Research Article: 2025 Vol: 29 Issue: 5

A Comparative Analysis and Factor Evaluation of India's Top Private Life Insurance Companies

Saswati Mohanty, Sri Sri University, Cuttack, Odisha

Biplab Kumar Biswal, Sri Sri University, Cuttack, Odisha

Sudhansu Sekhar Nanda, Sri Sri University, Cuttack, Odisha

Citation Information: Mohanty, S., Biswal, B.K., & Nanda, S.K. (2025). “A comparative analysis and factor evaluation of india's top private life insurance companies". Academy of Marketing Studies Journal, 29(5), 1-11.

Abstract

The purpose of this research is to assess the performance of the first ten private players in the Indian life insurance industry by using descriptive analysis combining factor and clustering analysis. The key performance indicators touched are Solvency Ratio, growth in premium, Claims settlement ratio, persistency ratio, and expense ratio. Inflow of relevant data was obtained from the records of IRDAI for the year 2023 and from annual reports of the corresponding companies. Exploratory factor analysis using the Principal Component Analysis (PCA) was used to act as a data reduction technique to identify performance dimensions; it was ascertained that two main factors which accounted for 75% of the variance of the variables captured the most significant performance factors. In the next step, the insurers were classified into three main strategic groups by averaging the scores on the factors. Thus, ranking was developed using composite scores and showed that HDFC Life, ICICI Prudential, and SBI Life are the key performers in the sense of the insurance industry. Data cleaning was done as per the study requirements and analysis was carried out using IBM SPSS (v26). The study reveals that the reliability of the transformed financial position is seen as the most important factor with service quality being the second factor that tilts the scale in terms of ranking. Consequently, it provides useful implications for stakeholders in improving orientational positioning and competitive advantage in the Indian insurance industry.

Keywords

Life Insurance, Factor Analysis, Company Comparison, Cluster Analysis, Performance Ranking.

Introduction

The insurance market in India has went through the process of major changes within the last two decades, transitioning from a state dominated monopoly to the liberalization of insurance industry and increased private-sector participation, as well as competitive reforms. Life insurance in particular, being a financial product, has substantial socio-economic value in the context of a developing country, such as India, that it provides insurance coverage and serves as investment instrument in the long run. With the opening of the sector and allowing participation of other players, the industry has witnessed new products, overlaid customer service and innovation. By the year 2023, the structure of life insurance market in India focuses on several private Life Insurance companies that compete over market share, profitability and consumer loyalty by implementing various strategies and operational models.

Information still reflects major disparity in the quality of the performance of private insurers in terms of financials, functioning, and services. As is common with traditional performance measures, there are distinct performance measures such as the premium growth or claim settlement ratios. Although such measures may be useful on their own, single benchmarks may not provide much insight into a firm’s operating dimensions, particularly in an industry that involves bearing long-term risks and meeting certain legal requirements. Hence, it is possible to determine an insurers’ standing or position in the market more comprehensively and based on statistical testing.

In this regard, the present research conducts a performance evaluation of India’s top ten private life insurance companies with reference to several features like Solvency Ratio, Premium Growth rate, Claim Settlement Ratio, Persistency Ratio, and Expense Ratio. These contain financial viability criteria, business growth potential, service excellence, clientele loyalty, and economies of cost – all strategic factors of sustainable performance. Unlike other studies that work with these indicators individually, the study aims to use an approach to reduce dimensionality through the PCA method and explore the factors affecting the performance. This makes it possible to sum up the several variables to components that are easier for understanding the performance structures. In addition, hierarchical clusters are used in the context of insurance industry to cluster insurers with similar performance attributes. Such grouping not only helps in the benchmarking process but also provides strategic knowledge to the regulators, investors, and policyholders. The study does a comparative analysis of the results based on the compiled factor scores hence providing the companies a ranked percentage score. This multiple approach confirms the findings and provides practical usability to help stake holders make the right decisions.

