Research Article: 2023 Vol: 27 Issue: 6

A Bibliometric Analysis of Literature on Corporate Solvency and Insolvency In India

Ravikant Agarwal, Shri Mata Vaishno Devi University, Kakryal

Ashutosh Vashishtha, Shri Mata Vaishno Devi University, Kakryal, J&K, (India)

Citation Information: Agarwal, R., & Vashishtha, A. (2023). A bibliometric analysis of literature on corporate solvency and insolvency in india. Academy of Marketing Studies Journal, 27(6), 1-11.

Abstract

Purpose: The present study analyzed the existing literature related to corporate solvency and insolvency by using the technique of bibliometric analysis which may serve as guide-map for future researchers and policy makers. Method: Bibliometric analysis is conducted in the present study by using various techniques like citation analysis, co-citation analysis, co-occurrence of keywords, thematic mapping by using visualization of similarities (VOS) viewer open-source software and R-based bibliometrix. Results: The study highlighted the most significant journals, authors, co-cited authors, institutions, keywords co-occurrence, and most cited articles in the area of corporate solvency and insolvency on the basis of bibliometric analysis of 388 studies taken from the database of Scopus for the time period between 1991 and 2021. Conclusion: We have highlighted significant citations, co-citations and keywords co-occurrence to summarize the literature. The present bibliometric study convincingly highlights the key focus areas in the evolving dynamics of bankruptcy prediction and may facilitate fellow researchers in exploring these domains. It is observed that that interest regarding corporate solvency/insolvency prediction is mounting in the recent years.

Keywords

Literature, Corporate Solvency, Insolvency, Scopus, Bibliometric Analysis.

Introduction

Prediction of corporate business failure, measured primarily in terms of Solvency and Bankruptcy of a company, has been a key area of research interest amongst research scholars for the last 5 decades starting from Beaver who first published ,”Financial Ratios as Predictors of Failure” in Journal of Accounting Research, 4,71-111 in 1966 (Beaver, 1966). A major breakthrough was the publication ‘Z’ Score for bankruptcy prediction, by E.I.Altman in 1968, which was calculated by applying statistical discriminant analysis tools to key financial ratios of selected publicly listed manufacturing companies. Over the years, Altman published various iterations of his bankruptcy prediction model for non manufacturing companies and different economies like emerging markets. Since the development of ‘Z’ Score by altman, using multiple Discriminant Analysis, a lot of other statistical models, like logitanalysis, probit analysis, decision trees, survival analysis and neural networks etc. have been used by various researchers for bankruptcy prediction.

With the evolution of technology and proliferation of advanced computational technologies and communication networks like internet in the 1990s, banks and financial institutions acquired significant competencies in credit risk modelling and the concurrent operational efficiencies led to a multifold rise in loan disbursals; it is also imperative for the lending institutions to spruce their abilities to predict credit default by the borrowers. Thus we can say that the real significance of the insolvency prediction models rose in the last decade of the 20th Century. Therefore, the authors have taken into consideration studies published during the period starting from 1991 till date for bibliometric analysis.

The rationale for this paper lies inacknowledging the actuality that this research field has been growing noticeably in recent past especially after the Asian financial crisis of 1997 and the Global financial crisis of 2008. This reiterates the need to scale and describe the research trends through bibliometric analysis and data visualization of already published literature.

But after extensive perusal of the published literature, there is no comprehensive bibliometric analysis studying the evolution of corporate solvency/insolvency prediction. Hence, the present study was conceptualized to fill the existing gap in this area of research.

Given the importance of this topic, the current study aims to explore the existing academic literature regarding corporate solvency/insolvency predictions using intelligent techniques and the specific objectives are as follows:

1. To describe how this area of research is organized and progressed in terms of publications, authors, and journals, and identify the biblio-metric trends (co-authorship, geographical area of authors, co-citation, co-occurrence and text mining, etc.) of bankruptcy prediction applying intelligent techniques.

2. To present an overview study bringing together research work classified in business, finance and management fields with the computer science field so as to have a multidisciplinary research in bankruptcy prediction modelling.

