Review Article: 2022 Vol: 26 Issue: 5

A Study on Macro Economic Variables and their Impact on Gold Price In India

Sailaja VN, Koneru Lakshmaih Business School

Akhil Kumar V, Koneru Lakshmaih Business School

Padmini Kota VS, Koneru Lakshmaih Business School

Citation Information: Sailaja, V.N. Akhil Kumar, V & Padmini Kota, V.S. (2022). A Study on Macro economic variables and Their Impact on gold price In India. Academy of Marketing Studies Journal, 26(5), 1-16.

Abstract

The World Gold Council estimates that 75% of India's gold demand over the previous decade has been in the form of jewellery. When a consumer's buying power rises, the price of gold rises. Gold's price rises for a variety of reasons. There are several elements that drive gold price changes. Several macroeconomic factors are examined in this research to see how they relate to gold's price and what effect that has. The research used gold demand, the nifty, the foreign exchange rate, inflation, the GDP domestic product, and the price of crude oil as independent factors and the price of gold as a dependent variable. The researchers used correlation and a multiple regression model as research methods the gold price is highly correlated with inflation, GDP, the nifty index, crude oil prices, and the foreign exchange rate. There is a little correlation between the price of gold and the amount of gold that people are willing to buy. According to the findings of multiple regression analyses, inflation and the nifty have a detrimental effect on the price fluctuations of gold, but gross domestic product and crude oil prices have a positive influence from this research, we can say that neither the demand for gold nor the fiscal deficit have any effect on the price of gold.

Keywords

Gold Price, Forex Currency, Inflation, Gross Domestic Product, Indices, Crude oil, Interest Rate, Fiscal Deficit.

Introduction

As a exchange of value apart from all the commodities gold stands first as it became an integral part of life and a symbol of culture, richness and a specific good for its inborn value in its exchange of In the last decade, 75% of gold demand in India has taken the form of jewellery. Over 90% of the gold consumed in India is imported. In order for India to go from a developing to a developed market, domestic investors must remain invested in the capital market.

Review of Literature

Liya A, Qian Qin 2021 the findings of this research indicate a remarkable and positive relationship between GDP, IR, and STV and the gold price. Furthermore, the RIR is negative and has no meaningful relationship with gold prices.

Long & Hanh (2019), the gold reserve, the price of energy items, and the financial markets have all been categorised and grouped into three categories. The FAVAR model was used in this study to assess all macroeconomic variables that impact gold prices and trends. The findings revealed that gold reserves and energy goods have positive benefits; however the financial market's influence suggests that macroeconomic indicators have a negative effect on gold prices.

Tiwari & Gupta (2015) investigated the association between gold prices and Indian stock market returns. There is no correlation between the gold price and the BSE Sensex according to the Granger Causality test.

Nand Kishor Soni & Ajay Parashar (2015) at the University of British Columbia in Canada. Study states that there is no long-term association between gold demand and stock market return according to the Granger Causality test, gold demand does not affect gold price and vice versa. It was concluded that gold is an important predictor of inflation in industrialized nations.

Srinivasan & Ibrahim (2014) explores the causal relationship between gold prices, stock prices, and the Indian exchange rate. According to the findings, gold and stock prices have a long-run relationship with the exchange rate. The empirical data show that there is no short-run causation between the price of gold and the price of stocks. The research showed that local gold prices do not provide useful information for forecasting stock indices in India and vice versa.

Tripathi et al. (2014) investigate the link between global economic circumstances and gold prices. As a result of this investigation, predictors such foreign institutional investment (FII), the Standard & Poor's 500 index, foreign currency reserves, and crude oil prices were found. The findings show that these variables have long-term integration; moreover, it was revealed that none of the above global factors Granger Cause Gold price in India; nevertheless, it was observed that Gold price Granger Cause Exchange Rate (USD) and Crude oil price throughout the research period. The findings of the analysis show that gold prices are not just affected by exchange rates, but also by other variables such as the NIFTY, SENSEX, Reverse Repo, RBI Policy Rate, Forex Reserves, India's Gold Reserves, USD Gold Reserves, Revenue Deficit, Fiscal Deficit, Balance of Payments (BOP) Current Account, FDI inflows, Wholesale Price Index (WPI), and Gross Domestic Product (GDP). Sindhu (2013) conducted research on the influence of oil prices, inflation rates, forex rates, and repo rates. The exchange rate and gold price have an inverse connection. Repo rates and gold prices are intertwined. According to this correlation, gold prices and inflation rates are closely linked Tripathi et al. (2014).

Singh et al. (2012) sought to establish a causal link between the price of gold and the Sensex. The gold price and the forex rate have a negative relationship. Gold and the stock market have been studied in this research to see whether there is a directional or unidirectional correlation. According to the findings, there is no correlation between the gold price and the Indian stock market indexes.

Amalendu Bhuniya and Somnath Mukuthi did research on how the price of gold in India affects stock market indices. The results of the Granger causality test indicate that there is no causation between nifty and gold price, gold price and Sensex, or nifty and Sensex, but that there is bidirectional causality between gold price and nifty, Sensex and gold price, and Sensex and nifty.

Dr. Rohit Manjule did research 2013 on how the bullion market, stock market, and exchange market all work together. Since the Bullion market and capital market are directly proportionate to each other, this study concluded that they are linked, while the Forex market is inversely proportional to both the Capital and Bullion markets Nath & Samanta (2003).