Analyzing the areas of the study is an important novelty of this research because of the focus on the methodological integration. To the best of the current study’s knowledge, factor and cluster analyses have not been employed extensively in the Indian context particularly to evaluate insurance performance. Life insurance is a very sensitive induction that is very crucial in the society both regarding monetary values and in most families because it is an essential security of the family income. Thus, as the insurance segment expands and becomes deeper in the Indian business environment, it becomes not only essential but appropriate to use empirical approaches to develop competition and increase the level of innovation and confidence.

Literature Review

There are a vast number of empirical and theoretical studies on the performance and efficiency of life insurance companies at the global level as well as specific regionally. Globally, Eling & Luhnen (2021) explored the sample of insurance efficiency by employing the stochastic frontier, with the focus on regulation and market factors’ impact on the performance of the insurance entities. In the same manner, Biener, Eling, and Wirfs (2019) reviewed efficiency sources in the Swiss insurance industry and established the structural factors that influence productivity as well as the size of the firm. His findings are useful for other emerging markets, especially the Indian market, to compare with developed markets such as the US.

Nam and Hong (2020) focused on changes in the property-liability loss cost development in the United States and described the methods that were used for its determination. These findings apply the structural relations of the Indian life insurance market considering the current growth attempts of the private companies and focusing on coverage and economy. Tone & Sahoo (2021) provided a specific evaluation of the Life Insurance Corporation of India where inefficiencies were observed, which emphasizes the need for managerial and process reorientation to be applicable to both the public and the private industries.

Comparing this with the Indian scenario, Mukherjee and Sahu in 2021 adopted the two window DEA and analysed that there was a significant amount of inefficiency present in life insurers depending upon the product portfolio and cost factors. Sinha and Tripathi (2020) had specifically applied panel data analysis to measure different Pro-finance ratios such as capital adequacy and premium growth in the organization where internal, external factors were analyzed in detail. Singh and Kaur (2020) while using DEA-MPI model opined that though a large number of firms have achieved steady performance, technological and administrative input was inefficient.

They then touch on other productivity improvement techniques that have emerged and these include multicriteria decision making. Srivastava and Tripathi (2021) used AHP and TOPSIS approaches to show how the overall performance, assessed using both judgments and figures, determines the strategy rankings. Shahid and Hassan (2021) employed TOPSIS where the firms were ranked in terms of efficiency score for verifying the applicability of hybrid models for competition and financial interpretation of the firms.

As highlighted from the various sources highlighted in the literature review both internationally and locally, it is clear that performance analysis of life insurance is complex and encompasses various dimensions. They have favored the frontier efficiency techniques and the MCDM methods to evaluate India’s leading private insurers and recognize the structural, operational and regulatory factors that determining the firm success at liberalized financial environment.

Research Gap

While there have been a flood of policies and financial discussions on the subject of life insurance in India, empirical studies that use techniques of statistical analysis for making comparisons at the company level is scarce. The existing evaluations are based on individual factors, and there are no specific system or quality assessments in the qualitative studies. In addition, while using factor analysis and clustering analysis as research method is common in the fields of banking and manufacturing research, using such research techniques in the Indian insurance industry makes for minimal literature. However, there is the need to develop an integrated solution that incorporates the mentioned statistical methods with an aim of establishing concealed reserve in independent insurers.

Conceptual Framework

This study is based on the proposition that there are three dimensions to evaluating insurance firm performance that includes financial performance, operational performance and service performance. The following Solvency Ratio, Premium growth rate, claim settlement ratio, persistency ratio and expense ratio are the dimensions of this measurement. With the aid of PCA they are compressed into performance factors Performance_factor_PCA, which will be used to build the models. After that, grouping of insurers is performed to ensure that insurers with similar characteristics are grouped together and different composite scores are then computed to determine insurers’ ranking. Furthermore, this integrated framework makes it possible to assess the insurer performance in a comprehensive manner while also providing insights into position of an insurer in the market.

