Research Article: 2022 Vol: 26 Issue: 1S

A Study on Bankers Perception towards Export Finance on Leather Industry Provided by Selected Commercial Banks In Vellore District

R. Jayanthi, Vellore Institute of Technology

M. Muthumeenakshi, Vellore Institute of Technology

Citation Information: Jayanthi, R., & Muthumeenakshi, M. (2022). A study on bankers perception towards export finance on leather industry provided by selected commercial banks in vellore district. Academy of Marketing Studies Journal, 26(S1), 1-9.

Abstract

Export finance plays a crucial role in enabling exporters in accepting and efficiently executing their export orders. Export credit is required for short periods of time both before and after the dispatch/shipment of an order. While the pre-shipment export finance is required as working capital for accomplishing timely production, packing and shipment of the orders, the post-shipment finance facilitates in sustaining exporters business operations while still waiting to receive payments due from foreign buyers. Commercial banking institutions have been important sources of export credit in India. The Reserve Bank of India regulates provision of export credit by the commercial banks in India, both Indian and foreign, through stipulating some minimum proportion of their total lending to be provided as export finance. From time to time, the RBI announces various rule and guidelines to ensure smooth and efficient operation of this system. The researcher had chosen selected banks in commercial banks. The Multi stage sampling method had been chosen for the study. The tools used for the analysis is Percentage Analysis, ANNOVA & Correlation. Therefore, the present study is an attempt to study the bankers perception towards export finance on leather industry provided by selected commercial banks.

Keywords

Commercial Banks, Leather Industry, Export credit, Business Operations.

Introduction

India does not provide direct subsidies to exporters. Abraham & Dewit (2000) Instead, India relies on a wide range of indirect measures, including duty and tax concessions, export finance, export insurance and guarantee, and export promotion and marketing assistance. We shall focus mainly on export finance in this study with some references to export insurance and guarantees. Commercial banks provide export finance at a rate lower than their prime lending- rate. With progressive deregulation of interest rates, banks now have considerable flexibility to decide their deposit and lending rate structures and manage their assets and liabilities with greater efficiency. On the lending side, banks are free to prescribe their own lending rates including the Prime Lending Rate (PLR). On the deposit side, banks have been given the freedom to offer a fixed rate or a floating rate subject to the approval of their Boards.

Banks have been found to be granting export credit for the working capital needs of a vast majority of exporters. Except for some apparent hesitation on the part of foreign banks, various bank groups cater to the needs of new exporters. Claessens (2006)Apart from certain important criteria regarding financial standing of the export unit asking for finance, nearly 84 per cent of all the bank branches have been found skirting the RBI suggestion with regard to "no insistence" on collateral security. Relatively more frequent occurrence of this situation across regions is in bank branches in north while across bank group’s nationalised and private bank branches have been observed behaving like this. Malouche (2009) Bank branches in east and foreign banks across the country are relatively conservative in catering to the needs of small exporters, i.e. with export turnover of less than Rs. 50 lakh. Nearly half the bank branches have reported no fixed target of achieving export credit disbursal during the year 2000-01. The priority sector lending is an important function of India’s commercial banks. It includes lending to agriculture, small-scale industries (SSI), transport operators, etc. Export credit is over and above the priority sector. The foreign banks operating in India have to allocate a target of 32 per cent of their net bank credit (NBC) to priority sector and export finance with sub-sectoral targets of 10 per cent for SSI and 12 per cent for exports.

Statement of the Problem

Export Financing Financial assistance extended by the banks to exporters at Pre-shipment and post-shipment stages. While the pre-shipment finance is provided for working capital for the purchase of raw material, processing, packing, transportation, warehousing, etc, of the goods meant for export, post-shipment finance is generally provided in order to bridge the gap between the shipping of goods and the realization of proceeds. With a view to providing pre-shipment credit to Indian exporter at internationally competitive rates, interest, Reserve bank of India announced a new scheme in November 1993 to provide Pre-shipment Credit in Foreign Currency (PCFC) by the banks in India. The PCFC scheme is in addition to normal packing credit schemes in Indian rupees presently available to Indian exporters. Commercial banks play an important role in financing the credit requirements of exporters at different stages of export, viz., pre-shipment and post-shipment stage. Granting of short-term finance for working capital requirements has always remained an area exclusively reserved for the commercial banks. The importance of leather industry in India lies in its becoming an important foreign exchange earner, where 75 per cent of the output is exported. It gives employment to a large and growing number of people in the unorganized and small-scale sector of the Indian economy. Therefore there is need to analyze the perception regarding bankers towards export finance provided by commercial banks in Vellore district.