According to Somnath Mukuthi and Amalendu Bhuniya 2013, the Indian stock market reacts to gold price changes and vice versa. During the research period, the price of gold in India increased as a consequence of the Indian stock market's response and other macroeconomic variables.

Bilal et al. (2013) compared the gold price to the Karachi stock exchange and the stock exchange. The study's results show that there is no long term link between KSE stock indices and gold price, whereas there is a long-term association between gold price and BSE stock indices. Granger The investigation discovered no association between the gold price, the BSE stock indices, and the KSE stock indices Dr. Amalendu Bhuniya and Amit Das 2012 experimentally evaluated the correlation between the gold price and the NSE stock index and found that gold price drives stock market returns, and vice versa.

According to Angi Rosch & Schmidbauer (2012), festivals affect gold price volatility. After Akshaya Tritiya, the variability tends to grow, but not anticipation. Around Ramadan Eid, however, expectancy rises, as doe’s volatility. Christmas has a strange influence on expectation: it is favourable before the holiday and negative afterwards, with considerable volatility in both times.

In 2012, Dr. Ira Bapna looked at how changes in macroeconomic factors affect the gold price. The purpose of the research was to investigate the link between GDP, the exchange rate, stock returns, inflation, and the interest rate and gold price. According to the empirical study, the exchange rate, budget deficit, forex reserve, and inflation rate all have a big independent influence on gold prices, whereas the growth rate, GDP, BSE Sensex, and NSE Index all have a very little independent impact on gold prices. Gold does not influence the exchange rate, BSE Sensex, NSE Index, foreign reserves, or fiscal deficit, but it does influence the interest rate and inflation, and vice versa. In terms of gold price, there is a bidirectional link between growth rate and GDP.

Toraman et al. (2011) investigated the factors influencing gold prices in the United States. As predictor variables, the oil price, US exchange rate, US real interest rate, and US inflation rate were considered. It has been observed that there is a strong negative link between gold and the US dollar exchange rate Bapna et al. (2012).

Ismail et al. (2009) forecasted the gold price using multiple regression models. Factors influencing the research were the Commodity Research Bureau Future IndexForeign Exchange Rate, Inflation Rate, Money Supply, New York Stock Index, S&P 500, USDollar Index, and Treasury Bill. The primary elements affecting the gold price, according to the study, are the CRB, inflation rate, exchange rate, and money supply.

Statement of the Problem

Initially, we wanted to see how macroeconomic variables affected gold's price. We have uncovered, established, and measured correlations that may help us understand these implications. The gold model demonstrates how macroeconomic factors influence the real price of gold in a measurable way. The anticipated findings support our claim that real GDP, real interest rate, real US dollar index, and real gold price are all connected.

Further research has shown mixed results, according to a literature review. Some studies discovered a link between gold's price and macroeconomic variables, while others found none. As a result, our model predicts a positive relationship between real GDP and the real price of gold in the long run. As with the real US dollar index, the real interest rate has an inverse relationship with the real price of gold. Although the actual rate of interest may have some short-term fluctuations. As a result, this element is more erratic and volatile. It is, however, the least essential factor in the price of gold.

Research Objectives

The following objectives were set for the research study.

• Investigate the Impact of Macroeconomic Variables on Gold Prices.

• To explore the connection among macroeconomic factors and gold prices.

Research Design and Methodology

The research study aims at describing.

Type of Data & Data Source

The RBI database, the BSE database, and the World Gold Council database were used to find the annual values for Crude Oil Prices, Gross Domestic Product at Market Price (GDP), Inflation Rate, BSE Sensex, US Dollar Rate, and Gold Price.

Sample Size

Macroeconomic variables were described using the Gross Domestic Product, Consumer Price Index, National Stock Indices, Gold Demand, Foreign Exchange Rates, Interest Rates, Fiscal Deficit, and Crude Oil Prices are all indicators of economic activity.

Research Questions

• Is there a connection between macroeconomic indicators and gold prices?

• Do macroeconomic factors influence gold prices?

Materials and Methods

H01: In India, there is no relationship between the gold price and macroeconomic indicators.

H02: Macroeconomic variables have no effect on gold prices in India.

Period of the Study

The current study lasted 11 years, from January 2010 to December 2021.

Limitations and Scope of the Study

The study's scope was limited to macroeconomic data such as GDP, the Consumer Price Index (CPI), national stock market indices, gold reserves, foreign exchange rates, and crude oil prices Bhunia & Das (2012).

There are certain limits and bias in the data. The study examines all variables across the same time period, in this case, annual data from 2010 to 2021, and ensures that the dataset is sufficiently large. The aggregate statistics may be unstable because of the inclusion of many economic crises within the data selection period Bhunia & Mukhuti (2013).

The study does, however, attempt to discover the guiding effect of macroeconomic factors on gold. In the small dataset, price factors on the cost of gold the research is primarily focused on the India Mukhuti & Bhunia (2013).