3. To discuss, based on results and knowledge obtained, the under-explored areas and reflect on possible future research opportunities to gain a more profound insight and understanding of this research topic.

Methodology

The present study scrutinized articles from one database i.e., Scopus obtained by searching Sixteen keywords viz. “Corporate Solvency" OR "Insolvency" AND "Cash Flow" OR "Liquidity" OR "Profitability" OR "Turnover" OR "Leverage" OR "Debt Equity Ratio" OR "Financial Coverage" OR "Promoter" OR "Credit Rating" OR "Rating Agency" OR "Auditor" OR "Corporate Lifecycle" OR "Contingent Liabilities" OR "Forex” and the sample consisted of 388 academic publications in this study. We included only research papers and review articles that were published in journals while book chapters and conference papers were excluded for fear of repetition and also since reliability of material published in journals is higher, for the reason that the peer review process of journal research papers is more scrupulous. Also, articles published in English only were retrieved as it is the most commonly used language in scientific literature. In addition, most of the published bibliometric studies in the top research journals used a similar process of extraction. For the time period between 1991 and 2021, we extracted 388 articles. For bibliographic extraction, the source of database needs to be consistent and of good quality. Web of Science and Scopus are commonly used databases for bibliometric analysis but for the present study the methodology highlighted by De lR?´o-Rama et al. (2020) was followed and Scopus database was used to acquire data, as this database includes more than 21000 journals, is broader as compared to Web of Science, it is easier to retrieve the data from it, its coverage is quite comprehensive along with highquality standards and its citation database is more detailed in comparison to other databases. Visual network and bibliometric analysis was used for mapping the structure of the present study. For bibliometric analysis, VOS viewer 1.6.16 software was used which examines the development trend of a research topic via scientific collaborations, analysis of citations and analysis of keywords. The software also assures strong reliability of statistical data and creates comprehensible graphics of high definition.

Results based on Bibliometric Analysis

TITLE-ABS-KEY ( "Corporate Solvency" OR "Insolvency" AND "Cash Flow" OR "Liquidity" OR "Profitability" OR "Turnover" OR "Leverage" OR "Debt Equity Ratio" OR "Financial Coverage" OR "Promoter" OR "Credit Rating" OR "Rating Agency" OR "Auditor" OR "Corporate Lifecycle" OR "Contingent Liabilities" OR "Forex" ) AND ( LIMIT-TO ( SRCTYPE , "j" ) ) AND ( LIMIT-TO ( DOCTYPE , "ar" ) ) AND ( LIMIT-TO ( LANGUAGE , "English" ) ).

Table 1 depicts that 388 articless were extracted from Scopus database by using keywords (Corporate Solvency" OR "Insolvency" AND "Cash Flow" OR "Liquidity" OR "Profitability" OR "Turnover" OR "Leverage" OR "Debt Equity Ratio" OR "Financial Coverage" OR "Promoter" OR "Credit Rating" OR "Rating Agency" OR "Auditor" OR "Corporate Lifecycle" OR "Contingent Liabilities" OR "Forex").

| Table 1 Search Tool |

|

|---|---|

| Articles | 388 |

| Authors | 4018 |

| Affiliations | 158 |

| Countries | 71 |

| Total citations | 15507 |

Table 2 shows the top ten most productive international journals with their total citations. Journal of banking and finance is on the top position with six publications in the field of corporate solvency/insolvency and a total of 595 citations. The second most prominent journal is Journal of Financial Services Research with three papers and 166 citations followed by a third Journal named Research in International Business and Finance with 139 citations. However, journal Emerging Markets Finance and Trade showed the lowest number of publications and citations (2 each) among the top ten journals.