Review of Literature

Sandeep Gupta at.al (2018), in their article examined that “Sustainability Strategies in the Indian Leather Industry: An Empirical Analysis”, the main objectives of the study is to examines the various sustainability strategies by applying economic value creation (evaluation of growth in total turnover, evaluation of the growth in profitability, evaluation of leverage), social value creation (evaluation of the growth in wages, evaluation of the growth in employee welfare expenses), and environmental value creation (conservation in raw material consumption, conservation in energy consumption, evaluation of waste management practices). The researcher concluded that the sustainability of the Indian leather industry in TN, WB, and UP states, in terms of economic, social, and environmental value creation over a 15-year window (1998-2013). Indeed, the results are mixed for the three states, with each state leading in different categories. Thus, none of the three leading states in the Indian leather industry has complete domination over the others in all three dimensions of sustainability.

Syed Tanimul Haque at.al (2017), in their article examined that “Role of Banks and Financial Institutions in Export Finance of Bangladesh”, the main objectives of the study is to analyze the the role of banks and financial institutions in export financing. The tools used for the analysis is Trend analysis technique of Time series analysis has been used to compare and evaluate the data. The researcher concluded that Exporters also observed bribery by customs officials, loan terms

and lack of knowledge about market as number one problem in the growth of export. It is also observed that more finance is needed to plug the gaps between export finance and export. However, based on the findings of survey and evaluation of export finance data, important point that comes out is procedural simplification of EDF, extension of cash assistance, publicity of ECG, training of employees of commercial banks and good governance; not only economic but also political and social. Few reforms and lucrative incentive packages could not improve the situation. To chase the chiming challenge of globalization bankers need to integrate policy formulation, its implementation and have to improve law and order situation, appropriate judicial system.

Alam Ahmed (2016), in their article said that “EXIM bank of India’s Export Financing strategies: An Analysis”, the main objectives of the study is to examine the strategies of financial assistance to exporters by EXIM Bank of India. Verma & Jain (2014)The researcher concluded that the Bank operates a wide range of financing programmes aimed at enhancing the export competitiveness of Indian companies. In Special cases EXIM Bank is providing import finance programmes also. The Bank has in place an innovative facility to support globalization of rural industries through its grassroots initiatives. But it is very clear from the data disclosed by bank in its annual reports that bank is more focused towards the project exports than other finance programs of the bank. Therefore the exporters (other than project exporters) are not getting satisfactory financing services from EXIM Bank. They rely on other commercial banks to get the credit for their export orders.

Need for the Study

Many International brands and retailers source leather products from south India. Tamil Nadu has a dominant presence in the leather and leather based Industries. Tamil Nadu in the south is home to a growing export industry for shoes and other leather goods. There is a well established in Ambur. The Vellore district is the top exporter of finished leather goods in the country, that leather accounts for more than 37% of the country’s export of leather products. There are around 1226 leather units in Vellore district predominately in Alangayam, Madhanur and Wallajah Block. There are many leather manufacturing and leather based industries in and around Vellore District. Commercial banks plays major role in providing export finance in Vellore district. Therefore there is need to study the bankers opinion regarding export finance in commercial banks.

Research Methodology

Research methodology is the scientific approach to validate the research design. It is the process by which the researcher produces authentic research findings. The methodology part provides details about the research design for the study, the nature and source of data collected for the study and details about the research instrument used. Further, it provides a brief description of the variables used for the study and provides details about the various tests employed to establish the reliability and validity of the collected data for the purpose of data analysis. Finally, it provides details about the statistical package and statistical tools used for analyzing the data to empirically test the hypotheses based on the objective of the study.

Research Design

The research carried out by the researcher is both descriptive and analytical in nature. This type of research is mainly concerned with description of facts. This study is called descriptive since it describes the different aspects such as perception towards bankers regarding export finance. This is also analytical in nature as it analyzes the perception regarding bankers towards export finance provided by commercial banks in Vellore district.

