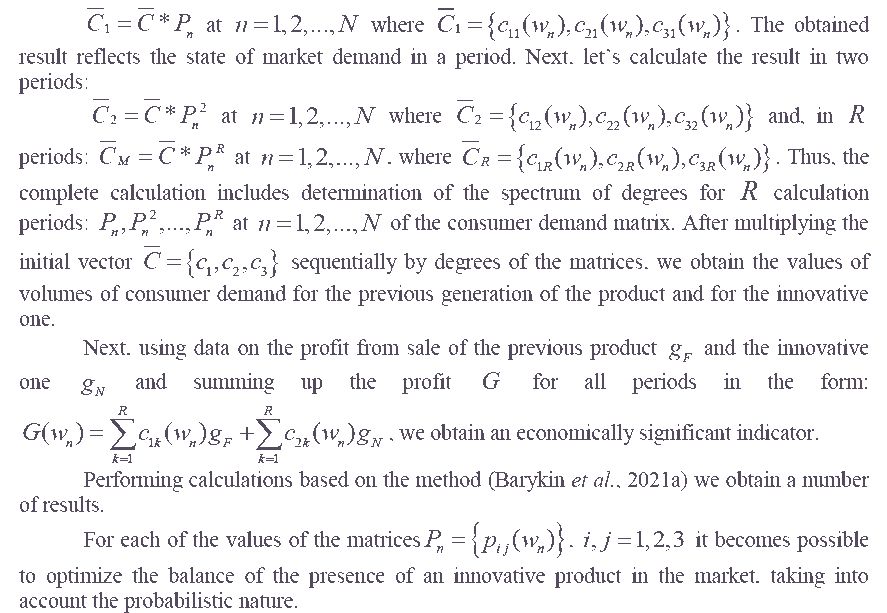

Building a dataset for each value of a venture investment will allow us to build a data vector on the probable profitability in dependence of G(wn) on wn (at n = 1, 2,..,N) - the value of the investment.

By combining the dependencies for all calculations for a set of matrices , Pn = {pij(wn)} , i, j = 1,2,3 we get the final diagram (Figure 5):

Additionally, risk ratio of investments is marked on the diagram.

Analysis of the Results

Applying of the method for predictive assessment of the probable effect of venture investments allows to assess the degree of risk of investing in an innovative product. Such calculations will differ greatly for possible investments in existing segments of economic activity, both in terms of the depth of the planning horizon, in terms of development time and product turnover, and in the degree of competition in the intended direction of investment. However, this method is fully scalable and invariant due to the use of computer calculations in relative units. Making a decision on the degree of risk is carried out taking into account all the factors known to investors. Additionally, it becomes possible to determine the spin-off expediency threshold of a subsidiary if there are prerequisites for development or improvement of a product with significant or probable potential. This is especially in demand in venture projects associated with a radical change in the structure of an existing enterprise, including personnel, price segment and management strategy. As we approach the threshold of the technological singularity, this practice is widespread and is considered as an essential element of development based on restructuring and constant search for a balance between risk and profit from venture projects.

Recommendations for the Russian Federation

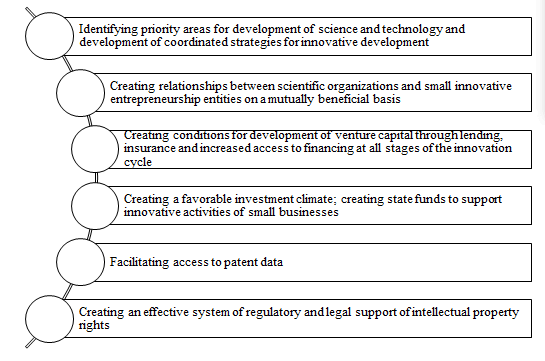

Effective cooperation between the state and innovative business shall be considered as an important aspect of active development of small innovative entrepreneurship and venture entrepreneurship on a national scale. Figure 6 shows the main directions of interaction between small innovative business and the state.

Accordingly, it is possible to identify the key areas of development of innovative entrepreneurship and venture entrepreneurship in the Russian Federation.

First, it is necessary to develop legal regulation of venture entrepreneurship, since today many aspects of operation of the venture capital market are not covered by legal norms.