| Table 2 Top Ten Most Productive International Journals And Total Citations |

||||

|---|---|---|---|---|

| Sources | Documents | % of Documents | Citations | Citations/Documents |

| Journal of Banking and Finance | 6 | 21.43 | 595 | 99.17 |

| Journal of Financial Services Research | 3 | 10.71 | 166 | 55.33 |

| Research in International Business and Finance | 3 | 10.71 | 139 | 46.33 |

| Pacific Basin Finance Journal | 2 | 7.14 | 85 | 42.50 |

| Emerging Markets Review | 2 | 7.14 | 63 | 31.50 |

| International Journal of Managerial Finance | 2 | 7.14 | 62 | 31.00 |

| Environmental Science and Pollution Research | 2 | 7.14 | 58 | 29.00 |

| Global Finance Journal | 2 | 7.14 | 46 | 23.00 |

| Review of Quantitative Finance and Accounting | 4 | 14.29 | 20 | 5.00 |

| Emerging Markets Finance and Trade | 2 | 7.14 | 2 | 1.00 |

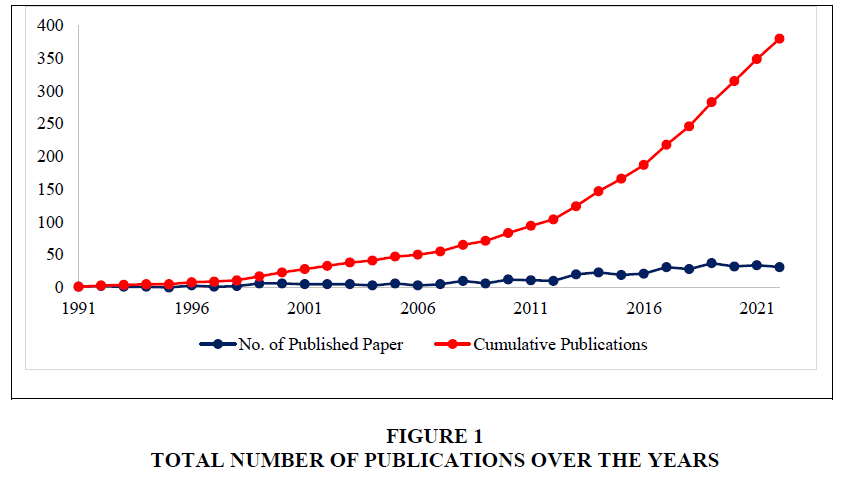

Figure 1 shows the total number of publications in the field of corporate solvency and insolvencyover the years. The first paper was published in 1991 and the number of papers increased sluggishly in the initial two decades. However, after 2009, there was a steady increase in the cumulative publications which signifies that the interest in Corporate Solvency and Insolvency grew rapidly from there on.

Individual and Country Co-authorship Analysis

Reyes et al. (2016) said that co-authorship research is an important part of bibliometric analysis and that the level of collaboration is a way to figure out where research stands in a certain field.The collaborative strength in the area of corporate solvency and insolvency has been examined in this study from the perspective of people and nations.It is critical to define co-authorship and co-citations in this context.The term co-author means to write a research paper, book, report etc. together with other people (Cambridge University Press, 2008). Co-authorship analysis looks at the strength of scientific collaborations in a given field (Liao et al., 2018). However, when a piece of writing that is being cited also references the work of other authors, this is known as a co-citation.It is a sort of document coupling that is characterized by the regularity with which two pieces of earlier literature are cited alongside one another, by subsequent literature (Small, 1973).

