Review Article: 2023 Vol: 27 Issue: 2S

A Study on Green Banking Initiatives in India: Customer Perception towards Sustainability

Riya Gupta, Manipal University Jaipur, Jaipur

Tina Shivnani, Manipal University Jaipur, Jaipur

Citation Information: Gupta, R., & Shivani, T. (2023). A study on green banking initiatives in india: customer perception towards sustainability. Academy of Marketing Studies Journal, 27(S2), 1-9.

Abstract

In this competitive world, making the country pollution-free is one of the top priorities of the banks. Presently, Indian banks are trying to adopt green bank marketing to make their banks sustainable. "Green banking" is defined as a nature-friendly bank. The aim of this study is to find out the level of awareness among customers about “green banking practices” and to identify the various factors impacting customers' adoption of “green banking practices”. A random sample of members having bank accounts in different public and private sector banks in Rajasthan is chosen. In order to collect data, a questionnaire tool and an in-depth discussion method are used. With the use of SPSS 26, Amos SPSS for model fit and an Independent T-test for comparing public and private sector banks, were carried out. Several things were learned from the study. The most important thing that was learned from the survey is that customers are aware of environmental issues, but they have trouble using green products because of barriers. This makes it harder for banks to contribute to sustainable development. From the point of view of the people in the study sample, there are strong links between the variables used in this paper and how green bank marketing affects sustainable development.

Keywords

Green banking, green marketing, Sustainable development, Sustainable banking, Green banks.

Introduction

The term "green banking" has gained popularity over the past few years among both the general public and the financial and banking industries (Zhixia et al., 2018). The adoption of green banking has increased over the last few decades in both developed and developing economies (Bukhari et al., 2020). The banking system is the country's lifeline because of its critical role in economic regulation. The banking sector in India has faced numerous challenges, including a shift in consumer behavior, technological changes, regulatory changes, and now the method of banking is changing, with greening the banking becoming increasingly important. This traditional banking method will soon be supplanted by fully digitalized banks. Green banking is a step towards the fully digitalization and branchless banking Asim et al. (2020).

As a responsible member of society, banks that engage in "green banking" activities conduct their everyday business while considering both internal and external environmental sustainability. Green banks, ethical banks, and socially responsible banks are all terms used to describe banks that carry out these types of banking activities (Zhixia et al., 2018)

For sustainable banking, banks implement a variety of "go green" initiatives, particularly for retail customers. Because retail banking is the most commonly used service in every bank location. Retail banking refers to personal and business banking products and services aimed at individuals, households, and small and medium-sized businesses rather than large corporate or institutional clients (Mitic, 2012).The simplest method for the retail banking industry to deliver environmentally friendly goods and services is to encourage customers to use all of the green goods and services that banks provide. Both the consumer and the bank may see the benefits. The customer saves time, there is no need to drive to the bank, which reduces pollution, and there is no need to fill out paperwork, which lowers the costs of fees that the bank charges for various transactions. As the number of retail customers rises and total administrative costs decline, banks can cut back on the cost of their branches, employee salaries, and printing and postage fees.