Variables Used

Variables of the study are identified with the help of review of literature. The present study uses two major types of variables such as demographic variables and research variables. The demographic variables include the type of bank, Age, Qualification, Year of Experience, Designation of the banker. The research variable consists of the perception regarding bankers towards export finance provided by commercial banks in Vellore district.

Study Unit of Research

There are 32 districts in Tamil Nadu. The researcher has selected Vellore districts of Tamil Nadu as study area. Because Vellore district is one of the top exporter of finished leather goods in the country.

Population of the Study

The researcher collected data from bankers. The researcher has chosen Vellore districts in Tamil Nadu. Nine taluks from Vellore districts were selected on the basis of higher number of bank branches in each district. There are 51 commercial banks in Tamil Nadu. The researcher has considered only five commercial banks on the basis of those bank have higher number of bank branches such as SBI, Indian overseas bank, Indian Bank, Canara bank and HDFC banks Table 1.

| Table 1 Total Number of Bank Branches in Vellore Districts of Tamil Nadu | ||||

| S.No | District Name | Bank Name | Branches | Total |

| 1 | VELLORE | Indian Bank | 56 | 168 |

| 2 | Indian Overseas Bank | 31 | ||

| 3 | State Bank of India | 58 | ||

| 4 | Canara Bank | 15 | ||

| 5 | HDFC Bank | 8 | ||

Sources of Data

The primary data were collected using structured questionnaire. Face to face, self-administered, was used as a data collection tool to collect the data from Bankers and Secondary data were collected from Reserve bank of India Websites & EXIM report.

Sample Size: The sample size for the study is 168.

Sampling Technique: Multi - stage random sampling method is used to draw required samples for the study.

Tools used for the analysis: The tools used for the analysis is percentage analysis and ANOVA.

Data Analysis & Interpretation

Export finance system of the country could play a significant role in pursuance of Government’s export-led growth strategy. With this view in mind Government introduced several financial incentives for increasing export of our country over past several years. Gianturco (2001)Commercial bank plays an major role in providing export credit to the leather Industry in Vellore District. The researcher collected data from bank managers/executives involved in export financing to know their opinion as regards the exporters as well as their perception regarding bankers.

Gender of the Respondents

Gender has always been a distinguishing study variable in social sciences and behavioral studies. Gender has been named into male and female. Today the FI schemes are designed based on the gender. The respondents are asked to indicate their gender in the interview schedule. Table 2 depicts the information regarding the gender of the respondents. 82 per cent of the respondents are male and 18 per cent are females. It is noted from the table that majority of the respondents are males. Therefore, more male respondents were working in the bank than female.

| Table 2 Demographic Profile of the Respondents | ||

| Gender | Respondents | Percentage |

| Male | 138 | 82 |

| Female | 30 | 18 |

| Total | 168 | 100 |

| Age | ||

| 20 to 30 years | 40 | 23.8 |

| 30 to 40 years | 81 | 48.2 |

| Above 40 Years | 47 | 27.9 |

| Total | 168 | 100 |

| Educational Qualification | ||

| Under graduate | 87 | 51.7 |

| Post Graduate | 54 | 32.1 |

| Others | 27 | 16.0 |

| Total | 168 | 100 |

| Experience level of the Respondents | ||

| Up to 1 year | 8 | 4.7 |

| 1-5 years | 87 | 51.7 |

| 5-10 years | 68 | 40.4 |

| Above 10 years | 5 | 2.9 |

| Total | 168 | 100 |

Age of the Respondents

The age of an individual plays a vital role in the Bank employee. Age is the entry point to include the people for availing the respectively working in bank. The standardized age group of the people to working the banking activities above 18 years. Table 2 shows that 24% percent of the respondents are in the age group of between 20-30 years, 48% percent comes under the age group of 30-40, 27% percent fall under the age group of Above 40 years. It is clear from the table that majority of the respondents come under the age group of 30-40 years.

Educational Qualification of the Respondents

Education makes a person think originally and take decisions intellectually, socially and economically feasible one. An Individual knowledge and decision making skill can be cultivated by education. The researcher has classified the respondents according to their educational qualification as under graduates, post graduates and professional degree holders. As per the survey made, about 51 percent of the employees are having UG qualification 32 per cent having PG degree and 16 per cent have qualified themselves in professional courses. It is inferred that majority of the bank employees have completed the UG Degree, because the basic qualification for entering into a banking sector is under graduate degree.