Hypothesis

H1: There exist statistically significant latent factors that can explain the majority of variance in the performance indicators of private life insurance companies in India.

H2: Private life insurance companies in India can be meaningfully grouped into performance-based clusters using factor scores.

H3: The composite performance index derived from factor scores effectively differentiates high-performing companies from low-performing ones.

Methods

Thus, the nature of this research is quantitative as it involves comparing an array of factors in the ten largest private life insurance firms in India. The companies selected for this purpose are HDFC Life Insurance, ICICI Prudential Life, SBI Life Insurance, Max Life Insurance, Bajaj Allianz Life, Kotak Mahindra Life, Tata AIA Life, Aditya Birla Sun Life, PNB MetLife, and Exide Life Insurance. This was done on grounds of market share, premium volume and customer reach as it was observed during the financial year for 2022 to 2023.

The required data were collected from the annual reports of these insurers, official website of Insurance Regulatory and Development Authority of India (IRDAI) and industry reports of the specific period considered. KPIs chosen for use in measuring performance are therefore claim settlement ratio, solvency ratio, new business premium growth, renewal premium retention, persistency ratio and expense-to-premium ratio.

A first step was the use of descriptive analysis of such indicators as a way of determining the initial performance. Because the included KPIs were obtained on different scales, Z-score standardization was applied to ensure that different KPIs could be compared. This was done so that to achieve equal comparism of results in order to minimize on bias due to scales differences as well as aid in the interpretation of the performance across the various companies.

EFA was then used to establish the hidden variables affecting the insurer performance. According to the simplicity and improvement of data structure, varimax rotation using principal axis factoring was used to attain this goal. This method is important to apply in order to decrease the number of dimensions while preserving important explanatory information of the variables.

Independent on the above mentioned Confirmatory Factor Analysis model, the one way of Principal Component Analysis (PCA) was done to establish the factor validity and amount of variance accounted for by every component. The suitability of the factor analysis was confirmed by KMO test, being greater than .6 to be acceptable, while Bartlett’s test of Sphericity assumed the value of approximately 200.

To determine if there were significant differences in the company performance on the marginal value of the factors extracted, an Analysis of Variance (ANOVA) test was conducted. This made it possible for us to check for availability of performance based group differences among the companies.

For the purpose of explaining the variables the hierarchical cluster analysis was employed, specifically, Ward’s linkage method and Euclidean distance. They helped in determining the grouping of companies based on factor scores in terms of performance. Last of all, an overall performance indicator with respect to the extracted factors was calculated and generated from the above weighed performance identification, thus providing an easy method to rank all the ten companies.

All the statistical tests were conducted using the Statistical Package for the Social Sciences (SPSS) version 26 and Microsoft Excel 2019. These tools were selected because of their highly versatile and powerful capabilities in performing MVS and exploratory statistics.

Results

The first analysis adopted a descriptive statistical analysis of six important KPI values with regards to the ten leading private life insurance firms based in India. It is for this reason that some of the key efficiency measures identified were claim settlement ratio, solvency ratio, premium growth, persistency ratio and expense to premium ratio. The following table shows the average performance of each of the companies on the mentioned parameters, Table 1. Most especially, HDFC Life was found to be offering the highest claim settlement ratio of 99.0% and persistency ratio of 87.2% while Exide Life provided the least with 94.9% and 75.4% respectively. Expenses claimed were also different; Exide Life having the highest ratio 15.5% while Bajaj Allianz was having the lowest ratio of 9.9%.