Literature Review

One of the researchers' findings is that sustainable banking promotes financial development. Nonetheless, due to different formal institutions in each country, the relationship is not uniform across countries. Empirical findings highlight the role of well-developed institutions in promoting financial development, which can ultimately contribute to the achievement of long-term goals. Notably, informal institutions play a key role in reducing the bad effects of sustainable banking on financial development, which are made worse by the weaknesses of formal institutions. (Úbeda et al., 2022). One researcher supported that banks should take steps to raise awareness about mobile banking services through advertisements, pamphlets, demo fares, and other means, so that customers feel well informed. The emphasis should be on improving the system's usefulness, creating a more user-friendly interface, building trust, reducing risks, and lowering costs. Mobile banking is reshaping the global banking and payment industry. There is a need to raise awareness about mobile banking services so that more people can take advantage of them. Mobile banking is used by both high-end and low-end users. It is also used in cities, towns, and rural areas. (Scholar, n.d.). Some studies found that green banking activities have a big positive effect on how well banks take care of the environment and where they get their green financing. The study found that the biggest problems were that customers didn't know much about green banking; investment costs were high; there were technical problems and obstacles; and it was hard to figure out how green projects were doing (Zhang et al., 2022). One researcher concluded that green banks are only getting started in India. Despite the fact that green practices are becoming increasingly popular, most Indian banks have yet to adopt them. The Reserve Bank of India and the Indian government should take a lead in promoting green banking by developing green policy guidelines. This study also found that more than 60% of those who took part thought that green banking initiatives helped restore customer trust by making the bank's green brand image better (Sharma & Choubey, 2022). Green banking services have the potential to help Bangladesh provide better banking services. While its ability to execute social and task-related tasks draws clients, financial, time, individual, and cyber concerns frequently stymie uptake of such services. Green banking implementation in Bangladesh could be a long-term endeavour (Iqbal et al., 2021). Adopting "green banking" by banks can make a big difference in reducing environmental problems that hurt a country's growth. Also, the fact that there isn't much academic research on the adoption of "green banking" shows how important this research area is (Bukhari et al., 2020). Systematically looking at the real world shows that the idea of "green banking" has been accepted as one of the new issues in banking and finance, but most banking customers don't know much about "green banking" practices. Fear of information security is seen as the main problem, and saving time has been seen as the most immediate benefit of green banking services. But the issue needs to be looked into in detail in the context of Nepal as a whole (Rai et al., 2019). One paper conducted research on GB, and that study's major goal is to create a conceptual model for bank customers' intentions to use GB products and services. Examining the perspectives of many bank professionals across several platforms’ aids in the development of a realistic and objective picture of the phenomenon. The researchers were able to find out that not many UAE bank customers use products made in Great Britain (Bouteraa et al., 2021). The results of one of the studies on green banking show that customers' intentions are most affected by their attitudes, followed by how much control they feel they have over their behavior, and then by their own subjective norms. Concerning the other constructs, it was found that customers' perceptions of environmental outcomes had a big effect on their plans and that environmental awareness and trust were important factors that led to their attitudes, which in turn had a big effect on their plans (Taneja & Ali, 2021).

Challenges of Implementing Green Banking Initiatives

By seeing the green banking growth in India, It was found that over three-fourths of consumers who utilized their banks' online banking services were either unfamiliar with the term "green banking" or mistook it for "digital banking." The middle and senior age groups have particularly low levels of awareness of green banking. In the future, there will be a substantial research gap in understanding the effects of demographics. Strong and sound banking procedures are required for inclusive economic growth. In India, a green bank's main activities are concentrated on paperless banking, internet banking, and ATMs. According to the study, Indian banks still have a long way to go before they are ready to undertake green banking initiatives. Environmental regulations are significantly facilitated by the Reserve Bank of India. In a developing nation like India, the social aspect of banking needs to be given more attention in addition to economic development. Some Indian banks have promoted green banking practices in compliance with international standards. The legal system has to be strengthened.

Objective of the study:

1. To identify the factors influencing the adoption of green banking practices in Indian banking sector.

2. To Develop a model for measuring sustainability using the factors affecting the adoption of green banking practices.

Problem Statement

At the COP26 climate summit, India's Prime Minister declared that the country will achieve net zero emissions by 2070. To meet this goal, all industries, including banks, must do their part to save the environment. The consumption and use of paper, electricity, water, fuel, stationery, equipment, and technology by banking institutions pollutes the environment. To reduce the use of this and make the bank sustainable, various green banking initiatives have been taken by the banking industry so far and there are still various initiatives in their nascent stage. It is critical to raise public awareness of the environmental consequences of various green banking practices. Employee efforts, as well as consumer awareness and acceptance, are critical to the success of any initiative.

