Research Article: 2022 Vol: 26 Issue: 4

A Study on Impact of Dividend Policy and Stock Price Volatility on Health Care Market

Venkata Ramana J., Koneru Lakshmaiah Education Foundation

Nasika Shamini, MBA, Business School, Koneru Lakshmaiah Education Foundation (KLEF)

Tangirala Sai Nikhil, MBA, Business School, Koneru Lakshmaiah Education Foundation ((KLEF)

Citation Information: Venkata Ramana,J., Nasika, S., & Tangirala, S.N. (2022). A study on impact of dividend policy and stock price volatility on Health Care market. Academy of Marketing Studies Journal, 26(3), 1-6.

Abstract

Our target to be reached through this research to measure the impact of the strength of electronic rumours circulating through social networking sites on the demand of the consumer for foodstuffs in light of the COVID-19 pandemic. For which purpose, analysis has been made for the dimensions of both electronic rumours and social networking sites, in addition to the demand for foodstuffs in light of the COVID-19 pandemic. Besides, based on the field study using the questionnaire that has been distributed to a specific sample consisting of 394 consumers using one of the social networking sites, the study demonstrated the existence of a statistically significant effect of the electronic rumours on the consumer demand for foodstuffs in light of such pandemic. More to the point, this study attributed that effect to three factors pertaining to the nature of the electronic rumours and the means of their distribution, in addition to factors relating to the consumer personality, and other factors associated with the environmental conditions created by the pandemic in terms of economic, social and psychological aspects. Furthermore, amongst the most important of such factors, we uncover: the relative importance of rumours with regards to the consumer, and the degree of ambiguity that distinguished the crisis period about the measures taken by government to cope with the crisis, along with the degree of credibility and confidence that the consumer allocates to those rumours, in addition to the spread of anxiety and stress resulting from the crisis in question.

Keywords

Electronic Rumours, Social Networking Sites, Demand For Foodstuffs, COVID-19 Pandemic.

Introduction

Traditionally, it has been questioned whether a corporation may influence the value of its shares by changing its dividend policy to suit the investors rather than the company itself in order to keep them invested. The most popular and straightforward argument/debate is that the company can increase the value of its stock by increasing its dividend-payout ratio. Researchers believe that investors would prefer a rupee of dividends to a rupee of capital gains because "a bird in the hand is worth a lot more than a bird in the bush," which has a slim probability of making its way into investors' hands following capital appreciation in this turbulent market. As a result, investors will bid up the price of common shares or equity of companies that pay generous dividends in comparison to companies that pay lower dividends. The most effective and well-known proponents of this viewpoint are Graham and Dodd (1951).

Dividend policy is considered to be one of the most widely debated and researched topics in the financial sector. The long-standing debate among directors, managers, CEOs, politicians, and researchers on whether dividend policy has a positive or negative impact on stock prices continues. Every company in every industry has a specific payout model or dividend policy that is based on government rules and regulations as well as corporate policy and is used as a measure of the company's financial performance. An increase in dividend payment is viewed as a good and optimistic indicator, whilst a reduction in dividend payment is viewed as a bad indicator for the company's long-term earnings and future prospects, resulting in an increase or fall in share prices. The corporation is required to pay the dividend distribution tax to its local and central governments when paying dividends to investors. As a result, it raises the company's costs and reduces the funds available for future project investments Ramana & Sridhar (2019).

Individual and professional investors, managers of funds such as mutual funds, ETFs, and hedge funds, lenders such as banks, and other stakeholders (suppliers, distributors, and customers, among others...) are all affected by dividend policy. It is critical for investors because they consider dividends not only as a source of income but also as a means of determining how to evaluate companies from an investing standpoint. The investing point of view is a method of determining whether or not a firm can create profit. An investor can do a sharper and more exact examination of the company's financial status by collecting vital information on dividend yield (DY) and dividend payout ratio (DPR) Ramana et al. (2019).