Experience Level of the Respondents

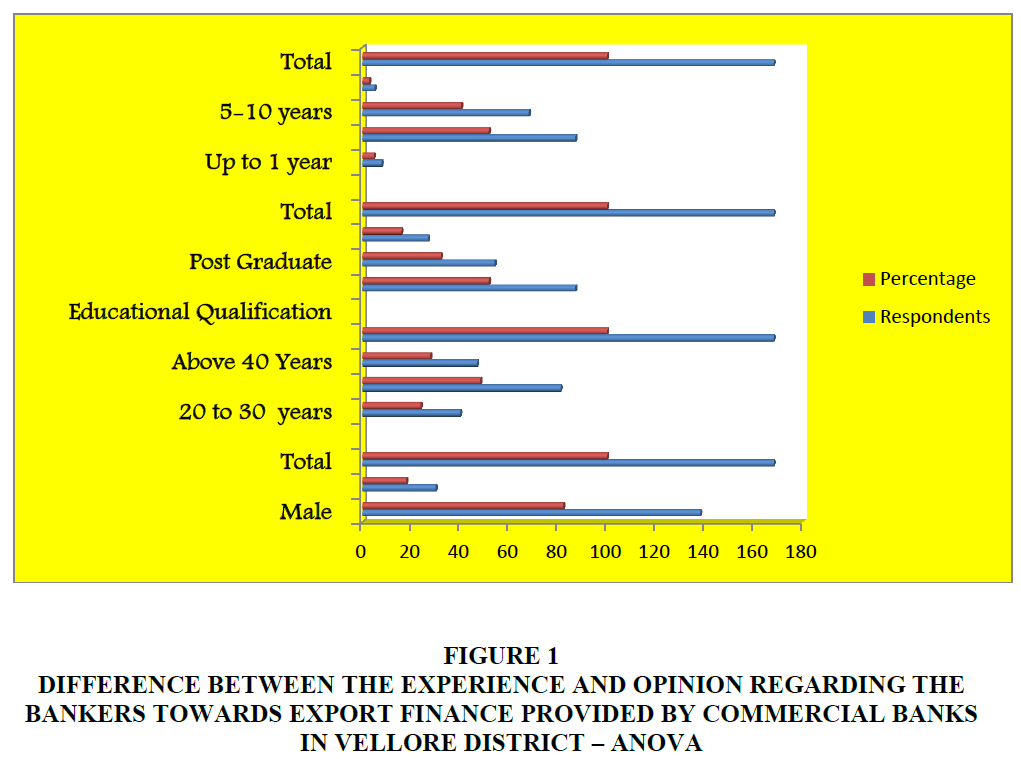

A good banking service starts from understanding the customer’s expectation on product and services. The customer develops his usage of accounts based on the experience he has with the bank during his transactions. The components of Experience level are added year by year. So due to necessity, People become customers of the bank by opening accounts. Table 2 portrays the duration of using the services of the banks by the sample respondents. Out of 168 sample respondents, 4 per cent are using the account for a period of up to one year, 52 per cent are using the services for a period of one to five years and 40 per cent are using the account Five – ten years and 2 per cent of the respondents are using it for a period of above 3 years respectively Figure 1.

Figure 1 Difference Between the Experience and Opinion Regarding the Bankers Towards Export Finance Provided by Commercial Banks in Vellore District – ANOVA

Through the factor analysis, it is identified that Less procedures for providing export finance, Sanctioning process in within stipulated period, Adequacy of credit, Whether the customers provide all the documents, Proper repayment of Loan are considered as dependent variable. Bank profile such as Experience is considered as independent variable. ANOVA is the specific tool to measure the significant difference or variance between more than two groups. Inorder to know the level of significant difference of the Experience and opinion regarding the bankers towards export finance provided by commercial banks, ANOVA has been used. It is a method used to measure the total variance of the groups. The total variances are split up into two components such as variation within a group of samples such as Experience level and variation between the groups of samples such as experience level.