Methodology

This study is exploratory and descriptive in nature. The sampling method used for this research is random sampling. In this study, the Structure Equation Model (SEM) is used, for which a minimum sample size of 250 is required for accurate results. Sample is taken: (Number of statements *10). Data is collected from 271 people, among whom 19 were rejected due to uneven data, and 252 are accepted for the model. For the collection of data, a structured questionnaire and interview method are used and distributed among customers having bank accounts in public and private sector banks in Rajasthan. Various RBI reports, websites of banks, articles, and journals are preferred for the collection of secondary data. Analysis and interpretation of data are done using Excel and SPSS Software 26; SPSS Software 26 is used for model fit, and an independent T-test is used for comparing public and private sector banks.

Methods of Data analysis: From Customer’s Perspective

This paper entails analyzing survey conducted on green banking awareness among customer in public and private sector banks, which includes demographic profile, descriptive, Exploratory Factor Analysis, Confirmatory Factor Analysis and Structure Equation Modeling Tables 1-4.

| Table 1 Summary of Reliability Statistics | |||

| Factor Name | Observed Variables | Cronbach’s Alpha | Reliability Results |

| Positivity & Awareness | 5 | 0.848 | Good |

| Security & Trust | 5 | 0.860 | Good |

| Infrastructure Availability | 5 | 0.851 | Good |

| Comfort and Simplicity | 5 | 0.860 | Good |

| Green Banking | 5 | 0.839 | Good |

| Overall | 30 | 0.866 | Good |

| Table 2 KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy | 0.844 | |

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 3064.323 |

| Df | 300 | |

| Sig. | 0.000 | |

| Table 3 Convergent & Discriminant Validity Scores | |||||||||

| CR | AVE | MSV | MaxR(H) | CS | PA | ST | IA | GBA | |

| CS | 0.871 | 0.578 | 0.356 | 0.888 | 0.760 | ||||

| PA | 0.849 | 0.530 | 0.177 | 0.856 | 0.159 | 0.728 | |||

| ST | 0.863 | 0.559 | 0.151 | 0.869 | 0.203 | 0.389 | 0.748 | ||

| IA | 0.853 | 0.537 | 0.356 | 0.854 | 0.597 | 0.042 | 0.296 | 0.733 | |

| GBA | 0.843 | 0.524 | 0.177 | 0.864 | 0.124 | 0.421 | 0.232 | 0.017 | 0.724 |

| Table 4 Model Fit Index | |||

| Category | Level of Acceptance | This model’s Level | Accepted/Rejected |

| Absolute fit Indices/ Chi-square | =< 5.0 (Best between 2 to 2.5) | 2.023 | Accepted |

| Root mean square error of approximation (RMSEA) | <0.08 | 0.051 | Accepted |

| Root mean square residual (RMR)/ Incremental fit Indices | =<0.80 | 0.040 | Accepted |

| Comparative Fix Index (CFI) | >0.90 | 0.939 | Accepted |

| Tucker-lewis Index (TLI) | >0.90 | 0.931 | Accepted |

| Incremental Fix Index (IFI) | >0.90 | 0.940 | Accepted |

| Parsimony Fit Indices (PCFI) | >0.50->=0.90 | 0.829 | Accepted |

Cronbach's Alpha was 0.866 for the set of 25 variables, which is good enough to figure out how reliable the scale is. Cronbach's alpha coefficients for all five factors are higher than 0.6. This means that they are all reliable and can be used for further analysis.

Data Adequacy

To do a factor analysis, it was important to look at these two measures, KMO' and KMO'. Bartlett's "Sphere Test." They help show how good the sample results are:

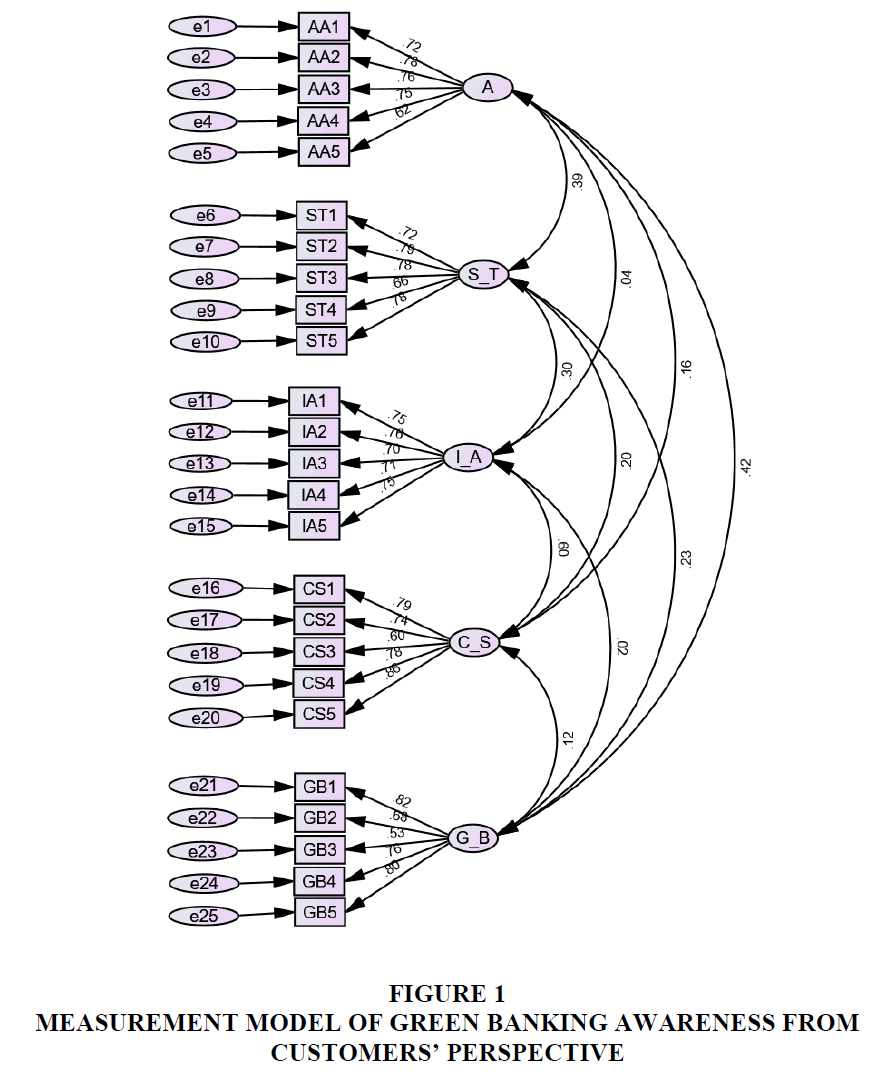

KMO checks sampling adequacy, and a value of more than 0.6 is thought to be good for a number of responses. Based on the number of responses, the value of KMO in this analysis is 0.844 and p<0.001, which is a very good result. The Bartlett’s Test of Sphericity results of the test showed enough clarity to show that Exploratory Factor Analysis is a good way to look at the researcher perception scale items Figures 1-2.

Reliability Analysis

Based on what was found, the likelihood value of the critical ratio is less than 1% of the significance level. So, with a confidence level of 95%, we can assume that all the statements used in the study are statistically valid and reflect the many factors that describe green banking. The result also shows that all standardized estimates of different things are thought to be higher than 0.7. Composite reliability (CR) is a measure of the reliability and convergent validity of a construct in a measurement model. If the value of CR is more than 0.7, it means that the scale is reliable enough. So, we can say that the Composite Reliability of each construct in the measurement model is more than 0.70. This means that all of the constructs in the measurement model that represent Green Banking are reliable. This seems to show that the model has convergent validity. Convergent validity and existence show two reasons why green banking and sustainability are important. First, there is a strong positive correlation between the things that make up the construct. Second, the statement is a good representation of the whole construct.