Financial specialists have begun to formulate their arguments in favour of the aforementioned two ground-breaking investigations, which have produced disparate and, in many cases, contradictory results. According to a study conducted by Gordon (1963), paying higher dividends and investing less reduces the risk that a company faces, which in turn influences the price of capital and thus the share price. Baskin (1989) proposed in a similar study that dividend yield isn't simply a proxy-dividend and, as such, may influence Stock Exchange risk. Miller and Modigliani's (1961) irrelevance notion of dividends payout to companies and investors worth, value, and wealth was criticised by DeAngelo et al. (2006), who claimed that speculation led in moderating researchers' views on dividends payment. Many studies conducted by researchers across Europe, Asia, Australia, and other markets found a positive relationship between dividend and share price fluctuations (Gordon (1963; Baskin (1969), Hashemijoo (2012), Tsoukalas (2005), Marvides (2003), Hussainey (2011)), indicating that dividend policy has influenced stock/share price volatility.

Dividends are important not only in perfect markets, but also in developing markets like India, Pakistan, and Africa, as Miller and Modigliani argue. Deregulation of the monetary sector, the Narashimam Committee's appointment to reform the capital market in 1991, the formation of the Securities Exchange Board of India (SEBI) as the apex regulator of the capital market in 1992, the opening of the capital market to foreign institutional investors (FII), and demonetization have all resulted in a recent transformation of the Indian capital market. As a result, the goal of this research is to look into the relationship between dividend policy and share price volatility after the ocean shifts.

Literature Review

There has been a lot of discussion about dividend policy and how it affects a company's value. Many studies have been conducted since the turn of the century to determine the impact of dividend policy on stock value. Some academics believe that paying dividends to shareholders boosts the value of the stock. On the other hand, although some have argued that dividends are irrelevant, others have argued that paying dividends results in a decrease in shareholder wealth. Despite the fact that many research studies are conducted in the field of dividend policy and value, only a few studies explain the impact of dividend policy on MPSs. As a result, in order to add value to the current research and contribute to the literature, this study examines the impact of dividend policy on the MPSs of health-care companies.

To explain how corporate dividend programmes affect stock prices, payout theories have evolved over time. Dividend policy is irrelevant to shareholders in a perfect market, according to Miller and Modigliani (1961), because the firm's value is determined by its investment and finance decisions rather than payout decisions. This argument is based on the following assumptions about perfect capital markets: (1) there is no tax, (2) there is no flotation or transaction, (3) information is symmetrical and priceless (i.e., all market participants have free and equal access to the same information); (4) there are no conflicts of interest between managers and shareholders, and thus no agency costs; and (5) all market participants are price takers. Miller and Modigliani (1961) conclude that all dividend schemes are practically the same for all investors based on these assumptions. This is because investors can generate "homemade" dividends by selling a portion of their stock holdings. As a result, dividends and capital gains would be irrelevant to stockholders. The dividend irrelevance theory is supported by a large body of empirical evidence.

Bird-in-Hand Theory: The bird-in-hand theory is a guide to the investors based on this bird in hand theory discovered by Myron Gordon and John Lintner during 1964. This theory tells that investor would want to have less risk to their investment hence they find dividend are less risky that future capital gains. This theory is discovered as a counter point to dividend irrelevance theory. Investors believe that firms cannot alter the characteristics of a dividend so there is a less chance of losing money. Whereas in capital gain the real return on investment is known when the stocks are sold and selling price must be greater than the cost price because of heigh uncertainty of the stock market it is impossible to predict the value of the capital gain in future but however in the case of dividend investors are provided with dividend payout ratios. Investors use there payout ratios to calculate the returns on their investment. Most of the investors find that dividend is one of the way to find the growth off the organization and they argue that the stock which pays higher dividend have more value and the higher the value of the stock the more investments they get.

Tax preference theory: The tax preference theory was found by R.H. Litzenberger and K. Ramaswamy. This theory states that investors prefer to keep their investments in a long term with expectation of low payout ratio because of 6tax benefits. Investors argue that due to the low payout the invested capital gain becomes a long-term investment which does not charge any tax unless the stock is sold or purchased. Another advantage of the tax preference theory in capital gain is when a stockholder dies without selling his stock in the company can be inhered by their family and can be sold. The government cannot charge tax for selling a dead person stock in market.