Second, it is necessary to optimize the domestic patent system in such aspects as reducing administrative barriers to patenting, facilitating access to patent resources.

Third, it is necessary to improve the domestic banking system in such aspects as lending to small innovative businesses, usage of intellectual property as a pledge.

Fourth, it is necessary to develop the activities of the domestic stock market, attract massive non-professional investors and their resources, and develop the activities of venture funds.

Implementation of a set of measures in accordance with these areas will allow to achieve the development of domestic venture entrepreneurship and, accordingly, the innovative activities of small Russian enterprises.

Discussion

The authors strive to hold a discussion that the set of measures applied in different countries to implement state support for innovative entrepreneurship and venture entrepreneurship can be differentiated into different groups. First, one can distinguish measures of material support for innovative and venture entrepreneurship (providing enterprises with loans, subsidies, creating venture funds with state participation and making investments) and measures of intangible support (consulting assistance, information assistance, organizational assistance to small innovative enterprises). In terms of the degree and nature of the possible impact, the support provided by the state can be both direct (making targeted allocations from the state budget for various purposes) and indirect (various legal and organizational measures aimed at improving the investment climate and business climate). Also, state support can be carried out both on reimbursable and non-reimbursable basis.

Key areas of development of innovative entrepreneurship and venture entrepreneurship in the Russian Federation include development of legal regulation of venture entrepreneurship, optimization of the domestic patent system, improvement of the domestic banking system and development of the domestic stock market, and development of activities of venture funds.

Conclusion

Based on the results of the analysis of the world experience of state support for venture entrepreneurship, it is possible to identify the key areas of governmental activity that contribute to creation of an efficiently operating and developing venture market.

In particular, the following factors contributed to sustainable development and growth of the American venture market:

- A developed stock market and a high level of activity of various groups of investors;

- Participation of universities in venture activities and activities of business incubators;

- Developing of a specific innovation ecosystem in the Silicon Valley, functioning as an innovation cluster.

Key elements of Israel’s innovation policy, particularly contributing to development of the national venture capital ecosystem, include:

1) Broad opportunities for implementation of technical and managerial expertise and consulting support for small innovative enterprises through:

a) A wide network of professional contacts;

b) A developed culture of entrepreneurship;

c) Open access of local enterprises to foreign investors;

2) Developed innovative infrastructure and technological infrastructure:

a) Corporate departments and departments that deal with research and development;

b) State institutions carrying out scientific and educational activities;

c) Business incubators;

d) A system for protection of intellectual property.

The newly industrialized countries of the Asia-Pacific Region, as a rule, establish national venture capital funds that invest in science-driven startups, and form the information and consulting support structure for small innovative enterprises. In addition, Asian countries apply subsidizing of small innovative enterprises, lending, developing of a special insurance system, and provision of small innovative enterprises with tax preferences.

Today, the world experience has accumulated a fairly wide range of various measures for implementation of state support for innovative entrepreneurship. At the same time, the mechanisms and tools for development of small innovative entrepreneurship and venture entrepreneurship in different countries are not uniform. Nevertheless, it is possible to distinguish common features among such tools and mechanisms.

Application of the developed method makes it possible to assess the degree of risk of investment in an innovative product, and the decision on the degree of risk is made taking into account all the factors known to investors. The method allows determining the spin-off expediency threshold of a subsidiary if there are prerequisites for development or improvement of a product with significant or probable potential. Therefore, the developed approach is highly relevant in venture projects associated with a radical change in the structure of an existing enterprise and management strategy. In whole, the method under discussion can be considered as an essential element of development based on restructuring and constant search for a balance between risk and profit from venture projects.

References

- Avnimelech, G., & Harel, S. (2012). Global venture capital 'hotspots': Israel. Handbook of Research on Venture Capital, 2. A Globalizing Industry. 209-226. 10.4337/9781849801683.00018.