Model Fit

Absolute Fit Indices are used to measure how well the overall model fits. These indices include:

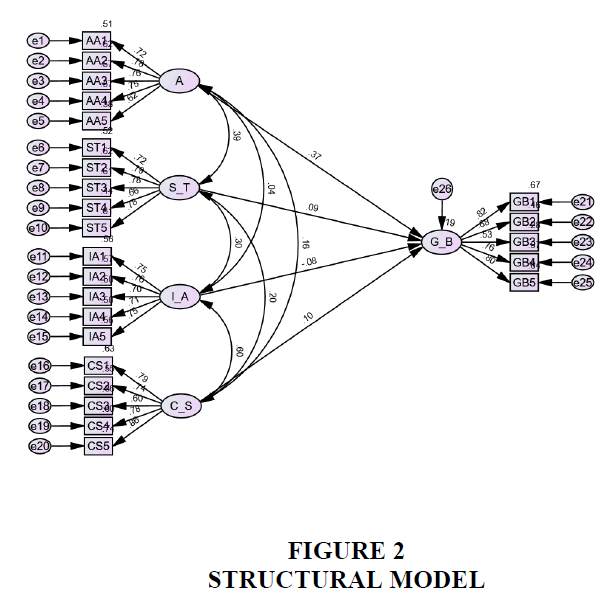

Structural Equation Modeling (SEM)

SEM was used to test the structural model so that the hypothesized conceptual research model could be looked at. To reach the research goals, the structural model is based on the following four hypotheses from the customers' point of view.

H1: There is a strong relation associated with Attitude & Knowledge (AA) on Green Banking.

H2: There is a strong relation associated with Security and Trust (ST) on Green Banking.

H3: There is a strong relation associated with the Infrastructure Available (IA) on Green Banking.

H4: There is a strong relation associated with Comfort and simplicity (CS) on Green Banking.

The results suggest that the structural model's estimates are accurate. The results showed that there is a strong link between the use of green banking practices and sustainability. The results show that the constructs of positivity and awareness (Standardized Regression Coefficient=0.37; p0.05), security and trust (Standardized Regression Coefficient=0.09; p0.05), infrastructure availability (Standardized Regression Coefficient=0.08; p0.05), and comfort and simplicity (Standardized Regression Coefficient=0.10; p0.05) all have a positive effect on green banking. So, all of the study's hypotheses H1, H2, H3, and H4 are true, and all of the constructs have a big effect on green banking awareness on the way to sustainability.

Conclusion

India is walking towards an aggressive stage of sustainability and soon will attain complete sustainability in the banking industry. Despite the fact that green practices are becoming increasingly popular, most Indian banks have yet to adopt them. Sustainability in banking can be achieved if all Indian banks provide green services to their customers. The Consumption and use of paper, electricity, water, fuel, stationery, equipment, and technology by banking institutions pollutes the environment. Various green banking initiatives have been taken by the banking industry so far. Customers are aware of environmental issues but face obstacles in using green products. Based on the review of the literature, a conceptual model was proposed that shows how green banking initiatives and customer views on sustainability are related. Statistical methods are used to look at the collected primary response data. The analysis starts with making the measurement scale, which includes the whole thing that is being measured in the study. The measurement model is looked at to see if it is reliable and if the scale has the necessary convergent and discriminant validity. The confirmatory factor analysis (CFA) is used to test the construct validity of a measurement scale that has already been made. In the sections that follow, the results of these statistical methods are given and talked about. The reliability of the instrument means that it gives consistent scores from a test and the table. There are many ways to test how reliable an instrument is, but in this study, Cronbach's alpha is used to test how reliable the instrument is internally. Cronbach's alpha can be used to find out how reliable an instrument is on the inside. Cronbach's alpha values of more than 0.7 are good, those of more than 0.8 are good, and those of more than 0.9 are thought to show very good internal consistency (Cronbach, 1955). The study used a model that loops back on itself, and the sample size was 252. The most important finding is that Attitude and knowledge (AA) have a strong effect on sustainability (S 0.37; P 0.00), which supports H1. This is followed by Comfort & Simplicity (CS), which has a strong effect on sustainability (S 0.10; P 0.00), which supports H4. Next, there is support for H2, showing Security & Trust (ST) on sustainability with (S 0.09; P 0.00). The impact of infrastructural availability (IA) on sustainability is important for H3 (S 0.08; P 0.008). All of the hypotheses are supported by the results of this research. The structural model's goodness-of-fit is just barely good. The values for R2/df, CFI, TLI, and IFI are 2.023, 0.939, 0.931, and 0.940, which are all within the acceptable ranges. The RMSEA is 0.051, which is close to 0 and means that the model fits well. So, we can say that the model used in this paper is accepted based on the fit indices, and we can keep analyzing the research hypotheses that we set up in the model. The independent sample t-test shows that ownership doesn't make a big difference between banks. The researcher says that the RBI needs to give clear rules to all banks that require them to take part in "green banking" initiatives. The RBI should also set up help centres where customers can get answers to their questions about these products and learn about the green initiatives and how they help society as a whole.