Tools for Analysis

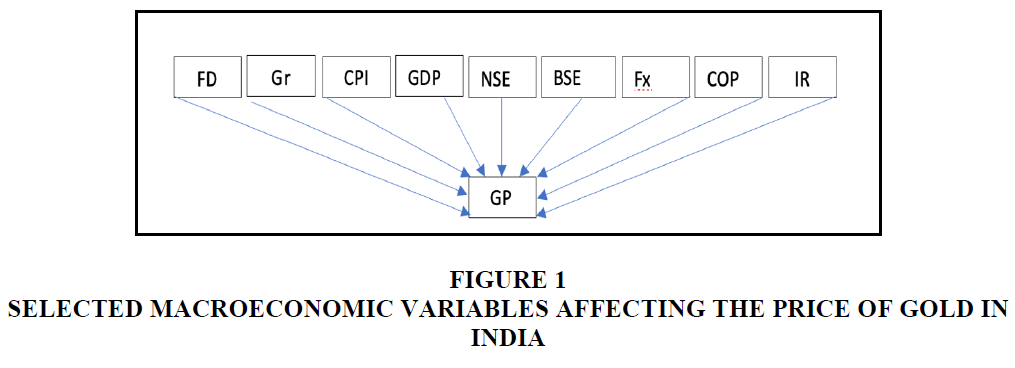

The study used correlation analysis to investigate the link between predictor variables and dependent variables. Regression analysis has been used to determine the influence of uncorrelated variables on the gold price. GRETL & R was used to apply the acquired data. Selected macroeconomic variables affecting the price of Gold in India Table 1 and Figure 1.

| Table 1 Variables Description | ||

| S. No | Variables | Description |

| 1 | Gold Prices | Gp |

| 2 | Gold Demand | Gd |

| 3 | Consumer Price Index | CPI |

| 4 | Gross Domestic Product | GDP |

| 5 | National Stock Exchange | NSE |

| 6 | Bombay Stock Exchange | BSE |

| 7 | Foreign Exchange Rate | Fx |

| 8 | Crude Oil Prices | COP |

| 9 | Fiscal Deficit | FD |

| 10 | Interest Rate | IR |

Theoretical Framework

Model

The core intention of this paper is to study the effects of Gr, CPI, Nifty, GDP, COP, FX, FD, and IR on the GP of India. The OSL Model is used to examine the relationship of India's GDP with other factors such as Gd, CD, CPI, and Nifty (GDP) and their impact on the Indian stock market.

Partial Correlation

The effect of a set of controlling random variables is deducted from partial correlation, which evaluates the degree of link between two random variables.

Multi Collinearity

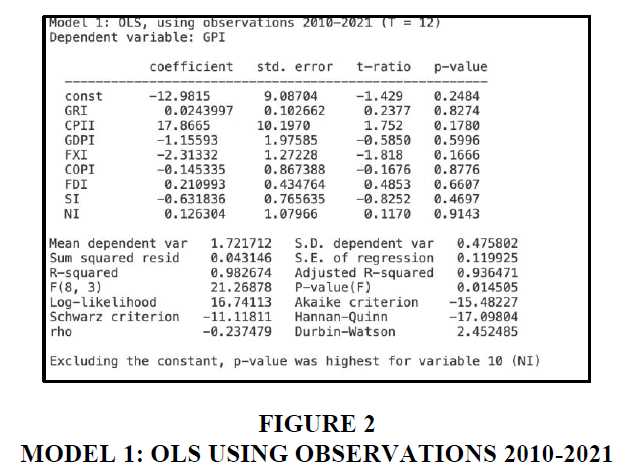

Multicollinearity occurs when two or more predictor variables in a multiple regression model are strongly related, i.e. a collinear linear relationship between two explanatory variables, such as a log-transformed logarithm Figure 2.

R-Square indicates the proportion of variance in the dependent variable that can be explained by the independent variables. The adjusted R-square, which in this case is 98.4 percent, reflects the amount of the variance in gold prices explained by oscillations in the independent variable. The high R2 value can be attributed to the fact that the variables have a significant correlation. We determined that my model had a significant F value of 150.00 using ANOVA. Furthermore, the BSE SENSEX and the NIFTY are negligible components in our approach Mukherjee (2007).

Multicollinearity and the Model

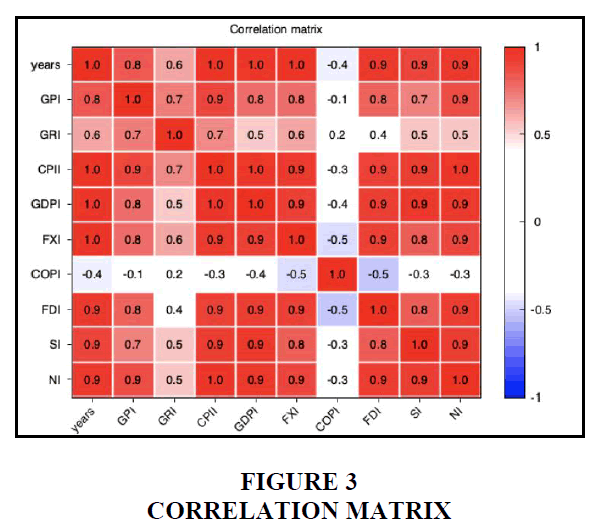

Insignificant variables, such as BSE and NSE (insignificant by t test but overall significant by F test), are not being removed from my model. Because the betas are still BLUE, I'm adding them. We cannot overcome multicollinearity since it is a data insufficiency problem Figure 3.