Individual co-authorship Analysis

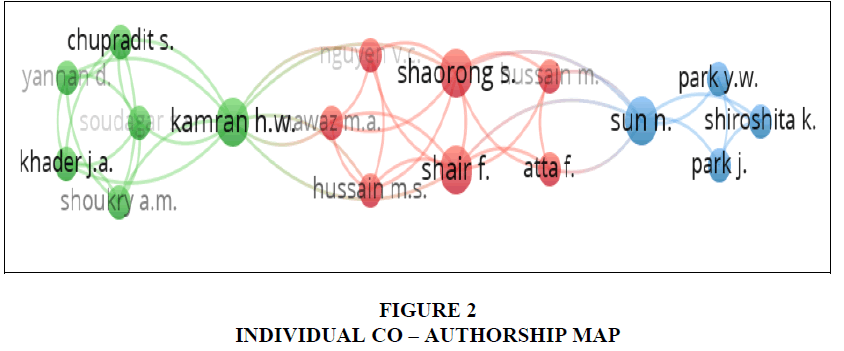

This study used VOS-viewer software to construct an individual co-authorship network. For data selection, the minimum number of documents of an author was 3, and the minimum number of citations of an author was zero. Among 829 authors in total, 17 met these thresholds and their co-authorship visualization is presented in figure 2, where each node denotes an author, and the line and distance reflect the relation among them. The distance between two nodes indicates the intensity of relation, which means when two nodes are closer to each other, they tend to have strong relation. Authors who have higher weight, in terms of citations and publications, are represented by larger nodes.

A link is a relation between two items, and the stronger the link between two items, the thicker is the line that displays the link in the visualization of the map. In figure 2, links refer to the co-authorship between researchers. Each link has a strength, indicating the number of publications the two researchers have co – authored (Van Eck and Waltman, 2019). The link strength can be used as a quantitative index to depict the relationship between two items and the total link of a node is the sum of link strengths of this node with all the other nodes (Pinto et al., 2014). It can be observed from the figure that the largest four nodes for Kamran, Shaorong, Shair and Sun show the highest weight of citations and total link strength. The rest of the authors display significantly lower weight of citations and publications and less collaboration links, as clusters are distributed separately, and one cluster is barely connected to another. Samitas and Kampouris (2018) analyzed the co-authorship in the field of finance in general and indicated that the collaboration network of authors in the financial market area is greatly integrated. In the context of bankruptcy prediction, Shi and Li (2019) carried out the co-authorship analysis without specifying the use of techniques and found a low density in a collaboration network among the main researchers.

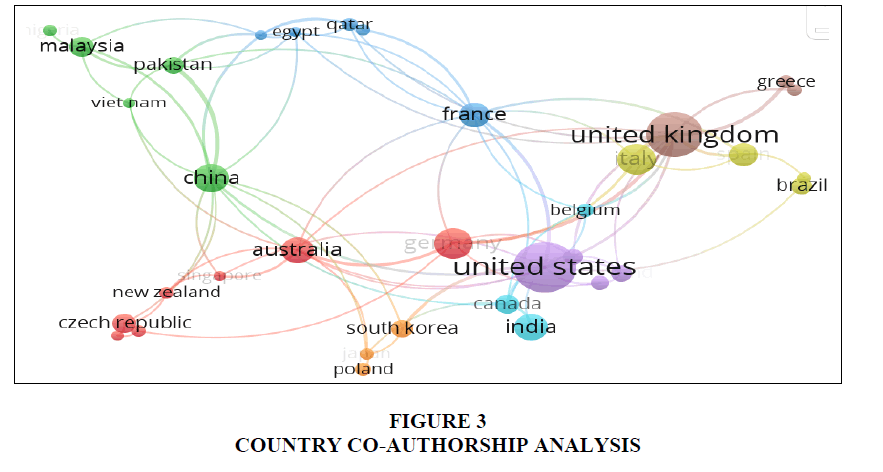

Country co-authorship Analysis

Country co-authorship analysis is an important form of co-authorship analysis, as it can reflect the degree of communication among researchers in various countries and the most influential countries in a given research field (Liao et al., 2018). Country co-authorship network visualization has been represented in figure 3. For the data selection and thresholds, the minimum number of documents from a country was 3 and the minimum number of citations from a country was zero. Among 71 countries, there were 39 that met these thresholds. We can ascertain in the figure that there are several nodes that indicate countries with the largest number of publications viz, United States, United Kingdom, Australia, France, China, and India. It should be noted that the size of the node is proportional to the number of publications. As depicted in the figure, United States represents the largest node with the highest link strength signifying broadest connections and collaborations with numerous other countries.