This tax preference is created based on the American stock markets. During 1968 in American stock market only 40% of the dividend payout and capital gain are taxed. But later of only 20% of tax is availed on the long-term capital gains. According to Indian tax laws the tax preference theory does not applicable India because regardless of dividend or capital gain the tax is impose on the revenue gained by the stock after selling.

Signaling Theory: Signalling theory was initially developed by Michael spencer based on the gaps between organization and prospective employee which led to adapt many other domains. Signaling theory. These are the corporate financial decisions that are send by the companies. According to experts these signailling theory are the financial decisions that are made by the company which prove investors to invest them in the company.

Agency Cost Theory: The agency cost theory is found by Barry Mitnick in 1973.

This theory states the relationship between an agent and principal. Here principal refers to the company whereas agent refers to person who takes decision on behalf of the company. An agency costs theory is an economic concept that refers to the cost associated with the relationship between and the agent.

This agency is cost theory is a characterized through the conflict of interest between owners and managers. This theory assume that large scale retention of earnings encourages behavior by mangers that does not maximize the shareholder value. This theory is used to analyze the conflict between share holder payout for their investment and mangers of the company.

Dividend Policy and Share Price Volatility: Dividend policy is a policy which are showcased by the company to attract investors to invest capital in their organization. Investors purchase shares of the company as an indication of investment and in return investors expect dividend pay for their investment. The dividend is paid to a person who holds share of a company. Share price is the price of the company is the monetary value of the stock this share value keeps changing according to the market Ilaboya & Aggreh (2013).

Dividend policy and share price violation is the effect of dividend policy on the share price of the company .Generally before distribution of dividend a company declares the dividend amount and date of payment it also includes the last date when the shares can be purchased, due to this declaration investors shows interest in purchasing companies shares before the last date tis causes the price of the stock in the market as more investors want to buy the shares Omran & Pointon (2004).

There are some variables which effect the violation of dividend policy and stock price. The variables include (Share price) (Dividend payout ratio) (Dividend yield) and (earnings per share). Analysis of the given variables provided the co relation between dividend policy and share price violation. we take controllable variables into consideration in order to find the significant relation between the dividend and share price of a company this analysis may be change from industry to industry. Some other factors also effect the dividend policy and share price violation like Government taxation policy: due to some taxation policy of the government investors lack of interest in purchasing of shares even thought the dividend declared is profitable the tax availed on selling and purchasing of the shares creates a negative effect on investors.

Methodology Research

Objective of the Study

1. To understand the impact of dividend policy on share price.

2. To explore the variables that are affected by the dividend policy which in succession affects the share price.

3. To analyze the impact of value of the firm on the market price of the shares.

Hypothesis Formulation

H0: There's no significant effect of dividend policy on share price.

H1: There's a significant effect of dividend policy on share price.

The methodology which we are visiting use is multiple linear regression analysis. We identify the dependent and independent variables supported the volatility of market in healthcare sector. Now assume the hypothesis for all the variables and provide certain formulas to calculate the hypothesis Almanaseer (2019). We use statistical method models like multiple least square regressions.

Formulae for Calculation

We have identified the specific formulae needed to perform calculations and analyze the findings Hashemijoo et al. (2012).

1. Dividend yield: Cash Dividend per share / market price per share * 100. Dividend Payout Ratio: =Dividends Paid/Net Income

2. Earnings per Share=Net Income − Preferred Dividends/End-of- Period stock Outstanding

3. DPS = (total dividends paid out over a period - any special dividends) ÷ (shares outstanding)

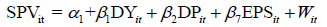

Equation Employed In this Research Article

Where, “i” and “t” shows cross sectional and time units respectively, SPV is stock price volatility, DY is dividend yield, DP is dividend payout ratio, EPS is earnings per share and at last “Wit” is combined random effect error term Zakaria et al. (2012).