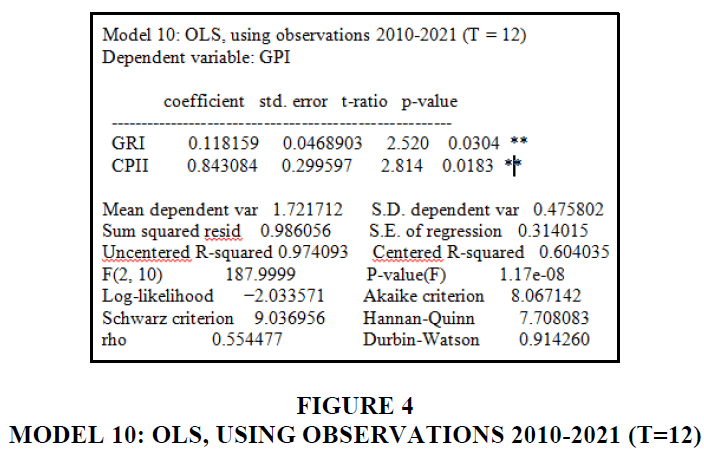

The NIFTY and BSE Sensex (stock indices) have an effect on gold prices, although it is minor due to data multicollinearity Srinivasan & Prakasam (2015). This has resulted in a high R2 that may be deceiving. The central gold reserves, inflation, and exchange rate were all relevant in both analyses. Reasons for this disparity include the fact that the two models are different, therefore the findings may differ.

From the data analysis, we can interpret the following RohitManjule (2013).