References

Asim, S., Bukhari, A., Hashim, F., & Amran, A. (2020a). The Journey Of Pakistan ’ S Banking Industry Towards Green Banking Adoption. 1–11.

Indexed at, Google scholar, Cross Ref.

Bouteraa, M., Rizal, R., & Raja, I. (2021). Exploring Determinants Of Customers ’ Intention To Adopt Green Banking?: Qualitative Investigation. 16(3), 187–203.

Indexed at, Google scholar, Cross Ref.

Iqbal, M., Rifat, A., & Nisha, N. (2021). Evaluating Attractiveness And Perceived Risks?: The Case Of Green Banking Services In Bangladesh. 12(1), 1–23. Https://Doi.Org/10.4018/Ijabim.20210101.Oa1

Indexed at, Google scholar, Cross Ref.

Mitic, P. (2012). Green Banking - Green Financial Products With Special Emphasis On Retail Banking Products Slobodan Raki ? - Petar Miti ?. 47009(Iii).

Rai, R., Kharel, S., Devkota, N., & Paudel, U. R. (2019). Customers Perception On Green Banking Practices?: A Desk Review Customers Perception On Green Banking Practices?: A Desk Review. September.

Sharma, M., & Choubey, A. (2022). Green Banking Initiatives?: A Qualitative Study On Indian Banking Sector. Environment, Development And Sustainability, 24(1), 293–319. Https://Doi.Org/10.1007/S10668-021-01426-9

Indexed at, Google scholar, Cross Ref.

Taneja, S., & Ali, L. (2020). Journal Of Retailing And Consumer Services Determinants Of Customers ’ Intentions Towards Environmentally Sustainable Banking?: Testing The Structural Model. Journal Of Retailing And Consumer Services, December, 102418. Https://Doi.Org/10.1016/J.Jretconser.2020.102418

Indexed at, Google scholar, Cross Ref.

Úbeda, F., Javier, F., & Su, N. (2022). Do Formal And Informal Institutions Shape The Influence Of Sustainable Banking On Financial Development?? 46(July 2021). Https://Doi.Org/10.1016/J.Frl.2021.102391

Indexed at, Google scholar, Cross Ref.

Zhang, X., Wang, Z., Zhong, X., Yang, S., & Siddik, A. B. (2022). Do Green Banking Activities Improve The Banks ’ Environmental Performance?? The Mediating Effect Of Green Financing. 1–18.

Indexed at, Google scholar, Cross Ref.

Zhixia, C., Sami, S., & Begum, M. (2018). Asian Economic And Financial Review Green Banking For Environmental Sustainability- Present Status And Future Agenda?: Experience From Bangladesh. 8(5), 571–585. Https://Doi.Org/10.18488/Journal.Aefr.2018.85.571.585

Indexed at, Google scholar, Cross Ref.

Received: 02-Nov-2022, Manuscript No. AMSJ-22-12796; Editor assigned: 04-Nov-2022, PreQC No. AMSJ-22-12796(PQ); Reviewed: 18- Nov-2022, QC No. AMSJ-22-12796; Revised: 25-Nov-2022, Manuscript No. AMSJ-22-12796(R); Published: 05-Dec-2022