Research Article: 2022 Vol: 26 Issue: 6

A Perception Study of Women Investors In 21st Century with Special Reference to Delhi, India

Priya Sharma, Vivekananda Institute of Professional Studies

Citation Information: Sharma, P. (2022). A perception study of women investors in 21st century with special reference to delhi, india. Academy of Marketing Studies Journal, 26(5), 1-6.

Abstract

As an investment procedure, investors must make intelligent judgments based on the sort of investment they choose. Investing business fidelity examined eight million client accounts and discovered that female consumers generated a 0.4% higher (Kumari Indira, (2016)) return on their investments. Earlier this year, the Indian government announced the "Pradhan Mantri Jan-Dhan Yojana" programme, which aims to give bank accounts to all of the country's underprivileged residents. A vast number of people are motivated by their returns as a result of the universal financial inclusion that it promotes. When it comes to making an investment, men and women have different priorities. This study, on the other hand, emphasises the importance of women's roles in society and their investment philosophy.

Keywords

Investment, Wise Decisions, Financial Inclusion, Women Investors, India, Economy.

Introduction

For financial inclusion to be achieved, savings must be transformed into investments. This leads to economic growth Shah (2017). Investing is a long-term strategy to gain a profit in the present. Capital growth or income from the use of funds are two possible outcomes from such an investment strategy.

Risk, return, and time all come into play when making an investment. The current use is sacrificed in order to reap future benefits. There is a set amount that must be sacrificed up front, but the future returns are uncertain because of the inherent risk. When it comes to investing, most people aim for the highest possible returns with the lowest possible risk.

Fixed annuities, money market funds, and savings accounts are examples of low-risk investments. Mutual funds are a good option for high-risk, high-return investments. Investors come from a wide range of backgrounds. Income, education, career, and age all factor into the decision to invest. Women play a key role in society because they are more cautious in their pursuit of a steady return on investment.

Statement of the Problem

Saving for the future is vital in today's fast-paced environment. Because money is needed at any time in life. They need to start thinking about investing as soon as possible. Due to the fact that it may be used by people of all ages, as well as those of different ages. This research examines the preferences of working and non-working women in the city of Delhi, India. Working women's financial planning is rarely examined in academic research. This study investigates the investment practises of women in India with the sample of Delhi.

Objectives of The Study

1. To study the Investment methods prevailing among the women investors in Delhi.

2. To analyse the motives of investments with respect to age and amount of monthly savings.

3. To find the factors that influence the investment decision.

Limitations of The Study

1. This study covers the women investors of Delhi city only. And its conclusions mayn’t be applicable to any other geographical location.

2. The investment details provided by the investors are subject to confidential information, due to which it is difficult to authenticate.

3. Current study does not take into account of caste and religion of women investors.

Review of Literature

Angel Christy Praveena, C. (2012) conducted a study on Madurai's college instructors. When compared to other major cities, Madurai's costs are quite low. There is a possibility that it will help you save money. In this study, monies flow into acceptable investment possibilities are made aware to the general public.

According to Indira (2016), working women in TINSUKIA district's public sector organisations (IOCL, Public sector bank, and Northeast Frontier Railway TINSUKIA division) were studied for their investment habits.

Sriraaj (2016) analyses the investment behaviour of Delhi’s salaried workforce. It's all about what makes people want to invest in certain things.

Shah (2017) intends to analyse the risk and expected return on their investment. A total of 400 residents of Solapur City, including wage earners, company owners, professionals, and pensioners, took part in the survey.

Investing habits of working women in the city of Chennai were studied by Mercy Silvester (2020). T-tests and frequency distributions were utilised in the investigation. According to the findings, there is a strong link between income and investment.

In a comparative study, Bansal (2020) examine the attitudes and investment patterns of Punjab and Haryana, two neighbouring states.

Research Gap

Lot of studies have been done on investment behaviour, investment options, risk, and the expected return associated with investing instruments from a literature survey. And it's all geared toward female employees in both the public and private sectors, as well as individual shareholders. There hasn't been a study on women that includes both working and non-working women, according to the researcher.

Research Methodology

This research conducted a survey and analysed data to determine the most popular investment methods used by female investors. The SPSS tool has been used for the data interpretation and analysis.