Reference Co-citation analysis

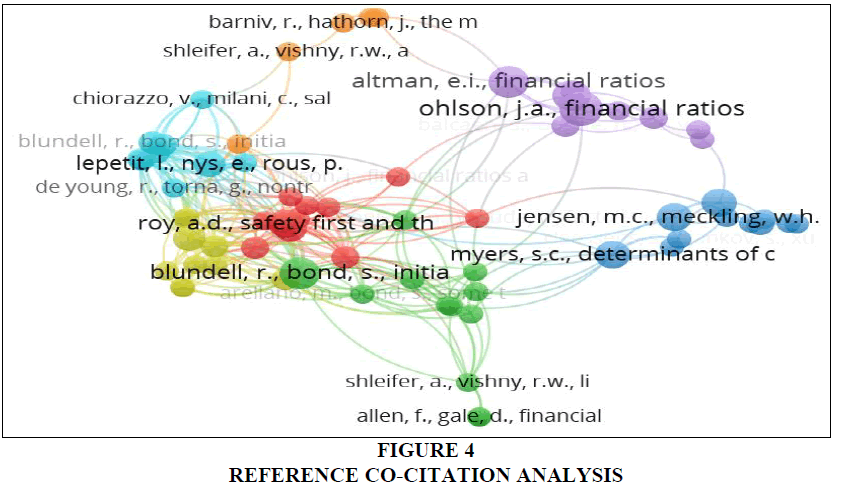

Co-citation is a form of document coupling which is defined as the frequency with which two documents are cited together by other documents (Small, 1973). A co-citation map consists of a set of nodes representing journal and a set of edges representing the co-occurrence of nodes and/or articles in reference list of papers of the map (Fahimnia et al., 2015). A reference co-citation map based on bibliographic data was created in VOS viewer (see figure 4). The minimum number of citations of the cited reference was taken 3, and among 15507 cited references, only 75 met the threshold. The figure illustrates that the largest node is Altman (1968), whose paper titled “Financial Ratios, Discriminant Analysis and Prediction of Corporate Bankruptcy” firstly introduced multivariate analysis. The second largest node is Roy (1952). The third largest node is Ohlson (1980) who created an O – score for bankruptcy prediction. The fourth largest node is Blundell & Bond (1998) titled “Initial conditions and moment restrictions in dynamic panel data models”.

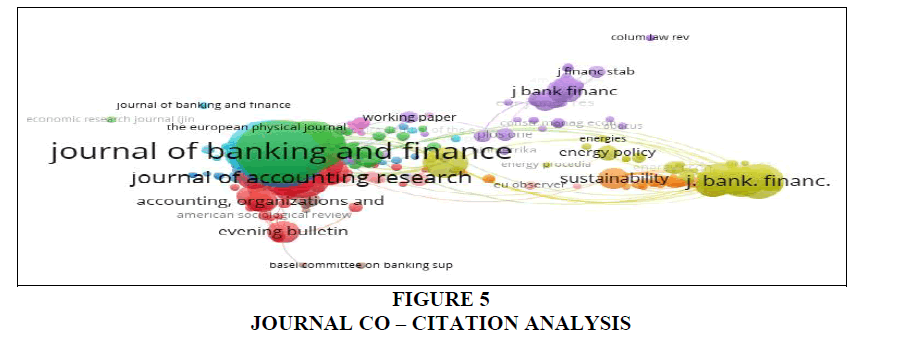

Journal co-citation analysis

Journal co-citation analysis reveals the overall structure of a subject and the characteristics of a journal (Liao et al., 2018). The distance between two journals in the visualization indicates the relatedness of the journals in terms of co-citation links. In general, the closer two journals are located to each other, the stronger their relatedness. The strongest co-citation links between journals are also represented by lines (Van Eck and Waltman, 2019). Figure 5 shows the journal co-citation network with minimum number of journals set at 20. Among 6808 sources, 68 journals met the threshold. The size of the nodes represents the activeness of the journal and smaller distance between two nodes represents a higher co – citation frequency.