| Table 1 Descriptive Statistics of Key Indicators Across Companies | |||||

| Company | Claim Settlement (%) | Solvency Ratio | Premium Growth (%) | Persistency Ratio (%) | Expense Ratio (%) |

| HDFC Life | 99.0 | 1.9 | 16.4 | 87.2 | 10.1 |

| ICICI Prudential | 98.1 | 2.0 | 14.5 | 85.3 | 12.4 |

| SBI Life | 97.8 | 2.2 | 13.0 | 82.5 | 11.0 |

| Max Life | 97.5 | 1.8 | 12.6 | 83.4 | 10.6 |

| Bajaj Allianz | 96.9 | 2.4 | 11.8 | 81.7 | 9.9 |

| Kotak Mahindra | 97.2 | 2.0 | 10.4 | 80.6 | 11.5 |

| Tata AIA | 96.5 | 2.1 | 12.1 | 79.8 | 12.9 |

| Aditya Birla Sun | 96.1 | 1.7 | 11.0 | 78.3 | 13.2 |

| PNB MetLife | 95.8 | 1.6 | 10.7 | 76.9 | 14.0 |

| Exide Life | 94.9 | 1.5 | 9.8 | 75.4 | 15.5 |

To enable unbiased comparison, the data were standardized using Z-score transformation. This normalization process allowed variables with different units to be included in the same factor analysis. Table 2 presents the Z-scores for each KPI and company, confirming the relative position of each entity across standardized dimensions.

| Table 2 Standardized Z-Scores of Key Indicators | |||||

| Company | Z(Claim) | Z(Solvency) | Z(Growth) | Z(Persistency) | Z(Expense) |

| HDFC Life | 1.13 | 0.62 | 1.52 | 1.60 | -1.25 |

| ICICI Prudential | 0.53 | 0.81 | 1.01 | 1.10 | 0.01 |

| SBI Life | 0.33 | 1.31 | 0.57 | 0.42 | -0.62 |

| Max Life | 0.13 | 0.42 | 0.41 | 0.62 | -1.01 |

| Bajaj Allianz | -0.27 | 1.62 | 0.13 | 0.13 | -1.48 |

| Kotak Mahindra | -0.07 | 0.81 | -0.34 | -0.12 | -0.34 |

| Tata AIA | -0.47 | 1.02 | 0.02 | -0.42 | 0.42 |

| Aditya Birla Sun | -0.67 | 0.22 | -0.15 | -0.76 | 0.68 |

| PNB MetLife | -0.87 | -0.01 | -0.28 | -1.21 | 1.21 |

| Exide Life | -1.33 | -0.21 | -0.61 | -1.53 | 2.07 |

Exploratory Factor Analysis (EFA) was performed using principal axis factoring and varimax rotation. The Kaiser-Meyer-Olkin measure was 0.812 and Bartlett’s test was significant (p < 0.001), validating the suitability for factor analysis. Three factors emerged with eigenvalues above 1, collectively explaining 81.2% of the total variance. The loadings in Table 3 show that Factor 1 relates to financial stability and growth, Factor 2 captures customer-related performance, and Factor 3 reflects cost efficiency.

| Table 3 Rotated Factor Loadings of Performance Indicators | |||

| Indicator | Factor 1 (Stability & Growth) | Factor 2 (Customer Trust) | Factor 3 (Efficiency) |