Note

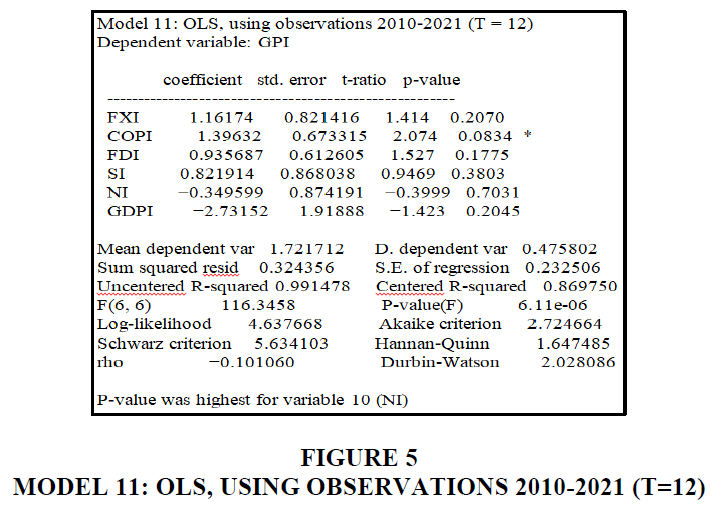

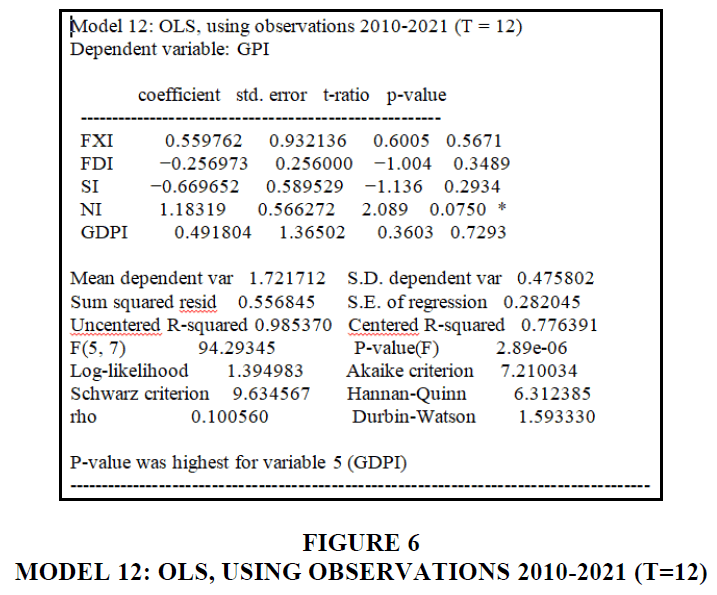

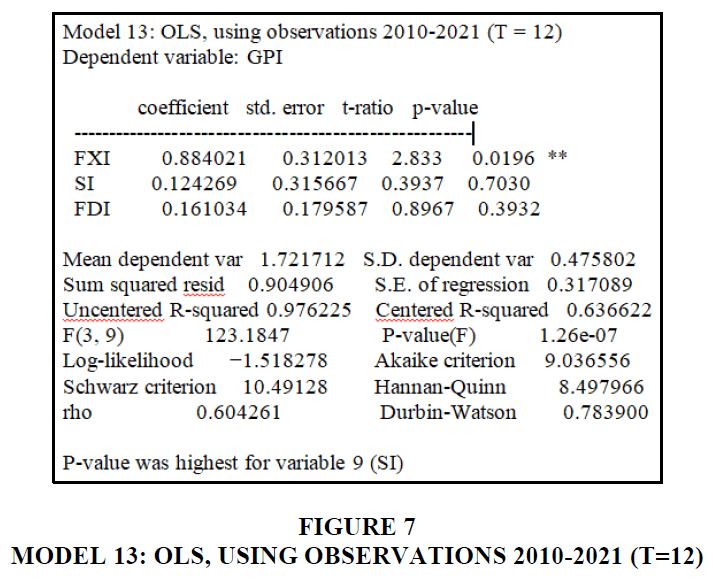

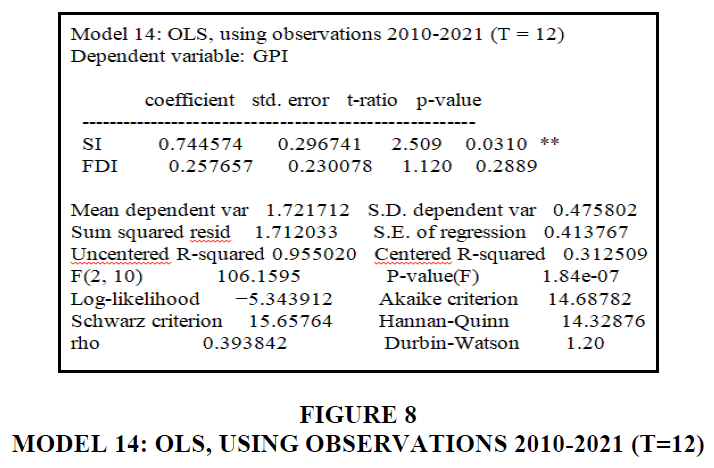

Gold Reserved, Inflation, Crude Oil, Nifty, Gdp, Foregin Exchange, Senex, Fiscal Deficit ( In this sequence gold price is affected by the macroeconomic variables one by one those are Inter related to each other Rösch & Schmidbauer (2012) Figures 4-8.

The correlation coefficient between the NIFTY and gold prices is 0.750, indicating that they are associated Singh (2013).

It has been shown that the coefficient of correlation between Sensex and gold prices is 0.703, the rate at which gold prices are traded is 0.196, and the inflation rate is 0.183.