For computing the F value the following formula has been used

F= Between column variance

Within column variance

H1: There is no difference between Experience level of employees and difference between opinion regarding the bankers towards export finance provided by commercial banks

From the above Table 3 it is inferred that relating to strategies adopted by the bankers while providing financial Inclusion services show a significant difference with the Experience level of respondents, since the significant value is less than the “P” value (0.05%). Hence the null hypothesis is rejected. Less procedures for providing export finance, Sanctioning process in within stipulated period, Adequacy of credit, whether the customers provide all the documents, Proper repayment of Loan shows no significant difference with the experience level of respondents.

| Table 3 Difference Between Experience Level of Employees and Difference Between Opinion Regarding the Bankers Towards Export Finance Provided by Commercial Banks | |||||||

| S. No | Preference Factors | Sum of Squares | Df | Mean Square | F | Sig. | |

| 1 | Less procedures for providing export finance | Between Groups | 0.84526 | 8 | 0.24 | 0.641 | .001* |

| Within Groups | 141.5867 | 160 | 0.641 | ||||

| Total | 142.4319 | 168 | 0.881 | ||||

| 2 | Sanctioning process in within stipulated period | Between Groups | 6.167 | 8 | 2.152 | 6.871 | .001* |

| Within Groups | 143.547 | 160 | 0.456 | ||||

| Total | 149.714 | 168 | 2.608 | ||||

| 3 | Adequacy of credit | Between Groups | 45.515 | 8 | 14.812 | 21.975 | .000* |

| Within Groups | 302.675 | 160 | 0.686 | ||||

| Total | 348.190 | 168 | 15.498 | ||||

| 4 | Whether the customers provide all the documents | Between Groups | 3.337 | 8 | 12.364 | 6.387 | .005* |

| Within Groups | 105.463 | 160 | 0.256 | ||||

| Total | 108.800 | 168 | 12.62 | ||||

| 5 | Proper repayment of Loan | Within Groups | 26.606 | 8 | 12.364 | 15.047 | .000* |

| Between group | 254.248 | 160 | 0.587 | ||||

| Total | 280.854 | 168 | 12.951 | ||||

| *Significant at 0.05 % level | |||||||

Findings of the Study

1. It is observed that out of 168 respondents, 82 per cent of the respondents are male and 18 per cent are females. It is noted from the table that majority of the respondents are males. Therefore, more male respondents were working in the bank than female.

2. It is examined that out of 168, 24% percent of the respondents are in the age group of between 20-30 years, 48% percent comes under the age group of 30-40, 27% percent fall under the age group of Above 40 years. It is clear from the table that majority of the respondents come under the age group of 30-40 years.

3. It is noted that Out of 168 respondents, 51 percent of the employees are having UG qualification 32 per cent having PG degree and 16 per cent have qualified themselves in professional courses. It is inferred that majority of the bank employees have completed the UG Degree, because the basic qualification for entering into a banking sector is under graduate degree.

4. It is observed that Out of 168 sample respondents, 4 per cent are using the account for a period of up to one year, 52 per cent are using the services for a period of one to five years and 40 per cent are using the account Five – ten years and 2 per cent of the respondents are using it for a period of above 3 years respectively. The FI concept was introduced recently for which majority of them became customers of the banks just in two years.

5. It is inferred that relating to opinion regarding the bankers towards export finance provided by commercial banks shows a significant difference with the Experience level of respondents, since the significant value is less than the “P” value (0.05%). Hence the null hypothesis is rejected. Less procedures for providing export finance, Sanctioning process in within stipulated period, Adequacy of credit, whether the customers provide all the documents, Proper repayment of Loan shows no significant difference with the experience level of respondents.

Conclusion

Tamil Nadu enjoys a leading position with 40% share in India’s export. Government of Tamil Nadu offers a special subsidy to further encourage the leather industry. TALCO-estate govt. organization is setting common effluent treatment plants in leather industry clusters. A recent study by the National Council of Applied Economic Research (NCAER) made comparison of the incentive packages of all Indian States which reveal that Tamil Nadu offers the most attractive package among industrialized States of India. The Vellore district has a dominant presence in the Leather and Leather based industries. Vellore District accounts for more than 37% of the country’s. Export of Leather and Leather related products such as finished leathers, shoe uppers, shoes, garments, gloves and so on. The researcher concluded that, Less procedures for providing export finance, Sanctioning process in within stipulated period, Adequacy of credit, whether the customers provide all the documents, Proper repayment of Loan shows no significant difference with the experience level of respondents.

References

Verma, R., & Jain, A.K. (2014). Impact of export Import Bank (EXIM) on building a climate for investment &growth in india: a study on emergent global share of indian agricultural industry. International Journal of Trade & Global Business Perspectives, 3(3), 1219.