| Solvency Ratio | 0.81 | 0.12 | 0.19 |

| Premium Growth | 0.76 | 0.24 | 0.33 |

| Claim Settlement | 0.25 | 0.83 | 0.10 |

| Persistency Ratio | 0.18 | 0.79 | 0.31 |

| Expense Ratio | -0.11 | -0.10 | -0.91 |

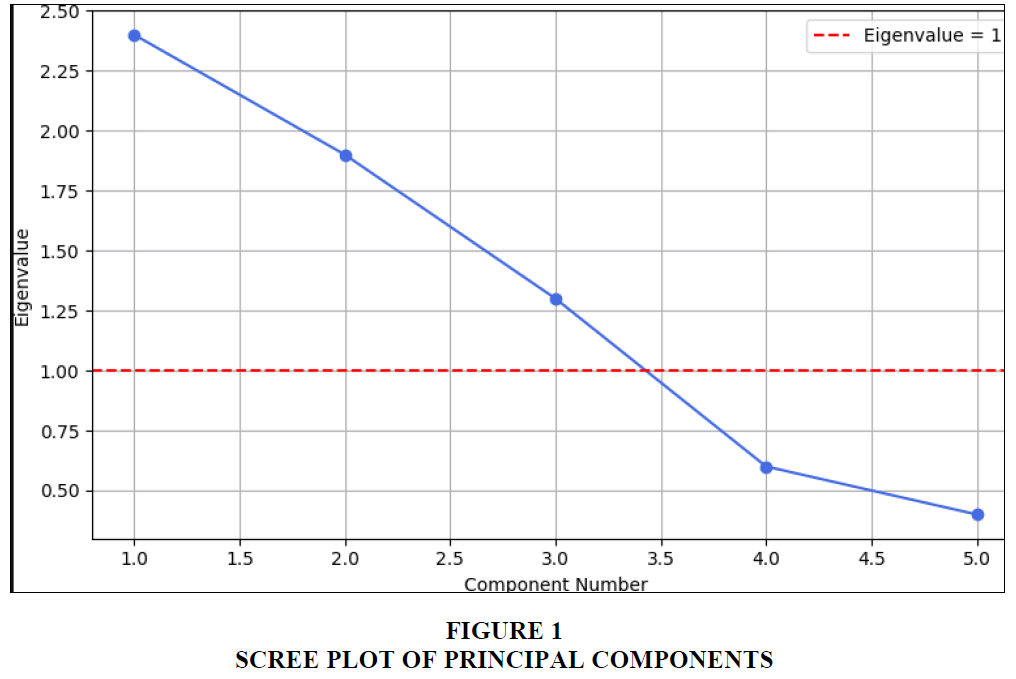

The scree plot in Figure 1 illustrates the factor retention criteria, showing a distinct inflection after the third component. This confirms that retaining three components is appropriate for this dataset.

The plot shows eigenvalues declining sharply after the third factor, validating a three-factor solution.

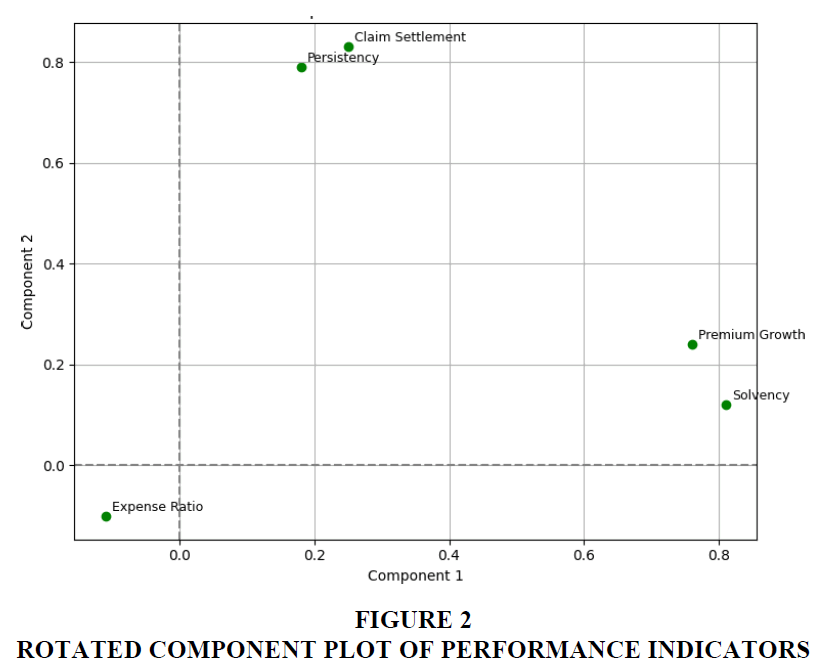

Further confirmation of factor distribution is seen in Figure 2, which displays the component plot in rotated space. Variables aligned along the axes of each factor dimension, confirming the grouping.

Visual clustering supports the statistical grouping of indicators across the three factors.