- Avnimelech, G. (2002). Venture capital policy in Israel: A comparative analysis & lessons for other countries.: https://www.researchgate.net/publication/253934035_venture_capital_policy_in_israel_a_comparative_analysis_lessons_for_other_countries

- Barykin, S.Y. Bochkarev, A.A., Sergeev, S.M., Baranova, T.A., Mokhorov, D.A., & Kobicheva, A.M. (2021a). A methodology of bringing perspective innovation products to market. Academy of Strategic Management Journal, 20(2), 19. Available at: https://www.abacademies.org/articles/a-methodology-of-bringing-perspective-innovation-products-to-market.pdf.

- Barykin, S.Y., Kapustina, I.V., Sergeev, S.M., Kalinina, O.V., Vilken, V.V., Poza, E.d.l., Putikhin, Y.Y., & Volkova, L.V. (2021b). Developing the physical distribution digital twin model within the trade network. Academy of Strategic Management Journal, 20(1), 1–24. Available at: https://www.abacademies.org/articles/developing-the-physical-distribution-digital-twin-model-within-the-trade-network.pdf.

- Barykin, S.Y., Kapustina, I.V., Kalinina, O.V., Dubolazov, V.A., Esquivel, C.A.N., Alyarovna, N.E., & Sharapaev, P. (2021c). The sharing economy and digital logistics in retail chains: Opportunities and threats. Academy of Strategic Management Journal, 20(2), 1–14. Available at: https://www.abacademies.org/articles/the-sharing-economy-and-digital-logistics-in-retail-chains-opportunities-and-threats.pdf.

- Barykin, S.Y., Bakharev, V.V., Mottaeva, A.B., Aminov, K.I., & Ikramov, R.A. (2021d). Features of a combined approach to corporate innovative strategic planning. Academy of Strategic Management Journal, 20(2), 1–10.

- Barykin, S.Y., Bochkarev, A.A., Dobronravin, E., & Sergeev, S.M. 2021e. The place and role of digital twin in supply chain management. Academy of Strategic Management Journal, 20(2), 1–19. Available at: https://www.abacademies.org/articles/the-place-and-role-of-digital-twin-in-supply-chain-management.pdf.

- Berger, M., & Hottenrott, H. (2020). Public subsidies and the sources of venture capital. SSRN Electronic Journal. DOI: 10.2139/ssrn.3770514.

- Chen, S. (2020). The development of venture capital in China. 10.1007/978-3-030-46220-8_15.

- Dalal, A. (2020). Venture capital market in China and Japan: Comparative Study. Asia and Africa today. 34. 10.31857/S032150750008729-3.

- Dursteler, J.G. (1966). An evaluation of the small business investment company program, it's history and development, with emphasis on the Utah SBIC Industry // All Graduate Theses and Dissertations.

- Golosnoy, A.S., Provotorov, V.V., Sergeev, S.M., Raikhelgauz, L.B., & Kravets, O.J. (2019). Software engineering math for network applications. Journal of Physics: Conference Series, 1399(4).

- Ibrahim, D. (2018). Public or private venture capital?. SSRN Electronic Journal. DOI: 10.2139/ssrn.3266756.

- Kuratko, D., & Hornsby, J. (2020). Venture choices. 10.4324/9781003034292-4.

- Kwon, C. (2020). Strategy of venture startup and patent utilization in Japan Universities. Sogang Journal of Law and Business, 10, 3-29. 10.35505/sjlb.2020.08.10.2.3.

- Murray, G. (2021). Ten meditations on government venture capital. Venture Capital, 1-23. DOI: 10.1080/13691066.2021.1903677.

- Paterno, V. (2019). Southeast Asian experience in industrial joint ventures. 10.4324/9780429309427-14.

- Razin, A. (2018). High tech and venture capital inflows: The case of Israel. 10.13140/RG.2.2.15736.49920.

- Reich, R., & Mankin, E. (2017). Joint ventures with Japan give away our future. 10.4324/9781315199689-23.

- Sergeev, S., & Kirillova, T. (2019). Information support for trade with the use of a conversion funnel. IOP Conference Series: Materials Science and Engineering, 666(1).

- Shmatko, A., Barykin, S., Sergeev, S., & Thirakulwanich, A. (2021). Modeling a logistics hub using the digital footprint method — The implication for open innovation engineering. Journal of Open Innovation: Technology, Market, and Complexity, 7(59), 16.