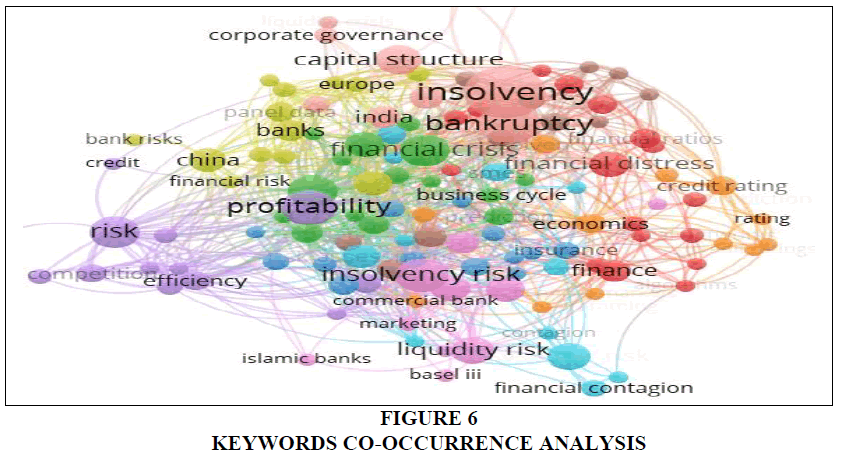

Keywords Co-occurrence Analysis

Authors constructed a map based on a co-occurrence matrix (figure 6) with minimum number of occurrences of a keyword set at 3. Among 1488 keywords, 126 met the threshold, showing 126 nodes. In order to obtain more precise results, the authors used the thesaurus function of VOS-viewer and successfully combined the different formats of keywords. The keyword “insolvency” had the highest occurrence and total link strength. Other keywords with a high occurrence included “bankruptcy”, “insolvency risk”, “profitability”, “risk”, “liquidity risk”, and “finance”.

The top ten international most cited papers are presented in table 3. The number of co-citation frequency is calculated according to the reference list of papers within the same dataset. More specifically, journal co-citation analyzes how many times one journal is cited together with another journal by the same document (Van Eck and Waltman, 2019). For instance, the first paper “Systemic risk, interbank relations, and liquidity provision by the central bank” was co-cited (be cited together with another journal by one paper) 508 times. The second paper “Ownership structure, risk and performance in the European banking industry” was cited 148 times and the last one “Hybrid models based on rough set classifiers for setting credit rating decision rules in the global banking industry” was cited only 61 times.

| Table 3 Top Ten Most Cited International Papers |

||

|---|---|---|

| Authors’ name | Title | Citation |

| Freixas et al. (2000) | Systemic risk, interbank relations, and liquidity provision by the central bank | 508 |

| Iannotta et al. (2008) | Ownership structure, riskand performance in the European banking industry | 148 |

| Cornett et al. (2010) | The impact of state ownership on performance differences in privately-owned versus state-owned banks: An international comparison. | 148 |

| Sanya&Wolfe (2011) | Can Banks in Emerging Economies Benefit from Revenue Diversification? | 119 |

| Pennathur et al. (2012) | Income diversification and risk: Does ownership matter? An empirical examination of Indian banks. | 96 |

| Safiullah&Shamsuddin(2018) | Risk in Islamic banking and corporate governance. | 73 |

| Hong et al. (2014) | The information content of Basel III liquidity risk measures. | 72 |

| Mirza et al. (2020) | Price reaction, volatility timing and funds’ performance during Covid-19. | 71 |

| Rivard& Thomas (1997) | The effect of interstate banking on large bank holding company profitability and risk. | 64 |

| Chen& Cheng (2013) | Hybrid models based on rough set classifiers for setting credit rating decision rules in the global banking industry. | 61 |

Discussion and Limitations

The present study has been conducted to review the literature on corporate solvency/insolvency prediction by examining articles published from 1991- 2021. Unlike previous studies in this domain, the present research has used bibliometric analysis that included citation analysis, co-occurrence of keywords and co-citation analysis on 388 articles. Individual co-authorship analysis, revealed the largest four nodes for Kamran, Shaorong, Shair and Sun depicting highest weight of citations and total link strength. On carrying out Reference Co-citation analysis, it was observed that the largest node was Altman (1968), whose paper titled “Financial Ratios, Discriminant Analysis and Prediction of Corporate Bankruptcy” firstly introduced multivariate analysis.In terms of country co-authorship analysis, United States represents the highest link strength signifying broadest connections and collaborations with numerous other countries. Journal of banking and finance has contributed the maximum articles (six) with 595 citations. The paper “Systemic risk, interbank relations, and liquidity provision by the central bank” was co-cited 508 times and emerged as one of the topmost cited papers. Furthermore, through concurrence analysis, the keyword “insolvency” had the highest occurrence and total link strength. Other keywords with a high occurrence included “bankruptcy”, “insolvency risk”, “profitability”, “risk”, “liquidity risk”, and “finance”.