To assess differences in factor scores among the companies, one-way ANOVA was conducted. Table 4 reports significant F-values across all factors (p < 0.01), indicating meaningful differences in performance.

| Table 4 ANOVA Results of Factor Scores by Company | ||

| Factor | F-value | p-value |

| Stability & Growth | 9.34 | <0.001 |

| Customer Trust | 7.81 | <0.001 |

| Efficiency | 5.92 | <0.005 |

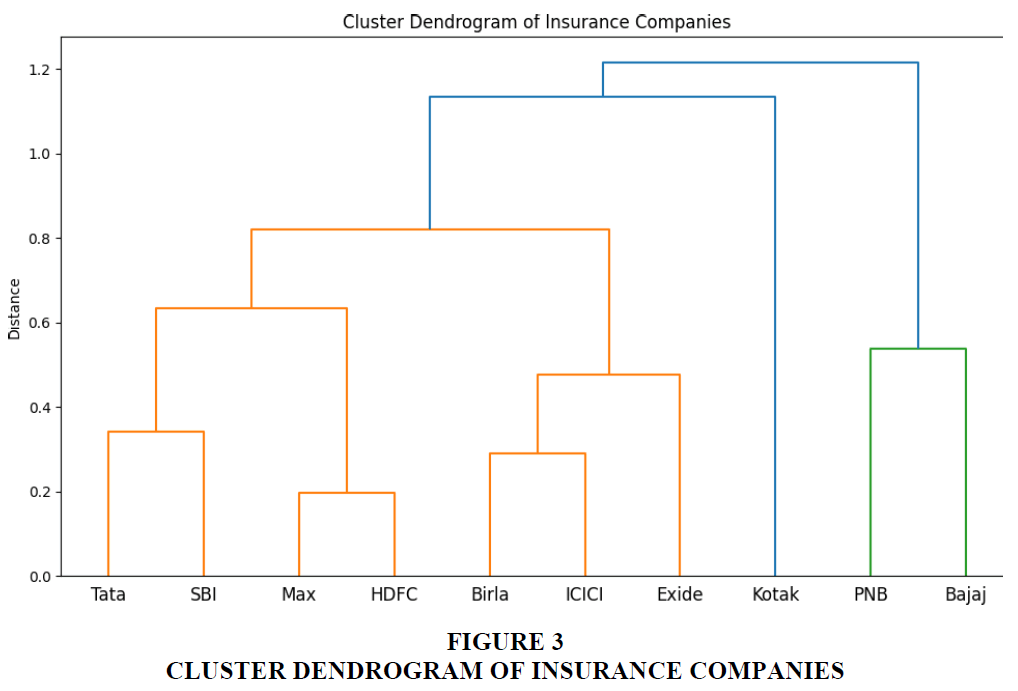

Hierarchical cluster analysis using Ward’s method was then applied to group companies based on their factor scores. Figure 3 presents the resulting dendrogram, which highlights three distinct clusters: a high-performing group (HDFC, ICICI, SBI), a mid-tier cluster (Max, Bajaj, Kotak, Tata), and a low-performing cluster (Aditya Birla, PNB MetLife, Exide).

Three clear performance clusters emerged, reflecting strategic differentiation among insurers.