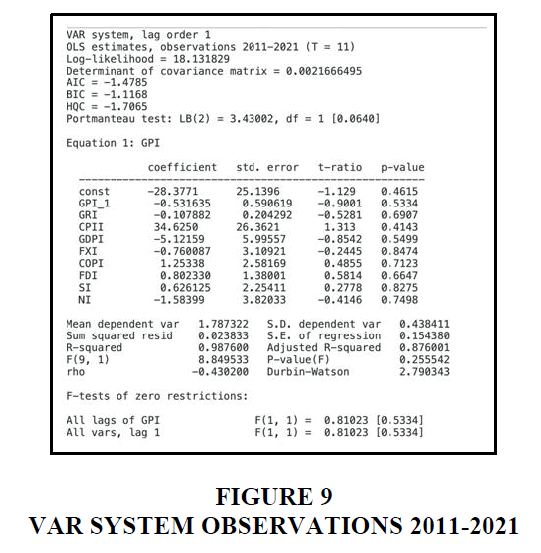

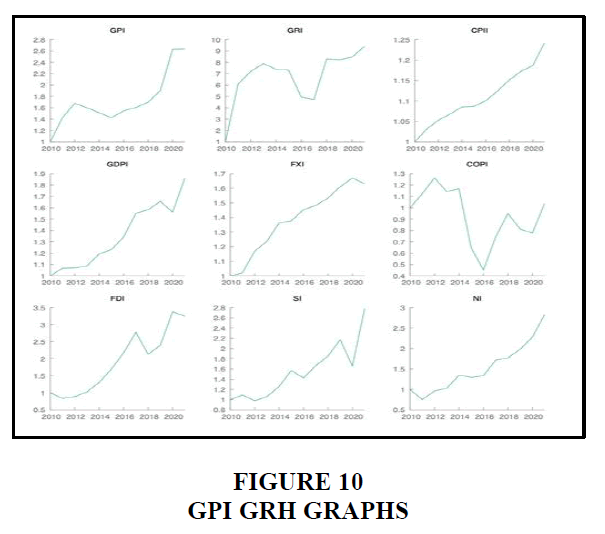

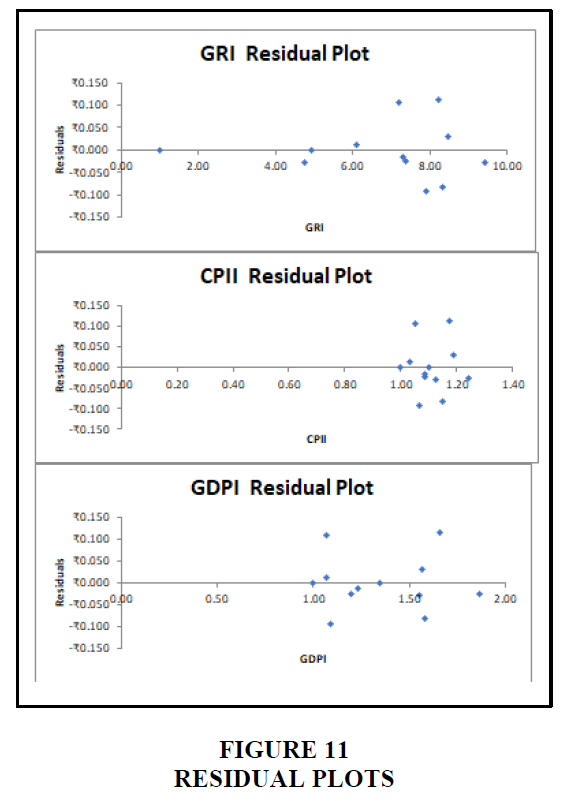

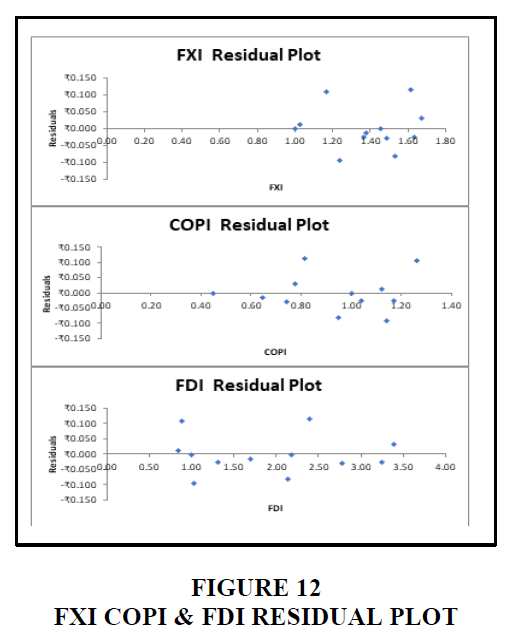

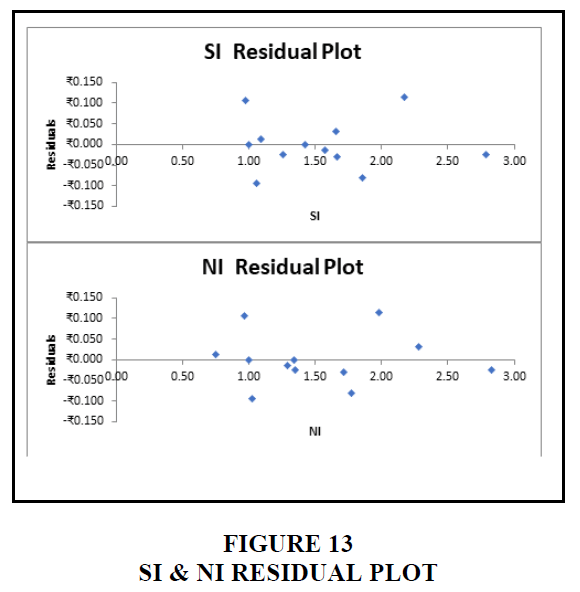

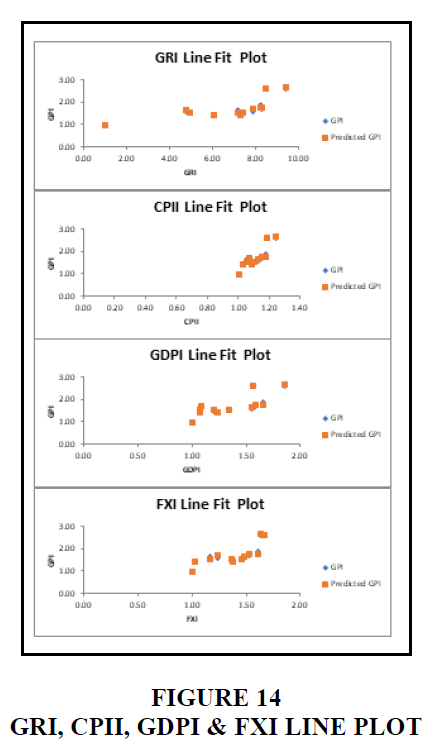

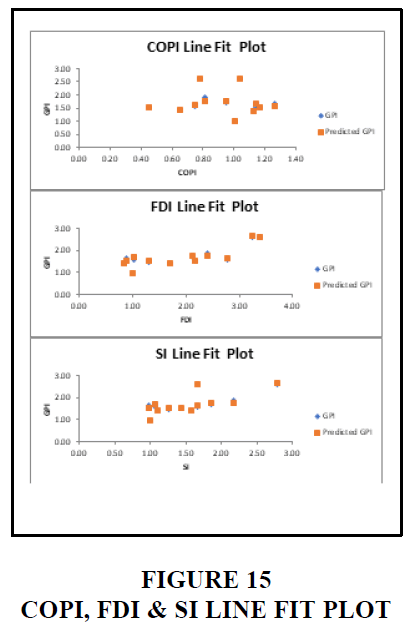

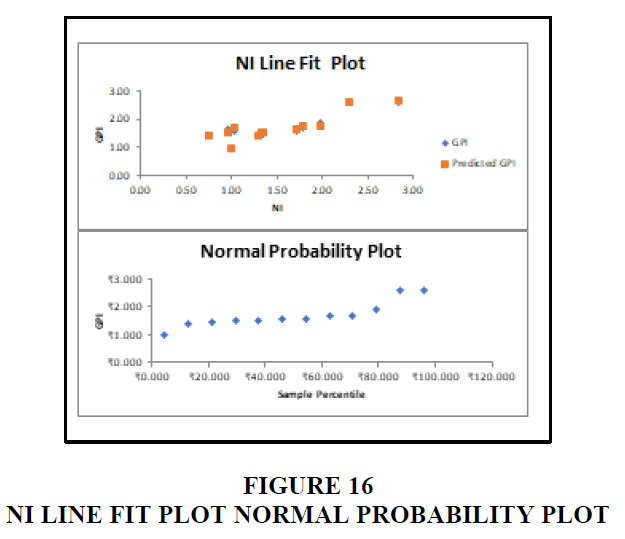

Table 2 individually, correlations can be seen in every independent factor that has a positive correlation with gold prices. Inflation, India/US exchange rate, Nath et al. (2003) Central Bank reserves, Crude oil, NIFTY and BSE Sensex are positively affected or negatively affected by the gold prices. We see that all the independent variables are positively correlated with the dependent variable. A unit increase/decrease in gold prices will lead to an increase or decrease in each of these independent variables individually, as can be seen in the Trend analysis Patel (2012) Figures 9-16.