These findings point towards keyfocus areas in the evolving dynamics of bankruptcy prediction and may facilitate fellow researchers in exploring these domains. Our findings demonstrate that interest regarding corporate solvency/insolvency prediction is rising and also showcase the most impactful and key contributions in this field. Our strength lies in the fact that we have presented anexhaustive overview of the literature on corporate solvency/insolvency prediction whilenot many studies have done this kind of analysis. Despite the relevance, quality and width of the research, some limitations need to be addressed. First limitation of bibliometric methods is that the bibliometric analysis cannot capture the complex nature of citing behavior rigourously (Vogel and Guttel, 2012). The second limitation is the restriction to one scientific database (Scopus) wherein many noteworthy articles might have been omitted by not including other databases, which could have been valuable to study the topic. Therefore, a bibliometric review based on other databases mayalso be attempted in the future.The purpose and the context of citation structure could not be identified from the study. Additionally, it is also recommended that future studies may utilize various artificial intelligence or machine learning algorithms for insolvency prediction. Moreover, greater keennessand communication can address the weak collaboration among authors, especially at the international level. In addition, the future authorship or co-authorship research in the corporate solvency/insolvency field may consider authors’ affiliations and/or gender (Koseoglu, 2016), which are not explored so far.

Conclusion

Unlike previous studies, this research has used bibliometric analysis to synthesize an intellectual and conceptual framework for corporate solvency/insolvency prediction. For theoretical analysis, we have illustrated significant citations, co-citations and keywords co-occurrence to summarize the literature. This will provide a blue print to future researchers to probe deeper into this area. The present bibliometric study, inspite of the above caveats, has generated fresh insights which can aid in exploring the uncharted territories within the field of corporate solvency/insolvency field using the evolutionary pattern of the existing studies in the literature.

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy.The journal of finance,23(4), 589-609.

Beaver, W. H. (1966). Financial ratios as predictors of failure.Journal of accounting research, 71-111.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models.Journal of econometrics,87(1), 115-143.

Indexed at, Google Scholar, Cross Ref

Chen, Y. S., & Cheng, C. H. (2013). Hybrid models based on rough set classifiers for setting credit rating decision rules in the global banking industry.Knowledge-Based Systems,39, 224-239.

Indexed at, Google Scholar, Cross Ref

Cornett, M. M., Guo, L., Khaksari, S., &Tehranian, H. (2010). The impact of state ownership on performance differences in privately-owned versus state-owned banks: An international comparison.Journal of financial intermediation,19(1), 74-94.

Indexed at, Google Scholar, Cross Ref

Del Río-Rama, M. D. L. C., Maldonado-Erazo, C. P., Álvarez-García, J., &Durán-Sánchez, A. (2020). Cultural and natural resources in tourism Island: Bibliometric mapping.Sustainability,12(2), 724.

Indexed at, Google Scholar, Cross Ref

Fahimnia, B., Sarkis, J., &Davarzani, H. (2015). Green supply chain management: A review and bibliometric analysis.International Journal of Production Economics,162, 101-114.

Indexed at, Google Scholar, Cross Ref

Freixas, X., Parigi, B. M., &Rochet, J. C. (2000). Systemic risk, interbank relations, and liquidity provision by the central bank.Journal of money, credit and banking, 611-638.

Hong, H., Huang, J. Z., & Wu, D. (2014). The information content of Basel III liquidity risk measures.Journal of Financial Stability,15, 91-111.