Type of Research

Descriptive Research – Women investors in the city of Delhi for the financial year 2020-2021 are asked to fill out questionnaires via Google Form, which is a descriptive way of gathering primary data.

Sampling technique - Samples are selected as per simple random sampling technique.

Sample size - Sample of 50 investors.

Data collection - A questionnaire was used to obtain primary data. Secondary data is gathered from a variety of sources, such as published books, periodicals, newspapers, and journals.

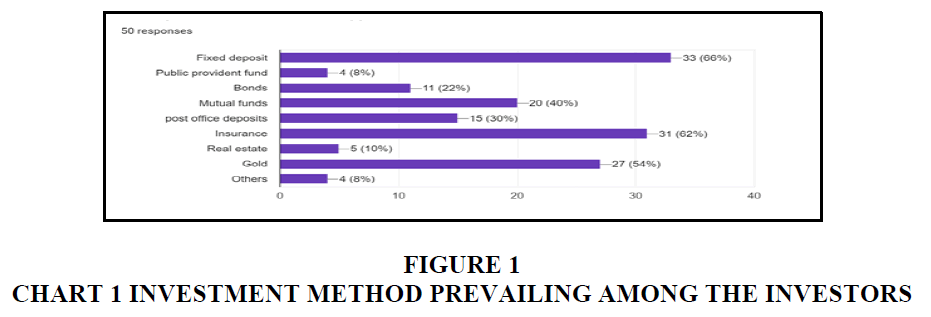

Statistical tools used - Percentage analysis and Chi-square analysis Figure 1.

Data Analysis and Interpretation

The below table represents the demographic characters of the respondents Table 1.

| Table 1 Demographic Character | |||

| Demographic Character | Variance | Frequency | Percentage |

| Age | 20-30 | 14 | 28 |

| 31-40 | 24 | 48 | |

| 41-50 | 9 | 18 | |

| 51 and above | 3 | 6 | |

| Marital Status | Married | 27 | 54 |

| Single | 17 | 34 | |

| Other | 6 | 12 | |

| Education | HS Education | 3 | 6 |

| Graduate | 15 | 30 | |

| Post graduate | 24 | 48 | |

| Professional degree | 8 | 16 | |

| Other | 0 | 0 | |

| Occupation | Salaried | 19 | 38 |

| Self employed | 15 | 30 | |

| Self - employed Profession | 7 | 14 | |

| Retired | 1 | 2 | |

| Home Maker | 8 | 16 | |

Interpretation

Fixed deposit is preferred by 22 percent of female investors. Insurance is preferred by 21 percent of investors. A whopping 18% of investors select gold as their preferred investment. In order to diversify their portfolios, investors use mutual funds. Post office deposits are preferred by 10% of investors due to the safety of depositors. Bonds are preferred by 7% of investors. It is preferred by only 3% of investors Avadhani (2010) Table 2.

| Table 2 Primary Data | |||||

| Motives of your investment /Age | 20-30 | 31-40 | 41-50 | 51 and above | Grand Total |

| Building a house | 5 | 3 | 0 | 0 | 8 |

| Education of Children | 0 | 7 | 2 | 0 | 9 |

| Future emergencies | 3 | 6 | 3 | 0 | 12 |

| Holiday | 2 | 3 | 1 | 0 | 6 |

| Marriage | 2 | 3 | 1 | 0 | 6 |

| Medical purpose | 0 | 1 | 1 | 2 | 4 |

| Retirement life | 2 | 1 | 1 | 1 | 5 |

| Grand Total | 14 | 24 | 9 | 3 | 50 |

H1: Chi-square test was performed to analyse second objectives.

H2: There is no significant difference between age and motives of investment.

H3: There is a significant difference between age and motives of investment.

P=0.23066>0.05 Therefore there is statistically significant evidence to exhibit that H0 is true or there is no significant difference between age and motives of investment Venkateswaran (2012) Table 3.

| Table 3 Primary Data | |||||

| Amount of monthly savings / Motives of investment | Above 10000-20000 | Above 20000 | Above 5000- 10000 | Up to 5000 | Grand Total |

| Building a house | 0 | 0 | 4 | 4 | 8 |

| Education of Children | 1 | 0 | 4 | 4 | 9 |

| Future emergencies | 2 | 0 | 1 | 9 | 12 |

| Holiday | 1 | 1 | 2 | 2 | 6 |

| Marriage | 0 | 0 | 3 | 3 | 6 |

| Medical purpose | 0 | 0 | 2 | 2 | 4 |

| Retirement life | 1 | 1 | 2 | 1 | 5 |

| Grand Total | 5 | 2 | 18 | 25 | 50 |

H0: There is no significant difference between amount of monthly savings and motives of investment.