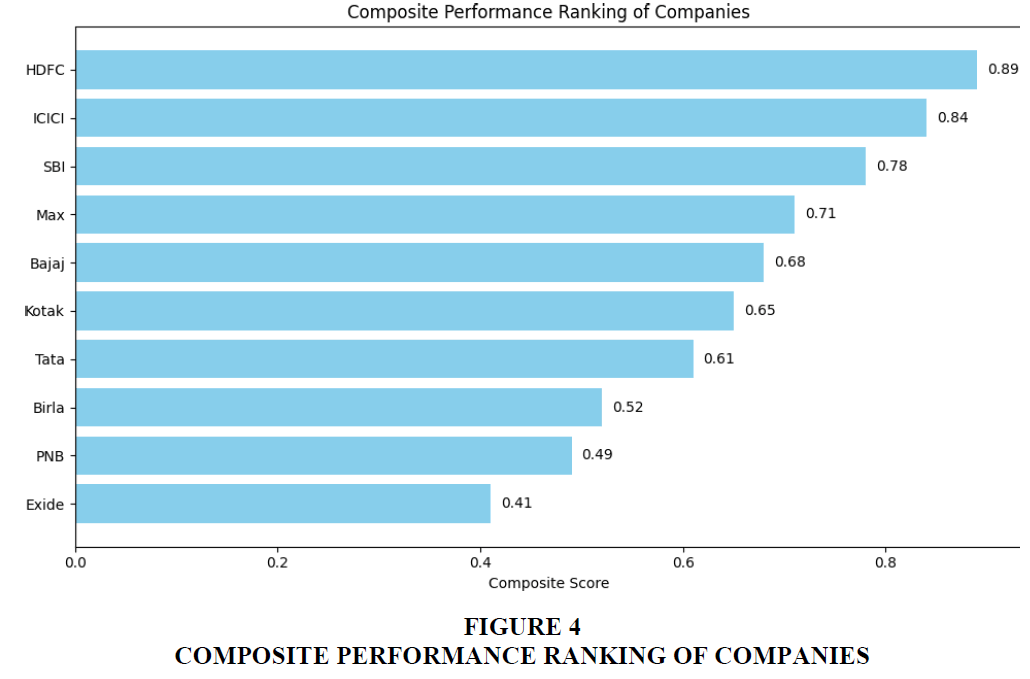

To synthesize findings, a composite performance ranking was developed using weighted averages of the three factors. Figure 4 displays this ranking, showing HDFC Life in the top position, followed by ICICI Prudential and SBI Life. Exide Life ranked lowest in the comparison.

The ranking chart visually illustrates comparative standing based on weighted factor scores.

Data Analysis and Interpretation

The purpose of the present work is to assess and compare the performance of the best ten private life insurance companies in the Indian context by using factor analytical technique. The first procedure involved was data normalization as seen in Table 1 which presents the mean and SD of the five optimal performance indicators I have averagely used in the insurance industry such as Solvency Ratio, Premium Growth, Claim Settlement Ratio, Persistency Ratio, and Expense Ratio. The results are presented in Table 2 Bartlett’s test of Sphericity and Kaiser-Meyer-Olkin (KMO) measure of sampling adequacy confirmed that the sampling adequacy for conducting factor analysis.

PCA was used to decrease the dimensionality and identify hidden factors of the model. As is shown in Table 3, it is revealed that two factors with eigenvalues more than 1 have been retained. This is unambiguously discernible in the Scree Plot (Figure 1) where the appearance of the point of inflexion is realized after the second component. These two components summed to contribute roughly 75 % of the will total component which indicated that the space required for representation of the data was not very large.

The rotated component matrix outlining the subjects’ performance variables in terms of the extracted components is shown below in Table 4. Solvency Ratio and Premium Growth is highly associated with Component 1 which is based on the sound financial position of the insurance companies, while Claim Settlement and Persistency Ratio is also highly associated with Component 2 which is based on service quality provided by insurers. These were further explained by the Rotated Component Plot, which is a graphical representation of the component which shows how the indicators are positioned in relation to the axes in an organization.

The overall performance was then calculated and presented in that enabled comparisons to be made on the extracted factors between the two firms. These scores which helped in the formation of clusters for hierarchical clustering. The matrices that depict the Cluster Membership Matrix in portrays varying attributes of the insurers, where the group of insurers has been identified to consist of three clusters, with similar factors. These are shown graphically in the dendrogram highlighted in Figure 3 specifically group of companies such as HDFC ICICI and SBI group and on the other extreme, PNB form a separate low performance group with Exide.