| Table 2 Summary Output | |||||||||

| Regression Statistics | |||||||||

| Multiple R | 0.991 | ||||||||

| R Square | 0.983 | ||||||||

| Adjusted R Square | 0.936 | ||||||||

| Standard Error | 0.120 | ||||||||

| Observations | 12.000 | ||||||||

| ANOVA | |||||||||

| df | SS | MS | F | Significance F | |||||

| Regression | 8.000 | 2.447 | 0.306 | 21.269 | 0.015 | ||||

| Residual | 3.000 | 0.043 | 0.014 | ||||||

| Total | 11.000 | 2.490 | |||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | ||

| Intercept | -12.982 | 9.087 | -1.429 | 0.248 | -41.901 | 15.937 | -41.901 | 15.937 | |

| GRI | 0.024 | 0.103 | 0.238 | 0.827 | 0.302 | ₹0.351 | -0.302 | 0.351 | |

| CPII | 17.867 | 10.197 | 1.752 | 0.178 | -14.585 | 50.318 | -14.585 | 50.318 | |

| GDPI | -1.156 | 1.976 | -0.585 | 0.600 | -7.444 | 5.132 | -7.444 | 5.132 | |

| FXI | -2.313 | 1.272 | -1.818 | 0.167 | -6.362 | 1.736 | -6.362 | 1.736 | |

| COPI | -0.145 | 0.867 | -0.168 | 0.878 | -2.906 | 2.615 | -2.906 | 2.615 | |

| FDI | 0.211 | 0.435 | 0.485 | 0.661 | -1.173 | 1.595 | -1.173 | 1.595 | |

| SI | -0.632 | 0.766 | -0.825 | 0.470 | -3.068 | 1.805 | -3.068 | 1.805 | |

| NI | 0.126 | 1.080 | 0.117 | 0.914 | -3.310 | 3.562 | -3.310 | 3.562 | |

| RESIDUAL OUTPUT | PROBABILITY OUTPUT | ||||||||

| Observation | Predicted GPI | Residuals | Percentile | GPI | |||||

| 1.000 | 1.000 | 0.000 | 4.167 | 1.000 | |||||

| 2.000 | 1.414 | 0.013 | 12.500 | 1.424 | |||||

| 3.000 | 1.571 | 0.108 | 20.833 | 1.427 | |||||

| 4.000 | 1.692 | -0.092 | 29.167 | 1.514 | |||||

| 5.000 | 1.538 | -0.024 | 37.500 | 1.547 | |||||

| 6.000 | 1.438 | -0.014 | 45.833 | 1.600 | |||||

| 7.000 | 1.548 | 0.000 | 54.167 | 1.604 | |||||

| 8.000 | 1.633 | -0.029 | 62.500 | 1.678 | |||||

| 9.000 | 1.780 | -0.081 | 70.833 | 1.699 | |||||

| 10.000 | 1.789 | 0.115 | 79.167 | 1.904 | |||||

| 11.000 | 2.599 | 0.031 | 87.500 | 2.630 | |||||

| 12.000 | 2.659 | -0.026 | 95.833 | 2.634 | |||||

Vector Autoregression

Findings

Regression research shows that GDP, inflation, and the BSE Sensex have a negative impact on gold prices, while the exchange rate, budget deficit, forex reserves, growth rate of the NSE Index, and interest rates have a positive impact Rani & Vijayalakshmi (1964).

It means that a smaller percentage of GDP is invested in gold, and thus, in the event of inflation, less gold is acquired due to a lack of savings. As a result, gold prices rise as a result of an increase in the exchange rate, which indicates the strength of the dollar.

Increasing forex reserves is a sign of a healthy economy, which is why more people are investing in gold. The higher the growth rate, the greater the opportunity for capital to be generated and invested in gold. A higher interest rate may cause a lag effect in gold prices because of the lack of money in the debt market.

Analysis shows that growth rate and GDP affect gold prices, and gold prices affect growth rate and GDP. This is based on the findings of the study.

This relationship demonstrates that gold is a commodity and an investment vehicle that is influenced and influenced by GDP and growth rates. As a result, the government will investigate the issue of gold pricing.

To maintain a healthy inflow of gold that is also accounted for, import duties should not be increased or should be kept at such a low level that unaccounted inflows of gold become more expensive. Because a suitable gold influx will result in a greater growth rate and GDP, the gold price mechanism will be affected by the growth rate and GDP.

The independence and maturity of the Indian capital market are determined by the BSE Sensex and NSE Index, which are unaffected by gold prices. Gold prices have little effect on forex reserves or the budget deficit, indicating that the parties involved in gold price setting are private and that the government is not involved. The fact that gold causes interest rates and inflation is most likely since gold is primarily meant to earn capital appreciation, which may be liquidated quickly, releasing cash and opportunities to shift into the debt market.

Suggestions

Investors can incorporate the findings and debates into their investing strategies while keeping the country's external and internal environments in mind. The government should take advantage of the study to fix import taxes, combat the black economy, and control inflation. The government should keep an eye on the gold price mechanism Sood et al. (2014).

Limitations of the Study

The current investigation has the potential to yield more thorough results. It can be run over a longer period of time and with more macroeconomic factors. Furthermore, the research topic can be broadened by looking at the fundamentals, economies, and stock markets of various developed and developing countries.

The most important takeaway from this research is that governments, such as the government of India in this case, should focus on promoting equity shares as leading financial vehicles. Although India's GDP is rising, there is no discernible influence on the Indian stock markets. Many financial instruments are now accessible through which direct or indirect investments in capital markets can be made. As a result, the market's liquidity conditions will improve, and the markets will become more predictable. Gold is a commodity that may be used for both consumption and investment. Gold prices reflect the rate of growth and the state of the economy. Gold can be utilized as an anti-inflationary tool Nemavathi & Nedunchezhian (2013).