H1: There is a significant difference between amount of monthly savings and motives of investment.

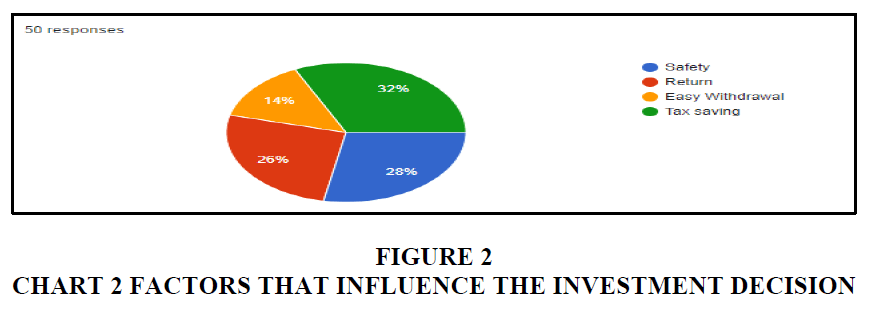

P = 0.76414623>0.05 Therefore there is statistically significant evidence to exhibit that H0 is true or there is no significant difference between amount of monthly savings and motives of investment Figure 2.

Interpretation

32 percent of investors are affected by tax savings plans, according to research. 28 percent of investors are inspired by the plan's security. There are 26% of investors that care about the financial return. Only 14% of investors are interested in quick and easy fund withdrawals.

Findings

Twenty-two percent of those polled said they preferred a fixed deposit because of its guaranteed and stable returns. According to the survey, 21% of respondents choose tax-deductible insurance coverage.

1. There is no major variation in investment decisions based on one's age or one's motivation for investing.

2. To make a good investment decision, the quantity of money saved each month isn't a crucial factor.

3. 32 percent of respondents cite tax savings as a factor in their decision-making.

Suggested Implications

1. A capital market training curriculum includes the selection and transfer of funds as well as regular market analysis. It may help investors overcome their apprehensions and gain trust in a wide range of investing options.

2. Every investment comes with a degree of risk. Women investors' risk tolerance ability must be developed by making them aware of their financial actions and their role.

3. College students should be educated about various financial possibilities through workshops or seminars, and then encouraged to make investments in those options.

4. Banking and financial market businesses should be combined by the government because most female investors favour banking investments because they are free of unethical behaviour.

Conclusion

Investment alternatives for respondents were confined to banking operations (fixed deposit) or insurance, as a result of factors including tax savings and safety of investment. Despite the fact that the majority of those surveyed had a college degree, they lacked in-depth knowledge of investment strategies. The appropriate investment selection can be made by assisting women investors. Keeping track of investors' income and returns is made easier by this tool. Individual wealth creation and the building of a nation are linked to financial inclusion.

References

Avadhani, V.A. (2010). Investment management. Himalaya Publishing House.

Bansal, A. (2020). Investment Patterns of Individual Investors A Comparative Study of Punjab and Haryana.

Indira, k. (2016). A study of the investment behaviour of working women in select public sector organizations in tinsukia district.

Shah, S.K. (2017). An analytical study of investment behavior of individual investors in Solapur city.

Silvester, m. (2020). A study on investment behaviour of working women in chennai city.

Sriraaj, p (2016). A study of the investment pattern of salaried employees in private sector with special reference to Chennai.

Venkateswaran, S. (2012). A study on investment pattern among investors with special reference to college teachers in Madurai city.

Received: 20-Jul-2022, Manuscript No. AMSJ-22-12351; Editor assigned: 25-Jul-2022, PreQC No. AMSJ-22-12351(PQ); Reviewed: 16-Aug-2022, QC No. AMSJ-22-12351; Revised: 25-Aug-2022, Manuscript No. AMSJ-22-12351(R); Published: 02-Sep-2022