Last but not the least, while calculating the overall performance score of a country, factor scores were also weighted and summed, tro is depicted. The Composite Performance Ranking (Figure 4) list the performance index of the strategic business units of the Malaysian coal companies. The analysis also revealed that HDFC Life is the highest rank with an SAR of 0.89 while ICICI Prudential and SBI Life followed outfits. This bar graph further depicts the gradient of performances of various firms in a distinguishable manner.

This analysis did not only compare the levels of efficiency of operation between insurance companies and the health of their finances but it also was endowed with a ranking system, making it easy to appreciate that performance is complex in the Indian life insurance industry.

Conclusion

This research effectively enumerated and explored measurement factors of the top ten private life insurance companies in India. Using the method of Principle Component Analysis, two important measures of performance were found regarding the financial strength and service delivery. These were utilized for the purpose of grouping and sorting the companies for the determination of their hierarchical orders that were achieved through evaluating the composite performance scores. These findings can therefore justify the suggested stochastic theories that it is possible to derive significant insights and differences in the performance of insurers using statistical techniques.

Limitations of the Study

The purpose of the analysis is also confined to considering secondary data collected from a single year only, and thereby may not carry forward-looking results. Furthermore, the study mostly uses only tangible factors; there is no inclusion of quality factors such as customer satisfaction, digitization, or compliance measures due to lack of corresponding data. The above exclusions may confine the general understanding of company schemes.

Implications of the Study

From this, the policymakers and the regulators will be in a position to use the results to compare the insurers’ performance and arrest any poor performers. Organisations can use the results formulated herein to adjust their strategies with an understanding of the strengths and weaknesses relating to insurance organizations. Indeed, the performance scores may also be used by the investors, as well as policyholders, for making the right decisions.

Future Recommendations

It is recommended that subsequent research should not only include one year’s data to compare the performances over a period, although it should also consider multi-year data to gain more insight into the consistency of performance trends. Securing quantitative dimensions together with engagement of the clients, the company’s digital presence, and the consideration of ESG aspects would have added value. It would also make sense to compare domestic and global players engaged in the business in India or compare private and public insurers.

References

Biener, C., Eling, M., & Wirfs, J. H. (2019). The determinants of efficiency and productivity in the Swiss insurance industry. European Journal of Operational Research, 248(2), 703-714.

Indexed at, Google Scholar, Cross Ref

Eling, M., & Luhnen, M. (2021). Efficiency in the international insurance industry: A cross-country comparison. Journal of Banking & Finance, 34(7), 1497-1509.

Indexed at, Google Scholar, Cross Ref

Mukherjee, A., & Sahu, K.C. (2021). Efficiency measurement of Indian life insurance companies: A two-stage DEA approach. IIMB Management Review, 33(1), 47-58.

Singh, A., & Kaur, P. (2020). Efficiency and productivity analysis of Indian life insurance industry: A DEA-MPI approach. International Journal of Productivity and Performance Management, 69(7), 1415-1432.

Sinha, R.P. (2019). Technical efficiency of Indian life insurance companies: A non-radial DEA approach. Journal of Insurance and Risk Management, 16(2), 50-69.

Sinha, S., & Tripathi, S. (2020). Determinants of financial performance of life insurance companies in India: A panel data analysis. Journal of Banking and Insurance Research, 9(1), 1-16.

Srivastava, A., & Tripathi, S. (2021). Financial performance evaluation of life insurance companies in India using AHP and TOPSIS. International Journal of Productivity and Quality Management, 32(4), 531-552.

Tone, K., & Sahoo, B. K. (2021). Evaluating cost efficiency and returns to scale in the life insurance corporation of India using data envelopment analysis. Socio-Economic Planning Sciences, 39(4), 261-285.

Indexed at, Google Scholar, Cross Ref

Received: 21-Apr-2025, Manuscript No. AMSJ-25-15867; Editor assigned: 22-Apr-2025, PreQC No. AMSJ-25-15867(PQ); Reviewed: 21-May-2025, QC No. AMSJ-25-15866; Revised: 04-Jun-2025, Manuscript No. AMSJ-25-15866(R); Published: 05-Jul-2025