| Table 1 Descriptive Statistics |

||||

|---|---|---|---|---|

| Statistics | SPV | DY | DP | EPS |

| Mean | 0.5562 | 0.0768 | 0.502 | 25.0010 |

| Median | 0.5198 | 0.0691 | 0.4129 | 13.9887 |

| Maximum | 1.312 | 0.3212 | 1.099 | 299.36 |

| Minimum | 0.1710 | 0 | 0.0011 | -40.001 |

| Standard deviation | 0.2456 | 0.0478 | 0.2893 | 35.0006 |

| Sum | 234.78 | 27.721 | 197.19 | 9900.165 |

| Sum square deviation | 23.123 | 0.9756 | 30.909 | 466789 |

| Observations | 400 | 400 | 400 | 400 |

| Table 2 Correlation Analysis |

||||

|---|---|---|---|---|

| Variables | SPV | DY | DP | EPS |

| SPV | 1 | |||

| DY | -0.211* | 1 | ||

| DP | -0.098* | 0.451* | 1 | |

| EPS | 0.061 | 0.099** | -0.089 | 1 |

Values are significant at *1%, **5%, ***10% level of significance. SPV: Stock price volatility, DY: Dividend yield, DP: Dividend payout, EPS: Earning per share.

Regression with Dividend Policy and Control Variables

| Table 3 Dependent Variable: Spv |

||||

|---|---|---|---|---|

| Method: Panel EGLS (cross-section random effects) | ||||

| Variables | Coefficient | Standard error | t-statistic | P |

| DY | -0.9791* | 0.2812 | -3.3183 | 0.0010 |

| DP | -0.0156 | 0.0610 | -0.2250 | 0.8222 |

| EPS | 0.0001 | 0.0005 | 1.5848 | 0.1139 |

R2=0.0452, adjusted R2=0.0275, F-statistic=2.6670, P (F-statistic=0.22105 and D.W=2.10). Values significant at: *1%, **5%, ***10% level of significance. SPV: Stock price volatility, DY: Dividend yield, DP: Dividend payout, EPS: Earning per share.

Findings

1. The findings we have brought up by this research are significant. The variable’s which are taken under the calculation of share price violation show that there is some significant effect on the variables with respect to dividend policy of the company.

2. According to the company dividend policy the share price and value of the share can be or cannot be affected. The effect of dividend policy shows partial effect on the share price violation.

3. According to the observations of the study we found that the control variables earnings per share has a significantly positively relation with stock price violation. Which proves the point that dividend policy has a significantly positive or negative effect on the share of the company.

4. There is a significant negative relation between stock price violation and the dividend policy of the respective company in health care sector.

Conclusion

In the sight of this research, we can conclude that dividend policy of companies in health care sector are significantly affected by the stock price of the company and There is a significant negative relation between stock price violation and the dividend policy of the respective company in health care sector.

References

Almanaseer, S. R. (2019). Dividend policy and share price volatility: evidence from Jordan.Accounting and Finance Research. https://doi. org/10.5430/afr. v8n2p75.

Hashemijoo, M., Mahdavi Ardekani, A., & Younesi, N. (2012). The impact of dividend policy on share price volatility in the Malaysian stock market.Journal of business studies quarterly,4(1)

Indexed at, Google Scholar, Cross Ref

Ilaboya, O. J., & Aggreh, M. (2013). Dividend policy and share price volatility.Journal of Asian Development.

Omran, M., & Pointon, J. (2004). Dividend policy, trading characteristics and share prices: empirical evidence from Egyptian firms.International Journal of Theoretical and Applied Finance,7(02), 121-133.

Ramana, J. V., & Sridhar, P. (2019). The movement of industrially applicable yellow metal and its impact on global currencies.International Journal of Recent Technology and Engineering,8(3), 7066-7070.

Ramana, J. V., Reddy, D. H., & Kumar, K. V. An Empirical Study on Marketing of Handloom Fabrics in Andhra Pradesh (A Case Study with reference to Guntur District).

Zakaria, Z., Muhammad, J., & Zulkifli, A. H. (2012). The impact of dividend policy on the share price volatility: Malaysian construction and material companies.International Journal of Economics and Management Sciences,2(5), 1-8.

Received: 05-May-2022, Manuscript No. AMSJ-22-11994; Editor assigned: 07-May-2022, PreQC No. AMSJ-22-11994(PQ); Reviewed: 21-May-2022, QC No. AMSJ-22-11994; Revised: 23-May-2022, Manuscript No. AMSJ-22-11994(R); Published: 30-May-2022