Indexed at, Google Scholar, Cross Ref

Hu, C., &Racherla, P. (2008). Visual representation of knowledge networks: A social network analysis of hospitality research domain.International journal of hospitality management,27(2), 302-312.

Indexed at, Google Scholar, Cross Ref

Iannotta, G., Nocera, G., &Sironi, A. (2007). Ownership structure, risk and performance in the European banking industry.Journal of banking & finance,31(7), 2127-2149.

Indexed at, Google Scholar, Cross Ref

Koseoglu, M. A., Rahimi, R., Okumus, F., & Liu, J. (2016). Bibliometric studies in tourism.Annals of tourism research,61, 180-198.

Indexed at, Google Scholar, Cross Ref

Liao, H., Tang, M., Luo, L., Li, C., Chiclana, F., & Zeng, X. J. (2018). A bibliometric analysis and visualization of medical big data research.Sustainability,10(1), 166.

Indexed at, Google Scholar, Cross Ref

Mirza, N., Naqvi, B., Rahat, B., & Rizvi, S. K. A. (2020). Price reaction, volatility timing and funds’ performance during Covid-19.Finance Research Letters,36, 101657.

Indexed at, Google Scholar, Cross Ref

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy.Journal of accounting research, 109-131.

Pennathur, A. K., Subrahmanyam, V., &Vishwasrao, S. (2012). Income diversification and risk: Does ownership matter? An empirical examination of Indian banks.Journal of Banking & Finance,36(8), 2203-2215.

Indexed at, Google Scholar, Cross Ref

Pinto, M., Pulgarín, A., &Escalona, M. I. (2014). Viewing information literacy concepts: a comparison of two branches of knowledge.Scientometrics,98, 2311-2329.

Indexed at, Google Scholar, Cross Ref

Reyes-Gonzalez, L., Gonzalez-Brambila, C. N., &Veloso, F. (2016). Using co-authorship and citation analysis to identify research groups: a new way to assess performance.Scientometrics,108, 1171-1191.

Indexed at, Google Scholar, Cross Ref

Rivard, R. J., & Thomas, C. R. (1997). The effect of interstate banking on large bank holding company profitability and risk.Journal of Economics and Business,49(1), 61-76.

Indexed at, Google Scholar, Cross Ref

Roy, A. D. (1952). Safety first and the holding of assets.Econometrica: Journal of the econometric society, 431-449.

Safiullah, M., &Shamsuddin, A. (2018). Risk in Islamic banking and corporate governance.Pacific-Basin Finance Journal,47, 129-149.

Samitas, A., &Kampouris, E. (2018). Empirical investigation of co-authorship in the field of finance: A network perspective.International Review of Financial Analysis,58, 235-246.

Indexed at, Google Scholar, Cross Ref

Sanya, S., & Wolfe, S. (2011). Can banks in emerging economies benefit from revenue diversification?.Journal of financial services research,40, 79-101.

Indexed at, Google Scholar, Cross Ref

Shi, Y., & Li, X. (2019). An overview of bankruptcy prediction models for corporate firms: A systematic literature review.Intangible Capital,15(2), 114-127.

Indexed at, Google Scholar, Cross Ref

Small, H. (1973). Co?citation in the scientific literature: A new measure of the relationship between two documents.Journal of the American Society for information Science,24(4), 265-269.

Indexed at, Google Scholar, Cross Ref

Van Eck, N. J., &Waltman, L. (2019). Accuracy of citation data in Web of Science and Scopus.arXiv preprint arXiv:1906.07011.

Vogel, R., &Güttel, W. H. (2013). The dynamic capability view in strategic management: A bibliometric review.International Journal of Management Reviews,15(4), 426-446.

Indexed at, Google Scholar, Cross Ref

Received: 22-May-2023, Manuscript No. AMSJ-23-13620; Editor assigned: 23-May-2023, PreQC No. AMSJ-23-13620(PQ); Reviewed: 26-Jun-2023, QC No. AMSJ-23-13620; Revised: 28-Aug-2023, Manuscript No. AMSJ-23-13620(R); Published:16-Sep-2023