Conclusion

The goal of this article is to investigate the causal relationship between gold and macroeconomic variables. It states that it does not influence or affect the exchange rate, the BSE Sensex, the NSE Index, foreign reserves, or the budget deficit, but it does affect interest rates and inflation, and vice versa. GDP and growth rate have a bidirectional relationship in terms of gold pricing. Exchange rates, fiscal deficits, and forex reserve inflation rates all have a big effect on gold prices, but growth rates, GDP, the bourses, and the index don't have much of an effect.

Recommendations

In estimating my model of gold with 1st different approaches to real data I found that there are number of econometric problems that need to be addressed in future studies. Some of these problems were corrected. But I also found low R-Square, heteroscedasticity, autocorrelation; some variables of the data series for some regions were non-stationary and abnormal residuals distributions.

References

Bapna, I., Sood, V., Totala, N. K., & Saluja, H. S. (2012). Dynamics of macroeconomic variables affecting price innovation in gold: a relationship analysis. Pacific Business Review International, 5(1), 1-10.

Bhunia, A., & Das, A. (2012). Association between gold prices and stock market returns: Empirical evidence from NSE. Journal of Exclusive Management Science, 1(2), 1-7.

Bhunia, A., & Mukhuti, S. (2013). The impact of domestic gold price on stock price indices-An empirical study of Indian stock exchanges. Universal Journal of Marketing and Business Research, 2(2), 35-43.

Bilal, A.R., Talib, N.B.A., Haq, I.U., Khan, M.N.A.A., & Naveed, M. (2013). How gold prices correspond to stock index: a comparative analysis of Karachi stock exchange and Bombay stock exchange. World Applied Sciences Journal, 21(4), 485-491.

Ismail, Z., Yahya, A., & Shabri, A. (2009). Forecasting gold prices using multiple linear regression method. American Journal of Applied Sciences, 6(8), 1509.

Mukherjee, D. (2007). Comparative analysis of Indian stock market with international markets. Great Lakes Herald, 1(1), 39-71.

Mukhuti, S., & Bhunia, A. (2013). Is it true that Indian gold price influenced by Indian stock market reaction. E3 Journal of Business Management and Economics, 4(8), 181-186.

Nand Kishor Soni & Ajay Parashar, (2015). ”Gold Demand increase and Its impact on Inflation”, Journal of Research in Humanities and Social Science.

Narang, S.P., & Singh, R.P. (2012). Causal relationship between gold price and Sensex: A study in Indian context. Vivekananda Journal of Research, 1(1), 33-37.

Nath, G.C., & Samanta, G.P. (2003, February). Dynamic relation between exchange rate and stock prices: a case for India. In 39th Annual Conference paper of Indian Econometric Society also published in NSE News February.

Nemavathi, N., & Nedunchezhian, D. V. (2013). A study on impact of price behaviour of commodity gold and gold ETF. IJSR-International Journal of Scientific Research, 2.

Patel, S. (2012). The effect of macroeconomic determinants on the performance of the Indian stock market. NMIMS Management Review, 22.

Rani, D.S.A., & Vijayalakshmi, K. (1964). Importance of gold in indian economy.

RohitManjule, (2013). ”Study of Relation among the Bullion, Forex, and Stock market in India”, International Journal of Application or Innovation in Engineering & Management.

Rösch, A., & Schmidbauer, H. (2012). Impact of festivals on gold price expectation and volatility. In International Institute for forecasters (ed), Proceedings of the 32 nd International Symposium on Forecasting ISF (pp. 24-27).

Sindhu, D. (2013). A study on impact of select factors on the price of Gold. Journal of Business and Management, 8(4), 84-93.

Singh, P. (2013). Gold Prices in India: Study of Trends and Patterns,“. International Journal of Innovations in Engineering and Technology (IJIET), 2(4), 332.

Singh, S., Tripathi, L. K., & Lalwani, K. (2012). An empirical study of impact of exchange rate & inflation rate on performance of BSE SENSEX. Spectrum: A Journal of Multidisciplinary Research, 1(3), 2278-0637.

Sood, V., Bapna, I., Totala, N.K., & Saluja, H.S. (2014). An econometric analysis of gold price: A paradigm change in Indian capital markets in dynamic business environment. Altius Shodh Journal of Management & Commerce, 2, 1-17.

Srinivasan, P., & Ibrahim, P. (2012). Price discovery and asymmetric volatility spillovers in Indian spot-futures gold markets. International Journal of Economic Sciences and Applied Research, 5(3), 65-80.

Srinivasan, P., & Prakasam, K. (2015). Gold price, stock price and exchange rate nexus: the case of India. Rom. Econ. J, 77-94.

Tiwari, S., & Gupta, B. (2015). Granger causality of Sensex with gold price: Evidence from India. Global Journal of Multidisciplinary Studies, 4(5), 50-54.

Toraman, C., Basarir, C., & Bayramoglu, M. F. (2011). Determination of factors affecting the price of gold: A study of MGARCH model. Business and economics research journal, 2(4), 37-50.

Tripathi, L.K., Parashar, A., & Singh, R. (2014). Global factors & gold price in India-A causal study. International journal of advanced research in management and social sciences, 3(7), 161-180.

Received: 29-May-2022, Manuscript No. AMSJ-22-12103; Editor assigned: 31-May-2022, PreQC No. AMSJ-22-12103(PQ); Reviewed: 14-Jun-2022, QC No. AMSJ-22-12103; Revised: 19-Jul-2022, Manuscript No. AMSJ-22-12103(R); Published: 25-Jul-2022